Asia Pacific Functional Food Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD5539

November 2024

98

About the Report

Asia Pacific Functional Food Market Overview

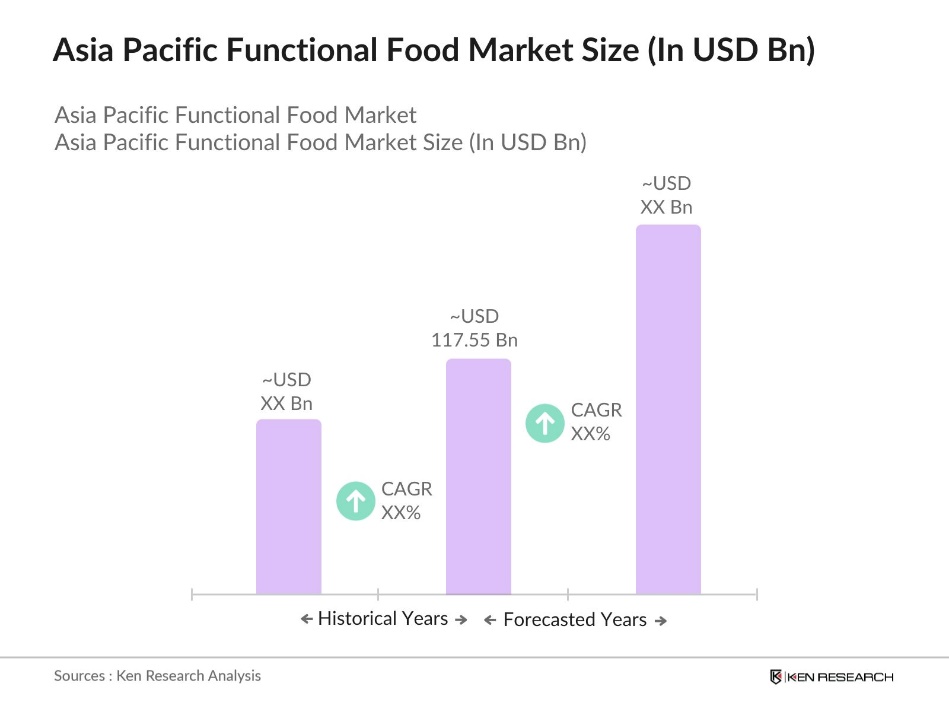

- The Asia Pacific functional food market, valued at USD 117.55 billion, is driven by increasing consumer awareness about health and nutrition. The rising prevalence of chronic diseases and a growing aging population have led to a heightened demand for foods that offer additional health benefits beyond basic nutrition.

- China and Japan are the dominant markets in the Asia Pacific region. China's dominance is attributed to its large population base, rapid urbanization, and increasing health consciousness among consumers. Japan's leadership stems from its aging population and a long-standing cultural emphasis on health and wellness, which have driven the demand for functional foods.

- Import and export regulations significantly impact the functional food market in the Asia Pacific region. In 2022, the total food imports reached approximately $139.62 billion. However, stringent import regulations, such as mandatory product registration and labeling requirements, can pose challenges for foreign manufacturers. Understanding and navigating these regulations are crucial for market entry and expansion.

