Asia Pacific Armored Vehicle Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD6014

December 2024

84

About the Report

Asia Pacific Armored Vehicle Market Overview

- The Asia Pacific Armored Vehicle Market is valued at USD 20.34 billion, based on a five-year historical analysis. The market's growth is driven by increasing regional tensions, ongoing border disputes, and the significant defense expenditure of countries like China and India. With a growing focus on modernization of defense forces and the need for rapid military mobilization, the demand for advanced armored vehicles has seen a continuous rise.

- China and India are dominant players in the Asia Pacific armored vehicle market. China dominates due to its extensive investment in defense modernization and its strategy to create an indigenous defense industry, allowing it to manufacture a large number of vehicles domestically. India, on the other hand, is focused on expanding its armored fleet to address regional security challenges and strengthen its military capabilities. Both countries' geopolitical focus and defense-driven economies make them leading markets for armored vehicles.

- Defense procurement policies across the Asia-Pacific are increasingly geared towards boosting local manufacturing. Indias Defense Acquisition Procedure (DAP) 2020 mandates that over 60% of defense equipment be sourced domestically by 2025. Similarly, Japans defense procurement guidelines require the localization of key components in military vehicles, fostering the growth of domestic production. These policies are aimed at reducing dependence on foreign suppliers and enhancing the regions defense manufacturing capabilities.

Asia Pacific Armored Vehicle Market Segmentation

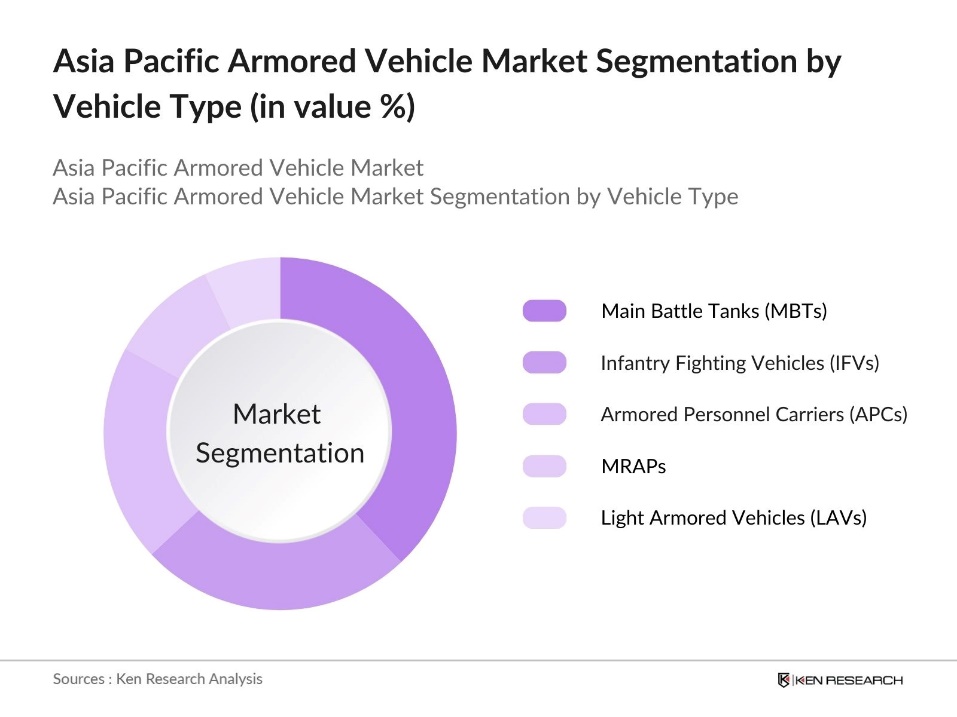

By Vehicle Type: The Asia Pacific armored vehicle market is segmented by vehicle type into Infantry Fighting Vehicles (IFVs), Armored Personnel Carriers (APCs), Main Battle Tanks (MBTs), Mine-Resistant Ambush Protected Vehicles (MRAPs), and Light Armored Vehicles (LAVs). Among these, Main Battle Tanks (MBTs) hold the dominant market share due to their critical role in military operations, providing superior firepower and defense capabilities. In particular, the increased demand from countries like India and China for modernizing their tank fleets and replacing older vehicles has contributed to MBTs' dominance. These tanks are a cornerstone of the mechanized forces in these nations, especially with the development of indigenous tank programs in both countries.

