KSA Auto Finance Market Outlook to 2026F

Driven by Women Entering the Market, Growing Private Entities and Initiatives by the Government

Region:Middle East

Author(s):Anoushka Chawla, Vidhi Tiwari, Anushi Chhabra

Product Code:KR1204

October 2022

150

About the Report

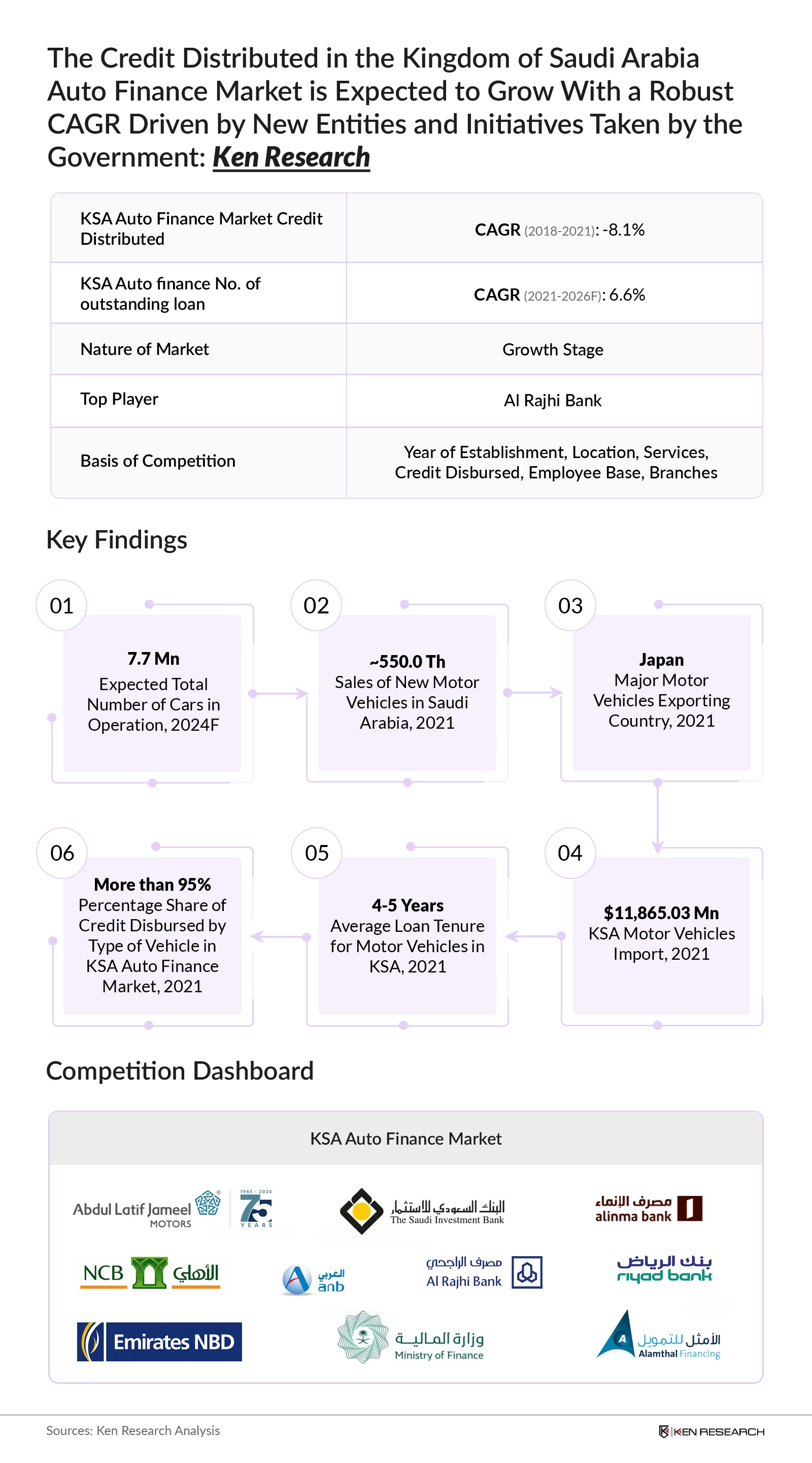

The report “KSA Auto Finance Market Outlook to 2026F– Driven by Women Entering the Market, Growing Private Entities and Initiatives by the Government” by Ken Research provides a comprehensive analysis of the potential of the Auto Finance Industry in KSA. The report also covers overview and genesis of the industry, market size in terms of credit disbursed and loan outstanding; market segmentation by types of lenders, by types of motor vehicle, growth enablers and drivers, challenges and bottlenecks, trends driving adoption trends; regulatory framework; end user analysis, industry analysis, competitive landscape including competition scenario, market shares of major players on the basis of number of players present across KSA. The report concludes with future market projections of each segmentation and analyst recommendations.

Detailed Analysis on the KSA Auto Finance Market:

KSA Auto Finance Market is in growing stage, being driven by banks and NBFCs and introduction of Fin-Tech companies and online personal loan aggregator platforms. The credit disbursed market fell and experienced a downfall due to factors like Covid outbreak and semiconductor chip shortage. Automotive sales were also affected by higher shipping costs in 2021 as prices of shipping containers container freight rates have risen steeply. Higher prices were shifted to the consumers leading to increase in credit disbursed. However, the market is recovering and registering a positive growth since 2021. Entry of women drivers in the market has led to an increase in the total cars sold and hence the credit disbursed in automotive sector.

KSA Auto Finance Market Segmentations:

By Type of Lenders: NBFCs, Bank and OEMs are main lenders in KSA. Captive financing was dominant in the Saudi market 10-15 years back, after which Banks and Finance Companies saw potential in the market and entered it.

