Asia Pacific Car Rental Market Outlook to 2030

Region:Asia

Author(s):Shambhavi Awasthi

Product Code:KROD9799

November 2024

82

About the Report

Asia Pacific Car Rental Market Overview

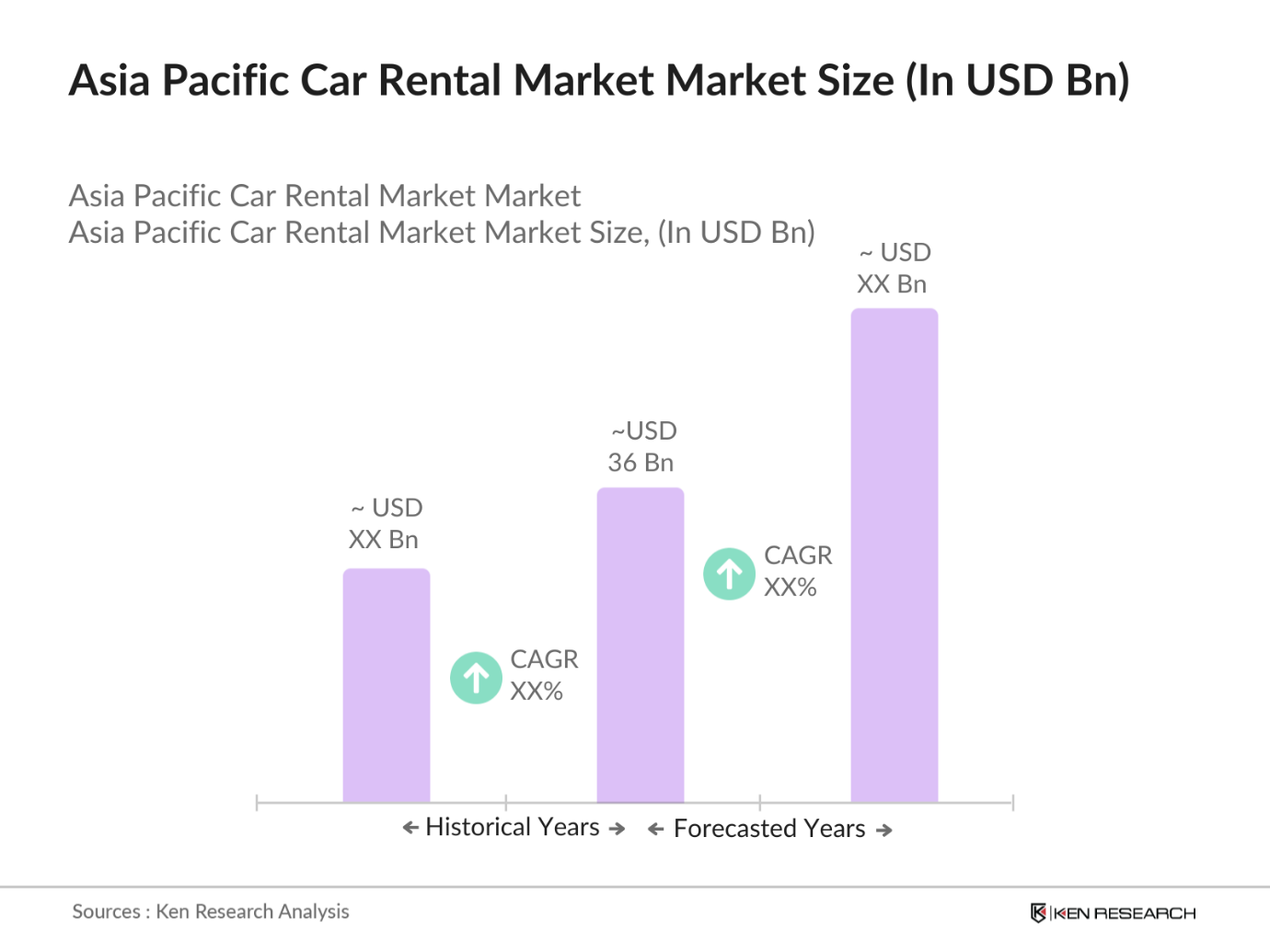

- The Asia Pacific car rental market, valued at USD 36 billion, is largely driven by a growing tourism sector and an increasing trend toward car rentals as an alternative to vehicle ownership. Key factors fueling this market include rising urbanization, favorable government regulations, and robust economic growth, which have collectively boosted consumer demand for rental services. Urban centers across Asia Pacific are also witnessing an increase in both domestic and international tourists, who prefer rental vehicles for flexibility and cost efficiency, further supporting market growth.

