Asia Pacific LPG Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD7245

November 2024

96

About the Report

Asia Pacific LPG Market Overview

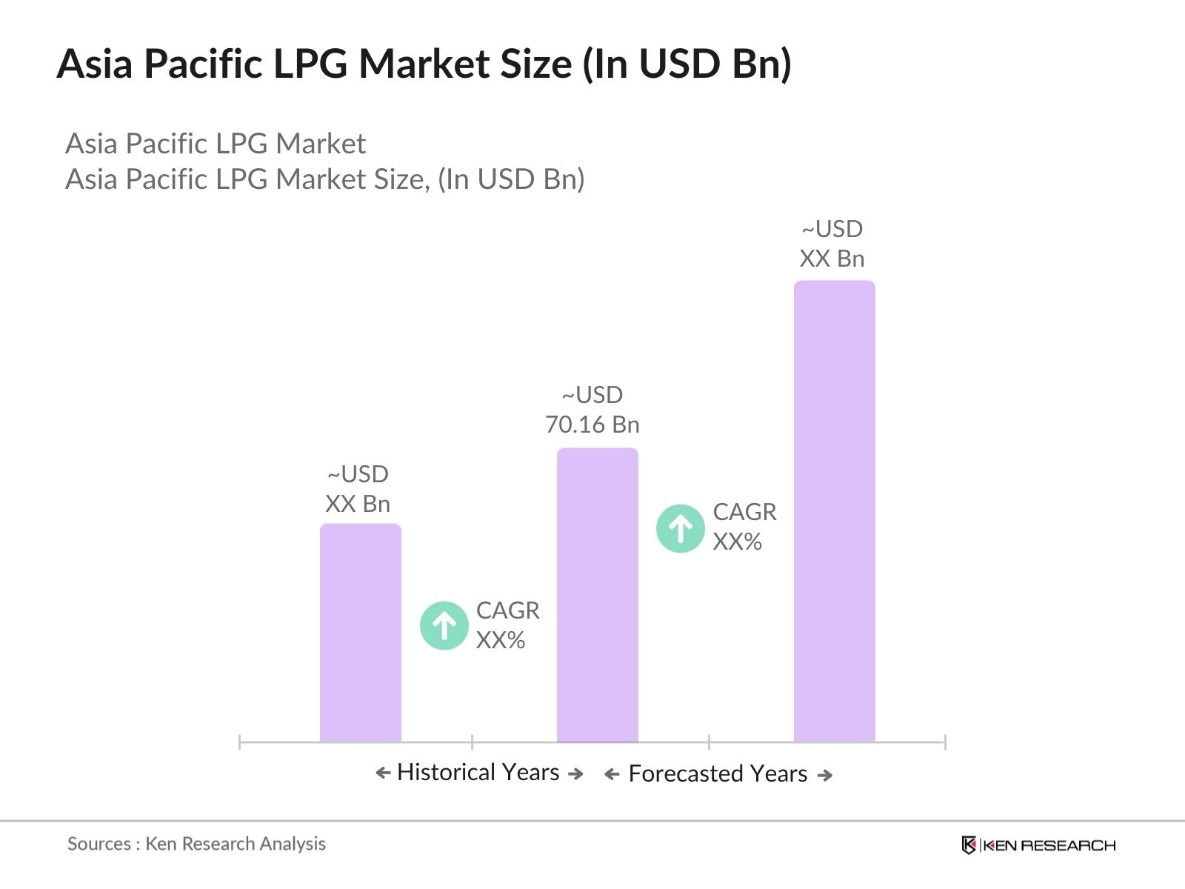

- The Asia Pacific LPG Market is valued at USD 70.16 billion. The market's growth is primarily driven by rising urbanization, increased demand for clean and efficient cooking fuel, and government policies promoting the use of LPG over conventional fuels. The expanding industrial sector and the use of LPG in the automotive sector, particularly for Autogas, have also fueled the market.