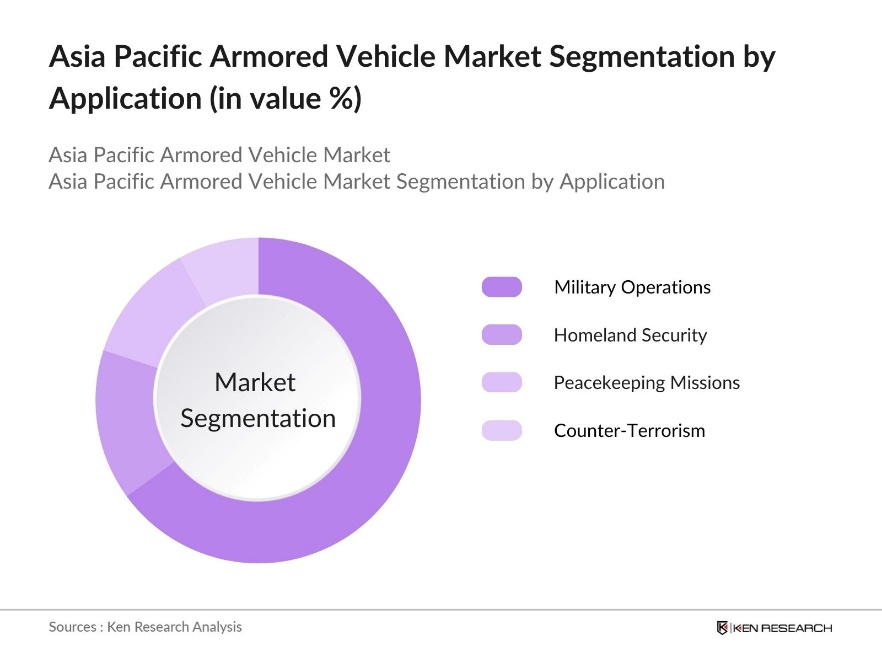

By Application: The Asia Pacific armored vehicle market is segmented by application into Military Operations, Homeland Security, Peacekeeping Missions, and Counter-Terrorism. Military Operations dominate the market due to the rising defense budgets in the region and the strategic importance of maintaining a robust armored fleet to secure borders. For example, China and India continue to expand their armored forces for high-intensity conflicts and large-scale military engagements, driving significant demand in this segment. Armored vehicles' versatility and enhanced protection capabilities make them indispensable in the region's complex security environment.

Asia Pacific Armored Vehicle Market Competitive Landscape

The market is dominated by a combination of global defense giants and regional manufacturers. Key players invest heavily in R&D and collaborate with governments for defense contracts, driving consolidation in the market. The market is competitive, with companies engaging in strategic partnerships and collaborations to strengthen their product offerings and meet increasing regional demand.

|

Company |

Establishment Year |

Headquarters |

Production Capacity |

Government Contracts |

Innovations in Mobility |

Indigenous Production |

Revenue in 2023 |

Strategic Collaborations |

|

BAE Systems |

1999 |

London, UK |

||||||

|

General Dynamics |

1952 |

Virginia, USA |

||||||

|

Hanwha Defense |

1977 |

Seoul, South Korea |

||||||

|

Rheinmetall AG |

1889 |

Dsseldorf, Germany |

||||||

|

Tata Motors |

1945 |

Mumbai, India |

Asia Pacific Armored Vehicle Industry Analysis

Growth Drivers

- Increasing Military Expenditure (Government Spending, Budget Allocations): Military spending across the Asia-Pacific region has seen significant increases in recent years due to rising geopolitical tensions and the need for stronger defense capabilities. In 2024, Japan's defense spending indeed reflects a significant increase, with allocations reaching approximately 8.9 trillion ($56.7 billion), driven by territorial disputes and regional defense priorities. This increased spending boosts the demand for armored vehicles in various countries across the region.

- Rising Border Disputes (Geopolitical Tensions, Regional Conflicts): Border disputes in the Asia-Pacific, particularly between China and India, and around the South China Sea, have spurred an increase in military activity and investment in armored vehicles. In 2024, India deployed more than 50,000 additional troops along its contested borders with China. Additionally, tensions in the South China Sea have led to an increase in the militarization of the region, with countries like Vietnam boosting defense acquisitions, including armored vehicles, to safeguard their interests. These disputes continue to drive the need for armored fleets.

- Expanding Defense Industry in Emerging Markets: Emerging economies in Asia, such as India and Indonesia, are heavily investing in local manufacturing to bolster their defense sectors. Initiatives like India's "Make in India" program have significantly boosted domestic production of armored vehicles, aiming to reduce reliance on imports. Likewise, Indonesia is focusing on developing its local defense industry to strengthen self-reliance in military equipment manufacturing. This shift toward local production is enhancing the capacity of the Asia-Pacific region to meet its defense needs, while also fostering the growth of the regional defense industry and reducing dependency on foreign suppliers.