By Type of Vehicle Financed: The KSA Auto Finance market is largely dependent upon pricing, the used cars market space's pricing is almost close to the new car market space and hence people prefer financing new cars itself. It’s a trend in KSA to mostly buy new cars and change a car every 5 years.

By Tenure of New and Old Vehicles: Majorly auto loans are taken for a duration of 4-5 years. A popular product in KSA Auto Finance market is 50-50 product, with 50% paid upfront and the other 50% after 2 years with no interim installments taken. This covers around 10-12% of the market and reduces the average loan tenure.

By Type of Passenger Vehicle: Unlike South Asian countries where almost every household has a two-wheeler, in Saudi Arabia even the lowest income category commutes using a car. Two wheelers are used for the purpose of luxury.

KSA Auto Finance Market Competition Scenario

KSA Auto Finance Market is moderately consolidated and has total 60-70 players with new private players making entry such as Fin-tech companies. The major players in the auto loan market include Al Rajhi and SNB followed by Emirates NBD, Banque Saudi Fransi. New banks that have entered the market include Al Jazira, Arab National Bank and Alinma. Companies are increasingly moving towards higher technological advancements to improve operational profits as well as customer experience.

Future Outlook for KSA Auto Finance Market

KSA Auto Finance Market is expected to grow with a positive CAGR during the future period 2021-2026F. The Vision 2030 project in KSA has massive plans for the economy targeting to improve employment figures that might aid the auto finance market as well. A lot of new construction activities are taking place like the Neom and Red Sea project which will increase demand for commercial vehicles and majorly HCVs. It is expected that the commercial vehicles demand/ production is going to rise till 2025, thereby positively affecting the market.

Key Topics Covered in the Report

- KSA Automotive Market Overview

- Landscape of Total Number of Cars in KSA Automotive Market, 2021-2024F

- KSA Automotive Finance Market Overview

- Ecosystem of KSA Auto Finance Market

- KSA Auto Finance Market Evolution and Business Cycle

- KSA Auto Finance Market Size, 2018-2021

- KSA Auto Finance Market Segmentation, 2021 (By Type of Vehicle Financed, By Tenure of New and Old Vehicles, By Type of Commercial Vehicle, Type of Lending Bank and By Type of Lenders)

