Asia Pacific Smart Manufacturing Market Outlook to 2028

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD2926

October 2024

88

About the Report

Asia Pacific Smart Manufacturing Market Overview

- The Asia Pacific Smart Manufacturing Market was valued at USD 52.9 billion in 2023. The growth is driven primarily by the increasing adoption of Industry 4.0 technologies, including IoT, AI, and big data analytics. These technologies have enabled manufacturers to enhance productivity, reduce operational costs, and improve product quality.

- The market is dominated by several key players, including Siemens AG, Honeywell International Inc., Schneider Electric, Mitsubishi Electric Corporation, and ABB Ltd. These companies have established a strong foothold in the market through continuous innovation, strategic partnerships, and investments in research and development.

- In December 2023, Mitsubishi Electric inaugurated a new manufacturing plant in Maharashtra, India, valued at INR 2,200 million. This state-of-the-art facility spans 40,000 sq.m and focuses on advanced Factory Automation Systems. The plant supports the growing demand for smart manufacturing solutions in India and aligns with the government's "Make in India" initiative, enhancing local production and innovation.

- China remains the dominant force in the market because of its large manufacturing base, strong government support, and early adoption of Industry 4.0 technologies. The Chinese government's focus on transforming the country into a global manufacturing leader has led to significant investments in smart factory initiatives and industrial automation.

Asia Pacific Smart Manufacturing Market Segmented

The market is segmented into various factors like technology, industry vertical, and region.

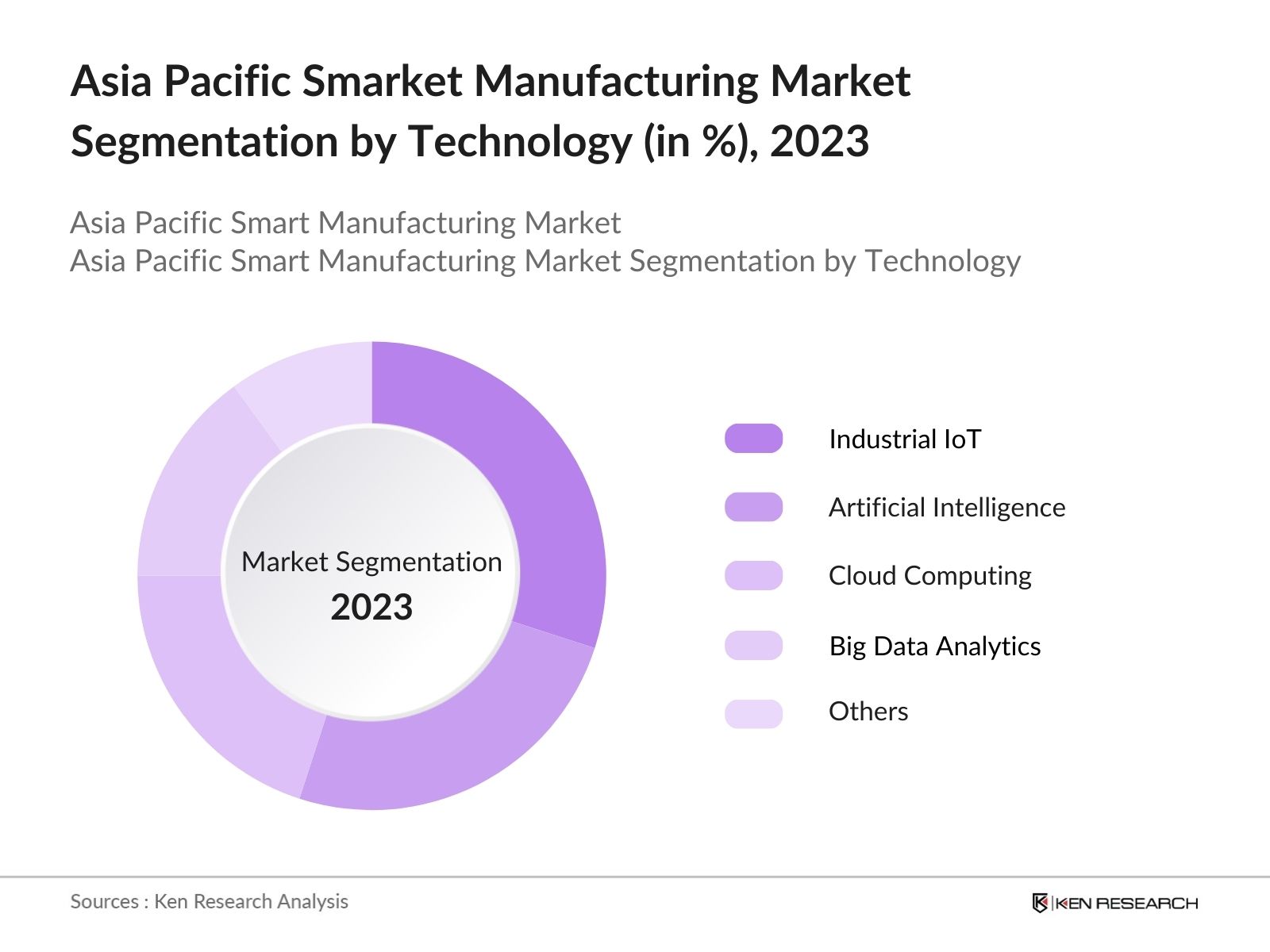

By Technology: The market is segmented by technology into Industrial IoT, Artificial Intelligence, Cloud Computing, and Big Data Analytics. In 2023, Industrial IoT held the largest market share due to its widespread adoption across various industries, including automotive, electronics, and pharmaceuticals.

