USA Metaverse Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD4399

December 2024

84

About the Report

USA Metaverse Market Overview

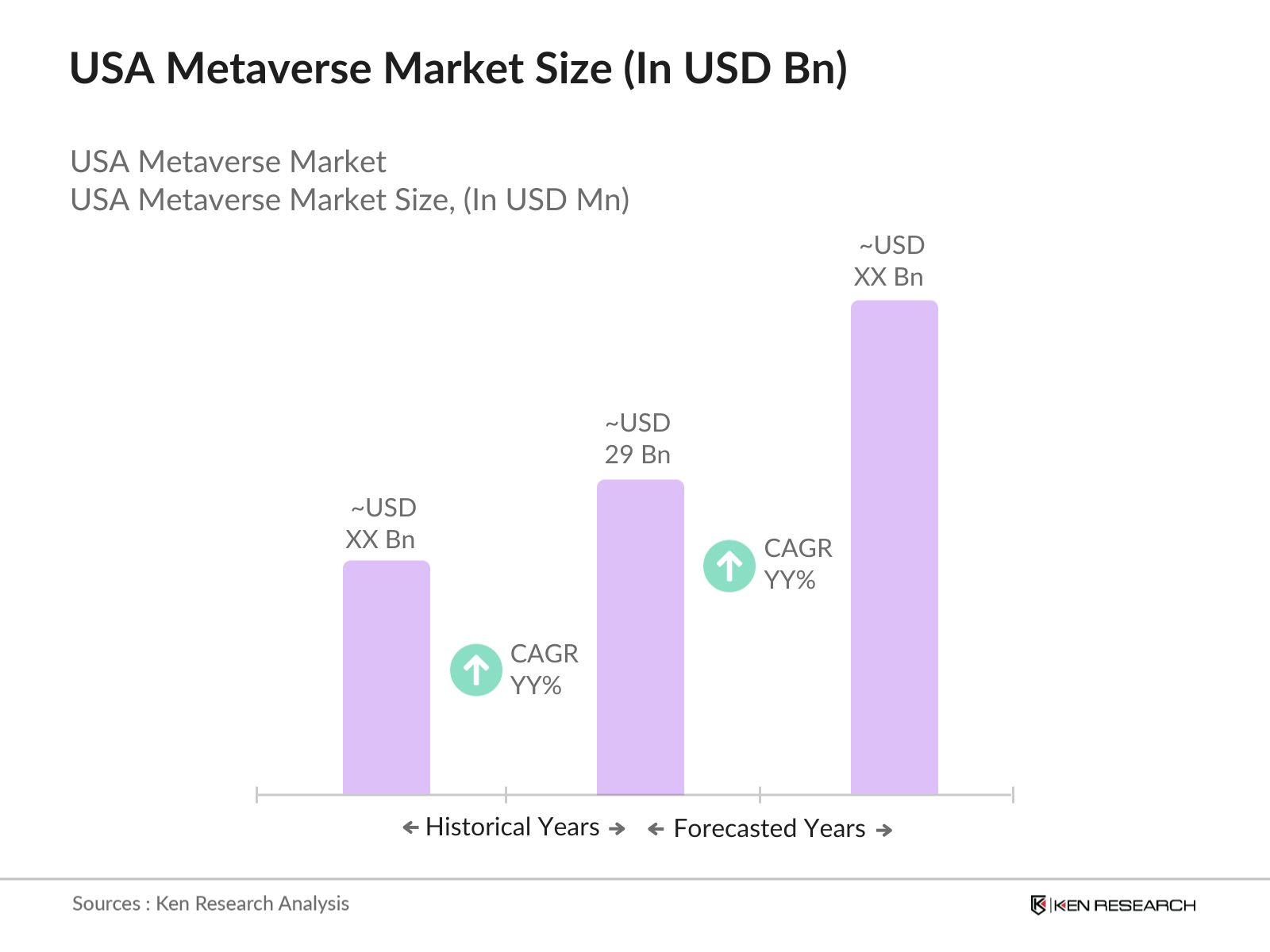

- The USA Metaverse market is valued at USD 29 billion, based on a comprehensive five-year analysis. This growth is driven by increasing investments from technology giants like Meta and Microsoft, aimed at enhancing VR and AR experiences, alongside robust demand for digital environments across various sectors such as gaming, social media, and e-commerce. The continued expansion of 5G and advancements in graphics processing technologies also bolster the metaverses value proposition, creating new user engagement opportunities and fueling market growth.

