Global Anti Inflammatory Tea Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD9565

December 2024

95

About the Report

Global Anti-Inflammatory Tea Market Overview

- The Global Anti-Inflammatory Tea Market is valued at USD 1.5 billion based on a five-year historical analysis, with the market experiencing steady growth due to increased consumer awareness of natural health benefits. This segment has gained popularity as people become more conscious of the anti-inflammatory properties offered by ingredients like turmeric, ginger, and chamomile.

- Countries like the United States, Japan, and Germany dominate the anti-inflammatory tea market due to the high consumption of health-conscious products and a well-established herbal tea culture. In these countries, consumer preference is heavily influenced by wellness trends, especially within urban populations, where natural remedies and organic products are sought after.

- The European Union's "Farm to Fork" strategy, part of the European Green Deal, aims to increase organic farming practices across member states. By 2024, the EU is expected to have over 30% of its agricultural land certified as organic. This focus on sustainability will drive the production of organic ingredients used in anti-inflammatory teas, enhancing market accessibility and consumer confidence in these products.

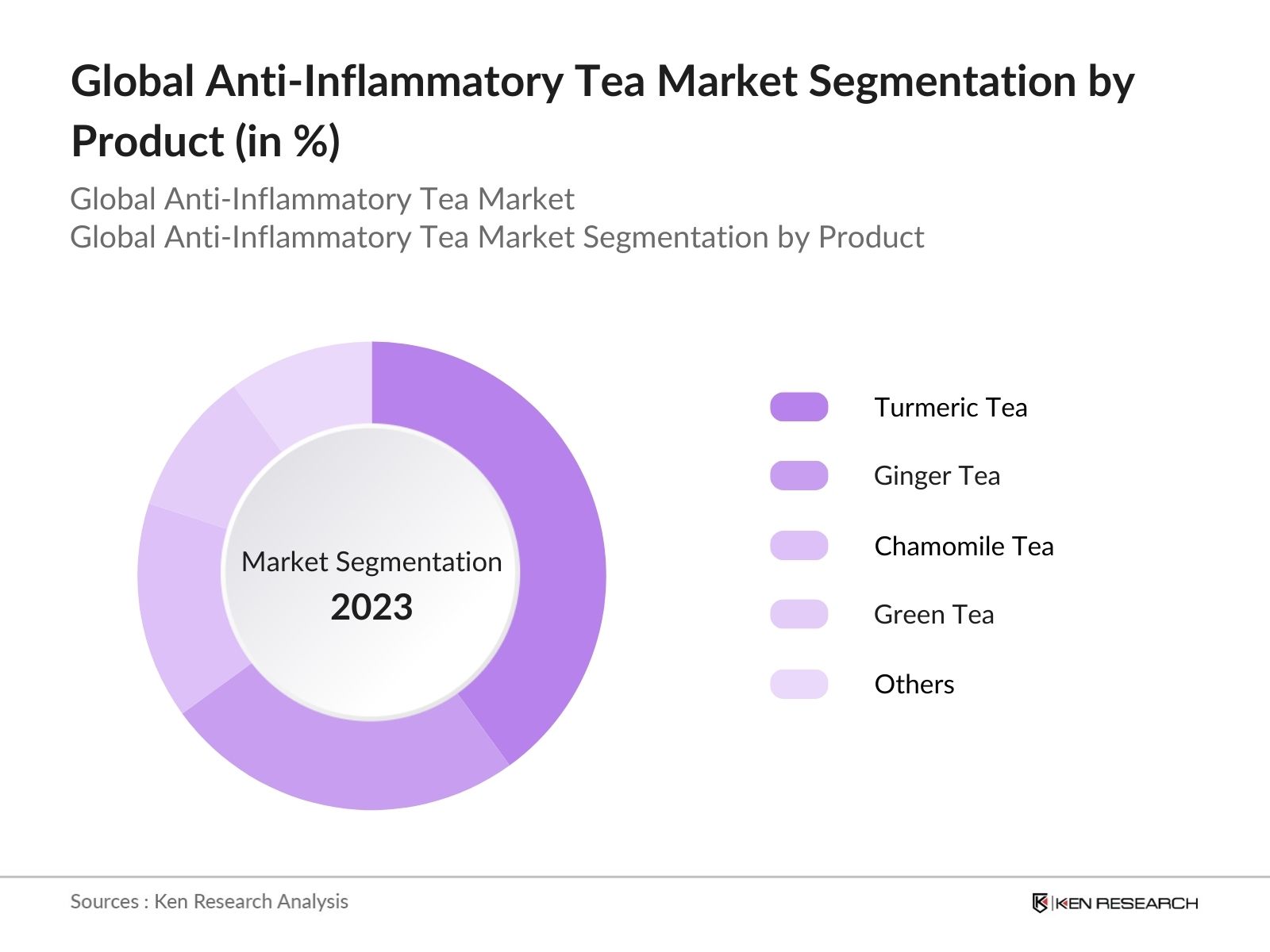

Global Anti-Inflammatory Tea Market Segmentation

By Product Type: The market is segmented by product type into turmeric tea, ginger tea, chamomile tea, green tea, and peppermint tea. Among these, turmeric tea holds a dominant market share, driven by its well-established medicinal properties, such as its ability to reduce inflammation. The global rise in chronic inflammatory conditions like arthritis and digestive disorders has propelled turmeric's popularity as a preventive health measure.

By Distribution Channel: The market is also segmented by distribution channels into supermarkets & hypermarkets, specialty stores, convenience stores, and e-commerce platforms. The e-commerce segment dominates, capturing a significant share due to the growing preference for online shopping. With convenience being a critical factor, consumers increasingly opt for digital platforms to explore a broader range of products and make purchases from the comfort of their homes.

