France Agri Equipment Market Outlook to 2027

Driven by Adoption of Technological Advancements in Farming Techniques and Financial support of Government

Region:Europe

Author(s):Oshina Agarwal

Product Code:KR1371

August 2023

85

About the Report

Market Overview:

France has a significant agricultural sector, and the market for agricultural equipment has been robust. The market size and trends can vary based on factors like economic conditions, technological advancements, and policy changes. In the years leading up to 2021, the market had been experiencing a steady growth trajectory. The agricultural machinery sector in France has demonstrated consistent growth throughout the study period. This expansion can be attributed to the increasing mechanization within the country's agriculture industry, complemented by a notable rise in farmers' income. A significant driver of this growth is the considerable pressure to enhance productivity across agricultural lands. This, in turn, is expected to encourage a growing inclination among farmers and land operators to embrace automation technologies within their equipment. As a result, the trend towards integrating automation into agricultural machinery is projected to gain momentum over the forecast period.

The French agricultural equipment market faces challenges related to sustainable farming practices, increasing efficiency, and adhering to environmental regulations. There are opportunities for manufacturers to develop and promote more sustainable and technologically advanced solutions that address these challenges.

France New Agri-Equipment Market Analysis

France New Agri-Equipment Market Analysis

- The France Agriculture Equipment Market is expected to grow in the forecasted period of 2022-2027, owing to the introduction of smart farming techniques such as precision farming and digital farming, rising disposable income, the country's increasing urbanization, rising standard of living and rising labour costs.

- Six prominent players, namely CLAAS Group, Lely France, and John Deere SAS, dominate the market, collectively holding a significant share. The scarcity of labor caused by the global health emergency, coupled with the escalating costs linked to it, has directly contributed to an increase in the market share of the French Agriculture Equipment Market.

- Throughout the study duration, there has been a consistent upward trajectory in the expansion of agricultural machinery within France. This growth can be attributed to the increasing integration of mechanization within the country's agricultural sector, complemented by a notable upswing in farmers' earnings.

- A key catalyst behind this expansion is the significant impetus to enhance productivity across agricultural lands. This, in turn, is projected to cultivate a trend where farmers and land operators are more inclined to adopt automation technologies within their equipment, further boosted by the forecasted period's conditions.

Key Trends by Market Segment:

By Horsepower: 100-250 HP tractors can handle most extreme farming conditions. This horsepower range can perform all the heavy tasks like harvesting, cultivation, tilling, post-harvesting, etc. 100-250 horsepower tractors are very efficient in the most challenging working conditions. Higher horsepower tractors will further reduce in the future owing to the new energy and low emission regulations.

By Harvester Type: Combine harvesters are most useful for large cereal exploitations. Self-propelled forage harvester will develop more for methane production if energy crisis carries on. We have some wine specific harvester but low and stable quantities.

Competitive Landscape:

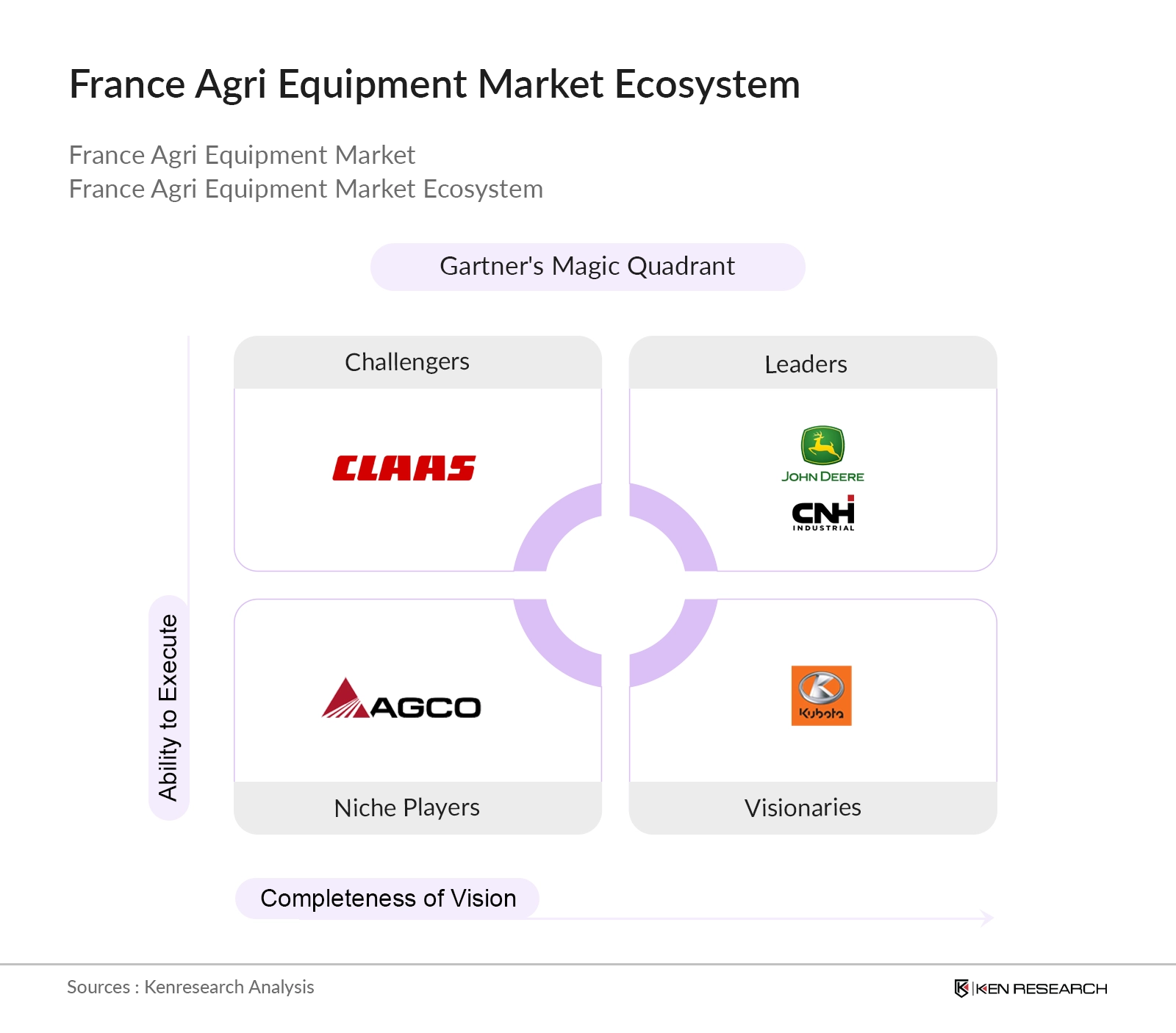

The competitive landscape of the France Agri-Equipment Market was dynamic and competitive, with both domestic and international companies operating in the market. The industry attracted various players offering a wide range of Agricultural Equipment products. Established brands and technological innovation were key factors in the competition. Key players include well-known global brands as well as local manufacturers. The competitive landscape of the agricultural machinery market in France is characterized by the presence of several key players vying for market share. Among them, six major companies, including CLAAS Group, Lely France, and John Deere SAS, stand out as leaders, collectively holding a substantial portion of the market.

Recent Developments:

- AGCO has introduced an innovative online operational planning tool called Geo-Bird, designed to benefit farmers across Western Europe. Notably, the tool has been launched on the Valtra Stand in Paris, France.

- KUHN SAS, headquartered in SAVERNE, France, has unveiled an exciting addition to its lineup: a new 12-meter model for the Optimer minimum tillage stubble cultivator. This model stands out as the first in its width category to incorporate the Steady Control system by the company. This system ensures a consistent working depth even when operating at higher speeds and across undulating terrain.