- Countries such as China, Japan, and Australia dominate the Asia Pacific car rental market due to their well-developed infrastructure and high tourism rates. China, in particular, sees high demand due to its extensive transportation network, while Japans strong economy and thriving business travel sector contribute significantly. Australia's well-established tourism industry and consumer preference for self-driven travel across diverse landscapes make it a leader in this market. These countries offer mature rental infrastructures and robust service providers, making them favorable rental hubs.

- Governments in Asia-Pacific enforce stringent emission norms to reduce vehicle emissions. Japans Green Vehicle Program mandates emission reductions for all vehicle fleets, including rentals, pushing companies to adopt electric and hybrid models. Similarly, India has introduced BS-VI emission standards, impacting car rental providers that must upgrade fleets to comply. Compliance with these standards requires significant investment, especially for companies operating large fleets, and non-compliance can lead to penalties, impacting overall operational efficiency and costs for the rental market.

Asia Pacific Car Rental Market Segmentation

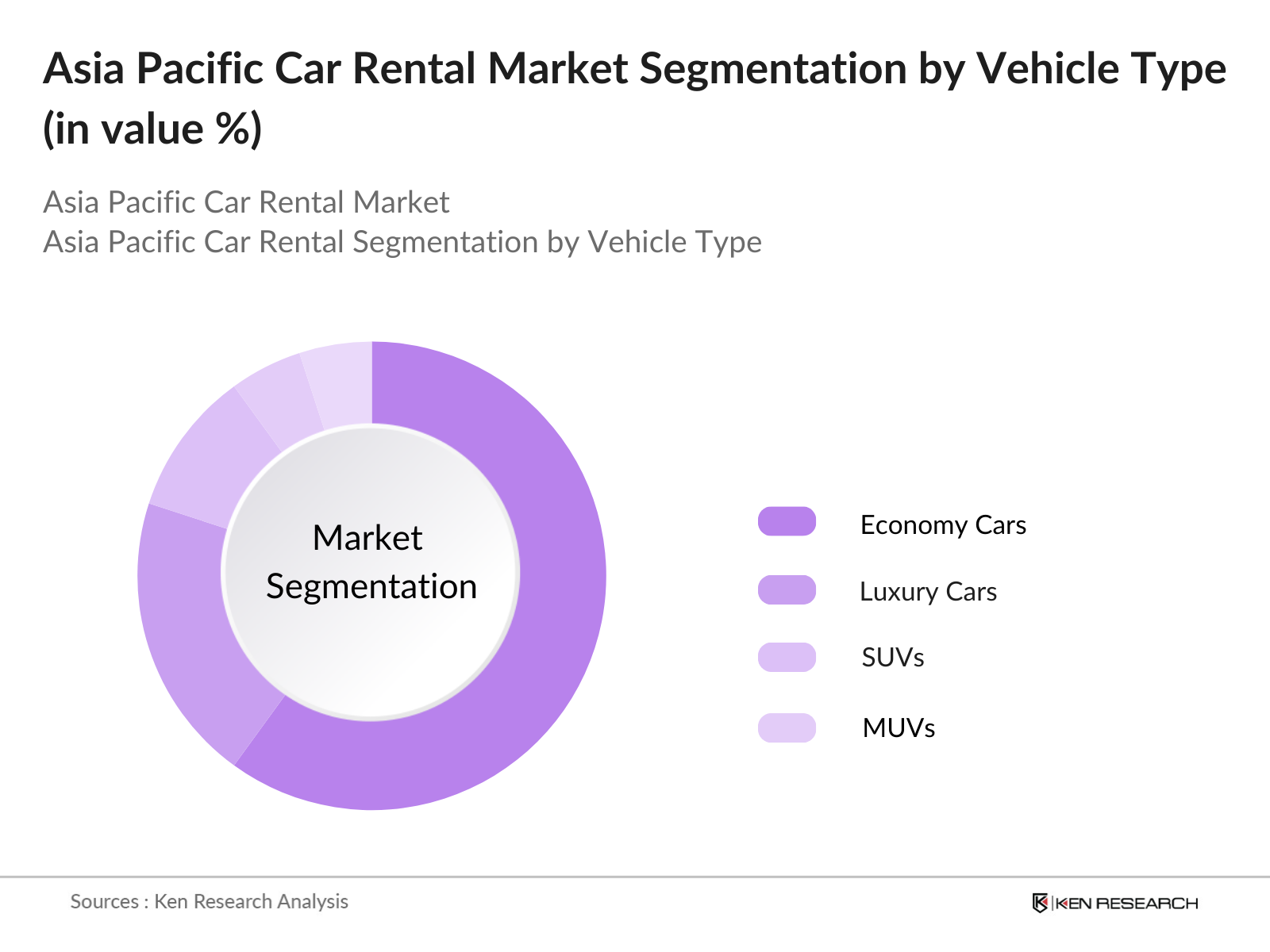

- By Vehicle Type: The Asia Pacific car rental market is segmented by vehicle type into economy cars, luxury cars, SUVs, and MUVs. Economy cars hold a dominant market share under this segmentation, primarily due to their affordability, fuel efficiency, and suitability for short-term rentals. Demand for economy cars is strong among budget-conscious travelers and business clients looking for economical solutions for short trips. The popularity of economy cars is especially notable in urban areas with high density, where such vehicles are preferred for navigating congested streets efficiently.

