Global Marine Lubricants Market Outlook to 2030

Region:Global

Author(s):Sanjeev

Product Code:KROD1758

November 2024

87

About the Report

Global Marine Lubricants Market Overview

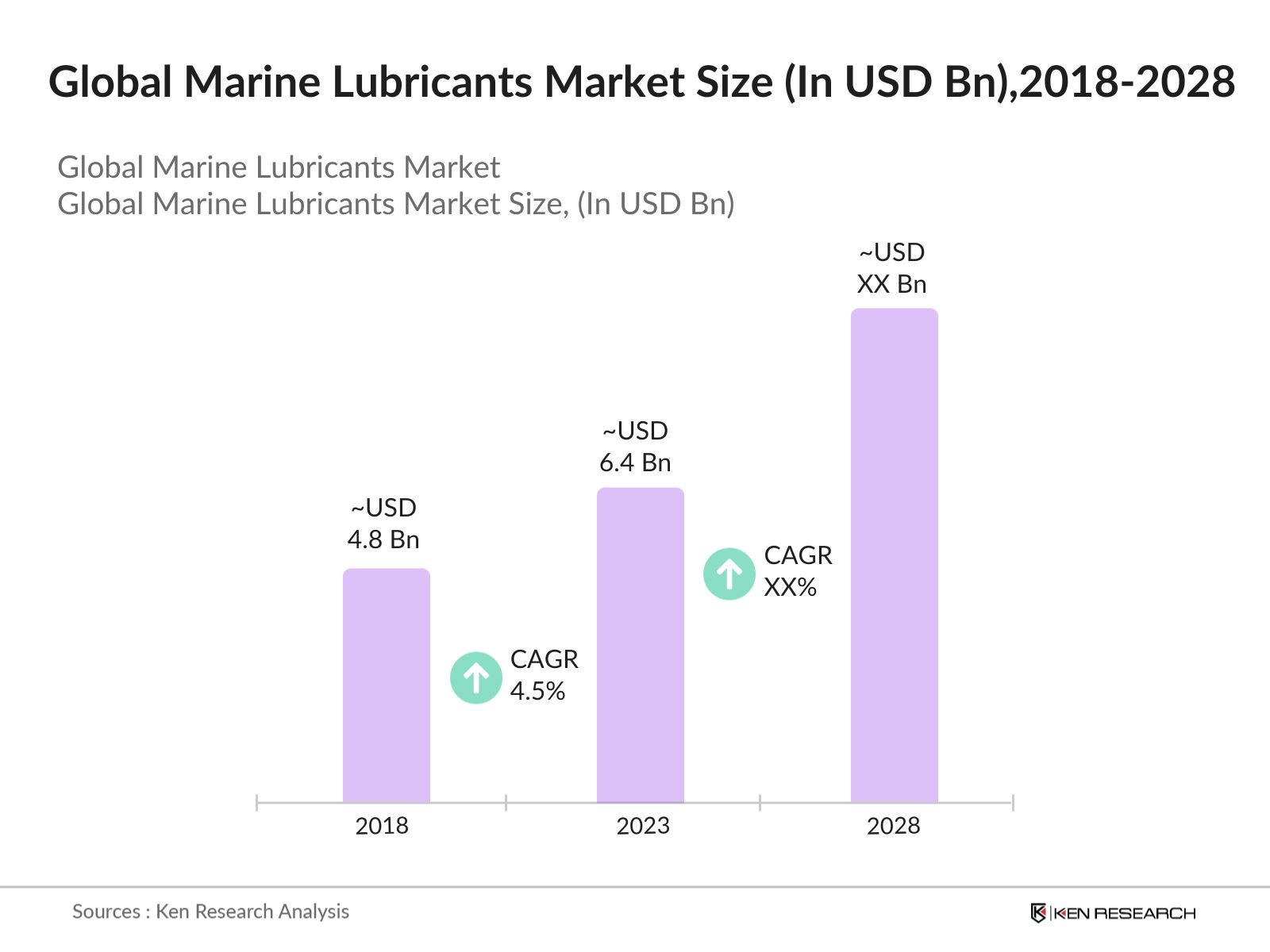

- In 2023, the Global Marine Lubricants Market was valued at USD 6.4 billion, driven by the growing demand for efficient and eco-friendly marine lubricants. The market's growth is influenced by increasing maritime trade, stringent environmental regulations, and the advancement of marine engine technologies. With the rise in international shipping activities, the need for high-performance lubricants that ensure engine efficiency and longevity has surged, pushing the market forward.

