Egypt Blood Gas Analyzer, POC Immunoassay Analyzer and Transcutaneous Monitors Market Outlook to 2025

Growing Healthcare Infrastructure, Increasing Testing Parameters and Higher Demand for POC Devices to Drive the market

Region:Middle East

Author(s):Jalaj Bhayana

Product Code:KR1109

January 2022

91

About the Report

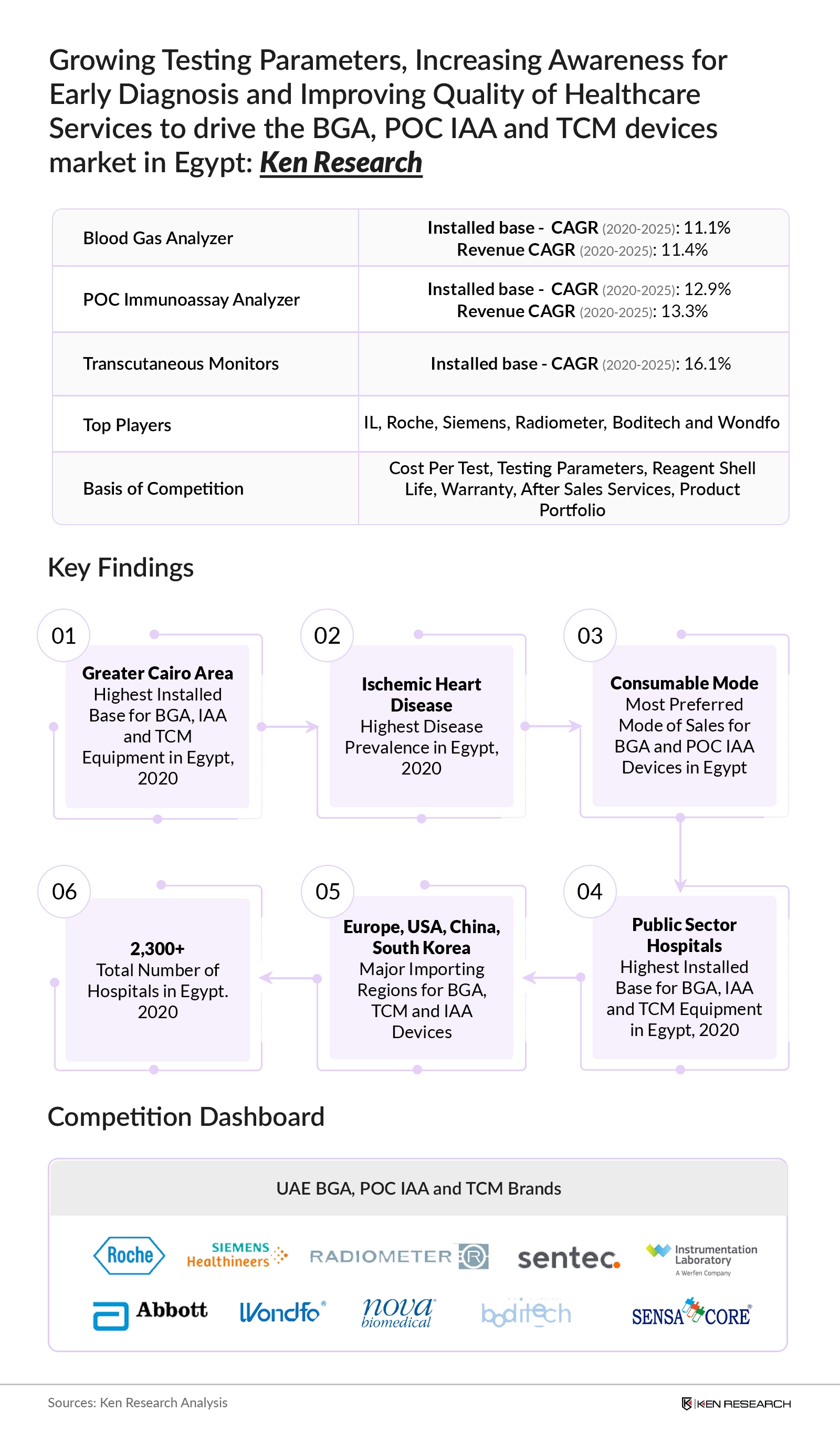

The report titled “Egypt Blood Gas Analyzer, POC Immunoassay Analyzer and Transcutaneous Monitor Market Outlook to 2025- Growing Healthcare Infrastructure, Increasing Testing Parameters and Higher Demand for POC Devices to Drive the market” provides a comprehensive analysis of the Diagnostic Equipments which are Blood Gas Analyzer (POC and Centralized), Immunoassay Analyzer (POC Benchtop) and Transcutaneous Monitoring Devices. The report also covers overview and genesis of the industry, product wise market size in terms of installed base and revenue; market segmentation by type of product, type of device, type of workload, type of sales model, type of end-user and end-user entity and type of region, trends and developments, issues and challenges and comparative landscape including competition scenario, market shares of major brands based on Installed base, cross comparison of major players on qualitative and quantitative parameters, opportunities and bottlenecks for Blood Gas Analyzer, POC Immunoassay Analyzer and Transcutaneous Monitor in Egypt. The report concludes with future market projections for each product category and Analyst recommendations for Marketing & Promotional Strategies including Business Framework for Manufacturers of these devices.

Egypt Diagnostic Device Market (Blood Gas Analyzer, POC Immunoassay Analyzer and Transcutaneous Monitors) Overview and Market Size: Egypt Diagnostic Device (Blood Gas Analyzer, POC Immunoassay Analyzer and Transcutaneous Monitors)market will be growing at a steady growth rate over the period of 5 years, 2020-2025 and is supported by increased testing due to high disease prevalence in the country and the demand for such devices by healthcare facilities as they are shifting towards POC Devices. Increasing healthcare infrastructure is also going to generate demand for such products in Egypt.

Detailed Analysis on the Egypt Blood Gas Analyzer (BGA) Market

