Asia Pacific Land Survey Equipment Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD5898

November 2024

97

About the Report

Asia Pacific Land Survey Equipment Market Overview

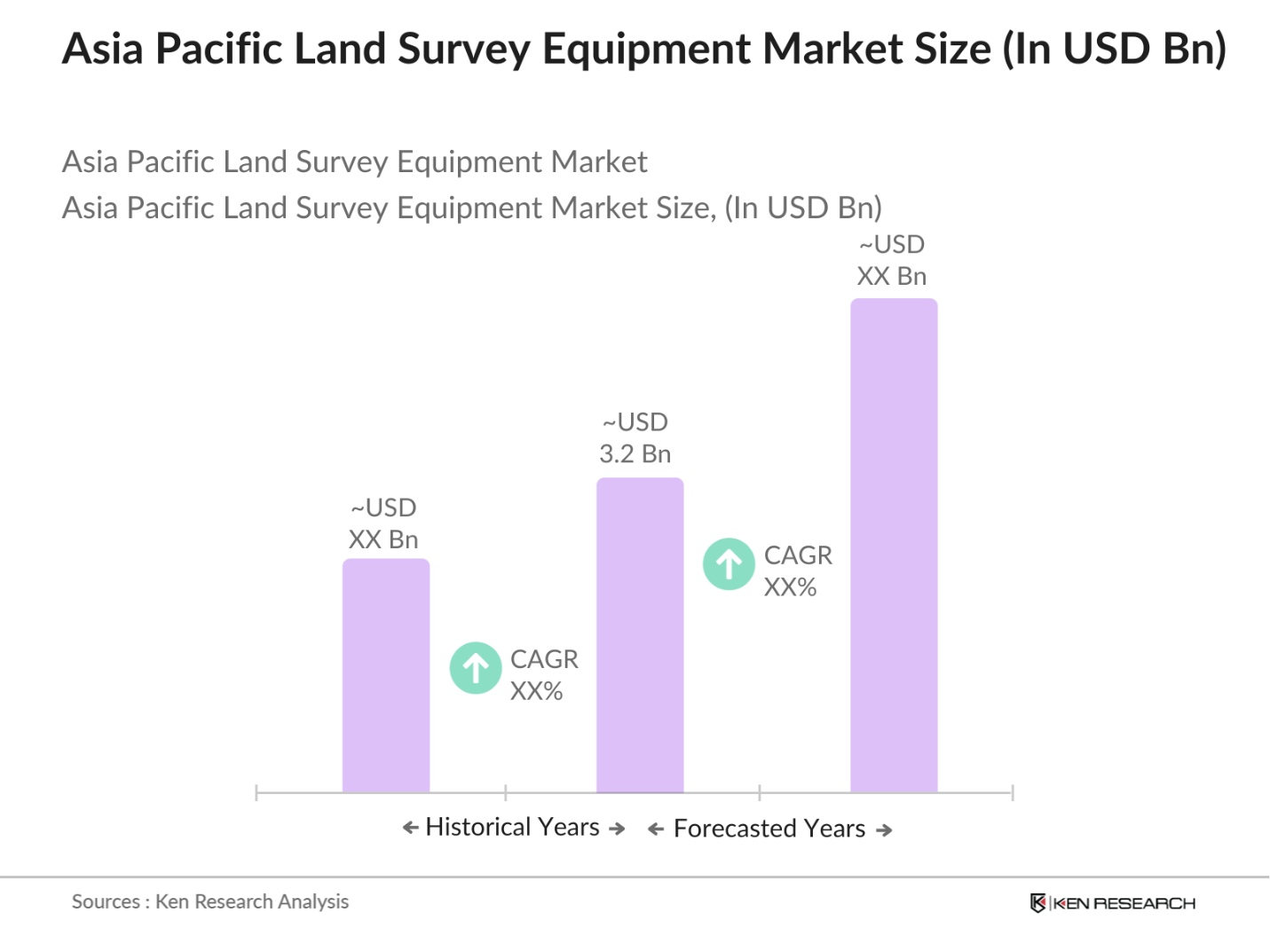

- The Asia Pacific land survey equipment market is valued at USD 3.2 billion, based on a five-year historical analysis. The market's growth is primarily driven by the surge in infrastructure development projects, urbanization, and government investments in smart city initiatives across key countries in the region. Additionally, the adoption of advanced technologies like GNSS, UAVs, and 3D scanning for precise geospatial data has fueled the demand for modern surveying equipment.