- Prominent players in the marine lubricants market include Shell, ExxonMobil, BP, Chevron, and TotalEnergies. These companies lead the industry with a wide range of lubricant products designed to meet various marine engine needs, including cylinder oils, system oils, and trunk piston engine oils. Shell's Marine Lubricants are known for their comprehensive range of products that enhance engine performance and fuel efficiency while adhering to environmental regulations.

- In North America, the United States stands out as a market for marine lubricants due to its large fleet of commercial vessels and strong focus on maritime trade. The countrys marine industry is characterized by stringent environmental regulations and the adoption of high-performance, eco-friendly lubricants, contributing to its leadership in the global market.

- In 2023, ExxonMobil launched a new line of marine lubricants designed specifically for low-sulfur fuel oil engines, aligning with the International Maritime Organizations (IMO) 2020 sulfur cap regulations. This product launch highlights the continuous innovation and adaptation within the Marine Lubricants market to meet evolving regulatory requirements and technological advancements.

Global Marine Lubricants Market Segmentation

The Global Marine Lubricants Market can be segmented based on product type, application, and region:

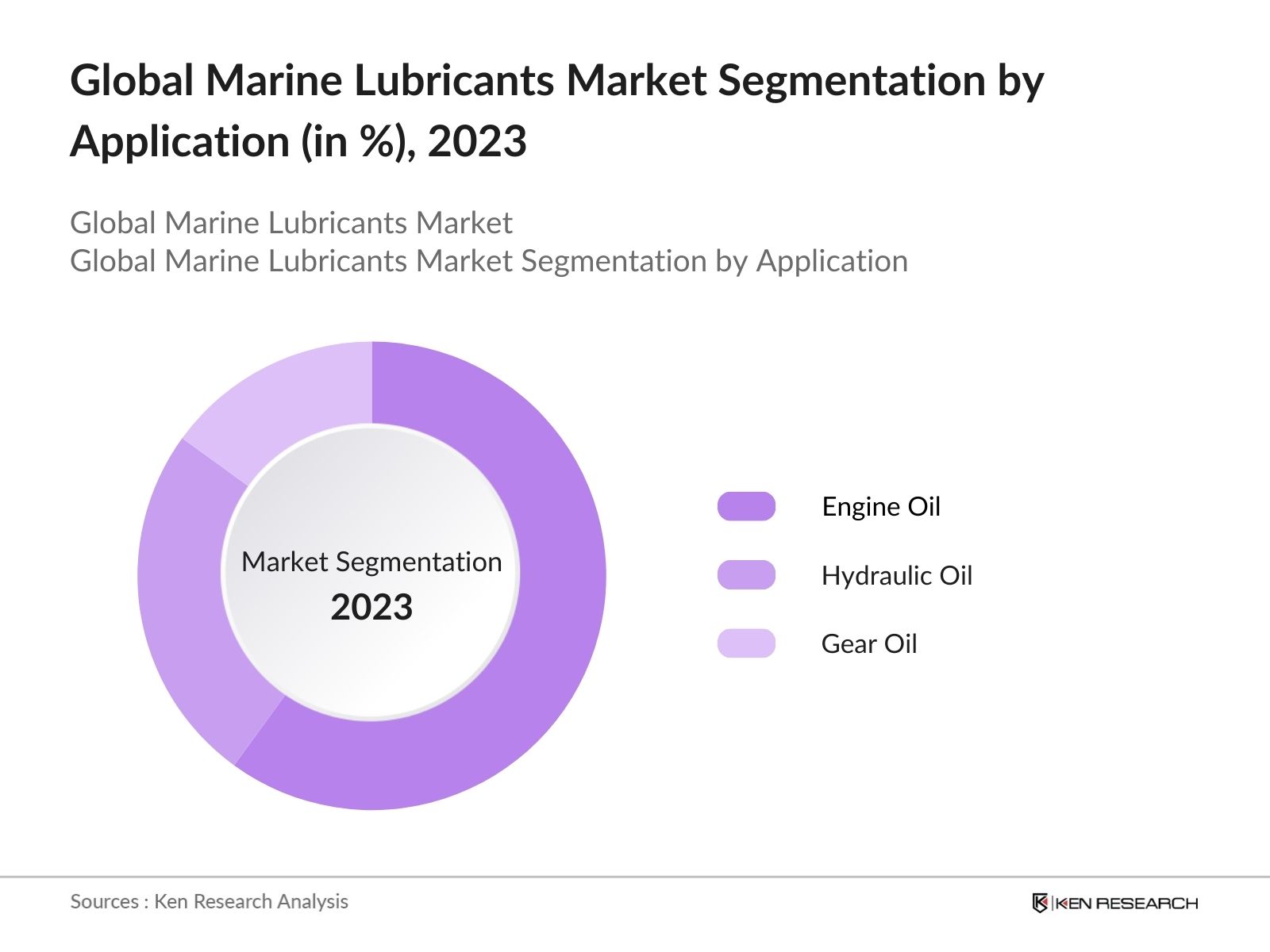

- By Application: The market is segmented into engine oil, hydraulic oil, and gear oil. In 2023, the Engine Oil segment led the market, driven by the extensive use of lubricants for engine protection and performance enhancement. Engine oils are critical for maintaining the efficiency and longevity of marine engines, which are essential for both commercial and recreational vessels.

