Mexico Car Finance Market Outlook 2027F

driven by government regulations & technological innovations

Region:North America

Product Code:KROD135

February 2023

70

About the Report

The report provides a comprehensive analysis of the potential of Mexico Car finance Market. The report covers an overview and genesis of the industry, market size in terms of car dealerships.

Its market segment includes by type of vehicle financing (New car, used car), by type of car financed (Hatchback, Sedan, SUV, Multipurpose), by tenure (3-4 years, 4-5 years), by type of institution (bank, NBFC, Captive), by mode of booking (Online, Offline), by price (high, medium, low). The report includes Porter’s five force analysis, growth enablers, recent trends & developments, pain points & solutions. The report concludes with future market projections of each market segmentation and analyst recommendations.

Market Overview

According to Ken Research estimates, the Mexico Car finance Market which grew at a CAGR of ~% from 2017-2022 & is forecasted to grow at a CAGR of ~% from 2023-2027F owing to government regulations, increased demand for cars & technological innovations.

- The Mexico car Finance market is witnessing a steady growth & is recovering from the negative impact it suffered as a result of the global pandemic.

- New innovations on technological front & government interventions & regulations are anticipated to pave the way for positive growth in the Mexico car Finance market.

- Growth rate of total cars financed is going to increase over the period as financing becomes easier, market penetration rates increase.

Key Trends by Market Segment:

By Type of Vehicle Financed: New cars are expected to capture a large share of the market in the upcoming years owing to an increasing population & wealth.

By type of car financed: Multipurpose vehicles are preferred as compared to others and will probably drive the market in upcoming years.

By type of car financed: Multipurpose vehicles are preferred as compared to others and will probably drive the market in upcoming years.