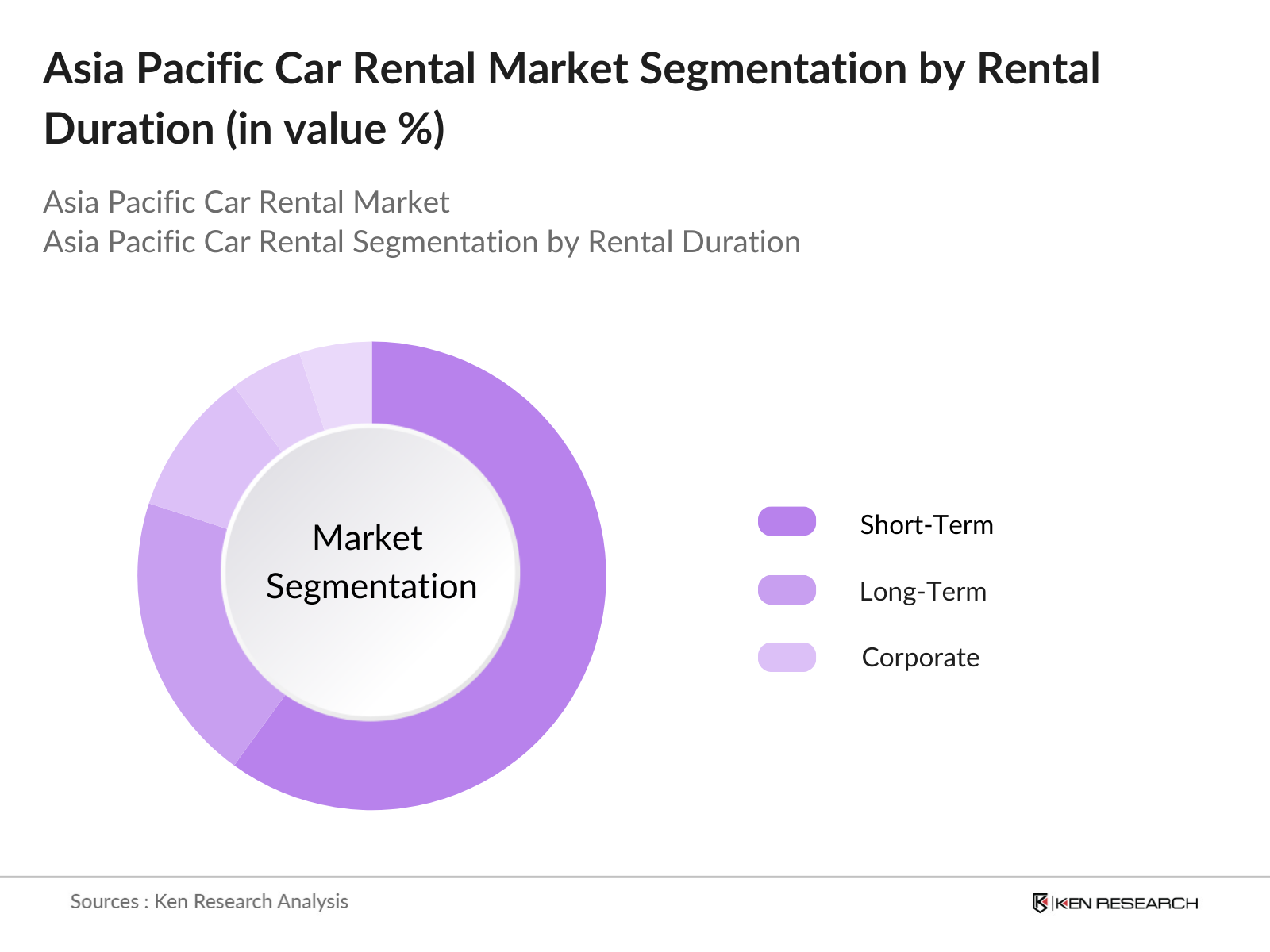

- By Rental Duration: The Asia Pacific car rental market is further segmented by rental duration into short-term rentals (daily to weekly), long-term rentals (monthly), and corporate rentals. Short-term rentals represent the most popular sub-segment due to the prevalence of tourists and business travelers requiring vehicles for a limited duration. This segment benefits from the rise in domestic tourism and business travel within the Asia Pacific region, with consumers increasingly opting for short-term rentals to maximize flexibility and convenience. With tourism and regional mobility on the rise, the demand for short-term rentals remains a pivotal growth driver.