Egypt has a large installed base for blood gas analyzers owing to the presence of 2000+ hospitals in the country. The Blood Gas Analyzer market is a 100% import driven Market with major products being imported from European countries, US, China, Korea and India. Increasing demand for blood gas testing and growth in number of patients in critical care and emergency departments due to high prevalence of NCDs are driving the market growth.

Egypt BG Analyzer is a concentrated market largely occupied by IL, Radiometer and Siemens devices. Gem Premier 4000 and ABL 800 are the most installed Blood Gas Analyzers across Hospitals and Labs in Egypt. Majority of the Blood Gas Analyzer Manufacturers have partnered with multi-brand distributors for better brand visibility in the Egypt.

Egypt Blood Gas Analyzer (BGA) market is set to grow at a CAGR of 11.3% in terms of Installed base with revenue growing @11.6% CAGR (2021-2025F). Easy operation, fast analytical outcome and affordable cost will create high demand for Point of Care Blood Gas Analyzers in Egypt. Rise ageing population and number of patient visits in hospitals coupled with surge in the number of treatments needing testing for appropriate diagnosis will boost the market growth in Egypt. Implementation of Digital Solutions, Integration with HIS/LIS, Dependency on POC Devices and AI will be the future of Blood Gas Analyzers.

Egypt Blood Gas Analyzer (BGA) Market Segmentations

By Type of Product: Centralized Device is a popular choice and dominated the market in terms of installed base for despite the end users high preference of POC devices owing to the high volume testing on centralized devices.

By Sales model: Consumable model is the most preferred sale model for Blood Gas Analyzer in Egypt. Outright sale model is avoided to pay for the high priced devices as well as the maintenance charges.

By Type of Workload: Medium to High Workload contributed majority share of installed units in 2020 with Public and Private Sector Hospitals being the major end users. Handheld devices (Abbott iStat) are usually single test blood gas analyzers.

By Type of Healthcare facilities and demand: Hospitals have the higher installed base over independent labs since BGA have a higher testing demand for overnight admitted patients and devices are required for patients in ICUs and NICUs. Public Hospitals dominated the market share since the cost per test is lower in Government Hospitals as the testing demand and frequency is higher.

