India Agriculture Tractor Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD5290

December 2024

92

About the Report

India Agriculture Tractor Market Overview

- The India agriculture tractor market is valued at USD 7 billion, based on a five-year historical analysis, driven by increased mechanization of farming practices and government subsidies. Tractors are crucial for enhancing agricultural productivity, particularly in a country where agriculture remains a key sector of the economy. The demand for tractors has grown due to the adoption of modern farming techniques and the need for more efficient agricultural processes. Additionally, favourable government policies such as subsidies and financing schemes have boosted tractor sales.

- The dominant regions in the Indian agriculture tractor market include northern states like Punjab, Haryana, and Uttar Pradesh. These states lead in agricultural output, especially in crops such as wheat and rice, which require mechanized farming techniques for ploughing, sowing, and harvesting. Additionally, the region benefits from a more advanced irrigation infrastructure, allowing for larger-scale farming, which drives higher tractor adoption compared to other areas in India.

- The Government of India has been promoting agricultural mechanization through schemes such as the Sub-Mission on Agricultural Mechanization (SMAM). In 2024, the government allocated INR 25 billion towards SMAM, which aims to increase the penetration of agricultural machinery, including tractors, in rural India. The scheme provides subsidies on tractor purchases, especially for small and marginal farmers, to encourage mechanization.