Asia Pacific Car Rental Market Competitive Landscape

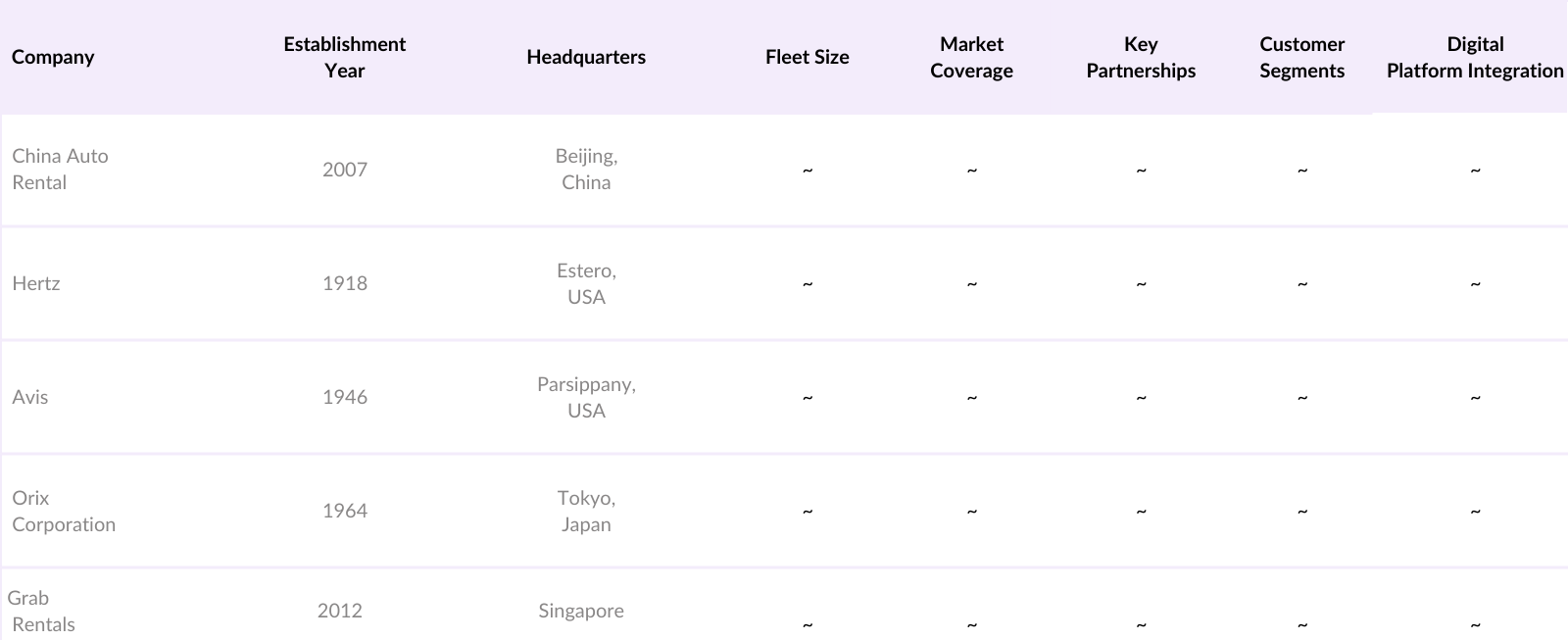

The Asia Pacific car rental market is dominated by a mix of regional and international players that leverage strong brand presence and service quality to maintain competitive edges. Major players include local companies such as China Auto Rental Holdings, along with international brands like Hertz and Avis.

Asia Pacific Car Rental Market Analysis

Growth Drivers

- Increasing Tourist Influx and Regional Travel: Asia-Pacific remains one of the worlds fastest-growing tourism markets, with over 385 million international arrivals annually, as reported by the UNWTO. Tourism boosts demand for car rentals, especially in countries like Thailand, Japan, and Australia, where tourism revenue contributes heavily to the economy. In 2023, Japan saw a sharp increase in international visitors reaching 33 million arrivals, translating into significant demand for car rentals in both urban centers and rural sightseeing spots. This influx supports long-term growth in tourism-specific rental services in these regions.

- Technological Advancements in Vehicle Tracking: Technological advancements such as GPS and real-time tracking systems have led to widespread adoption among rental companies. By 2024, over 65% of rental vehicles in the Asia-Pacific region have integrated tracking technology, allowing firms to reduce theft, optimize fleet management, and improve customer experience. GPS-enabled devices also enhance route planning and reduce fuel consumption, which is beneficial in fuel-cost-sensitive markets like Indonesia and Malaysia. These improvements make rentals safer and more efficient, contributing to customer satisfaction and supporting higher rental volumes.