By Type of Region: Greater Cairo Area is dominating the installed base of Blood Gas Analyzers in Egypt as new technology arrives in the advanced healthcare facilities in the capital city followed by the Delta Region in 2020. Greater Cairo Area has high number of Government and Private Hospitals contributing to its greater number of installations.

Detailed Analysis on the Egypt POC Immunoassay Analyzer (Benchtop) Market

POC Benchtop IAA Market in Egypt is 100% import driven, majority being imported from the European countries, China, Korea and USA. It has witnessed an increase in average number of tests on a device in 2020 post covid-19 pandemic. The market has grown at a double digit CAGR of 11.7% (2020-2021) owing to test spectrum offered on one single device, increased number of testing due to onset of COVID pandemic and reducing cost per test for private hospitals.

Egypt POC Immunoassay Analyzer is a concentrated market with Boditech accounting for more than 35% market share of installed units in 2020. Major companies in Egypt POC Immunoassay Analyzer include Boditech, Wondfo, Abbott, Roche, Mitsubishi and others with Wondfo’s Finecare Series having the largest testing menu for the POC Benchtop Immunoassay Analyzers when compared to its competitors. iChroma Immunoassay Analysers by Boditech is the most preferred in POC settings owing to its lightweight and high testing speed.

POC Immunoassay Analyzer (Benchtop) Market set to grow at a double digit CAGR in terms of Installed base with revenue growing @13.5% CAGR (2021-2025F). Diversified service offerings of IAA in testing parameters to increase the sales volume for POC Benchtop IAA devices in Egypt. Market growth will be driven by factors such as product innovation and the increased number of testing menu on a single device. Hospitals will continue to be the major end user for POC Benchtop IAA Devices in Egypt owing to the rapid test results and easy access near the patient side.

Egypt POC Immunoassay Analyzer (Benchtop) Market Segmentations

By Product Type: Majority of the POC Immunoassay Analyzers installed in Egypt are Benchtop Devices in 2020 as they provide a larger testing menu to the healthcare facilities. Abbott’s iStat devices are the most preferred POC Handheld IAA in Egypt.

By Sales model and Demand: Consumable model dominated the sales mode for POC Benchtop IAA in Egypt with most devices installed through a tender Process. Outright sale model is avoided to pay for the high priced devices as well as the maintenance charges.

By Type of Healthcare Facilities: Hospitals have the majority share of installed base as IAA is required for testing of cardiac parameters of patients with Public Hospitals accounting for major share in installed units in 2020. Low installation in the independent labs is due to the low demand for such tests at a lab. Independent labs and clinics prefer sending the samples to the central lab devices for accurate results.

By Type of Region: Greater Cairo Area has the most IAA devices installed owing to the presence of some of the most advanced healthcare facilities in the region. Greater Cairo Area has the most developed and advanced healthcare facilities that are equipped with highly advanced diagnostic equipments across the Egypt. Other governorates including Luxor, Sohag, Ismalia, Aswan, Faiyum and more accounts for 18.0% of the total POC Benchtop IAA in Egypt.

Detailed Analysis on the Egypt Transcutaneous Monitors (TCM) Market

Egypt Transcutaneous Monitors (TCM) Market have a very limited installed base in Egypt because of the lack of awareness of the product in the country. TCM device has a very low penetration rate of ~1% in Egypt with currently two players operating in this segment, namely Sentec and Radiometer. TCM is a non-invasive technique hence most doctors believe that the results obtained from the device may be unreliable.

Egypt Transcutaneous Monitors is a highly consolidated and competitive market without dominant players. Radiometer has a higher installed base for TCM devices owing to the higher technologically advanced TCM devices in Egypt. Both the players operating in the market, i.e., Sentec and Radiometer, have invested high in terms of technology to overcome invasive techniques on a new born.

