Global Glamping Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD6223

November 2024

99

About the Report

Global Glamping Market Overview

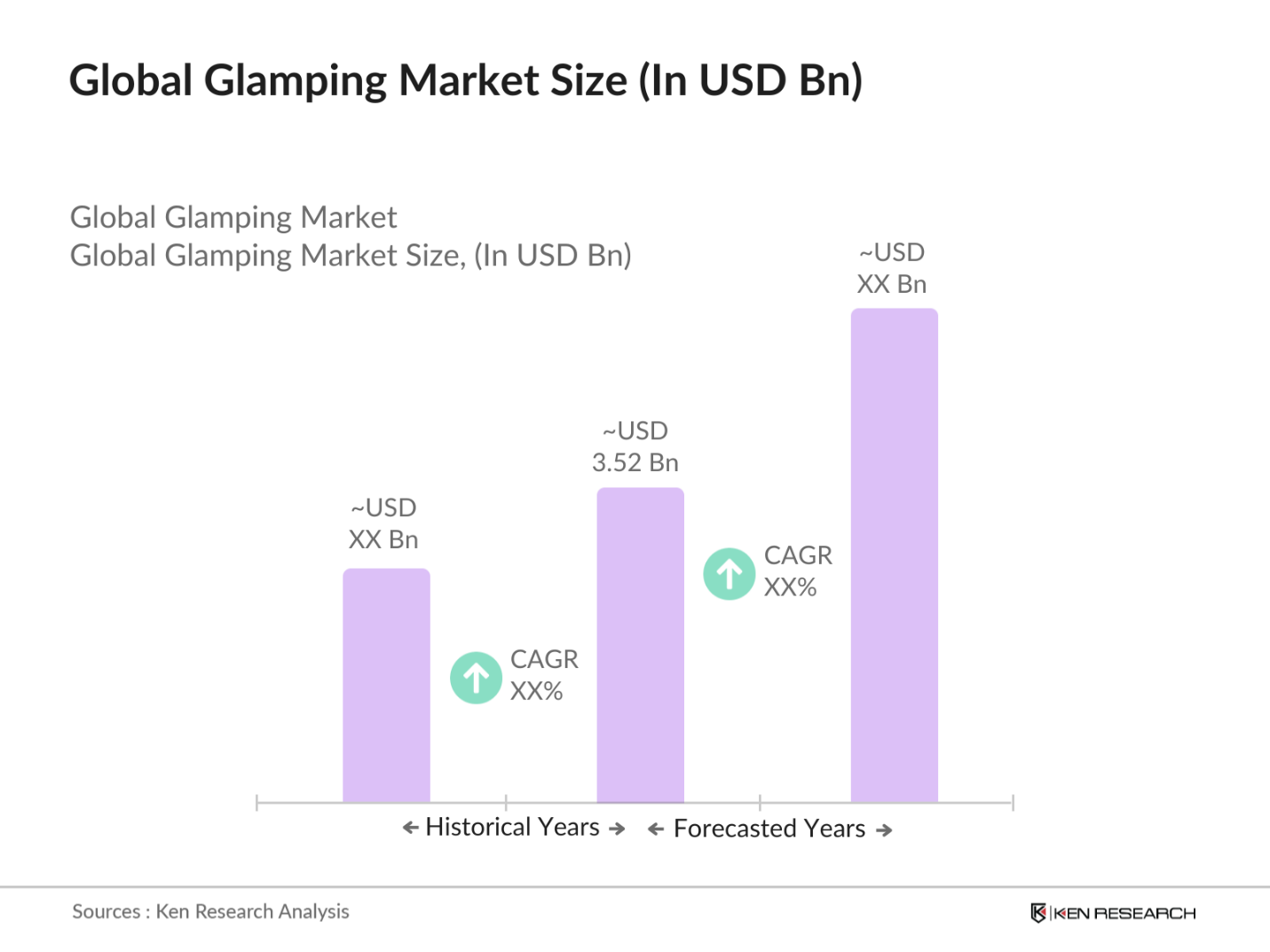

- The glamping market has seen a significant surge in demand, with the market valued at USD 3.52 billion. This expansion is driven by the rising trend of experiential and luxury outdoor travel, combining comfort and nature. The increasing preference for eco-friendly accommodation and unique travel experiences has contributed to the market's growth. With more consumers seeking sustainable travel options, glamping offers a perfect blend of luxury and minimal environmental impact.

