India Artificial Intelligence (AI) Market Outlook to 2028

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD4232

December 2024

87

About the Report

India Artificial Intelligence (AI) Market Overview

- The India Artificial Intelligence (AI) market is valued at USD 5.95 billion, driven by significant investments in technology and an increase in the adoption of AI solutions across various industries. The demand for AI in sectors such as healthcare, finance, and retail is propelling market growth. The government's push for digitalization and the rise of data analytics are further contributing to the market expansion. In 2024, the market is anticipated to grow, bolstered by advancements in machine learning and natural language processing.

- Several cities in India, including Bengaluru, Hyderabad, and Delhi, dominate the AI market. Bengaluru is often referred to as the "Silicon Valley of India," hosting a plethora of tech companies and startups focused on AI innovations. Hyderabad benefits from strong government support and a skilled workforce, making it a hub for IT and AI development. Delhi, with its robust infrastructure and access to capital, is increasingly becoming a center for AI research and application.

- Indias National AI Strategy, formulated by NITI Aayog, emphasizes the development of AI technologies in priority sectors, including healthcare, education, and smart cities. In 2024, the government allocated 5,000 crore to enhance AI research, education, and infrastructure development. The National AI Strategy also includes ethical guidelines for AI implementation to ensure responsible usage. This policy framework is designed to foster innovation while addressing concerns around AI ethics and accountability. The AI strategy is critical for shaping India's AI ecosystem.

India Artificial Intelligence (AI) Market Segmentation

By Component: The India Artificial Intelligence market is segmented by component into hardware, software, and services. Among these, the software segment holds a dominant market share due to the rapid integration of AI software solutions in various sectors. The increasing reliance on AI for business automation, data analysis, and customer interaction has propelled software adoption, especially in industries like finance and healthcare.The software segment's dominance stems from its ability to enhance operational efficiency and decision-making processes across organizations. Companies are increasingly investing in AI software solutions to automate tasks, analyze large datasets, and improve customer experiences. This shift towards software solutions reflects a broader trend of digital transformation across industries, positioning AI software as a critical enabler of business success.

