Global Autonomous Ships Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD5066

December 2024

94

About the Report

Global Autonomous Ships Market Overview

- The global autonomous ships market is valued at USD 5 billion, based on a five-year historical analysis. This market is driven by technological advancements in artificial intelligence (AI), machine learning, and maritime automation, alongside the growing need for operational efficiency in global shipping. As the industry focuses on reducing human error and optimizing fuel consumption, autonomous ships are becoming integral to commercial shipping and defense operations, particularly in long-distance voyages and unmanned marine missions.

- Countries such as Norway, Japan, and South Korea are leading in the development and deployment of autonomous ships. Norways dominance is largely due to its early adoption of maritime automation technologies and strong government support for environmental sustainability in shipping. Meanwhile, Japan and South Koreas dominance stems from their significant investment in maritime research, their strategic focus on technological advancements, and the presence of globally leading shipbuilders. These nations are driving innovation in the industry, setting a benchmark for other countries to follow.

- The International Maritime Organization (IMO) introduced comprehensive guidelines on Maritime Autonomous Surface Ships (MASS) in 2023, aimed at ensuring the safe operation of these vessels. The guidelines focus on areas such as navigation, communication, and emergency response protocols, with the IMO reporting that these regulations have been implemented by over 25 member states as of 2024.

Global Autonomous Ships Market Segmentation

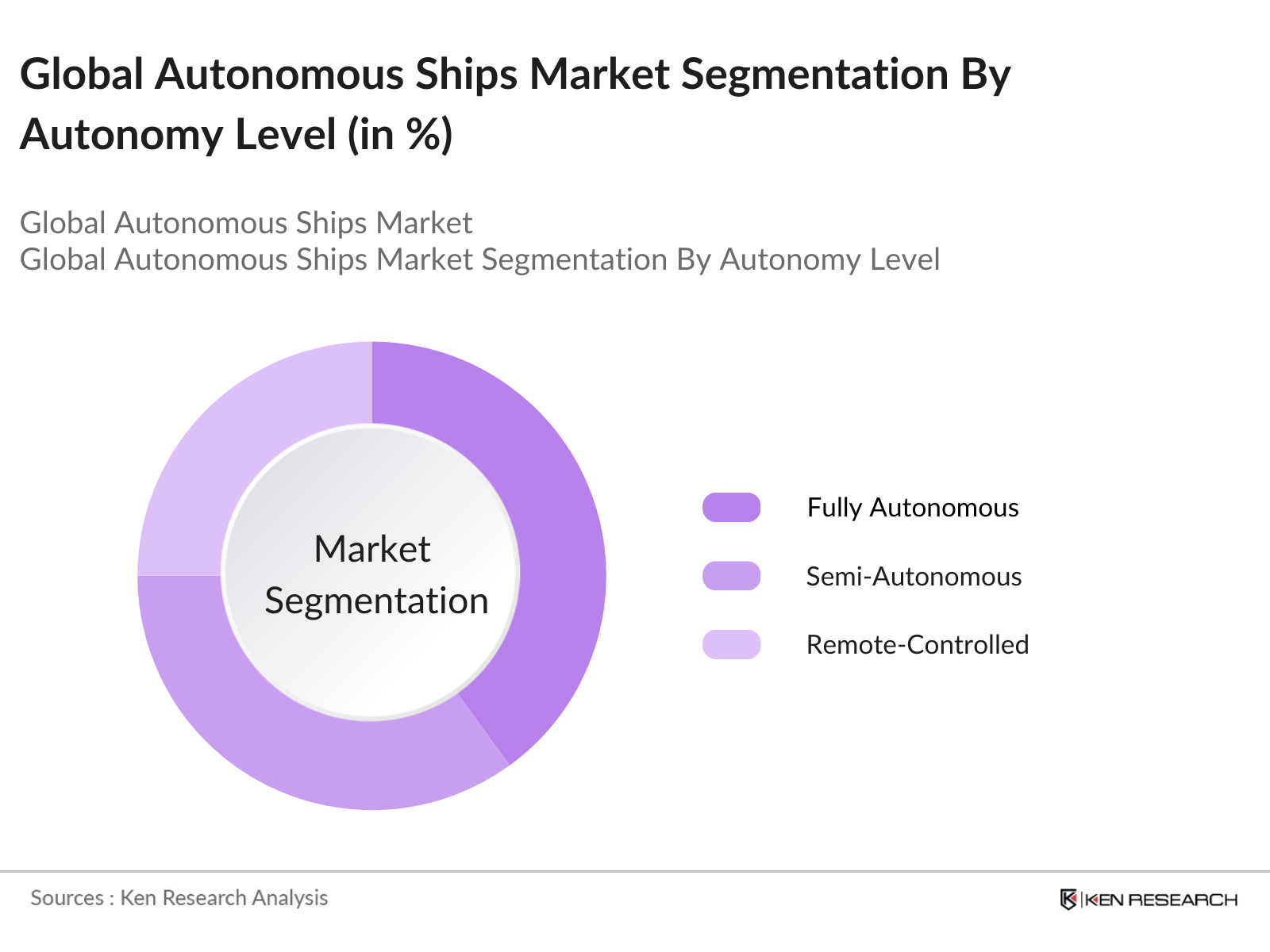

By Autonomy Level: The market is segmented by autonomy level into fully autonomous, semi-autonomous, and remote-controlled vessels. Fully autonomous ships hold the dominant market share due to the increasing push for unmanned vessels capable of long-distance voyages. These vessels eliminate human error, increase fuel efficiency, and reduce crew-related operational costs. Fully autonomous ships are becoming increasingly popular in commercial shipping, particularly for cargo and tanker operations were long voyages across transoceanic routes demand minimal human involvement.

By Ship Type: The market is segmented by ship type into commercial ships, defense vessels, ferries, and research and survey ships. Commercial ships, including bulk carriers, container ships, and tankers, dominate the market due to the sheer volume of maritime trade conducted globally. The efficiency of autonomous systems in reducing operational costs and fuel consumption makes them highly appealing for commercial operators.

