Restaurant Industry in Istanbul Outlook to 2025

Driven by changing consumer behavior and rebound in tourism activity

Region:Europe

Author(s):Lakshay Aggarwal, Angshuman Dutta

Product Code:KR1115

January 2022

72

About the Report

The report provides a comprehensive analysis of the potential of Restaurant Industry in Istanbul. The report covers an overview and genesis of the industry, market size in terms of revenue generated.

The report has market segmentation which include segments by categories of restaurant and by type of visitors; growth enablers and drivers; challenges and bottlenecks; trends driving adoption trends; regulatory framework; end-user analysis, industry analysis, competitive landscape including competition scenario and market shares of major players. The report concludes with future market projections of each market segmentation and analyst recommendations.

Market Overview:

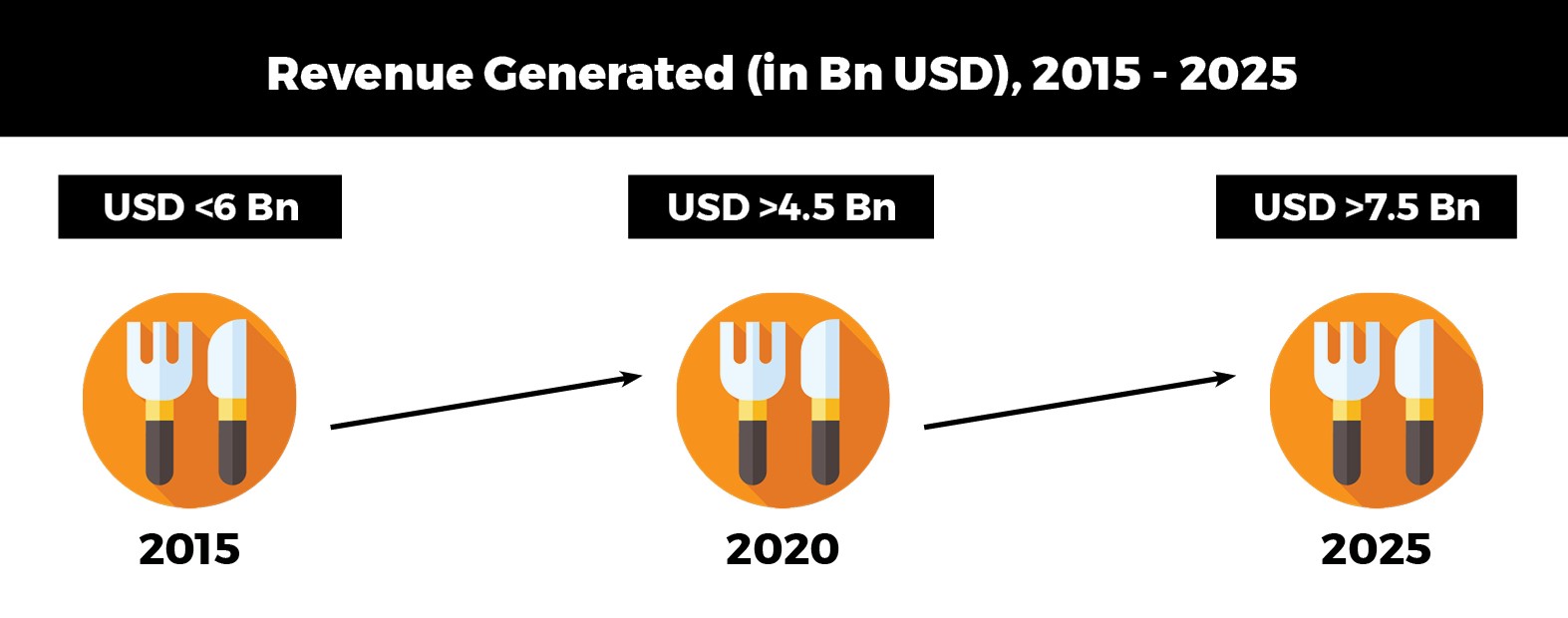

According to Ken Research estimates, the Market Size of Istanbul Restaurant has shown increasing trend. Istanbul is the most-preferred destination for restaurant customers across Turkey followed by Ankara, Izmir, Bursa, Antalya and others. Being economically prosperous, Istanbul also attracts high domestic tourists & internally migrating population.

- New entrants are leveraging unique propositions to gain market share. While Fuudy focuses on food delivery from exclusive restaurants, Tikla Gelsin aggregates order from QSRs only.

- Future looks bright with increasing adoption of food delivery services, expected growth of 2x by 2025.

- Restaurants also changed their perspective & partnered increasingly with online food delivery platforms.

Key Trends by Market Segment:

By Categories: QSR category has highest number of outlets and also fetch higher weekly footfalls – posing as leader in restaurant industry.

By Type of Visitors: Domestic population has the higher share in visitor type as they live in country permanently.

