Asia Pacific Industrial Air Filtration Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD10619

November 2024

92

About the Report

Asia Pacific Industrial Air Filtration Market Overview

- The Asia Pacific industrial air filtration market, valued at USD 1.83 billion, has seen steady growth due to rising awareness about air quality and stringent regulations regarding industrial emissions. The market is driven by the necessity for industries to maintain clean air environments, ensuring worker safety and product quality.

- China and India are the dominant players in the Asia Pacific industrial air filtration market, largely due to their rapid industrialization, urbanization, and significant manufacturing activities. China has the largest share, driven by its strict environmental regulations, heavy industrial base, and government initiatives to control pollution. India follows closely, with an increasing need for pollution control systems, spurred by its National Clean Air Program.

- APAC countries enforce stringent emission control standards, such as the Air Pollution Control Act in South Korea, which mandates emission limits for various pollutants. In 2024, China is indeed set to issue 70 national standards aimed at improving carbon emissions, energy efficiency, and carbon capture technologies. These regulations are aimed at curbing air pollution, compelling industries to invest in high-efficiency air filtration systems to avoid non-compliance penalties.

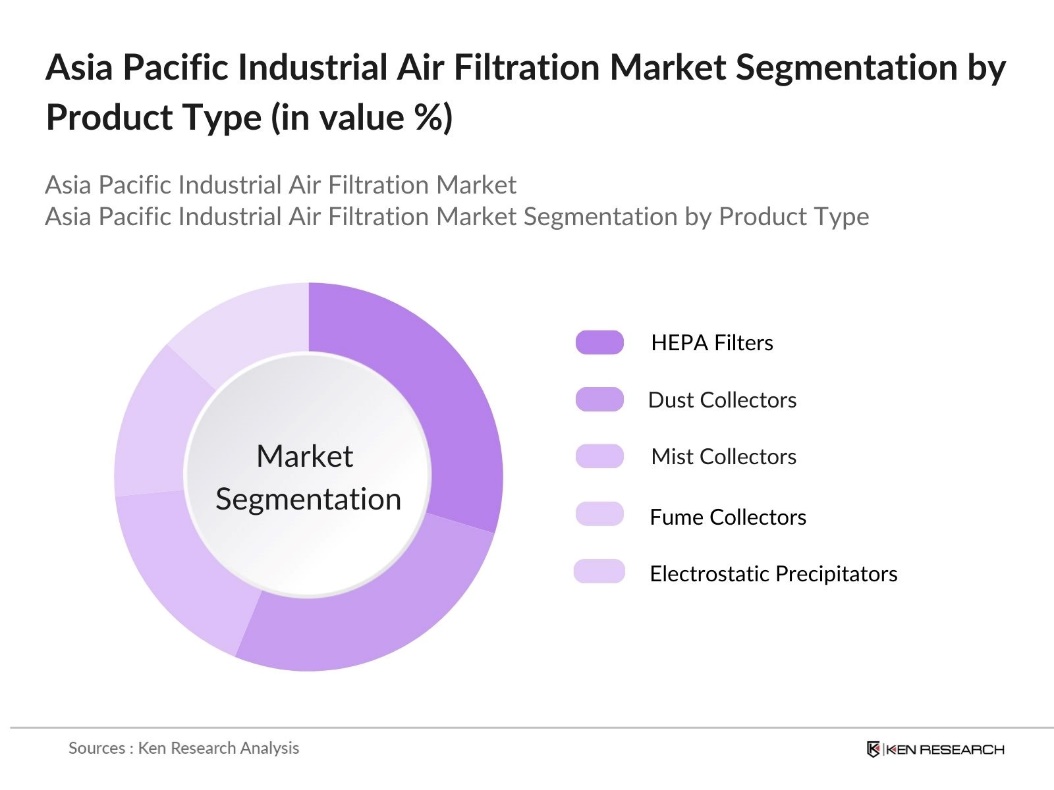

Asia Pacific Industrial Air Filtration Market Segmentation

By Product Type: The market is segmented by product type into HEPA filters, dust collectors, mist collectors, fume collectors, and electrostatic precipitators. HEPA filters dominate this segment due to their efficiency in capturing fine particles, which is essential in industries like pharmaceuticals and electronics. The demand for HEPA filters has surged due to their effectiveness in providing high air quality, which is critical for both product safety and employee health in environments prone to airborne contaminants.