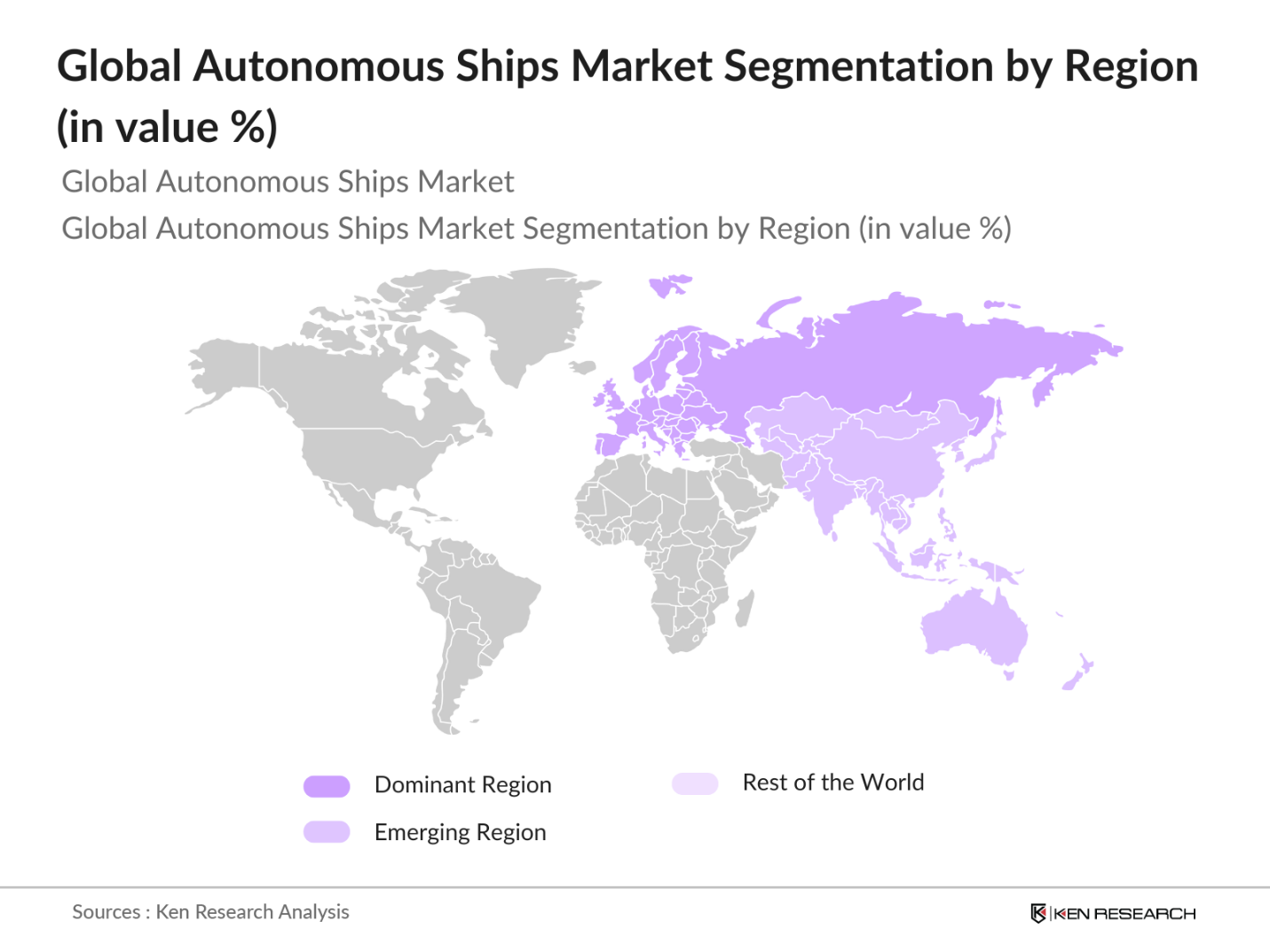

By Region: Geographically, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Europe holds the largest market share in the autonomous ships market, primarily driven by the proactive adoption of environmental regulations and the push for sustainable maritime transport. Countries like Norway, the UK, and Finland are pioneers in testing and deploying autonomous vessels.

Global Autonomous Ships Market Competitive Landscape

The global autonomous ships market is dominated by key players with strong technological capabilities and an extensive focus on research and development. These companies are continuously improving their autonomous systems to cater to the growing demand for efficient and safe maritime operations. The market is characterized by strategic collaborations between technology providers, shipbuilders, and maritime operators to develop integrated solutions for autonomous shipping.

Global Autonomous Ships Industry Analysis

Growth Drivers

- Increased Shipping Efficiency (Fuel Efficiency, Reduced Human Error): Autonomous ships are being increasingly adopted due to their potential for enhanced fuel efficiency and reduced human error. According to the International Maritime Organization (IMO), maritime shipping accounts for approximately 2.89% of global greenhouse gas emissions. The integration of autonomous systems could reduce fuel consumption by optimizing routes, reducing idle time, and managing vessel speed with precision. In 2024, it is estimated that the global shipping industry can save nearly 85 million tonnes of fuel annually with AI-assisted systems.

- Rising Maritime Trade (Transoceanic Shipping Routes): The increase in maritime trade is a key driver for autonomous ships, particularly along major transoceanic shipping routes. The World Bank reported that global maritime trade reached 11.08 billion tonnes in 2023, driven by strong demand from emerging markets in Asia and Africa. Autonomous vessels offer the potential to manage the growing traffic on these routes more efficiently by reducing the need for onboard crews and minimizing delays caused by human errors.

- Advancements in Sensor Technology (AI and Machine Learning Integration): Recent advancements in sensor technologies, especially those integrating AI and machine learning, are fueling the adoption of autonomous ships. Sensors now play a critical role in real-time monitoring of oceanic conditions, detecting obstacles, and navigating complex maritime environments without human intervention. In 2024, AI-driven navigation systems are estimated to reduce accidents by 25%, according to the International Maritime Organization.

