China Steel Market Outlook to 2030

Region:Asia

Author(s):Pranav Krishn

Product Code:KROD280

June 2024

100

About the Report

China Steel Market Overview

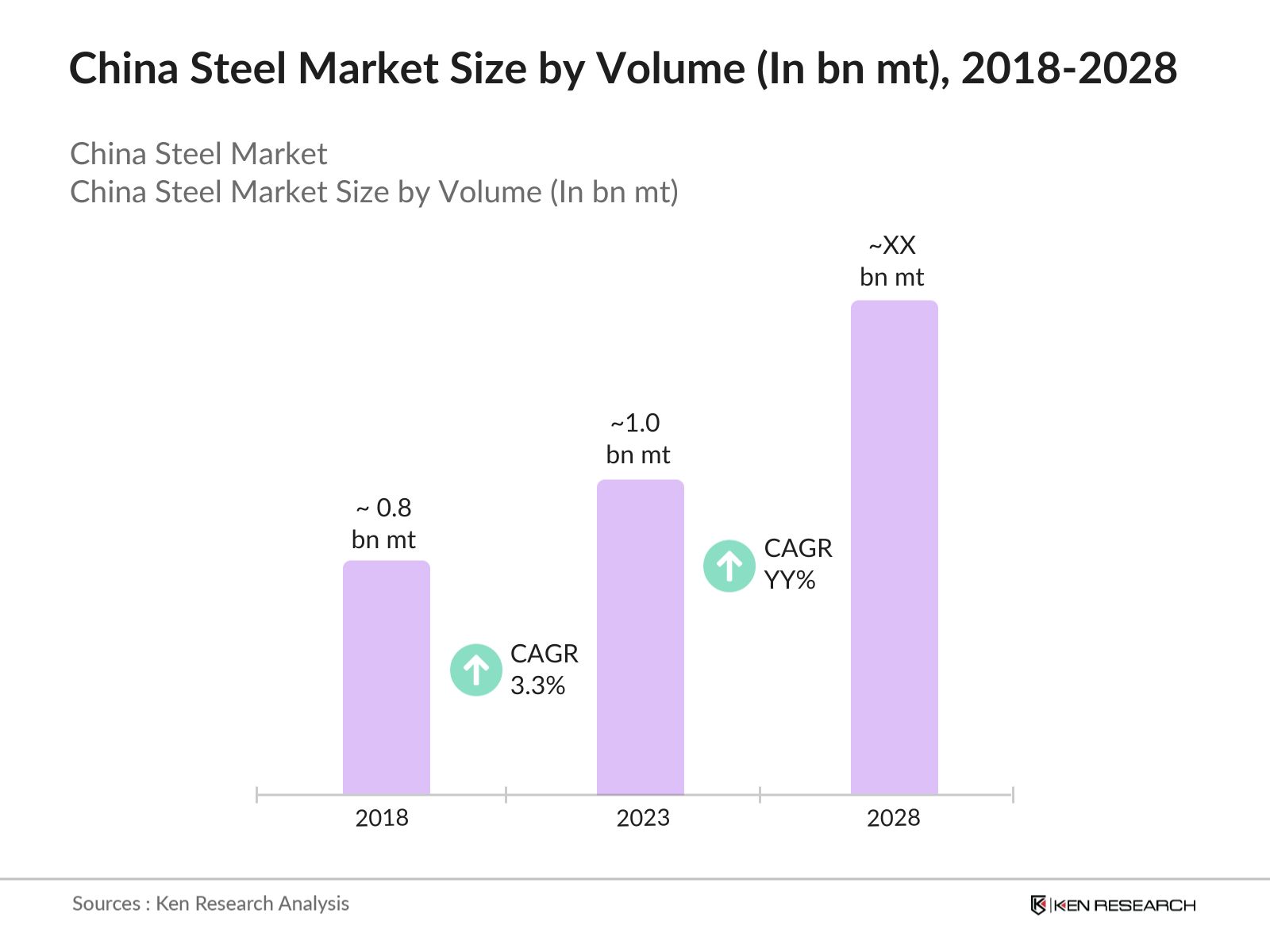

- The China steel market has demonstrated substantial growth over recent years. In 2018, the market size was valued at approximately 0.85 billion metric tons, driven by infrastructure development and urbanization projects. By 2023, the market size had expanded to around 1.05 billion metric tons, reflecting a compound annual growth rate (CAGR) of 3.3% during this period.