Competitive Landscape:

Future Outlook:

Market Size of Istanbul Restaurant is expected to show increasing trend from 2021 to 2025. This is owing to partnering with food aggregator platforms, rising tourism, rise of e-service channels and government support. Pandemic linked restrictions boosted adoption of e-channels of food & grocery ordering & delivery among urban population, expected to grow 10-15x by 2030.

Scope of the Report

|

Istanbul Restaurant Market Segmentation |

|

|

By Categories |

QSRs Casual Dining Fine Dining Hotel Based Cuisine Specific Night Clubs Shisha Lounges Coffee - Shops Patisserie &Dessert Parlors Middle Eastern Cuisine Restaurants |

|

By Type of Visitors |

Domestic Population Foreign Visitors |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

- Restaurants and Hotel Chains

- Food Aggregators

- Catering Companies

- Real Estate Companies

- Potential Market Entrants

Time Period Captured in the Report:

- Historical Period: 2015-2020

- Base Year: 2020

- Forecast Period: 2020-2025

Companies

Major Players Mentioned in the Report:

Quick Service Restaurants

- McDonald's

- Burger King

- Sbarro Pizzeria

- KFC

- Popeye's

- Simit Sarayi

- Karafirin

- Panista (Komsufirin)

- Pasa Doner

- Usta Donerci

Casual Dining Restaurants

- Big Chefs

- Midpoint

- Happy Moon's

- Sazeli

- Gunaydin

- Cookshop

- Mado

- Emirgan Sutis

- Ozsut

- Kofteci Ramiz

Fine Dining Restaurants

- Zuma

- Paper Moon

- Nusr-et

- Da Mario

- Nobu

- Vogue

- Spago

- 360

- Sunset Grill & Bar

- Lacivert

Hotel Based Restaurants

- 16 Roof, Swissotel

- Mikla

- Spago

- Tugra

- Shang Palace

- Toro

- Novikov

Shisha Lounges

- Huqqa

- PS Lounge

- Ajjna

- Lulu

- Ali Baba Nargile

- Azure The Bosphorus

Middle Eastern Cuisine Restaurants

- Tahin

- Hatay Medeniyetler Sofrası

- Buuzecedi

- Arada Beyrut Cafe

- Al Hallab

- Arada Endulus

- Nomads

Night Clubs

- Sortie

- 360

- Klein

- Ulus 29

- Oligark

- Masquarade

Coffee-Shops

- Espresso Lab

- Viyana Kahvesi

- Petra

- Kronotrop

- Kahve Dunyasi

- Cup of Joy

- Coffee Department

- Ministry of Coffee

- Walter's Coffee

- Coffeetopia

Patisserie & Desert Parlours

- Vakko

- Baylan

- Mendel's

- Maia

- Divan

- Pelit

- Asuman

Table of Contents

1. Executive Summary

2. Socio-Demographic and Economic Outlook of Turkey

2.1. Socio-Demographic Indicators of Turkey

2.2. Trends of High Internal Migration and Domestic Tourism

2.3. Economic Analysis of Turkey

2.4. Economic Outlook of Turkey (2020, 2025, 2030)

3. Overview of F&B Industry in Turkey

3.1. Industry Ecosystem

3.2. Market size and Trends in F&B Industry of Turkey

3.3. Import-Export Scenario of F&B Industry

3.4. Import-Export Scenario of Top F&B Commodities

4. Snapshot on Online Food Delivery Platforms in Turkey

4.1. Overview and Market Size of Online Food Delivery Platforms in Turkey

4.2. Company Profiles of Major players (Yemeksepeti, Getir Yemek, Fuudy, Tikla Gelsin)

5. Overview of Restaurants Industry in Turkey

5.1. Market Size of Restaurants Industry and HORECA Ecosystem, 2016-2021

5.2. Challenges and Turnaround Measures of Industry

5.3. Province Wise Population, Arrival of Foreign Visitors and Contribution to Restaurants Industry in Turkey, 2021

6. Istanbul – Largest City in Turkey – Home to 15 Mn+ People

6.1. Socio-Demographic Outlook of Istanbul – Domestic Population

6.2. Other Customer Cohorts in Istanbul

6.3. Foreign Tourists and Country of Origin in Istanbul

6.4. Location advantage of Istanbul

6.5. Major District Clusters of Customers

6.6. Supply Side Indicators and Market Size of Restaurants Industry in Istanbul, 2016-2021

7. District Analysis of Istanbul

7.1. Top 10 Districts with Population, Population Density, Foreign Visitors

7.2. Comparison of Top 10 districts on Customer Cohort Indicators (Domestic Demographics and Foreign Tourist Arrival)

7.3. Comparison of Top 10 Districts on Location, Ecosystem Supportiveness & Business Opex

8. Analysis of Categories of Restaurants in Istanbul

8.1. Competing Parameters and Key Findings from Categories of Restaurants on the Basis of Operational Parameters

8.2. Segmentation Insights of Franchise and Non-Franchise Outlets

9. Analysis of Quick Service Restaurants

9.1. Sample Composition of Study and Key Neighborhood Areas

9.2. Cross-Comparison Basis Business and HR Related Parameters

9.3. Cross-Comparison Basis Operational and Financial Parameters

9.4. Cross-Comparison Basis Analysis of Key Operational Metrics

9.5. Case Study and Field Visit Insights of Usta Donerci

10. Analysis of Casual Dining Restaurants

10.1. Sample Composition of Study and Key Neighborhood Areas