- The market dominance is particularly notable in cities such as San Francisco, New York, and Los Angeles, as well as states like California and Texas. These locations host a significant concentration of technology companies, startups, and venture capital firms that support the innovation ecosystem essential for metaverse development.

- In 2024, the U.S. government allocated $500 million towards research on digital transformation, including advancements in metaverse technology. This funding is directed towards institutions and private companies exploring AI, VR, and blockchain applications that support metaverse development, fostering innovation.

USA Metaverse Market Segmentation

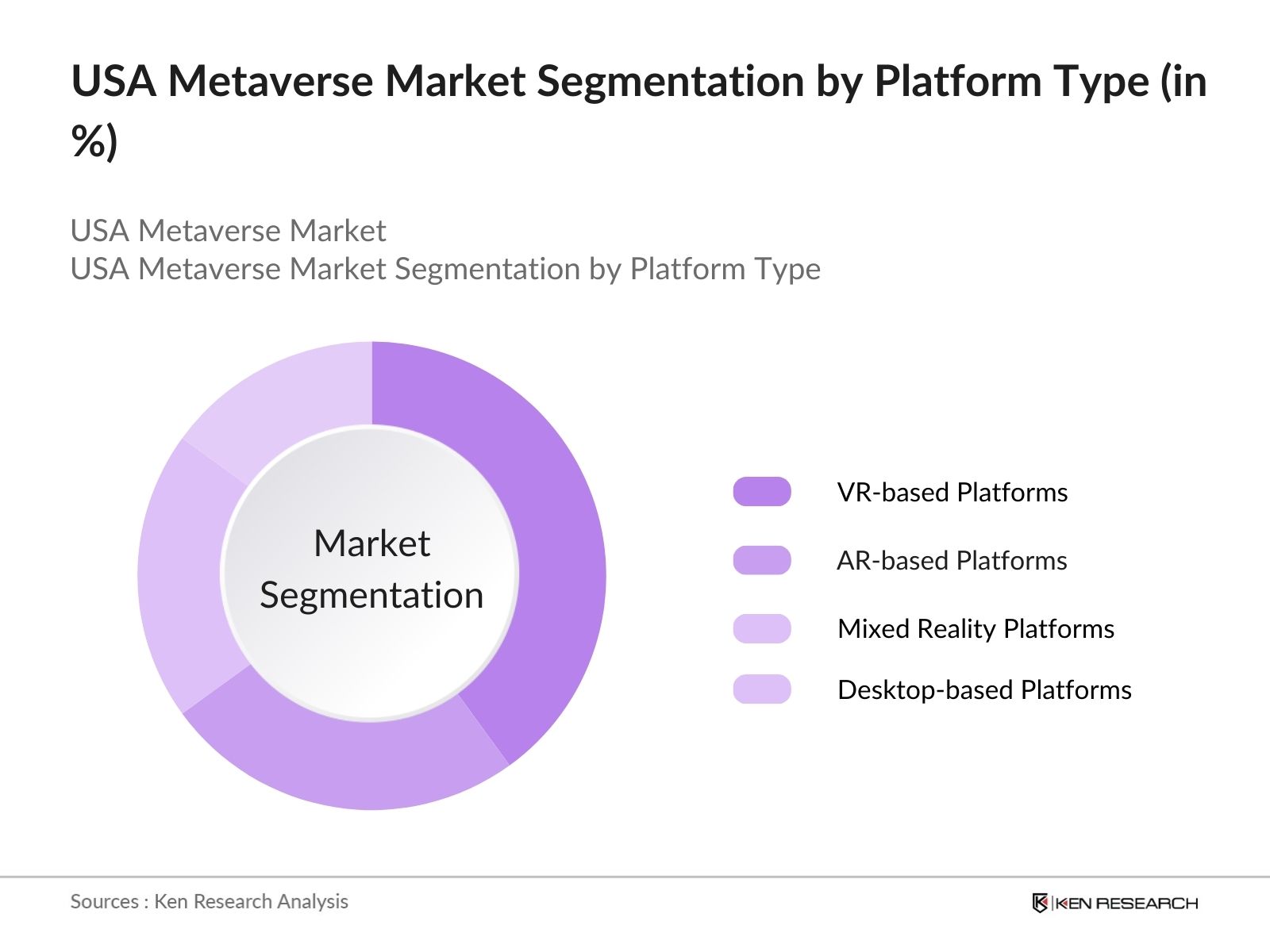

By Platform Type: The market is segmented by platform type into VR-based platforms, AR-based platforms, mixed reality platforms, and desktop-based platforms. VR-based platforms currently hold a dominant market share in the USA metaverse space, primarily due to the immersive experiences they offer, which have found widespread applications in gaming, social interactions, and virtual events. Major technology companies, such as Meta and HTC, have invested heavily in VR technology, contributing to its dominant position by driving both innovation and consumer adoption.

