Global Corporate Finance Market Outlook 2028

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11215

November 2024

94

About the Report

Global Corporate Finance Market Overview

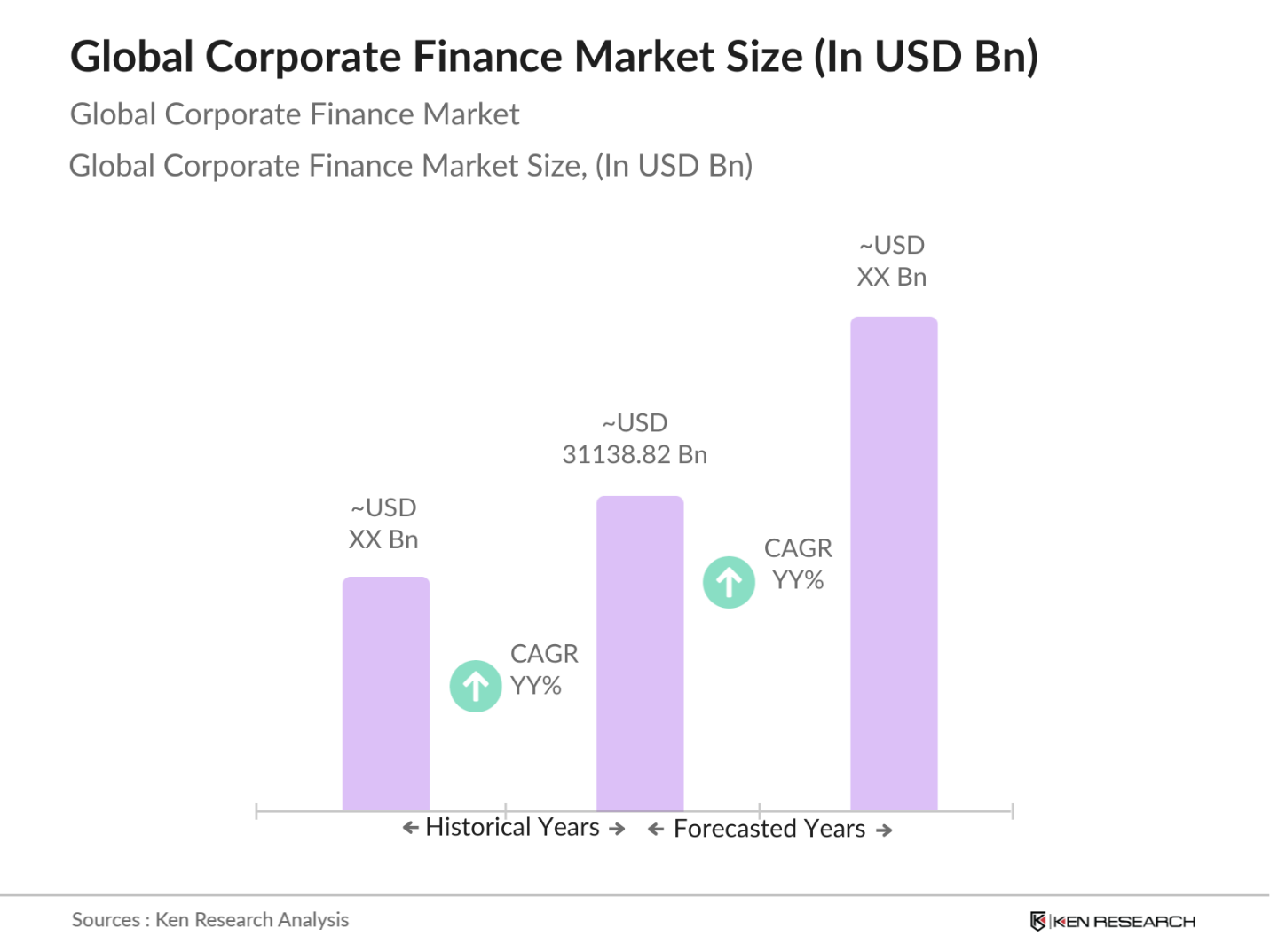

- The Global Corporate Finance Market has expanded significantly, driven by the growing complexity of financial transactions, globalization of business operations, and increasing activity in mergers and acquisitions. Valued at approximately USD 31138.82 billion, the market encompasses a wide range of services, including M&A advisory, capital restructuring, financial risk management, and valuation services. With advancements in financial technology and an increasing focus on ESG investing, corporate finance is evolving to provide sophisticated solutions for companies navigating a dynamic global economy.