By End-Use Industry: The market is segmented by end-use industry into food & beverage, pharmaceuticals, cement, chemicals & petrochemical, and electronics manufacturing. The food & beverage sector holds a significant share, attributed to the stringent air quality requirements needed to prevent contamination and ensure product safety. For instance, the requirement for clean processing environments has increased due to rising food safety standards across Asia Pacific, particularly in regions with high exports of processed food products.

Asia Pacific Industrial Air Filtration Market Competitive Landscape

The Asia Pacific industrial air filtration market is dominated by a few established players. These companies play a vital role in defining market trends and offering innovative solutions. The competitive landscape is shaped by factors such as product innovation, strategic expansions, and mergers and acquisitions.

Asia Pacific Industrial Air Filtration Industry Analysis

Growth Drivers

- Industrialization in Developing Economies (Industrialization Index): The Asia-Pacific region, especially countries like India, Vietnam, and Indonesia, has observed an upsurge in its industrialization index over recent years. This industrial expansion has driven demand for efficient air filtration systems to ensure compliance with environmental standards and maintain productivity in industrial plants. For instance, the IIP grew by 3.8% in December 2023, with significant contributions from the manufacturing sector, which accounts for a substantial portion of the index. This push is critical to reduce air pollution in confined environments, as mandated by national regulatory bodies, and to prevent operational disruptions.

- Rising Demand for Cleanroom Environments (Cleanroom Expansion Rate): Cleanroom infrastructure has expanded across APAC, driven largely by the pharmaceutical and semiconductor industries. Japan and South Korea saw a 22% increase in cleanroom installations across industrial facilities by 2024, enhancing the demand for high-grade air filtration systems to maintain ISO-certified air quality standards. This trend is attributed to rising production standards, as cleanroom demand has become imperative to meet contamination-free requirements, especially in medical device and electronics manufacturing. Regulations now mandate stringent filtration for cleanrooms to prevent product contamination.

- Demand for Workplace Safety (Incidence of Occupational Hazards): Increased incidents of respiratory diseases in industrial sectors are heightening demand for air filtration systems across APAC. With a focus on labor health, especially in manufacturing, governments are enforcing stricter air quality standards to protect workers. This push leads companies in sectors like automotive, manufacturing, and pharmaceuticals to prioritize high-efficiency filtration solutions, aiming to reduce workplace hazards and ensure safer environments.

Market Challenges

- High Initial Installation Costs (Cost-Benefit Analysis): Industrial air filtration systems, particularly advanced models with HEPA or ULPA capabilities, involve high initial installation costs. Although these systems prove cost-effective over time, the steep upfront investment can be a hurdle, especially for small-scale industries. While certain regions offer regulatory incentives to alleviate these costs, these efforts are currently insufficient for widespread adoption of high-quality filtration systems across the sector.

- Skilled Workforce Shortage (Talent Availability Metric): A shortage of skilled technicians trained to operate and maintain advanced filtration systems poses a challenge in the APAC region. This skill gap, particularly in countries like Indonesia and Thailand, slows the adoption of industrial air filtration and increases operational risks due to maintenance issues. Workforce development initiatives aim to address this gap, but their impact on the industry remains limited so far.