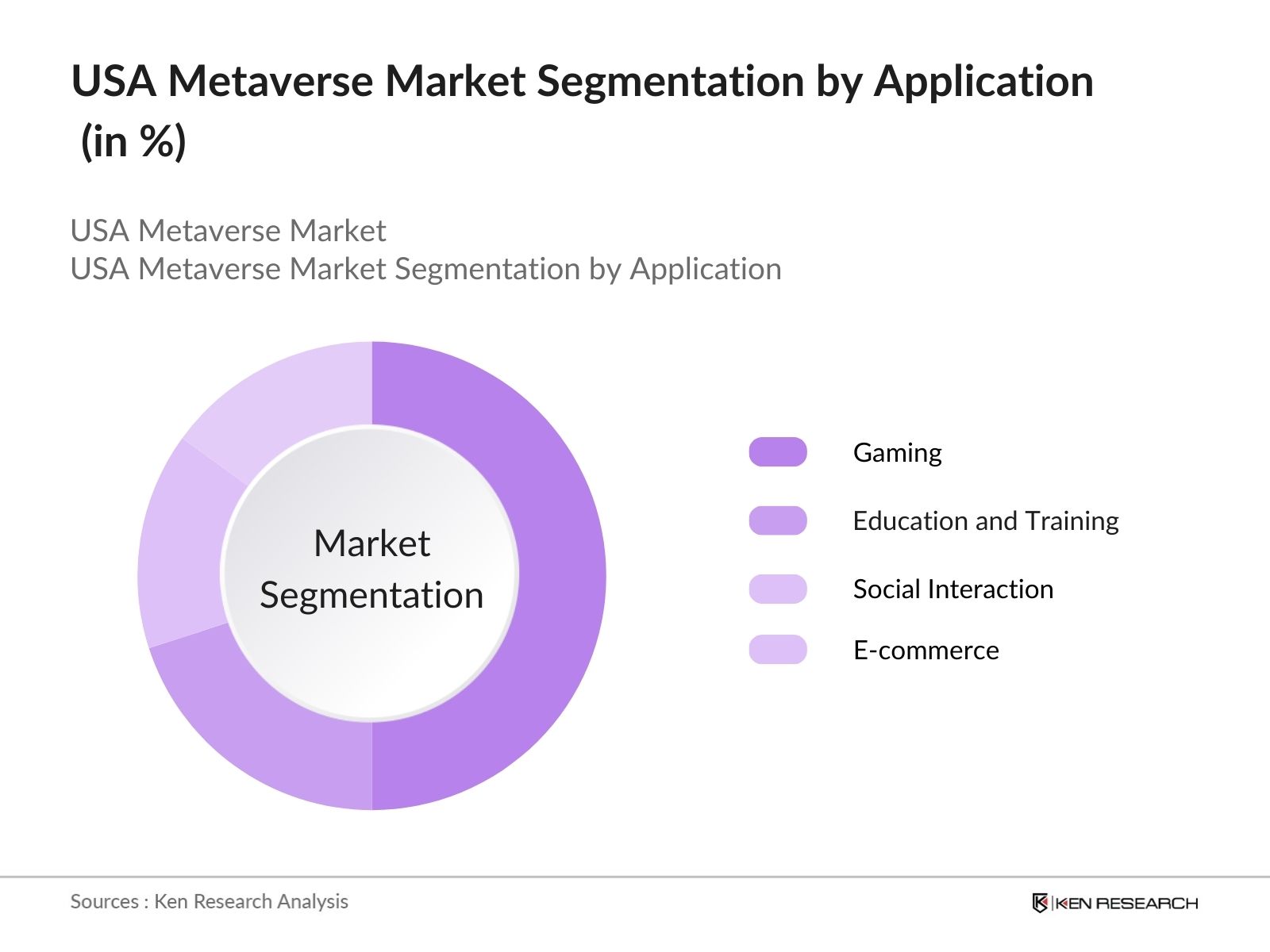

By Application: The market is also segmented by application into gaming, education and training, social interaction, and e-commerce. The gaming segment has a prominent market share within the metaverse applications, driven by high consumer demand for interactive experiences and the growth of online multiplayer games. Companies such as Epic Games and Roblox have capitalized on this trend by creating immersive, interactive environments that blend gaming and social interaction, making gaming the leading application in the USA metaverse market.