Egypt Transcutaneous Monitors (TCM) Market is set to grow at a CAGR of 16.1% in terms of Installation (2021-2025F) owing to increased awareness programs and word of mouth marketing from the current users. Few devices are expected to be installed in the laboratories from private sector with independent laboratories also witnessing few installations. Hospitals will continue to dominate the End user base for TCM but a few devices would be installed in specialized labs.

Egypt Transcutaneous Monitors (TCM) Market Segmentations

By Business Model: Transcutaneous Monitor Devices are currently only sold through Outright Sales model in Egypt.

By Type of Healthcare facilities: Currently the TCM market in Egypt is only catering the hospitals, however the trend is expected to change in future. Public Hospitals dominated the market in terms of installations in 2020.

By Type of Region: Greater Cairo region dominated the market on the basis of installed units capturing majority share in 2020 followed by Mansoura, Delta Region Sohag and others.

Key Topics Covered in the Report

- Egypt Blood Gas Analyzer, POC Immunoassay Analyzer and Transcutaneous Monitoring Devices Introduction

- Market Ecosystem – Supply Side and Demand Side

- Value chain Analysis

- Government Regulations

- Detailed Analysis on Blood Gas Analyzer Market in Egypt (Market Size – Installed base and Revenue 2020; Market Segmentation; Market Shares; Product Comparison; Cross Comparison on Major Players; Future Market Size, 2025; Future Trends and Technologies)

- Detailed Analysis on POC Immunoassay Analyzer Market in Egypt (Market Size – Installed base and Revenue 2020; Market Segmentation; Market Shares; Product Comparison; Cross Comparison on Major Players; Future Market Size, 2025; Future Trends and Technologies)

- Detailed Analysis on Transcutaneous Monitors Market in Egypt (Market Size – Installed base and Revenue 2020; Market Segmentation; Market Shares; Product Comparison; Cross Comparison on Major Players; Future Market Size, 2025; Future Growth Drivers)

- Major Challenges in Egypt Blood Gas Analyzer, POC Immunoassay Analyzer and Transcutaneous Monitoring Devices Market

- Business Opportunity (Customer Analysis, Major upcoming Healthcare Projects in Egypt)

- Recommendations (Sales and Marketing Strategies, Positioning Strategies, Business Framework)

Products

Key Target Audience

Healthcare Industry

Medical Device Manufacturing Companies

Medical Device Distributors

Hospitals

Multi-specialty and Super Specialty Clinics

Diagnostic Centers

Time Period Captured in the Report:

Base Year: 2020

Forecast Period: 2021F–2025F

Companies

Key Segments Covered

Blood Gas Analyzer

By Installed Base

By Revenue

By Type of Product

By Type of Demand

By Type of End-user

By Type of End-User Entity

By Type of Workload

By Type of Device

By type of Sales Mode

By Region

POC Immunoassay Analyzer (Benchtop)

By Installed Base

By Revenue

By Type of Demand

By End User

By Type of End-User Entity

By Type of Sales Mode

By Region

Transcutaneous Monitors

By Installed Base

By Type of Product

By End User

By End User

By End-User Entity

By Region

Companies Covered:

Equipment Manufacturers

Roche Diagnostics

Abbott

Siemens

Radiometer

Wondfo

Boditech

Mitsubishi

Sentec

Instrumentation Laboratory

Sensacore and Others

Table of Contents

1. Egypt Overview

1.1 Country overview of Egypt (country demographics, major industries, GDP, Trade scenario)

1.2 Demographics of Egypt (Population Stats in Egypt)

1.3 Healthcare Infrastructure in Egypt (No. of Hospitals by type, No. of Beds by type of

Hospitals, No. of Public Clinics)

1.4 Healthcare Spending (Healthcare spending in Egypt over the years, Public VS Private

Healthcare spending)

1.5 Disease Prevalence in Egypt (Major Causes of Deaths, Distribution of Causes of Death Among

Children)

1.6 Government Regulations in Egypt (Regulations Related to Medical Devices in Egypt)

2. Overview of the Egypt Blood Gas Analyzer, POC Immunoassay Analyzer and Transcutaneous Monitoring Devices Market

2.1.Executive Summary (Installed base, sales volume, revenue, CAGR, product segmentations, growth drivers)

