Global Cloud ERP Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2278

November 2024

98

About the Report

Global Cloud ERP Market Overview

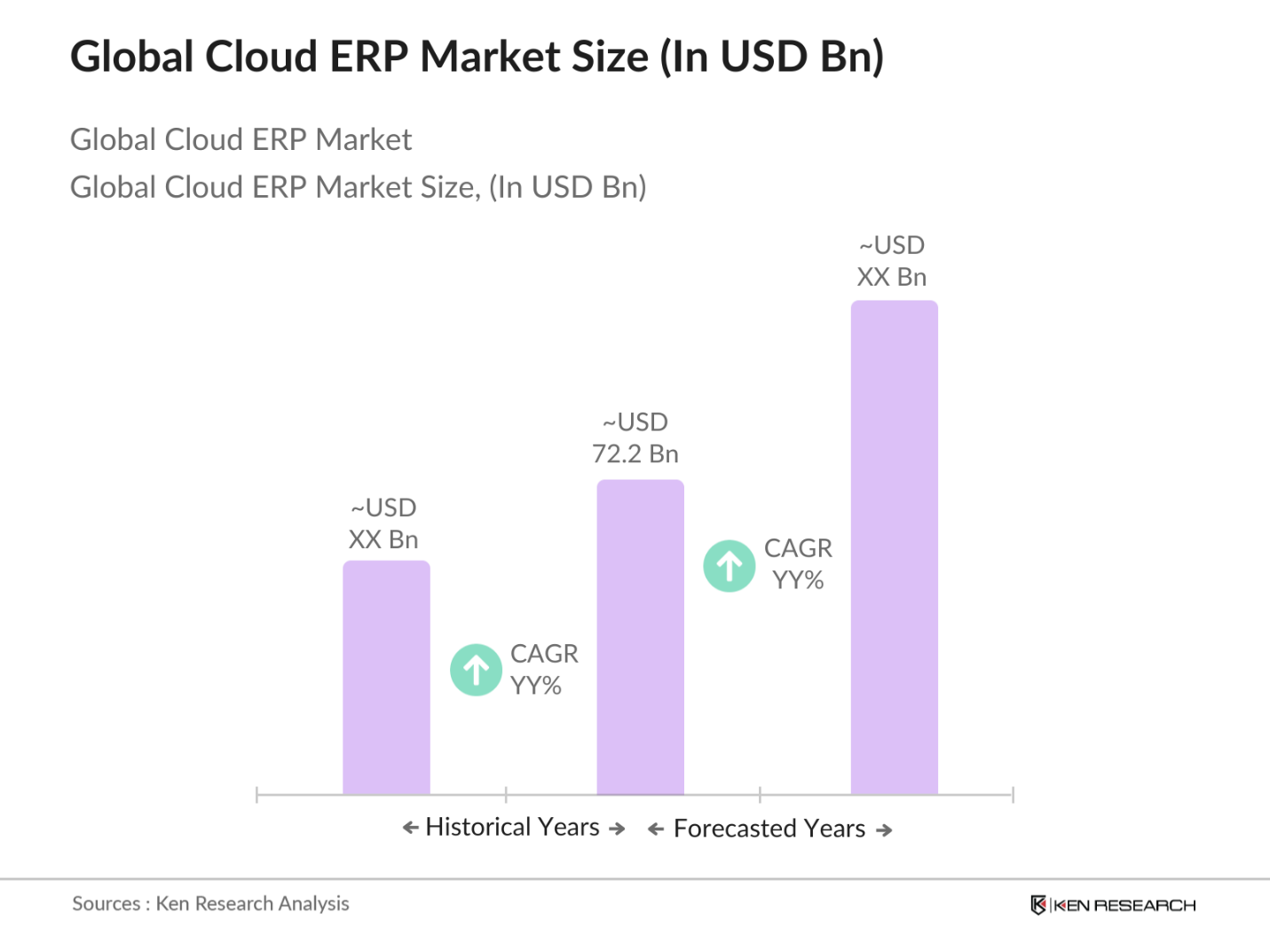

- The Global Cloud ERP market is valued at USD 72.2 billion, driven by the increasing adoption of cloud-based solutions by organizations seeking scalability and efficiency. This market growth is propelled by technological advancements, the rising need for real-time data analytics, and the shift toward remote work environments.

