South Africa Fitness Service Market Outlook to 2023

Bay Market Structure (Organized and Unorganized), By Revenue Streams (Membership Fee and Personal Training), by Membership Subscription Package (1 Month, 3 Months, 6 Months & 12 Months), by Provinces and by Gender

Region:Africa

Author(s):Pritha Koley

Product Code:KR838

July 2019

200

About the Report

The report titled "South Africa Fitness Service Market Outlook to 2023 - By Market Structure (Organized and Unorganized), By Revenue Streams (Membership Fee and Personal Training), by Membership Subscription Package (1 Month, 3 Months, 6 Months & 12 Months), by Provinces and by Gender" provides a comprehensive analysis of fitness services market of South Africa. The report covers the market overview, business cycle, ecosystem, emerging growth drivers and trends; issues and challenges; customer pain points and decision making parameters, competitive landscape of players in the organized sector and government regulations. The report concludes with the market projection and analysis recommendations highlighting the major opportunities and cautions.

Market Overview

Market Overview

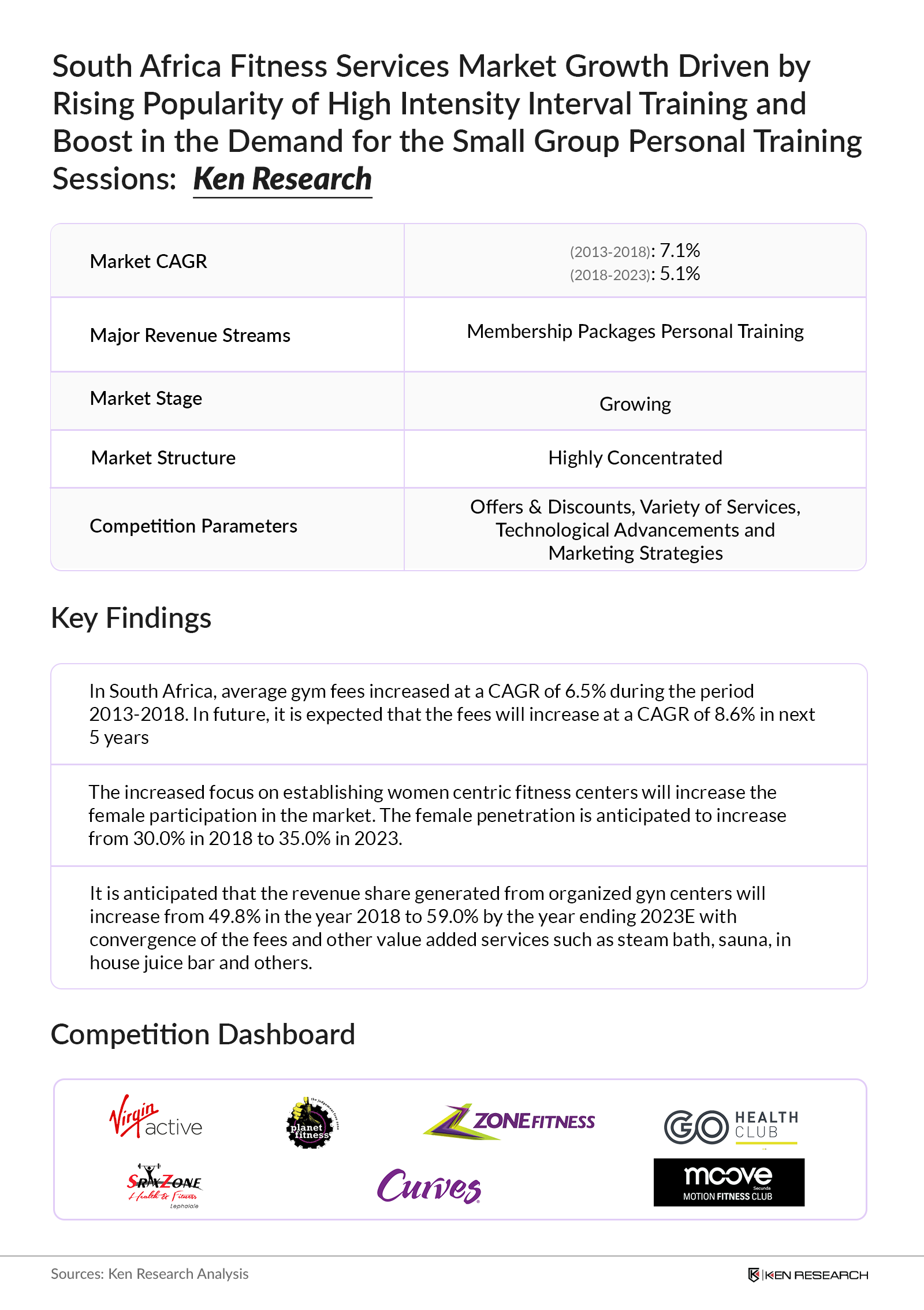

The fitness services market has experienced a positive single-digit CAGR from 2013 to 2018. South Africa Fitness Service Market is at the growth stage witnessing a cut-throat competition amongst players in the unorganized & organized sectors. Due to the prevalence of few health problems including diabetes, obesity, hypertension, cholesterol, and others in South Africa, there has been an increased demand for fitness services as people have become more health-conscious and aware. The prevalence of obesity was observed to be higher in the urban regions as compared to the rural regions in South Africa due to the higher consumption of junk food. The need for fitness services providers is required more in areas such as Gauteng, KwaZulu-Natal, and other urban areas.

In South Africa, the consumers spending witnessed a decline in 2017 due to the recession in the country. The fitness service market is still expected to recover in the next 5 years with expected slow revenue growth by 2023.

Market Segmentation

By Market Structure: The organized fitness centers dominated the fitness industry in South Africa in terms of revenue and number of subscribers in 2018. Organized chains such as Virgin Active, Planet Fitness, and Zone Fitness have dominated the market in terms of revenue generation in 2018. The unorganized centers have been in a better position to enter the fitness industry due to reasonably priced membership plans and easier to set up an unorganized fitness center as compared to the organized ones.

By Revenue Streams: In South Africa, the major portion of the revenue is generated from the Gym membership. The Gym Membership segment dominated the fitness market due to the availability of premium and diverse services, such as Yoga, High-Intensity Interval Training, Swimming pool, sauna, steam, and many others, at affordable membership packages. Personal Training accounted for a small revenue in the South Africa Fitness Services Market.

