Australia Dental Services Market Outlook to 2022

By Payer (Individual, Government, Private Health Insurance and Others), by Service (Restorative, Preventive & Diagnostic, Endodontic, Prosthodontics, Oral Surgery and Others), by Organized Dental Chains and Standalone Dental Clinics

Region:Asia

Product Code:KR606

March 2018

84

About the Report

Australia Dental Services Market Segmentation

By Payer: Individual or out-of-pocket expenditure on dental services comprised for a large part of revenues for overall Australia dental services market in FY'2017. Majority of dental establishments in Australia are privately operated and private health insurance funds only partly covers for dental care treatment costs. Out-of-pocket expenditure accounted for ~% market share in FY'2017, in terms of revenue. Government expenditure, private health insurance funds and others comprised for ~%, ~% and ~% market share in FY'2017, respectively.

By Services: Most dental visits by Australians, post regular check-up, were for restoration services. The need for restorative dental treatment has increased due to large number of people willing to retain their natural teeth and a breakdown of restorations in existing filling and restorations. Increased spending on aesthetic appearance also aided in market growth of restorative services. As of FY'2017, restorative services comprised for ~% market share in the overall dental services market, in terms of revenue. Preventive and diagnostic services, Endodontics, Prosthodontics, Oral surgery and all other services comprised for market share of ~%, ~%, ~%, ~% and ~% respectively in FY'2017.

By States: Victoria and New South Wales are biggest market both in terms of revenue and supply of doctors, dental clinics. Victoria and New South Wales comprised for ~% and ~% market share in FY'2017, driven by presence of two most populated cities- Melbourne and Sydney in respective states. Queensland, Western Australia, South Australia, Australian Capital Territory, Tasmania and Northern Territory comprised for market share of ~%, ~%, ~%, ~%, ~% and ~% respectively in FY'2017.

Market Competition: The dental services market is highly fragmented with majority of providers operating from small scale single locations, although corporate activity in the sector is increasing. The market is in mid-late growth stage, recording low single digit growth year-on-year. However, organized dental clinics have grown at a health rate in the last decade by expanding their clinics network through acquisitions or organic growth.