Market Challenges

- High Capital Costs: The deployment of autonomous ships involves substantial capital investment, particularly in terms of initial setup, sensor technology, and AI system integration. The World Bank estimates that converting a traditional vessel into an autonomous one can cost approximately USD 6 million, which presents a significant financial barrier for many shipping companies, particularly smaller operators. Moreover, the cost of maintenance and technological upgrades is anticipated to remain high in 2024, further hindering widespread adoption across all sectors of the maritime industry.

- Cybersecurity Risks: As autonomous ships rely on advanced communication and data exchange systems, they are particularly vulnerable to cyberattacks. According to the European Union Agency for Cybersecurity (ENISA), the maritime sector has seen a 40% increase in cybersecurity incidents over the past two years, driven by the rising adoption of digital systems. In 2024, experts warn that autonomous vessels could be a target for hackers looking to disrupt global trade routes, resulting in massive financial and reputational damage for shipping operators.

Global Autonomous Ships Market Future Outlook

Over the next five years, the global autonomous ships market is expected to witness substantial growth driven by continuous advancements in automation, AI, and sensor technologies. Government regulations mandating reduced emissions and operational efficiency in maritime transportation will further drive the adoption of autonomous vessels. Moreover, the need to cut operational costs and enhance fuel efficiency will continue to be a strong motivator for ship operators to transition to autonomous systems.

Market Opportunities

- Expansion of Unmanned Cargo Shipping: The growth of unmanned cargo shipping presents a significant opportunity for the autonomous ship market. According to the United Nations Conference on Trade and Development (UNCTAD), unmanned cargo vessels accounted for 0.5% of total global shipping in 2023. This is expected to increase as governments and regulatory bodies, such as the IMO, provide more clarity on operational guidelines. With over 11 billion tonnes of goods transported annually, there is immense potential for autonomous ships to capture a larger share of the cargo market.

- Strategic Collaborations Between OEMs and Software Providers: Strategic partnerships between Original Equipment Manufacturers (OEMs) and software companies specializing in AI and machine learning offer substantial growth opportunities. In 2024, nearly 60% of all new autonomous ships will likely be equipped with systems developed through these collaborations. This trend is supported by increased investment from shipping giants and government entities keen to leverage technological advancements to enhance efficiency and reduce costs.

Scope of the Report

|

By Autonomy Level |

Fully Autonomous Semi-Autonomous Remote-Controlled |

|

By Ship Type |

Commercial Ships Defense Vessels Ferries Research and Survey Ships |

|

By Component |

Hardware (Sensors, Control Systems) Software (AI, Analytics Platforms) Communication Systems (Satellite, V2X) |

|

By End-User |

Shipping Companies Naval Defense Port Authorities Research Institutions |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Shipping Companies

Naval Defense Authorities

Port Authorities

Marine Research Institutions

OEMs and Technology Providers

Environmental Regulators (International Maritime Organization, National Maritime Authorities)

Government and Regulatory Bodies (IMO, National Coast Guards)

Investments and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Rolls-Royce Holdings PLC

Kongsberg Gruppen

Wartsila Corporation

General Electric

ABB Ltd

Mitsui O.S.K. Lines, Ltd.

NYK Line

HHI Group

Fugro

L3Harris Technologies

Table of Contents

1. Global Autonomous Ships Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Autonomous Ships Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Autonomous Ships Market Analysis

3.1. Growth Drivers

3.1.1. Increased Shipping Efficiency (Fuel Efficiency, Reduced Human Error)

3.1.2. Rising Maritime Trade (Transoceanic Shipping Routes)

3.1.3. Advancements in Sensor Technology (AI and Machine Learning Integration)

3.1.4. Regulatory Support for Autonomous Systems

3.2. Market Challenges

3.2.1. High Capital Costs

3.2.2. Cybersecurity Risks

3.2.3. Technical and Operational Barriers

3.3. Opportunities

3.3.1. Expansion of Unmanned Cargo Shipping

3.3.2. Strategic Collaborations Between OEMs and Software Providers

3.3.3. Environmental Regulations Driving Autonomy Adoption

3.4. Trends

3.4.1. Increasing Use of AI in Maritime Navigation Systems

3.4.2. Adoption of Autonomous Tugboats for Port Operations

3.4.3. Remote-Controlled Operations as a Transitional Model

3.5. Government Regulations

3.5.1. IMO Guidelines on Autonomous Ships

3.5.2. National Regulations on Autonomous Maritime Operations

3.5.3. Port Authority Compliance Standards for Autonomous Vessels

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Global Autonomous Ships Market Segmentation