- Countries like China and India dominate the Asia Pacific LPG market due to their large populations and heavy reliance on LPG for household cooking. Chinas dominance is further reinforced by its well-established LPG distribution network and substantial investments in infrastructure, which ensure widespread availability. Meanwhile, India benefits from significant government subsidies and programs aimed at promoting LPG use in rural and urban areas.

- The Asia Pacific region has introduced stringent safety standards to regulate LPG storage and distribution. In 2023, countries like Japan and Australia updated their safety guidelines to ensure proper handling, transportation, and storage of LPG cylinders. These standards focus on minimizing risks such as explosions and leakages, ensuring that LPG infrastructure is safe and reliable. Compliance with these safety standards is mandatory for all LPG distributors and retailers.

Asia Pacific LPG Market Segmentation

By Application: The Asia Pacific LPG market is segmented by application into Residential Cooking, Commercial Heating, Industrial Uses, and Autogas. The Residential Cooking has a dominant market share in the Asia Pacific under the application segmentation due to government initiatives in countries like India and China promoting LPG as a clean cooking fuel. Programs such as the Pradhan Mantri Ujjwala Yojana in India have significantly increased the adoption of LPG in rural households, replacing traditional biomass fuels. The convenience and availability of LPG in densely populated regions further contribute to its high demand in this sub-segment.

