Asia Pacific Coffee Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD9180

December 2024

93

About the Report

Asia Pacific Coffee Market Overview

- The Asia Pacific Coffee Market is valued at USD 112 billion, based on a five-year historical analysis. The market's growth is driven by an expanding middle class, rising consumer preference for specialty coffee, and a growing caf culture, particularly in urban areas. Countries like China, Japan, and Australia are seeing an increasing number of coffee drinkers, fueled by a rising demand for premium and organic coffee. The growing disposable income and preference for Western lifestyle habits are also contributing to the market's expansion.

- Cities like Tokyo, Shanghai, and Sydney dominate the Asia Pacific coffee market due to the strong caf culture and a high concentration of premium coffee shops. Tokyo and Shanghai, for instance, have seen significant growth in specialty coffee chains, and Sydneys coffee culture is deeply rooted in artisanal coffee practices. These cities act as hubs for coffee innovation and cater to a large consumer base that is willing to pay a premium for high-quality coffee.

- In 2023, the Vietnamese government introduced several initiatives to support the coffee sector. Notably, Decree No. 57/2018/ND-CP offers financial assistance, covering up to 60% of investment costs for companies in the agricultural sector, including coffee. Additionally, the government is promoting sustainable farming and offering subsidies for projects that link enterprises and farmers. These efforts aim to improve production capacity and enhance Vietnam's position in the global coffee market.

