Asia Pacific Architectural Service Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD11036

December 2024

99

About the Report

Asia Pacific Architectural Service Market Overview

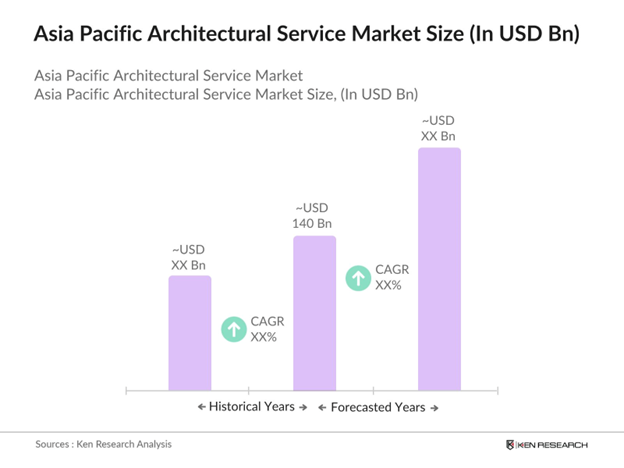

- The Asia Pacific Architectural Service Market is valued at USD 140 billion, primarily driven by rapid urbanization, infrastructural development, and the increasing demand for sustainable building solutions. The push for smart cities and eco-friendly designs across major urban centers has significantly boosted demand for specialized architectural services. Growing emphasis on green building certifications and environmental compliance continues to drive innovation and market expansion.

- The market is dominated by countries like China, Japan, and India, which are at the forefront of urban and commercial infrastructure development. Chinas strong economic framework and extensive urban planning initiatives have positioned it as a leader, while Japans focus on high-quality, technologically advanced architecture attracts substantial global interest. India's fast-paced construction growth and government initiatives on affordable housing also fuel its dominance in the region.

- The regulatory framework for construction permits in Asia Pacific has been strengthened, emphasizing compliance with urban planning and safety standards. In India, obtaining permits for commercial projects in high-density areas like Mumbai requires extensive documentation, contributing to longer project timelines (source). Singapores Urban Redevelopment Authority implemented stricter criteria in 2023, allocating an additional USD 60 million to streamline permit processes, aimed at reducing delays and supporting urban growth.