Asia Pacific Functional Food Market Segmentation

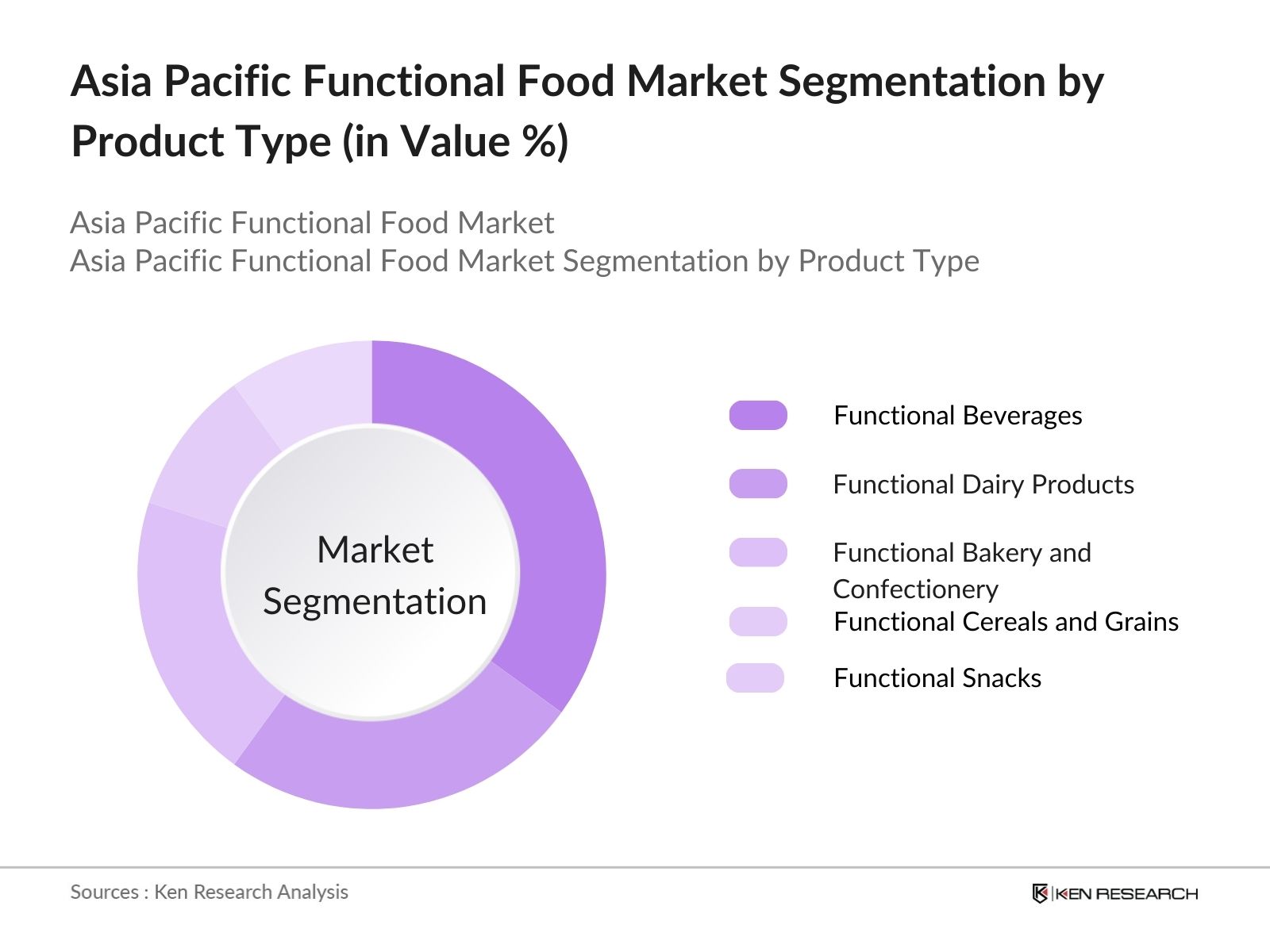

By Product Type: The market is segmented by product type into functional dairy products, functional bakery and confectionery, functional beverages, functional cereals and grains, and functional snacks. Functional beverages hold a dominant market share due to their convenience and the incorporation of health-boosting ingredients like probiotics, vitamins, and minerals. Consumers prefer these beverages for their ease of consumption and the immediate health benefits they offer, such as improved digestion and enhanced immunity.

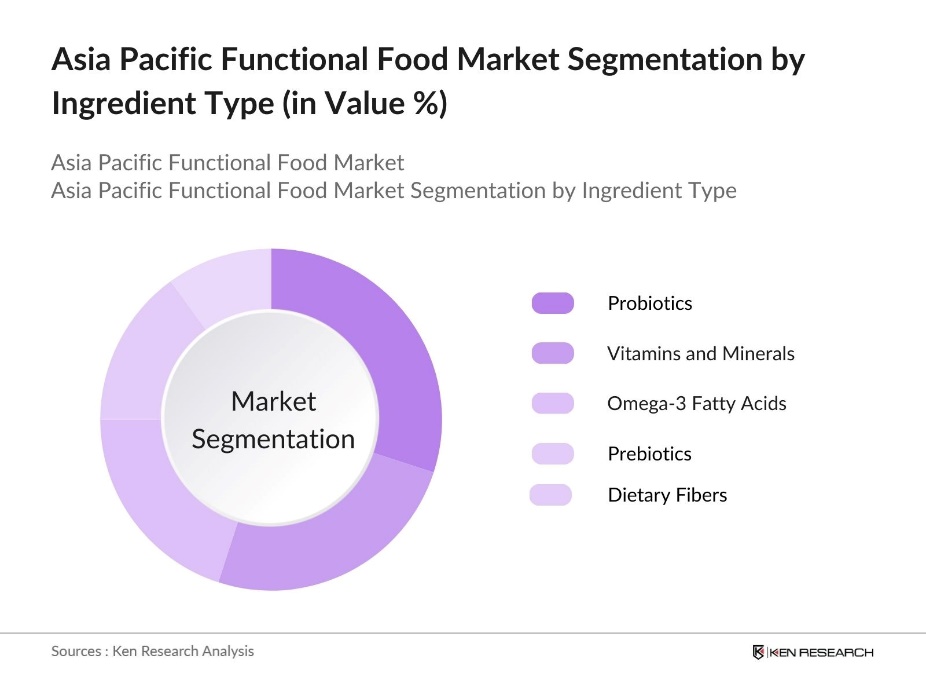

By Ingredient Type: The market is segmented by ingredient type into probiotics, prebiotics, omega-3 fatty acids, vitamins and minerals, and dietary fibers. Probiotics dominate this segment, driven by their proven benefits in promoting gut health and boosting the immune system. The increasing consumer awareness about the importance of gut microbiota in overall health has led to a surge in demand for probiotic-infused products, including yogurts, drinks, and supplements.