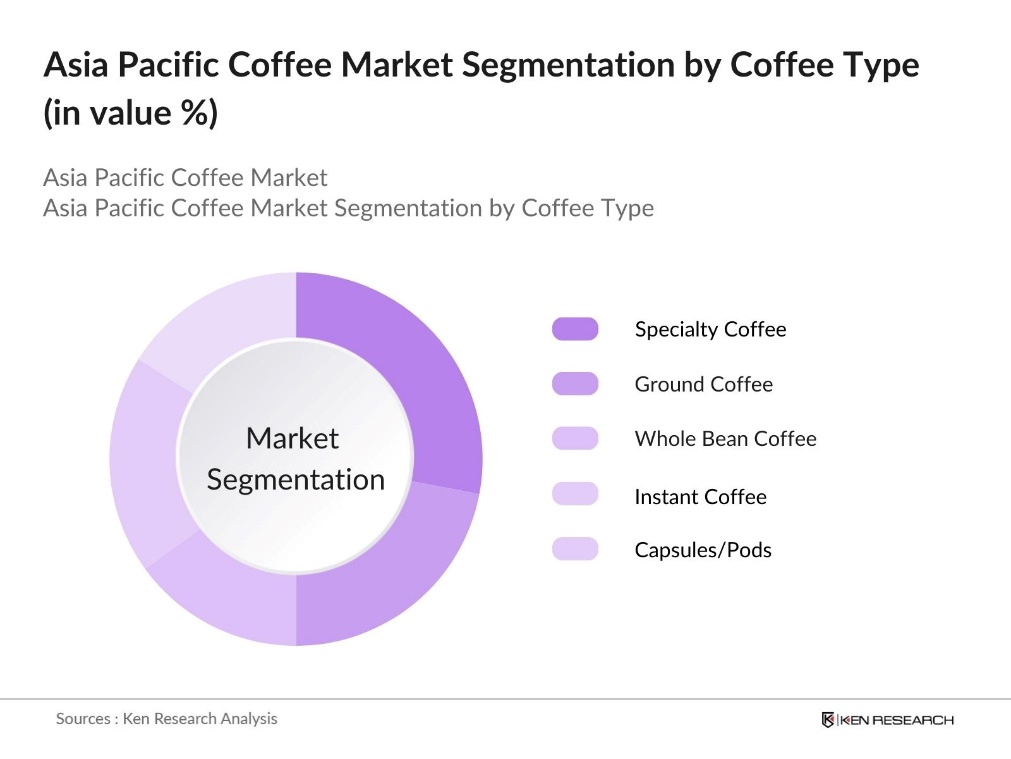

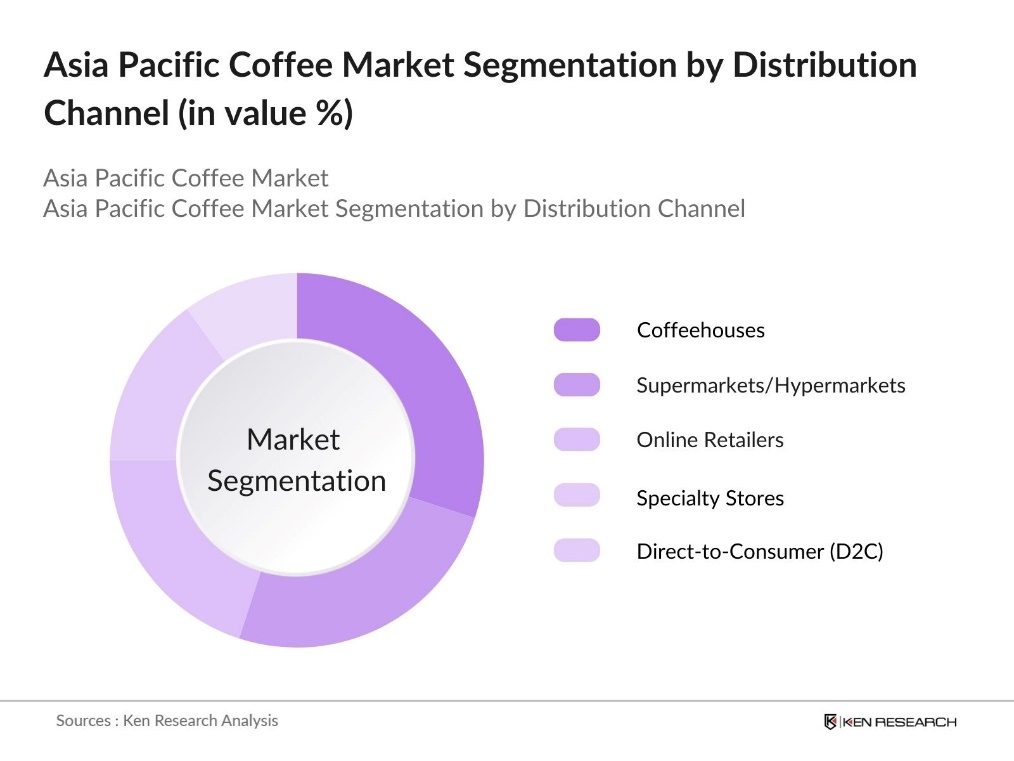

Asia Pacific Coffee Market Segmentation

By Coffee Type: The Asia Pacific coffee market is segmented by coffee type into whole bean coffee, ground coffee, instant coffee, specialty coffee, and capsules/pods. Among these, specialty coffee holds a dominant market share due to the increasing preference for unique flavors, artisanal brewing methods, and premium coffee experiences. Specialty coffee shops are rapidly expanding across major cities, particularly in countries like Japan and China, where consumers are drawn to the craftsmanship and exclusivity associated with this category. This trend is also fueled by a rise in consumer knowledge about coffee origin, processing methods, and sustainable sourcing.

By Distribution Channel: The Asia Pacific coffee market is segmented by distribution channels into supermarkets/hypermarkets, coffeehouses, online retailers, specialty stores, and direct-to-consumer (D2C). In this category, coffeehouses hold the largest market share, driven by the social experience of drinking coffee in cafs and the rapid expansion of global coffee chains like Starbucks and local specialty cafes. Coffeehouses in urban areas are also becoming increasingly popular for business meetings and social gatherings, contributing to their dominance. Online retailers, however, are showing strong growth, especially post-pandemic, as consumers embrace convenience.

Asia Pacific Coffee Market Competitive Landscape

The market is highly competitive, with leading companies like Nestl and Starbucks leading the way. These companies benefit from robust distribution networks and strong brand loyalty, which allows them to capture a large segment of the market. Additionally, local coffee chains such as Vietnam's Trung Nguyen Coffee and India's Blue Tokai Coffee Roasters continue to thrive due to their focus on sustainable coffee sourcing and specialty brews.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue |

Product Portfolio |

Global Presence |

Digital Strategy |

Sustainability Initiatives |

|

Starbucks Corporation |

1971 |

Seattle, USA |

||||||

|

Nestl S.A. |

1867 |

Vevey, Switzerland |

||||||

|

Tata Coffee Ltd. |

1922 |

Bangalore, India |

||||||

|

UCC Ueshima Coffee Co. Ltd. |

1933 |

Kobe, Japan |

||||||

|

Lavazza Group |

1895 |

Turin, Italy |

Asia Pacific Coffee Industry Analysis

Growth Drivers

- Expanding Urban Coffee Chains: In 2023, the expansion of urban coffee chains across major cities in the Asia Pacific region has been notable. Countries like China saw over 20,000 new coffee shops open, driven by rapid urbanization. Cities like Tokyo, Shanghai, and Bangalore have become coffee hubs, fueled by rising disposable incomes and evolving consumer preferences for premium coffee experiences. The population in the region now lives in cities, increasing demand for such premium coffee outlets.

- Specialty Coffee Trend: The demand for specialty coffee is growing rapidly, particularly in countries like South Korea, Japan, and Thailand. A study conducted by the Ministry showed that in 2022, coffee sales in South Korea were valued at KRW 5.7 trillion (USD $4.3 billion), making it the worlds third-largest coffee market. The rise in middle-class consumers with disposable income and interest in premium coffee products is driving this trend.