- John Deere, a leading player in the agricultural machinery sector, has introduced the new 6R 185 tractors, which are primarily engineered for exceptional fuel efficiency. These tractors are specifically designed for machines with a horsepower rating under 250 hp and excel in terms of on-the-road fuel economy.

Future Outlook:

- The France Agriculture Equipment Market is projected to show a significant growth of CAGR ~13.5% in the forecasted period of 2022-2027, with introduction of smart farming techniques such as precision farming and digital farming, rising disposable income, the country's increasing urbanization, rising standard of living and rising labor costs. Continued integration of advanced technologies like AI, IoT, and automation will enhance equipment efficiency, data-driven decision-making, and precision agriculture practices. Greater automation and robotics usage will alleviate labor shortages and improve operational efficiency in various farming tasks.

- The future of the France Agri-Equipment market holds a transformational shift toward technology-driven, sustainable, and efficient farming practices. The industry's evolution will be influenced by advancements in data analytics, automation, and innovation, with a strong emphasis on meeting the demands of modern agriculture while minimizing environmental impact.

Scope of the Report

|

France Agri-Equipment Market Segmentation |

|

|

By Product Type |

Tractors Garden machinery Soil working, sowing and fertilizing equipment Machine parts and spare parts Livestock equipment Harvesting equipment Balers and hay-making Transport equipment |

|

By Mode of Sales |

Offline Online |

|

By Type of Purchase |

Financed purchase Non-Financed purchase |

|

By Automation |

Semi-automatic Automatic Manual |

|

By Sales Channel |

Aftermarket OEM |

|

By Zones |

North West East South |

|

By Horsepower |

100-250 HP Less than 100 HP 250-400 HP Above 400 HP |

|

By Drive Type |

4WD 2WD |

|

By Utility |

Utility Tractors Row crop Tractors Compact Utility Tractors |

|

By Harvester |

Combine harvester Self-propelled forage harvesters |

|

By Manufacturers |

John Deere CNH Industrial AGCO corporation CLAAS KGaA mbH Kubota |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

- Existing Agricultural Equipment Companies

- Agricultural Equipment Financing Companies

- Investors & Venture Capital Firm

- Agricultural Equipment Manufacturers

- Agricultural Equipment Distributors

- Agricultural Equipment Associations

- Government Entities

- Potential Market Entrants

- Industry Associations

- Consulting Agencies

- Government Bodies & Regulating Authorities

Time Period Captured in the Report:

- Historical Period: 2017-2022

- Base Year: 2022

- Forecast Period: 2022-2027

Companies

Major Players Mentioned in the Report:

- John Deere Sas

- CNH Industrial (New holland)

- AGCO Corporation (Massey ferguson, fendt)

- CLAAS KGaA mbH

- Kubota Europe SAS

Table of Contents

1. Executive Summary of France Agriculture Equipment Market

1.1 Executive Summary (Market Overview, Market Size, Growth Drivers and Restraints, Competition Scenario and Way Forward)

2. Country Overview

2.1 France Country Profile (Overview, Major Cities, GDP and Inflation Rate, Percentage of GDP Composition by Sector, Trade Scenario)

2.2 France Population Analysis (Population by Gender, by Age Group, by Urban and Rural population, Demographics of France)