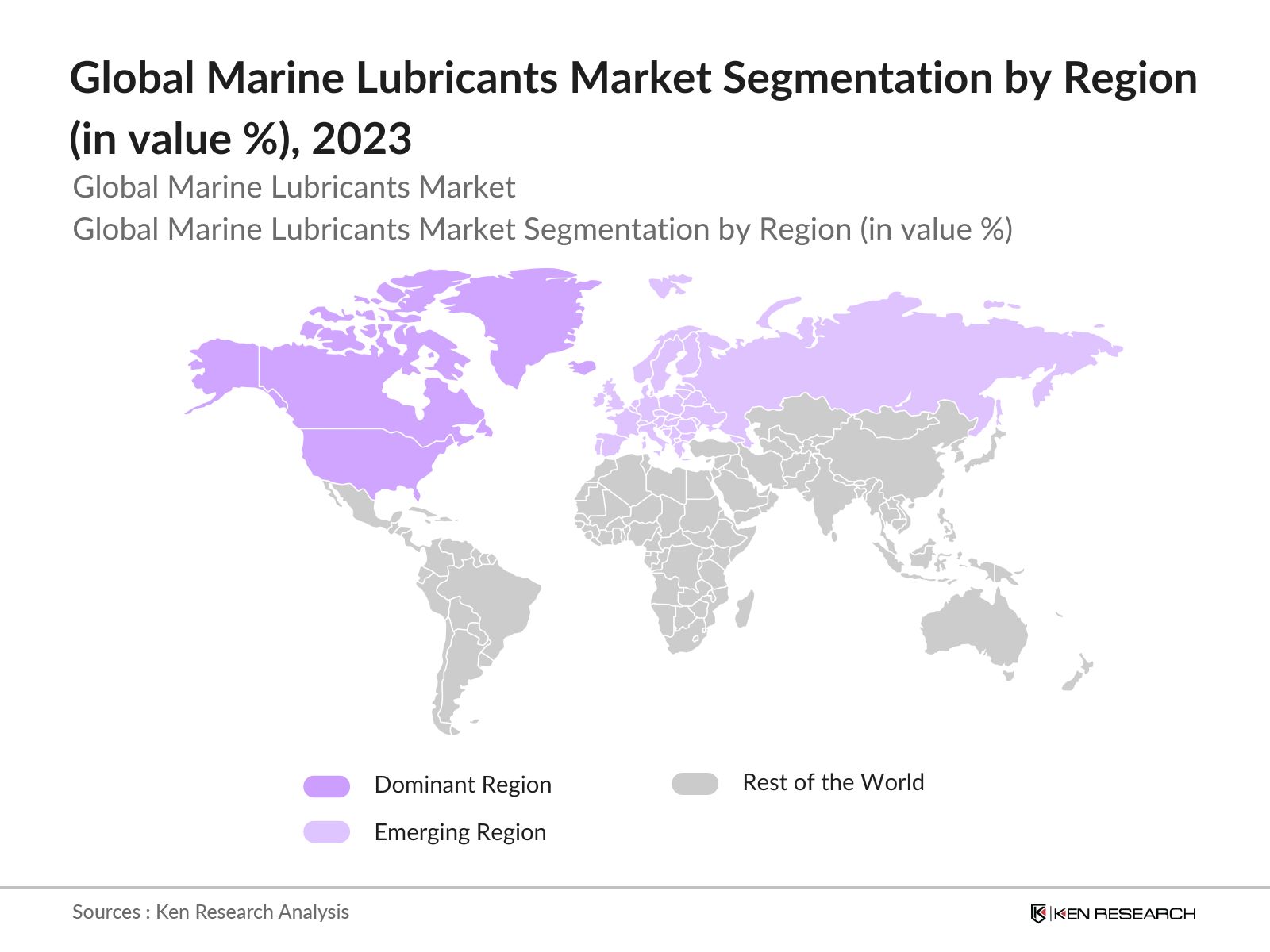

- By Region: The market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America led the global market in 2023, driven by its robust maritime industry and stringent environmental regulations promoting the use of high-performance, eco-friendly lubricants. Europe also holds a substantial share, with a strong demand for advanced lubricants in countries like Germany, the UK, and Norway, where marine trade and strict environmental regulations are prevalent.

- By Product Type: The market is segmented into mineral oil, synthetic oil, and bio-based oil. In 2023, the Mineral Oil segment dominated the market due to its cost-effectiveness and widespread use in various marine applications. Mineral oils are preferred for their ability to provide reliable performance under standard operating conditions, making them a popular choice for many shipping companies.

Global Marine Lubricants Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Shell |

1907 |

The Hague, Netherlands |

|

ExxonMobil |

1999 |

Irving, USA |

|

BP |

1909 |

London, UK |

|

Chevron |

1879 |

San Ramon, USA |

|

TotalEnergies |

1924 |

Courbevoie, France |

- Shell: In 2023, Shell continued to dominate the market with a significant share in marine lubricants, attributed to its extensive range of products designed for different engine types and operational conditions. Shell's marine lubricants, such as the Shell Alexia 40 and Shell Argina, are popular for their ability to enhance engine performance and reduce emissions.

- ExxonMobil: In 2023, ExxonMobil launched a new line of lubricants, MobilGard 540 and MobilGard 300 C, specifically tailored for low-sulfur fuel oil engines, reinforcing its commitment to compliance with environmental regulations and high-performance standards. These lubricants are designed to meet the International Maritime Organizations (IMO) 2020 sulfur cap regulations, providing superior engine protection and improved fuel efficiency.