- Evolving Consumer Preferences for Cost Efficiency and Flexibility: The rising middle-class population in Asia-Pacific, projected to reach 1.7 billion individuals by 2030, influences a shift towards cost-efficient travel options. In China, flexible rental options now account for over 40% of total rentals, as consumers prioritize budget travel and flexible durations for short-term rentals. This shift supports a dynamic rental market where consumers can rent vehicles as needed, creating a surge in demand for flexible, on-demand, and subscription-based rental models that appeal to various budgets and travel requirements.

Market Challenges

- High Maintenance and Operational Costs: Operational expenses remain high in Asia-Pacific due to labor costs, maintenance, and fuel. For instance, maintenance costs have risen by 7% in the past two years, while labor costs in developed countries like Japan and South Korea continue to rise. These factors pressure companies to maintain competitive pricing without eroding profit margins. Additionally, fuel costs in Asia-Pacific rank among the highest globally, impacting fleet operation costs and profitability, especially for small to mid-sized rental firms that operate on tight margins.

- Regulatory Challenges and Compliance Costs: Asia-Pacifics regulatory environment varies significantly by country, adding compliance complexity and costs for multinational rental companies. Regulations in Australia require adherence to rigorous environmental and emission standards for fleet vehicles, resulting in increased investment in green technologies. Similarly, Indonesias vehicle registration requirements and Thailands insurance mandates add substantial compliance costs. These varying regulations create operational complexities, making it difficult for rental companies to standardize services across the region, impacting scalability and cross-border operations.

