Market Study on India Liquid Packaging Market

Characterized by leading players expanding their production capacities aggressively in the past few years

Region:Asia

Author(s):Aditya Konnur

Product Code:KR1263

December 2022

55

About the Report

The report provides a comprehensive analysis of the potential of Liquid Packaging industry in India. The report covers an overview of the industry, market size in terms of revenue as well as volume.

The report covers market segmentation by Material Type on the basis of Revenue as well as on the basis of Volume. The report further covers market share of key players in the liquid packaging industry as well as the market share of key players within the glass packaging segment. The report concludes with highlighting the market dynamics (major entry, exit, acquisition, etc.) in the past few years and providing a summary on the future of liquid packaging in India.

Market Overview:

According to Ken Research estimates, the India Liquid Packaging Market has grown at a CAGR of 7% over the last five years.

Due to pent-up demand in the post-COVID era in the end user sectors, the liquid packaging industry also witnessed a steep Y-o-Y growth of ~20% in FY 22.

- Liquid Packaging: The liquid packaging space has witnessed new market entrants, acquisitions and JVs in the past couple of years, along with incumbents foraying into new space post patent expiry.

- Glass Packaging: Despite the recent acquisitions in the glass packaging segment, the market has witnessed new entrants and aggressive expansion of production capacity by incumbents, thereby maintaining the fragmented competitive nature of the market.

Key Trends by Market Segment:

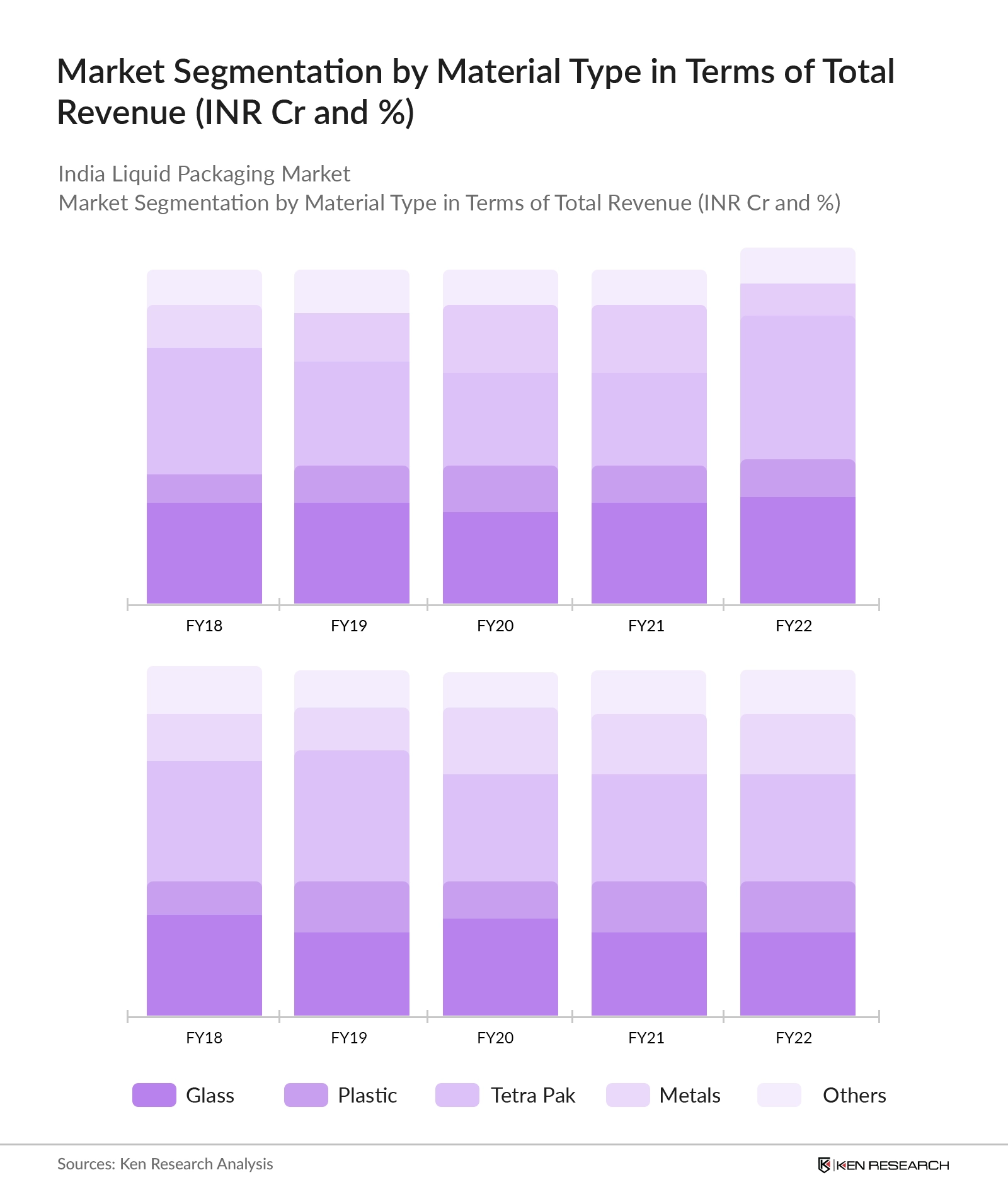

By Material Type in terms of Total Revenue: The biggest segment of liquid packaging market in revenue terms is flexible packaging market, i.e., Tetra Pak, which is also one of the fastest growing packaging segments.

By Material Type in terms of Total Volume: In terms of volume, glass has a higher market share among all the material types

The glass segment includes major manufacturer for pharma, liquor and F&B segment and the share of this segment in the liquid packaging market has been dwindling in the recent years

Competitive Landscape:

- Liquid Packaging: The liquid packaging space is dominated by both global and Indian players. Global Players include Tetra Pak and Huhtamaki while Uflex, Essel Propack and Tinplate are the major Indian companies. Along with the Indian players, global players are also setting up manufacturing facilities across India.

