Thailand Clinical Laboratory Market Outlook to 2026F

Driven by widening customer base, Government initiatives and increasing corporate requirements for clinical testing

Region:Asia

Author(s):Ms. Grantha Banerjee

Product Code:KR1277

December 2022

87

About the Report

The report provides a comprehensive analysis of the potential of the Clinical Laboratory Market in Thailand. The report covers an overview and genesis of the industry, market size in terms of revenue generated.

The market is segmented by an independent laboratory, by payer, by customers, by type of tests, by type of routine tests, by type of esoteric tests, by region, by type of laboratory in private hospitals; growth enablers and drivers, challenges and bottlenecks, trends; regulatory framework; industry analysis, competitive landscape including competition scenario and market shares of major players. The report concludes with future market projections of each segmentation and analyst recommendations.

Market Overview:

According to Ken Research estimates, the Clinical Laboratory Market – which grew at a CAGR of 9.0% in the period of 2016-2021 – is expected to grow at a CAGR of 9.5% in the forecasted period of 2022F-2026F, owing to the increasing healthcare spending by aging population, expanding healthcare spending by the Government, growth in non-communicable disease and chronic diseases and increasing public awareness.

- The market is led by N Health; having the major share of the Clinical Laboratory Market in Thailand. Other players include Pathlab, Thonburi Clinical Labs, Bangkok Medical Labs, Medical Line Lab, Innotech Laboratories and others.

- Around 60.0% of medical decisions regarding early disease diagnosis, patient prognosis and treatment selection are based on laboratory diagnostic results.

Key Trends by Market Segment:

By Payer: Private health insurance makes up the majority of the revenue sources for laboratories. Private health insurance is an option for expats in Thailand who want a larger variety of coverage or are ineligible for public health insurance. One can receive treatment in any public or private hospital in Thailand if they purchase a private insurance plan.

