Global Detox Drinks Market Outlook to 2028

Region:Global

Author(s):Mukul

Product Code:KROD4658

December 2024

90

About the Report

Global Detox Drinks Market Overview

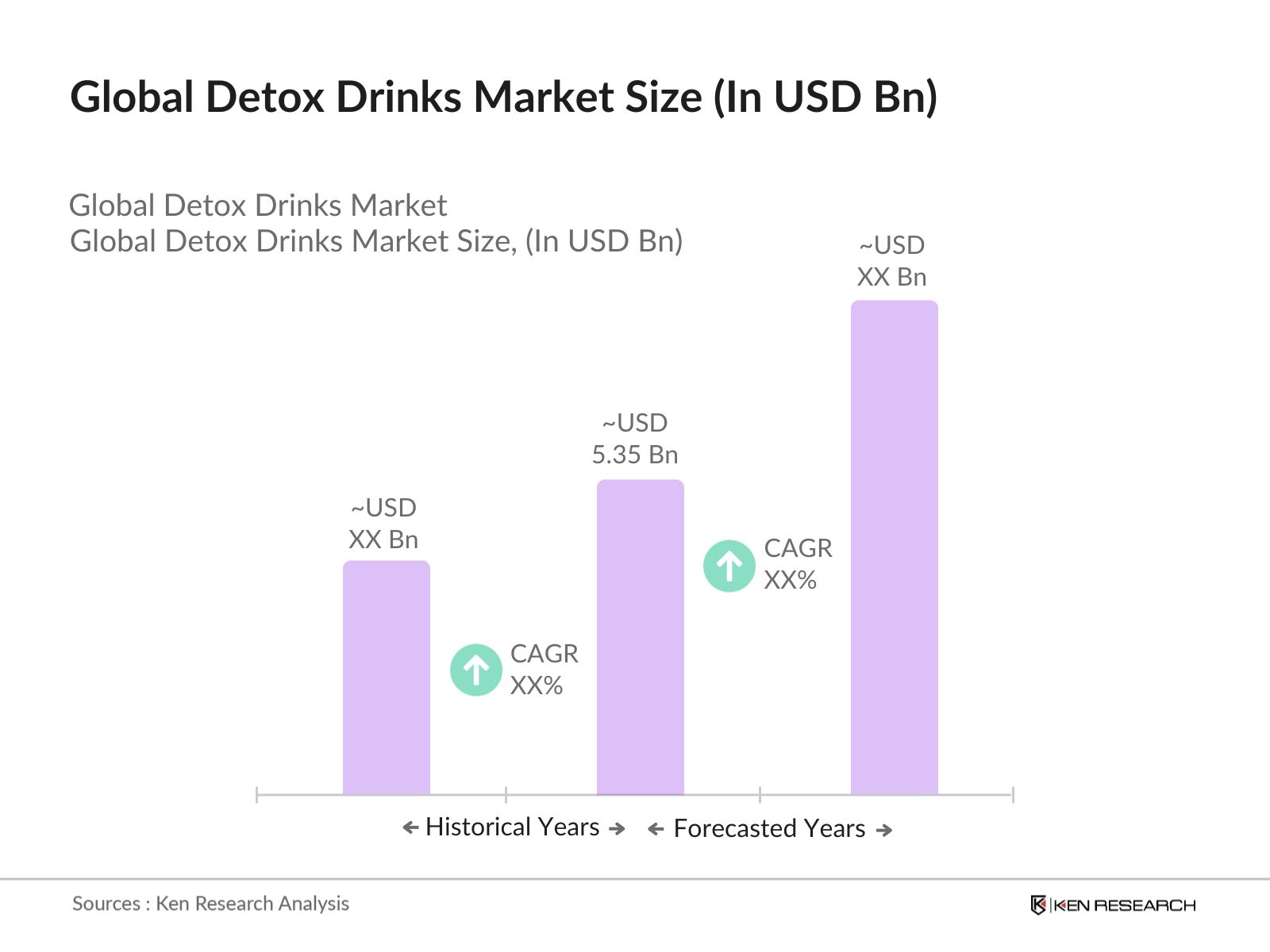

- The global detox drinks market is valued at USD 5.35 billion, based on a five-year historical analysis. This market is driven by increasing consumer awareness about health and wellness, combined with a growing preference for natural and organic ingredients in beverages. Urbanization and the rise of fast-paced lifestyles have led to a demand for convenient health solutions like detox drinks, which are often marketed for their health benefits such as cleansing, digestion support, and boosting immunity.