Global Marine Lubricants Market Analysis

Market Growth Drivers:

- Increasing Maritime Trade: The expansion of global maritime trade has significantly boosted the demand for marine lubricants. In 2023, the global seaborne trade volume reached approximately 12 billion tons, reflecting a steady increase in cargo transport across international shipping routes. This growth in trade necessitates the use of high-performance lubricants to ensure the efficiency and reliability of vessels, which operate under varying conditions and extended periods.

- Stringent Environmental Regulations: Stricter environmental regulations have been a major driver for the marine lubricants market. The International Maritime Organizations (IMO) 2020 sulfur cap regulation, which limits the sulfur content in marine fuels to 0.5 grams per kilogram from the previous 3.5 grams per kilogram, has significantly impacted the market. This regulation has led to a surge in demand for advanced lubricants that not only comply with these stringent standards but also help in reducing pollutants and enhancing fuel efficiency, promoting the development and adoption of low-sulfur and biodegradable lubricants.

- Advancements in Marine Engine Technologies: The marine industry has seen significant advancements in engine technologies over the past decade. Modern marine engines are designed to operate at higher pressures and temperatures, offering better fuel efficiency and performance. These advanced engines require premium lubricants that can withstand harsh conditions and provide superior protection and efficiency. In 2023, the market for high-performance marine lubricants saw substantial growth, supported by the development of next-generation marine engines that prioritize both performance and environmental sustainability.

