Asia Pacific Consumer Electronics Market Outlook to 2028

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD11080

November 2024

95

About the Report

Asia Pacific Consumer Electronics Market Overview

- The Asia Pacific Consumer Electronics Market is valued at USD 584.2 billion, based on a five-year historical analysis. This substantial market valuation is driven by multiple factors, including increased disposable income, technological advancements, and growing urbanization. Rising demand for connected devices, smart home products, and advancements in technology like AI and IoT further propel this market.

- China, Japan, and South Korea are dominant players in the Asia Pacific consumer electronics market. Chinas dominance arises from its extensive manufacturing capabilities and large consumer base, coupled with supportive government policies favoring domestic electronics manufacturing. Japan and South Korea lead in technological innovations, particularly in sectors like smartphones, home appliances, and audio-visual equipment, thanks to established R&D infrastructure and globally recognized brands that influence market trends and consumer preferences regionally and internationally.

- Governments in Asia-Pacific have implemented stringent environmental protection standards in response to rising e-waste concerns. In 2024, China introduced e-waste regulations targeting half of its electronic waste by 2025, while South Korea mandated energy consumption limits on new consumer devices. Such regulations require manufacturers to adopt recycling and energy-efficient technologies, reducing their environmental footprint while adhering to legal requirements, essential for market entry and continued operation.

Asia Pacific Consumer Electronics Market Segmentation

By Product Type: The market is segmented by product type into smartphones, laptops and tablets, wearables, home appliances, and entertainment devices. Recently, smartphones have a dominant market share under the product type segmentation. This is due to their ubiquitous presence and the fact that smartphones have become essential for both personal and professional use. Additionally, brands like Samsung and Xiaomi offer a variety of options, from premium to budget-friendly models, addressing diverse consumer needs and strengthening their dominance in the market.

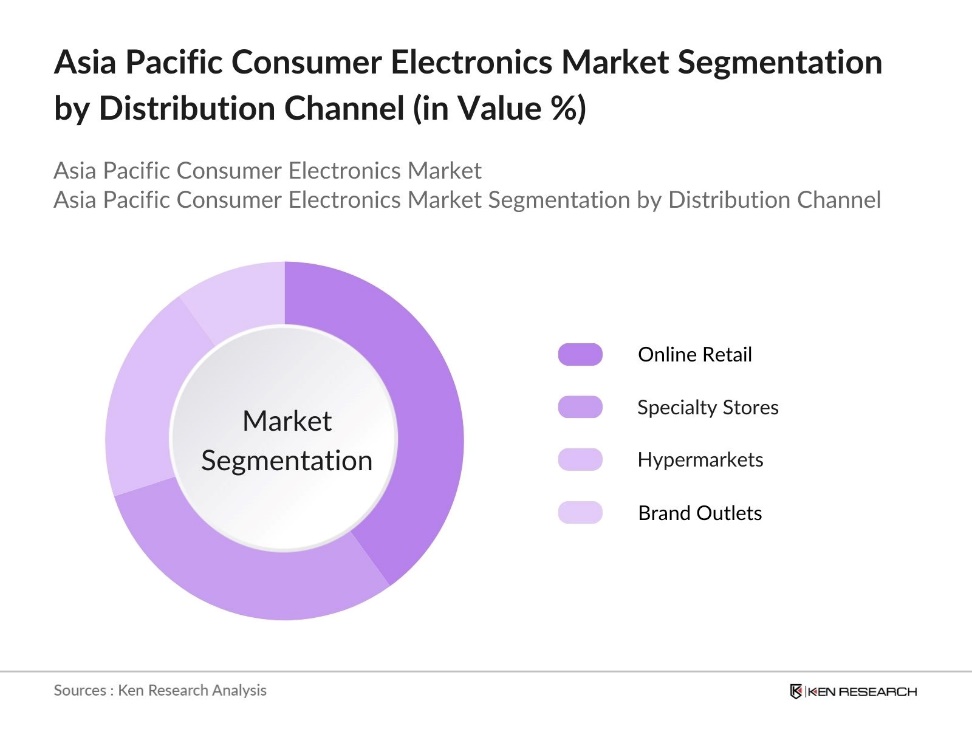

By Distribution Channel: The market is segmented by distribution channel into online retail, specialty stores, hypermarkets and supermarkets, and brand outlets. The online retail channel holds a significant share due to the convenience it offers, especially in a region where e-commerce has rapidly grown. Platforms like JD.com, Flipkart, and Lazada facilitate easy access to consumer electronics, often with exclusive deals, promotions, and fast delivery options. Additionally, online retail channels benefit from the digital-savvy consumer base across Asia, leading to its dominance in distribution.

Asia Pacific Consumer Electronics Market Competitive Landscape

The Asia Pacific consumer electronics market is dominated by several key players with extensive influence in both local and global markets. This consolidation highlights the strategic importance and competitive nature of the industry, driven by innovation, customer loyalty, and technological advancements. Major companies like Samsung, Sony, and Panasonic lead due to their broad product portfolios, strong R&D capabilities, and extensive distribution networks.