By Membership Subscription (1 Month, 3 Months, 6 Months and 12 Months): The annual membership packages are the major revenue-generating streams as the customers find the annual membership packages more pocket-friendly as compared to the other membership packages. The second major revenue-generating stream is the 6 months membership package, which is followed by 3 months. The 1-month membership packages are expensive as compared to the other packages due to which clients tend to opt for these packages less often.

By Provinces: In South Africa, the majority of the fitness centers have been registered in Gauteng province. This province is followed by KwaZulu-Natal which has the second-highest number of fitness centers in the country. The least number of fitness centers have been registered in the province Free State and Northern Cape.

By Gender: The market for fitness services in South Africa has been driven slightly more by the male population. The female penetration in the fitness industry is low due to lack of female-specific fitness centers in South Africa. The rise in disposable income of working mothers will give them the motivation to join fitness gyms which will result in a rise in female membership subscriptions and will drive the share of female membership in the future.

Competitive Landscape

The competition in the South African fitness industry is highly concentrated in terms of revenue generated and membership subscriptions, with the top 10 major fitness services players capturing the major portion of the market share in 2018. The major parameters on the basis of which the players in the market compete include technological advancement and equipment, variety in services and facilities offered, experienced and qualified fitness personnel, membership packages in terms of different durations and prices, offers and discounts, marketing strategies, personal training services and timings of classes. Major players operating in the market include Virgin Active, Planet Fitness, Zone Fitness, Curves Fitness, Gym Company, Bodytec, Go Health Gym, Viva Gym, Motion Fitness, Moove Motion Fitness and others.

South Africa Fitness Services Market Future Outlook and Projections

In the long run, it has been anticipated that the South Africa Fitness Service market would register a slow growth at a single-digit CAGR during the period 2018 to 2023. The growth would be slow in the next five years due to a recession and low economic conditions of the consumers. Growth during this period is expected to be supported by the increase in the number of fitness centers in the untapped regions, growth in consumer spending, increase in population under the age bracket 15 - 44 years and boost in the personal training services offered by the fitness service centers in the market.