- Countries like China, India, and Japan dominate the market due to their vast infrastructure projects and construction industries. Chinas government has heavily invested in large-scale infrastructure projects, while India is ramping up its smart cities initiative. Japan's dominance stems from its advanced technological infrastructure, where precise land data is crucial for urban development, disaster prevention, and resource management. These countries prioritize high-quality surveying tools to support these ventures.

- The use of unmanned aerial vehicles (UAVs) in land surveying is rapidly gaining traction due to their ability to capture high-resolution aerial data quickly and efficiently. In 2023, UAVs accounted for approximately 25% of all surveying projects in the Asia Pacific, reflecting a growing trend toward adopting drone technology for mapping and inspection tasks. The integration of UAVs not only reduces the time required for surveying but also enhances data collection accuracy, thereby transforming traditional surveying practices. As the technology continues to evolve, it is anticipated that UAVs will play an even more significant role in shaping the future of land surveying in the region.

Asia Pacific Land Survey Equipment Market Segmentation

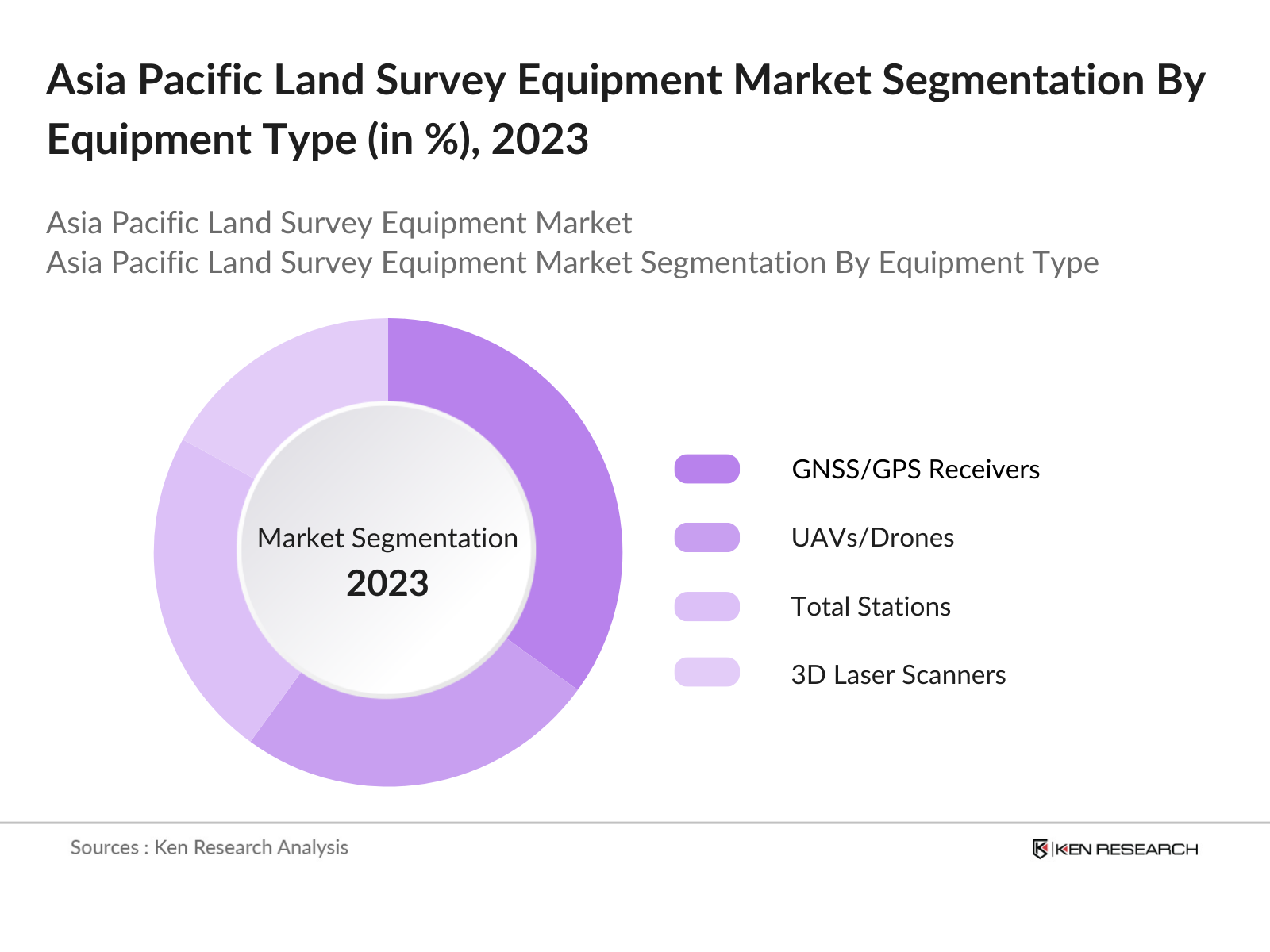

By Equipment Type: The Asia Pacific Land Survey Equipment market is segmented by equipment type into total stations, GNSS/GPS receivers, theodolites, 3D laser scanners, and UAVs/drones. Among these, GNSS/GPS receivers hold a dominant market share due to their widespread use across construction, agriculture, and infrastructure development projects. The ability of GNSS/GPS to provide accurate location data in real-time makes them essential for high-precision tasks such as mapping, surveying, and land division.