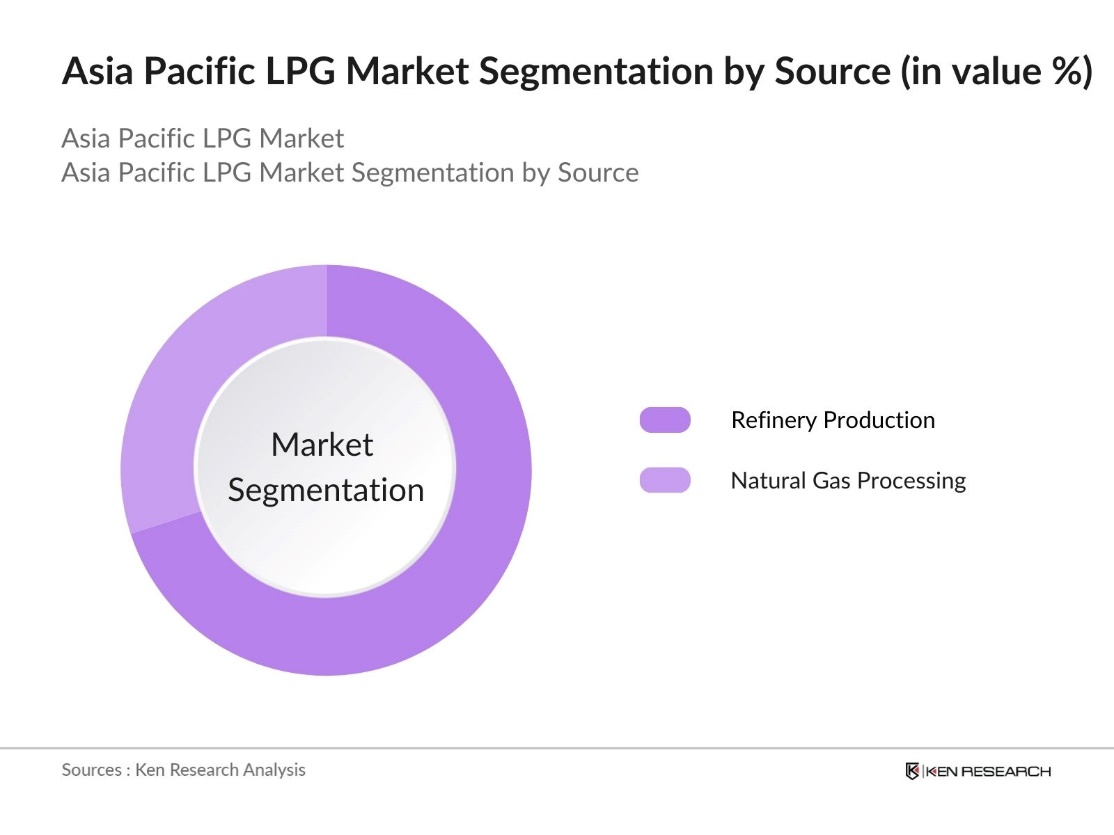

By Source: The Asia Pacific LPG market is segmented by source into Refinery Production and Natural Gas Processing. Refinery Production dominates the LPG market in the Asia Pacific region due to the region's strong refining capacity and integration with global energy markets. Major refineries in countries like China, Japan, and South Korea produce a significant portion of the LPG consumed domestically. These refineries play a pivotal role in ensuring a steady supply of LPG, meeting the demand for both industrial applications and residential cooking, especially in rapidly urbanizing countries.

Asia Pacific LPG Market Competitive Landscape

The market is dominated by major global and regional players that have established strong networks for supply and distribution. These companies leverage their extensive refining and distribution capabilities to ensure market leadership. The market shows consolidation with key players focusing on strategic partnerships and infrastructure development to enhance their competitive position.

|

Company Name |

Establishment Year |

Headquarters |

Refining Capacity |

Revenue (USD bn) |

No. of Employees |

LPG Production (MT/year) |

Distribution Network (Countries) |

Market Focus |

|

Saudi Aramco |

1933 |

Dhahran, Saudi Arabia |

||||||

|

China National Petroleum |

1988 |

Beijing, China |

||||||

|

Reliance Industries |

1966 |

Mumbai, India |

||||||

|

Petronas |

1974 |

Kuala Lumpur, Malaysia |

||||||

|

Shell Eastern Petroleum |

1891 |

Singapore |

Asia Pacific LPG Industry Analysis

Growth Drivers

- Urbanization and Rising Energy Demand: The urban population in Asia is expected to grow by 50% by 2050, with an additional 1.2 billion people. This growing urban population has led to increased energy consumption across sectors, particularly in residential and commercial areas where liquefied petroleum gas (LPG) is preferred for heating and cooking due to its clean-burning nature. The energy demand in the Asia Pacific region has grown from 2022 to 2024. LPG, being a more convenient and cleaner energy source, has seen increased adoption in response to this demand.

- Shift Toward Clean Energy and Environmental Regulations: Countries in the Asia Pacific region, such as India, China, and Japan, are increasingly focusing on reducing carbon emissions as part of global commitments like the Paris Agreement. China has committed to reducing its carbon emissions per unit of GDP by 65% compared to 2005 levels by the year 2030. The transition towards LPG aligns with strict environmental regulations in the region.

- Expansion of Distribution Infrastructure: The Asia Pacific region has focused on enhancing LPG distribution infrastructure to increase accessibility. Countries have invested in expanding distributor networks and pipeline systems, ensuring reliable LPG supply for residential, industrial, and commercial use. These improvements, including new storage and transportation facilities, are essential to meet the rising demand for LPG across various sectors, supporting the regions growing energy needs.

Market Challenges

- Fluctuations in Crude Oil Prices: LPG prices are significantly influenced by the volatility of global crude oil prices, which poses a major challenge to market stability. As LPG is a byproduct of oil refining, any fluctuations in crude oil prices directly impact its affordability. This unpredictability affects supply chains and pricing strategies, making it difficult for both suppliers and consumers to maintain consistent access to LPG in the Asia Pacific region.

- Lack of Infrastructure in Remote Areas: While urban centers in the Asia Pacific region have well-developed LPG infrastructure, rural and remote areas face significant accessibility challenges. In many countries, rural populations still rely on traditional energy sources due to the lack of efficient LPG distribution networks. This infrastructural gap limits LPG market penetration in these areas, making it difficult for rural communities to switch to cleaner, more efficient energy alternatives.

Asia Pacific LPG Market Future Outlook

Over the next five years, the Asia Pacific LPG market is expected to experience substantial growth. This growth will be driven by several factors, including increasing government support for clean energy, rising consumer demand for LPG as a cooking fuel, and expanding industrial usage. The widespread adoption of Autogas, especially in countries like South Korea and Thailand, is also expected to contribute to market expansion. As infrastructural investments increase, the LPG market will continue to penetrate both urban and rural areas, ensuring consistent growth across multiple sectors.

