Australia Baby Food Market Outlook to 2023

By Type (Dried Baby Food, Prepared Baby Food, Milk Formula and Other Baby Food), By Organic Baby Food), By Region and By Channels of Distribution

Region:Asia

Product Code:KR764

March 2019

107

About the Report

The report titled "Australia Outlook to 2023 - By Type (Dried Baby Food, Prepared Baby Food, Milk Formula and Other Baby Food), By Organic Baby Food), By Region and By Channels of Distribution" provides information on Baby Food market segmentation by category (Milk Formula, Dried baby food, Prepared Baby Food and Other Baby Food), by Milk Formula (Standard Milk Powdered Formula, Follow-on Milk Powdered Formula, Growing-up Milk Formula and Special Baby Milk Formula),by Age Group (0-6 Months, 6-12 Months, 12+ Months), by Nature (Inorganic Food and Organic Food),by Region (New south Wales, Victoria, Queensland, South , Western Australia, Tasmania, Australian Capital Territory, Northern Territory) and by Channel of Distribution (Supermarkets, Health and Beauty Specialist Retailers, Internet Retailing, Discounters, Other Foods Non Grocery Specialists, Convenience Stores and Forecourt Retailers). Company Profiles of Major Players in Australia Market (Nestle SA, Danone Group, Aspen Pharmacare and Other Companies (Kraft Heinz, Bellamy's Australia Ltd., A2 Milk Co. and others) have been covered in the publication. The report concludes with market projection and analyst recommendations.