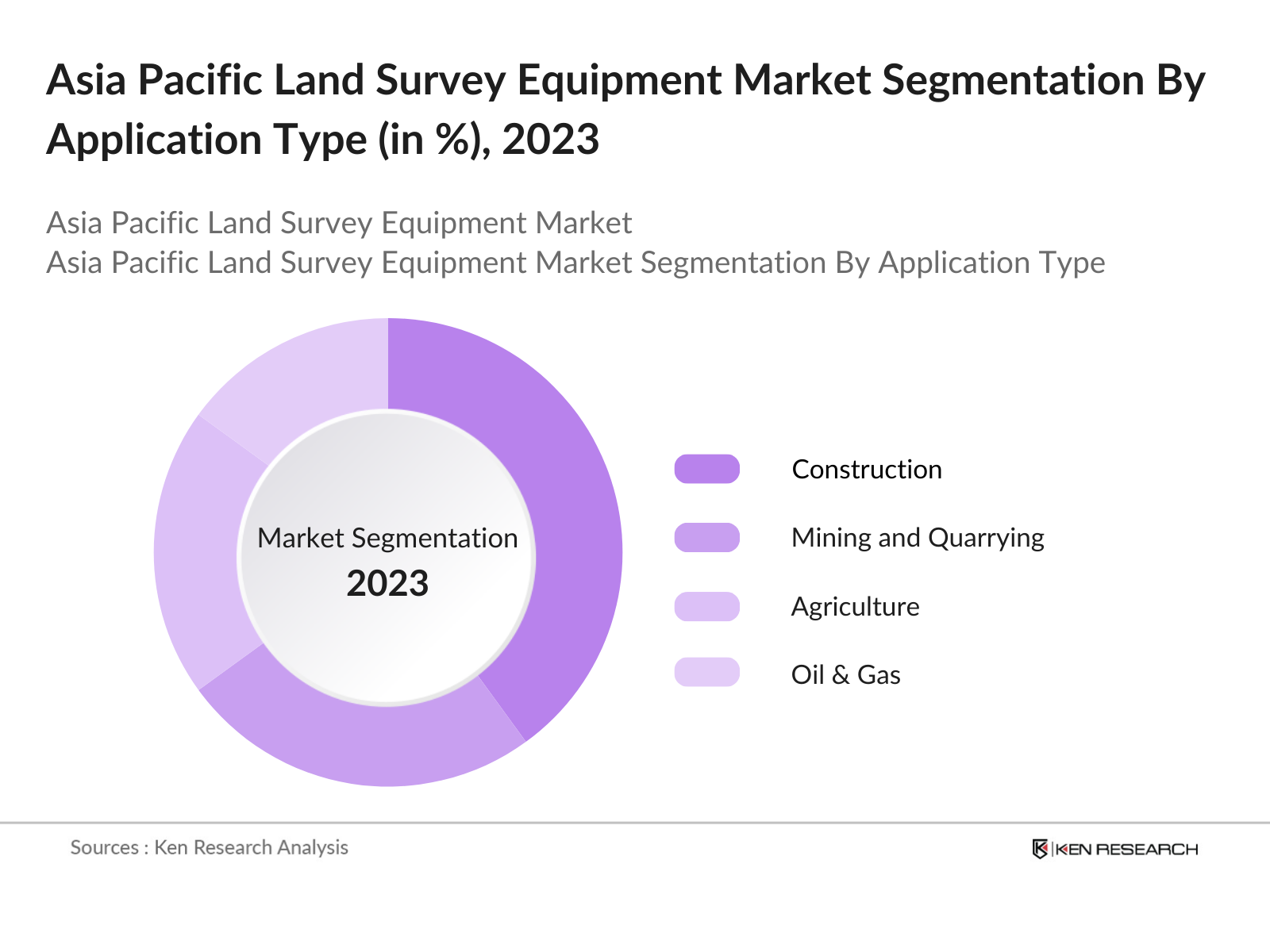

By Application: The Asia Pacific land survey equipment market is segmented by application into construction, agriculture, mining and quarrying, oil & gas, and defense and security. Construction dominates this segment with the largest market share, driven by rapid urbanization and the need for efficient land management in megacities. Surveying equipment plays a pivotal role in accurate land measurements, site mapping, and construction planning, making it indispensable in this sector.

Asia Pacific Land Survey Equipment Market Competitive Landscape

The Asia Pacific land survey equipment market is dominated by a few key players, both regional and global, who are investing heavily in R&D and strategic partnerships to maintain their market positions. Companies like Trimble and Hexagon AB lead the charge with their innovative technologies, while local players like Hi-Target Surveying Instrument Co. have a strong foothold in regional markets due to their cost-effective solutions and local expertise.

Asia Pacific Land Survey Equipment Industry Analysis

Growth Drivers

- Expanding Urbanization: Urbanization is accelerating in the Asia Pacific region, with projections indicating that 66% of the population will reside in urban areas by 2050, up from 50% in 2020. This urban shift necessitates robust land survey equipment to facilitate the planning and development of housing, infrastructure, and public amenities. In 2022, the region experienced an urban population growth of approximately 80 million people, highlighting the increasing demand for precise surveying services to manage urban planning and development effectively. These trends point to a continued need for advanced land survey equipment to support the demands of expanding urban areas.

- Infrastructure Modernization Programs: Countries in the Asia Pacific are investing heavily in infrastructure modernization. For instance, the Asian Development Bank estimates that developing Asia requires $26 trillion in infrastructure investment from 2016 to 2030, averaging $1.7 trillion annually. Major projects, such as transportation networks, smart city initiatives, and public utilities, rely heavily on accurate land surveying to ensure compliance with regulatory frameworks and to optimize design and execution. As infrastructure programs are rolled out, the demand for high-precision land survey equipment is expected to surge, driven by the need to meet these ambitious investment goals.

