Global Petrochemical Packaging Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD2300

November 2024

94

About the Report

Global Petrochemical Packaging Market Overview

- The global petrochemical packaging market is valued at USD 1104 billion, based on a five-year historical analysis. This market is primarily driven by the expanding petrochemical industry and the rising need for safe, durable packaging solutions, especially for hazardous materials. With continuous advancements in packaging technology and increased demand from sectors such as chemicals, fertilizers, and lubricants, petrochemical packaging solutions are essential for ensuring the safe and efficient transport of petrochemical products worldwide.

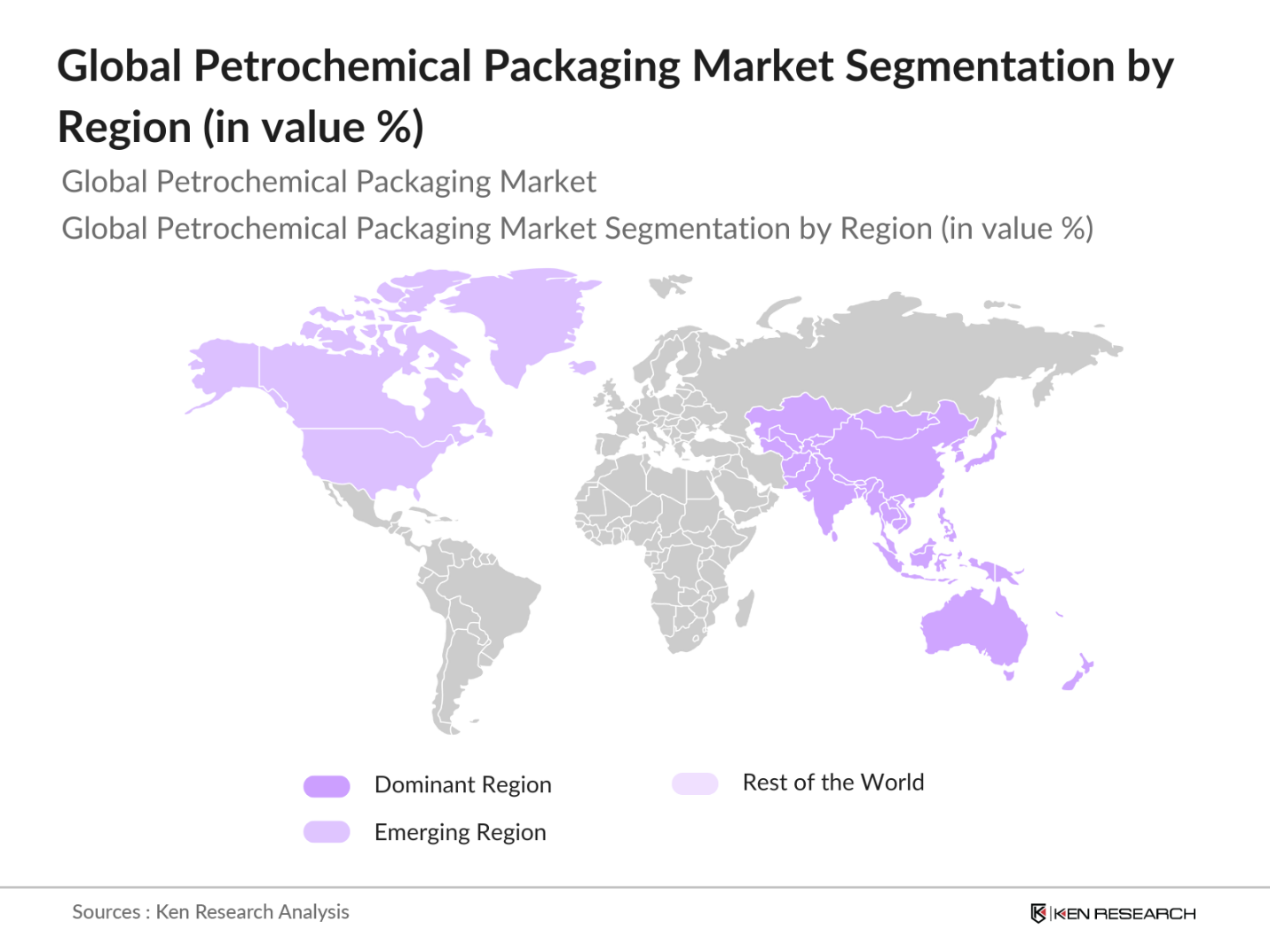

- Asia-Pacific emerges as the dominant region in the petrochemical packaging market, attributed to rapid industrialization and urbanization in countries such as China and India. The substantial production and consumption of petrochemicals in these nations have led to a significant demand for efficient packaging solutions. Additionally, the presence of major petrochemical producers and a well-established manufacturing sector further bolster the market in this region.

- Governments worldwide are implementing stringent environmental protection standards affecting the petrochemical packaging industry. For example, the European Union's Single-Use Plastics Directive aims to reduce the impact of certain plastic products on the environment, directly influencing packaging manufacturers. Compliance with such regulations requires companies to adopt sustainable materials and practices, impacting production processes and costs.