- The market is dominated by regions like North America and Europe, driven by the presence of health-conscious populations and an increasing trend of detoxification and wellness routines. In particular, the U.S. leads the market due to the higher penetration of premium health products and strong distribution networks. Additionally, countries like Germany and the U.K. see high consumption of detox teas and juices, largely due to their established wellness industries.

- Government agencies like the FDA in the U.S. and the EFSA in Europe impose stringent guidelines on labeling and ingredients for detox drinks. For instance, detox drinks must clearly list their ingredients and adhere to guidelines prohibiting false health claims. As of 2023, the FDA reported a 22% increase in label audits for health beverages to ensure compliance. These regulations aim to protect consumers from misleading information, but they also pose challenges for brands in terms of reformulation and compliance

Global Detox Drinks Market Segmentation

- By Product Type: The global detox drinks market is segmented by product type into liquid detox drinks, detox teas, and ready-to-drink (RTD) beverages. Among these, liquid detox drinks hold the dominant market share due to their easy availability and strong presence in supermarkets and health food stores. These products are often marketed as a quick and effective solution for cleansing the body and are available in a variety of flavors, targeting consumers looking for both taste and functionality. Brands like Suja Life and Project Juice have capitalized on the growing demand for premium detox drinks.

- By Region: Geographically, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America holds the largest market share due to the regions strong consumer demand for health and wellness products, along with the wide availability of detox drinks in retail and e-commerce platforms. The U.S., in particular, has a well-established network of health-conscious consumers and is home to some of the most prominent detox drink brands.

- By Ingredient Type: The market is segmented by ingredient type into herbal ingredients, fruit and vegetable blends, activated charcoal, and aloe vera-based detox drinks. Fruit and vegetable blends dominate the market share due to their wide appeal and natural health benefits. These products, often containing superfoods like kale, spinach, and ginger, are popular for their perceived detoxifying properties and are available in various forms such as juices and smoothies. Their growth is further supported by the increasing consumer focus on plant-based diets and clean-label products.

Global Detox Drinks Market Competitive Landscape

The global detox drinks market is dominated by several major players who are leveraging product innovation, strong branding, and extensive distribution networks to maintain their market positions. Companies are focusing on expanding their product portfolios with functional ingredients, collaborating with fitness and wellness influencers, and enhancing their e-commerce presence.

|

Company |

Year Established |

Headquarters |

Market Penetration |

Product Portfolio |

Sustainability Initiatives |

R&D Spending |

Geographic Presence |

Innovation Capabilities |

|

Suja Life, LLC |

2012 |

San Diego, USA |

||||||

|

Pukka Herbs |

2001 |

Bristol, UK |

||||||

|

Raw Generation, Inc. |

2012 |

New Jersey, USA |

||||||

|

Detoxify LLC |

1993 |

Scottsdale, USA |

||||||

|

Numi Organic Tea |

1999 |

Oakland, USA |

Global Detox Drinks Industry Analysis

Growth Drivers

- Rising Health Consciousness (Consumer Awareness): With global healthcare expenditure reaching over $9 trillion in 2023, there is a rising shift in consumer behavior towards preventive health measures. Increased consumption of detox drinks reflects this awareness, especially in developed economies like the United States and Europe. The World Health Organization (WHO) notes that diseases related to unhealthy diets are among the top causes of mortality, driving a demand for healthier, natural detoxification products. In 2024, this growing awareness is forecasted to boost the detox drinks market, as consumers increasingly prioritize health-conscious options. This trend is pronounced in urban areas with growing disposable incomes.

- Increasing Urbanization (Demand for Convenient Health Solutions): The United Nations reports that urbanization will reach nearly 57% globally by 2024, creating a robust demand for convenient health solutions, including ready-to-drink detox beverages. The fast-paced urban lifestyle limits consumers time to prepare meals, pushing them towards quick, on-the-go health products. This has led to the rapid adoption of detox drinks, especially in densely populated cities across Asia and North America. Consumers in urban centers spend nearly 30% more on health-centric beverages than their rural counterparts, providing a clear growth driver for the detox drink market.

- Shift towards Natural Ingredients (Clean Label Trend): Consumer preferences are increasingly aligned with products featuring natural, organic ingredients. The global shift towards "clean labels" is evident, as nearly 70% of consumers in a 2023 EU survey reported their preference for products free from artificial additives. This trend is especially prevalent in detox beverages, with companies focusing on using fruits, herbs, and botanicals. The European Food Safety Authority (EFSA) notes that products without artificial preservatives are more likely to gain approval in health-conscious markets, especially in Europe and North America, supporting the industry's growth in these regions.