- Health Benefits Driving Consumption: Rising awareness of coffees health benefits, such as its antioxidant properties and potential to support heart health and reduce type 2 diabetes risk, is driving consumption across Asia Pacific. Governments in countries like Japan and Australia have promoted these benefits through health campaigns, boosting coffees popularity. This trend is particularly strong among health-conscious, urban consumers, reflecting a growing focus on functional and wellness-oriented beverages in the region.

Market Challenges

- Fluctuating Raw Material Prices: Coffee producers in Asia Pacific face challenges due to fluctuating raw material prices, which impact profitability. Volatility in supply chains has contributed to inconsistent costs for essential inputs, making it difficult for producers to maintain stable production levels. These price fluctuations create uncertainty, complicating the ability of coffee farmers and businesses to plan effectively, particularly in major producing countries like Vietnam and Indonesia.

- Coffee Crop Vulnerability to Climate Change: Climate change poses a significant threat to coffee production in Asia Pacific, as rising temperatures and unpredictable weather patterns affect crop yields. Extended dry seasons and shifting rainfall patterns have made coffee farming increasingly difficult, especially in regions like Indonesia and Vietnam. These climate-related challenges result in reduced yields and crop failures, further straining the coffee supply chain and impacting regional exports.

Asia Pacific Coffee Market Future Outlook

The Asia Pacific coffee market is expected to continue its robust growth trajectory in the coming years. This growth will be primarily driven by an increasing number of specialty coffee shops, rising demand for organic and sustainable coffee, and the expansion of e-commerce channels for coffee sales. Additionally, the introduction of new brewing techniques and premium coffee products will attract a more discerning consumer base. Urbanization, a shift toward healthier beverages, and rising disposable income levels will further fuel market demand across the region.

Market Opportunities

- Organic and Fair-Trade Coffee: Consumer demand for organic and fair-trade coffee is rising in the Asia Pacific market, driven by a shift toward ethical consumption. Certifications and labeling backed by governments, particularly in countries like Australia, are boosting consumer trust in these products. This trend presents an opportunity for coffee brands that prioritize sustainable and fair-trade practices, as more consumers seek transparency and sustainability in their purchases.

- E-commerce Growth: E-commerce has opened up significant opportunities for coffee brands across Asia Pacific. The rapid growth of online platforms, fueled by increasing smartphone penetration and the widespread use of digital payment solutions, has transformed how consumers purchase coffee. As a result, e-commerce has become a vital channel for retail coffee sales, reshaping distribution and marketing strategies for brands in the region.

Scope of the Report

|

Coffee Type |

Whole Bean Ground Instant Specialty Capsules/Pods |

|

Distribution Channel |

Supermarkets Coffeehouses Online Retailers Specialty Stores, D2C |

|

End-User |

Residential Commercial (Cafes, Hotels, Restaurants) Offices |

|

Origin |

Arabica Robusta Blends |

|

Region |

China India Japan Australia ASEAN |

Products

Key Target Audience

Coffee manufacturers

Coffee packaging companies

Event and catering services

Online retailers and e-commerce platforms

Government and regulatory bodies (e.g., Food Safety and Standards Authority of India, China Food and Drug Administration)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Starbucks Corporation

Nestl S.A.

Tata Coffee Ltd.

Lavazza Group

UCC Ueshima Coffee Co. Ltd.

Trung Nguyen Coffee

Blue Tokai Coffee Roasters

Suntory Beverage & Food Ltd.

The Kraft Heinz Company

Jacobs Douwe Egberts

Table of Contents

1. Asia Pacific Coffee Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Coffee Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Coffee Market Analysis

3.1 Growth Drivers (e.g., Rising Coffee Culture, Specialty Coffee Demand, Urbanization, Health Consciousness)

3.1.1 Expanding Urban Coffee Chains

3.1.2 Specialty Coffee Trend

3.1.3 Health Benefits Driving Consumption

3.1.4 Digital Transformation in Coffee Retail

3.2 Market Challenges (e.g., Coffee Price Volatility, Supply Chain Disruptions, Climate Impact)

3.2.1 Fluctuating Raw Material Prices

3.2.2 Coffee Crop Vulnerability to Climate Change

3.2.3 Lack of Consistent Quality Across Regions

3.2.4 High Competition Among Local Brands

3.3 Opportunities (e.g., Rise of Sustainable Coffee, E-commerce, Regional Export Growth)

3.3.1 Organic and Fair-Trade Coffee

3.3.2 E-commerce Growth

3.3.3 Coffee Subscription Services

3.3.4 Increasing Coffee Exports to the West

3.4 Trends (e.g., RTD Coffee, Cold Brew, Sustainability Practices)

3.4.1 Cold Brew and Ready-to-Drink Coffee Popularity

3.4.2 Sustainability Initiatives in Coffee Supply Chain

3.4.3 Innovations in Coffee Brewing Technologies

3.4.4 Increasing Preference for Plant-Based Coffee Creamer

3.5 Government Regulations (e.g., Import/Export Tariffs, Quality Standards, Sustainability Policies)

3.5.1 Regional Coffee Quality Standards

3.5.2 Government Initiatives for Coffee Farming

3.5.3 Tariff and Trade Regulations Impacting Coffee Imports

3.5.4 Environmental and Sustainability Regulations

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis (e.g., Threat of Substitutes, Supplier Power)