- Digital Mapping and GIS Adoption: The adoption of Geographic Information Systems (GIS) and digital mapping technologies is rapidly transforming the land surveying landscape. As of 2023, approximately 45% of government agencies across the Asia Pacific utilize GIS technologies for land use planning and management. This increase has been propelled by the need for more efficient data collection and analysis methods to support urban planning, environmental assessments, and disaster management. With the regional push towards digital transformation, the market for advanced survey equipment that integrates with GIS systems is poised for significant growth, reflecting the increasing reliance on technology for land management.

Market Challenges

- High Initial Investment for Advanced Equipment: The initial investment required for advanced land survey equipment remains a significant barrier for many firms, particularly small and medium-sized enterprises (SMEs). In 2022, the average cost of high-end surveying instruments, such as total stations and GNSS equipment, ranged between $10,000 to $50,000, which can be prohibitive for smaller operators. This high cost is often coupled with additional expenses related to maintenance and training, making it challenging for SMEs to adopt the latest technologies. As a result, many companies may opt for outdated equipment, potentially impacting the overall efficiency and accuracy of survey operations in the region.

- Lack of Skilled Workforce: The shortage of skilled professionals in the land surveying field poses a substantial challenge to market growth. In 2023, it was estimated that there was a deficit of over 25,000 surveyors in the Asia Pacific region, particularly in emerging economies where education and training in surveying are limited. This gap in the workforce hampers the ability of firms to fully utilize advanced surveying technologies and can lead to inefficiencies in project delivery. Initiatives to enhance vocational training and higher education programs are essential to address this skills gap and meet the increasing demand for skilled land surveyors.