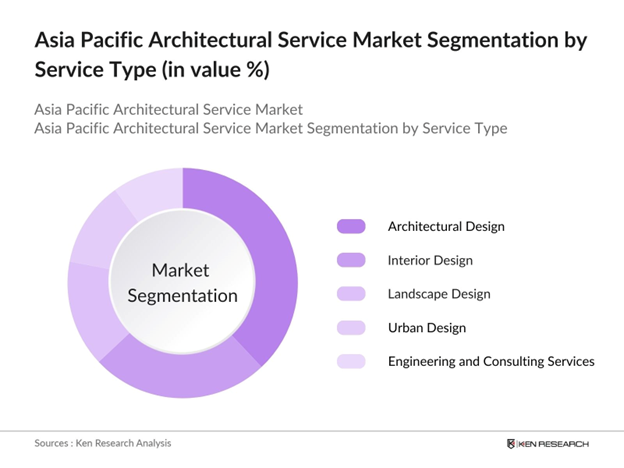

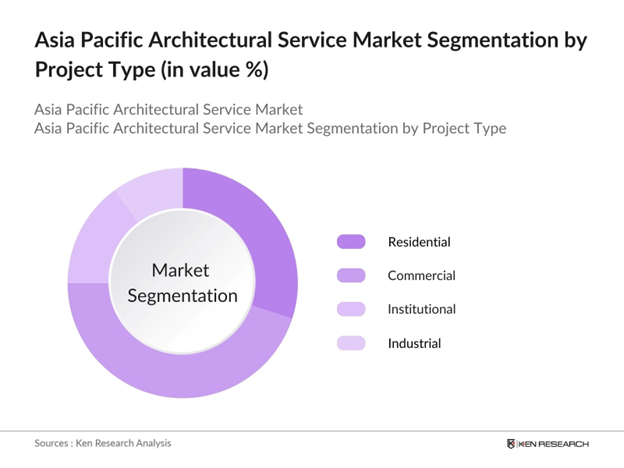

Asia Pacific Architectural Service Market Segmentation

By Service Type: The Asia Pacific Architectural Service market is segmented by service type into Architectural Design, Interior Design, Landscape Design, Urban Design, and Engineering and Consulting Services. Architectural Design holds the dominant market share due to its foundational role in construction projects. The necessity for precise structural planning and aesthetic alignment has made architectural design indispensable for both commercial and residential projects across the region.

By Project Type: The Asia Pacific Architectural Service market is also segmented by project type into Residential, Commercial, Institutional, and Industrial projects. The Commercial segment leads due to the expanding need for retail, office spaces, and urban complexes driven by economic growth in key countries. The prevalence of high-rise buildings and the demand for state-of-the-art commercial spaces in cities like Tokyo, Shanghai, and Mumbai underpin this dominance. Additionally, the trend of mixed-use developments further fuels this sub-segment's significance within the architectural services market.

Asia Pacific Architectural Service Market Competitive Landscape

The Asia Pacific Architectural Service Market is dominated by major regional and international players, including Aedas and Nikken Sekkei. This competitive consolidation underscores the market's reliance on established brands with extensive portfolios, technological expertise, and regional presence. These companies benefit from strong reputations in project delivery, sustainability initiatives, and client engagement, further reinforcing their influence in the market.

Asia Pacific Architectural Service Market Analysis

Growth Drivers

- Urban Infrastructure Development: Asia Pacifics urban infrastructure investments continue to escalate, with national budgets in countries like China and India earmarking billions for urban development. In 2023, China allocated USD 364.5 billion towards urbanization projects, including infrastructure modernization in key metropolitan areas. This intensive funding is fueling the demand for architectural services, as governments focus on urban regeneration, sustainable planning, and transportation infrastructure to support growing urban populations.

- Rise in Smart City Projects: With rapid urbanization, Asia Pacific has committed heavily to smart city initiatives, significantly enhancing demand for architectural expertise. Indias Smart Cities Mission covers 100 cities, with USD 27 billion sanctioned for developments that prioritize green architecture and efficient urban design. Meanwhile, South Koreas smart city initiative at Sejong is receiving more than USD 1 billion for intelligent infrastructure. Such projects increase demand for architectural design firms, especially those skilled in integrating advanced infrastructure and sustainable practices.

- Sustainable Building Practices: Governments in Asia Pacific are intensifying policies toward sustainable building. Japan, for instance, mandates zero-energy buildings (ZEB) in the public sector by 2025, driving demand for eco-efficient architecture. By 2023, Japan allocated USD 3 billion to sustainable construction, while Australias Building Sustainability Index (BASIX) enforces water and energy efficiency standards in new developments.

Challenges

- Cost Pressures and Budget Constraints: Rising construction costs across Asia Pacific are creating budgetary challenges for architectural firms. Chinas construction material costs rose by over 5% in 2023, attributed to inflationary pressures on resources like steel and concrete (source). In India, government-funded projects face delays, as infrastructure spending slows, with project budgets frequently revised to accommodate rising costs. This restricts project scope for architectural firms, particularly in public sector projects that undergo significant cost assessments.

- Regulatory Compliance and Standards: Stringent building codes and environmental standards in the region demand continual updates from architectural firms. In Singapore, compliance with the Building Control Act now mandates energy-efficient designs, with annual penalties exceeding USD 5 million for non-compliance. In Japan, seismic building standards require architectural firms to comply with complex structural guidelines, impacting both project timelines and costs. These regulatory pressures create an operational hurdle, particularly for firms working across multiple Asia Pacific jurisdictions.