Key Topics Covered in the Report

- South Africa Fitness Service Market Size

- South Africa Fitness Service Market Genesis

- South Africa Fitness Service Market Ecosystem

- South Africa Fitness Service Market Segmentations

- SWOT Analysis of South Africa Fitness Service Market

- Trends and Development in South Africa Fitness Service Market

- Issues and Challenges in South Africa Fitness Service Market

- South Africa Fitness Service Market Investment Model

- Regulatory Framework in South Africa Fitness Services Market

- Competitive Landscape in South Africa Fitness Service Market

- Competitive Scenario in South Africa Fitness Service Market

- Profiles of Major Fitness Clubs in South Africa Fitness Service Market

- Customer Decision Making Parameters

- Pain Points of Customers

- Strengths and Weaknesses of Major Players

- Snapshot on South Africa Personal Training Market

- Snapshot of South Africa Yoga Market

- Case Study of Virgin Active

- South Africa Fitness Service Market Future Outlook and Projections, 2018-2023E

- South Africa Fitness Service Future Market Segmentation, 2018-2023E

- Analyst Recommendation in South Africa Service Fitness Market

Products

Key Target Audience

- Organized and Unorganized Fitness Centres

- Fitness Equipment Manufacturers

- Sports Authority

- Private Equity Firm

- Fitness Training and Trainers Associations

Time Period Captured in the Report:

- Historical Period: 2013-2018

- Forecast Period: 2019E - 2023E

Companies

Key Segments Covered

By Market Structure (On the basis of Revenue, Number of Members, Number of Gyms Centers)

- Organized

- Unorganized

By Revenue Streams

- Membership Fees

- Personal Training Fees

By Membership Subscription Packages (On the basis of Revenue, Number of Members)

- 1 Month

- 3 Months

- 6 Months

- 12 Months

By Provinces (On the basis of Number of Gyms)

- Gauteng

- KwaZulu-Natal

- Western Cape

- North West

- Mpumalanga

- Eastern Cape

- Limpopo

- Free State

- Northern Cape

By Gender (on the basis of Revenue and Number of Members)

- Male

- Female

Major Fitness Centres Covered:

- Virgin Active

- Planet Fitness

- Zone Fitness

- Gym Company

- Viva Gym

- Moove Motion Fitness

- Motion Fitness

- Go Health Gym

- Ignite Fitness

- Dream Body Fitness

- Family Fitness

- BUC Personal Fitness Studio

- Body Classique

- Better Bodies Gym

- Bodytec

- Sweat 1000

- Roarks Gym

- F45 Training

- Bold

- Srix Zone

- and others

Table of Contents

1. Executive Summary

2. Research Methodology

2.1. Market Definitions

2.2. Abbreviations

2.3. Market Sizing and Modeling

consolidated approrach -Market Sizing

Market Sizing – South Africa Fitness Service Market

Variables (Dependent and Independent)

Multifactor Based Sensitivity Model

Regression Matrix

Limitations

Final Conclusion

3. Economy Analysis, 2013 – 2023E

3.1. Cause and Effect Relationship

4. South Africa Fitness Service Market Introduction and Evolution

4.1. South Africa Fitness Service Market Overview and Genesis

4.2. South Africa Fitness Service Market Supply Side Evolution

4.3. South Africa Fitness Service Market Demand Side Evolution

5. South Africa Fitness Service Market Ecosystem

6. South Africa Fitness Service Market Size (by Revenue, by Membership and by Number of Fitness Centers), 2013– 2018

Total Addressable Market and Penetration Rate for South Africa Fitness Service Market, 2013-2018