Asia Pacific Car Rental Market Future Outlook

The Asia Pacific car rental market is anticipated to experience significant growth over the next five years, fueled by rising disposable incomes, urbanization, and a shift towards flexible mobility solutions. Growing environmental consciousness is also expected to drive demand for eco-friendly rental options, including electric and hybrid vehicles. With technological advancements in digital booking platforms and the integration of real-time data solutions, service providers can enhance customer experience, potentially expanding their consumer base in both urban and rural areas.

Market Opportunities

- Expansion in Emerging Economies: Emerging economies in Asia-Pacific, including India and the Philippines, offer untapped growth potential for car rentals, driven by increased urbanization and middle-class growth. Indias urban population alone has grown by over 30 million since 2020, creating demand for flexible, short-term travel options. In 2024, the Philippines is seeing increased investment in road infrastructure, with nearly 10,000 kilometers of new highways under construction, improving accessibility and supporting car rental growth in both urban and intercity markets.

- Growth of Electric and Hybrid Car Rental Segment: Rising environmental awareness and government support for green technologies are driving growth in the electric vehicle (EV) rental market. South Korea has incentivized EV rentals through tax rebates, with over 200,000 EVs currently on its roads. China has seen a 30% rise in electric vehicle adoption, with many rental companies adding EVs to their fleets to meet consumer demand for sustainable options. These developments support growth in EV and hybrid rentals as governments and consumers alike push toward sustainable mobility solutions.

Scope of the Report

|

Segments |

Sub-Segments |

|

By Vehicle Type |

Economy Cars |

|

By Rental Duration |

Short-Term Rentals |

|

By Rental Type |

On-Airport Rentals |

|

By Application |

Leisure and Tourism |

|

By Region |

East Asia |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Tourism and Hospitality Industry Stakeholders

Travel Management Companies

Car Rental Service Providers

Government and Regulatory Bodies (e.g., Ministry of Transport)

Fleet Management Firms

Technology Solution Providers for Car Rentals

Automobile Manufacturers and Dealerships

Companies

Players mentioned in the Market

China Auto Rental

Hertz Corporation

Avis Budget Group

Orix Corporation

Grab Rentals

Enterprise Holdings

Europcar

Sixt SE

Shouqi Car Rental

KST Car Rental

Uber Rentals

Budget Car Rental

Carzonrent India Pvt Ltd

Ezi Car Rental

Smove Car Rentals

Table of Contents

1. Asia Pacific Car Rental Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate Analysis

1.4 Market Segmentation Overview

2. Asia Pacific Car Rental Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Developments and Market Milestones

3. Asia Pacific Car Rental Market Dynamics

3.1 Growth Drivers

3.1.1 Rising Urbanization and Mobility Demand

3.1.2 Increasing Tourist Influx and Regional Travel

3.1.3 Technological Advancements in Vehicle Tracking

3.1.4 Evolving Consumer Preferences for Cost Efficiency and Flexibility

3.2 Market Challenges

3.2.1 High Maintenance and Operational Costs

3.2.2 Regulatory Challenges and Compliance Costs

3.2.3 Limited Infrastructure in Rural Regions

3.3 Opportunities

3.3.1 Expansion in Emerging Economies

3.3.2 Growth of Electric and Hybrid Car Rental Segment

3.3.3 Partnerships with Ride-Sharing Platforms

3.4 Trends

3.4.1 Shift to Sustainable Mobility Solutions

3.4.2 Increase in Mobile App-based Booking Systems

3.4.3 Growth in Corporate Car Rental Programs

3.5 Government Regulations

3.5.1 Emission and Environmental Standards

3.5.2 Safety and Vehicle Inspection Regulations

3.5.3 Car Rental Licensing and Operating Standards

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. Asia Pacific Car Rental Market Segmentation

