Europe Trucks Market Outlook to 2030

Region:Europe

Author(s):Sanjna

Product Code:KROD5041

December 2024

89

About the Report

Europe Trucks Market Overview

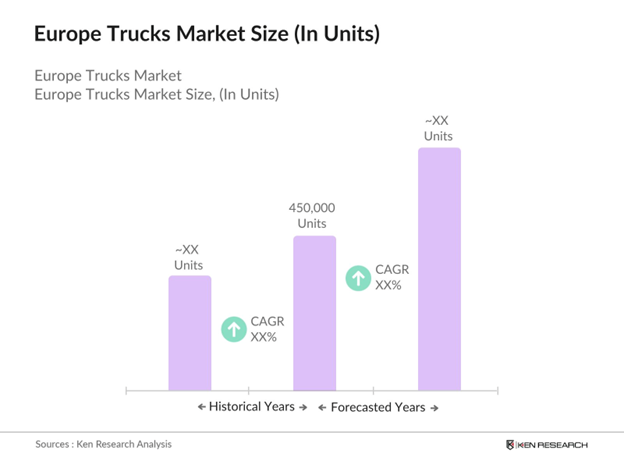

The Europe Trucks market recorded sales of 450,000 units based on a five-year historical analysis. This market is driven by the growing demand for freight transportation, fueled by the expansion of e-commerce and construction activities. Increased government investment in infrastructure and urbanization across key European countries further support the growth. The introduction of stringent emission regulations, such as Euro VI standards, is pushing manufacturers to innovate in fuel efficiency and sustainability, making Europe one of the leaders in truck technology advancements.

Germany, France, and the United Kingdom dominate the Europe Trucks market. The dominance of Germany stems from its strong manufacturing base, which includes major truck manufacturers like MAN and Daimler Trucks. France and the UK also hold a significant share due to their well-established logistics sectors and strategic geographic locations that make them central hubs for European freight and logistics. Additionally, government initiatives supporting electrification and stringent emission regulations in these countries further contribute to their leading positions.

Many European cities have implemented low emission zones (LEZs) that restrict access to older, more polluting trucks. As of 2023, over 250 LEZs exist across Europe, particularly in cities like London, Paris, and Berlin. These regulations incentivize the use of electric and low-emission vehicles for urban deliveries, compelling logistics companies to upgrade their fleets or risk facing penalties and restricted access to key urban markets.

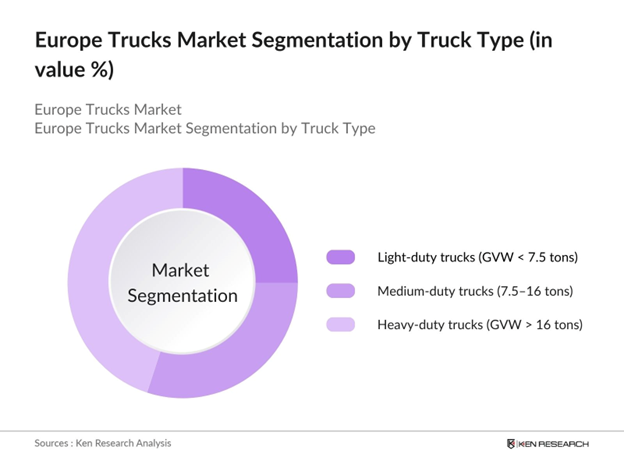

Europe Trucks Market Segmentation

By Truck Type: The Europe Trucks market is segmented by truck type into light-duty trucks (GVW < 7.5 tons), medium-duty trucks (7.516 tons), and heavy-duty trucks (GVW > 16 tons). Heavy-duty trucks have a dominant market share in Europe under the truck type segmentation. This is primarily due to their use in long-haul freight transportation and large-scale logistics operations. These trucks are preferred for international transportation due to their higher payload capacity and durability, which is essential in industries such as construction and manufacturing.