- The China steel market is dominated by several key players including China Baowu Steel Group, HBIS Group, Ansteel Group, Jiangsu Shagang Group, and Shougang Group. These players are involved in extensive production and have a wide range of products catering to various industries, ensuring their dominance in the market.

- In 2024, Baowu Steel raised $1.4 billion through a bond issue, with nearly $1 billion of the capital being used to expand the northern blocks of the Simandou iron ore project in Guinea.

China Steel Market Analysis

- The automotive sector in China is a significant steel consumer, especially for electric vehicles (EVs). In 2023, China produced over 6 million new energy vehicles (NEVs), a 40% increase from the previous year. This rising demand for EVs, driven by government incentives and a growing middle class, boosts the need for high-quality steel in manufacturing.

- The steel market significantly impacts China's economy, contributing to employment, GDP, and the growth of ancillary industries such as construction and machinery. The steel industry supports millions of jobs directly and indirectly, underscoring its importance to the national economy.

- The Eastern region of China, particularly the provinces of Jiangsu, Shandong, and Guangdong, dominates the steel market. These regions are industrial hubs with advanced infrastructure and a concentration of steel production facilities, contributing to their leadership in the market.

China Steel Market Segmentation

The China Steel Market is segmented based on various factors. Here are three key segmentation types with their sub-segments and estimated market share ranges:

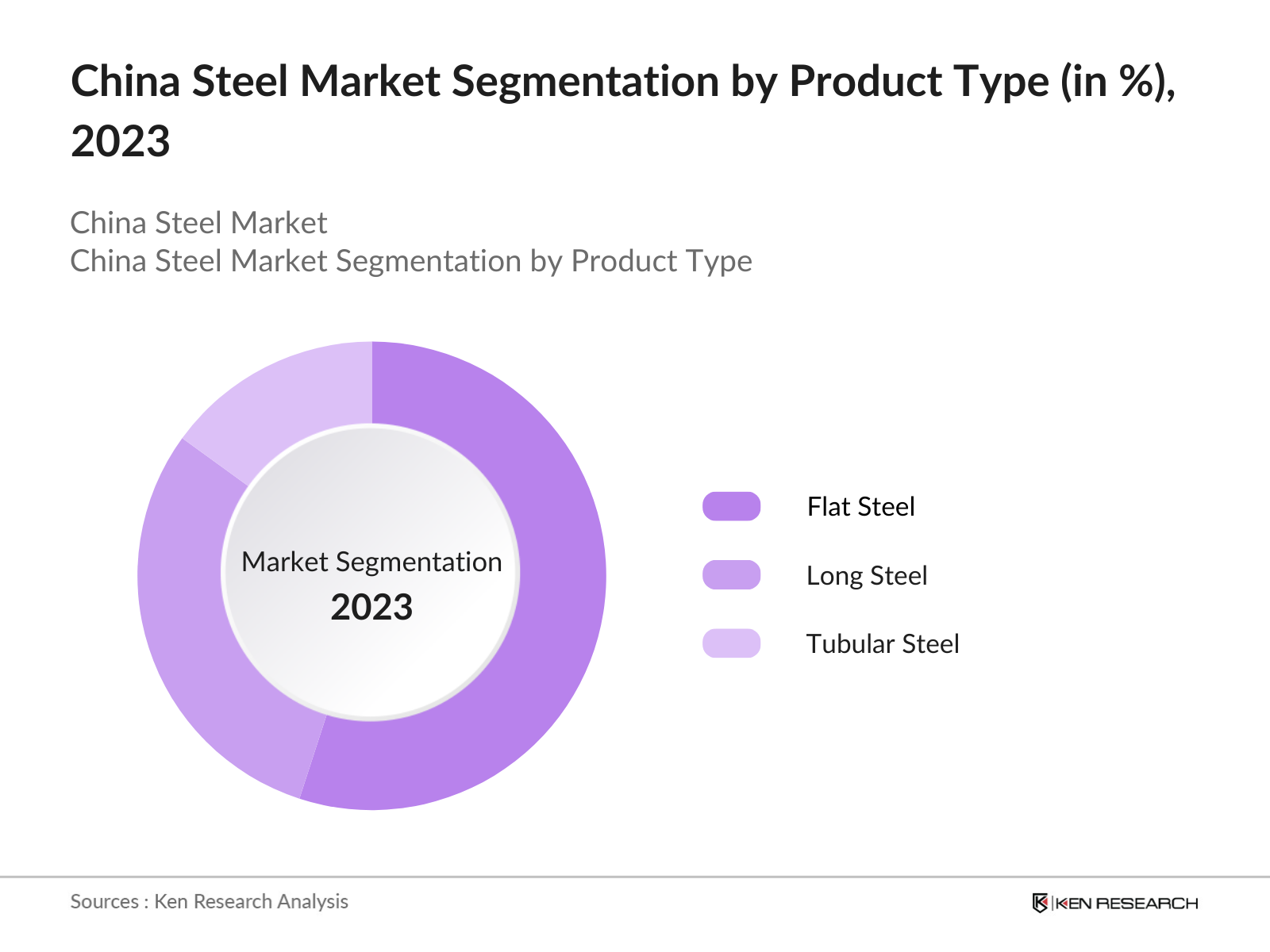

By Product Type: In 2023, the China Steel Market is segmented by product type into flat, long, and tubular steel. Flat steel products, particularly hot-rolled coils, dominate due to their extensive application in the construction and automotive sectors, which demand high volumes of versatile and durable steel for structural and manufacturing purposes.

By End-User Industry: In 2023, the China Steel Market is segmented by end-user industry into construction, automotive, machinery, energy, and others. The construction segment dominates the China steel market due to extensive government investment in infrastructure projects such as highways, railways, bridges, and urban development. This massive scale of projects necessitates significant steel consumption, driving demand and market share.

By Region: In 2023, the China Steel Market is segmented by region into eastern, northern, southern, and western. Eastern China, particularly Shanghai and Jiangsu, dominates due to its status as an industrial hub with significant demand for steel driven by extensive manufacturing activities, high urbanization rates, and major infrastructure projects.

China Steel Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

China Baowu Steel Group |

2016 |

Shanghai |

|

HBIS Group |

2008 |

Shijiazhuang |

|

Ansteel Group |

1916 |

Anshan |

|

Jiangsu Shagang Group |

1975 |

Zhangjiagang |

|

Shougang Group |

1919 |

Beijing |

- The leading players in the market include China Baowu Steel Group, HBIS Group, and Ansteel Group. They have a significant impact on market dynamics due to their large production capacities and extensive product portfolios.

- These companies are driving market growth through continuous investments in technology and sustainable practices. For instance, China Baowu Steel Group's focus on green steel production is setting a benchmark for the industry.

- Ansteel Group recently introduced a new type of high-strength steel, which is expected to revolutionize the automotive and construction industries due to its enhanced durability and lightweight properties.

China Steel Industry Analysis

China Steel Market Growth Drivers:

- Automotive Industry Expansion: The automotive sector in China is a major consumer of steel, particularly in the production of electric vehicles (EVs). In 2023, China produced over 6 million new energy vehicles (NEVs). The growing demand for EVs, driven by government incentives and a rising middle class, necessitates high-quality steel for manufacturing, thus propelling market growth.

- Technological Advancements in Steel Production: Advancements in steel production technology, such as the development of high-strength, lightweight steel alloys, are driving market growth. These innovations are essential for industries like automotive and construction. For instance, the introduction of third-generation advanced high-strength steels (AHSS) has improved the safety and fuel efficiency of vehicles, enhancing their market appeal.

China Steel Market Challenges

- Environmental Regulations: The government has set ambitious targets to reduce carbon emissions, aiming for carbon neutrality by 2060. According to the Ministry of Ecology and Environment, non-compliance can result in hefty fines and production halts, affecting profitability and market stability.

- Overcapacity Issues: The Chinese steel market has historically struggled with overcapacity, leading to inefficiencies and reduced profitability. Despite efforts to curb production, the country produced 1.03 billion metric tons of crude steel in 2022, far exceeding domestic demand. This surplus has resulted in increased exports, often at lower prices, which undermines global market stability

- Trade Tensions and Tariffs: International trade tensions, particularly with the United States and the European Union, have resulted in tariffs and anti-dumping measures against Chinese steel products. For instance, in 2022, the U.S. imposed a 25% tariff on Chinese steel imports, significantly affecting export volumes.

China Steel Market Government Initiatives

- Made in China 2025 Initiative: Launched in 2015, the "Made in China 2025" initiative aims to modernize China's manufacturing sector, including the steel industry. The initiative focuses on innovation, quality improvement, and sustainability. The government provides financial support, including subsidies and tax incentives, to companies investing in technological advancements and green production methods.

- Belt and Road Initiative (BRI): The Belt and Road Initiative, launched in 2013, aims to enhance global trade and infrastructure connectivity. This initiative has significantly boosted the demand for steel in infrastructure projects across Asia, Europe, and Africa. In 2022, China invested $60 billion in BRI projects, with a substantial portion allocated to steel-intensive infrastructure development.