USA Metaverse Market Competitive Landscape

The market is characterized by the dominance of a few major players, including Meta Platforms, Microsoft, and Google, alongside emerging companies like Roblox and Unity Technologies. This concentration underscores the significant influence of these leading companies, who are continuously innovating and investing in metaverse-related technologies.

USA Metaverse Market Analysis

Market Growth Drivers

- Increased Adoption of VR/AR Headsets: In 2024, around 25 million virtual and augmented reality (VR/AR) headsets were sold in the U.S., driven by the rising interest in immersive gaming and digital experiences within the metaverse. These headsets are essential entry points for users into virtual environments, enabling significant user engagement and contributing to the growth of the metaverse ecosystem.

- Rise in Digital Workforce and Remote Collaboration Tools: The shift towards remote work has led to a demand for digital collaboration tools within virtual environments. In 2024, over 10 million U.S. employees accessed metaverse-based collaboration platforms, such as virtual meeting rooms and digital workspaces, supporting enhanced productivity and interaction.

- Investment Surge in Metaverse-related Infrastructure: The U.S. has witnessed substantial private investment in metaverse infrastructure, with over $30 billion allocated towards development by major tech companies in 2024. This funding is directed at creating foundational tools, such as blockchain, edge computing, and digital assets, necessary for building and sustaining metaverse environments, signifying robust support from the tech sector.

Market Challenges

- Cybersecurity and Privacy Concerns: In 2024, the metaverse reported over 100,000 instances of data breaches and privacy violations, primarily due to insufficient data protection mechanisms in virtual spaces. The increased complexity of metaverse environments requires advanced cybersecurity measures, which many platforms struggle to implement comprehensively.

- Regulatory and Legal Ambiguities: The U.S. government recorded around 15,000 legal inquiries related to the metaverse in 2024, indicating significant regulatory uncertainty around issues like intellectual property, digital asset ownership, and data usage. This lack of clear regulations could deter companies from investing in metaverse technologies until structured guidelines are established.

USA Metaverse Market Future Outlook

Over the next five years, the USA Metaverse industry is anticipated to grow, supported by advancements in immersive technologies such as AR, VR, and AI. Major drivers include increased consumer interest in virtual spaces, growth in digital asset investments (e.g., NFTs), and expanding applications in education, healthcare, and virtual workspaces.

Future Market Opportunities

- Increasing Use of Metaverse in Education and Skill Development: Over the next five years, educational institutions are projected to integrate metaverse platforms for immersive learning experiences. By 2029, more than 5 million U.S. students could regularly use the metaverse for various subjects, creating an enhanced, interactive learning environment.

- Growth in Virtual Employment Opportunities: Employment within the metaverse is expected to create over 100,000 new virtual jobs by 2029, including roles in digital asset management, virtual real estate, and content creation, expanding the digital economy.

Scope of the Report

|

Platform Type |

VR-based Platforms |

|

AR-based Platforms |

|

|

Mixed Reality Platforms |

|

|

Desktop-based Platforms |

|

|

Application |

Gaming |

|

Education and Training |

|

|

Social Interaction |

|

|

E-commerce |

|

|

Component |

Hardware |

|

Software |

|

|

Services |

|

|

End User |

Consumer |

|

Enterprise |

|

|

Government |

|

|

Healthcare |

|

|

Region |

North America |

|

Europe |

|

|

Asia-Pacific |

|

|

Latin America |

|

|

Middle East and Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FCC, FTC)

Technology Startups

Gaming and Entertainment Companies

Digital Advertising Agencies

Cloud Service Providers

Software and Hardware Manufacturers

Financial Institutions and Payment Processors

Companies

Players Mentioned in the Report:

Meta Platforms, Inc.

Microsoft Corporation

NVIDIA Corporation

Roblox Corporation

Epic Games, Inc.

Unity Technologies

Google LLC

Apple Inc.