India Agriculture Tractor Market Segmentation

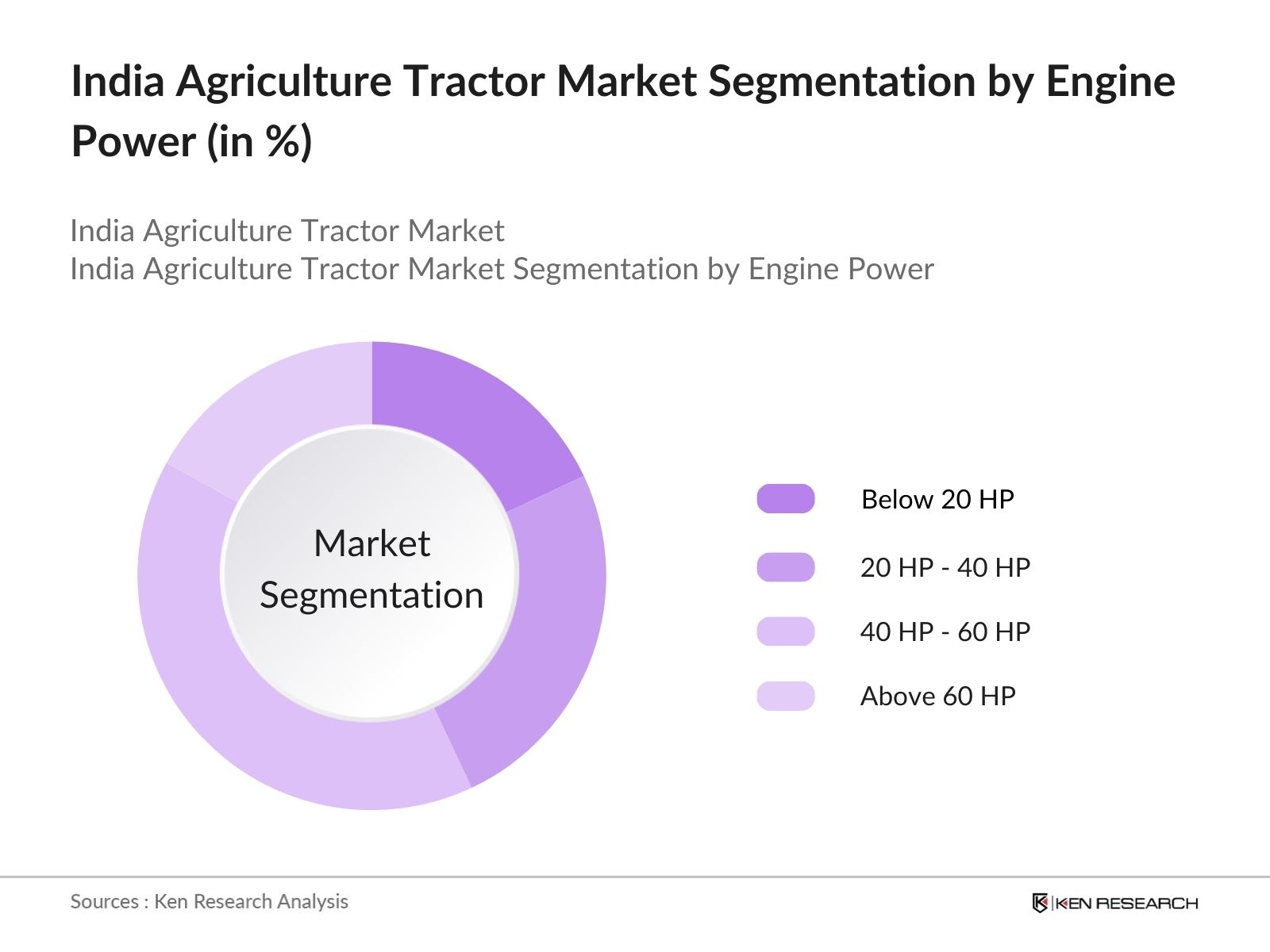

- By Engine Power: The India agriculture tractor market is segmented by engine power into below 20 HP, 20 HP-40 HP, 40 HP-60 HP, and above 60 HP. The 40 HP-60 HP segment holds the dominant share of the market. This is largely due to its versatility, as it caters to medium-to-large farms which are common in states like Punjab and Maharashtra. These tractors are ideal for a variety of tasks, from ploughing to sowing and irrigation. Additionally, government subsidies and easy financing options make tractors in this power range accessible to more farmers.