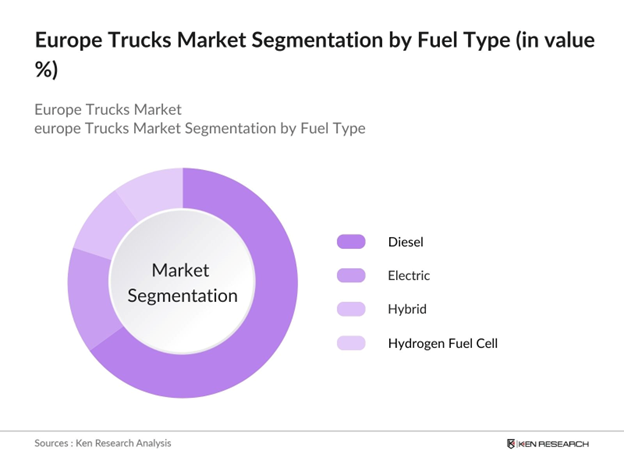

By Fuel Type: The market is segmented by fuel type into diesel, electric, hybrid, and hydrogen fuel cell trucks. Diesel trucks continue to dominate the market due to their established infrastructure and widespread availability across Europe. Although electric and hybrid trucks are gaining momentum due to environmental concerns and government initiatives for lower emissions, diesel trucks remain the preferred choice for long-haul transportation. The lower upfront costs and higher fuel availability, especially for large fleets, sustain diesel's leadership in the fuel type segment.

Europe Trucks Market Competitive Landscape

The Europe Trucks market is dominated by a few major players, including global giants like Daimler Trucks, Volvo Trucks, and Scania. These companies are known for their long-standing expertise in the truck manufacturing industry and extensive R&D investments. The market is characterized by high consolidation, with these key players setting industry standards for innovation, fuel efficiency, and sustainable practices. The presence of local players like Iveco and DAF also contributes to healthy competition and regional diversity.

|

Company |

Establishment Year |

Headquarters |

Revenue (2023) |

Production Capacity |

Market Share |

Fleet Electrification Rate |

R&D Investments |

Global vs. Regional Presence |

Profit Margins |

|

Volvo Trucks |

1927 |

Gothenburg, Sweden |

- |

- |

- |

- |

- |

- |

- |

|

Daimler Trucks |

1896 |

Stuttgart, Germany |

- |

- |

- |

- |

- |

- |

- |

|

Scania AB |

1891 |

Sdertlje, Sweden |

- |

- |

- |

- |

- |

- |

- |

|

MAN Truck & Bus |

1758 |

Munich, Germany |

- |

- |

- |

- |

- |

- |

- |

|

DAF Trucks |

1928 |

Eindhoven, Netherlands |

- |

- |

- |

- |

- |

- |

- |

Europe Trucks Market Analysis

Growth Drivers

- Increasing Demand for Freight Transportation: Freight transportation in Europe is expected to maintain strong momentum driven by the regions economic activity. In 2022, the EU's road freight transport reached approximately 1.9 trillion ton-kilometers, reflecting a growing demand for trucking services, particularly for cross-border and long-haul transportation. The region's strategic position in global trade and its extensive internal market further intensifies this demand.

- Expansion of E-commerce Logistics (Number of E-commerce Transactions)

E-commerce has experienced a substantial boom in Europe, driven by consumer shifts towards online purchasing. In 2023, approximately2.35 billion transactionswere made online in France alone, which represents a4.9% increasefrom the previous year. Trucks play an essential role in these logistics networks, facilitating the swift movement of goods from distribution centers to consumers. - Stringent Emission Regulations: The implementation of the Euro VI emission standards in 2022 has prompted the trucking industry to adopt cleaner technologies. The European Unions commitment to reducing CO2 emissions by 55% by 2030 has led to increased investments in electric and hybrid trucks, along with the retirement of older, non-compliant vehicles. For example, compliance with Euro VI standards mandates a significant reduction in nitrogen oxides (NOx) and particulate matter (PM), driving up demand for newer, more efficient trucks.

Challenges

- High Ownership and Maintenance Costs: Truck ownership and maintenance are increasingly expensive in Europe. The total cost of ownership for heavy-duty trucks has risen due to inflationary pressures on raw materials and components, with truck prices reaching USD 126,000 or more for standard models in 2023. These expenses, coupled with rising insurance and regulatory compliance costs, challenge fleet operators, especially small and medium-sized enterprises (SMEs).

- Fuel Price Volatility: Fuel prices in Europe have experienced sharp fluctuations, with diesel costs peaking at 1.90 per liter in 2022. Fuel accounts for approximately 25-30% of a trucks operating costs, making it one of the most significant variable expenses for fleet operators. The volatility in global oil markets, exacerbated by geopolitical tensions and supply chain disruptions, poses a persistent challenge to maintaining cost-effective trucking operations.

