Spain Pet Insurance Market Outlook to 2027F

Driven by rising pet population, increased humanization of pets and awareness of pet health in Spain

Region:Europe

Author(s):Ms. Hiteshi Kaul

Product Code:KR1292

December 2022

82

About the Report

The report provides a comprehensive analysis of the potential of Pet Insurance in Spain. The report covers an overview and genesis of the industry, market size in terms of gross written premium.

Its market segmentations include by policy type, by type of animals, by sales channel, by veterinary insurance coverage type and by insurance type; growth enablers and drivers; challenges and bottlenecks; trends driving adoption trends; regulatory framework; end-user analysis, industry analysis, competitive landscape including competition scenario and market shares of major players. The report concludes with future market projections of each market segmentation and analyst recommendations.

Market Overview:

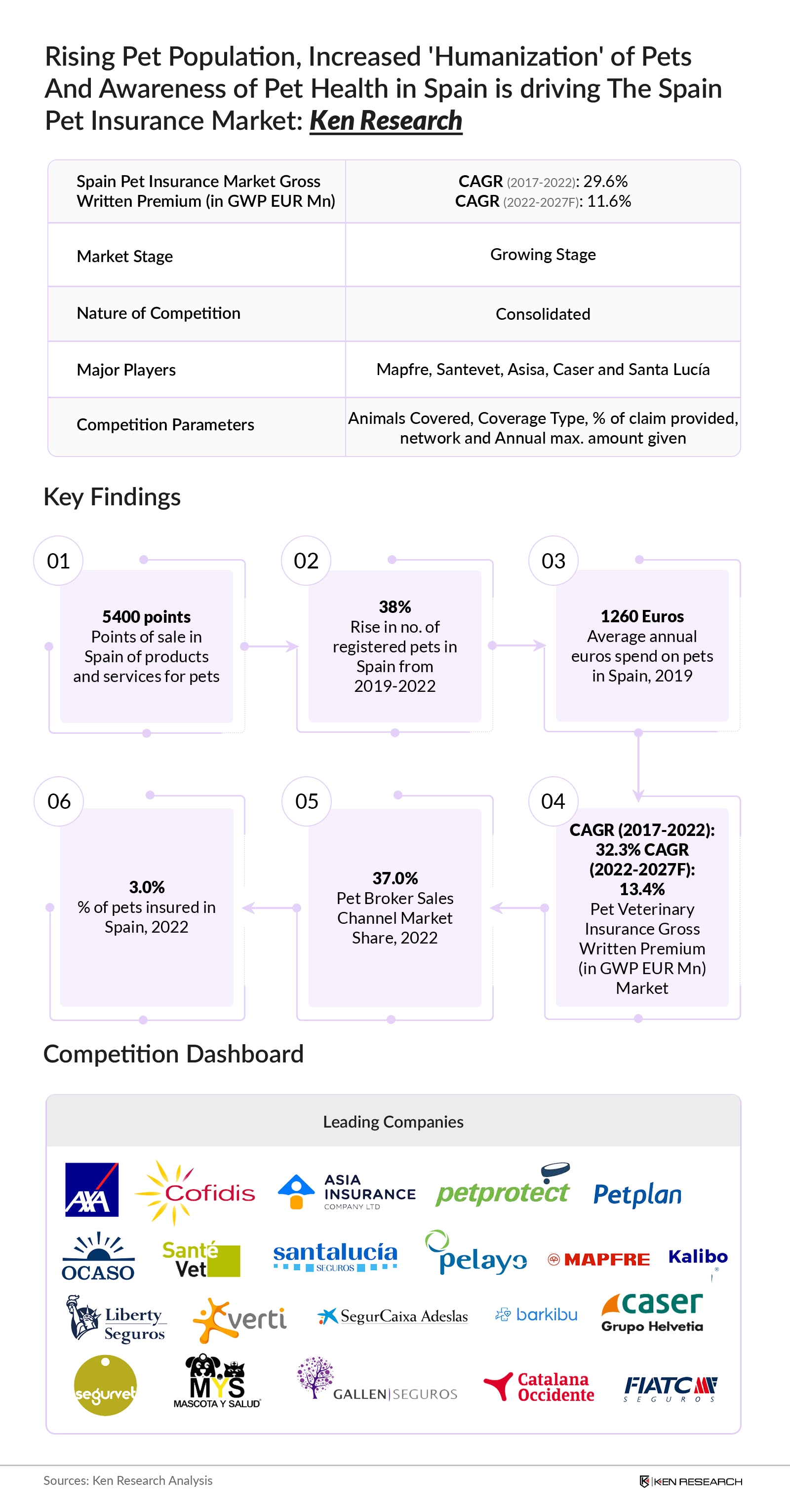

According to Ken Research estimates, the Spain Pet Insurance Market – which grew from approximately EUR ~24 Mn in 2017 to approximately EUR ~88 Mn in 2022 – is forecasted to grow further into EUR ~150 Mn opportunity by 2027F in terms of gross written premium, owing to the New Government Policies, Growth in Adoption of Pets and Entry of New Players in the Market.

.jpg)

- In 2019, Spanish households spent 3,721 million euros on products and services for pets.

- The number of dogs and cats living in Spain already exceeds 20 million.

- Spaniards spend an average of 1,260 euros a year on their pets in 2019, 7.3% more than 2 years ago. That is, €823 in food, €353 in veterinary expenses and €83 in accessories and toys.

Key Trends by Market Segment:

By Policy Type: A gradual decreasing trend is observed in Pet Liability insurance segment from 2017 to 2022P. More awareness about pet’s health is spreading and because of new animal welfare and protection law, people are valuing their pets more, leading to increased % share of Veterinary insurance segment.