4.1. By Autonomy Level (In Value %)

4.1.1. Fully Autonomous

4.1.2. Semi-Autonomous

4.1.3. Remote-Controlled

4.2. By Ship Type (In Value %)

4.2.1. Commercial Ships

4.2.2. Defense Vessels

4.2.3. Ferries

4.2.4. Research and Survey Ships

4.3. By Component (In Value %)

4.3.1. Hardware (Sensors, Control Systems)

4.3.2. Software (AI, Analytics Platforms)

4.3.3. Communication Systems (Satellite, V2X)

4.4. By End-User (In Value %)

4.4.1. Shipping Companies

4.4.2. Naval Defense

4.4.3. Port Authorities

4.4.4. Research Institutions

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Autonomous Ships Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Rolls-Royce Holdings PLC

5.1.2. Kongsberg Gruppen

5.1.3. Wartsila Corporation

5.1.4. General Electric

5.1.5. ABB Ltd

5.1.6. Mitsui O.S.K. Lines, Ltd.

5.1.7. NYK Line

5.1.8. HHI Group

5.1.9. Fugro

5.1.10. L3Harris Technologies

5.1.11. Siemens AG

5.1.12. Autonomous Marine Systems Inc.

5.1.13. Shone Automation

5.1.14. Ocean Infinity

5.1.15. Marine AI

5.2 Cross Comparison Parameters (Market Capitalization, Technology Leadership, Fleet Size, Partnerships, AI and Software Integration, Port Presence, Number of Patents, Customer Base)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants and Support

5.8 Venture Capital Funding

6. Global Autonomous Ships Market Regulatory Framework

6.1 IMO Standards and Regulations

6.2 National Maritime Authorities Compliance

6.3 Autonomous Ship Certification Processes

7. Global Autonomous Ships Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Autonomous Ships Future Market Segmentation

8.1 By Autonomy Level (In Value %)

8.2 By Ship Type (In Value %)

8.3 By Component (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. Global Autonomous Ships Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step in this research involved mapping the ecosystem of the global autonomous ships market. This was done through an extensive desk research process using proprietary databases and secondary resources. The aim was to identify critical variables influencing the market dynamics, such as advancements in AI, regulatory support, and shifts in global shipping demands.

Step 2: Market Analysis and Construction

In this phase, historical data was analyzed to understand the market penetration of autonomous systems in maritime operations. A detailed assessment of market drivers, such as the increasing demand for fuel-efficient ships, was conducted. This data was cross-checked with real-world examples to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

The insights gathered were validated through consultations with industry experts via interviews. These experts, representing both shipping companies and technology providers, provided valuable perspectives on market trends and operational challenges, further refining the market analysis.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the research into actionable insights by engaging with leading shipbuilders. This ensured that the data derived from desk research was aligned with on-ground realities, particularly in terms of autonomous ship operations and market potential.

Frequently Asked Questions

1. How big is the Global Autonomous Ships Market?

The global autonomous ships market is valued at USD 5 billion, based on a five-year historical analysis. This market is driven by technological advancements in artificial intelligence (AI), machine learning, and maritime automation, alongside the growing need for operational efficiency in global shipping.

2. What are the challenges in the Global Autonomous Ships Market?

Challenges in the market include high capital costs for building autonomous vessels, cybersecurity risks, and technical barriers related to long-distance navigation.

3. Who are the major players in the Global Autonomous Ships Market?

Major players include Rolls-Royce Holdings PLC, Kongsberg Gruppen, Wartsila Corporation, General Electric, and ABB Ltd, all of whom lead in innovation and technological integration.

4. What are the growth drivers of the Global Autonomous Ships Market?

The market is driven by advancements in AI, the need for efficient maritime transport, and supportive regulations from international and national bodies aimed at reducing emissions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.