Global Petrochemical Packaging Market Segmentation

By Material Type: The market is segmented by material type into plastic, metal, wood, and other materials. Plastic materials hold a dominant market share due to their durability, flexibility, and cost-effectiveness. They offer excellent barrier properties and are lightweight, making them ideal for transporting hazardous petrochemicals safely. The versatility of plastics in molding into various shapes and sizes also contributes to their widespread adoption in the industry.

By Packaging Type: The market is further segmented by packaging type into industrial bulk containers, drums, pails, boxes, and other products. Industrial bulk containers (IBCs) dominate this segment due to their high capacity and efficiency in handling large volumes of petrochemicals. IBCs are designed to store and transport bulk quantities safely, reducing the need for multiple smaller containers and thereby optimizing logistics and reducing costs.

By Region: Regionally, Asia-Pacific holds the largest share of the petrochemical packaging market. The region's dominance can be attributed to the rapid industrialization and urbanization in countries such as China and India. The increasing production and consumption of petrochemicals in these countries have led to a significant demand for efficient packaging solutions. Additionally, the presence of major petrochemical producers and a well-established manufacturing sector further boost the market in this region.

Global Petrochemical Packaging Market Competitive Landscape

The global petrochemical packaging market is characterized by the presence of several key players who contribute significantly to market dynamics. These companies are engaged in continuous research and development to introduce innovative and sustainable packaging solutions, thereby maintaining a competitive edge.

Global Petrochemical Packaging Industry Analysis

Growth Drivers

- Expanding Demand from End-Use Industries: The petrochemical packaging market is experiencing significant growth due to increased demand from end-use industries such as chemicals, fertilizers, and lubricants. In 2023, global chemical production reached 3.5 billion metric tons, necessitating substantial packaging solutions for safe transportation and storage. Similarly, global fertilizer consumption was approximately 200 million metric tons in 2023, further driving the need for specialized packaging. The lubricants sector also contributed, with global consumption around 40 million metric tons in 2023, underscoring the critical role of packaging in maintaining product integrity.

- Advancements in Packaging Technologies: Technological advancements are propelling the petrochemical packaging market forward. Innovations such as smart packaging, which includes features like RFID tags and QR codes, enhance supply chain transparency and product tracking. Additionally, the development of high-barrier materials improves the shelf life and safety of petrochemical products. These advancements are crucial for meeting the stringent safety and quality standards required in the petrochemical industry.

- Growth in Emerging Economies: Emerging economies are playing a pivotal role in the expansion of the petrochemical packaging market. Countries like China and India are experiencing rapid industrialization and urbanization, leading to increased production and consumption of petrochemical products. For instance, China's industrial output grew by 6.3% in 2023, while India's manufacturing sector expanded by 7.1% in the same year. This industrial growth necessitates efficient packaging solutions to handle the increased volume of petrochemical products.

Market Challenges

- Volatility in Raw Material Prices: The petrochemical packaging market faces challenges due to the volatility in raw material prices. Fluctuations in crude oil prices directly impact the cost of petrochemical-derived packaging materials. For example, crude oil prices ranged between $60 and $80 per barrel in 2023, leading to unpredictable production costs for packaging manufacturers. This volatility affects profit margins and pricing strategies within the industry.

- Stringent Environmental Regulations: Stringent environmental regulations are posing challenges to the petrochemical packaging market. Governments worldwide are implementing policies to reduce plastic waste and promote recycling. For instance, the European Union's Single-Use Plastics Directive aims to reduce the impact of certain plastic products on the environment, affecting packaging manufacturers. Compliance with these regulations requires significant investment in sustainable materials and processes, impacting operational costs.

Global Petrochemical Packaging Market Future Outlook

Over the next five years, the global petrochemical packaging market is expected to exhibit significant growth, driven by continuous advancements in packaging technologies, increasing demand for sustainable solutions, and the expansion of the petrochemical industry in emerging economies. The focus on reducing environmental impact through the adoption of recyclable and biodegradable materials is anticipated to create new opportunities for market players.

Market Opportunities

- Rising Demand for Eco-Friendly Packaging: There is a growing demand for eco-friendly packaging solutions in the petrochemical industry. Consumers and businesses are increasingly prioritizing sustainability, leading to a surge in demand for biodegradable and recyclable packaging materials. This trend presents opportunities for companies to innovate and develop environmentally friendly packaging options, aligning with global sustainability goals and consumer preferences.

- Investments in Advanced Material Research: Investments in advanced material research are opening new avenues in the petrochemical packaging market. Developing materials with enhanced properties, such as improved strength, flexibility, and resistance to chemicals, can lead to more efficient and durable packaging solutions. These advancements can also contribute to sustainability by reducing material usage and enhancing recyclability, meeting both industry needs and regulatory requirements.