- North America holds the largest market share, benefiting from a robust financial services infrastructure, high M&A activity, and significant venture capital investments. Europe follows, driven by regulatory frameworks encouraging transparency and sustainable finance. The Asia-Pacific region is emerging as a key market, supported by economic growth, increased investment in financial services, and growing corporate presence.

- Financial transparency standards require corporations to disclose comprehensive financial data, promoting accountability and investor trust. Standards like IFRS and GAAP enforce consistency in financial reporting, allowing stakeholders to assess corporate performance accurately. In regions like the U.S. and Europe, transparency standards are strictly enforced, impacting corporate finance practices as firms must provide detailed disclosures. Compliance with these standards is fundamental in maintaining investor confidence and regulatory alignment.

Global Corporate Finance Market Segmentation

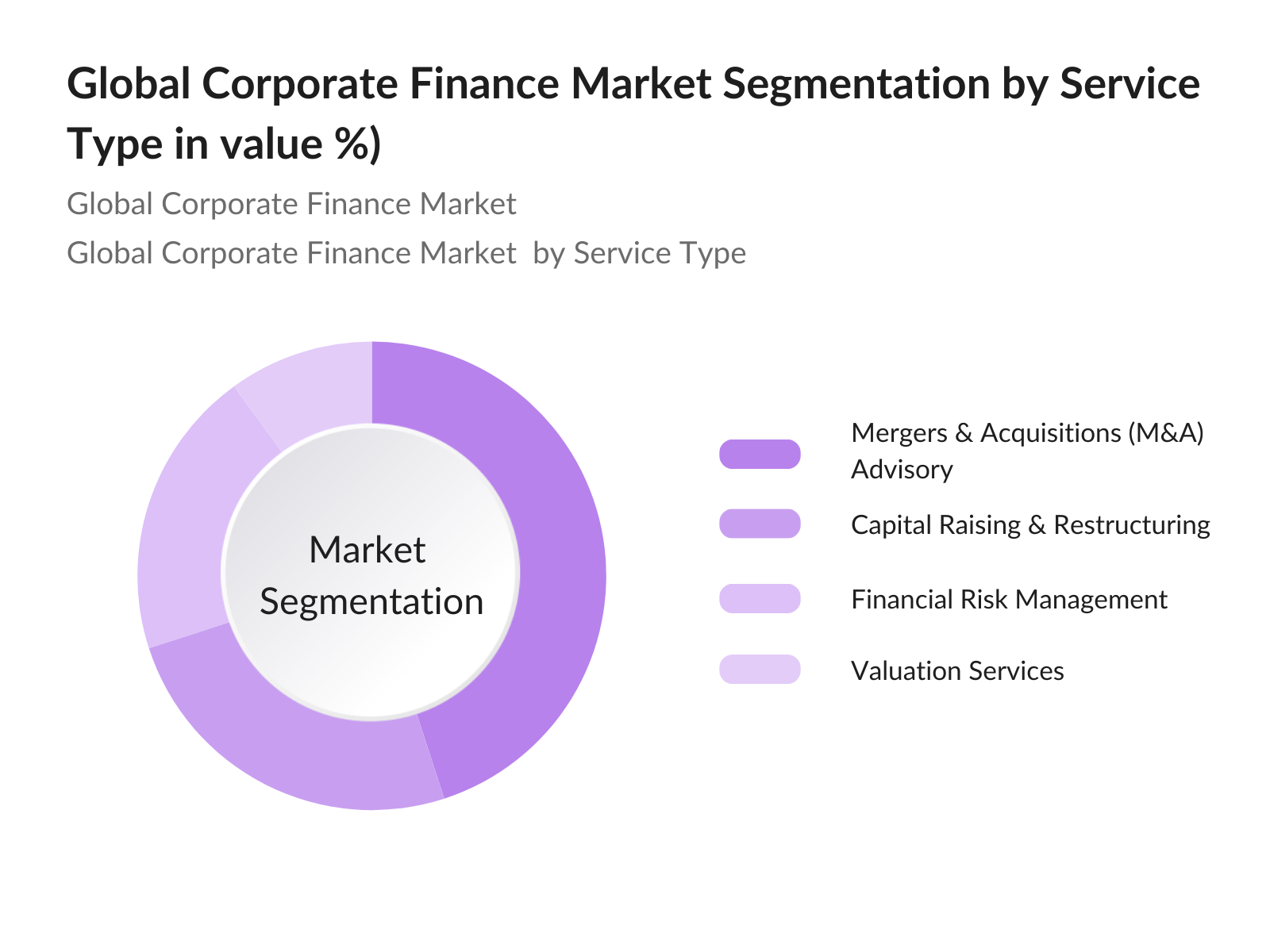

By Service Type: The Corporate Finance Market is segmented by service type into M&A advisory, capital raising & restructuring, financial risk management, and valuation services. M&A advisory holds the largest market share due to the high volume of transactions and cross-border deals. Capital restructuring is also prominent, especially for companies seeking growth or turnaround solutions.

By Region: The Corporate Finance Market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads due to its well-developed financial ecosystem and high level of corporate finance activity. Europe is strong in ESG-focused investments, while the Asia-Pacific region is rapidly growing due to economic expansion and rising interest in corporate finance services.

Global Corporate Finance Market Competitive Landscape

The Global Corporate Finance Market is competitive, with leading firms focusing on providing tailored financial solutions, strategic advice, and transaction support. Major players like JPMorgan Chase, Goldman Sachs, and Morgan Stanley lead the market with expertise in high-value transactions, global reach, and advanced financial technology. The competitive landscape is shaped by strategic mergers, acquisitions, and a strong emphasis on ESG investing.

|

Company |

Establishment Year |

Headquarters |

Employees |

Revenue |

Core Services |

Key Sectors |

Customer Satisfaction Ratings |

Global Presence |

|

JPMorgan Chase & Co. |

2000 |

New York, USA |

||||||

|

Goldman Sachs Group, Inc. |

1869 |

New York, USA |

||||||

|

Morgan Stanley |