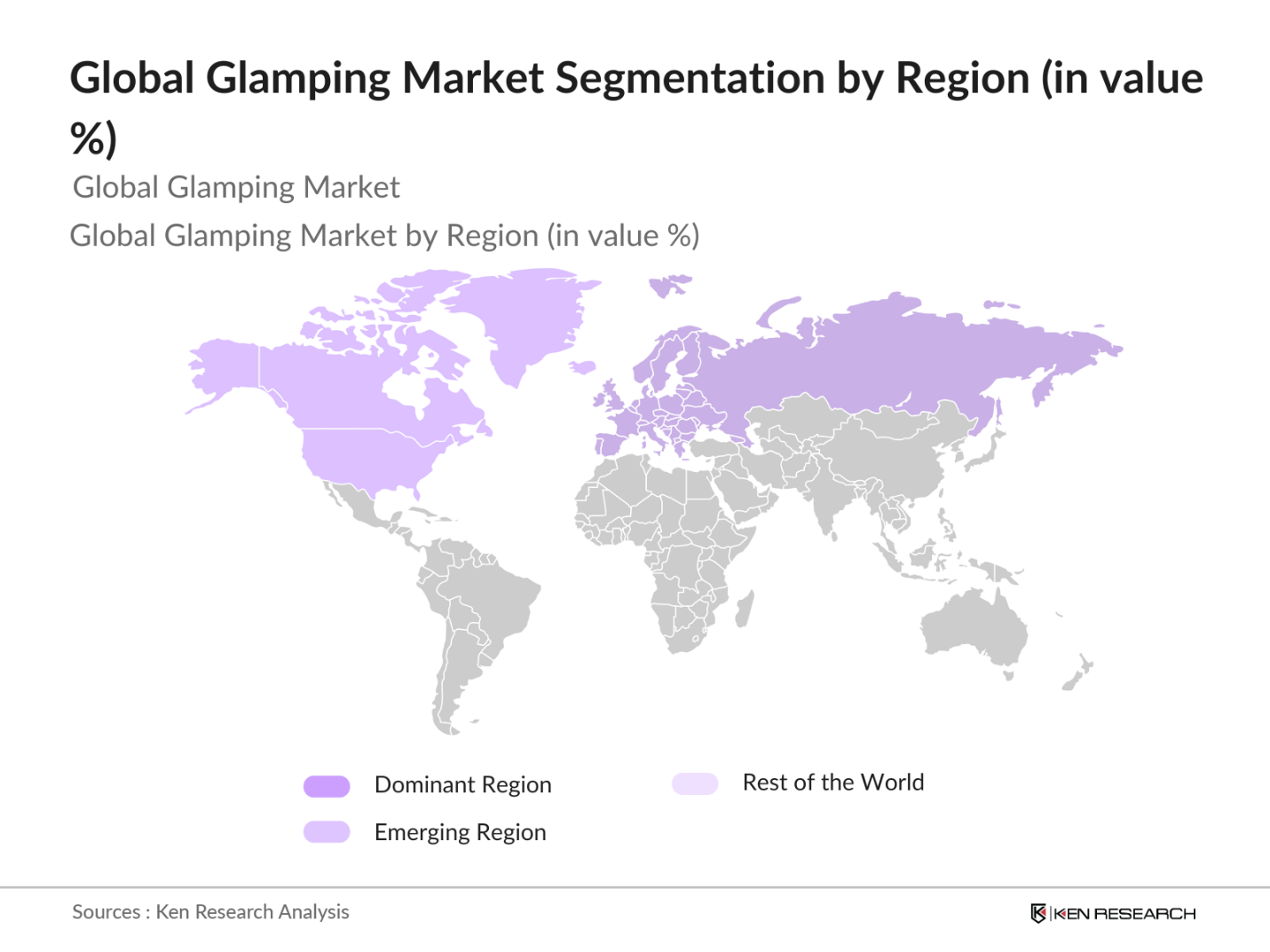

- Countries like the U.S., the U.K., and France dominate the glamping market due to their established tourism infrastructure, rich natural landscapes, and increasing consumer preference for premium travel experiences. These regions offer diverse glamping sites, ranging from luxury treehouses to safari tents, often located in scenic national parks and rural areas. Additionally, government support for eco-tourism and sustainable travel in these regions has enabled the market to flourish.