2.2. Competition Scenario (Top players in each product segmentation)

2.3. Market Scenario (Market type and consolidation ratio for each product type)

3. Egypt Blood Gas Analyzer, POC Immunoassay Analyzer and Transcutaneous Monitoring Devices Market Analysis

3.1 Overview and Genesis

3.2 Timeline of Distributors (Timeline of major distributors present in Egypt)

3.3 Industry Ecosystem (Supply side and Demand side)

3.4 Value Chain Analysis (Lead-time, Margins, Procurement and distribution)

3.5 Procurement Funnel (Customer Acquisition journey for a BGA, POC IAA or a TCM Device in

Egypt)

3.6 Challenges and Bottlenecks (Major Challenges and Bottlenecks faced in Egypt related to BGA,

POC IAA and TCM Devices)

3.7 Competitive Landscape (Magic Quadrant, Competition Parameters)

4. Egypt Blood Gas Analyzer Market

4.1. Executive Summary (Current Scenario, Key Highlights, Growth Drivers)

4.2. Market Size for Blood Gas Analyzer in Egypt (Installed base and sales revenue)

4.3. Market Segmentation for the Blood Gas Analyzer Products (By type of Product, Type of

Device, type of sales model, type of workload, type of entity, type of demand By type of end

user, type of region on the basis of installed units)

4.4. Brand Shares (on the basis of Installed units: Radiometer, Siemens, Instrumentation

Laboratory, Roche and Others)

4.5. Qualitative and Quantitative Cross Comparison between Major Brands (on the basis of

distributor name, distribution type, best-selling device, installed units, price of device,

cost per test)

4.6. Cross Comparison between Major Brands (Strengths and Weakness)

4.6. Product Comparison (Product Series, Features, Average Pricing)

4.7. Future Projections (Future Market Size and Product Segmentation)

4.8. Emerging Trends and Future Technologies

5. Egypt POC Immunoassay Analyzer Market

5.1. Executive Summary (Current Scenario, Key Highlights, Growth Drivers)

5.2. Market Size for Immunoassay Analyzer in Egypt (Installed base and sales revenue)

5.3. Market Segmentation for the Immunoassay Analyzer Products (By type of sales model, type

of entity, type of demand By type of end user, type of region on the basis of installed units)

5.4. Brand Shares (on the basis of Installed units: Abbott, Roche, Radiometer, Siemens and

Others)

5.5. Qualitative and Quantitative Cross Comparison between Major Brands (on the basis of

distributor name, distribution type, best-selling device, installed units, price of device,

cost per test)

5.6. Cross Comparison between Major Brands (Strengths and Weakness)

5.7. Product Comparison (Product Series, Features, Average Pricing)

5.8. Future Projections (Future Market Size and Product Segmentation)

5.9. Emerging Trends and Future Technologies

6. Egypt Transcutaneous Monitor Market

6.1. Executive Summary (Current Scenario, Key Highlights, Growth Drivers)

6.2. Market Size for Transcutaneous Monitor Marketin Egypt (by Installed base and sales

revenue)

6.3. Market Segmentation for the Transcutaneous Monitor (by type of entity, type of demand By

type of end user, type of region on the basis of installed units)

6.4. Brand Shares (on the basis of Installed units)

6.5. Cross Comparison between Major Brands (on the basis of distributor name, distribution

type, best-selling device, installed units, price of device)

6.6. Cross Comparison between Major Brands (Strengths and Weakness)

6.7. Product Comparison (Product Series, Features)

6.8. Future Projections (Future Market Size and Product Segmentation)

6.9. Emerging Trends and Future Technologies

7. Business Opportunities

7.1. Target Customers by Type of Healthcare Facilities

7.2. Upcoming Healthcare Projects in Egypt

8. Recommendations

10.1. Understanding the Buying Decision Process

10.2. Customer Journey

10.3. Sales and Promotion Strategy

10.4 Business Framework

9. Appendix

10. Research Methodology

11. Disclaimer

12. contact us

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.