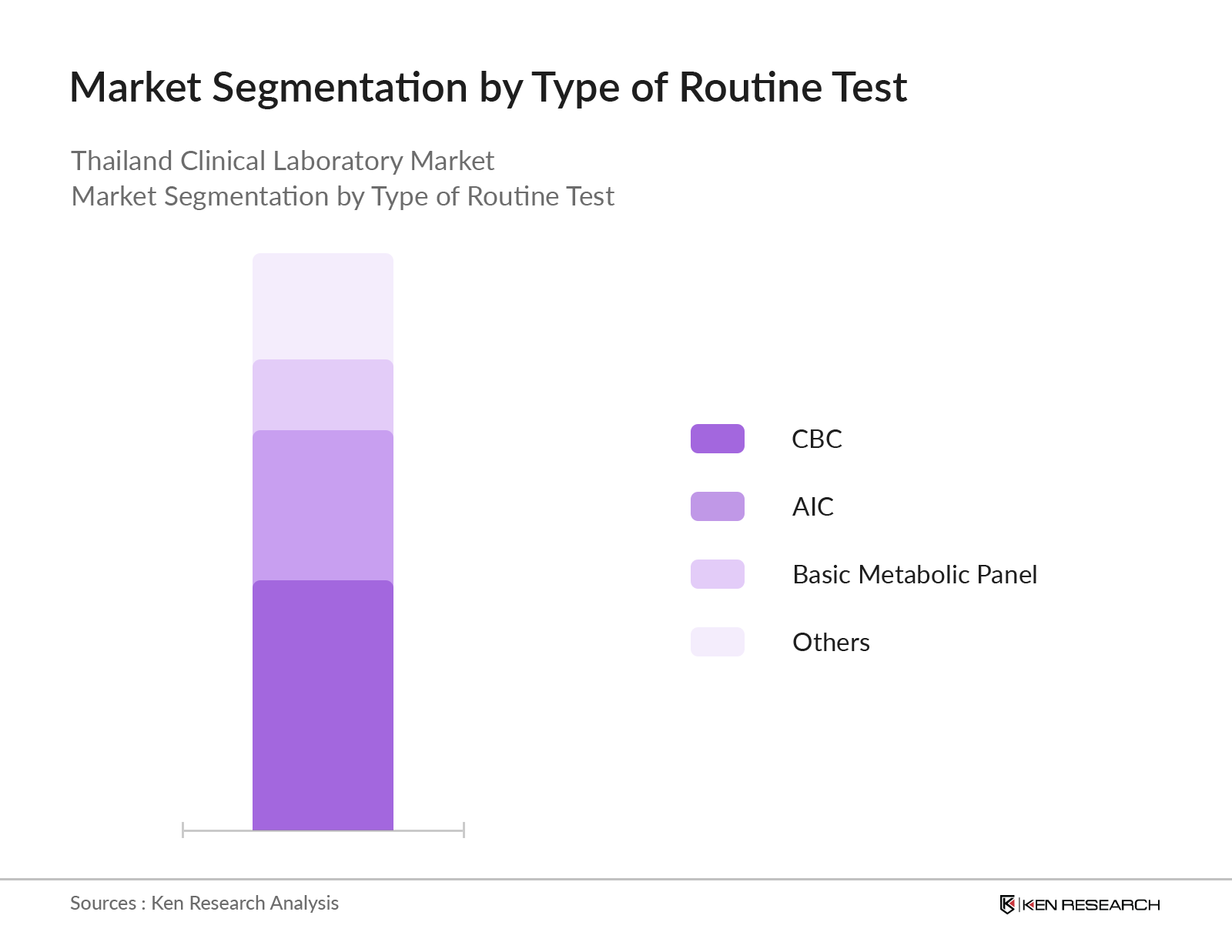

By Type of Routine Test: CBC is the most common routine test performed. The prevalence of numerous infectious diseases is on the rise, which presents a favourable chance for the industry to expand. The need for patient monitoring via blood testing services is growing along with medical tourism. The region's blood-testing sector has benefited from this.

Competitive Landscape

Future Outlook

The Thailand is projected to show a growth of CAGR 9.5% in the forecasted period of 2022F-2026F, owing to the increasing healthcare spending by aging population, expanding healthcare spending by the Government, growth in non-communicable disease and chronic diseases, increasing focus on preventive medicine, rising disposable income resulted in increasing demand for health check-ups, preference for evidence-based treatment and increasing public awareness.

Scope of the Report

|

By Independent Laboratory |

Organized Labs Unorganized Labs |

|

By Payer |

Private Health Insurance Corporates Out of Pocket |

|

By Customers |

Walk-Ins Doctor Referrals Corporate Clients Online Bookings |

|

By Type of Tests |

Routine Esoteric Non-Laboratory |

|

By Type of Routine Tests |

CBC (Complete Blood Count) A1C Basic Metabolic Panel Others |

|

By Type of Esoteric Tests |

Infectious Disease Endocrine Allergic Disease Oncology Others |

|

By Region |

Bangkok Nakhon Ratchasima Samut Prakan Ubon Ratchathani Khon Kaen Others |

|

By Type of Laboratory in Private Hospitals |

In-house Labs Third Party Tie-Ups |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

Clinical Laboratory companies

Organized Clinical Laboratories

Unorganized Clinical Laboratories

Private Hospitals

Private Equity and Venture Capitalist

Industry Associations

Technology providers

Government Bodies & Regulating Authorities

Time Period Captured in the Report

Historical Period: 2016-2021

Base Year: 2021

Forecast Period: 2022F-2026F

Companies

Major Players Mentioned in the Report

Organized Labs

N Health

Pathlab

Thonburi Clinical Labs

Bangkok Medical Labs

BRIA Group

MIC Labs

Unorganized Labs

Medical Line Lab

Innotech Laboratories

Service Co., Ltd.Innolab

Prolab

Pattaya Clinic Laboratory

CCS Medical laboratory

Excellent Pathological

Lab Company Limited

DNA Testing Laboratory Co.,Ltd.