Asia Pacific Architectural Service Market Future Outlook

Over the next five years, the Asia Pacific Architectural Service Market is expected to grow robustly, fueled by increasing infrastructure development and a strong shift toward sustainable, smart, and resilient urban design. Government incentives and policies promoting green buildings are anticipated to further drive the demand for eco-friendly architectural services, while technological advancements like BIM (Building Information Modeling) integration are likely to enhance the efficiency and scope of service offerings.

Market Opportunities

- Growing Demand for Green Building Certifications: The emphasis on green buildings in Asia Pacific has created significant opportunities for architectural firms that provide sustainable certifications. In 2023, over 2,500 buildings in China were awarded green certifications, with significant demand in urban areas (source). Singapores Green Building Masterplan further incentivizes green design through government grants for certifications, estimated at USD 100 million. Architectural firms with expertise in eco-certifications like LEED and Green Mark are thus positioned for growth, as these certifications become prerequisites for commercial projects.

- Technology-Driven Design Solutions (BIM Integration): The adoption of Building Information Modeling (BIM) is becoming a competitive advantage for architectural firms in Asia Pacific. South Korea mandates BIM use for public construction projects valued above USD 50 million, and Japan has integrated BIM into its architectural standards (source). As governments and private clients prioritize high-quality digital modeling for efficient project management, demand for firms skilled in BIM solutions is rising. This trend offers significant opportunities, as BIM adoption drives down project timelines and facilitates design precision.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Service Type |

Architectural Design Interior Design Landscape Design Urban Design Engineering and Consulting Services |

|

By Project Type |

Residential Commercial Institutional Industrial |

|

By Design Process |

Concept Design Schematic Design Design Development Construction Documentation Contract Administration |

|

By End-User Industry |

Real Estate Developers Government Agencies Corporate and Private Clients Educational Institutions Hospitality Sector |

|

By Country |

China India Japan South Korea Australia |

Products

Key Target Audience

Real Estate Developers

Corporate and Private Clients

Construction and Building Contractors

Smart City Project Planners

Architectural Engineering Service Providers

Urban Infrastructure Management Firms

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Urban Development, Environmental Protection Agency)

Companies

Players Mentioned in the Report

Aedas

Nikken Sekkei Ltd.

DP Architects

Surbana Jurong

Woods Bagot

B+H Architects

CPG Consultants

Architects 61

Arcplus Group PLC

Nihon Sekkei

Table of Contents

1. Asia Pacific Architectural Service Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Industry Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Architectural Service Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Architectural Service Market Dynamics