By Industry Vertical: The market is segmented by industry vertical into Automotive, Electronics, Food & Beverage, and Pharmaceuticals. In 2023, the Automotive sector dominated the market with the adoption of smart manufacturing technologies, particularly in countries like Japan and South Korea, which has contributed to this dominance.

By Region: The market is segmented by region into China, South Korea, Japan, India, Australia, and the Rest of APAC. In 2023, China held the largest market share by its large-scale manufacturing capabilities, government support, and early adoption of smart manufacturing technologies.

Asia Pacific Smart Manufacturing Market Analysis

Market Growth Drivers

- Growing Adoption of Predictive Maintenance: Predictive maintenance has gained traction in the Asia Pacific manufacturing sector in 2024. Companies in Japan and China have increasingly adopted predictive maintenance solutions to minimize downtime and reduce maintenance costs. In 2024, Japanese manufacturers implementing predictive maintenance systems, which utilize AI and IoT to monitor equipment health and predict failures before they occur.

- Rising Demand for High-Quality Production: The demand for high-quality production processes has accelerated the adoption of smart manufacturing technologies in the Asia Pacific region. In 2024, South Korea's electronics sector upgraded its manufacturing facilities with advanced automation systems to meet the stringent quality standards required for export markets. This trend is particularly evident in sectors like semiconductor manufacturing, where precision and reliability are critical, thereby driving the adoption of smart manufacturing solutions.

- Increased Investment in Automation Technology: In 2024, the Asia Pacific region has seen a surge in investments in automation technology, particularly in China and Japan. The Chinese government development of industrial automation systems, leading to a significant boost in demand for smart manufacturing solutions. These investments are aimed at enhancing production efficiency and reducing operational costs across various sectors, including automotive and electronics, thus driving the market growth for smart manufacturing in the region.

Market Challenges

- Skills Gap in the Workforce: The shortage of skilled labor to operate and maintain advanced manufacturing systems is a significant challenge in the region. In 2024, a report highlighted that over 40% of manufacturing companies in China faced difficulties in finding qualified personnel to manage their smart factories.

- Cybersecurity Risks: The increasing reliance on interconnected systems in smart manufacturing has raised concerns about cybersecurity risks in 2024. The Asia Pacific region has seen a rise in cyberattacks targeting industrial control systems, with a notable incident in Japan where a major electronics manufacturer reported losses due to a ransomware attack on its smart manufacturing facilities.

Government Initiative

- China's "Made in China 2025" Program: The "Made in China 2025" initiative, launched in 2015, aims to elevate China's manufacturing sector by increasing domestic content of core materials to 40% by 2020 and 70% by 2025. The government has committed approximately $1.4 trillion to enhance high-tech industries, focusing on AI, robotics, and advanced manufacturing technologies.

- Japan's "Society 5.0" Vision: Japan's government has been actively promoting its "Society 5.0" vision, which integrates physical and digital spaces to create a highly advanced society. In 2024, the Japanese government allocated JPY 300 billion to support the development of smart manufacturing solutions as part of this initiative. The focus is on creating smart factories that utilize AI, IoT, and robotics to enhance productivity and address labor shortages, particularly in the aging population.

Asia Pacific Smart Manufacturing Market Future Outlook

The future trends in the Asia Pacific smart manufacturing industry include the widespread adoption of AI and machine learning, the expansion of 5G-enabled smart factories, the growth of sustainable manufacturing practices, and the rise of collaborative robots (cobots). These trends are expected to shape the market over the next five years.

Future Market Trends

- Expansion of Industrial IoT Networks: The integration of Industrial IoT (IIoT) networks will expand rapidly by 2028, with an estimated 1 billion new connected devices being deployed across the Asia Pacific manufacturing sector. These networks will facilitate real-time data collection and analysis, enabling manufacturers to optimize operations and improve decision-making processes.

- Shift Towards Circular Economy Models: By 2028, the Asia Pacific smart manufacturing sector will increasingly adopt circular economy models. These models will focus on reducing waste and promoting the reuse of materials, aligning with global sustainability goals and driving innovation in the manufacturing sector.