7. South Africa Fitness Service Market Segmentation, 2018

7.1. By Major Revenue Streams (Gym Membership and Personal Training), 2018

7.1.1. Market Segmentation by Revenue Stream (Gym Membership Revenue and PT Revenue) By Market

Structure (Organized and Unorganized), 2018

7.2. By Provinces (Gauteng, KwaZulu-Natal, Western Cape, North West, Mpumalanga, Eastern Cape,

Limpopo, Free State, Northern Cape), 2018

7.3. Rental Rates by Region, 2018

7.4. By Membership Subscription (1 month, 3 months, 6 months and 1 year), 2018

7.4.1. By Membership Subscription On the Basis of Market Structure (Organized and Unorganized),

2018

7.5. By Gender Composition (Male and Female), 2018

7.6. By Market Structure (Organized and Unorganized), 2018

7.6.1. On the Basis of Number of Centers, Number of Members and Revenue Generated, 2018

8. South Africa Fitness Service Market Growth Drivers and Trends

8.1. Trends and Recent Developments

Outdoor Fitness Programme

Body Weight and Strength Training Exercises

Fitness Snacking

Digital Fitness Training

Group Training

Workplace Fitness Promotion

Wearable Technology

8.2. Growth Drivers

Increase in Lifestyle Diseases

Tie-Ups and Partnerships with Medical Aid Companies

Government initiatives to promote healthy lifestyles

Expanding Disposable Income

Boost in Personal Trainer requirement

Availability of Additional Facilities

Growth in Organized Gym Chains

Focus on Establishing Female-Specific Fitness Centers

Investing In Building Customer Awareness And Trust

Growing Trend Of Corporate Fitness Programs

Change in Consumer Behavior Spurred by Change in Demographics

9. Issues and Challenges in South Africa Fitness Service Market

Low Conversion Rates

Member Retention

Subsidized Membership Packages of the Top Major Players

Scalability

Lack of Availability of Trained and Experienced Personnel

Expensive Maintenance

Technological Advancements

Stiff Competition from Unorganized Players

High Cost of Establishment

Low Focus on the Sub-Urban Areas

High Cost of Marketing

10. South Africa Fitness Service Market Investment Model

10.1. Introduction

10.2. Assumptions Considered

10.3. Fixed Investment

10.4. Sources Of Finance

10.5. Variable Cost

10.6. Profitability

11. Regulatory Framework in South Africa Fitness Services Market

12. Customer Profiling-South Africa Fitness Service Market

12.1. Customer Decision Making Parameters, 2018

12.2. Pain Points Of Customers

13. Snapshot on Personal Training Market In South Africa

14. Snapshot on Yoga Market in South Africa, 2018

15. SWOT Analysis in the South Africa Fitness Service Market

16. Competitive Landscape in South Africa Fitness Service Market

16.1. Competition Scenario (Market Nature, Bargaining Power, Entry Barriers, Market Positioning

and Competition Parameters), 2018

Strengths and Weaknesses of Major Players (Virgin Active, Planet Fitness, Zone Fitness, Gym

Company, Viva Fitness, Adventure Boot Camp For Women) in South Africa Fitness Service market

16.2. Market Share of Major Players (Virgin Active, Planet Fitness, Zone Fitness, Curves

Fitness, Gym Company, Bodytec & Others), 2018

16.3. Comparison Matrix in South Africa Fitness Service Market, 2018

16.4. Company Profile Of Major Players In South Africa Fitness Service Market

16.4.1. Virgin Active

16.4.2. Planet Fitness

16.4.3. Zone Fitness

16.4.4. Gym Company

16.4.5. Curves Fitness

16.4.6. BODYTEC

16.4.7. Viva Gym

16.4.8. GO Health Club

16.4.9. Moove Motion Fitness

16.4.10. Dream Body Fitness

16.5. Other Company Profiles of Organized Fitness Market

16.5.1. Body Classique

16.5.2. Motion Fitness

16.5.3. Ignite Fitness

16.5.4. Family Fitness

16.5.5. BUC Personal Fitness Studio

16.5.6. Better Bodies Gym

16.5.7. SWEAT 1000

16.5.8. Roark Gym

16.5.9. F45 Training

16.5.10. Switch Playground

16.5.11. Cape CrossFit

16.5.12. Motley Crew CrossFit

16.5.13. Ritual Gym

16.5.14. Yoga South Africa

16.5.15. Living Yoga

16.5.16. DynamX Ladies Health Studio

16.5.17. Yoga Experience

16.5.18. Adventure Boot Camp for Women

16.5.19. Women in Fitness

16.5.20. ElectroFitness

16.5.21. Shapes For Women

16.6. Other Company Profiles of Unorganized Fitness Market

16.6.1. Bold

16.6.2. Srix Zone

16.6.3. Proactive Fitness Gym

16.6.4. Fast Fitness

16.6.5. BodyMind Fitness

16.6.6. Eden Fitness

17. Case Study- Virgin Active

18. South Africa Fitness Service Market Future Outlook and Projections, 2018E– 2023E

Total Expected Addressable Market and Penetration Rate

18.1. South Africa Fitness Service Future Market Segmentation By Market Structure (Organized

and Unorganized) on the basis of Number of Fitness Centers, 2023E

18.2. South Africa Fitness Service Future Market Segmentation by Gender (Male and Female) on

the Basis of Revenue, 2023E

19. Analyst Recommendations

Disclaimer

Contact Us

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.