1935 |

New York, USA |

||||||

|

Deutsche Bank AG |

1870 |

Frankfurt, Germany |

||||||

|

Citigroup, Inc. |

1998 |

New York, USA |

Global Corporate Finance Market Analysis

Market Growth Drivers

- Economic Globalization and Expansion of Cross-Border Investments: Economic globalization has driven cross-border investments, with over $1.3 trillion in foreign direct investment flowing globally in 2023. Multinational corporations increasingly leverage corporate finance solutions to manage diverse portfolios and tap into new markets. Cross-border investments are prominent in regions like Southeast Asia and Latin America, where foreign capital supports infrastructure projects and industrial expansion. Corporate finance firms play a critical role in facilitating these investments by providing the capital structure, risk management, and financial strategy needed to support international growth.

- Rising Mergers & Acquisitions (M&A) in Key Sectors: M&A activity has surged globally, with over 40,000 deals completed in 2023 alone, driven by consolidations in technology, healthcare, and energy sectors. Corporate finance is instrumental in structuring these transactions, assessing valuation, and navigating regulatory frameworks. This increase in M&A deals supports the demand for advisory, debt structuring, and financial risk management services within corporate finance, as firms seek to expand market share and access new capabilities.

- Growth in Private Equity Investments and Venture Capital: Private equity (PE) and venture capital (VC) investments have seen strong growth, with PE deal volumes surpassing $500 billion in 2023, reflecting investor appetite for high-growth opportunities. Start-ups and high-growth industries, particularly in technology and green energy, attract significant VC funding. Corporate finance services assist in deal structuring, funding rounds, and exit strategies, providing financial expertise crucial for supporting innovation and expansion in these capital-intensive sectors.

Market Challenges:

- Strict Regulatory Compliance Requirements and Reporting Standards: Corporate finance operates within a stringent regulatory environment, requiring compliance with international and regional standards, such as IFRS and GAAP. These standards mandate transparency, regular financial reporting, and adherence to complex tax and accounting regulations. Non-compliance can result in fines, penalties, and reputational damage, creating a burden for corporate finance teams to meet reporting standards across multiple jurisdictions, particularly as global financial regulations evolve.