Asia Pacific Consumer Electronics Industry Analysis

Growth Drivers

- Increased Disposable Income: The Asia-Pacific region has witnessed a rise in disposable income, which has substantially increased consumer spending on electronic goods. According to the World Bank, middle-income countries are classified based on their Gross National Income (GNI) per capita, which ranges from $1,136 to $13,845, driving higher demand for items such as smartphones, televisions, and appliances as consumers upgrade to premium products. This disposable income growth is strongly linked to rapid urbanization and economic resilience, especially in countries like China and India, fostering an expansion in consumer electronics purchases.

- Technological Advancements: Technological advancements in the Asia-Pacific consumer electronics market have boosted product quality, energy efficiency, and smart connectivity features. In 2024, regional R&D investments in consumer electronics reached USD 2.53 trillion, led globally. Enhanced production methods, especially in semiconductor and display technologies, have strengthened product offerings, aligning with rising consumer expectations for high-performance and multi-functional devices. This surge in investment highlights the importance of sustained innovation, positioning Asia-Pacific as a critical player in global consumer electronics.

- Urbanization and Smart Cities Development: Rapid urbanization in the Asia-Pacific, particularly in countries like China and India, has led to widespread adoption of smart city initiatives. These government-backed projects integrate advanced electronics and IoT to enhance infrastructure, sustainability, and connectivity. This urban shift fuels demand for consumer electronics that support smart living, creating opportunities for tech-forward devices in both residential and public sectors focused on energy efficiency and digital innovation.

Market Challenges

- Supply Chain Disruptions: Supply chain disruptions are significantly impacting the Asia-Pacific consumer electronics market, with material shortages leading to delays and cost increases. Reliance on imported components, particularly in semiconductor manufacturing, has exposed the region to trade restrictions and post-pandemic logistics challenges. These issues have slowed production timelines and driven up component costs, creating obstacles for manufacturers in meeting demand efficiently and maintaining smooth production flows.

- High Manufacturing Costs: Increasing energy and labor costs have raised manufacturing expenses in the Asia-Pacific region, impacting profitability for electronics manufacturers. High utility prices and rising wages in key production hubs add to operational costs, making it challenging for companies to keep prices competitive. These financial pressures affect overall product pricing, compelling manufacturers to seek cost-efficient methods or pass on costs to consumers, impacting affordability in the market.

Asia Pacific Consumer Electronics Market Future Outlook

The Asia Pacific consumer electronics market is set to experience substantial growth. This growth trajectory is driven by the continuous rise in consumer spending on electronics, especially as connectivity and IoT adoption increase. Innovations in 5G, AI, and IoT will play a pivotal role, alongside government support in countries like China and India to boost domestic electronics manufacturing. Additionally, the shift toward digital lifestyles post-pandemic has accelerated demand for connected devices, propelling this market toward further expansion.

Market Opportunities

- Expansion in Rural Areas: Rural markets in Asia-Pacific offer substantial growth potential for consumer electronics, as many areas still lack access to advanced technology. Government initiatives to bridge the digital divide are steadily improving infrastructure, making electronics more accessible in underserved regions. This push into rural markets allows manufacturers to expand their distribution and reach new consumer bases, catering to rising demand as connectivity and digital access increase in these areas.

- Rising Demand for IoT-Enabled Devices: Demand for IoT-enabled consumer electronics is growing rapidly across Asia-Pacific, particularly in urban households where smart devices are becoming integral to daily life. Government support for IoT integration through incentives and policy initiatives is further driving adoption of connected devices. This rising trend offers a promising avenue for manufacturers to develop and supply innovative IoT-enabled products tailored to tech-savvy, digitally connected consumers in the region.

Scope of the Report

|

By Product Type |

Smartphones Laptops and Tablets Wearables Home Appliances Entertainment Devices |

|

By Distribution Channel |

Online Retail Specialty Stores Hypermarkets Brand Outlets |

|

By End-User |

Residential Commercial |

|

By Technology |

Wi-Fi-Enabled Devices 5G Technology Devices Bluetooth-Enabled Devices |

|

By Region |

China India Japan South Korea Southeast Asia |

Products

Key Target Audience

- Consumer Electronics Manufacturers

- Retail and E-Commerce Platforms

- Telecommunications Companies

- Technology Hardware Companies

- Investors and venture capital Firms

- Banks and Financial Institutions

- Government and Regulatory Bodies (e.g., Ministry of Industry and Information Technology, Japans Ministry of Economy, Trade, and Industry)

Companies

Players Mentioned in the Report

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Panasonic Corporation

- Xiaomi Corporation

- Huawei Technologies Co., Ltd.

- LG Electronics Inc.

- Lenovo Group Ltd.