Asia Pacific Functional Food Market Competitive Landscape

The Asia Pacific functional food market is characterized by the presence of both multinational corporations and regional players, leading to a competitive environment. Companies are focusing on product innovation, strategic partnerships, and mergers and acquisitions to strengthen their market position. The emphasis is on developing products that cater to specific health needs, such as immunity boosting, digestive health, and weight management, to meet the diverse demands of consumers.

Asia Pacific Functional Food Industry Analysis

Growth Drivers

- Increasing Health Consciousness: The Asia Pacific region has witnessed a significant rise in health consciousness among its population. This shift is evident in countries like Japan, where the Ministry of Health, Labour and Welfare reported a 15% increase in the consumption of health-oriented food products over the past five years. For instance, in September 2024, the NHC launched a month-long program themed "Three Reductions and Three Health," which focuses on reducing salt, oil, and sugar intake while promoting overall health awareness. These trends underscore a growing demand for functional foods that offer specific health benefits beyond basic nutrition.

- Rising Disposable Incomes: The Asia Pacific region has experienced substantial economic growth, leading to increased disposable incomes. For instance, China's GDP per capita was noted to be around $12,600 in 2023. This economic uplift has empowered consumers to allocate more resources toward health and wellness products. For instance, in South Korea, the Ministry of Economy and Finance observed a 12% annual increase in spending on health-related food products.

- Technological Advancements in Food Processing: Technological advancements in the Asia Pacific have reshaped food processing, enabling the creation of functional foods with improved nutritional profiles. Innovations in biotechnology and food engineering have led to breakthroughs in nutrient fortification and retention of bioactive compounds. These developments support the production of health-oriented foods that align with consumer demand for products offering added benefits, catering to an increasingly health-conscious market.

Market Challenges

- High Production Costs: Producing functional foods often requires substantial investment in research, specialized ingredients, and advanced processing, which raises overall production costs. The need for unique bioactive compounds, probiotics, and other health-boosting elements can elevate expenses significantly compared to conventional foods. These higher costs may lead to increased retail prices, potentially limiting consumer accessibility and hindering broader market adoption for functional food products.

- Regulatory Compliance: Functional food manufacturers face complex regulatory requirements across the Asia Pacific region, as each country enforces its own standards for health claims, labeling, and ingredient approvals. Meeting these diverse regulatory demands requires extensive documentation and adherence to strict guidelines, often leading to longer product launch timelines and additional compliance costs. These regulatory challenges add to the operational burden on producers, impacting their market agility.

Asia Pacific Functional Food Market Future Outlook

Over the next five years, the Asia Pacific functional food market is expected to experience significant growth, driven by continuous consumer demand for health-enhancing products, advancements in food technology, and increasing disposable incomes. The focus will likely be on personalized nutrition, with products tailored to individual health needs and preferences. Additionally, the incorporation of natural and organic ingredients is anticipated to gain traction, aligning with the growing consumer preference for clean-label products.

Market Opportunities

- Expansion into Emerging Markets: Emerging markets in the Asia Pacific region offer substantial growth opportunities for functional food manufacturers. Rapid urbanization and a growing middle class in countries like Vietnam and Indonesia have spurred lifestyle changes and a rising demand for health-oriented products. This shift creates a favorable environment for functional foods, as consumers increasingly seek products that promote well-being and align with healthier lifestyles.

- Product Innovation and Diversification: Innovating and diversifying functional food offerings can help capture a wider consumer base. In markets across Asia, there is a focus on creating products that incorporate traditional, health-promoting ingredients and address specific nutritional needs. These innovative approaches cater to varied health preferences, enhancing consumer appeal and supporting market growth by aligning products with local tastes and wellness priorities.

Scope of the Report

|

Product Type |

Functional Dairy Products |

|

Ingredient Type |

Probiotics |

|

Application |

Cardiovascular Health |

|

Distribution Channel |

Supermarkets and Hypermarkets |

|

Region |

China |

Products

Key Target Audience

Functional Food Manufacturers

Nutritional Supplement Companies

Health and Wellness Product Manufacturers

Government and Regulatory Bodies (e.g., Food Safety and Standards Authority of India)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Nestl S.A.