Market Opportunities

- Adoption of LPG as a Clean Cooking Fuel in Rural Areas: In rural areas of the Asia Pacific region, LPG is increasingly being adopted as a cleaner alternative to traditional biomass for cooking. Government initiatives across various countries aim to promote the use of LPG, making it more accessible in underserved areas. This growing shift towards clean cooking fuels offers significant opportunities for LPG suppliers to expand their reach in rural markets, improving energy access and reducing reliance on traditional fuels.

- LPG for Automotive Use (Autogas Market Growth): The use of LPG as a fuel for vehicles, known as Autogas, is gaining traction in the Asia Pacific region. Several countries are adopting LPG as a cleaner and more affordable alternative for transportation. This growing trend in the automotive sector presents significant growth opportunities for LPG suppliers, as more consumers and industries recognize the benefits of using LPG-powered vehicles over conventional fuels.

Scope of the Report

|

By Source |

Refinery Production Natural Gas Processing |

|

By Application |

Residential Cooking Commercial & Industrial Heating, Transport (Autogas) Petrochemical Feedstock |

|

By End-User |

Households Industrial & Manufacturing Units Agriculture Sector Automotive (Autogas) |

|

By Distribution Channel |

Bulk Supply Cylinder Sales |

|

By Region |

East Asia Southeast Asia South Asia Oceania |

Products

Key Target Audience

LPG Producers

Industrial Manufacturers

Automotive Companies (Autogas)

Household Appliance Manufacturers

Transport and Logistics Companies

Government and Regulatory Bodies (e.g., Ministry of Energy, Environmental Protection Agencies)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Saudi Aramco

China National Petroleum Corporation (CNPC)

Reliance Industries

Petronas

Shell Eastern Petroleum

ExxonMobil

BP Plc

Total SE

Chevron Corporation

Indian Oil Corporation

Table of Contents

1. Asia Pacific LPG Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Consumption Growth, Export-Import Trends)

1.4. Market Segmentation Overview

2. Asia Pacific LPG Market Size (In USD Bn)

2.1. Historical Market Size (Supply, Demand, Production Capacity)

2.2. Year-On-Year Growth Analysis (Supply Chain Disruptions, Infrastructure Development)

2.3. Key Market Developments and Milestones (Refinery Expansion, LPG Storage)

3. Asia Pacific LPG Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Rising Energy Demand

3.1.2. Shift Toward Clean Energy and Environmental Regulations

3.1.3. Government Subsidies and Policies Supporting LPG Adoption

3.1.4. Expansion of Distribution Infrastructure

3.2. Market Challenges

3.2.1. Fluctuations in Crude Oil Prices

3.2.2. Lack of Infrastructure in Remote Areas

3.2.3. Competition from Alternative Energy Sources (Natural Gas, Solar)

3.3. Opportunities

3.3.1. Adoption of LPG as a Clean Cooking Fuel in Rural Areas

3.3.2. LPG for Automotive Use (Autogas Market Growth)

3.3.3. Technological Innovations in Storage and Distribution

3.4. Trends

3.4.1. Increasing Use of LPG in Petrochemical Industry

3.4.2. Growing Preference for Portable LPG Cylinders

3.4.3. Integration of IoT in LPG Distribution Chains

3.5. Government Regulation

3.5.1. LPG Pricing Policies and Subsidies

3.5.2. Emission Reduction Targets for LPG Use in Industry

3.5.3. Safety Standards for LPG Storage and Distribution

3.5.4. Public-Private Partnerships for Expanding LPG Access

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Distributors, Producers, End-Users)