Asia Pacific Industrial Air Filtration Market Future Outlook

Over the next five years, the Asia Pacific industrial air filtration market is expected to see robust growth. This growth will be driven by increasingly stringent regulatory frameworks, especially in China and India, which continue to emphasize air quality improvements. The market will also benefit from technological advancements in filtration efficiency and energy-saving systems, aligned with the regions shift towards sustainable manufacturing. Additionally, growing awareness of workplace air quality and health standards is anticipated to fuel market demand further

Market Opportunities

- Technological Advancements (Filtration Efficiency Improvements): Advancements in filtration technology, including high-efficiency particulate air (HEPA) and ultra-low particulate air (ULPA) systems, have greatly enhanced filtration effectiveness in industrial applications. These technologies enable the APAC industrial sector to comply more effectively with air quality standards. Additionally, research and development efforts in the region are focused on producing energy-efficient filters that help reduce operational costs while maintaining optimal air quality.

- Expanding Pharmaceutical Industry (Growth Rate by Application): The growing pharmaceutical industry in the APAC region has intensified the demand for clean, controlled environments, driving the need for industrial air filtration. Nations like China and India, with extensive pharmaceutical manufacturing, require advanced filtration systems to meet stringent hygiene and safety regulations. This industry growth emphasizes the importance of reliable filtration solutions that can ensure compliance with high standards of cleanliness in pharmaceutical production.

Scope of the Report

|

Product Type |

HEPA Filters Dust Collectors Mist Collectors Fume Collection Filters Electrostatic Precipitators |

|

End-Use Industry |

Food & Beverage Pharmaceutical Cement Chemicals & Petrochemical Electronics Manufacturing |

|

Technology |

Activated Carbon Electrostatic Precipitation UV-C Purification |

|

Sales Channel |

OEM Aftermarket |

|

Region |

China India Japan Southeast Asia Australia |

Products

Key Target Audience

Industrial Manufacturers (particularly in food & beverage, cement, and electronics)

Pharmaceutical Companies (requiring controlled environments)

Automotive Manufacturing Companies

Healthcare Facilities

Electronics Manufacturing Plants

Government and Regulatory Bodies (e.g., National Clean Air Program in India, APAC Clean Air Standards)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Daikin Industries Ltd.

Honeywell International Inc.

Camfil

Donaldson Company, Inc.

3M

Parker Hannifin Corp.

Mann+Hummel

Absolent Group

Pall Corporation

SPX Technologies Inc.

Table of Contents

1. Asia Pacific Industrial Air Filtration Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (CAGR)

1.4 Market Segmentation Overview

2. Asia Pacific Industrial Air Filtration Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Industrial Air Filtration Market Analysis

3.1 Growth Drivers

3.1.1 Industrialization in Developing Economies (Market-Specific Metric: Industrialization Index)

3.1.2 Environmental Regulations (e.g., APAC Clean Air Standards)

3.1.3 Demand for Workplace Safety (Incidence of Occupational Hazards)

3.1.4 Rising Demand for Cleanroom Environments (Cleanroom Expansion Rate)

3.2 Market Challenges

3.2.1 High Initial Installation Costs (Cost-Benefit Analysis)

3.2.2 Skilled Workforce Shortage (Talent Availability Metric)

3.2.3 Technology Integration Barriers (Technology Adoption Index)

3.3 Opportunities

3.3.1 Technological Advancements (Filtration Efficiency Improvements)

3.3.2 Expanding Pharmaceutical Industry (Growth Rate by Application)

3.3.3 Demand for Energy-Efficient Systems (Energy Efficiency Metrics)

3.4 Trends

3.4.1 Integration with IoT Systems (Smart Industry Applications)

3.4.2 Automated Filtration Systems (Innovation Rate)

3.4.3 Shift Toward Eco-Friendly Filtration Materials (Environmental Impact Score)

3.5 Government Regulation

3.5.1 Emission Control Standards

3.5.2 Industry Compliance Requirements

3.5.3 National Air Quality Goals

3.6 SWOT Analysis

3.7 Stake Ecosystem (Manufacturers, Distributors, and Regulatory Bodies)

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Asia Pacific Industrial Air Filtration Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 HEPA Filters