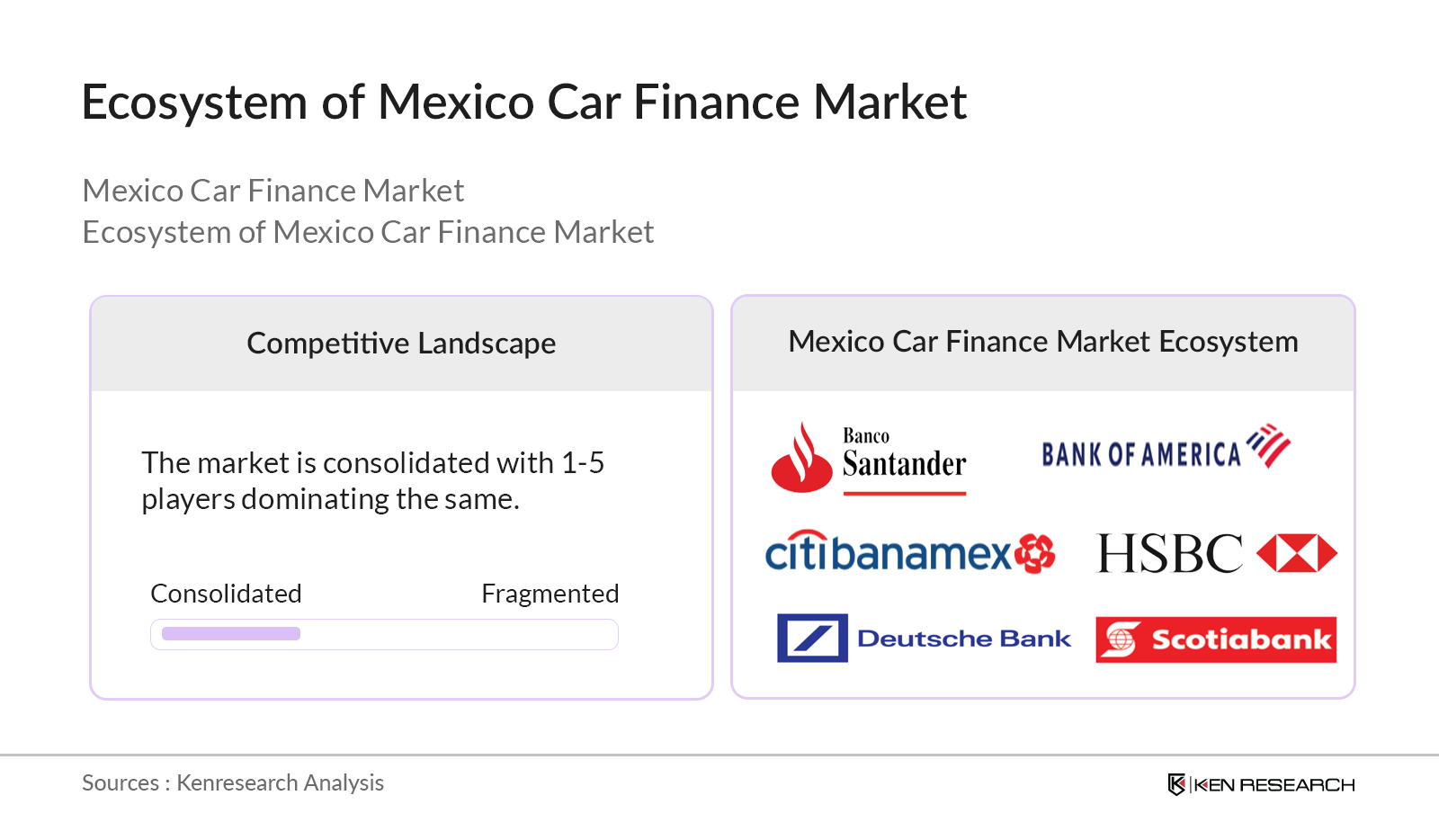

Competitive Landscape

The Mexico Car Finance market is consolidated with a few players occupying almost half of the market. The key players operating in the market are not only competing based on product quality and promotion but are also focusing on strategic moves to hold larger market shares. The major companies dominating the Mexico car Finance market for its products, services, and continuous product developments are Bank of America, Deutsche Bank, Scotia Bank, Bacco Santander, Citibanamex

Future Outlook

The Mexico Car Finance Market witnessed significant growth during the period 2017-2021, suffered a setback during 2020 but saw an uptick during the later phases of 2021

Growth rate of total cars financed is going to increase over the period as financing becomes easier, market penetration rates increase.

Scope of the Report

|

By Type Vehicle Financed |

Used car Financing New car Financing |

|

By Type of car Financed |

Hatchback Sedan SUV Multipurpose others |

|

By tenure |

3-4 years 4-5 years |

|

By Price |

High (500,000+) Medium (200k-500k) Low (below 200K) |

|

By type of institution |

Bank NBFC Captives |

|

By mode of booking |

Online Offline |

Products

Key Target Audience

- Banks and its Subsidiaries

- NBFCs

- Captive Finance Companies

- Government and Institutions

- Automobile Companies

- Car Dealers

- Government and Institutions

- Existing Car Finance Companies

- OEM Dealerships

- New Market Entrants

- Investors

- Auto mobile Associations

Time Period Captured in the Report:

- Historical Period: FY’17- FY’22P

- Base Year: FY’22P

- Forecast Period: FY’23P – FY’27F

Companies

Major Companies Covered

- Bank of America

- Deutsche Bank

- JP Morgan Chase

- HSBC

- Scotia Bank

- Citi

Table of Contents

1. Executive Summary

2. Mexico Car Finance Market Overview

2.1 Taxonomy of the Mexico Car Finance Market

2.2 Industry Value Chain

2.3 Ecosystem

2.4 Government Regulations/Initiatives for the Mexico Car Finance Market

2.5 Growth Drivers of the Mexico Car Finance Market

2.6 Issues and Challenges of the Mexico Car Finance Market

2.7 Impact of COVID-19 on the Mexico Car Finance Market

2.8 SWOT Analysis

3. Mexico Car Finance Market Size, 2017 – 2022

4. Mexico Car Finance Market Segmentation

4.1 By Loan Tenure, 2017 - 2022

4.2 By Institute, 2017 - 2022

4.3 By Regional Split (North/East/West/South/Central), 2017 - 2022

5. Mexico Car Finance Market Competitive Landscape

5.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

5.2 Strategies Adopted by Leading Players

5.3 Company Profiles – (Top 5 - 7 Major Players)

5.3.1 HSBC

5.3.2 Bank of America

5.3.3 Scotia Bank

5.3.4 Deutsche Bank

5.3.5 CITI Banamex

5.3.6 Banco Santander

5.3.7 JP Morgan Chase

6. Mexico Car Finance Future Market Size, 2022 – 2027

7. Mexico Car Finance Future Market Segmentation

7.1 By Loan Tenure, 2022 - 2027

7.2 By Institute, 2022 - 2027

7.3 By Regional Split (North/East/West/South/Central), 2022 - 2027

8. Analyst Recommendations

9. Research Methodology

10. Disclaimer

11. Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on used car and new car over the years, penetration of car finance and down payment ratio to compute overall credit disbursed for cars. We will also review central bank statistics to understand credit disbursed and outstanding amount which can ensure accuracy behind the datapoint shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple finance providing channels and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from car finance providers.

Frequently Asked Questions

01 What is the Study Period of this Market Report?

The Mexico Car Finance Market is covered from 2017–2022 in this report, including a forecast for 2023-2027.

02 What is the Future Growth Rate of the Mexico Car Finance Market?

The Mexico Car Finance Market is expected to witness a CAGR of ~% over the next four years.

03 What are the Key Factors Driving the Mexico Car Finance Market?

Government initiatives, technological innovation & increasing demand for cars are some of the major growth drivers of Mexico Car Finance Market.

04 Who are the Key Players in the Mexico Car Finance Market?

HSBC, Bank of America, Deutsche Bank are some of the prominent players in the market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.