- Governments globally are increasingly supporting eco-friendly accommodations through tourism policies and green initiatives. For example, the European Unions Green Deal has allocated 1 billion in funding to support sustainable tourism projects, including the development of eco-friendly glamping sites, as of 2023. These policies aim to reduce the carbon footprint of the tourism sector, incentivizing businesses to adopt greener practices. This regulatory support is expected to enhance the long-term viability of glamping as part of a broader eco-tourism strategy.

Global Glamping Market Segmentation

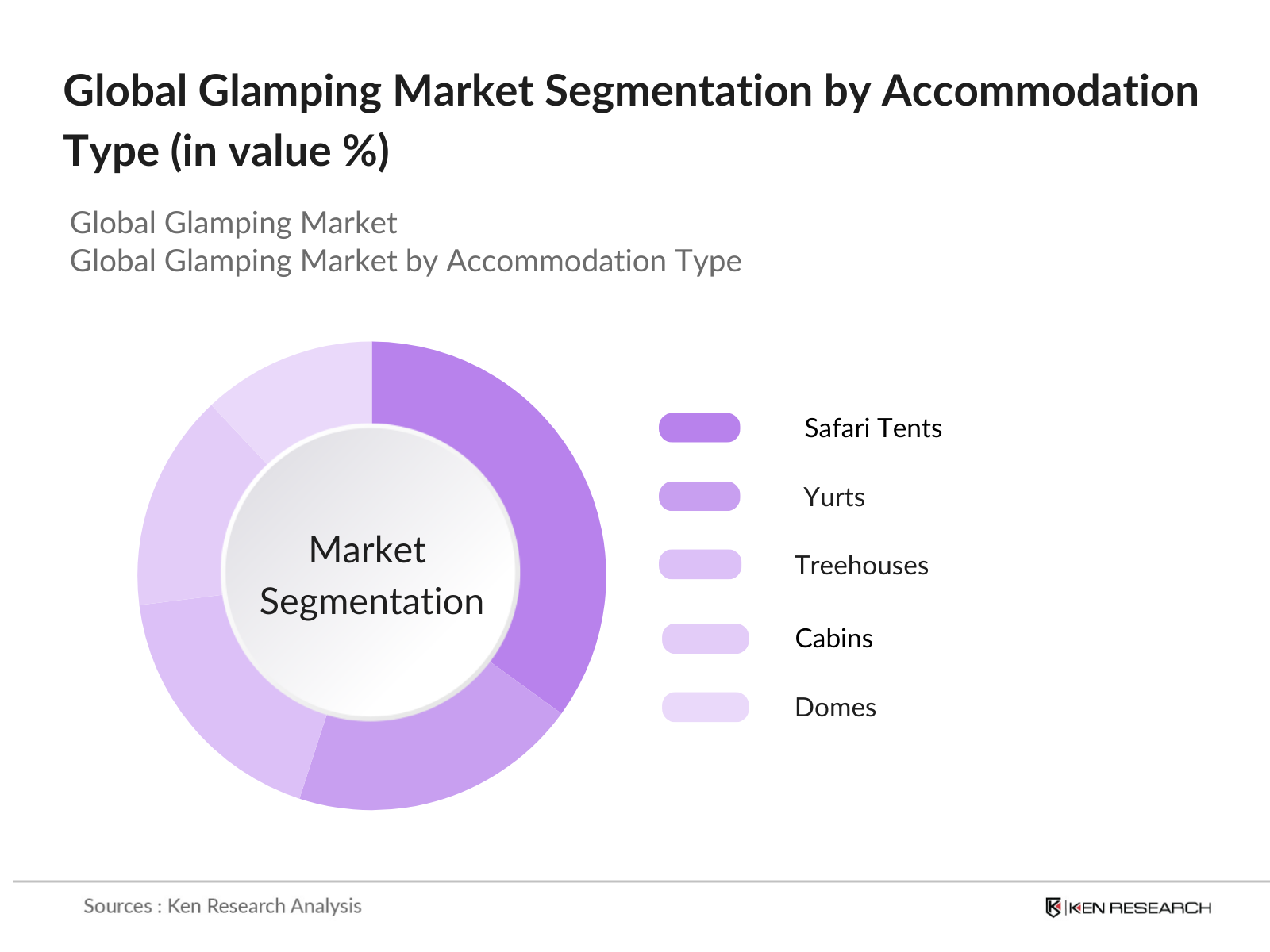

By Accommodation Type: The global glamping market is segmented by accommodation type into safari tents, yurts, treehouses, cabins, and domes. Among these, safari tents dominate due to their widespread use in luxury resorts and campgrounds. These tents offer a unique blend of adventure and comfort, attracting high-end travelers who seek a premium outdoor experience. Safari tents are often designed with luxury amenities, including king-sized beds, en-suite bathrooms, and gourmet dining options, which appeal to affluent customers looking for comfort in the wilderness.

By Region: The global glamping market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Among these, Europe dominates the market due to its established tourism infrastructure and increasing consumer demand for luxury and eco-friendly travel experiences. Countries like the U.K. and France lead the way, offering a variety of high-end glamping sites located in scenic natural landscapes such as national parks, rural areas, and coastal regions.

Global Glamping Market Competitive Landscape

The global glamping market is characterized by several key players, ranging from independent operators to large hospitality chains. These companies compete based on location, service quality, sustainability initiatives, and customer experience offerings. The market is highly fragmented, with numerous small operators specializing in niche experiences, while larger chains offer standardized luxury services across multiple locations. This fragmentation allows for diverse options for consumers but also heightens competition among players striving to stand out in terms of uniqueness and sustainability.

|

Company Name |

Established |

Headquarters |

No. of Sites |

Sustainability Initiatives |

Unique Selling Point (USP) |

Revenue (USD Bn) |

Geographic Reach |

Customer Satisfaction Ratings |

|

Collective Retreats |

2015 |

Denver, USA |

10 |

|||||

|

Under Canvas |

2009 |

Montana, USA |

15 |

|||||

|

Huttopia |