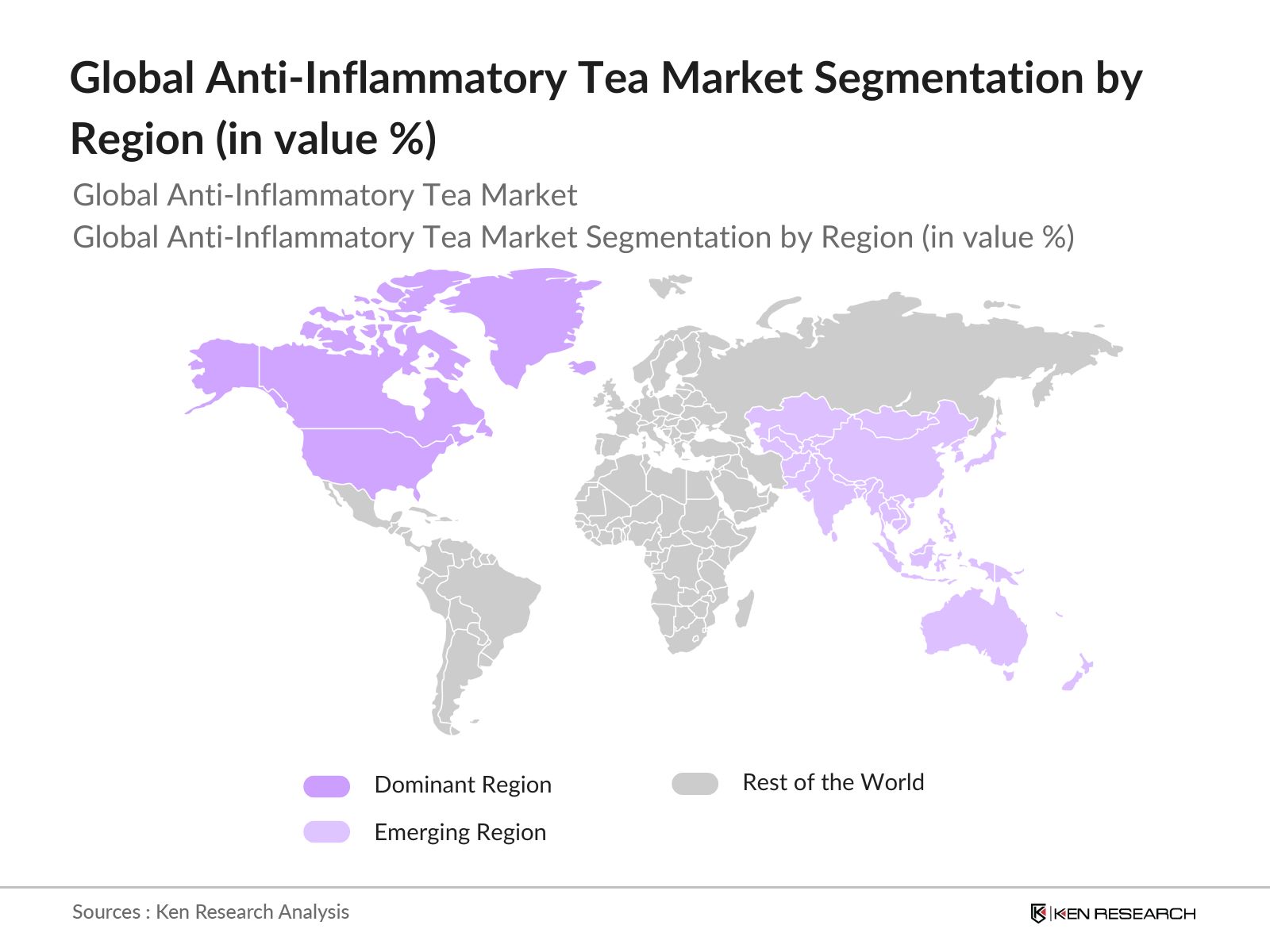

By Region: North America, Europe, and Asia-Pacific represent the largest markets for anti-inflammatory tea. North America holds a significant share of the market due to increasing consumer demand for natural remedies and the widespread adoption of wellness products. Europe follows closely, with countries like the UK and Germany showing strong demand due to the rising trend of herbal teas. Meanwhile, the Asia-Pacific region, particularly India and China, benefits from large-scale tea production and cultural preferences for tea consumption, making it a critical market for anti-inflammatory tea.

Global Anti-Inflammatory Tea Market Competitive Landscape

The market is characterized by the presence of key players who dominate through established distribution networks and innovative product offerings. Major companies focus on product development to cater to the growing demand for natural and organic teas.

|

Company |

Established |

Headquarters |

No. of Employees |

Revenue |

Market Presence |

Sustainability Initiatives |

Product Portfolio |

Innovation |

|

The Hain Celestial Group |

1993 |

New York, USA |

||||||

|

Tata Consumer Products |

1962 |

Mumbai, India |

||||||

|

Dilmah Ceylon Tea Company |

1988 |

Colombo, Sri Lanka |

||||||

|

Bigelow Tea Company |

1945 |

Fairfield, USA |

||||||

|

Mountain Rose Herbs |

1987 |

Oregon, USA |

Global Anti-Inflammatory Tea Market Analysis

Market Growth Drivers

- Increased Awareness of Health Benefits of Anti-Inflammatory Ingredients: Consumers are becoming more aware of the health benefits of anti-inflammatory ingredients such as turmeric, ginger, and green tea. In 2024, there is projected to be a noticeable rise in consumer demand for natural remedies, including anti-inflammatory teas, due to their well-documented ability to alleviate chronic conditions such as arthritis and cardiovascular disease.

- Increasing Prevalence of Chronic Diseases: The increasing prevalence of chronic diseases, particularly those related to inflammation, such as cardiovascular diseases and diabetes, will drive demand for anti-inflammatory teas. In 2024, the global incidence of cardiovascular diseases is expected to exceed 550 million cases, according to health authorities.

- Growing Consumer Preference for Herbal and Functional Teas: Herbal teas with functional benefits are witnessing an increasing consumer preference. For instance, in 2024, the global functional beverage market is expected to generate over $80 billion in sales, with a significant portion attributed to herbal teas. Anti-inflammatory tea, particularly those with natural ingredients like chamomile and ginger, will benefit from this trend.