- Emission Trading System (ETS): Implemented in 2021, China's Emission Trading System (ETS) is designed to control carbon emissions by allowing companies to trade emission allowances. The steel industry, as a major emitter, is significantly affected by this policy.

China Steel Market Future Outlook

The China steel market is expected to continue growing, driven by urbanization, infrastructure development, and technological advancements in steel production. The focus on green and sustainable steel production will also play a crucial role in shaping the market's future.

Market-Specific Trends

- Green Steel Production and Infrastructure Initiatives: The shift towards environmentally friendly steel production is gaining momentum, with major players investing in green technologies. Ongoing and planned infrastructure projects under the Belt and Road Initiative will continue to fuel the steel demand.

- Technological Advancements: Innovations in steel production, such as high-strength and lightweight steel, are expected to drive market growth. For instance, the introduction of third-generation advanced high-strength steels (AHSS) has enabled the production of lighter, stronger vehicles, with 50 million tons of AHSS projected to be used by 2025.

Scope of the Report

|

China Steel Market Segmentation |

|

|

By Product Type |

Flat Steel Products Long Steel Products Tubular Steel |

|

By End-User Industry |

Construction Automotive Machinery Energy Others |

|

By Region |

Eastern China Northern China Southern China Western China |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Steel Production Companies

Construction and Infrastructure Firms

Automotive Manufacturers

Heavy Machinery Manufacturers

Real Estate Development Companies

Government Regulatory Bodies (National Development and Reform Commission (NDRC))

Raw Material Suppliers (Iron Ore, Coking Coal)

Energy and Utility Companies

Logistics and Transportation Providers

Technology Providers for Industrial Automation

Trade Associations in the Steel Sector

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

China Baowu Steel Group

HBIS Group

Ansteel Group

Shougang Group

Shagang Group

Maanshan Iron and Steel

Baotou Iron and Steel Group

Wuhan Iron and Steel Corporation

Rizhao Steel

Jiangsu Shagang

Tianjin Iron and Steel Group

Benxi Iron and Steel Group

Jiuquan Iron and Steel Group

Chongqing Iron and Steel Company

Nanjing Iron and Steel Group

Table of Contents

1. China Steel Market Overview

1.1 China Steel Market Taxonomy

2. China Steel Market Size (in Bn mt), 2018-2023

3. China Steel Market Analysis

3.1 China Steel Market Growth Drivers

3.2 China Steel Market Challenges and Issues

3.3 China Steel Market Trends and Development

3.4 China Steel Market Government Regulation

3.5 China Steel Market SWOT Analysis

3.6 China Steel Market Stake Ecosystem

3.7 China Steel Market Competition Ecosystem

4. China Steel Market Segmentation, 2023

4.1 China Steel Market Segmentation by Product Type (in %), 2023

4.2 China Steel Market Segmentation by End-User Industry (in %), 2023

4.3 China Steel Market Segmentation by Region (in %), 2023

5. China Steel Market Competition Benchmarking

5.1 China Steel Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters, and advanced analytics)

6. China Steel Market Future Market Size (in Bn mt), 2023-2028

7. China Steel Market Future Market Segmentation, 2028

7.1 China Steel Market Segmentation by Product Type (in %), 2028

7.2 China Steel Market Segmentation by End-User Industry (in %), 2028

7.3 China Steel Market Segmentation by Region (in %), 2028

8. China Steel Market Analysts’ Recommendations

8.1 China Steel Market TAM/SAM/SOM Analysis

8.2 China Steel Market Customer Cohort Analysis

8.3 China Steel Market Marketing Initiatives

8.4 China Steel Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2 Market Building:

Collating statistics on China Steel Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for China Steel Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4 Research output:

Our team will approach multiple steel market companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such steel industry companies.

Frequently Asked Questions

01 How big is the China Steel Market?

The current market size of the China Steel Market is at 1.05 billion metric tons in 2023, driven by a compound annual growth rate (CAGR) of 3.3% during 2018-2023.

02 Who are the major players in China Steel Market?

The major players in the China Baowu Steel Group, HBIS Group, Ansteel Group, Jiangsu Shagang Group, and Shougang Group.

03 What factors drive the China Steel Market?

The factor driving the China Steel Market include urbanization, infrastructure development, and technological advancements in steel production.

04 What are the challenges in the China Steel Market?

The challenges faced in China steel market include environmental regulations, overcapacity issues, trade tensions and tariffs.

05 Which segment dominates the China Steel Market?

Flat steel products dominate the China Steel Market by product type, accounting for half of the market share in 2023.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.