1999 |

Lyon, France |

55 |

|||||

|

Canopy & Stars |

2010 |

Bristol, UK |

30 |

|||||

|

The Resort at Paws Up |

2005 |

Montana, USA |

5 |

Global Glamping Market Analysis

Market Growth Drivers

- Increased Interest in Outdoor Travel: Global glamping tourism has seen a notable rise due to increasing outdoor travel preferences. Data from the World Tourism Organization (UNWTO) indicates that international tourist arrivals rebounded to 960 million by 2023, with outdoor destinations being a significant part of this recovery. This reflects the trend toward nature-focused experiences, particularly in markets like the U.S. and Europe, where local travel surged post-pandemic. The glamping sector benefits directly, as consumers seek less crowded, unique outdoor accommodations compared to traditional hotels.

- Shift Towards Eco-Friendly Accommodations: As sustainability becomes central to travel preferences, eco-friendly accommodations have seen greater demand. The International Energy Agency (IEA) notes a global reduction in energy consumption in tourism infrastructure, driven by 210,000 glamping units globally adopting energy-saving practices like solar-powered tents by 2023. Governments in Europe, particularly in Scandinavia, have also launched eco-tourism initiatives offering incentives for green businesses, driving the shift.

- Expansion of Digital Nomad Lifestyles: By 2023, the number of digital nomads worldwide had reached 35 million, with more individuals seeking non-traditional work environments that blend travel and accommodation, according to a survey by the International Labour Organization (ILO). The U.S. alone accounted for 16 million of these nomads, many of whom prefer outdoor and nature-integrated stays like glamping accommodations, which offer both luxury and high-speed connectivity. As more people adopt the remote work lifestyle, this growing demographic has created a sustained demand for longer-term glamping stays in diverse locations.

Market Challenges

- Infrastructure Development Costs: Building the infrastructure necessary to support glamping can be costly, particularly in remote or eco-sensitive locations. A report from the United Nations World Tourism Organization (UNWTO) highlights that establishing high-end glamping sites with the necessary utilities, such as water, power, and sewage systems, can exceed $150,000 per unit in remote areas. The high upfront costs often deter potential investors from entering the market. In countries where land acquisition and regulatory approvals are more complex, this challenge is further magnified, especially in environmentally protected regions.