Europe Trucks Market Future Outlook

The Europe Trucks market is expected to see robust growth driven by increasing demand for sustainable transportation solutions, rapid urbanization, and technological advancements in electric and autonomous trucks. Government incentives for electric vehicles, coupled with the adoption of low-emission zones across European cities, will significantly bolster the demand for electric and hybrid trucks. Additionally, the rise in e-commerce and the need for last-mile delivery solutions are expected to drive innovations in light-duty and autonomous truck segments.

Market Opportunities

- Electric and Hybrid Truck Adoption: The European truck market is seeing increasing adoption of electric and hybrid trucks, spurred by regulatory incentives and environmental goals. In 2023, approximately5,279 electric truckswere registered in the European Union (EU) during the year, reflecting a234.1% growthcompared to the previous year. This presents opportunities for manufacturers and fleet operators to invest in low-emission vehicles, aligning with the EUs emissions reduction targets.

- Autonomous Truck Technology: Autonomous truck technology is gaining traction in Europe, with several countries piloting self-driving truck initiatives. By 2023, countries like Germany and Sweden had conducted successful trials of level 3 and level 4 autonomous trucks on highways. These innovations aim to reduce labor costs and increase efficiency in long-haul transportation. Furthermore, autonomous technology can help mitigate the driver shortage issue, providing an opportunity for logistics companies to adopt cutting-edge solutions to streamline operations.

Scope of the Report

|

By Truck Type |

Light-duty Trucks (GVW < 7.5 tons) Medium-duty Trucks (7.5–16 tons) Heavy-duty Trucks (GVW > 16 tons) |

|

By Fuel Type |

Diesel Electric Hybrid Hydrogen Fuel Cell |

|

By Application |

Freight and Logistics Construction Mining Municipal Services |

|

By End-user |

Fleet Operators Logistics Companies Government and Municipalities |

|

By Country |

Germany France United Kingdom Italy Spain Poland Netherlands Sweden Belgium Austria |

Products

Key Target Audience

Truck Manufacturers

Leasing and Financing Companies

Logistics Companies

Construction Companies

Retail and E-Commerce Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (European Union, National Ministries of Transport)

Freight Forwarders and Transport Service Providers

Companies

Major Players in the Europe Trucks Market

Daimler Trucks

Volvo Trucks

Scania AB

MAN Truck & Bus

DAF Trucks

Iveco S.p.A.

Renault Trucks

Ford Trucks

Nikola Corporation

Hyundai Motor Company

BYD Company Limited

Hino Motors

Tata Motors

Navistar International

Isuzu Motors

Table of Contents

1. Europe Trucks Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Trucks Market Size (In Units)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Trucks Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Freight Transportation (Ton-kilometers)

3.1.2. Expansion of E-commerce Logistics (Number of E-commerce Transactions)

3.1.3. Stringent Emission Regulations (EU Emission Norms)

3.1.4. Growth in the Construction Sector (Growth Rate of Infrastructure Investments)

3.2. Market Challenges

3.2.1. High Ownership and Maintenance Costs (Total Cost of Ownership)

3.2.2. Shortage of Skilled Drivers (Driver Availability Index)

3.2.3. Fuel Price Volatility (Fuel Cost as % of Operating Costs)

3.3. Opportunities

3.3.1. Electric and Hybrid Truck Adoption (EV Trucks Penetration Rate)

3.3.2. Autonomous Truck Technology (Autonomous Driving Level Integration)

3.3.3. Demand for Last-mile Delivery Trucks (Urban Logistics Demand Growth)

3.4. Trends

3.4.1. Electrification of Fleets (Battery-electric Trucks Market Share)

3.4.2. Integration of IoT and Telematics (Telematics System Adoption Rate)

3.4.3. Growth in Leasing and Rental Market (Truck Leasing Market Size)

3.5. Government Regulations

3.5.1. Euro VI Emission Standards

3.5.2. Weight and Dimension Regulations (Max GVW Limits)

3.5.3. Urban Low Emission Zones (Impact on Urban Truck Operations)

3.5.4. CO2 Emission Reduction Targets (EU Green Deal Targets)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Europe Trucks Market Segmentation