Asia Pacific Land Survey Equipment Market Future Outlook

Over the next five years, the Asia Pacific land survey equipment market is expected to show steady growth, driven by large-scale infrastructure development projects, technological advancements, and the increasing adoption of smart city initiatives across the region. The demand for advanced geospatial technologies like UAVs and LiDAR is anticipated to grow as precision in land data becomes more critical for urban planning, agriculture, and defense. Governments in key markets such as China and India will continue to invest heavily in modernizing infrastructure, creating a conducive environment for the growth of survey equipment. Furthermore, the integration of AI and automation in land survey processes will likely enhance the efficiency and accuracy of data collection, further driving market growth.

Opportunities

- Integration of AI and Automation in Surveying: The integration of artificial intelligence (AI) and automation into land surveying processes presents significant opportunities for market growth. As of 2023, around 30% of surveying firms in the Asia Pacific have begun incorporating AI technologies to enhance data analysis and automate routine tasks, which has been shown to increase efficiency by up to 40%. The potential for AI-driven solutions to improve data accuracy and reduce operational costs is driving investment in innovative surveying technologies. This trend indicates a shift toward smarter, more efficient surveying practices that can accommodate the rising complexity of land development projects.

- Strategic Alliances with Local Governments and Firms: Partnerships between surveying companies and local governments or firms are becoming increasingly vital in navigating the complexities of land management and development. In 2022, over 50% of surveying projects in the Asia Pacific involved collaboration with local authorities, facilitating smoother project approvals and access to necessary data. These strategic alliances enable firms to leverage local knowledge and resources, enhancing their capacity to deliver timely and compliant surveying services. As the demand for collaborative approaches to land development grows, such partnerships will be essential for companies looking to expand their reach and influence within the market.

Scope of the Report

|

Equipment Type |

Total Stations GNSS/GPS Receivers Theodolites 3D Laser Scanners UAVs/Drones |

|

Technology |

GNSS/GPS-Based Surveying Robotic Survey Systems Photogrammetry and Remote Sensing LiDAR Surveying Autonomous Survey Solutions |

|

Application |

Construction Agriculture Mining and Quarrying Oil & Gas Defense and Security |

|

End-User |

Government and Public Sector Private Surveying Firms Infrastructure Development Companies Research Institutes Utilities and Energy |

|

Region |

China India Japan Southeast Asia Australia and New Zealand |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies (Ministries of Land, Urban Planning Departments)

Infrastructure Development Companies

Real Estate and Construction Companies

Surveying and Mapping Companies

Mining and Resource Exploration Companies

Defense and Security Comapnies

Utilities and Energy Companies

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Trimble Inc.

Hexagon AB

Hi-Target Surveying Instrument Co.

South Surveying & Mapping Technology Co.

Leica Geosystems AG

Topcon Corporation

Nikon-Trimble Co., Ltd

Stonex Srl

Spectra Precision

RIEGL Laser Measurement Systems GmbH

Table of Contents

1. Asia Pacific Land Survey Equipment Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Land Survey Equipment Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Land Survey Equipment Market Analysis

3.1 Growth Drivers

3.1.1 Expanding Urbanization

3.1.2 Infrastructure Modernization Programs

3.1.3 Digital Mapping and GIS Adoption

3.1.4 Growing Need for Precise Data in Construction and Mining

3.2 Market Challenges

3.2.1 High Initial Investment for Advanced Equipment

3.2.2 Lack of Skilled Workforce

3.2.3 Regional Variability in Land Use Policies

3.3 Opportunities

3.3.1 Integration of AI and Automation in Surveying

3.3.2 Strategic Alliances with Local Governments and Firms

3.3.3 Expansion into Emerging Economies and Rural Development Projects

3.4 Trends

3.4.1 Rise of Unmanned Aerial Vehicles (UAVs) in Land Surveying

3.4.2 Increased Adoption of LiDAR and 3D Laser Scanning

3.4.3 Growth in Portable Surveying Devices for On-site Accuracy

3.5 Government Regulations

3.5.1 Land Tenure and Ownership Regulation Compliance

3.5.2 Surveying Equipment Certification Standards

3.5.3 National Infrastructure Development Plans

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Asia Pacific Land Survey Equipment Market Segmentation