4.1.2 Dust Collectors

4.1.3 Mist Collectors

4.1.4 Fume Collection Filters

4.1.5 Electrostatic Precipitators

4.2 By End-Use Industry (In Value %)

4.2.1 Food & Beverage

4.2.2 Pharmaceutical

4.2.3 Cement

4.2.4 Chemicals & Petrochemical

4.2.5 Electronics Manufacturing

4.3 By Technology (In Value %)

4.3.1 Activated Carbon

4.3.2 Electrostatic Precipitation

4.3.3 UV-C Purification

4.4 By Sales Channel (In Value %)

4.4.1 OEM

4.4.2 Aftermarket

4.5 By Region (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 Southeast Asia

4.5.5 Australia

5. Asia Pacific Industrial Air Filtration Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Daikin Industries Ltd.

5.1.2 Honeywell International Inc.

5.1.3 Camfil

5.1.4 Donaldson Company, Inc.

5.1.5 3M

5.1.6 Mann+Hummel

5.1.7 Parker Hannifin Corp.

5.1.8 Pall Corp.

5.1.9 Absolent

5.1.10 General Electric

5.1.11 SPX Technologies Inc.

5.1.12 Purafil

5.1.13 IQAir

5.1.14 Industrial Air Filtration, Inc.

5.1.15 Lydall

5.2 Cross Comparison Parameters (Revenue, Headquarters Location, Market Reach, Product Range, Employee Strength, Environmental Certifications, M&A Activity, Product Innovation)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Joint Ventures, Expansions)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (PE & VC Funding)

5.7 Government Grants

5.8 Private Equity Investments

6. Asia Pacific Industrial Air Filtration Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Asia Pacific Industrial Air Filtration Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Industrial Air Filtration Future Market Segmentation

8.1 By Product Type

8.2 By Application

8.3 By Technology

8.4 By Region

9. Asia Pacific Industrial Air Filtration Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Strategic Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with the construction of a comprehensive ecosystem map for stakeholders in the Asia Pacific Industrial Air Filtration Market. This involves thorough desk research leveraging secondary sources to define critical variables shaping market trends, including regulatory factors, technology adoption, and manufacturing needs.

Step 2: Market Analysis and Construction

This step involves the historical analysis of key data points within the Asia Pacific Industrial Air Filtration Market. Using data on industry expansion, regulatory impacts, and revenue generation, an in-depth analysis is conducted to assess the markets performance and understand service provider saturation levels across countries.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed from secondary data are validated through expert interviews. Engaging with industry professionals from various segments allows for refined insights into technology trends, product preferences, and operational nuances impacting market growth.

Step 4: Research Synthesis and Final Output

The final phase integrates insights from primary and secondary sources, creating a synthesized analysis. This validated information forms the basis for forecasting and strategic insights, ensuring a comprehensive, actionable market report tailored for business professionals.

Frequently Asked Questions

01. How big is the Asia Pacific Industrial Air Filtration Market?

The Asia Pacific industrial air filtration market was valued at USD 1.83 billion, driven by the demand for air quality maintenance in industrial sectors and regulatory compliance needs.

02. What are the challenges in the Asia Pacific Industrial Air Filtration Market?

Key challenges in Asia Pacific industrial air filtration market include the high installation costs of advanced filtration systems, shortage of skilled operators, and barriers in technology integration, impacting adoption rates among small and medium enterprises.

03. Who are the major players in the Asia Pacific Industrial Air Filtration Market?

The Asia Pacific industrial air filtration market includes significant players like Daikin Industries Ltd., Honeywell International Inc., Camfil, Donaldson Company, and 3M. These companies are influential due to their extensive product range, innovation, and strong market presence.

04. What drives the demand for industrial air filtration systems in Asia Pacific?

Demand is primarily driven in the Asia Pacific industrial air filtration market by government regulations on emission control, workplace safety requirements, and the need for cleaner manufacturing environments, especially in pharmaceuticals and food processing sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.