- Economic Uncertainty and Impact on Investment Decisions: Economic uncertainty, driven by factors like inflation, geopolitical tensions, and fluctuating interest rates, impacts corporate finance decision-making. In 2023, economic volatility led to a cautious approach in capital investment, with many companies delaying M&A and expansion activities. Uncertainty affects investor confidence, complicates financial forecasting, and limits the ability of firms to pursue aggressive growth strategies, as corporate finance teams focus on risk management and capital preservation.

Global Corporate Finance Market Future Outlook

Over the next five years, the Corporate Finance Market is expected to grow, driven by increasing M&A activity, digital transformation in finance, and a rising focus on ESG. Technological advancements such as AI in financial analysis and blockchain in transactions will enhance efficiency and transparency in corporate finance. Emerging markets will provide growth opportunities as economic conditions stabilize and businesses seek cross-border investment.

Market Opportunities:

- Expansion of Corporate Finance Services in Emerging Markets: Emerging markets present significant growth opportunities for corporate finance, as countries like India, Brazil, and Indonesia see rapid economic development. In 2023, investment flows to emerging markets exceeded $700 billion, supporting infrastructure and industrial projects. Corporate finance services are essential in these regions, providing capital structuring, risk analysis, and project financing solutions. Expanding into these markets enables corporate finance firms to support regional growth while diversifying their portfolios.

- Rise in Sustainable Finance and Environmental, Social, and Governance (ESG) Investments: The shift toward sustainable finance and ESG investments presents opportunities for corporate finance, as investors prioritize ethical and sustainable projects. Global ESG assets under management are expected to surpass $30 trillion by 2024, with significant growth in sectors like renewable energy, water conservation, and sustainable infrastructure. Corporate finance plays a key role in structuring and funding ESG-focused projects, supporting clients' sustainability goals and aligning with regulatory trends favoring eco-friendly investments.

Scope of the Report

|

By Service Type |

Mergers & Acquisitions (M&A) Advisory Capital Raising & Restructuring Financial Risk Management Valuation Services |

|

By Industry |

Technology & Media |

|

By Enterprise Size |

Small and Medium Enterprises (SMEs) Large Enterprises |

|

By End-User |

Corporations Private Equity & Venture Capital Firms Government & Regulatory Bodies |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

- Corporate Treasurers and CFOs

- Private Equity and Venture Capital Firms

- Government and Regulatory Bodies (e.g., Financial Conduct Authorities)

- Investments and Hedge Funds

- Real Estate Investment Trusts (REITs)

- Family Offices

- Banking and Financial Institutions

- Sustainability-Focused Investors

Companies

Players Mention in the Report

- JPMorgan Chase & Co.

- Goldman Sachs Group, Inc.

- Morgan Stanley

- Bank of America Merrill Lynch

- Barclays Capital

- Deutsche Bank AG

- Citigroup, Inc.

- BNP Paribas

- Credit Suisse Group AG

- HSBC Holdings PLC

- Lazard Ltd

- UBS Group AG

- Rothschild & Co

- Evercore Inc.

- Houlihan Lokey, Inc.

Table of Contents

01. Global Corporate Finance Market Overview

Definition and Scope

Market Taxonomy

Market Growth Rate

Market Segmentation Overview

02. Global Corporate Finance Market Size (In USD Trillion)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

03. Global Corporate Finance Market Analysis

Growth Drivers (Economic Globalization, Increasing M&A Activity, Growth in Private Equity)

Economic Globalization and Expansion of Cross-Border Investments

Rising Mergers & Acquisitions (M&A) in Key Sectors

Growth in Private Equity Investments and Venture Capital

Expansion of Digital Financial Services in Corporate Finance

Market Challenges (Regulatory Compliance, Economic Uncertainty, Access to Capital)

Strict Regulatory Compliance Requirements and Reporting Standards

Economic Uncertainty and Impact on Investment Decisions

Limited Access to Capital for Small and Medium Enterprises (SMEs)

Opportunities (Emerging Markets, Technological Advancements, Sustainable Finance)

Expansion of Corporate Finance Services in Emerging Markets

Technological Advancements in Financial Analytics and Automation

Rise in Sustainable Finance and Environmental, Social, and Governance (ESG) Investments

Trends (AI in Financial Modeling, Rise of FinTech, Focus on ESG and Impact Investing)