By Sales Channel: Sales through brokers had the highest % share in the Spanish Pet Insurance market in 2022P, followed by Direct Sales by Pet Insurance companies. An increasing trend in the % share of Direct sales and Bancassurance is observed from the period of 2017 to 2022P.

Competitive Landscape

Spain Pet Insurance Market is at a growing stage and has a consolidated market with about 5-6 major players capturing large portion of the market. Mapfre is the market leader. The players are competing on the basis of Animals Covered, Coverage Type, % of claim provided, network and Annual max. amount given.

Future Outlook

The Spain Pet Insurance Market witnessed significant growth during the period 2017-2022, owing to Pet Tech and Increasing Companion Animal Population.

Growth rate of total pet insured is going to increase over the period as Increase in Online Presence, Spain’s new Animal Protection Law and Rise of Pet Tech & Explosion of Data

Scope of the Report

|

By Policy Type |

Pet Liability Insurance Pet Veterinary Insurance Others |

|

By Type of Animal |

Dog Cat Others |

|

By Sales Channel |

Direct Agents Brokers Bancassurance |

|

By Veterinary Insurance Coverage Type |

Accidental only General health (accident + illness) |

|

By Insurance Type |

House Insurance Stand-alone Policy |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

Private Insurance Providers

Public Insurance Providers

Insurance Agency

Bancassurance

Brokers

Related Government Agencies

New Entrants

Time Period Captured in the Report

Historical Period: 2017-2022

Base Year: 2022

Forecast Period: 2022-2027F

Companies

Major Players Mentioned in the Report

Mapfre

SantéVet

Asisa

Caser

Santa LucÃa

Pet Plan

Barkibu

Mascota Y Salud

Table of Contents

1. Executive Summary

1.1 Position of Spain Pet Insurance Market (Market Overview, Market Size, Growth Drivers and Restraints, Competition Scenario and Way Forward)

2. Country Overview

2.1 Spain Country Profile (Overview, Major Cities, GDP and Inflation Rate, Percentage of GDP Composition by Sector, Trade Scenario)