Market Restraints

- High Production Costs (Raw Material Sourcing): The rising cost of raw materials, particularly organic and natural ingredients, is a significant challenge for detox drink manufacturers. According to the Food and Agriculture Organization (FAO), global food prices, particularly for fruits and vegetables, increased by 15% between 2021 and 2023 due to supply chain disruptions and climate change. This has raised production costs, especially for premium detox drinks using organic and sustainably sourced ingredients. Small and mid-sized manufacturers are particularly affected, limiting their ability to compete in price-sensitive markets.

- Regulatory Approvals (Compliance with Food Safety Standards): Detox drinks often contain herbal and botanical extracts that require stringent regulatory approvals before being introduced to the market. In regions like the EU and the U.S., the Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) regulate the safety and labeling of such products. This regulatory landscape can significantly delay product launches and increase compliance costs. For example, in 2023, only 65% of new beverage products received timely regulatory approval due to stringent safety evaluations, limiting market growth.

Global Detox Drinks Market Future Outlook

Over the next five years, the global detox drinks market is expected to grow significantly, driven by consumer demand for natural and organic beverages, increased health awareness, and the expansion of e-commerce platforms. The shift towards plant-based and functional ingredients will further propel market growth, with companies likely to introduce more innovative formulations targeting specific health benefits such as gut health, immunity, and mental well-being. The growing popularity of detox kits and subscription-based services will also contribute to sustained demand in the market.

Market Opportunities

- Expansion into Emerging Markets (Asia-Pacific): Asia-Pacific is projected to see substantial growth in health-conscious consumerism due to increasing disposable incomes. The World Bank reports that income per capita in Southeast Asia has grown by 5.7% in 2023, enabling a larger share of the population to afford premium health products like detox drinks. Countries like India, Indonesia, and Vietnam are witnessing a surge in demand for health and wellness beverages. This expansion into emerging markets presents an enormous opportunity for detox drink manufacturers to capture untapped potential in these regions.

- Product Innovation (Functional Ingredients, Flavors): There is a growing demand for functional beverages, with consumers seeking added health benefits beyond detoxification. Ingredients like probiotics, antioxidants, and adaptogens are being incorporated into detox drinks to target specific health needs. In 2023, the U.S. Department of Agriculture (USDA) reported a 12% increase in the use of botanicals and superfoods in beverage formulations. The ability to innovate with functional ingredients and new flavors offers brands a chance to stand out in a crowded market and appeal to health-conscious consumers seeking tailored solutions.

Scope of the Report

|

Product Type |

Liquid Detox Drinks Powder Detox Drinks Detox Teas Ready-to-Drink (RTD) Detox Beverages Juice Detox |

|

Ingredient Type |

Herbal Ingredients Fruit and Vegetable Blends Activated Charcoal Aloe Vera Lemon-based Formulations |

|

Distribution Channel |

Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Convenience Stores |

|

Packaging Type |

Bottles Pouches Cans Sachets |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

- Detox Drink Manufacturers

- Raw Material Suppliers (Herbal Ingredients, Superfoods)

- Online and Offline Retailers (Supermarkets, E-commerce Platforms)

- Government and Regulatory Bodies (FDA, EFSA)

- Health and Wellness Influencers

- Investor and Venture Capitalist Firms

- Health and Fitness Centers

- Packaging and Bottling Companies

Companies

Players Mentioned in the Report

- Suja Life, LLC

- Pukka Herbs

- Raw Generation, Inc.

- Detoxify LLC

- Numi Organic Tea

- Hain Celestial Group, Inc.

- Dr. Stuarts

- Good Earth Tea

- Organic Avenue

- Project Juice

- Jus By Julie

- BluePrint

- The Honest Company

- Bootea

- Teami Blends

Table of Contents

1 Global Detox Drinks Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2 Global Detox Drinks Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3 Global Detox Drinks Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness (Consumer Awareness)