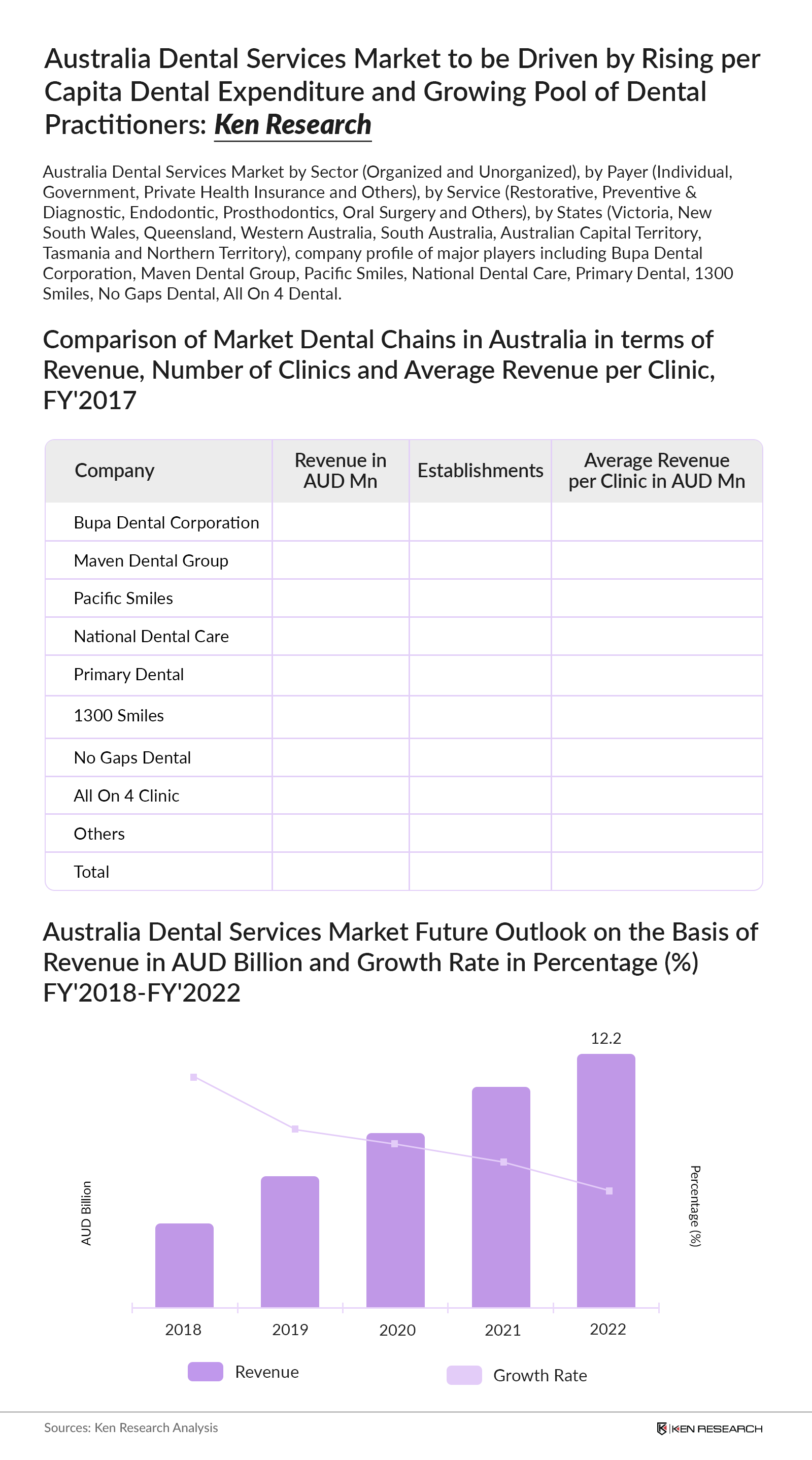

Bupa Dental Corporation is the largest dental chain operating in the country with around ~ establishments and comprised for around ~% market share in the organized dental care market in FY'2017, in terms of revenue. Maven Dental Group, Pacific Smiles and National Dental Care are other prominent players in the space which accounted for ~%, ~% and ~% market share in FY'2017, respectively. Other major dental chains operating in this sector included Primary Dental, 1300 Smiles, No Gaps Dental and All On 4 Dental which accounted for ~%, ~%, ~% and ~% market share respectively. All other organized dental chains comprised for the remaining ~% market share in FY'2017.

Australia Dental Services Market Future Outlook and Projections: Australia's ageing population, growing dental health awareness, inclining patient fee for dental services, rising out-of-pocket and private health insurance expenditure are likely to drive the market growth in the mid-long term. Growing private health insurance coverage would largely stimulate market growth going forward as patients would be willing to visit dental clinics on a more frequently and undergo expensive procedures as part of it is funded by insurance funds. The number of registered dental practitioners is anticipated to rise over ~ by 2022 from current ~. On the other hand, the number of dental establishments is expected to exceed over ~ by 2022 from ~ in 2017. Overall, the dental services market in Australia is expected to grow steadily at a CAGR of ~% during FY'2017-FY'2022 from AUD ~ Million in FY'2018 to AUD ~ Million by FY'2022.

Key Topics Covered in the Report:

- Australia Dental Services Market Size by Revenue

- Australia Dental Services Market Segmentation by Organized and Unorganized Sector, By Payer, By Services, By States, FY'2012-FY'2017

- Trends and Developments in Australia Dental Services Market

- Market Share of Major Players in Australia Dental Services Market

- Company Profiles of Major Players

- Snapshot on Dental Insurance Providers in Australia

- Snapshot on Australia Dental Tourism Sector

- Snapshot on Australia Dental Equipments and Consumables Market

- SWOT Analysis of Australia Dental Services Market

- Investment Model for Setting up a Dental Clinic

- Future Outlook for Australia Dental Services Market

- Analyst Recommendations

Products

Companies

Bupa Dental Corporation,

Maven Dental Group,

Pacific Smiles,

National Dental Care,

Primary Dental,

1300 Smiles,

No Gaps Dental,

All On 4 Dental.

Table of Contents

1. Executive Summary

Australia Dental Services Market Size

Australia Dental Services Market Segmentation

Market Competition

Australia Dental Tourism

Australia Dental Services Market Future Outlook

2. Research Methodology

2.1. Market Definition

2.2. Abbreviations

2.3. Market Sizing and Modeling

Research Methodology

Approach - Market Sizing

Variables (Dependent and Independent)

Multi Factor Based Sensitivity Model

Regression Matrix

Limitations

Final Conclusion

3. Australia Dental Services Market Ecosystem and Value Chain

4. Australia Dental Services Market Overview and Size, FY’2012-FY’2017

By Revenue and Per Capita Dental Expenditure

By Number of Session

By Average Revenue per Dental Clinic

By Number of Dentist and Dental Clinics

5. Australia Dental Services Market Segmentation

5.1. By Organized and Unorganized Clinics, FY’2017

5.2. By Payer (Individual, Government, Private Health Insurance Fund, Others), FY’2012-FY’2017

5.3. By Restorative, Preventive and Diagnostics, Endodontics, Prosthodontics, Oral Surgery and Others, FY’2012-FY’2017

5.4. By States wise - Revenue by Payer, Dental Clinics and Type of Dentist Practitioners, FY’2017

6. Trends, Developments and Restraints in Australia Dental Services Market

7. Snapshot on Dental Insurance Providers in Australia

8. SWOT Analysis of Australia Dental Services Market

9. Decision Making Parameters to Choose a Dental Clinic

10. Government Regulations for Australia Dental Services Market

11. Australia Dental Tourism Sector

12. Snapshot on Australia Dental Equipment and Consumables Market

Market Overview

Competition Scenario

Decision Makers

Import Regulations

Distribution Cluster

Future Drivers and Opportunities

13. Investment Model for Setting up a Dental Clinic

14. Market Share of Major Players, FY’2017

15. Company Profiles

15.1. Bupa Dental Corporation

15.2. Maven Dental Group

15.3. Pacific Smiles Group

15.4. National Dental Care

15.5. Primary Dental

15.6. 1300 Smiles Limited

15.7. No Gaps Dental

15.8. All On 4

Other Organized Dental chains

16. Australia Dental Services Market Future Outlook and Projections

16.1. By Organized and Unorganized Sector, FY’2022

16.2. By Services (Restorative, Preventive and Diagnostics, Endodontics, Prosthodontics, Oral Surgery and Others), FY’2022

17. Analyst Recommendations

Disclaimer Contact UsWhy Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.