4.1 By Equipment Type (In Value %)

4.1.1 Total Stations

4.1.2 GNSS/GPS Receivers

4.1.3 Theodolites

4.1.4 3D Laser Scanners

4.1.5 UAVs/Drones

4.2 By Technology (In Value %)

4.2.1 GNSS/GPS-Based Surveying

4.2.2 Robotic Survey Systems

4.2.3 Photogrammetry and Remote Sensing

4.2.4 LiDAR Surveying

4.2.5 Autonomous Survey Solutions

4.3 By Application (In Value %)

4.3.1 Construction

4.3.2 Agriculture

4.3.3 Mining and Quarrying

4.3.4 Oil & Gas

4.3.5 Defense and Security

4.4 By End-User (In Value %)

4.4.1 Government and Public Sector

4.4.2 Private Surveying Firms

4.4.3 Infrastructure Development Companies

4.4.4 Research Institutes

4.4.5 Utilities and Energy

4.5 By Region (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 Southeast Asia

4.5.5 Australia and New Zealand

5. Asia Pacific Land Survey Equipment Market Competitive Analysis

5.1 Detailed Profiles of Major Companies (Market Share, Key Offerings, and Regional Presence)

5.1.1 Trimble Inc.

5.1.2 Hexagon AB

5.1.3 Topcon Corporation

5.1.4 South Surveying & Mapping Technology Co.

5.1.5 Suzhou FOIF Co., Ltd

5.1.6 Nikon-Trimble Co., Ltd

5.1.7 Stonex Srl

5.1.8 Leica Geosystems AG

5.1.9 Hi-Target Surveying Instrument Co.

5.1.10 Carlson Software Inc.

5.1.11 Spectra Precision

5.1.12 CHC Navigation

5.1.13 KOREC Group

5.1.14 GeoMax Positioning AG

5.1.15 RIEGL Laser Measurement Systems GmbH

5.2 Cross Comparison Parameters (No. of Employees, Global Presence, Product Innovation, Patents, Revenue, R&D Expenditure, Customer Base, Market Reach)

5.3 Market Share Analysis (Top 10 Competitors)

5.4 Strategic Initiatives (Product Launches, Innovations, Partnerships, Contracts)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Venture Capital Funding, PE Investment)

5.7 Government and Private Grants

6. Asia Pacific Land Survey Equipment Market Regulatory Framework

6.1 Environmental Impact Standards

6.2 Equipment Safety and Compliance Guidelines

6.3 Data Protection Regulations in Surveying

7. Asia Pacific Land Survey Equipment Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Land Survey Equipment Future Market Segmentation

8.1 By Equipment Type

8.2 By Technology

8.3 By Application

8.4 By End-User

8.5 By Region

9. Asia Pacific Land Survey Equipment Market Analysts Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Strategic Marketing Initiatives

9.3 Expansion Opportunities

9.4 Customer Segmentation Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase involves mapping all stakeholders within the Asia Pacific Land Survey Equipment market. Comprehensive desk research is performed using secondary databases and proprietary sources to define the key factors driving market growth, such as infrastructure projects, technological developments, and regulatory frameworks.

Step 2: Market Analysis and Construction

Historical data is gathered on market performance, segment analysis, and revenue trends. Data pertaining to equipment sales, technological advancements, and regional demand variations are analyzed to build accurate projections and segment-wise market share calculations.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts are conducted through telephone interviews and surveys. These interviews offer insights into operational challenges, technological adoption rates, and market demand, which are used to validate market forecasts and hypotheses.

Step 4: Research Synthesis and Final Output

The research process is concluded by synthesizing data from primary and secondary sources. The final market analysis is validated using a bottom-up approach, ensuring comprehensive coverage of market trends and potential growth areas, with a focus on the Asia Pacific region.

Frequently Asked Questions

1. How big is the Asia Pacific Land Survey Equipment Market?

The Asia Pacific Land Survey Equipment market was valued at USD 3.2 billion, driven by expanding infrastructure projects, increasing adoption of UAVs for surveying, and the rise of smart city initiatives.

2. What are the key challenges in the Asia Pacific Land Survey Equipment Market?

Challenges include the high cost of advanced equipment, lack of skilled workforce, and the need for training to effectively operate modern geospatial technologies like UAVs and 3D scanners.

3. Who are the major players in the Asia Pacific Land Survey Equipment Market?

Key players include Trimble Inc., Hexagon AB, Hi-Target Surveying Instrument Co., Leica Geosystems AG, and South Surveying & Mapping Technology Co. These companies dominate the market through technological innovation and strong regional presence.

4. What are the growth drivers of the Asia Pacific Land Survey Equipment Market?

Growth is driven by urbanization, government investments in smart city projects, and the increasing need for accurate geospatial data in construction, agriculture, and resource management.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.