- Countries like the United States, Germany, and the United Kingdom dominate the Global Cloud ERP market due to their advanced technological landscapes and high adoption rates of cloud solutions. The United States leads in market share owing to its strong presence of technology companies and significant investments in IT infrastructure. In Europe, Germany stands out as a leader due to its focus on innovation and efficiency in manufacturing and logistics, while the UK benefits from its vibrant financial services sector that increasingly relies on cloud ERP for operational agility.

- Governments worldwide are implementing data localization laws, compelling organizations to store data within specific geographic boundaries. As of 2023, the World Bank reported that over 70 countries have enacted such regulations, significantly impacting how businesses manage their cloud operations. For example, the Indian government's Personal Data Protection Bill mandates that sensitive data be stored on domestic servers. Compliance with these laws is crucial for businesses, as non-compliance can result in substantial fines and legal ramifications. This regulatory environment necessitates organizations to adapt their Cloud ERP strategies to ensure adherence to local data protection laws.

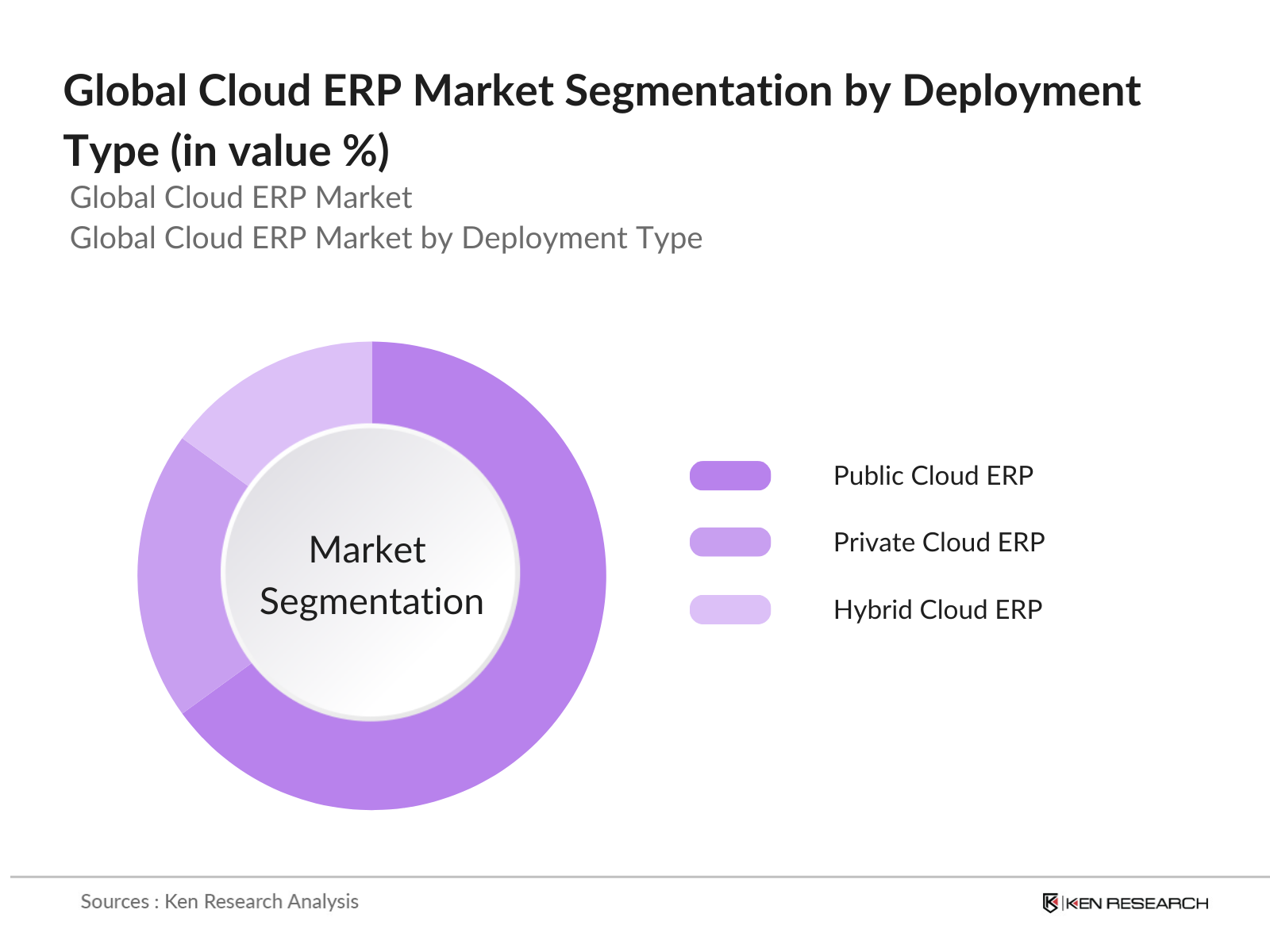

Global Cloud ERP Market Segmentation

By Deployment Type: The Global Cloud ERP market is segmented by deployment type into Public Cloud ERP, Private Cloud ERP, and Hybrid Cloud ERP. Public Cloud ERP currently holds a dominant market share due to its cost-effectiveness and ease of scalability. Companies favor public cloud solutions for their low upfront costs and the ability to quickly adapt to changing business needs without extensive IT infrastructure investments. The public cloud model allows for greater collaboration and access to advanced functionalities without the burdens of maintaining hardware, which has made it increasingly appealing to small and medium-sized enterprises (SMEs).

By Region: The Global Cloud ERP market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. North America commands a significant share of the market, primarily driven by the United States, where the rapid digital transformation of industries creates a high demand for cloud ERP solutions. The region benefits from an established IT ecosystem, a strong focus on innovation, and significant investments in cloud technologies. Europe follows, with countries like Germany and the UK leading in adoption rates due to their robust manufacturing and service sectors requiring efficient resource planning solutions.

