India All Wheel Drive (AWD) Market Outlook to 2028

Region:Asia

Author(s):Abhinav Kumar

Product Code:KROD697

January 2025

90

About the Report

India All Wheel Drive Market Overview

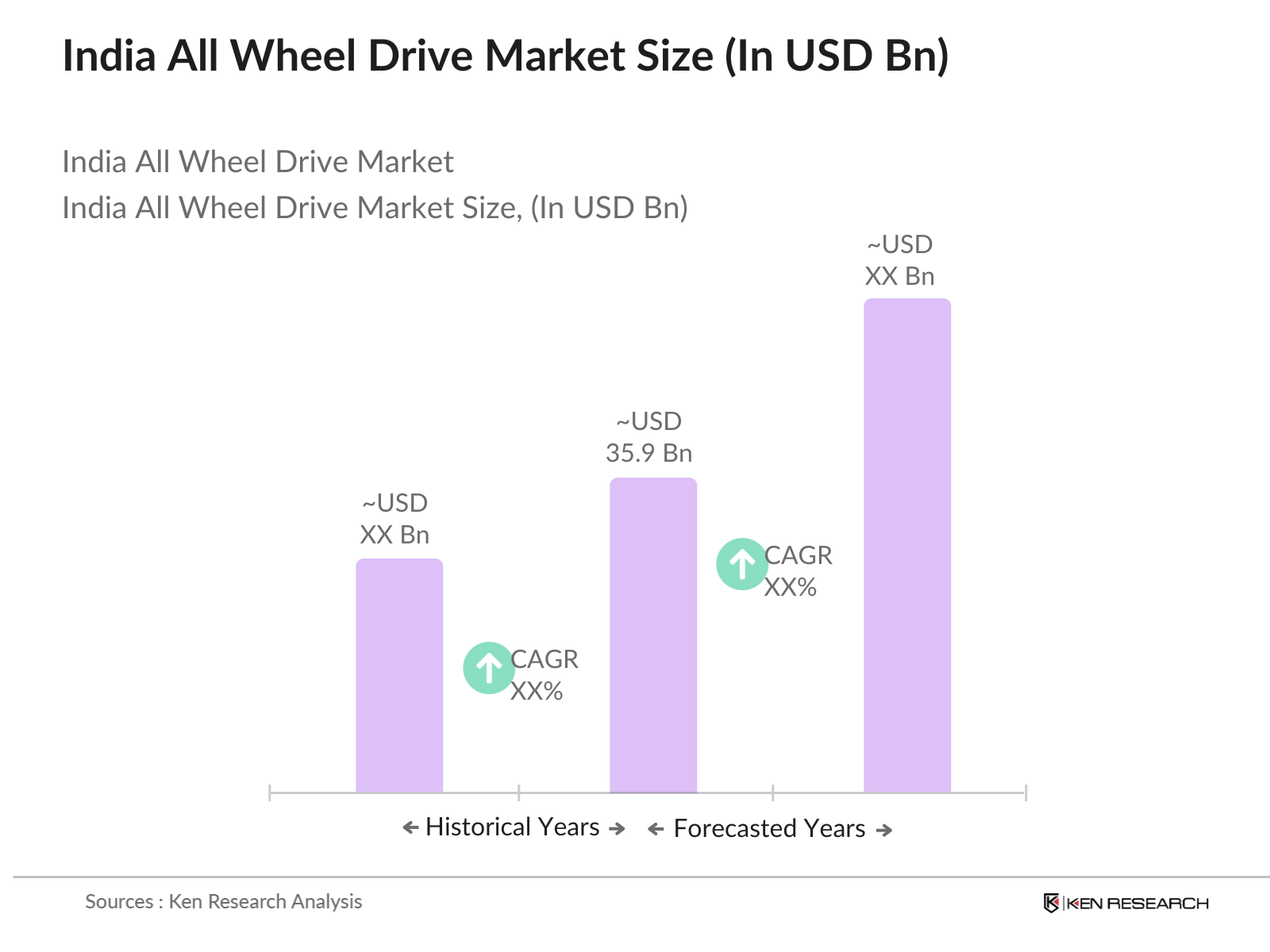

- The India All Wheel Drive has experienced notable growth, this is reflected by globalAll Wheel Drive reaching a valuation of USD 35.9 billion in 2023, driven by increasing consumer demand for enhanced vehicle safety and performance, particularly in adverse weather conditions and rough terrains. The growing popularity of SUVs and crossovers, which often feature AWD systems, is a significant factor contributing to this market expansion.

- Key players in the India AWD market include Mahindra & Mahindra, Tata Motors, Maruti Suzuki, Hyundai Motors, and Toyota Kirloskar. These companies are renowned for their extensive product portfolios, technological innovations, and strong dealership networks, which help them maintain a competitive edge in the market.