3.1.2. Increasing Urbanization (Demand for Convenient Health Solutions)

3.1.3. Shift towards Natural Ingredients (Clean Label Trend)

3.1.4. Expanding E-commerce Channels (Product Accessibility)

3.2. Market Challenges

3.2.1. High Production Costs (Raw Material Sourcing)

3.2.2. Regulatory Approvals (Compliance with Food Safety Standards)

3.2.3. Market Saturation (Brand Differentiation Challenges)

3.3. Opportunities

3.3.1. Expansion into Emerging Markets (Asia-Pacific)

3.3.2. Product Innovation (Functional Ingredients, Flavors)

3.3.3. Strategic Partnerships (Collaborations with Health and Fitness Brands)

3.4. Trends

3.4.1. Increased Focus on Organic and Plant-Based Detox Drinks

3.4.2. Popularity of Ready-to-Drink (RTD) Detox Beverages

3.4.3. Growth in Customizable Detox Kits (Direct-to-Consumer Brands)

3.5. Government Regulations

3.5.1. Labeling and Ingredient Regulations (FDA, EFSA Guidelines)

3.5.2. Taxation on Sugary and Artificial Products (Sugar Tax Impact)

3.5.3. International Trade Policies (Imports/Exports of Detox Products)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Raw Material Suppliers, Manufacturers, Retailers, and End Users)

3.8. Porters Five Forces

3.9. Competition Ecosystem (Product Differentiation, Distribution Channels)

4 Global Detox Drinks Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Liquid Detox Drinks

4.1.2. Powder Detox Drinks

4.1.3. Detox Teas

4.1.4. Ready-to-Drink (RTD) Detox Beverages

4.1.5. Juice Detox

4.2. By Ingredient Type (In Value %)

4.2.1. Herbal Ingredients

4.2.2. Fruit and Vegetable Blends

4.2.3. Activated Charcoal

4.2.4. Aloe Vera

4.2.5. Lemon-based Formulations

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Supermarkets/Hypermarkets

4.3.3. Specialty Stores

4.3.4. Pharmacies

4.3.5. Convenience Stores

4.4. By Packaging Type (In Value %)

4.4.1. Bottles

4.4.2. Pouches

4.4.3. Cans

4.4.4. Sachets

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5 Global Detox Drinks Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Suja Life, LLC

5.1.2. Pukka Herbs

5.1.3. Raw Generation, Inc.

5.1.4. Detoxify LLC

5.1.5. Numi Organic Tea

5.1.6. Hain Celestial Group, Inc.

5.1.7. Dr. Stuart's

5.1.8. Good Earth Tea

5.1.9. Organic Avenue

5.1.10. Project Juice

5.1.11. Jus By Julie

5.1.12. BluePrint

5.1.13. The Honest Company

5.1.14. Bootea

5.1.15. Teami Blends

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, Brand Positioning, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6 Global Detox Drinks Market Regulatory Framework

6.1. Food and Beverage Safety Regulations

6.2. Certification Requirements (USDA Organic, Non-GMO, Vegan)

6.3. Import/Export Regulations

6.4. Environmental Standards (Sustainability in Packaging)

7 Global Detox Drinks Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8 Global Detox Drinks Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Ingredient Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

9 Global Detox Drinks Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out all major stakeholders within the global detox drinks market. This step includes extensive desk research, utilizing secondary databases to gather industry-level information on key players, consumer trends, and market drivers. Critical variables such as product demand and ingredient trends are identified to guide the research.

Step 2: Market Analysis and Construction

Historical data is compiled to analyze the market penetration of detox drinks and their respective sub-segments. This includes evaluating sales data from retail and online channels, and assessing the growth of key product categories, enabling a precise market sizing.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through direct consultations with industry experts. Interviews with executives from major detox drink companies are conducted to gather insights on production trends, consumer preferences, and strategic initiatives. These insights help to refine the market forecasts.

Step 4: Research Synthesis and Final Output

The final step consolidates all gathered data and validates the findings through a bottom-up approach, ensuring the accuracy of market estimates. This includes cross-referencing with industry reports and adjusting for variances in regional demand.

Frequently Asked Questions

01 How big is the global detox drinks market?

The global detox drinks market is valued at USD 5.35 billion, driven by increasing consumer health consciousness and demand for natural, organic beverages.

02 What are the challenges in the global detox drinks market?

Challenges in the market include high production costs, regulatory hurdles, and intense competition from both established brands and new entrants.

03 Who are the major players in the global detox drinks market?

Key players in the market include Suja Life, Pukka Herbs, Raw Generation, Detoxify LLC, and Numi Organic Tea, known for their strong distribution networks and innovative product offerings.

04 What are the growth drivers of the global detox drinks market?

The market is driven by rising consumer awareness about health benefits, the demand for natural ingredients, and the growing trend of clean-label products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.