Global Cloud ERP Market Competitive Landscape

The Global Cloud ERP market is characterized by the presence of several major players, which include Oracle Corporation, SAP SE, Microsoft Corporation, Workday, and Infor. This consolidation illustrates the significant influence of these key companies, which are continuously innovating and expanding their offerings to maintain their competitive edge. The market landscape is dynamic, with these companies investing heavily in research and development to integrate emerging technologies such as artificial intelligence (AI) and machine learning (ML) into their ERP solutions.

|

Company |

Establishment Year |

Headquarters |

Revenue |

Market Share |

Employee Count |

Key Solutions |

Target Industries |

Geographical Presence |

|

Oracle Corporation |

1977 |

Redwood City, California |

||||||

|

SAP SE |

1972 |

Walldorf, Germany |

||||||

|

Microsoft Corporation |

1975 |

Redmond, Washington |

||||||

|

Workday |

2005 |

Pleasanton, California |

||||||

|

Infor |

2002 |

New York, New York |

Global Cloud ERP Market Analysis

Market Growth Drivers

- Growing Adoption of Cloud Computing in Enterprises: The adoption of cloud computing in enterprises is significantly impacting the Cloud ERP market, driven by the flexibility and scalability it offers. According to the International Telecommunication Union (ITU), the global cloud services market reached approximately $397 billion in 2022, highlighting a robust trend toward cloud infrastructure. As enterprises transition to cloud-based solutions, they can lower operational costs and improve efficiency, with the World Bank noting a direct correlation between cloud adoption and increased productivity in the digital economy.

- SaaS and IaaS Platform Integration: The integration of Software as a Service (SaaS) and Infrastructure as a Service (IaaS) platforms into Cloud ERP solutions is becoming increasingly vital. A report by the United Nations Conference on Trade and Development (UNCTAD) highlighted that the global SaaS market was valued at approximately $143 billion in 2022. This rapid growth underscores the need for integrated systems that offer seamless interoperability. Businesses that adopt such integrated platforms report improvements in operational efficiency and resource management, with cloud-based services allowing for enhanced collaboration across teams.