Amazon Web Services

Samsung Electronics

Table of Contents

1. USA Metaverse Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Metaverse Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Metaverse Market Analysis

3.1 Growth Drivers

3.1.1 Technological Advancements in VR/AR (VR/AR)

3.1.2 Increasing Consumer Demand for Digital Experiences (Consumer Behavior)

3.1.3 Expanding Digital Infrastructure (5G and Broadband Penetration)

3.1.4 Investments by Major Tech Giants (Investment Patterns)

3.2 Market Challenges

3.2.1 Privacy and Security Concerns (Data Privacy Regulations)

3.2.2 High Initial Setup Costs (Cost of Entry)

3.2.3 Regulatory Uncertainty (Government Policies)

3.2.4 Limited Consumer Awareness (Adoption Barriers)

3.3 Opportunities

3.3.1 Integration with E-commerce (E-commerce Market)

3.3.2 Growing Popularity of Virtual Social Spaces (Social Media)

3.3.3 Potential for Education and Training Applications (Education Market)

3.3.4 Use in Digital Twin Technology (Industrial Use Cases)

3.4 Trends

3.4.1 Adoption of Blockchain for Virtual Assets (Blockchain Integration)

3.4.2 Rising Demand for NFTs in the Metaverse (Digital Ownership)

3.4.3 Use of AI and Machine Learning in Avatars (AI Integration)

3.4.4 Brand Collaborations and Sponsorships (Branding Trends)

3.5 Government Regulation

3.5.1 Digital Privacy Standards (Data Privacy)

3.5.2 Compliance for Digital Transactions (Fintech Regulation)

3.5.3 Intellectual Property Protections (IP Law)

3.5.4 Standardization Initiatives (Regulatory Consistency)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Analysis

4. USA Metaverse Market Segmentation

4.1 By Platform Type (In Value %)

4.1.1 VR-based Platforms

4.1.2 AR-based Platforms

4.1.3 Mixed Reality Platforms

4.1.4 Desktop-based Platforms

4.2 By Application (In Value %)

4.2.1 Gaming

4.2.2 Education and Training

4.2.3 Social Interaction

4.2.4 E-commerce

4.3 By Component (In Value %)

4.3.1 Hardware

4.3.2 Software

4.3.3 Services

4.4 By End User (In Value %)

4.4.1 Consumer

4.4.2 Enterprise

4.4.3 Government

4.4.4 Healthcare

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East and Africa

5. USA Metaverse Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Meta Platforms, Inc.

5.1.2 Microsoft Corporation

5.1.3 NVIDIA Corporation

5.1.4 Epic Games, Inc.

5.1.5 Roblox Corporation

5.1.6 Unity Technologies

5.1.7 Tencent Holdings Ltd.

5.1.8 Snap Inc.

5.1.9 Amazon Web Services

5.1.10 Apple Inc.

5.1.11 Decentraland Foundation

5.1.12 Google LLC

5.1.13 ByteDance Ltd.

5.1.14 Samsung Electronics

5.1.15 Autodesk, Inc.

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Offerings, Digital Infrastructure Investment, R&D Spend, Strategic Partnerships, Consumer Reach, Number of Patents)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Metaverse Market Regulatory Framework

6.1 Digital Privacy Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. USA Metaverse Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Metaverse Future Market Segmentation

8.1 By Platform Type (In Value %)

8.2 By Application (In Value %)

8.3 By Component (In Value %)

8.4 By End User (In Value %)

8.5 By Region (In Value %)

9. USA Metaverse Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the USA Metaverse market ecosystem to identify all key stakeholders, from technology providers to end-users. This step included a comprehensive desk research process that utilized both secondary data sources and proprietary databases to map critical variables influencing the market.

Step 2: Market Analysis and Construction

Historical data related to market growth and penetration was analyzed to construct a robust model of the USA Metaverse market. This step included evaluating user engagement statistics and the markets technological ecosystem, providing a foundation for reliable revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through in-depth interviews with industry experts, including key personnel from leading companies in the metaverse space. These consultations provided insights into operational and strategic challenges within the market, refining data accuracy.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing data from interviews and secondary sources to develop a comprehensive and validated analysis. Direct engagement with metaverse stakeholders allowed for the validation of consumer trends, technology adoption rates, and market segmentation.

Frequently Asked Questions

01. How big is the USA Metaverse Market?

The USA Metaverse market was valued at USD 29 billion, driven by investment from tech giants and growing consumer demand for immersive digital experiences across multiple sectors.

02. What are the primary challenges in the USA Metaverse Market?

Challenges in the USA Metaverse market include privacy and security concerns, high initial costs for VR/AR devices, and regulatory uncertainties, particularly regarding digital ownership and data privacy.

03. Who are the major players in the USA Metaverse Market?

Key players in the USA Metaverse market include Meta Platforms, Microsoft, NVIDIA, Roblox, and Epic Games. Their dominance is due to substantial R&D investments, innovative product offerings, and extensive consumer reach.

04. What drives growth in the USA Metaverse Market?

Growth in the USA Metaverse market is propelled by advancements in immersive technologies, 5G expansion, and increased consumer interest in digital worlds for gaming, social interaction, and remote work.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.