Market Challenges

- High Production Costs (Raw Materials, Manufacturing Process): Producing armored vehicles is expensive due to the high costs of essential raw materials like steel and composite armor, coupled with the complexity of precision engineering. These production challenges are particularly difficult for manufacturers in emerging markets, limiting their ability to scale. High production expenses remain a significant barrier to growth, impacting the ability of the Asia-Pacific armored vehicle market to expand efficiently.

- Stringent Regulatory Requirements (Safety Standards, Export Restrictions): Stringent regulatory frameworks in the Asia-Pacific region, including strict safety standards and export restrictions, pose challenges for the armored vehicle market. Local content regulations also require a portion of defense procurement to be sourced domestically, making it difficult for international manufacturers to enter the market. These regulatory hurdles slow down the supply chain and complicate the production and export of military equipment.

Asia Pacific Armored Vehicle Market Future Outlook

Over the next five years, the Asia Pacific armored vehicle market is expected to see robust growth, driven by sustained government investments, geopolitical tensions, and ongoing modernization initiatives. Rising defense spending in key countries such as China, India, Japan, and South Korea will continue to push the demand for advanced armored vehicles. Additionally, technological advancements, including the integration of electric and hybrid systems into armored vehicles, will provide further growth opportunities.

Market Opportunities

- Expanding Role of Armored Vehicles in Non-Military Applications: Armored vehicles are increasingly being used beyond traditional military applications, with growing roles in homeland security and peacekeeping missions. They are deployed for tasks such as riot control, border security, and maintaining public order in volatile regions. This diversification into non-military uses is expanding the market for armored vehicles, creating new growth opportunities as governments invest in vehicles for domestic security and international peacekeeping efforts.

- Collaboration between Domestic and International Defense Manufacturers: Collaborations between local and international defense manufacturers are driving growth in the armored vehicle market. Partnerships allow for the co-development and production of advanced armored vehicles, fostering technology transfer and innovation. These collaborations enable the Asia-Pacific region to expand its production capacity while enhancing its defense capabilities. International cooperation is a key factor in improving the quality and quantity of armored vehicles available in the region.

Scope of the Report

|

Vehicle Type |

IFVs APCs MBT MRAPs LAVs |

|

Application |

Military Operations Homeland Security Peacekeeping Missions Counter-Terrorism |

|

Mobility |

Tracked Vehicles Wheeled Vehicles |

|

Armament Type |

Light Armament Heavy Armament |

|

Region |

China India Japan South Korea Australia |

Products

Key Target Audience

Military Vehicle Retrofit and Upgrade Companies

Military Vehicle Leasing Companies

Defense Electronics Manufacturers

Logistics and Maintenance Service Providers

Government and Regulatory Bodies (Japan Defense Agency, South Korea's Defense Acquisition Program Administration)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

BAE Systems

General Dynamics Corporation

Rheinmetall AG

Northrop Grumman Corporation

Lockheed Martin Corporation

Hanwha Defense

Mitsubishi Heavy Industries, Ltd.

Tata Motors Limited

China North Industries Group Corporation (NORINCO)

Larsen & Toubro Limited

Table of Contents

1. Asia Pacific Armored Vehicle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Production Rates, Demand by Vehicle Type)

1.4. Market Segmentation Overview

2. Asia Pacific Armored Vehicle Market Size (In USD Bn)

2.1. Historical Market Size (Key Countries: China, India, Japan, South Korea)

2.2. Year-On-Year Growth Analysis (Production, Imports, Exports)

2.3. Key Market Developments and Milestones (Defense Contracts, New Launches)

3. Asia Pacific Armored Vehicle Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Military Expenditure (Government Spending, Budget Allocations)

3.1.2. Rising Border Disputes (Geopolitical Tensions, Regional Conflicts)

3.1.3. Modernization of Defense Forces (Technological Advancements, Fleet Upgrades)

3.1.4. Expanding Defense Industry in Emerging Markets (Local Manufacturing Initiatives)

3.2. Market Challenges

3.2.1. High Production Costs (Raw Materials, Manufacturing Process)

3.2.2. Stringent Regulatory Requirements (Safety Standards, Export Restrictions)

3.2.3. Fluctuating Defense Budgets (Economic Constraints, Political Factors)

3.3. Opportunities

3.3.1. Expanding Role of Armored Vehicles in Non-Military Applications (Homeland Security, Peacekeeping)

3.3.2. Collaboration between Domestic and International Defense Manufacturers

3.3.3. Innovations in Armored Vehicle Technology (Autonomous Driving, Electric Vehicles)

3.4. Trends

3.4.1. Adoption of Electric Armored Vehicles

3.4.2. Integration of Advanced Communication and Surveillance Systems

3.4.3. Increased Focus on Lightweight Armored Solutions

3.5. Government Regulation

3.5.1. Defense Procurement Policies

3.5.2. Local Content Requirements (Localization of Supply Chains)

3.5.3. Export Control Laws and Regulations

3.5.4. Bilateral and Multilateral Defense Agreements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Suppliers, Government Agencies)