- In 2023, Maruti Suzuki launched the new Grand Vitara AWD, specifically designed for the Indian market. This vehicle features advanced AWD technology, aimed at providing better traction and safety. The launch is part of Maruti Suzuki's broader strategy to strengthen its presence in the SUV and crossover segments in India.

- The cities of Delhi, Mumbai, and Bangalore dominate the AWD market in India, primarily due to their higher purchasing power and urban infrastructure that supports the use of high-end vehicles. By 2028, the market is expected to witness further growth, driven by advancements in AWD technology, increasing availability of AWD vehicles in lower price segments, and growing awareness of vehicle safety features.

India All Wheel Drive Market Segmentation

By Vehicle Type: India All Wheel Drive Market is segmented by vehicle type into SUVs, sedans, and pickup trucks. In 2023, SUVs held the dominant market share, attributed to their versatility and increasing popularity among consumers. The demand for AWD SUVs is particularly strong among buyers seeking vehicles capable of handling diverse driving conditions, from urban environments to off-road terrains.

By Fuel Type: The market is segmented by fuel type into petrol, diesel, and hybrid vehicles. In 2023, Diesel-powered AWD vehicles have traditionally dominated due to their superior torque and fuel efficiency, crucial for heavy-duty and off-road applications. However, hybrid vehicles are gaining traction, especially with increasing environmental awareness and supportive government policies.

By Region: Regionally, the market is divided into North, South, East, and West India. North India, including states like Delhi and Punjab, dominated the market in 2023. This dominance is due to the region's challenging driving conditions and higher disposable incomes, which favor the adoption of AWD systems for enhanced vehicle control and safety.

India All Wheel Drive Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Mahindra & Mahindra |

1945 |

Mumbai, India |

|

Tata Motors |

1945 |

Mumbai, India |

|

Maruti Suzuki |

1981 |

New Delhi, India |

|

Hyundai Motors |

1967 |

Seoul, South Korea |

|

Toyota Kirloskar |

1997 |

Bangalore, India |

- Mahindra & Mahindra: In August 2024, Mahindra & Mahindra is expected to launch a new version of its Thar model, Thar ROXX, introducing advanced AWD technology. This version includes significant updates such as a redesigned grille, new LED headlights and tail lamps, a 10.25-inch touchscreen infotainment system, a panoramic sunroof, and Advanced Driver Assistance Systems (ADAS).

- Tata Motors: In 2023, Tata Motors announced a significant expansion of its manufacturing facilities to boost the production of all-wheel-drive (AWD) vehicles. Tata Motors' expansion includes the utilization of the Omega Factory, also known as Trim-Chassis-Fitment 2 (TCF-2), located at their Pimpri plant. The primary focus is on models such as the Tata Harrier and Tata Safari, which have been equipped with advanced features to meet the growing consumer demand for high-performance vehicles.

India All Wheel Drive Industry Analysis

India All Wheel Drive Market Growth Drivers:

- Increasing demand for SUVs and crossovers: According to the Society of Indian Automobile Manufacturers (SIAM), the sales of utility vehicles, including SUVs and crossovers, grew by 28.9% in the April-March period of 2022-23 compared to the previous year, reaching 1.2 million units. This growth is attributed to changing consumer preferences, with more buyers gravitating towards larger, more versatile vehicles that offer enhanced comfort and safety features.

- Rising popularity of adventure and off-road activities: The number of participants in outdoor adventure activities in India grew from 2.5 million in 2020 to 3.8 million in 2022, according to a survey conducted by the Outdoor Industry Association. This trend reflects a broader cultural shift towards experiential travel and outdoor exploration, where consumers seek vehicles capable of handling rugged landscapes.

- Expanding middle class and growing disposable incomes: The size of India's middle class is expected to reach 583 million by 2025, up from 504 million in 2022. This demographic shift is accompanied by rising disposable incomes, which allow consumers to invest in higher-value vehicles. With an increasing number of households able to afford premium SUVs and crossovers, manufacturers are likely to respond with more AWD options tailored to this segment, thereby enhancing the overall attractiveness of the AWD market in India.

India All Wheel Drive Market Challenges:

- High cost of AWD technology: The average price of a four-wheel drive vehicle in India is 25% higher than a two-wheel drive model, according to a study by the Automotive Component Manufacturers Association of India (ACMA). This price differential can deter potential buyers, especially in a price-sensitive market where consumers often prioritize affordability. As manufacturers strive to make AWD technology more accessible, the challenge remains to balance cost with the advanced features that consumers demand.

- Limited availability of premium AWD models: Only few of the total SUV and crossover models available in India offer an AWD option, according to a report by the Federation of Automobile Dealers Associations (FADA). This limited selection restricts consumer choice and may hinder market growth, as buyers often seek specific features that enhance their driving experience.

India All Wheel Drive Market Government Initiatives:

- FAME India Phase II Scheme: The Ministry of Heavy Industries has allocated a budget of Rs. 11,500 crores for the FAME India Phase II scheme, which aims to promote hybrid and electric vehicle technology in India. This initiative is designed to subsidize various electric vehicle categories, including e-Buses, e-3 Wheelers, e-4 Wheeler Passenger Cars, and e-2 Wheelers.