- Glass Packaging: Glass packaging companies in India have global manufacturing and supply. In India, companies have largely set up manufacturing facilities in Gujarat.

Import Scenario

- Value: Among all categories, import of glass packaging materials have witnessed the highest growth followed by Tetra Pak.

- Volume: Similar to the value trend, the share of imports of glass in the overall import market by volume has increased while metal and plastic & others have dropped.

Future Outlook

Market dynamics indicating more preference for packaging materials like that of Tetra Pak and PET bottles. In retailing, as trends like drone delivery come into being, Tetra Pak will hold an advantage over glass and tin packaging as “our packaging is lighter

Scope of the Report

|

By Material Type on the basis of Revenue |

Glass Plastics Metals Tetra Pak Others |

|

By Material Type on the basis of Volume |

Glass Plastics Metals Tetra Pak Others |

|

Market Share major players in Liquid Packaging |

Total Revenue (in INR Cr) Total Volume (in ‘000 MTPA) Domestic Revenue (excluding exports) (in INR Cr) Domestic Volume (excluding exports) (in ‘000 MTPA) |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

- Pharmaceuticals

- F&B

- Personal Care

- Household Care

Time Period Captured in the Report

- Period: 2018-2022

Companies

Major Players Mentioned in the Report

- Uflex

- Tinplate

- Essel

- Tetra Pak

- Huhtamaki

- PGP Glass

- Hindustan National Glass & Industries Limited

- AGI Greenpac

- Canpack

- Firozabad Cluster (major unorganized cluster in glass packaging)

Table of Contents

1. Market Overview

1.1. Market Overview

2. Ecosystem

2.1. Market Ecosystem - Supply

2.2. Market Ecosystem - Demand

3. Market Size

3.1. Market Size – By Revenue FY’18 to FY’22

3.2. Market Size -By Volume FY’18 to FY’22

4. Market Segmentation

4.1. 4.1 Market Segmentation by Material Type basis Revenue

4.2. 4.2 Market Segmentation by Material Type basis Volume

5. Competition Landscape

5.1. Market Share by Total Revenue – Liquid Packaging, 2022

5.2. Market Share by Total Revenue – Liquid Packaging, 2021 & 2020

5.3. Market Share by Total Revenue – Liquid Packaging, 2018 & 2019

5.4. Market Share by Total Volume– Liquid Packaging, 2022

5.5. Market Share by Total Volume – Liquid Packaging, 2021 & 2020

5.6. Market Share by Total Volume – Liquid Packaging, 2018 & 2019

5.7. Market Share by Total Revenue – Glass Packaging, 2022

5.8. Market Share by Total Revenue – Glass Packaging, 2021 & 2020

5.9. Market Share by Total Revenue – Glass Packaging, 2018 & 2019

5.10. Market Share by Total Volume– Glass Packaging, 2022

5.11. Market Share by Total Volume – Glass Packaging, 2021 & 2020

5.12. Market Share by Total Volume – Glass Packaging, 2018 & 2019

5.13. Market Share by Domestic Revenue – Liquid Packaging, 2022

5.14. Market Share by Domestic Revenue – Liquid Packaging, 2021 & 2020

5.15. Market Share by Domestic Revenue – Liquid Packaging, 2018 & 2019

5.16. Market Share by Domestic Volume– Liquid Packaging, 2022

5.17. Market Share by Domestic Volume – Liquid Packaging, 2021 & 2020

5.18. Market Share by Domestic Volume – Liquid Packaging, 2018 & 2019

5.19. Market Share by Domestic Revenue – Glass Packaging, 2022

5.20. Market Share by Domestic Revenue – Glass Packaging, 2021 & 2020

5.21. Market Share by Domestic Revenue – Glass Packaging, 2018 & 2019

5.22. Market Share by Domestic Volume– Glass Packaging, 2022

5.23. Market Share by Domestic Volume – Glass Packaging, 2021 & 2020

5.24. Market Share by Domestic Volume – Glass Packaging, 2018 & 2019

5.25. Competitive Assessment of major players in Liquid Packaging

5.26. Competitive Assessment of major players in Glass Packaging

6. Import Scenario

6.1. Import Scenario – By Value

6.2. Import Scenario – By Volume

7. Market Dynamics

7.1. Factors considered by players while entering the market

7.2. Porter’s Analysis for Glass Packaging Segment

7.3. Recent developments in the industry

7.4. Market Dynamics of the Liquid Packaging Industry

7.5. Market Dynamics of the Glass Packaging Segment

7.6. The Future of Liquid Packaging Industry

7.7. Use Cases of same liquid being packaged in glass and other packaging materials

8. Research Methodology

8.1. Market Definitions

8.2. Approach for Market Sizing & Market Share

8.3. Consolidated Research Approach & Limitations

Disclaimer

Contact us

Research Methodology

Frequently Asked Questions

01 What is the Study Period of this Market Report?

The India Liquid Packaging Market is covered from 2018–2022 in this report.

02 What is the Growth Rate witnessed in the India Liquid Packaging Market?

The liquid packaging market has shown a positive CAGR of 7% for period 2018-2022.

03 Which is the Largest Product Segment within the India Liquid Packaging Market?

The Glass Packaging segment held the largest share of the India Liquid Packaging Market in 2021, both in terms of value and volume.

04 Who are the Key Players in the India Liquid Packaging Market?

Uflex, Tinplate, Essel, Tetra pak, HNG, AGI Greenpac, PGP Glass. Huhtamaki, Canpack.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.