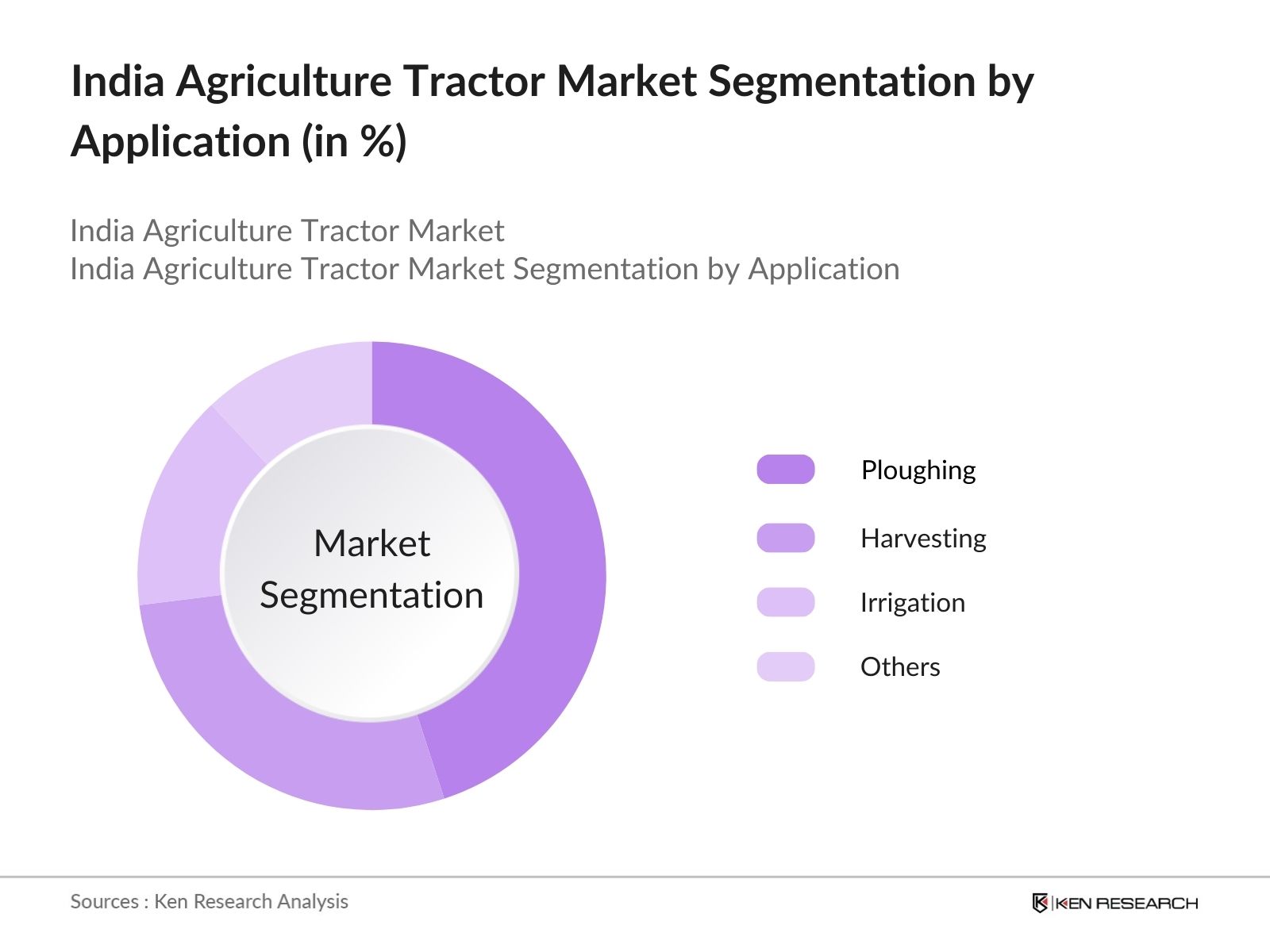

- By Application: The agriculture tractor market is further segmented by application into ploughing, harvesting, irrigation, and others. The ploughing segment dominates the market, driven by the widespread use of tractors in land preparation. Tractors are essential for breaking the hard soil in preparation for sowing, particularly in regions where wheat and rice are staple crops. The consistent demand for ploughing equipment across different crop cycles makes this segment the most in terms of tractor usage.

India Agriculture Tractor Market Competitive Landscape

The India agriculture tractor market is dominated by both domestic and international players. Major local manufacturers like Mahindra & Mahindra and Escorts have established a strong foothold due to their deep understanding of the Indian agricultural landscape. Meanwhile, international players such as John Deere and New Holland offer technologically advanced tractors, which cater to the increasing demand for smart farming solutions.

|

Company |

Establishment Year |

Headquarters |

Product Range |

Global Presence |

Technological Advancements |

Revenue (INR Bn) |

Customer Support |

Market Share |

|

Mahindra & Mahindra Ltd. |

1945 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

|

Escorts Limited |

1944 |

Faridabad, India |

- |

- |

- |

- |

- |

- |

|

John Deere India Pvt. Ltd. |

1998 |

Pune, India |

- |

- |

- |

- |

- |

- |

|

Tractors and Farm Equipment Ltd. |

1960 |

Chennai, India |

- |

- |

- |

- |

- |

- |

|

International Tractors Ltd. |

1995 |

Hoshiarpur, India |

- |

- |

- |

- |

- |

- |

India Agriculture Tractor Market Analysis

India Agriculture Tractor Market Growth Drivers

- Rising Mechanization in Agriculture: The mechanization of Indian agriculture has gained momentum, with the Government of India promoting the adoption of advanced agricultural machinery. According to the Ministry of Agriculture and Farmers Welfare, over 45% of Indian farmers are now using tractors and other machinery to cultivate their land. This shift from traditional methods to mechanized farming is driven by the need to enhance productivity and cope with labor shortages. The Indian government has allocated over INR 650 billion towards mechanization efforts under its various schemes in 2024, further supporting the growth of tractor usage across the country.

- Increasing Awareness about Precision Farming: Precision farming is becoming increasingly popular in India as farmers recognize the benefits of using technology for efficient farming. According to a 2023 report by NITI Aayog, precision farming practices, such as the use of GPS-enabled tractors, are being adopted by 10-15% of progressive farmers, especially in states like Punjab and Haryana. This adoption rate is expected to increase as awareness spreads through government and private initiatives, leading to more demand for technologically advanced tractors in the market.

- Shift towards Sustainable Farming Practices: Sustainable farming is gaining traction as Indian farmers are becoming more environmentally conscious. Tractors designed to support sustainable farming practices, such as those that minimize soil compaction and reduce fuel consumption, are in higher demand. According to the Ministry of Environment, over 30% of Indian farmers have shown interest in eco-friendly farming methods, such as organic farming and zero tillage, further driving the demand for tractors that support these initiatives in 2024.

India Agriculture Tractor Market Challenges

- High Cost of Tractors: The high upfront cost of tractors remains a major barrier for many Indian farmers. The average price of a mid-range tractor in India stands at INR 600,000-900,000 in 2024, which is unaffordable for a large section of small and marginal farmers. Although subsidies help, the upfront financial burden and high interest rates on tractor loans (averaging 12-15% annually) create a considerable challenge. According to the Reserve Bank of India, less than 25% of Indian farmers have access to formal credit, further limiting their ability to purchase tractors.

- Fragmented Landholding Structure: Indias agricultural landholding pattern is highly fragmented, with more than 85% of the land holdings classified as small or marginal (less than 2 hectares), according to the Agriculture Census of 2020-21. This makes it difficult for farmers to justify the cost of owning large tractors, as the small size of their plots does not require large machinery. As a result, many small farmers continue to rely on traditional methods, limiting the growth potential for tractor sales in this segment.