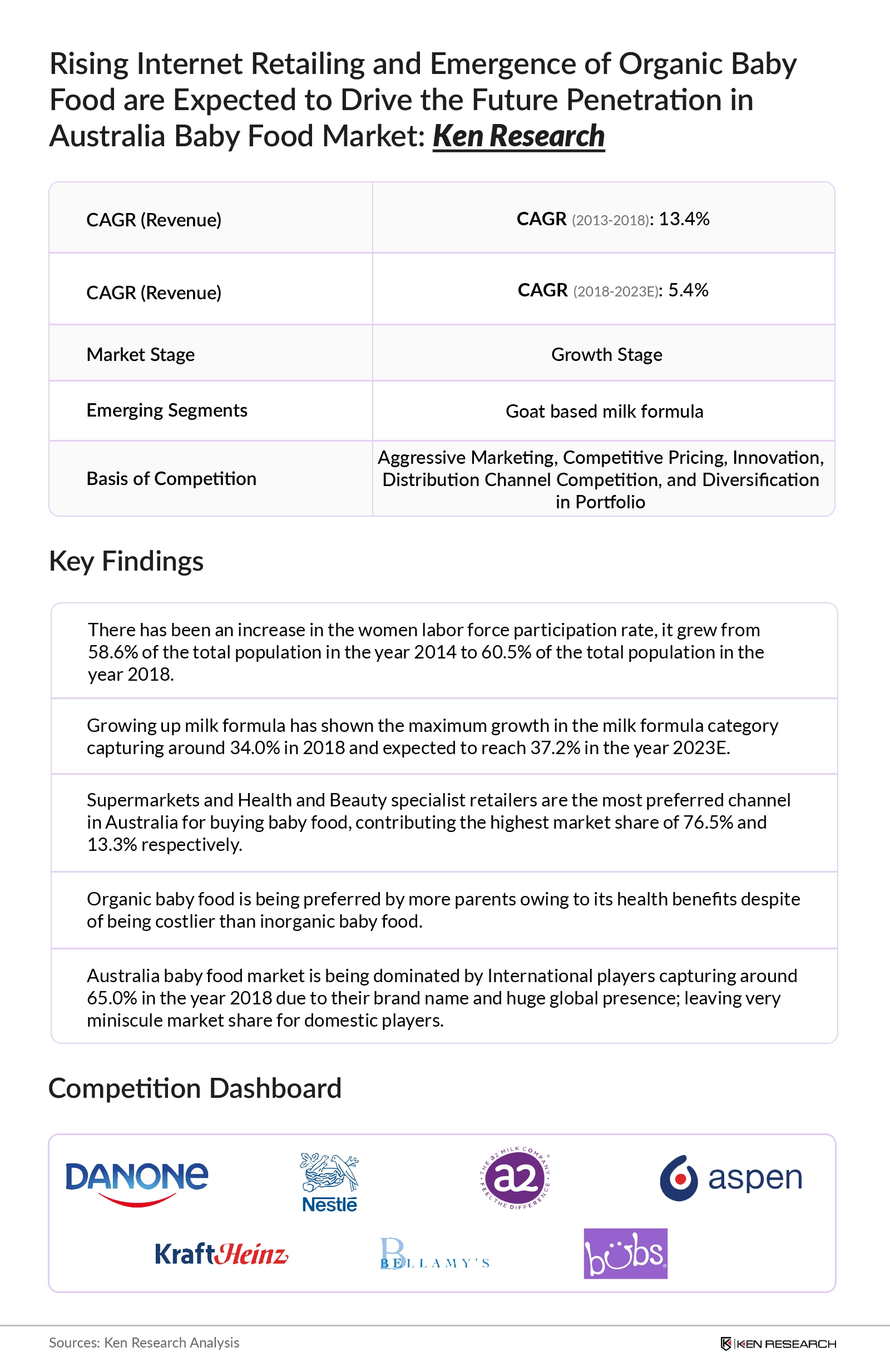

Market Overview: Australia baby food market has shown a remarkable growth in the past few years. It witnessed positive CAGR in the review period 2013-18. Increase in women workforce, rising population of infants from age 0-36 months, latent demand from China and growing urbanization are some of the major factors contributing to the positive growth. A shift in the preference of consumers was also witnessed in the review period. Organic baby food witnessed a huge demand due to rise in the parental concerns and awareness about the products. Bubs organic, Bellamy’s Organic Bio Bambino, Holle Baby Food, Rafferty Garden, Only organic and many more were some of the major brands selling organic baby food in Australia.

Growing-Up milk formula emerged as the growing category among the milk formula in the five year review period. The major reason behind this growth is that the maternity leave is only for 18 weeks and therefore, making mothers more dependent on milk formula for the nutrition of baby.

Market Segmentation: Milk formula was leading the market segment in the year 2018 since it is the most conventional and trustworthy baby food product in the market and is also considered as a prime substitute of mother’s milk. The majority of the milk formula sales in Australia were contributed through growing-up milk formula products due to a large number of infants falling in the age group of above 12 months. The largest market share was held by infants above 12 months or more in the year 2018. In terms of nature, inorganic baby food held a maximum share of retail sales as inorganic items costs much lesser than their organic counterpart therefore making them the most preferred category. New South Wales established itself as market leader by capturing a massive revenue share for retail sales of baby food in the year 2018. It was followed by Victoria and Queensland since they are among the most populated states in Australia. Supermarkets and Health stores are the most preferred channel for buying baby food by the consumers in Australia. Subsequent purchases after consulting health experts are majorly made from these renowned and trustworthy megastores. Online also emerged as one of the preferred channel for distribution due to the increase in number of internet users and also being convenient and time saving.

Competition Scenario in Australia Baby Food Market: Competition within Australia baby food market was observed as concentrated with more than half of the market being captured by international players while the rest share is being held by other domestic and regional players. Major international companies in the market are Danone Group, Nestle SA, Kraft Heinz, Aspen Pharmacare and PZ Cussons while domestic and regional players are The A2 milk Co., Bellamy’s Australia Ltd., Bubs Australia Ltd. and many others.

Australia Baby Food Market Future Projections

The future of Australia baby food looks not so attractive since the current market is largely impacted by huge demand from Chinese and other Asian countries. The market is expected to grow at a significant single digit CAGR during the five year forecast period 2018-2023E. Milk Formula is expected to remain the largest growing segment by the end of the year 2023E.

Key Topics Covered in the Report

- Executive Summary

- Research Methodology

- Stakeholders in Australia Baby Food Market

- Australia Baby Food Market Overview and Genesis

- Value Chain Analysis in Australia Baby Food Market

- Australia Baby Food Market Size, 2013-2018

- Australia Baby Food Market Segmentation, 2013-2018

- Trends and Developments in Australia Baby Food Market

- Issues and Challenges in Australia Baby Food Market

- Decision Making Criteria for Consumers

- Government Regulations for Doing Business

- SWOT Analysis of Australia Baby Food Market

- Competitive Landscape in Australia Baby Food Market

- Australia Baby Food Market Future Projections, 2018-2023E

- Analyst Recommendations in Australia Baby Food Market

Products

Key Target Audience

Baby Food Manufacturers

Baby Food Distributors

Government Agencies

Baby Food Store Retailing

NGO's Supporting Baby Food and Care

Pharmaceutical Stores

Online Sales and Retailing Agencies

Time Period Captured in the Report:

Historical Period: 2013-2018

Forecast Period: 2019-2023

Companies

Companies Covered:

Nestle SA

Danone Group

Kraft Heinz Co.