Danone S.A.

PepsiCo Inc.

Unilever PLC

The Coca-Cola Company

General Mills Inc.

Kellogg Company

Abbott Laboratories

Amway Corporation

Herbalife Nutrition Ltd.

Table of Contents

1. Asia Pacific Functional Food Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Functional Food Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Functional Food Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Health Consciousness

3.1.2 Rising Disposable Incomes

3.1.3 Technological Advancements in Food Processing

3.1.4 Government Initiatives and Regulations

3.2 Market Challenges

3.2.1 High Production Costs

3.2.2 Regulatory Compliance

3.2.3 Consumer Skepticism

3.3 Opportunities

3.3.1 Expansion into Emerging Markets

3.3.2 Product Innovation and Diversification

3.3.3 Strategic Partnerships and Collaborations

3.4 Trends

3.4.1 Demand for Natural and Organic Ingredients

3.4.2 Fortification of Traditional Foods

3.4.3 Personalized Nutrition Solutions

3.5 Government Regulations

3.5.1 Food Fortification Policies

3.5.2 Labeling and Health Claims Standards

3.5.3 Import and Export Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Asia Pacific Functional Food Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Functional Dairy Products

4.1.2 Functional Bakery and Confectionery

4.1.3 Functional Beverages

4.1.4 Functional Cereals and Grains

4.1.5 Functional Snacks

4.2 By Ingredient Type (In Value %)

4.2.1 Probiotics

4.2.2 Prebiotics

4.2.3 Omega-3 Fatty Acids

4.2.4 Vitamins and Minerals

4.2.5 Dietary Fibers

4.3 By Application (In Value %)

4.3.1 Cardiovascular Health

4.3.2 Digestive Health

4.3.3 Immune Support

4.3.4 Weight Management

4.3.5 Sports Nutrition

4.4 By Distribution Channel (In Value %)

4.4.1 Supermarkets and Hypermarkets

4.4.2 Convenience Stores

4.4.3 Online Retail

4.4.4 Specialty Stores

4.5 By Region (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 Australia

4.5.5 ASEAN Countries

5. Asia Pacific Functional Food Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Nestl S.A.

5.1.2 Danone S.A.

5.1.3 PepsiCo Inc.

5.1.4 Unilever PLC

5.1.5 The Coca-Cola Company

5.1.6 General Mills Inc.

5.1.7 Kellogg Company

5.1.8 Abbott Laboratories

5.1.9 Amway Corporation

5.1.10 Herbalife Nutrition Ltd.

5.1.11 Yakult Honsha Co., Ltd.

5.1.12 Meiji Holdings Co., Ltd.

5.1.13 GlaxoSmithKline plc

5.1.14 Arla Foods amba

5.1.15 Red Bull GmbH

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Regional Presence, R&D Investment, Strategic Initiatives, Number of Employees, Year of Establishment)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Functional Food Market Regulatory Framework

6.1 Food Safety Standards

6.2 Nutritional Labeling Requirements

6.3 Health Claims Regulations

7. Asia Pacific Functional Food Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Functional Food Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Ingredient Type (In Value %)

8.3 By Application (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Functional Food Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Functional Food Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data of the Asia Pacific functional food market is compiled and analyzed. This includes assessing market penetration, revenue generation patterns, and demand fluctuations within key product categories. A thorough analysis of sales channels and product preferences also forms part of this stage to ensure data accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on secondary research and subsequently validated through consultations with industry experts across diverse companies. These insights provide additional accuracy and operational perspectives, supporting the refinement of the market data.

Step 4: Research Synthesis and Final Output

The final phase synthesizes data and feedback obtained throughout the research, including direct interactions with functional food manufacturers. This step consolidates findings into a validated, cohesive analysis, with robust insights on market trends, product segments, and revenue forecasts for the Asia Pacific functional food market.

Frequently Asked Questions

01 How big is the Asia Pacific Functional Food Market?

The Asia Pacific functional food market was valued at USD 117.55 billion, driven by increasing consumer focus on health and wellness and a rise in disposable incomes across major economies.

02 What are the key growth drivers in the Asia Pacific Functional Food Market?

Key growth drivers in Asia Pacific functional food market include a rising prevalence of lifestyle-related diseases, increased consumer awareness around health and nutrition, and technological advancements in food processing.

03 Which are the leading companies in the Asia Pacific Functional Food Market?

Major players in Asia Pacific functional food market include Nestl S.A., Danone S.A., PepsiCo Inc., Unilever PLC, and The Coca-Cola Company, each known for their extensive portfolios and robust distribution networks.

04 What are the main challenges faced by the Asia Pacific Functional Food Market?

Key challenges in Asia Pacific functional food market include high production costs, regulatory compliance complexities, and consumer skepticism regarding health claims associated with functional food products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.