3.8. Porters Five Forces Analysis (Supplier Power, Buyer Power, Competitive Rivalry)

3.9. Competition Ecosystem (Armored Vehicle Manufacturers, Technology Providers)

4. Asia Pacific Armored Vehicle Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Infantry Fighting Vehicles (IFVs)

4.1.2. Armored Personnel Carriers (APCs)

4.1.3. Main Battle Tanks (MBTs)

4.1.4. Mine-Resistant Ambush Protected Vehicles (MRAPs)

4.1.5. Light Armored Vehicles (LAVs)

4.2. By Application (In Value %)

4.2.1. Military Operations

4.2.2. Homeland Security

4.2.3. Peacekeeping Missions

4.2.4. Counter-Terrorism

4.3. By Mobility (In Value %)

4.3.1. Tracked Armored Vehicles

4.3.2. Wheeled Armored Vehicles

4.4. By Armament Type (In Value %)

4.4.1. Light Armament

4.4.2. Heavy Armament

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Australia

5. Asia Pacific Armored Vehicle Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BAE Systems

5.1.2. General Dynamics Corporation

5.1.3. Rheinmetall AG

5.1.4. Northrop Grumman Corporation

5.1.5. Lockheed Martin Corporation

5.1.6. Mitsubishi Heavy Industries, Ltd.

5.1.7. Hanwha Defense

5.1.8. Tata Motors Limited

5.1.9. China North Industries Group Corporation (NORINCO)

5.1.10. Larsen & Toubro Limited

5.1.11. Oshkosh Corporation

5.1.12. Hyundai Rotem

5.1.13. KMW+Nexter Defense Systems (KNDS)

5.1.14. Uralvagonzavod

5.1.15. Iveco Defence Vehicles

5.2. Cross Comparison Parameters (Production Capacity, Innovation, Strategic Alliances, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Government Contracts

5.8. Private Sector Participation

6. Asia Pacific Armored Vehicle Market Regulatory Framework

6.1. Defense Procurement Laws

6.2. Regional Security Agreements

6.3. Export Control Standards

6.4. Certification Processes

7. Asia Pacific Armored Vehicle Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Armored Vehicle Future Market Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Application (In Value %)

8.3. By Mobility (In Value %)

8.4. By Armament Type (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Armored Vehicle Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Strategies

9.4. Technology Adoption Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Armored Vehicle Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on market penetration, vehicle production rates, and contract allocations are compiled and analyzed. The research assesses both the demand and supply sides of the market, focusing on operational efficiency and the impact of defense policies on market outcomes.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through direct consultations with experts from defense organizations, armored vehicle manufacturers, and regional defense ministries. These discussions provide valuable insights into market trends, strategic partnerships, and investment patterns.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from manufacturers and defense agencies to acquire insights into market segmentation, production trends, and consumer preferences. The resulting data is validated using bottom-up and top-down approaches to ensure the accuracy of revenue estimates and growth forecasts.

Frequently Asked Questions

01. How big is the Asia Pacific Armored Vehicle Market?

The Asia Pacific Armored Vehicle Market is valued at USD 20.34 billion, driven by rising regional tensions, defense modernization, and increasing investments in indigenous vehicle production across key countries.

02. What are the challenges in the Asia Pacific Armored Vehicle Market?

Challenges in Asia Pacific Armored Vehicle Market include high production costs, fluctuating defense budgets, and stringent export control regulations. Additionally, the slow pace of defense procurement in certain countries can impact market growth.

03. Who are the major players in the Asia Pacific Armored Vehicle Market?

Key players in Asia Pacific Armored Vehicle Market include BAE Systems, General Dynamics Corporation, Rheinmetall AG, Hanwha Defense, and Tata Motors, which dominate the market due to their production capabilities, technological innovations, and extensive government contracts.

04. What are the growth drivers of the Asia Pacific Armored Vehicle Market?

Key drivers in Asia Pacific Armored Vehicle Market include rising defense spending, technological advancements in mobility and armament systems, and the strategic need to modernize military forces in response to regional threats and border disputes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.