- Local Regulatory Restrictions: Many regions impose strict local regulations on glamping developments, particularly concerning land use and environmental impact assessments. According to the United Nations Environment Programme (UNEP), a significant portion of potential eco-tourism projects, including glamping sites, encounter delays or cancellations due to the complex compliance processes associated with local zoning laws and environmental impact assessments. In countries like France and the UK, rural zoning restrictions are particularly stringent, limiting large-scale developments in scenic areas.

Global Glamping Market Future Outlook

The glamping market is poised for continued expansion, driven by evolving consumer preferences for sustainable, unique, and high-end travel experiences. As eco-consciousness grows, the demand for glamping accommodations that blend luxury with nature is expected to rise. Regions like Asia-Pacific and Latin America, which have vast natural landscapes and are underexplored in terms of glamping, represent significant opportunities for future market growth.

Market Opportunities:

- Rise in Eco-Glamping Sites: Sustainable tourism is becoming central to the development of the glamping sector. According to the United Nations Environment Programme (UNEP), the number of eco-certified glamping sites globally reached 12,000 in 2023. These sites are increasingly utilizing renewable energy sources, water conservation methods, and sustainable materials for construction. Eco-conscious travelers are driving demand for accommodations that prioritize environmental responsibility, with glamping operators adapting their offerings to meet these expectations.

- Customizable Glamping Packages: Personalization in travel has become a key trend, with consumers seeking unique and customizable experiences. Luxury travelers increasingly prefer customized travel packages, including glamping, to suit individual preferences. Operators are responding by offering flexible itineraries, allowing guests to tailor their experiencesranging from selecting specific activities like guided hikes to choosing luxury amenities such as private chef services. This trend reflects the growing importance of personalization in the travel and hospitality sectors, with glamping operators adapting to meet evolving consumer expectations.

Scope of the Report

|

By Accommodation Type |

Safari Tents Yurts Treehouses Cabins, Domes |

|

By Application |

Adventure Travel Family Vacations Honeymoon Wellness Retreats Corporate Events |

|

By Consumer Group |

Millennials Baby Boomers Families Couple Solo Travelers |

|

By Service Provider |

Independent Operators Large Hospitality Chains Government-Owned Campsites |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Luxury Hospitality Chains

Independent Glamping Operators

Real Estate Developers

Tourism Boards and Regulatory Bodies (e.g., Tourism Authority of Thailand, Visit Britain)

Venture Capital Firms and Private Equity Investors

Government Agencies for Eco-Tourism Promotion (e.g., US National Park Service, France Ministry of Tourism)

Travel Agencies Specializing in Luxury Travel

Event Management Companies for Corporate Retreats

Companies

Players Mention in the Report

Collective Retreats

Under Canvas

Huttopia

Tentrr

EcoCamp Patagonia

The Resort at Paws Up

Glamping Hub

Canopy & Stars

Nightfall Camp

Clayoquot Wilderness Resort

Glampitect

Treetop Glamping

Camp Katur

Glamping Hideaways

Airstream Glamping

Table of Contents

Global Glamping Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Luxury Camping, Eco-tourism, Wellness Travel, Experiential Tourism)

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Global Glamping Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

Global Glamping Market Analysis

3.1. Growth Drivers (Tourism Trends, Millennial Preferences, Sustainability Initiatives)

3.1.1. Increased Interest in Outdoor Travel

3.1.2. Shift Towards Eco-Friendly Accommodations

3.1.3. Expansion of Digital Nomad Lifestyles

3.1.4. Increased Disposable Income for Luxury Travel

3.2. Market Challenges (High Initial Investment, Location Accessibility, Seasonality)

3.2.1. Infrastructure Development Costs

3.2.2. Local Regulatory Restrictions

3.2.3. Seasonal Demand Fluctuations

3.3. Opportunities (Untapped Regions, Tech Integration, Wellness Tourism)

3.3.1. Glamping Expansion into Emerging Markets

3.3.2. Adoption of Smart Technologies for Enhanced Experience

3.3.3. Collaboration with Wellness Resorts

3.4. Trends (Sustainable Tourism, Personalized Experiences, Virtual Booking Solutions)

3.4.1. Rise in Eco-Glamping Sites

3.4.2. Customizable Glamping Packages

3.4.3. Growth in Augmented Reality Booking Platforms

3.5. Government Regulation

3.5.1. Tourism Policies Supporting Eco-Friendly Accommodations

3.5.2. Incentives for Green Initiatives in Travel & Hospitality

3.5.3. Local Zoning Laws and Compliance for Glamping Sites

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Glamping Operators, Site Developers, Local Governments)