- Demand for Real-Time Data Access Across Businesses: The demand for real-time data access is a crucial driver for Cloud ERP systems, facilitating informed decision-making. The World Economic Forum (WEF) highlighted the growing significance of real-time data analytics in business strategy, indicating that executives recognize its importance for operational efficiency. Companies are leveraging cloud ERP to access live data feeds, which significantly improves responsiveness to market changes. Businesses utilizing cloud platforms can decrease reporting times from days to mere hours.

Market Challenges

- Data Security and Privacy Concerns: Data security and privacy remain significant challenges for the Cloud ERP market. The World Bank reported that cybercrime is projected to cost the global economy over $8 trillion annually by 2025, prompting businesses to approach cloud solutions with caution. Organizations are increasingly concerned about compliance with data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe.

- Integration Issues with Existing Legacy Systems: Integrating cloud ERP solutions with existing legacy systems poses substantial challenges for organizations. According to a report by the International Monetary Fund (IMF), many enterprises struggle with legacy system integration, which leads to inefficiencies and increased operational risks. These integration challenges can hinder data consistency and disrupt workflow processes, ultimately resulting in lost productivity. Organizations often hesitate to abandon legacy systems due to the perceived risks and costs associated with migration.

Global Cloud ERP Market Future Outlook

Over the next five years, the Global Cloud ERP market is expected to show significant growth driven by continuous advancements in technology, increased demand for cloud-based solutions, and the need for real-time data access among businesses. As organizations prioritize digital transformation to enhance operational efficiency, the adoption of cloud ERP solutions will become a critical strategy for many companies.

Market Opportunities:

- Emergence of Low-Code/No-Code ERP Platforms: The rise of low-code and no-code ERP platforms is transforming the Cloud ERP landscape, enabling organizations to develop custom solutions without extensive coding knowledge. In 2023, the International Telecommunication Union (ITU) reported that the low-code market reached $13 billion, with expectations for continued growth as businesses seek to streamline application development. This trend empowers non-technical users to create tailored workflows and applications, increasing agility and reducing dependency on IT departments.

- Growing Multi-Cloud Strategy Adoption: The adoption of multi-cloud strategies is gaining traction as organizations seek to optimize their cloud deployments. According to a report by the International Monetary Fund (IMF), many companies utilize multiple cloud services to enhance flexibility and mitigate vendor lock-in. In 2023, enterprises that employed multi-cloud strategies experienced improved disaster recovery capabilities and enhanced performance. This trend allows organizations to leverage the strengths of different cloud providers, optimizing costs while maintaining redundancy.

Scope of the Report

|

By Deployment |

Public Cloud ERP |

|

By Enterprise Size |

Large Enterprises |

|

By Vertical |

Manufacturing |

|

By Component |

Software |

|

By Region |

North America |

Products

Key Target Audience

Chief Financial Officers (CFOs)

Chief Information Officers (CIOs)

IT Directors and Managers

Supply Chain Managers

Government and Regulatory Bodies (e.g., Federal Trade Commission)

Investment and Venture Capitalist Firms

Business Development Executives

Procurement Officers

Companies

Players Mention in the Report

Oracle Corporation

SAP SE

Microsoft Corporation

Workday

Infor

Epicor Software Corporation

NetSuite Inc.

Sage Group

Acumatica, Inc.

Deltek, Inc.

Ramco Systems

Unit4

QAD Inc.