4.1 By Vehicle Type (In Value)

4.1.1 Economy Cars

4.1.2 Luxury Cars

4.1.3 SUV and MUV

4.1.4 Electric Vehicles

4.2 By Rental Duration (In Value)

4.2.1 Short-Term Rentals

4.2.2 Long-Term Rentals

4.2.3 Leasing

4.3 By Rental Type (In Value)

4.3.1 On-Airport Rentals

4.3.2 Off-Airport Rentals

4.3.3 Corporate Rentals

4.4 By Application (In Value)

4.4.1 Leisure and Tourism

4.4.2 Business and Corporate Travel

4.4.3 Others (Personal, Family Use)

4.5 By Region (In Value)

4.5.1 East Asia

4.5.2 South Asia

4.5.3 Southeast Asia

4.5.4 Oceania

4.5.5 Others

5. Asia Pacific Car Rental Market Competitive Analysis

5.1 Profiles of Major Competitors

5.1.1 Hertz Corporation

5.1.2 Avis Budget Group

5.1.3 Enterprise Holdings

5.1.4 Europcar Mobility Group

5.1.5 Sixt SE

5.1.6 Localiza Rent a Car

5.1.7 Carzonrent

5.1.8 Orix Auto Corporation

5.1.9 Toyota Rent a Car

5.1.10 Uber Rent

5.1.11 DriveMyCar Rentals

5.1.12 Zoomcar

5.1.13 Kinto Share

5.1.14 Ekodrive

5.1.15 Grab Rentals

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Year Established, Revenue, Fleet Size, Market Presence, Service Quality Rating, Technological Integration)

5.3 Market Share Analysis

5.4 Strategic Initiatives and Innovations

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Joint Ventures and Partnerships

5.8 New Market Entries

5.9 Technology and Digital Integration

6. Asia Pacific Car Rental Market Regulatory Framework

6.1 Regional Licensing and Compliance

6.2 Safety and Vehicle Standards

6.3 Environmental Standards and Emission Policies

6.4 Consumer Protection Laws

7. Asia Pacific Car Rental Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

8. Asia Pacific Car Rental Market Future Segmentation

8.1 By Vehicle Type

8.2 By Rental Duration

8.3 By Rental Type

8.4 By Application

8.5 By Region

9. Asia Pacific Car Rental Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Retention Strategies

9.3 Marketing and Promotional Strategies

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves mapping the stakeholder ecosystem within the Asia Pacific Car Rental Market. This requires a combination of primary and secondary research, aiming to identify critical market drivers and constraints for accurate analysis.

Step 2: Market Analysis and Construction

In this step, historical data from 2018-2023 is examined to analyze market dynamics. Key performance indicators, including market penetration and service quality metrics, are used to construct a reliable revenue forecast.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through interviews with industry experts. These consultations provide operational insights, enhancing the reliability of the data gathered and helping fine-tune market projections.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing insights from key market players. This includes evaluating their service offerings, market expansion strategies, and customer preferences, ensuring a holistic analysis of the Asia Pacific Car Rental Market.

Frequently Asked Questions

01. How big is the Asia Pacific Car Rental Market?

The Asia Pacific car rental market is valued at USD 36 billion, driven by high tourism activity, expanding urbanization, and increased demand for flexible transportation options in the region.

02. What are the main drivers of growth in the Asia Pacific Car Rental Market?

Key drivers include a thriving tourism industry, rising urban populations, and increased disposable income across the Asia Pacific, which has led to higher adoption of car rental services.

03. Which are the leading countries in the Asia Pacific Car Rental Market?

China, Japan, and Australia lead the market due to established infrastructure, a strong economy, and high demand for rental vehicles among tourists and business travelers.

04. Who are the major players in the Asia Pacific Car Rental Market?

Major players include China Auto Rental, Hertz, Avis, Orix Corporation, and Grab Rentals, each offering extensive fleets and high market coverage in key cities across the region.

05. What challenges does the Asia Pacific Car Rental Market face?

Challenges include regulatory constraints, high operational costs, and competition from ride-sharing services, which sometimes offer a more convenient alternative to traditional car rentals.

06. What technological trends are influencing the Asia Pacific Car Rental Market?

Integration of digital platforms, real-time data analytics, and electric vehicle rentals are emerging trends that enhance customer experience and offer sustainable rental options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.