3.8. Porters Five Forces

3.9. Competition Ecosystem

Global Glamping Market Segmentation

4.1. By Accommodation Type (In Value %)

4.1.1. Safari Tents

4.1.2. Yurts

4.1.3. Treehouses

4.1.4. Cabins and Pods

4.1.5. Domes

4.2. By Application (In Value %)

4.2.1. Adventure Travel

4.2.2. Family Vacations

4.2.3. Honeymoon & Romance

4.2.4. Wellness Retreats

4.2.5. Corporate Events

4.3. By Consumer Group (In Value %)

4.3.1. Millennials

4.3.2. Baby Boomers

4.3.3. Families

4.3.4. Couples

4.3.5. Solo Travelers

4.4. By Service Provider (In Value %)

4.4.1. Independent Glamping Operators

4.4.2. Large Hospitality Chains

4.4.3. Government-Owned Campsites

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

Global Glamping Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Collective Retreats

5.1.2. Under Canvas

5.1.3. Huttopia

5.1.4. Tentrr

5.1.5. EcoCamp Patagonia

5.1.6. The Resort at Paws Up

5.1.7. Glamping Hub

5.1.8. Canopy & Stars

5.1.9. Nightfall Camp

5.1.10. Clayoquot Wilderness Resort

5.1.11. Glampitect

5.1.12. Treetop Glamping

5.1.13. Camp Katur

5.1.14. Glamping Hideaways

5.1.15. Airstream Glamping

5.2. Cross Comparison Parameters (No. of Sites, Types of Accommodations, Geographic Reach, Revenue, Sustainability Initiatives, Unique Selling Points, Customer Ratings, Corporate Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Global Glamping Market Regulatory Framework

6.1. Sustainability Standards

6.2. Zoning and Land Use Regulations

6.3. Licensing and Permits

6.4. Environmental Impact Assessments

Global Glamping Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Global Glamping Future Market Segmentation

8.1. By Accommodation Type (In Value %)

8.2. By Application (In Value %)

8.3. By Consumer Group (In Value %)

8.4. By Service Provider (In Value %)

8.5. By Region (In Value %)

Global Glamping Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research process begins by identifying the key variables that shape the glamping market. This involves comprehensive desk research utilizing both secondary databases and proprietary sources to capture trends, major stakeholders, and competitive dynamics within the market.

Step 2: Market Analysis and Construction

Once the variables are identified, historical data on market size, revenue, and key developments are analyzed. This phase also evaluates regional penetration and the performance of different market segments such as accommodation types and applications.

Step 3: Hypothesis Validation and Expert Consultation

To validate our hypotheses, we engage in interviews with industry professionals, including glamping operators, site developers, and tourism board representatives. These insights ensure that our data is not only accurate but also reflective of the markets current landscape.

Step 4: Research Synthesis and Final Output

Finally, the research is synthesized to produce actionable insights. Multiple stakeholders, including large hospitality brands and government bodies, are consulted to cross-check and validate the findings before the final report is published.

Frequently Asked Questions

How big is the Global Glamping Market?

The global glamping market is valued at USD 3.52 billion, driven by increasing demand for eco-friendly, luxury outdoor experiences and the rise of experiential tourism across key regions such as North America and Europe.

What are the challenges in the Global Glamping Market?

Challenges include the high initial cost of developing luxury glamping sites, regulatory hurdles in acquiring permits for eco-friendly accommodations, and the seasonal nature of demand, which can impact year-round revenue.

Who are the major players in the Global Glamping Market?

Key players in the market include Collective Retreats, Under Canvas, Huttopia, Canopy & Stars, and The Resort at Paws Up. These companies dominate due to their unique locations, luxury offerings, and strong customer satisfaction ratings.

What are the growth drivers of the Global Glamping Market?

Growth drivers include rising consumer demand for eco-friendly accommodations, wellness-focused retreats, and unique, immersive travel experiences. Increasing disposable income and the global trend towards sustainable tourism are also major contributors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.