IFS AB

Syspro

Table of Contents

01. Global Cloud ERP Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Cloud ERP Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Cloud ERP Market Analysis

3.1. Growth Drivers (Cloud Adoption, Digital Transformation, SaaS Integration)

3.1.1. Growing Adoption of Cloud Computing in Enterprises

3.1.2. Demand for Real-Time Data Access Across Businesses

3.1.3. SaaS and IaaS Platform Integration

3.2. Market Challenges (Data Privacy, Legacy System Integration)

3.2.1. Data Security and Privacy Concerns

3.2.2. Integration Issues with Existing Legacy Systems

3.3. Opportunities (Vertical-Specific Cloud ERP Solutions, AI-Driven ERP)

3.3.1. Expansion of Vertical-Specific Cloud ERP Solutions

3.3.2. Adoption of AI, ML, and IoT within ERP Systems

3.4. Trends (Cloud Migration, Low-Code/No-Code Solutions, Multi-Cloud Strategies)

3.4.1. Increased Migration from On-Premise to Cloud-Based ERP

3.4.2. Emergence of Low-Code/No-Code ERP Platforms

3.4.3. Growing Multi-Cloud Strategy Adoption

3.5. Government Regulation (Data Localization, Compliance Standards)

3.5.1. Data Localization Laws and Compliance

3.5.2. Industry-Specific ERP Regulatory Compliance

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Vendors, Service Providers, Partners)

3.8. Porters Five Forces (Bargaining Power of Suppliers, Threat of Substitutes)

3.9. Competition Ecosystem

04. Global Cloud ERP Market Segmentation

4.1. By Deployment (In Value %)

4.1.1. Public Cloud ERP

4.1.2. Private Cloud ERP

4.1.3. Hybrid Cloud ERP

4.2. By Enterprise Size (In Value %)

4.2.1. Large Enterprises

4.2.2. Small and Medium-Sized Enterprises (SMEs)

4.3. By Vertical (In Value %)

4.3.1. Manufacturing

4.3.2. Retail & E-Commerce

4.3.3. Financial Services & Banking

4.3.4. Healthcare

4.3.5. IT & Telecom

4.4. By Component (In Value %)

4.4.1. Software

4.4.2. Services (Implementation, Training, Support)

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

05. Global Cloud ERP Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Oracle Corporation

5.1.2. SAP SE

5.1.3. Microsoft Corporation

5.1.4. Infor

5.1.5. Workday, Inc.

5.1.6. Epicor Software Corporation

5.1.7. Sage Group

5.1.8. NetSuite Inc.

5.1.9. Acumatica, Inc.

5.1.10. Deltek, Inc.

5.1.11. Ramco Systems

5.1.12. Syspro

5.1.13. Unit4

5.1.14. QAD Inc.

5.1.15. IFS AB

5.2. Cross Comparison Parameters (Cloud Infrastructure, Revenue, R&D Spending, Employee Base, Geographical Reach, Service Offerings, Customer Retention Rate, Key Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Venture Capital Funding

5.9. Private Equity Investments

06. Global Cloud ERP Market Regulatory Framework

6.1. Data Protection Laws (GDPR, HIPAA)

6.2. Cybersecurity Compliance (ISO 27001)

6.3. Cloud Service Provider Certifications

07. Global Cloud ERP Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global Cloud ERP Future Market Segmentation

8.1. By Deployment (In Value %)

8.2. By Enterprise Size (In Value %)

8.3. By Vertical (In Value %)

8.4. By Component (In Value %)

8.5. By Region (In Value %)

09. Global Cloud ERP Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Cloud ERP market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Global Cloud ERP market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple cloud ERP solution providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global Cloud ERP market.

Frequently Asked Questions

01. How big is the Global Cloud ERP market?

The Global Cloud ERP market is valued at USD 72.2 billion, driven by the increasing adoption of cloud-based solutions and the demand for real-time data analytics.

02. What are the key growth drivers of the Global Cloud ERP market?

The market is propelled by technological advancements, the shift toward remote work, and the rising need for scalable and efficient business solutions among enterprises.

03. Who are the major players in the Global Cloud ERP market?

Key players in the market include Oracle Corporation, SAP SE, Microsoft Corporation, Workday, and Infor, which dominate due to their innovative solutions and extensive market reach.

04. What challenges does the Global Cloud ERP market face?

Challenges include data security concerns, integration issues with legacy systems, and the need for continuous innovation to meet evolving customer demands.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.