Scope of the Report

|

Material Type |

Polyethylene (PE) Polypropylene (PP) Polyethylene Terephthalate (PET) Polyvinyl Chloride (PVC) Others |

|

Packaging Type |

Rigid Packaging Flexible Packaging Intermediate Bulk Containers (IBCs) |

|

End-Use Industry |

Chemicals Food and Beverage Agriculture Pharmaceuticals Others |

|

Functionality |

Barrier Protection Aesthetic Appeal Product Differentiation |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Petrochemical Manufacturers

Packaging Material Suppliers

Logistics and Transportation Companies

Environmental Regulatory Agencies (e.g., Environmental Protection Agency)

Industry Associations (e.g., American Chemistry Council)

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Transportation)

Research and Development Institutions

Companies

Players Mentioned in the Report

Amcor plc

Berry Global Inc.

Dow Inc.

Sealed Air Corporation

Sonoco Products Company

Mondi Group

Huhtamaki Oyj

WestRock Company

Reynolds Group Holdings

Alpla Group

Table of Contents

1. Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Market Analysis

3.1 Growth Drivers

3.1.1 Expanding Demand from End-Use Industries (e.g., Chemicals, Fertilizers, Lubricants)

3.1.2 Advancements in Packaging Technologies

3.1.3 Growth in Emerging Economies

3.1.4 Shift Towards Lightweight and Sustainable Materials

3.2 Market Challenges

3.2.1 Volatility in Raw Material Prices

3.2.2 Stringent Environmental Regulations

3.2.3 Recycling and Disposal Issues

3.3 Opportunities

3.3.1 Rising Demand for Eco-Friendly Packaging

3.3.2 Investments in Advanced Material Research

3.3.3 Increasing Adoption of Smart Packaging

3.4 Trends

3.4.1 Adoption of Sustainable and Biodegradable Packaging

3.4.2 Increasing Demand for Flexible Packaging

3.4.3 Development of Recyclable Petrochemical Packaging

3.5 Government Regulations

3.5.1 Environmental Protection Standards

3.5.2 Import and Export Controls

3.5.3 Circular Economy Initiatives

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Market Segmentation

4.1 By Material Type (In Value %)

4.1.1 Polyethylene (PE)

4.1.2 Polypropylene (PP)

4.1.3 Polyethylene Terephthalate (PET)

4.1.4 Polyvinyl Chloride (PVC)

4.1.5 Others

4.2 By Packaging Type (In Value %)

4.2.1 Rigid Packaging

4.2.2 Flexible Packaging

4.2.3 Intermediate Bulk Containers (IBCs)

4.3 By End-Use Industry (In Value %)

4.3.1 Chemicals

4.3.2 Food and Beverage

4.3.3 Agriculture

4.3.4 Pharmaceuticals

4.3.5 Others

4.4 By Functionality (In Value %)

4.4.1 Barrier Protection

4.4.2 Aesthetic Appeal

4.4.3 Product Differentiation

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Amcor plc

5.1.2 Berry Global Inc.

5.1.3 Dow Inc.

5.1.4 Sealed Air Corporation

5.1.5 Sonoco Products Company

5.1.6 Mondi Group

5.1.7 Huhtamaki Oyj

5.1.8 WestRock Company

5.1.9 Reynolds Group Holdings

5.1.10 Alpla Group

5.1.11 RPC Group

5.1.12 Pactiv LLC

5.1.13 Greif Inc.

5.1.14 Mauser Packaging Solutions

5.1.15 Smurfit Kappa Group

5.2 Cross Comparison Parameters (Headquarters, Revenue, Product Portfolio, Market Share, Sustainability Initiatives, Technology Investments, Global Presence, Strategic Alliances)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Regulatory Framework

6.1 Environmental Compliance

6.2 Safety Standards

6.3 Import and Export Regulations

7. Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1 By Material Type (In Value %)

8.2 By Packaging Type (In Value %)

8.3 By End-Use Industry (In Value %)

8.4 By Functionality (In Value %)

8.5 By Region (In Value %)

9. Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the global petrochemical packaging market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the global petrochemical packaging market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates. This phase aims to create a comprehensive market framework that reflects historical and current trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on the initial analysis and are subsequently validated through in-depth interviews with industry experts representing diverse sectors within the petrochemical packaging market. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data collected through secondary research.

Step 4: Research Synthesis and Final Output

In the final phase, we engage directly with major petrochemical packaging manufacturers and stakeholders to acquire detailed insights into product segments, sales performance, customer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the global petrochemical packaging market.

Frequently Asked Questions

1. How big is the global petrochemical packaging market?

The global petrochemical packaging market is valued at USD 1104 billion, based on a five-year historical analysis. This market is primarily driven by the expanding petrochemical industry and the rising need for safe, durable packaging solutions, especially for hazardous materials.

2. What are the primary growth drivers in the petrochemical packaging market?

Key growth drivers include advancements in packaging technology, the expansion of petrochemical production capacities, and a rising demand for sustainable packaging options, especially in emerging markets.

3. Who are the major players in the global petrochemical packaging market?

Major players include Amcor plc, Berry Global Inc., Dow Inc., Sealed Air Corporation, and Sonoco Products Company. These companies lead due to their extensive product portfolios, innovative packaging solutions, and global reach.

4. What challenges does the petrochemical packaging market face?

The market faces challenges such as fluctuating raw material prices, strict environmental regulations, and the need for sustainable packaging solutions that align with eco-friendly standards.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.