Region:Europe

Author(s):Harsh Saxena

Product Code:KR1554

Pages:90

Published On:December 2024

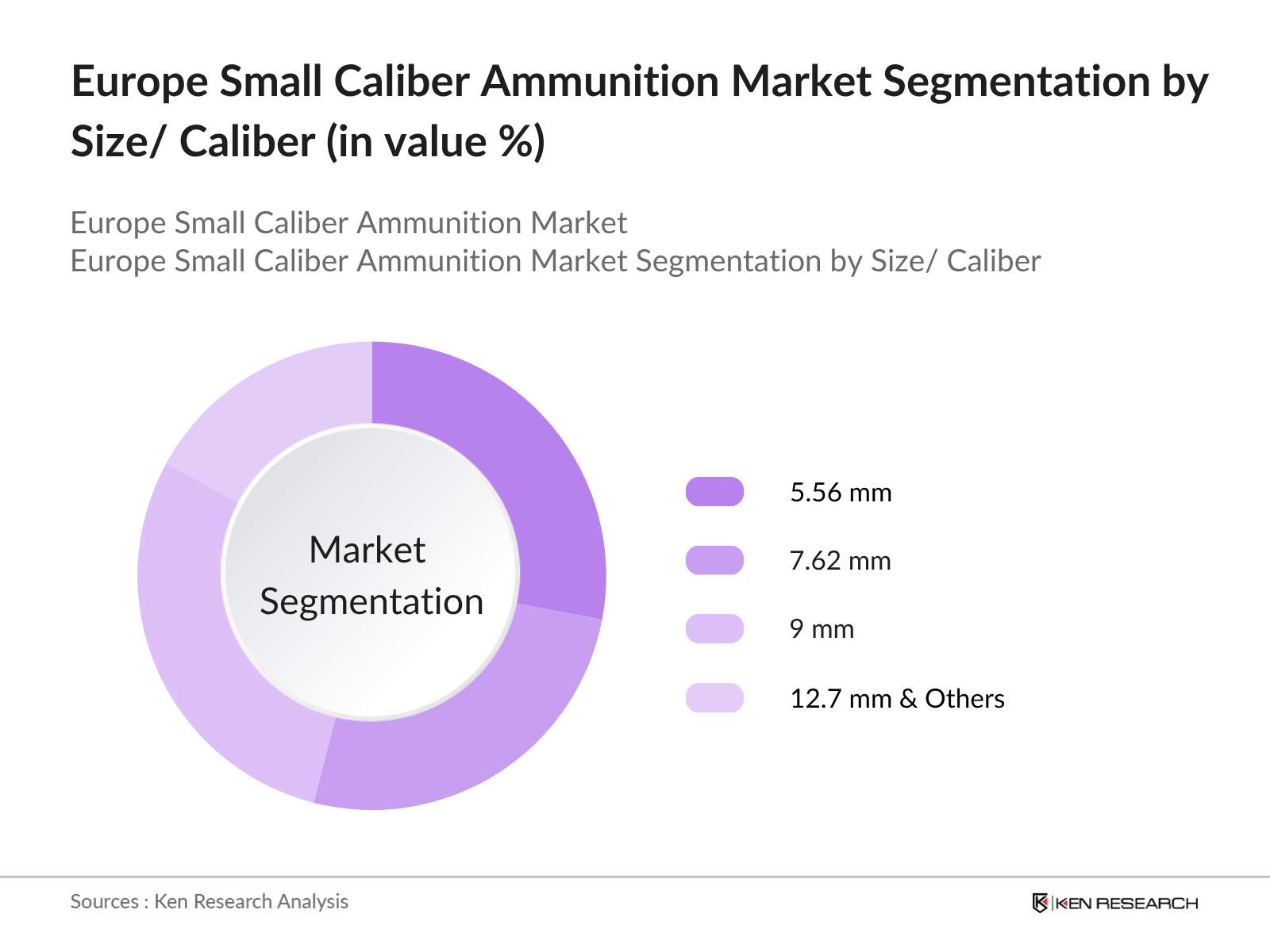

By Size/ Caliber:The Europe small caliber ammunition market is segmented into 5.56 mm, 7.62 mm, 9 mm, and 12.7 mm & other calibers. Among these, 5.56 mm holds a strong share driven by its extensive deployment across military and law-enforcement platforms. The 7.62 mm segment follows, supported by its continued relevance in machine guns and designated marksman rifles. Meanwhile, 9 mm ammunition remains widely adopted for personal defense and police sidearms, reflecting consistent demand. The 12.7 mm and other larger calibers cater mainly to heavy-duty applications, including anti-materiel roles and mounted weapon systems, contributing a smaller yet steady share of the overall market. .