3.8. Porters Five Forces Analysis (Threat of New Entrants, Supplier Power)

3.9. Competitive Landscape Analysis (Market Share of Top Competitors)

4. Asia Pacific LPG Market Segmentation

4.1. By Source (In Value %)

4.1.1. Refinery Production

4.1.2. Natural Gas Processing

4.2. By Application (In Value %)

4.2.1. Residential Cooking

4.2.2. Commercial & Industrial Heating

4.2.3. Transport (Autogas)

4.2.4. Petrochemical Feedstock

4.3. By End-User (In Value %)

4.3.1. Households

4.3.2. Industrial & Manufacturing Units

4.3.3. Agriculture Sector

4.3.4. Automotive (Autogas)

4.4. By Distribution Channel (In Value %)

4.4.1. Bulk Supply

4.4.2. Cylinder Sales

4.5. By Region (In Value %)

4.5.1. East Asia

4.5.2. Southeast Asia

4.5.3. South Asia

4.5.4. Oceania

5. Asia Pacific LPG Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Saudi Aramco

5.1.2. China National Petroleum Corporation (CNPC)

5.1.3. Reliance Industries

5.1.4. Petronas

5.1.5. Shell Eastern Petroleum

5.1.6. Chevron Corporation

5.1.7. Pertamina

5.1.8. Total SE

5.1.9. BP Plc

5.1.10. SK Gas

5.1.11. ExxonMobil

5.1.12. JGC Corporation

5.1.13. Eni S.p.A.

5.1.14. Indian Oil Corporation

5.1.15. Mitsubishi Corporation

5.2. Cross Comparison Parameters (Market Capitalization, Revenue, Production Capacity, Distribution Network)

5.3. Market Share Analysis (Top Companies by Regional Penetration)

5.4. Strategic Initiatives (Partnerships, Expansions)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants for LPG Expansion

5.8. Private Equity Investments in LPG Infrastructure

6. Asia Pacific LPG Market Regulatory Framework

6.1. Energy Policy and Regulation Compliance

6.2. Environmental Standards for LPG Use

6.3. Taxation and Subsidies for LPG Consumption

6.4. Health and Safety Certification Requirements for LPG Handling

7. Asia Pacific LPG Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Infrastructure, Urbanization)

8. Asia Pacific LPG Future Market Segmentation

8.1. By Source (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific LPG Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Target Market Expansion Strategies

9.4. Customer Behavior and Demand Drivers Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves the identification of key variables influencing the Asia Pacific LPG market, focusing on refining capacity, distribution infrastructure, and consumption trends. This phase includes an in-depth analysis of data obtained from secondary sources like government reports and trade journals.

Step 2: Market Analysis and Construction

This step involves the aggregation of historical data related to LPG production, import-export trends, and market penetration rates. We evaluate sector-specific consumption rates, including the residential, commercial, and industrial sectors, to develop accurate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Our team conducts interviews with industry experts, ranging from LPG producers to distributors, to validate market assumptions. This step ensures the accuracy of revenue estimates and market dynamics.

Step 4: Research Synthesis and Final Output

The final stage synthesizes all research findings, including market segment performance, competitive landscape analysis, and future growth prospects. This holistic approach ensures a comprehensive understanding of the Asia Pacific LPG market.

Frequently Asked Questions

01 How big is the Asia Pacific LPG market?

The Asia Pacific LPG Market is valued at USD 70.16 billion, driven by rising demand for clean cooking fuels, industrial usage, and government initiatives supporting LPG adoption.

02 What are the challenges in the Asia Pacific LPG market?

Key challenges in Asia Pacific LPG Market include fluctuating crude oil prices, lack of infrastructure in remote areas, and competition from alternative energy sources such as natural gas and solar power.

03 Who are the major players in the Asia Pacific LPG market?

Major players in Asia Pacific LPG Market include Saudi Aramco, China National Petroleum Corporation (CNPC), Reliance Industries, Petronas, and Shell Eastern Petroleum, who dominate the market due to their refining capacities and extensive distribution networks.

04 What are the growth drivers of the Asia Pacific LPG market?

The Asia Pacific LPG Market is driven by factors such as rising urbanization, government subsidies for LPG in rural areas, increased usage in the industrial sector, and growing demand for Autogas in the transportation sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.