Aspen Pharmacare (Pty) Ltd.

Bellamy's Australia Ltd.

A2 Milk Co.

Bubs Australia Ltd.

Table of Contents

1. Executive Summary

1.1. Australia Baby Food Market Size, 2013-18

1.2. Australia Baby Food Market Segmentation

1.3. Competition Scenario in Australia Baby Food Market

1.4. Australia Baby Food Market Future Projections

2. Research Methodology

2.1. Market Definitions

2.2. Abbreviations

2.3. Market Size and Modeling

2.3.1. Consolidated Research Approach

2.3.2. Market Sizing – Australia Baby Food Market

2.3.3. Variables (Independent)

2.3.4. Multi Factor Based Sensitivity Model

2.3.5. Regression Matrix

2.3.6. Limitations

2.3.7. Final Conclusion

3. Stakeholders in the Australia Baby Food Market

4. Australia Baby Food Market Overview and Genesis

5. Value Chain Analysis in Australia Baby Food Market

6. Australia Baby Food Market Size, 2013-2018

7. Australia Baby Food Market Segmentation, 2013-2018

7.1. By Food Category (Milk Formula, Dried Baby Food, Prepared Baby Food, and Other Baby food), 2013- 2018

7.1.1. Milk Formula By Type (Standard, Follow-On, Growing-Up, and Special Baby Milk Formula), 2013-2018

7.2. By Age group (0-6 Months, 6-12 Months, 12+ Months), 2018

7.3. By Inorganic and Organic Baby Food, 2018

7.4. By Region (New South Wales, Victoria, Queensland, South Australia, Western Australia, Tasmania, Australian Capital Territory, Northern Territory), 2018

7.5. By Distribution Channel (Supermarkets, Health and Pharmacy Retailers, Online Retailing, Discounters, Other Foods Non Grocery Specialists, Convenience Stores And Forecourt Retailers), 2013-2018

8. Trends and Developments in the Australia Baby Food Market

8.1. Preference to the organic baby food

8.2. Mergers and Acquistions

8.3. Increase in Urbanization

8.4. Emerging Diagou Trend

9. Issues and Challenges in the Australia Baby Food Market

9.1. Stringent MAIF Agreement

9.2. Highly Sensitive to Market Rumors

9.3. Stringent Government and Internationa Regulations

10. Decision Making Criteria For Consumers in Baby Food Market

11. Government Regulations for Doing Business

11.1. Australia New Zealand Food Standards Code- Standard 2.9.1

11.2. World Health organization (WHO) Code

11.3. Guidelines for labelling of baby food

11.4. Guidelines for composition of baby food

11.5. Guidelines for speciality milk fomula

12. SWOT Analysis

13. Competitive Landscape In the Australia Baby Food Market

13.1. Market Share of Major Players

13.2. Company Profiles

13.2.1. Nestle

13.2.2. Danone Group

13.2.3. Aspen Pharmacare (Pty) Ltd

13.2.4. Kraft Heinz

13.2.5. Bellamy’s Australia ltd.

13.2.6. A2 Milk co.

13.2.7. Bubs Australia Ltd.

13.3. Other Companies (Wattle Health Australia Ltd., Blackmores Infant Formula, PZ Cussons Plc And Others) Operating In Australia Baby Food Market

14. Australia Baby Food Market Future Projections, 2018-2023E

14.1. By Food Categories (Milk Formula, Dried Baby Food, Prepared Baby Food and Other Baby Food), 2018-2023E

14.2. By Type of Milk Formula (Growing-up Milk Formula, Follow-on Milk Formula, Standard Milk Powdered Formula and Special Baby Milk Formula), 2018-2023E

14.3. By Age Group (0-6 Months, 6-12 Months and 12+ Months), 2018- 2023E

14.4. By Nature (Inorganic and Organic Baby Food), 2018- 2023E

14.5. By Channel of Distribution (Hypermarkets, Supermarkets, Independent Small Grocers, Health and PharmacyRetailers, Other Foods Non Grocery Specialists, Internet Retailing), 2018-2023E

15. Analyst Recommendations in Australia Baby Food Market

Disclaimer Contact UsWhy Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.