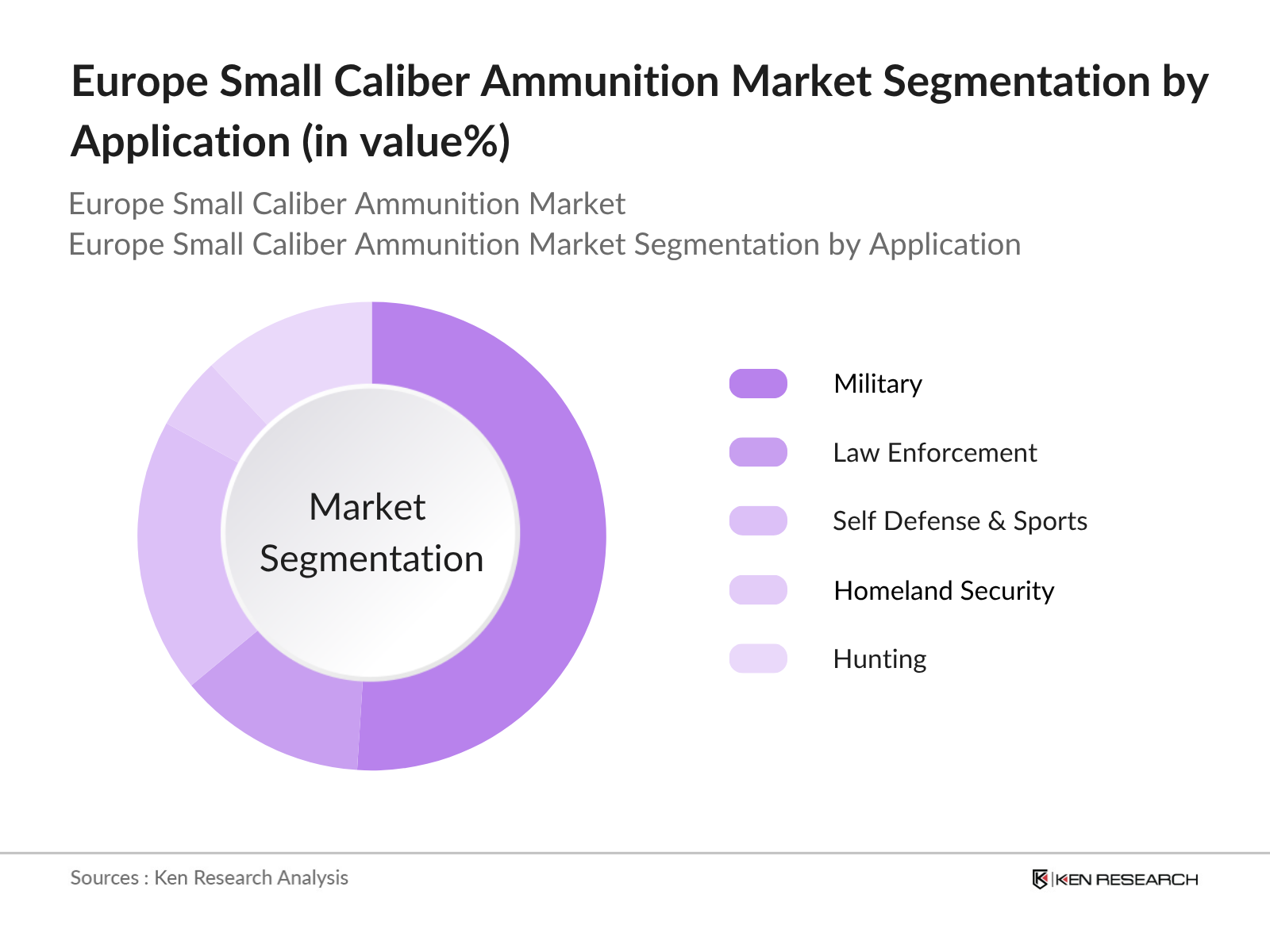

By Application:The application segmentation includes Military, Law Enforcement, Self Defence & Sports, Homelan Security, and Hunting. The Military segment holds the largest share due to ongoing defense contracts, military modernization programs, and increased training requirements across Europe. Law enforcement agencies are also driving demand for reliable ammunition for both operational and training purposes, while civilian demand is supported by the popularity of shooting sports and hunting .

The Europe Small Caliber Ammunition Market is characterized by a dynamic mix of regional and international players. Leading participants such as RUAG Ammotec, Winchester Ammunition, Federal Premium Ammunition, Sellier & Bellot, Hornady Manufacturing Company, Remington Arms Company, Prvi Partizan (PPU), Magtech Ammunition, Aguila Ammunition, Tula Cartridge Works, CBC Global Ammunition, Beretta Holding S.p.A., BAE Systems, Olin Corporation, Indian Ordnance Factory Board (OFB) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the small caliber ammunition market in Europe appears promising, driven by increasing defense expenditures and a growing civilian market. Innovations in smart ammunition technologies and eco-friendly production methods are expected to shape the industry landscape. Additionally, the rise of e-commerce platforms for ammunition sales will enhance accessibility for consumers, while strategic partnerships with defense contractors will further strengthen market positions, ensuring sustained growth and competitiveness in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Bullet Size/ Caliber | 5.56mm 7.62 mm 9mm 12.7mm Others |

| By Application | Military Law Enforcement Self Defence & Sports Homeland Security Hunting |

| By Distribution Channel | Direct Sales Online Retail Specialty Stores Others |

| By Bullet Type | Full Metal Jacket (FMJ) Hollow Point Soft Point Armor-Piercing Others |

| By Country | Germany United Kingdom France Italy Russia Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Departments | 100 | Procurement Officers, Defense Analysts |

| Law Enforcement Agencies | 80 | Police Chiefs, Tactical Unit Leaders |

| Shooting Sports Retailers | 60 | Store Managers, Sales Representatives |

| Manufacturers of Ammunition | 50 | Production Managers, R&D Directors |

| Hunting Associations | 40 | Association Leaders, Event Coordinators |

The Europe Small Caliber Ammunition Market is valued at approximately USD 3 billion, driven by increased defense budgets, concerns about personal safety, and rising demand for civilian sporting and hunting activities.