- Production Linked Incentive (PLI) Scheme: The Indian government has introduced the PLI scheme for the automotive sector with a budgetary outlay of Rs. 25,938 crores. This initiative is aimed at boosting the manufacturing of Advanced Automotive Technologies (AAT) products, including electric vehicles and components.

India All Wheel Drive Future Market Outlook

The India All Wheel Drive (AWD) market is expected to experience significant growth in the next five years, driven by the increasing demand for SUVs and crossovers, the rising popularity of adventure and off-road activities, and the expanding middle class with growing disposable incomes.

Future Trends

-

- Increasing adoption of hybrid and electric AWD models: The sales of hybrid and electric SUVs and crossovers in India are projected to reach 75,000 units by 2028. This growth will be fueled by government incentives, advancements in battery technology, and a growing consumer preference for eco-friendly vehicles, positioning hybrid and electric AWD models as a key segment in the market.

- Growing demand for premium and luxury AWD models: The sales of premium and luxury SUVs and crossovers in India are expected to reach around 100,000 units by 2028. This trend will be supported by an increasing number of affluent consumers seeking high-quality vehicles that offer advanced features and superior performance, further driving the expansion of the AWD segment.

Scope of the Report

|

By Vehicle Type |

SUVs Sedans Pickup Trucks |

|

By Fuel Type |

Petrol Diesel Hybrid |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing This Report:

- Automotive Manufacturers

- Automotive Component Suppliers

- Vehicle Dealers and Distributors

- Automotive Industry Consultants

- Government and Regulatory Bodies (e.g., Ministry of Road Transport and Highways)

- Insurance Companies

- Automotive Leasing and Financing Companies

- Investment and Venture Capitalist Firms

Time Period Captured in the Report

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Players Mentioned in the Report: Â

- Mahindra & Mahindra

- Tata Motors

- Maruti Suzuki

- Hyundai Motors

- Toyota Kirloskar

- Ford India

- Honda Cars India

- Nissan Motor India

- Renault India

- Volkswagen India

- Kia Motors India

- Jeep India

- Skoda Auto India

- MG Motor India

- Isuzu Motors India

Table of Contents

1. India All Wheel Drive Market OverviewÂ

1.1 India All Wheel Drive Market TaxonomyÂ

2. India All Wheel Drive Market Size (in USD Mn), 2018-2023Â

3. India All Wheel Drive Market Analysis

3.1 India All Wheel Drive Market Growth DriversÂ

3.2 India All Wheel Drive Market Challenges and IssuesÂ

3.3 India All Wheel Drive Market Trends and DevelopmentÂ

3.4 India All Wheel Drive Market Government RegulationÂ

3.5 India All Wheel Drive Market SWOT AnalysisÂ

3.6 India All Wheel Drive Market Stake EcosystemÂ

3.7 India All Wheel Drive Market Competition EcosystemÂ

4. India All Wheel Drive Market Segmentation, 2023

4.1 India All Wheel Drive Market Segmentation by Vehicle Type (in value %), 2023Â

4.2 India All Wheel Drive Market Segmentation by Fuel Type (in value %), 2023Â

4.3 India All Wheel Drive Market Segmentation by Region (in value %), 2023Â

5. India All Wheel Drive Market Competition Benchmarking

5.1 India All Wheel Drive Market Cross-Comparison (no. of employees, company overview,Â

business strategy, USP, recent development, operational parameters,Â

financial parameters and advanced analytics)Â

6. India All Wheel Drive Future Market Size (in USD Mn), 2023-2028

7. India All Wheel Drive Future Market Segmentation, 2028

7.1 India All Wheel Drive Market Segmentation by Vehicle Type (in value %), 2028Â

7.2 India All Wheel Drive Market Segmentation by Fuel Type (in value %), 2028Â

7.3 India All Wheel Drive Market Segmentation by Region (in value %), 2028Â

8. India All Wheel Drive Market Analysts’ Recommendations

8.1 India All Wheel Drive Market TAM/SAM/SOM AnalysisÂ

8.2 India All Wheel Drive Market Customer Cohort AnalysisÂ

8.3 India All Wheel Drive Market Marketing InitiativesÂ

8.4 India All Wheel Drive Market White Space Opportunity AnalysisÂ

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key VariablesÂ

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2: Market BuildingÂ

Collating statistics on India all-wheel drive market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India all-wheel drive Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3: Validating and FinalizingÂ

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4: Research OutputÂ

Our team will approach multiple all-wheel drive companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from all-wheel drive companies.

Frequently Asked Questions

01. How big is the India All Wheel Drive (AWD) Market?

02. What are the challenges in the India All Wheel Drive Market?

03. Who are the major players in the India All Wheel Drive Market?

04. What are the growth drivers of the India All Wheel Drive Market?

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.