4.1. By Truck Type (In Value %)

4.1.1. Light-duty Trucks (GVW < 7.5 tons)

4.1.2. Medium-duty Trucks (7.516 tons)

4.1.3. Heavy-duty Trucks (GVW > 16 tons)

4.2. By Fuel Type (In Value %)

4.2.1. Diesel

4.2.2. Electric

4.2.3. Hybrid

4.2.4. Hydrogen Fuel Cell

4.3. By Application (In Value %)

4.3.1. Freight and Logistics

4.3.2. Construction

4.3.3. Mining

4.3.4. Municipal Services

4.4. By End-user (In Value %)

4.4.1. Fleet Operators

4.4.2. Logistics Companies

4.4.3. Government and Municipalities

4.5. By Country (In Value %)

4.5.1. Germany

4.5.2. France

4.5.3. United Kingdom

4.5.4. Italy

4.5.5. Spain

4.5.6. Poland

4.5.7. Netherlands

4.5.8. Sweden

4.5.9. Belgium

4.5.10. Austria

5. Europe Trucks Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Volvo Trucks

5.1.2. Daimler Trucks

5.1.3. Scania AB

5.1.4. MAN Truck & Bus

5.1.5. DAF Trucks

5.1.6. Iveco S.p.A.

5.1.7. Renault Trucks

5.1.8. Ford Trucks

5.1.9. Nikola Corporation

5.1.10. Hyundai Motor Company

5.1.11. BYD Company Limited

5.1.12. Hino Motors

5.1.13. Tata Motors

5.1.14. Navistar International

5.1.15. Isuzu Motors

5.2. Cross Comparison Parameters (Headquarters, Production Capacity, Market Share, R&D Investments, Global vs. Regional Presence, Profit Margins, Fleet Electrification Rate, Aftermarket Service Offerings)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Europe Trucks Market Regulatory Framework

6.1. Emission Standards (Euro VI and Beyond)

6.2. Compliance with Weight and Dimension Regulations

6.3. Licensing and Insurance Requirements

6.4. Fleet Safety and Maintenance Standards

7. Europe Trucks Future Market Size (In Units)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Trucks Future Market Segmentation

8.1. By Truck Type (In Value %)

8.2. By Fuel Type (In Value %)

8.3. By Application (In Value %)

8.4. By End-user (In Value %)

8.5. By Country (In Value %)

9. Europe Trucks Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing and Sales Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the key stakeholders in the Europe Trucks Market. This includes major manufacturers, fleet operators, and logistics service providers. Desk research and proprietary databases will be used to gather relevant industry information, with a focus on identifying variables like truck production rates, fuel types, and usage patterns.

Step 2: Market Analysis and Construction

In this phase, we compile historical data related to truck sales and fleet penetration in Europe. This includes assessing production statistics, analyzing fleet electrification rates, and evaluating infrastructure developments. Key market trends and challenges will be identified through secondary research and data analysis.

Step 3: Hypothesis Validation and Expert Consultation

After constructing initial hypotheses, they will be validated through interviews with industry experts, including executives from major truck manufacturing companies and logistics providers. These consultations will provide qualitative insights into operational challenges, investment strategies, and technological adoption.

Step 4: Research Synthesis and Final Output

The final stage of the research involves synthesizing quantitative data with expert feedback to create a detailed and accurate market report. This will include top-down and bottom-up analyses to ensure that the findings reflect the actual market dynamics, particularly concerning production capacity, fuel type preferences, and regional truck sales.

Frequently Asked Questions

01. How big is the Europe Trucks Market?

The Europe Trucks market recorded sales of 450,000 units, driven by increased demand for freight transportation and expanding infrastructure investments across major European economies.

02. What are the challenges in the Europe Trucks Market?

Challenges include stringent environmental regulations, fluctuating fuel prices, and a shortage of skilled drivers. Additionally, the high cost of ownership, especially for electric and hybrid trucks, presents obstacles for smaller operators.

03. Who are the major players in the Europe Trucks Market?

Key players in the market include Daimler Trucks, Volvo Trucks, Scania AB, MAN Truck & Bus, and DAF Trucks. These companies dominate due to their strong manufacturing capabilities and innovations in fuel efficiency.

04. What are the growth drivers of the Europe Trucks Market?

Growth drivers include the increasing demand for logistics and freight services, driven by e-commerce, and government initiatives promoting the adoption of electric trucks to reduce emissions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.