10.2. Cross-Comparison Basis Business and HR Related Parameters

10.3. Cross-Comparison Basis Operational and Financial Parameters

10.4. Cross-Comparison Basis Analysis of Key Operational Metrics

10.5. Case Study and Field Visit Insights of Sazeli (Florya)

11. Analysis of Fine Dining Restaurants

11.1. Sample Composition of Study and Key Neighborhood Areas

11.2. Cross-Comparison Basis Business and HR Related Parameters

11.3. Cross-Comparison Basis Operational and Financial Parameters

11.4. Cross-Comparison Basis analysis of Key Operational Metrics

11.5. Case Study and Field Visit Insights of Zuma Restaurants

12. Analysis of Hotel-Based Restaurants

12.1. Sample Composition of Study and Key Neighborhood Areas

12.2. Cross-Comparison Basis Business and HR Related Parameters

12.3. Cross-Comparison Basis Operational and Financial Parameters

12.4. Cross-Comparison Basis Analysis of Key Operational Metrics

13. Analysis of Shisha Lounges

13.1. Sample Composition of Study and Key Neighborhood Areas

13.2. Cross-Comparison Basis Business and HR Related Parameters

13.3. Cross-Comparison Basis Operational and Financial Parameters

13.4. Cross-Comparison Basis Analysis of Key Operational Metrics

13.5. Case Study and Field Visit Insights of Ajjna Lounge

14. Analysis of Cuisine Specific Restaurants

14.1. Cross-Comparison Basis Business and HR Related Parameters

14.2. Cross-Comparison Basis Operational and Financial Parameters

15. Analysis of Nightclubs

15.1. Cross-Comparison Basis Business and HR Related Parameters

15.2. Cross-Comparison Basis Operational and Financial Parameters

16. Analysis of Coffee Shops

16.1. Sample Composition of Study and Key Neighborhood Areas

16.2. Cross-Comparison Basis Business and HR Related Parameters

16.3. Cross-Comparison Basis Operational and Financial Parameters

16.4. Cross-Comparison Basis Analysis of Key Operational Metrics

16.5. Case Study and Field Visit Insights of Walter’s Coffee and Espresso Lab

17. Analysis of Patisserie and Dessert Parlors

17.1. Sample Composition of Study and Key Neighborhood Areas

17.2. Cross-Comparison Basis Business and HR Related Parameters

17.3. Cross-Comparison Basis Operational and Financial Parameters

17.4. Cross-Comparison Basis Analysis of Key Operational Metrics

17.5. Case Study and Field Visit Insights of Baylan

18. Business Environment in Turkey

18.1. Ease of Doing Business Findings

18.2. Process to start Restaurant Business in Turkey

18.3. Direct, Indirect Taxation and Corporate Factors

18.4. Commonly Followed Malpractices in Restaurants Industry of Istanbul

19. Impact of COVID-19 on Restaurants Industry

19.1. COVID-19 Cases and Corresponding Arrival of Foreign Visitors

19.2. Type of Restrictions on Restaurants and Tourists

19.3. Live examples of Multiple Restaurants – Impact of COVID-19

19.4. Assessment of Overall Impact

20. Future Outlook of Industry

20.1. Future Outlook of Restaurants Industry in Istanbul and F&B Industry in Turkey, 2025

20.2. Future Plans of Select Restaurants and Industry Trends

20.3. Future Outlook and Industry Segmentation, 2025

21. Analyst Recommendations

21.1. Analysis of Top 10 Districts and Key Recommended Neighborhoods

21.2. Neighborhood Analysis – Besiktas, Beyoglu, Fatih, Sariyer, Sisli

21.3. Must Have’s and Marketing Strategies

21.4. Risk Factors Governing Restaurants Industry

22. Appendix

23. Research Methodology

24. Disclaimer

25. Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on restaurants over the years, penetration of marketplaces and service providers ratio to compute revenue generated for restaurants. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research output:

Our team will approach multiple restaurants, QSRs and Fine Dine Restaurants and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from restaurant owners._64a3ef3f4d2e6.jpg)

Frequently Asked Questions

01 What is the Study Period of this Market Report?

The Istanbul Restaurant Market is covered from 2015–2025 in this report, including a forecast for 2020-2025.

02 What are the Key Factors Driving the Istanbul Restaurant Market?

Partnering with Food Aggregator Platforms, Rising Tourism, Rise of E-service Channels and Government Support are likely to fuel the growth in the Istanbul Restaurant Market.

03 Which is the Largest Restaurant Category Type Segment within the Istanbul Restaurant Market?

The QSRs Category type segment held the largest share of the Istanbul Restaurant Market in 2020.

04 Who are the Key Players in the Istanbul Restaurant Market?

Burger King, Zuma, Cup of Joy, Stregis and Asuman.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.