Growing Use of AI and Machine Learning in Financial Modeling and Analysis

Rise of FinTech Solutions in Corporate Finance Management

Increasing Focus on ESG and Impact Investing in Corporate Portfolios

Government Regulations (Anti-Money Laundering, Transparency Standards, Tax Policies)

Anti-Money Laundering (AML) Regulations and Financial Transparency Requirements

International Tax Policies and Transfer Pricing Standards

Financial Transparency Standards for Corporations

SWOT Analysis

Stakeholder Ecosystem

Porters Five Forces Analysis

Competition Ecosystem

04. Global Corporate Finance Market Segmentation

By Service Type (In Value %)

Mergers & Acquisitions (M&A) Advisory

Capital Raising & Restructuring

Financial Risk Management

Valuation Services

By Industry (In Value %)

Technology & Media

Healthcare & Pharmaceuticals

Financial Services

Energy & Utilities

Consumer Goods & Retail

By Enterprise Size (In Value %)

Small and Medium Enterprises (SMEs)

Large Enterprises

By End-User (In Value %)

Corporations

Private Equity & Venture Capital Firms

Government & Regulatory Bodies

By Region (In Value %)

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

05. Global Corporate Finance Market Competitive Analysis

Detailed Profiles of Major Companies

JPMorgan Chase & Co.

Goldman Sachs Group, Inc.

Morgan Stanley

Bank of America Merrill Lynch

Barclays Capital

Deutsche Bank AG

Citigroup, Inc.

BNP Paribas

Credit Suisse Group AG

HSBC Holdings PLC

Lazard Ltd

UBS Group AG

Rothschild & Co

Evercore Inc.

Houlihan Lokey, Inc.

Cross Comparison Parameters (Headquarters, Inception Year, Revenue, Core Services, Key Sectors, Market Share, Customer Satisfaction Ratings, Global Presence)

Market Share Analysis

Strategic Initiatives

Mergers and Acquisitions

Investment Analysis

Private Equity Investments in Corporate Finance

Government Grants Supporting Financial Innovation

Venture Capital in FinTech and Financial Services

06. Global Corporate Finance Market Regulatory Framework

International Tax Policies and Standards

Compliance and AML Regulations

Transparency and Financial Reporting Standards

07. Global Corporate Finance Market Future Size (In USD Trillion)

Future Market Size Projections

Key Factors Driving Future Market Growth

08. Global Corporate Finance Market Future Segmentation

By Service Type (In Value %)

By Industry (In Value %)

By Enterprise Size (In Value %)

By End-User (In Value %)

By Region (In Value %)

09. Global Corporate Finance Market Analysts Recommendations

TAM/SAM/SOM Analysis

Customer Cohort Analysis

Marketing Initiatives

White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research began by identifying key drivers in the Corporate Finance Market, such as M&A activity, global economic conditions, and regulatory standards. Data was sourced from proprietary databases, financial reports, and government publications.

Step 2: Market Analysis and Construction

This phase involved historical data analysis on corporate finance transactions, segmentation by industry, and trends such as ESG investing. Key growth drivers like private equity growth and digital finance were also examined.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through consultations with corporate finance experts, investment analysts, and regulatory bodies. Their insights helped align market projections with real-world financial industry dynamics.

Step 4: Research Synthesis and Final Output

The final synthesis incorporated qualitative and quantitative insights, presenting a comprehensive view of the Corporate Finance Market, covering growth drivers, challenges, and future opportunities for stakeholders.

Frequently Asked Questions

01. How big is the Global Corporate Finance Market?

The global corporate finance market is valued at approximately USD 31138.82 billion, driven by increasing M&A activity, globalization, and growth in private equity investments.

02. What are the challenges in the Global Corporate Finance Market?

Challenges include regulatory compliance, economic uncertainty, and limited access to capital for small and medium enterprises.

03. Who are the major players in the Global Corporate Finance Market?

Key players include JPMorgan Chase & Co., Goldman Sachs, Morgan Stanley, Deutsche Bank, and Citigroup, known for their expertise in high-value transactions and global presence.

04. What are the growth drivers of the Global Corporate Finance Market?

Growth drivers include rising M&A activity, economic globalization, digital transformation in financial services, and an increased focus on ESG investing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.