Market Challenges

- Lack of Regulatory Clarity on Health Claims: The market faces challenges due to the lack of standardized regulatory frameworks across regions regarding health claims. In 2024, countries like the U.S. and the EU are expected to tighten regulations on how anti-inflammatory products are marketed, particularly concerning health benefit claims.

- Inconsistent Quality Standards: In 2024, one of the critical challenges for the market will be the inconsistency in quality standards across different regions. Many countries do not have strict quality control processes for herbal and natural products, leading to variations in product efficacy and consumer trust.

Global Anti-Inflammatory Tea Market Future Outlook

Over the next five years, the global anti-inflammatory tea industry is poised for growth, driven by the increasing demand for natural, organic remedies and the rising prevalence of chronic health issues like arthritis and digestive disorders.

Future Market Opportunities

- Growth in Organic and Clean-Label Products: Over the next five years, there will be a marked increase in demand for organic and clean-label anti-inflammatory teas, with consumers prioritizing transparency in ingredient sourcing. By 2029, over 70% of all anti-inflammatory teas are expected to be certified organic, according to industry projections.

- Rising Demand for Personalized Tea Blends: By 2029, the market for personalized anti-inflammatory tea blends is projected to grow as consumers seek customized solutions for inflammation-related health issues. Several major tea brands are expected to launch platforms that allow customers to tailor their tea blends based on their individual health needs.

Scope of the Report

|

By Product Type |

Turmeric Ginger Chamomile Green Tea |

|

By Packaging |

Loose Leaf Tea Bags Aluminum Tins |

|

By Distribution Channel |

Supermarkets Specialty Stores E-commerce |

|

By Ingredient |

Herbal Blends Single-ingredient |

|

By Region |

North America Europe Asia Pacific |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., USDA, FDA)

Private Equity Firms

Organic Food & Beverage Distributors

E-commerce Platforms

Herbal Tea Manufacturers

Banks and Financial Institution

Nutritional Supplement Companies

Companies

Players Mentioned in the Report:

The Hain Celestial Group

Tata Consumer Products

Dilmah Ceylon Tea Company

Bigelow Tea Company

Mountain Rose Herbs

Terra Teas Organic

Full Leaf Tea Co.

Davidsons Organics

ArtfulTea

Yogi Tea

Table of Contents

1. Global Anti-Inflammatory Tea Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Anti-Inflammatory Tea Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Anti-Inflammatory Tea Market Analysis

3.1 Growth Drivers (Health Benefits, Herbal Remedies)

3.1.1 Rising demand for health-conscious beverages

3.1.2 Shift towards natural and organic products

3.1.3 Growing awareness of anti-inflammatory properties

3.1.4 Expansion of online retail channels

3.2 Market Challenges (Consumer Preferences, Competitive Pressures)

3.2.1 Competition from pharmaceutical alternatives

3.2.2 High cost of premium organic ingredients

3.2.3 Regulatory hurdles in key markets

3.2.4 Limited consumer awareness in developing regions

3.3 Opportunities (Product Innovation, Expansion)

3.3.1 Growing adoption in wellness programs

3.3.2 Development of new flavors and blends

3.3.3 Collaboration with healthcare professionals

3.3.4 Expansion into untapped geographic markets

3.4 Trends (Functional Foods, E-commerce Growth)

3.4.1 Increasing preference for functional teas

3.4.2 Growth of eco-friendly packaging solutions

3.4.3 Rise in subscription-based tea services

3.4.4 Influence of social media on product awareness

3.5 Government Regulations (Global Trade, Import-Export Policies)

3.5.1 Organic certification and labeling

3.5.2 Health claims regulation in advertising

3.5.3 Import-export tariffs on herbal teas

3.5.4 Environmental standards for tea farming

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. Global Anti-Inflammatory Tea Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Turmeric Tea