- Haier Group Corporation

- Sharp Corporation

- TCL Technology

Table of Contents

1. Asia Pacific Consumer Electronics Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Consumer Electronics Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Consumer Electronics Market Analysis

3.1 Growth Drivers

3.1.1 Increased Disposable Income

3.1.2 Technological Advancements

3.1.3 Urbanization and Smart Cities Development

3.1.4 Digitalization of Lifestyle

3.2 Market Challenges

3.2.1 Supply Chain Disruptions

3.2.2 High Manufacturing Costs

3.2.3 Short Product Life Cycles

3.2.4 Regulatory Compliance

3.3 Opportunities

3.3.1 Expansion in Rural Areas

3.3.2 Rising Demand for IoT-Enabled Devices

3.3.3 Government Incentives for Electronics Manufacturing

3.4 Trends

3.4.1 Adoption of AI and ML in Consumer Devices

3.4.2 Growth of Wearable Technology

3.4.3 Rise of E-Commerce as a Sales Channel

3.4.4 Environmental Sustainability in Product Design

3.5 Government Regulations

3.5.1 Environmental Protection Standards (e-waste, energy consumption)

3.5.2 Import and Export Regulations (tariffs, local content requirements)

3.5.3 Tax Incentives for Local Manufacturing

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Asia Pacific Consumer Electronics Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Smartphones

4.1.2 Laptops and Tablets

4.1.3 Wearables (Smartwatches, Fitness Trackers)

4.1.4 Home Appliances (Refrigerators, Washing Machines, etc.)

4.1.5 Entertainment Devices (Televisions, Audio Systems)

4.2 By Distribution Channel (In Value %)

4.2.1 Online Retail

4.2.2 Specialty Stores

4.2.3 Hypermarkets and Supermarkets

4.2.4 Brand Outlets

4.3 By End-User (In Value %)

4.3.1 Residential

4.3.2 Commercial

4.4 By Technology (In Value %)

4.4.1 Wi-Fi-Enabled Devices

4.4.2 5G Technology Devices

4.4.3 Bluetooth-Enabled Devices

4.5 By Region (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 South Korea

4.5.5 Southeast Asia

5. Asia Pacific Consumer Electronics Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Samsung Electronics Co., Ltd.

5.1.2 LG Electronics Inc.

5.1.3 Sony Corporation

5.1.4 Panasonic Corporation

5.1.5 Xiaomi Corporation

5.1.6 Huawei Technologies Co., Ltd.

5.1.7 Lenovo Group Ltd.

5.1.8 Haier Group Corporation

5.1.9 Sharp Corporation

5.1.10 TCL Technology

5.1.11 AsusTek Computer Inc.

5.1.12 Apple Inc.

5.1.13 Acer Inc.

5.1.14 OPPO Electronics Corp.

5.1.15 Vivo Communication Technology Co., Ltd.

5.2 Cross Comparison Parameters (Market Share, Revenue, Product Diversification, Innovation Capacity, R&D Investment, Market Penetration, Supply Chain, Customer Base)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Consumer Electronics Market Regulatory Framework

6.1 Environmental Compliance Standards

6.2 Import Tariff Structures

6.3 Certification and Quality Standards

6.4 Local Manufacturing Policies

6.5 Intellectual Property and Data Security Regulations

7. Asia Pacific Consumer Electronics Future Market Size (In USD Mn)

7.1 Market Growth Projections

7.2 Key Growth Factors

8. Asia Pacific Consumer Electronics Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By End-User (In Value %)

8.4 By Technology (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Consumer Electronics Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation Strategy

9.3 Competitive Positioning Strategy

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that includes key stakeholders in the Asia Pacific consumer electronics market. This step leverages extensive desk research and proprietary databases to gather comprehensive information and identify variables that drive market dynamics.

Step 2: Market Analysis and Construction

This phase compiles and analyzes historical data for market penetration and consumer electronics demand across segments. Key focus areas include the impact of new technologies and consumer preferences on market growth.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through expert consultations and computer-assisted interviews. These industry insights ensure accurate data validation and add depth to the market analysis.

Step 4: Research Synthesis and Final Output

The final stage integrates primary insights from interviews with manufacturers and secondary data from verified sources. This synthesis provides a detailed, reliable analysis of the Asia Pacific consumer electronics market.

Frequently Asked Questions

01. How big is the Asia Pacific Consumer Electronics Market?

The Asia Pacific consumer electronics market is valued at USD 584.2 billion. This market is supported by a rapidly growing consumer base, technological advancements, and increased disposable incomes.

02. What are the main challenges in the Asia Pacific Consumer Electronics Market?

The Asia Pacific consumer electronics market faces challenges like high production costs, rapid technological obsolescence, and regulatory complexities. Additionally, supply chain issues due to geopolitical tensions pose a risk to the consistent supply of components.

03. Who are the major players in the Asia Pacific Consumer Electronics Market?

Key players in the Asia Pacific consumer electronics market include Samsung Electronics, Sony Corporation, Panasonic, Xiaomi, and Huawei. These companies are leaders due to their innovation, strong brand presence, and expansive distribution networks.

04. What are the growth drivers for the Asia Pacific Consumer Electronics Market?

Primary growth drivers in Asia Pacific consumer electronics market include rising disposable incomes, urbanization, and the adoption of technologies like IoT and AI. Government incentives for local manufacturing in countries like China and India also contribute to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.