3. Overview of France Agriculture Equipment Market

3.1 France Agricultural Sector Overview, 2021

3.2 Growth Drivers of France Agriculture Sector

3.3 Diversity of Agriculture across different regions in France

3.4 Benefits of Farm Mechanization in France in 2021

3.5 Farm predict in France Agriculture Market

3.6 Overview and Genesis of France Agriculture Equipment Market

3.7 Ecosystem of France Agriculture Equipment Market

3.8 Value Chain of France Agriculture Equipment Market

3.9 Timeline of Major Players in France Agriculture Equipment Market

3.10 Major Agricultural Equipment in France in 2021

3.11 Import and Export scenario of Agriculture equipment in France, 2017-21

4. Market Size of France Agriculture Equipment Market

4.1 Market Size by Sales Value and Sales Volume, 2017-2022

4.2 Market Segmentation of France Agriculture Equipment Market

4.3 Market Segmentation by Product Type on the basis of Value, 2022

4.4 Market Segmentation by Sales Channel on the basis of Value, 2022

4.5 Market Segmentation by Automation on the basis of Value,2022

4.6 Market Segmentation by Mode of Sales on the basis of Value, 2022

4.7 Market Segmentation by Type of Purchase by End Users on the basis of Value, 2022

4.8 Market Segmentation by Region on the basis of Value, 2022

4.9 Market Segmentation by Drive Type on the basis of Value, 2022

4.10 Market Segmentation by Horsepower on the basis of Value, 2022

4.11 Market Segmentation by Utility Type on the basis of Value, 2022

5. Industry Analysis of France Agriculture Equipment Market

5.1 SWOT Analysis of France Agriculture Equipment Market

5.2 Trends and Developments in France Agriculture Equipment Market

5.3Challenges and Restraints in France Agriculture Equipment Market

5.4Government Initiatives in France Agriculture Equipment Market

5.5Tractor and Machinery Association (TMA) of France

6. Consumer Analysis of France Agriculture Equipment Market

6.1 Decision Making Parameters of the Consumers

6.2 Impact of Emerging Technologies in Agriculture Equipment among consumers in France

7. Competitive Analysis of France Agriculture Equipment Market

7.1 Competitive Scenario of France Agriculture Equipment Market

7.2 Competitive Landscape and Market Positioning of Players in France Agriculture Equipment Market, 2027

7.3 Cross comparison of major players in France Agriculture Equipment Market

8. Future Outlook of France Agriculture Equipment Market, 2022- 2027

8.1 Market Size by Sales Value (AUD) and Sales Volume (In Units), 2022-2027

8.2 Market Segmentation by Type and Sales Channel, 2027

8.3 Market Segmentation by Type of Purchase, Automation and Mode of Sales, 2027

8.4 Market Segmentation by Application and Region, 2027

8.5 Market Segmentation by Horsepower, Drive Type and Utility Type, 2027

9. Covid Analysis of France Agriculture Equipment Market

9.1 Impact of Covid on France Agriculture Equipment Market

10. Analyst Recommendations

10.1 Recommendations for online sales of equipment in France

10.2 Recommendations on equipment preference

11. Research Methodology

11.1 Market Definitions and Assumptions

11.2 Abbreviations

11.3 Market Sizing Approach

11.4 Consolidated Research Approach

11.5 Sample Size Inclusion

11.6 Limitation and Future Conclusion

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on France Agri-Equipment Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Lubricant services. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team has approached multiple Agri-Equipment providing channels and understanded nature of product segments and sales, consumer preference and other parameters, which supported us validate statistics derived through bottom to top approach from Agri-Equipment Providers.

Frequently Asked Questions

01 How big is the France agri Equipment Market?

The French agri equipment market is anticipated to reach $8Bn in 2023.

02 what is the future market size of the France agri equipment market?

The future market size of the France agri equipment market is expected to reach $15 Bn in the forecasted period of 2023-2028 with a CAGR of 13.5%.

03 What are the major players in the France agri-equipment market?

John Deere Sas, CNH Industrial (New Holland), AGCO Corporation (Massey Ferguson, Fendt)

, CLAAS KGaA mbH and Kubota Europe SAS are the five prominent companies operating in the France agri-equipment market.

04 What are the latest trends in the France agri-equipment market?

Precision Agriculture, Sustainability and Environmental Concerns, Digitalization and Connectivity, and Mechanization and Automation are some of the key trends in the France agri-equipment market.

05 which sector is dominating the France agri-equipment market?

The Farm tractor segment of France's agri-equipment is dominating the market with a significant share of 22%.

06 what are the growth drivers of the France agri-equipment market?

Modernization and Mechanization, Precision Agriculture, Environmental Regulations and Sustainability, and Technological Advancement are the major growth drivers of the France agri-equipment market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.