India Agriculture Tractor Market Future Outlook

Over the next five years, the India agriculture tractor market is expected to witness robust growth driven by increasing mechanization in rural areas, government subsidies, and rising awareness of sustainable farming practices. With advancements in tractor technology, such as the development of electric and autonomous tractors, farmers are likely to invest more in innovative machinery. The ongoing trend towards precision farming and the expansion of irrigation facilities will further drive the demand for tractors.

India Agriculture Tractor Market Opportunities

- Growing Demand for Compact Tractors: Compact tractors are gaining popularity among Indian farmers due to their affordability and versatility. According to the Tractor Manufacturers Association (TMA), demand for compact tractors (less than 30 horsepower) has increased by 25% in 2023-24, particularly in regions with fragmented landholdings such as Uttar Pradesh and Bihar. These tractors are easier to maneuver on small farms and come with lower operational costs, making them a preferred choice for small and marginal farmers.

- Increased Adoption of Smart Tractors: Smart tractors equipped with GPS, sensors, and IoT technology are increasingly being adopted in India. According to the Ministry of Electronics and Information Technology, approximately 10% of new tractors sold in 2024 feature smart technologies that improve precision and productivity. These tractors help farmers optimize field operations, reduce fuel consumption, and monitor crop health. The rise in demand for smart tractors is driven by larger farms in states like Punjab and Maharashtra, which are early adopters of agricultural innovation.

Scope of the Report

|

By Engine Power |

Below 20 HP 20 HP - 40 HP 40 HP - 60 HP Above 60 HP |

|

By Application |

Ploughing Harvesting Irrigation Others |

|

By Drive Type |

2-Wheel Drive 4-Wheel Drive |

|

By Region |

Northern India Southern India Western India Eastern India |

|

By Distribution Channel |

Direct Sales Dealerships Online Channels |

Products

Key Target Audience

Agricultural Equipment Manufacturers

Tractor Dealers and Distributors

Farmer Cooperatives

Large Agricultural Enterprises

Government and Regulatory Bodies (Ministry of Agriculture, Department of Agriculture Cooperation & Farmers Welfare)

Investor and Venture Capitalist Firms

Rural Development Agencies

Banks and Financial Institutions

Agricultural Credit and Financing Institutions

Companies

Players Mentioned in the Report

Mahindra & Mahindra Ltd.

Escorts Limited

John Deere India Pvt. Ltd.

Tractors and Farm Equipment Ltd. (TAFE)

International Tractors Ltd. (Sonalika)

CNH Industrial India Pvt. Ltd.

Kubota Agricultural Machinery India Pvt. Ltd.

New Holland Agriculture (India)

VST Tillers Tractors Ltd.

Force Motors Limited

Table of Contents

1. India Agriculture Tractor Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Agriculture Tractor Market Size (In INR Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Agriculture Tractor Market Analysis

3.1 Growth Drivers

3.1.1 Rising Mechanization in Agriculture

3.1.2 Government Subsidies and Support

3.1.3 Increasing Awareness about Precision Farming

3.1.4 Shift towards Sustainable Farming Practices

3.2 Market Challenges

3.2.1 High Cost of Tractors

3.2.2 Fragmented Landholding Structure

3.2.3 Lack of Financing Options for Small Farmers

3.2.4 Unorganized Service and Distribution Network

3.3 Opportunities

3.3.1 Growing Demand for Compact Tractors

3.3.2 Increased Adoption of Smart Tractors

3.3.3 Entry of International Players into Indian Market

3.3.4 Development of Rental Models for Tractors

3.4 Trends

3.4.1 Shift towards Autonomous Tractors

3.4.2 Rising Popularity of Electric and Hybrid Tractors

3.4.3 Enhanced Focus on Farm Equipment Digitization

3.4.4 Preference for Custom Hiring Centers

3.5 Government Regulation

3.5.1 Agricultural Mechanization Promotion Scheme

3.5.2 Subsidies on Tractor Purchases and Leasing

3.5.3 Environmental Regulations for Emission Control

3.5.4 Initiatives for Rural Infrastructure Development

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. India Agriculture Tractor Market Segmentation