3.1 Growth Drivers

3.1.1 Urban Infrastructure Development

3.1.2 Rise in Smart City Projects

3.1.3 Sustainable Building Practices

3.1.4 Demand for High-Quality Interior Spaces

3.2 Market Challenges

3.2.1 Cost Pressures and Budget Constraints

3.2.2 Regulatory Compliance and Standards

3.2.3 Limited Skilled Workforce

3.3 Opportunities

3.3.1 Growing Demand for Green Building Certifications

3.3.2 Technology-Driven Design Solutions (BIM Integration)

3.3.3 Urban Revitalization and Renovation Projects

3.4 Trends

3.4.1 Adoption of Virtual and Augmented Reality in Design

3.4.2 Increasing Focus on Mixed-Use Developments

3.4.3 Integration of IoT in Smart Buildings

3.5 Government Regulations

3.5.1 Building Codes and Standards

3.5.2 Green Building Initiatives

3.5.3 Construction Permits and Licenses

3.5.4 Public-Private Partnerships

3.6 Stake Ecosystem

3.7 Porters Five Forces Analysis

3.8 Competitive Ecosystem

4. Asia Pacific Architectural Service Market Segmentation

4.1 By Service Type (In Value %)

4.1.1 Architectural Design

4.1.2 Interior Design

4.1.3 Landscape Design

4.1.4 Urban Design

4.1.5 Engineering and Consulting Services

4.2 By Project Type (In Value %)

4.2.1 Residential

4.2.2 Commercial

4.2.3 Institutional

4.2.4 Industrial

4.3 By Design Process (In Value %)

4.3.1 Concept Design

4.3.2 Schematic Design

4.3.3 Design Development

4.3.4 Construction Documentation

4.3.5 Contract Administration

4.4 By End-User Industry (In Value %)

4.4.1 Real Estate Developers

4.4.2 Government Agencies

4.4.3 Corporate and Private Clients

4.4.4 Educational Institutions

4.4.5 Hospitality Sector

4.5 By Country (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 South Korea

4.5.5 Australia

5. Asia Pacific Architectural Service Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Aedas

5.1.2 Nikken Sekkei Ltd.

5.1.3 DP Architects

5.1.4 Surbana Jurong

5.1.5 B+H Architects

5.1.6 CPG Consultants

5.1.7 Architects 61

5.1.8 Woods Bagot

5.1.9 Nihon Sekkei

5.1.10 Arcplus Group PLC

5.2 Cross Comparison Parameters (Revenue, Geographic Reach, Project Portfolio, Number of Offices, Workforce, Key Projects, Design Specialization, Green Building Certifications)

5.3 Market Share Analysis

5.4 Strategic Initiatives and Partnerships

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Innovation and R&D Initiatives

6. Asia Pacific Architectural Service Market Regulatory Framework

6.1 Building Codes and Regulations

6.2 Zoning and Land Use Policies

6.3 Environmental Compliance Standards

6.4 Health and Safety Regulations

7. Asia Pacific Architectural Service Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Architectural Service Market Analysts' Recommendations

8.1 TAM/SAM/SOM Analysis

8.2 Innovation and Digital Transformation Strategies

8.3 Emerging Design Trends

8.4 Investment Opportunities in Key Regions

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the architecture market ecosystem within Asia Pacific, identifying primary market stakeholders and service areas. This stage includes comprehensive secondary research across databases to establish the fundamental variables impacting market growth

Step 2: Market Analysis and Construction

Historical data is collected and examined to understand the performance of key segments. This includes evaluating residential, commercial, and industrial architecture demand and their projected influence on revenue generation, offering a baseline for future market estimations.

Step 3: Hypothesis Validation and Expert Consultation

In-depth interviews are conducted with architecture professionals, including project managers and designers, to validate initial data. These interactions offer critical insights into market practices, operational efficiencies, and industry challenges, ensuring a reliable market overview.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing data to construct a validated report. Collaboration with regional architecture firms provides further market insights, which are cross-verified against quantitative data, delivering a comprehensive view of the Asia Pacific Architectural Service Market.

Frequently Asked Questions

01. How big is the Asia Pacific Architectural Service Market?

The Asia Pacific Architectural Service Market is valued at USD 140 billion, primarily driven by urbanization, eco-friendly construction demands, and the expansion of smart city projects across the region.

02. What are the challenges in the Asia Pacific Architectural Service Market?

Challenges in Asia Pacific Architectural Service Market include regulatory compliance, high operational costs, and a shortage of skilled architects specializing in sustainable and smart designs. Meeting stringent building codes is also a significant obstacle for market growth.

03. Who are the major players in the Asia Pacific Architectural Service Market?

Key players in Asia Pacific Architectural Service Market include Aedas, Nikken Sekkei, DP Architects, Surbana Jurong, and Woods Bagot. These companies lead due to their established presence, technological integration, and commitment to sustainable design practices.

04. What are the growth drivers of the Asia Pacific Architectural Service Market?

Growth in Asia Pacific Architectural Service Market is driven by urban infrastructure expansion, government policies promoting sustainable building, and the rising demand for technologically advanced architectural solutions, particularly in commercial and institutional segments.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.