4.1.2 Ginger Tea

4.1.3 Chamomile Tea

4.1.4 Green Tea

4.2 By Packaging (In Value %)

4.2.1 Loose Leaf Tea

4.2.2 Tea Bags

4.2.3 Aluminum Tins

4.3 By Distribution Channel (In Value %)

4.3.1 Supermarket & Hypermarket

4.3.2 Specialty Stores

4.3.3 Convenience Stores

4.3.4 E-commerce

4.4 By Ingredient (In Value %)

4.4.1 Herbal Blends

4.4.2 Traditional Teas

4.4.3 Single-ingredient Infusions

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Anti-Inflammatory Tea Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 The Hain Celestial Group

5.1.2 Tata Consumer Products

5.1.3 Dilmah Ceylon Tea Company

5.1.4 Bigelow Tea Company

5.1.5 Mountain Rose Herbs

5.1.6 Terra Teas Organic

5.1.7 Full Leaf Tea Co.

5.1.8 Davidsons Organics

5.1.9 ArtfulTea

5.1.10 Yogi Tea

5.1.11 Lipton

5.1.12 NUMI Organic Tea

5.1.13 Teavana

5.1.14 Kusmi Tea

5.1.15 Art of Tea

5.2 Cross Comparison Parameters (No. of Employees, Revenue, Product Portfolio, Sustainability Practices, Distribution Network, Market Presence, Product Innovation, Organic Certifications)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. Global Anti-Inflammatory Tea Market Regulatory Framework

6.1 Health Regulations and Certifications

6.2 Compliance and Labeling Requirements

6.3 Trade Policies

6.4 Certification Processes

7. Global Anti-Inflammatory Tea Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Anti-Inflammatory Tea Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Packaging (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Ingredient (In Value %)

8.5 By Region (In Value %)

9. Global Anti-Inflammatory Tea Market Analyst Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Product Differentiation Strategies

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping all key stakeholders in the global anti-inflammatory tea market. Extensive desk research is conducted to collect and analyze data from secondary and proprietary databases, focusing on key factors such as consumer preferences, regulatory frameworks, and market dynamics.

Step 2: Market Analysis and Construction

During this stage, historical market data is gathered to assess market penetration and the revenue generation capacity of major players. Product segmentation and distribution channels are examined to forecast future trends and identify high-growth areas within the market.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market hypotheses, expert consultations are carried out using computer-assisted telephone interviews (CATIs) with leading herbal tea manufacturers. These consultations provide direct insights into industry trends, consumer behavior, and emerging opportunities.

Step 4: Research Synthesis and Final Output

In the final step, research findings are compiled into a comprehensive report, incorporating both quantitative and qualitative analysis. The synthesis includes data verification from primary sources and extensive engagement with tea producers to ensure accuracy in the market projections.

Frequently Asked Questions

01. How big is the Global Anti-Inflammatory Tea Market?

The global anti-inflammatory tea market is valued at USD 1.5 billion, driven by increasing consumer preference for natural health remedies, with a focus on turmeric and ginger-based teas.

02. What are the challenges in the Global Anti-Inflammatory Tea Market?

Challenges in the global anti-inflammatory tea market include competition from pharmaceutical products, regulatory hurdles in some regions, and limited consumer awareness in developing markets, which restrict broader adoption.

03. Who are the major players in the Global Anti-Inflammatory Tea Market?

Key players in the global anti-inflammatory tea market include The Hain Celestial Group, Tata Consumer Products, Dilmah Ceylon Tea Company, and Bigelow Tea Company. These companies dominate due to their global distribution networks and strong focus on organic product lines.

04. What are the growth drivers of the Global Anti-Inflammatory Tea Market?

The global anti-inflammatory tea market is propelled by rising consumer awareness of health benefits, an increase in lifestyle diseases, and a growing preference for organic and natural products, particularly in urban areas.

05. What is the future outlook for the Global Anti-Inflammatory Tea Market?

The global anti-inflammatory tea market is expected to grow, with innovations in product formulations and expansion into untapped geographic regions contributing to future growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.