4.1 By Engine Power (In Value %)

4.1.1 Below 20 HP

4.1.2 20 HP - 40 HP

4.1.3 40 HP - 60 HP

4.1.4 Above 60 HP

4.2 By Application (In Value %)

4.2.1 Ploughing

4.2.2 Harvesting

4.2.3 Irrigation

4.2.4 Others

4.3 By Drive Type (In Value %)

4.3.1 2-Wheel Drive

4.3.2 4-Wheel Drive

4.4 By Region (In Value %)

4.4.1 Northern India

4.4.2 Southern India

4.4.3 Western India

4.4.4 Eastern India

4.5 By Distribution Channel (In Value %)

4.5.1 Direct Sales

4.5.2 Dealerships

4.5.3 Online Channels

5. India Agriculture Tractor Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Mahindra & Mahindra Ltd.

5.1.2 Escorts Limited

5.1.3 Tractors and Farm Equipment Limited (TAFE)

5.1.4 John Deere India Pvt. Ltd.

5.1.5 International Tractors Limited (Sonalika)

5.1.6 CNH Industrial India Pvt. Ltd.

5.1.7 Kubota Agricultural Machinery India Pvt. Ltd.

5.1.8 New Holland Agriculture (India)

5.1.9 VST Tillers Tractors Ltd.

5.1.10 Force Motors Limited

5.1.11 Swaraj Tractors

5.1.12 HMT Tractors

5.1.13 Eicher Tractors

5.1.14 Indo Farm Equipment Limited

5.1.15 ACE Tractors

5.2 Cross Comparison Parameters

5.2.1 Market Share (%)

5.2.2 Product Line (Engine Power Range, Drive Type)

5.2.3 Sales Volume (Units Sold)

5.2.4 R&D Expenditure

5.2.5 Technological Innovation (Smart Tractors, Autonomous Solutions)

5.2.6 Global Presence (Export Markets, International Collaborations)

5.2.7 Sustainability Initiatives (Emission Norms, Electric Tractors)

5.2.8 Customer Support Infrastructure (Service Centers, Dealership Network)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, Collaborations)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Expansion Projects, Greenfield Investments)

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Agriculture Tractor Market Regulatory Framework

6.1 Standards for Agricultural Machinery and Equipment

6.2 Emission Norms and Environmental Regulations

6.3 Certification Processes for Tractor Manufacturers

6.4 Compliance Requirements for Tractor Dealers

7. India Agriculture Tractor Future Market Size (In INR Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Agriculture Tractor Future Market Segmentation

8.1 By Engine Power (In Value %)

8.2 By Application (In Value %)

8.3 By Drive Type (In Value %)

8.4 By Region (In Value %)

8.5 By Distribution Channel (In Value %)

9. India Agriculture Tractor Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis (Small-Scale Farmers, Commercial Farmers)

9.3 White Space Opportunity Analysis

9.4 Marketing Initiatives for Emerging Segments

Research Methodology

Step 1: Identification of Key Variables

The research process begins with identifying key variables affecting the India agriculture tractor market. This involves detailed desk research to map all stakeholders and outline the market's current landscape. Market-driving factors such as government schemes, agricultural policies, and demand for mechanization are closely examined.

Step 2: Market Analysis and Construction

Historical data related to tractor sales, distribution channels, and regional market penetration are collected. The analysis covers key regions across India, enabling a detailed evaluation of market dynamics, sales volumes, and product demand.

Step 3: Hypothesis Validation and Expert Consultation

Data-driven hypotheses are formulated and then validated through expert consultations, primarily with tractor manufacturers, agricultural economists, and rural market analysts. This provides a practical understanding of market trends and competitive dynamics.

Step 4: Research Synthesis and Final Output

The final output includes a synthesis of primary and secondary data. Interviews with tractor manufacturers, analysis of farmer preferences, and a review of government policy form the foundation of the reports conclusions and future outlook projections.

Frequently Asked Questions

01. How big is the India agriculture tractor market?

The India agriculture tractor market was valued at USD 7 billion, driven by increased mechanization and supportive government policies, making tractors essential for improving agricultural productivity across the country.

02. What are the key challenges in the India agriculture tractor market?

Key challenges in the India agriculture tractor market include the high cost of tractors, lack of financing options for small farmers, and fragmented landholding structures, which limit the ability of some farmers to invest in mechanized farming equipment.

03. Who are the major players in the India agriculture tractor market?

The major players in the India agriculture tractor market include Mahindra & Mahindra, Escorts Limited, John Deere India, TAFE, and International Tractors Ltd. These companies dominate due to their extensive distribution networks, innovative product offerings, and strong brand recognition.

04. What are the growth drivers of the India agriculture tractor market?

Growth in the India agriculture tractor market is driven by increasing demand for efficient farming solutions, government subsidies, rising mechanization in agriculture, and technological advancements in tractors, including electric and smart tractors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.