Market Challenges:

- Fluctuating Crude Oil Prices: The marine lubricants market is heavily influenced by the price of crude oil, as most lubricants are derived from petroleum products. Fluctuations in crude oil prices can lead to volatility in the cost of production and pricing of marine lubricants. This unpredictability makes it challenging for manufacturers to maintain stable pricing and profit margins, which can impact market growth and investment in new product development.

- Stringent Environmental Regulations: While stringent environmental regulations drive demand for eco-friendly marine lubricants, they also pose significant challenges for manufacturers. Compliance with these regulations often requires substantial investment in research and development to formulate new products that meet environmental standards. Additionally, different countries have varying regulations, making it difficult for manufacturers to develop a one-size-fits-all solution, thereby increasing production costs and complexity.

Government Initiatives

- United States Environmental Protection Agency (EPA) Vessel General Permit (VGP) Program: The EPAs VGP program regulates discharges from commercial vessels into U.S. waters, mandating the use of environmentally acceptable lubricants (EALs) in all oil-to-sea interfaces. This program has driven widespread adoption of green marine lubricants among companies operating in U.S. waters. As of 2023, over 10,000 vessels are compliant with the VGP program's requirement to use EALs, demonstrating the impact of this regulation on the U.S. marine lubricants market.

- India's Maritime Vision 2030: Introduced to transform Indias maritime sector into a globally competitive industry, the Maritime Vision 2030 emphasizes green shipping practices and the use of environmentally sustainable technologies, such as eco-friendly marine lubricants. The vision aims to align Indias maritime operations with international environmental standards. As part of this initiative, India targets to have at least 500 vessels using eco-friendly lubricants by 2030.

Global Marine Lubricants Market Future Outlook

The Global Marine Lubricants Market is projected to grow steadily, driven by the rising demand for efficient, eco-friendly lubricants, advancements in marine technologies, and stringent environmental regulations.

Future Market Trends:

- Shift Towards Sustainable Lubricants: By 2028, there is expected to be a substantial shift towards sustainable and biodegradable marine lubricants. The growing awareness of environmental issues and increasing regulatory pressures are likely to drive the adoption of eco-friendly lubricants. These lubricants not only minimize the environmental impact but also comply with international maritime environmental standards, such as those set by the International Maritime Organization (IMO).

- Growth in Demand for High-Performance Synthetic Lubricants: The demand for synthetic lubricants is anticipated to increase as shipping companies seek products that offer superior performance under extreme conditions. Synthetic lubricants are known for their stability at high temperatures, better viscosity, and extended service life, which makes them ideal for modern high-performance marine engines. This trend is expected to continue as vessel operators look for ways to reduce maintenance costs and improve fuel efficiency.

Scope of the Report

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

|

By Product Type |

Mineral Oil Mineral Oil Bio-Based Oil |

|

By Application |

Engine Oil Hydraulic Oil Gear Oil |

|

By Distribution Channel |

Direct Sales Distributors and Dealers Online Sales Retail Outlets Service Stations and Workshops |

|

By End-User |

Commercial Shipping Recreational Boating Naval and Defense Offshore Vessels |

Products

Key Target Audience:

Marine Vessel Operators

Ship Management Companies

Marine Engine Manufacturers

Oil & Gas Companies

Government Regulatory Bodies (IMO, EPA)

Marine Lubricant Distributors and Suppliers

Port Authorities

Environmental Agencies

Bank and Financial Institutes

Research and Development Institutes

Venture Capital Firms

Maritime Associations

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Shell

ExxonMobil

BP

Chevron

TotalEnergies

Castrol

Lukoil

Idemitsu Kosan

Fuchs Petrolub

Gulf Oil Marine

Sinopec

JXTG Nippon Oil & Energy Corporation

Penrite Oil

Valvoline Inc.