Pathology Diagnostic Center

Ubon Pathology

Rachvipa MRI Company Limited

hi-tech lab

Bangkok Pathology-Lab

Inter-Lab Pathology and Research Center

Table of Contents

1. Executive Summary

1.1 Executive Summary: Thailand Clinical Laboratory Market

2. Country Overview

2.1 Thailand Country Profile, 2021

2.2 Thailand Population Analysis, 2021

3. Overview of Thailand Healthcare Sector

3.1 Thailand Healthcare Overview

3.2 Structure of Thailand Healthcare

3.3 Hospital Statistics of Thailand, 2020

3.4 Thailand Healthcare Spending Details, 2021

3.5 Thailand Medical Tourism Facts

3.6 Health Insurance Policies of Thailand

3.7 Health Metrics and their Scores for Thailand

3.8 Health Infrastructure Gaps in Thailand

4. Overview of Thailand Clinical Laboratory Market

4.1 Snapshot of the Thailand Clinical Laboratory Market, 2021-2026F

4.2 Ecosystem of Major Entities of Thailand Clinical Labs Market

4.3 Business Cycle and Genesis of Thailand Clinical Lab Market

4.4 Timeline of Thailand Clinical Labs Market

4.5 Evolution of Clinical Labs Industry

4.6 Value Chain Analysis in Thailand Clinical Laboratory Market

4.7 Robust Clinical Laboratory Industry

4.8 Hub and Spoke Business Model

5. Thailand Clinical Laboratory Market Sizing

5.1 Thailand Clinical Laboratory Market Size, 2016-2021

5.2 Revenue Split by Type of Labs, 2017-2021

5.3 By Type of Laboratory (Private and Public)

6. Thailand Clinical Laboratory Market Segmentation

6.1 Market Segmentation By Type of Independent Laboratory

6.2 Market Segmentation By Type of By Payer

6.3 Market Segmentation By Type of Customers

6.4 Market Segmentation By Type of Tests

6.5 Market Segmentation By Type of Routine Tests

6.6 Market Segmentation By Type of Esoteric Tests

6.7 Market Segmentation By Region

6.8 Market Segmentation By Type of Laboratory In Private Hospitals

7. End User Analysis

7.1 Customer Analysis of Thailand Clinical Labs Market

7.2 Patient Journey in Clinical Labs

7.3 Pain Points and Solutions in Thailand Clinical Labs Market

7.4 Decision Making Parameters of choosing a Clinical Lab in Thailand

8. Industry Analysis

8.1 SWOT Analysis of Thailand Clinical Lab Market

8.2 Drivers of the Thailand Clinical Laboratory Industry

8.3 Key Challenges of Thailand Clinical Lab Market

8.4 Trends and Development of Thailand Clinical Lab Market

8.5 Technology Upgradation in Clinical Labs Industry

8.6 Stakeholders in Thailand Clinical Labs

8.7 Supportive Government Policies and Schemes

9. Competition Scenario for Thailand Clinical Laboratories Market

9.1 Market Share of Major Organized Clinical Laboratories in Thailand on the Basis of Revenues and Number of Labs, 2021

9.2 Company Profile/Competitive Landscape of Major Organized Diagnostics Labs in Thailand

9.3 Pricing Analysis of Major Players

10. Future Outlook and Projections

10.1 Thailand Clinical Laboratory Market Size, 2022-2026F

10.2 Revenue Split by Type of Labs, 2026F

10.3 By Number of Labs and By Private Hospital Labs, 2026F

10.4 Market Segmentation By Type of Tests, 2026F

10.5 By type of routine Test and By Type of Esoteric Test, 2026F

10.6 By Payers and By number of Tests, 2026F

10.7 By Region, 2026F

10.8 Next Generation Laboratory Technology Trends

11. Impact of COVID-19

11.1 Impact of COVID-19 on Clinical Laboratory Market (Test & Prices) in Thailand

11.2 Response to COVID-19 pandemic

12. Market Opportunities and Analyst Recommendation

12.1Strategies to Tap the Opportunities

12.2 Comprehensive Service Offering with Proposed Marketing Strategy

12.3 Needs and Ways to develop Thailand Clinical Labs Market

12.4 Key Success factor for the Clinical Laboratory Players

12.5 Growth Strategy for the Thailand Clinical Laboratory Industry

13. Research Methodology

13.1Market Definitions, Abbreviations Used, Market Sizing Approach, Primary Research Approach & Entity Analysis, Research Limitations and Future Conclusions

Disclaimer Contact UsResearch Methodology

Step 1:

First framed a hypothesis about the market through analysis of existing industry factors, obtained from company reports and from magazines, journals, online articles, ministries, government associations and data from Department of Health ministry and others. Along with this an ecosystem of the players was created.

Step 2:

Computer assisted telephonic interviews (CATIs with the management to understand their operating and financial indicators including product portfolio, average price of tests by type of tests (Routine, Esoteric and Non Laboratory) specifications of their best-selling tests and other value-adding information

Step 3:

Bottom to Top Approach in order to evaluate the overall market revenue and number of laboratories. It also includes segmentation of market by independent Labs, payer, type of customers, region, type of tests, number of tests. Revenue was evaluated by summing up the demand of different types of tests.

Step 4:

Sanity Checking from Industry Veterans and Professionals.

.jpg)

Frequently Asked Questions

01 What is the Study Period of this Market Report?

The Thailand Clinical Laboratory Market is covered from 2016–2026F in this report, including a forecast for 2022F-2026F.

02 What are the Key Factors Driving the Thailand Clinical Laboratory Market?

Increasing healthcare spending by aging population, expanding healthcare spending by the Government, growth in non-communicable disease and chronic diseases, and increasing public awareness.

03 What was the growth rate of Thailand Clinical Laboratory Market in the period of 2016-2021?

The Thailand Clinical Laboratory Market saw a growth of CAGR of 9.0% in the period of 2016-2021.

04 Who are the Key Players in the Thailand Clinical Laboratory Market?

N Health, Pathlab, Thonburi Clinical Labs, Bangkok Medical Labs, BRIA Group, MIC Labs and others.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.