3.9 Competitive Landscape

4. Asia Pacific Coffee Market Segmentation

4.1 By Coffee Type (In Value %)

4.1.1 Whole Bean Coffee

4.1.2 Ground Coffee

4.1.3 Instant Coffee

4.1.4 Specialty Coffee

4.1.5 Capsules/Pods

4.2 By Distribution Channel (In Value %)

4.2.1 Supermarkets/Hypermarkets

4.2.2 Coffeehouses

4.2.3 Online Retailers

4.2.4 Specialty Stores

4.2.5 Direct to Consumer (D2C)

4.3 By End-User (In Value %)

4.3.1 Residential

4.3.2 Commercial (Cafes, Hotels, Restaurants)

4.3.3 Offices

4.4 By Origin (In Value %)

4.4.1 Arabica

4.4.2 Robusta

4.4.3 Blends

4.5 By Region (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 Australia

4.5.5 ASEAN

5. Asia Pacific Coffee Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Nestl S.A.

5.1.2 JAB Holding Company

5.1.3 Starbucks Corporation

5.1.4 Tata Coffee Ltd.

5.1.5 Lavazza Group

5.1.6 Luigi Lavazza S.p.A.

5.1.7 Suntory Beverage & Food Ltd.

5.1.8 The Kraft Heinz Company

5.1.9 Unilever PLC

5.1.10 Jacobs Douwe Egberts

5.1.11 UCC Ueshima Coffee Co., Ltd.

5.1.12 PT. Excelso

5.1.13 Vietnam National Coffee Corporation

5.1.14 Blue Tokai Coffee Roasters

5.1.15 Barista Coffee Company Ltd.

5.2 Cross Comparison Parameters (Headquarters Location, Coffee Product Portfolio, Market Share, Revenue, No. of Employees, Global Presence, Digital Strategy, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Coffee Market Regulatory Framework

6.1 Import Tariffs on Coffee Products

6.2 Quality Control and Certifications (Fair-Trade, Organic)

6.3 Sustainability Standards in Coffee Cultivation

6.4 Government Subsidies for Local Coffee Farming

7. Asia Pacific Coffee Market Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Coffee Market Future Segmentation

8.1 By Coffee Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By End-User (In Value %)

8.4 By Origin (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Coffee Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation and Preferences

9.3 Marketing and Distribution Strategies

9.4 Regional Growth Opportunities Analysis

9.5 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involved creating a comprehensive overview of the Asia Pacific coffee market by identifying key stakeholders, consumer trends, and external market factors. Extensive desk research using proprietary databases was conducted to gather the required market data.

Step 2: Market Analysis and Construction

This phase focused on analyzing historical market trends, distribution channels, and growth patterns within the region. Special attention was given to the market's structural changes, including the rise of specialty coffee.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through consultations with key industry players such as coffee producers and distributors. These expert opinions helped refine the understanding of market dynamics and consumer behavior.

Step 4: Research Synthesis and Final Output

Final market insights were synthesized through direct engagement with regional coffee chains, leading to an accurate depiction of market performance and future opportunities. This process ensured that all statistical data was corroborated and presented in an actionable format for business professionals.

Frequently Asked Questions

01. How big is the Asia Pacific Coffee Market?

The Asia Pacific Coffee Market is valued at USD 112 billion, driven by the expanding middle class, rising caf culture, and increased demand for specialty coffee.

02. What are the challenges in the Asia Pacific Coffee Market?

The major challenges in Asia Pacific Coffee Market include fluctuating coffee bean prices, supply chain disruptions, and climate change impacts on coffee crops, which have the potential to affect production consistency.

03 Who are the major players in the Asia Pacific Coffee Market?

Key players in the Asia Pacific Coffee Market include Starbucks, Nestl, Tata Coffee, Lavazza, and UCC Ueshima Coffee Co., all of whom dominate due to their vast distribution networks and innovative product offerings.

04. What are the growth drivers of the Asia Pacific Coffee Market?

The Asia Pacific Coffee Market is propelled by factors such as urbanization, increased consumer spending on premium coffee, and the rise of specialty coffee shops across major cities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.