Scope of the Report

|

By Technology Type |

Industrial IoT Artificial Intelligence Cloud Computing Big Data Analytics Others |

|

By Industry Vertical |

Automotive Electronics Food & Beverage Pharmaceuticals Others |

|

By Region |

China South Korea Japan India Australia Rest of APAC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

- Government Regulatory Bodies (e.g., Ministry of Industry and Information Technology, China)

- Manufacturing Companies

- Energy Management Companies

- Financial Institutions and Banks

- Industrial Equipment Manufacturers

- Telecommunications Companies (for 5G integration)

- Cybersecurity Firms

- Venture Capitalist

Companies

Players Mentioned in the Report:

- Siemens AG

- Mitsubishi Electric Corporation

- ABB Ltd.

- Schneider Electric

- Honeywell International Inc.

- Rockwell Automation

- Fanuc Corporation

- Yokogawa Electric Corporation

- Emerson Electric Co.

- General Electric Company

- Bosch Rexroth AG

- Omron Corporation

- Hitachi Ltd.

- Panasonic Corporation

- Fuji Electric Co., Ltd.

Table of Contents

1. Asia Pacific Smart Manufacturing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Smart Manufacturing Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Smart Manufacturing Market Analysis

3.1. Growth Drivers

3.1.1. Increased Investment in Automation Technology

3.1.2. Rising Demand for High-Quality Production

3.1.3. Expansion of Smart Factory Initiatives

3.1.4. Growing Adoption of Predictive Maintenance

3.2. Restraints

3.2.1. High Initial Investment Costs

3.2.2. Skills Gap in the Workforce

3.2.3. Cybersecurity Risks

3.2.4. Regulatory Compliance Issues

3.3. Opportunities

3.3.1. Technological Advancements in AI and IoT

3.3.2. Government Support and Subsidies

3.3.3. Expansion into Emerging Markets

3.3.4. Integration with Sustainable Manufacturing Practices

3.4. Trends

3.4.1. Adoption of 5G Technology in Manufacturing

3.4.2. Growth of Collaborative Robots (Cobots)

3.4.3. Increased Use of Digital Twins

3.4.4. Shift Towards Circular Economy Models

3.5. Government Regulation

3.5.1. Chinas "Made in China 2025" Program

3.5.2. Japans "Society 5.0" Vision

3.5.3. Indias "Make in India" Initiative

3.5.4. South Koreas "Manufacturing Innovation 3.0" Strategy

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Asia Pacific Smart Manufacturing Market Segmentation, 2023

4.1. By Technology Type (in Value %)

4.1.1. Industrial IoT

4.1.2. Artificial Intelligence

4.1.3. Cloud Computing

4.1.4. Big Data Analytics

4.2. By Industry Vertical (in Value %)

4.2.1. Automotive

4.2.2. Electronics

4.2.3. Food & Beverage

4.2.4. Pharmaceuticals

4.3. By Region (in Value %)

4.3.1. China

4.3.2. Japan

4.3.3. South Korea

4.3.4. India

4.3.5. Australia

4.3.6. Rest of APAC

5. Asia Pacific Smart Manufacturing Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Siemens AG

5.1.2. Mitsubishi Electric Corporation

5.1.3. ABB Ltd.

5.1.4. Schneider Electric

5.1.5. Honeywell International Inc.

5.1.6. Rockwell Automation

5.1.7. Fanuc Corporation

5.1.8. Yokogawa Electric Corporation

5.1.9. Emerson Electric Co.

5.1.10. General Electric Company

-

Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Asia Pacific Smart Manufacturing Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Asia Pacific Smart Manufacturing Market Regulatory Framework

7.1. Industry Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Asia Pacific Smart Manufacturing Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Asia Pacific Smart Manufacturing Market Future Segmentation, 2028

9.1. By Technology Type (in Value %)

9.2. By Industry Vertical (in Value %)

9.3. By Region (in Value %)

10. Asia Pacific Smart Manufacturing Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on Asia Pacific Smart Manufacturing industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Asia Pacific Smart Manufacturing Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple smart manufacturing companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such smart manufacturing companies.

Frequently Asked Questions

01 How big is the Asia Pacific Smart Manufacturing market?

The Asia Pacific Smart Manufacturing Market was valued at USD 52.9 billion in 2023. The growth is driven primarily by the increasing adoption of Industry 4.0 technologies, including IoT, AI, and big data analytics.

02 What are the challenges in Asia Pacific Smart Manufacturing market?

The major challenges in the Asia Pacific Smart Manufacturing market include high initial investment costs, a shortage of skilled labor, cybersecurity risks, and regulatory compliance issues. These challenges can hinder the widespread adoption of smart manufacturing technologies, particularly among small and medium-sized enterprises (SMEs).

03 Who are the major players in the Asia Pacific Smart Manufacturing market?

Key players in the Asia Pacific Smart Manufacturing market include Siemens AG, Mitsubishi Electric Corporation, ABB Ltd., Schneider Electric, and Honeywell International Inc. These companies are leading the innovation and deployment of smart manufacturing solutions across various industries in the region.

04 What are the main growth drivers of the Asia Pacific Smart Manufacturing market?

The growth of the Asia Pacific Smart Manufacturing market includes factors such as increased investment in automation technologies, rising demand for high-quality production, government initiatives supporting smart manufacturing, and the expanding adoption of AI and IoT across various industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.