Table of Contents

1. Global Marine Lubricants Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Marine Lubricants Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Marine Lubricants Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Maritime Trade

3.1.2. Stringent Environmental Regulations

3.1.3. Advancements in Marine Engine Technologies

3.2. Restraints

3.2.1. Fluctuating Crude Oil Prices

3.2.2. Stringent Environmental Regulations

3.2.3. High R&D Costs for Innovation

3.3. Opportunities

3.3.1. Growing Demand in Emerging Economies

3.3.2. Expansion of Green Shipping Practices

3.3.3. Technological Advancements in Lubricant Formulations

3.4. Trends

3.4.1. Shift Towards Sustainable Lubricants

3.4.2. Growth in Demand for High-Performance Synthetic Lubricants

3.4.3. Rising Focus on Regulatory Compliance and Certification

3.5. Government Regulation

3.5.1. United States EPA VGP Program

3.5.2. India's Maritime Vision 2030

3.5.3. European Union's Clean Maritime Plan

3.5.4. China's Green Shipbuilding Initiative

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Global Marine Lubricants Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Mineral Oil

4.1.2. Synthetic Oil

4.1.3. Bio-Based Oil

4.2. By Application (in Value %)

4.2.1. Engine Oil

4.2.2. Hydraulic Oil

4.2.3. Gear Oil

4.3. By Region (in Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Latin America

4.3.5. Middle East & Africa

4.4. By Distribution Channel

4.4.1. Direct Sales

4.4.2. Distributors and Dealers

4.4.3. Online Sales

4.4.4. Retail Outlets

4.4.5. Service Stations and Workshops

4.5. By End-User

4.5.1. Commercial Shipping

4.5.2. Recreational Boating

4.5.3. Naval and Defense

4.5.4. Offshore Vessels

5. Global Marine Lubricants Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Shell

5.1.2. ExxonMobil

5.1.3. BP

5.1.4. Chevron

5.1.5. TotalEnergies

5.1.6. Castrol

5.1.7. Lukoil

5.1.8. Idemitsu Kosan

5.1.9. Fuchs Petrolub

5.1.10. Gulf Oil Marine

5.1.11. Sinopec

5.1.12. JXTG Nippon Oil & Energy Corporation

5.1.13. Penrite Oil

5.1.14. Valvoline Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Marine Lubricants Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Marine Lubricants Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Marine Lubricants Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Marine Lubricants Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

9.4. By Distribution Channel

9.5. By End-User

10. Global Marine Lubricants Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

Our research begins by identifying the key entities within the Global Marine Lubricants Market. This involves referencing multiple secondary and proprietary databases to conduct comprehensive desk research. We gather industry-level information on market drivers, challenges, key players, and technological advancements impacting the market.

Step 2: Market Building

We collect data on the global Marine Lubricants market over the years, including historical market size, growth rates, and the adoption of various lubricant types. Our analysis includes evaluating market share, revenue generated by major players, and emerging trends to ensure the accuracy and reliability of the data presented.

Step 3: Validating and Finalizing

To validate our findings, we formulate market hypotheses and conduct Computer-Assisted Telephone Interviews (CATIs) with industry experts from leading marine lubricant companies. These interviews provide direct insights into the operational and financial aspects of the market, helping us validate the collected statistics.

Step 4: Research Output

Our team engages with multiple marine lubricant providers to understand the dynamics of market segments, customer preferences, and sales trends. This process involves validating the derived statistics using a bottom-up approach, ensuring that the final data accurately reflects actual market conditions.

Frequently Asked Questions

01. How big is the Global Marine Lubricants Market?

In 2023, the Global Marine Lubricants Market was valued at USD 6.4 billion. The market is driven by the increasing demand for efficient and eco-friendly lubricants, advancements in marine technologies, and the rise in international shipping activities. The market's growth reflects the critical role of these lubricants in enhancing vessel efficiency and complying with environmental regulations.

02. What are the challenges in the Global Marine Lubricants Market?

Challenges in the Global Marine Lubricants Market include the high cost of synthetic and bio-based oils, supply chain disruptions, and varying regulatory requirements across regions. These factors can limit the market's growth potential, especially in cost-sensitive and less developed regions.

03. Who are the major players in the Global Marine Lubricants Market?

Major players in the Global Marine Lubricants Market include Shell, ExxonMobil, BP, Chevron, and TotalEnergies. These companies are at the forefront of innovation in marine lubrication technology, offering comprehensive solutions that cater to various marine engine needs and comply with stringent environmental standards.

04. What are the growth drivers of the Global Marine Lubricants Market?

Key growth drivers in the Global Marine Lubricants Market include the increasing maritime trade, stringent environmental regulations, and advancements in marine engine technologies. These factors are pushing the demand for high-performance lubricants that ensure vessel efficiency, reliability, and compliance with environmental norms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.