- Industry Analysis of KSA Auto Finance Services

- Decision Making Parameter for Selecting Car Loan Vendor

- Trends and Developments in KSA Auto Finance Industry

- SWOT Analysis of KSA Auto Finance Industry

- Issues and Challenges in KSA Auto Finance Industry

- Government policies affecting the KSA Auto finance Industry

- Covid-19 Impact on the KSA Auto Finance Industry

- Competition Framework for KSA Auto Finance

- Future Outlook and Projections of the KSA Auto Finance Market, 2021-2026F

- Market Opportunities and Analyst Recommendations

- Analyst Recommendations

- Research Methodology

Products

Key Target Audience

KSA Auto Industries

Government Bodies & Regulating Authorities

Finance Industry

Car company

Automobile dealer and users

Time Period Captured in the Report:

Historical Year: 2018-2021

Base Year: 2021

Forecast Period: 2022– 2026F

Companies

Key Segments Covered

KSA Auto Finance:

By Type of Lenders

Banks

NBFC

OEMS/Captives

By Type of Motor Vehicle:

Passenger

Commercial

By Type of Commercial Motor Vehicle:

HCV

MCV

LCV

By Type of Passenger Motor Vehicle:

4W

2W

By Type of Vehicle Financed:

New

Used

By Tenure of Loan for New Vehicles:

1 Year

2 Year

3 Year and more

By Tenure of Loan for Old Vehicles:

1 Year

2 Year

3 Year and more

Companies Covered:

Al Rajhi Bank

Riyad Bank

National Commercial Bank

Abdul Latif Jameel

Arab National Bank

The Saudi Investment Bank

Emirates NBD

Saudi Finance Company

Al Amthal Financing Company

Alinma Bank

Table of Contents

1. Executive Summary

1.1. Executive Summary: KSA Auto Finance Market

2. Country Overview of KSA

2.1 Country Demographics and Socioeconomic Indicators, 2021

2.2 KSA Population Analysis, 2021

3. KSA Automotive Market Overview

3.1 KSA Automotive Market Overview

3.2 KSA Motor Vehicles Import Export Scenario

3.3 Landscape of Total Number of Cars in KSA Automotive Market, 2021-2024F

3.4 Passenger Car Landscape and Major Car Brands in the KSA Automotive Market

4. KSA Automotive Finance Market Overview

4.1 Ecosystem of KSA Auto Finance Market

4.2 KSA Auto Finance Market Evolution and Business Cycle

4.3 KSA Auto Finance Value Chain Analysis

4.4 Timeline of Major Players in KSA Auto finance Market

4.5 KSA Auto Finance Market Overview, 2021

5. KSA Auto Finance Market Segmentation

5.1 By Type of Vehicle Financed

5.2 By Tenure of New and Old Vehicles

5.3 By Type of Passenger Vehicle

5.4 By Type of Commercial Vehicle and Type of Lending Bank

5.5 By Type of Lenders

6. Industry Analysis of KSA Auto Finance Services

6.1 Decision Making Parameter for Selecting Car Loan Vendor

6.2 Trends and Developments in KSA Auto Finance Industry

6.3 Trends & developments in KSA buyer persona

6.4SWOT Analysis of KSA Auto Finance Industry

6.5 Issues and Challenges in KSA Auto Finance Industry

6.6 Government policies affecting the KSA Auto finance Industry

7. Covid-19 Impact on the KSA Auto Finance Industry

8. Competition Framework for KSA Auto Finance

8.1 Operational Cross Comparison of Players in KSA Auto Finance Market

9. Future Outlook and Projections of the KSA Auto Finance Market

9.1 Future KSA Auto Finance Market Overview

9.2 Future Segmentation by Type of Vehicles Financed

9.3 Future Segmentation by Duration of Loans for New and Old Vehicles

9.4 Future Segmentation by Type of Motor Vehicle and Commercial Vehicle

9.5 Future Segmentation by Type of Passenger Vehicles

9.6 Future Segmentation by Type of Lenders

9.7 Future Segmentation by the Type of Lending Bank

10. Market Opportunities and Analyst Recommendations

10.1 Best Practices for Building a Successful Chain of Auto finance Practices

10.2 Growth strategies for KSA Auto finance market

10.3 Operational Strategies for KSA Auto finance Services Market

11. Research Methodology

11.1 Market Definitions and Assumptions

11.2 Abbreviations

11.3 Market Sizing Approach

11.4 Consolidated Research Approach

11.5 Sample Size Inclusion

11.6 Limitation and Future Conclusion

Disclaimer

Contact Us

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.