2.2 Spain Population Analysis (Population by Gender, by Age Group, Demographics of Spain)

3. Overview of Pet Insurance Industry in Spain

3.1 Market Definitions

3.2 Overview and Genesis of Spain Pet Insurance Market

3.3 End-to-End Buying Process of Pet Insurance

3.4 Ecosystem of Spain Pet Insurance Market

3.5 Timeline of Major Players in Spain Pet Insurance Market

3.6 Types of Insurance products in Spain Pet Insurance Market in 2022P

3.7 Regulations in Spain pertaining to Pets and Pet Insurance

4. Market Size of Spain Pet Insurance Market 2022PP

4.1 Market Size of Pet Insurance Market by Total Written Premium, 2017-2022P

5. Market Segmentation of Pet Insurance Market in Spain, 2022P

5.1 Spain Pet Insurance Market Segmentation by Policy Type, 2017-2022P

5.2 Spain Pet Insurance Market Segmentation by Pet type, 2017-2022P

5.3 Spain Pet Insurance Market Segmentation by type of Sales Channel, 2017-2022P

5.4 Spain Pet Insurance Market Segmentation by type of Veterinary Coverage, 2017-2022P

5.5 Spain Pet Insurance Market Segmentation by Insurance Type, 2017-2022P

5.6 Number of Pets in Spain and Percentage of Pets Insured, 2017-2022P

6. Industrial Analysis of Pet Insurance Market in Spain, 2022P

6.1 SWOT Analysis of Spain Pet Insurance Market

6.2 Trends and Developments in Spain Pet Insurance Market

6.3 Growth Drivers in Spain Pet Insurance Market

6.4 Challenges in Spain Pet Insurance Market

7. Technological Trends of Pet Insurance Market in Spain, 2022P

7.1 Key Business and Technology Themes

7.2 Digital user experience enhancement: Transition from customer satisfaction to customer delight

7.3 Key AI-enabled use cases across the Pet Insurance Value Chain

7.4 Reconfigured Pet Claims Journey

7.5 New Initiatives in Spain Pet Market

8.Customer Analysis of Pet Insurance Market in Spain, 2022P

8.1 Decision Making Parameters

8.2 Customer Demographic Analysis

8.3 Customer Purchase Journey of Pet Insurance in Spain

8.4 Distribution Channel in Spain Pet Insurance Market

9. Competitive Analysis of Pet Insurance Market in Spain, 2022P

9.1 Strengths and Weaknesses of Major Players in Spain Pet Insurance Market

9.2 Cross Comparison of Major Players in Spain Pet Insurance Market

10. Future Outlook and Projections of Pet Insurance Market in Spain, 2022P-2027F

10.1 Market Size of Pet Insurance Market by Total Written Premium, 2022P-2027F

10.2 Spain Pet Insurance Market Segmentation by Policy Type, 2022P-2027F

10.3 Spain Pet Insurance Market Segmentation by Pet type, 2022P-2027F

10.4 Spain Pet Insurance Market Segmentation by type of Sales Channel, 2022P-2027F

10.5 Spain Pet Insurance Market Segmentation by type of Veterinary Coverage, 2022P-2027F

10.6 Spain Pet Insurance Market Segmentation by Insurance Type, 2022P-2027F

10.7 Number of Pets in Spain and Percentage of Pets Insured, 2022P-2027F

11. Impact of COVID-19 on Pet Insurance Market in Spain

11.1 Impact of Covid-19 on Pet Insurance Market in Spain

12. Analyst Recommendations for Pet Insurance Market in Spain

12.1 Increased Insurance Penetration through creating awareness

12.2 Target Population in Spain Pet Insurance Market

12.3 Use of Technology to Prevent Frauds and Increase Efficiency

13. Research Methodology

13.1 Market Definitions

13.2 Abbreviations Used

13.3 Market Sizing Approach

13.4 Consolidated Research Approach

13.5 Sample Size Inclusion

13.6 Research Limitations

13.7 Future Conclusion

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on pet insured over the years, penetration of pet insurance companies’ ratio to compute gross written premium for pet insured. We will also review pet insurance firm’s statistics to understand GWP and number of pets which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple insurance providing channels and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from car finance providers.

.jpg)

Frequently Asked Questions

01 What is the Study Period of this Market Report?

The Spain Pet Insurance Market is covered from 2017–2027 in this report, including a forecast for 2022-2027.

02 What is the Future Growth Rate of the Spain Pet Insurance Market?

The Spain Pet Insurance Market is expected to witness a CAGR of ~11.6% over the next years.

03 What are the Key Factors Driving the Spain Pet Insurance Market?

New Government Policies, Rising Animal Health Concerns, Entry of New Players in the Market and Spaniards prefer pet over child.

04 Which is the Largest Sales Channel Segment within the Spain Pet Insurance Market?

The broker type sales channel segment held the largest share of the Spain Pet Insurance Market in 2022.

05 Who are the Key Players in the Spain Pet Insurance Market?

Mapfre, Santevet, Asisa, Caser and Santa LucÃa

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.