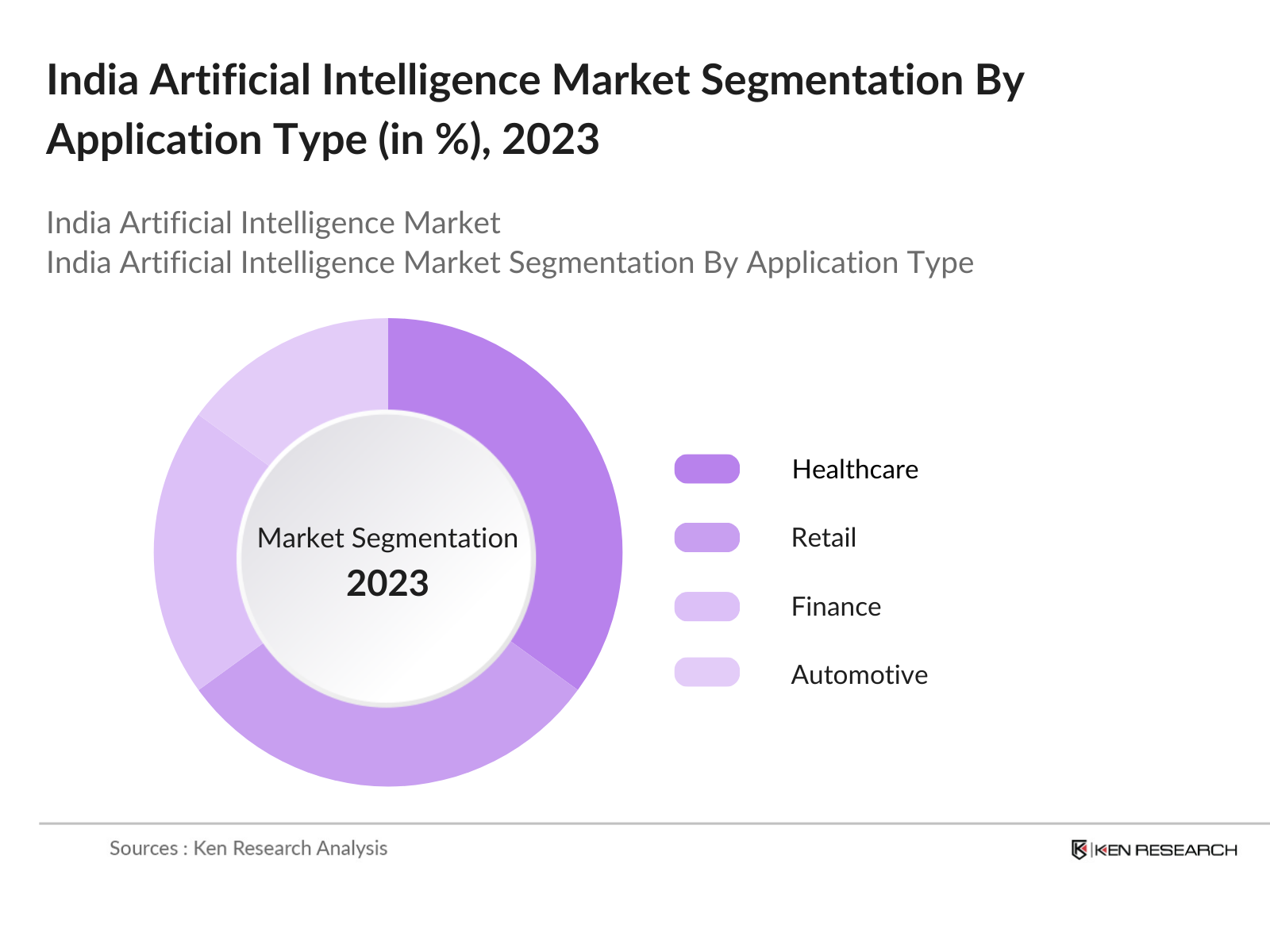

By Application: The India Artificial Intelligence market is also segmented by application, including healthcare, retail, finance, automotive, and others. The healthcare segment is leading this market due to the growing demand for AI in diagnostics, treatment recommendations, and patient management systems.The healthcare application segment's growth can be attributed to the increasing need for efficient healthcare solutions and better patient outcomes. AI technologies, such as machine learning and natural language processing, are transforming how healthcare providers deliver services. By implementing AI-driven tools, hospitals and clinics can enhance diagnostic accuracy, streamline administrative tasks, and improve patient engagement, thus driving the segment's dominance.

India Artificial Intelligence (AI) Market Competitive Landscape

The Indian AI market is dominated by these major players, which highlight their influence in driving innovation and service delivery. Each company brings unique strengths to the table, enabling a wide range of AI applications tailored to meet diverse business needs. The India Artificial Intelligence market is characterized by a competitive landscape featuring several key players. Major companies in the market include:

|

Company Name |

Year Established |

Headquarters |

Market Cap (USD) |

Product Offerings |

Key Technologies |

Customer Base |

|

Tata Consultancy Services |

1968 |

Mumbai, India |

_ |

_ |

_ |

_ |

|

Infosys |

1981 |

Bengaluru, India |

_ |

_ |

_ |

_ |

|

Wipro |

1945 |

Bengaluru, India |

_ |

_ |

_ |

_ |

|

HCL Technologies |

1976 |

Noida, India |

_ |

_ |

_ |

_ |

|

Accenture |

1989 |

Dublin, Ireland |

_ |

_ |

_ |

_ |

India Artificial Intelligence (AI) Industry Analysis

Growth Drivers

- Digital Transformation Initiatives: India has seen a major push toward digital transformation across sectors, driven by government initiatives like "Digital India." As of 2024, the country has over 1.2 billion mobile connections and 700 million internet users, fueling the demand for AI-based technologies in services, agriculture, and industries. With the Indian government allocating 3,058 crore to its Digital India program in 2022, AI technologies are being increasingly integrated into public services and infrastructure. This extensive data generation and digitization are creating a fertile ground for AI innovations to improve efficiencies in multiple sectors.

- Investment in Research and Development: In 2024, the Indian governments allocation for research and development (R&D) in AI has significantly increased. The Union Budget of 2024 allocated 6,000 crore to promote AI-based innovation in the country, focusing on establishing centers of excellence in various technological universities. Public and private sector companies, including giants like Tata Consultancy Services and Infosys, are significantly investing in AI R&D, resulting in advancements in machine learning, deep learning, and natural language processing technologies. The rise in R&D investment is expected to accelerate AI applications across industries.

- Increasing Data Generation and Adoption: As of 2024, India generates approximately 8 exabytes of data daily due to the rapid adoption of digital technologies, smartphone penetration, and expanding broadband coverage. This large data pool is a crucial driver for AI adoption, providing the training data required for machine learning models. The governments emphasis on smart city initiatives and the digitization of services has further accelerated data collection, making AI solutions essential for data analysis and predictive modeling. Indias increasing role as a global data center hub has further propelled AI development across industries.

Market Challenges

- Data Privacy Concerns: The lack of comprehensive data privacy laws in India poses a significant challenge to the AI market. As of 2024, Indias Personal Data Protection Bill is still under discussion in Parliament, and the absence of stringent regulations exposes AI systems to misuse of personal data. While approximately 79% of the population in 2024 are internet users, the absence of proper data protection laws leaves a vacuum in terms of

- Skill Shortage in AI: As of 2024, India faces a shortage of approximately 200,000 skilled AI professionals, despite being a hub for IT talent. The AI talent gap hampers the growth of AI innovation, particularly in specialized areas like deep learning and natural language processing. With only around 20% of IT graduates receiving AI-related education, the supply is far below industry demand. This skill shortage, combined with the rapid pace of technological advancements, remains a substantial challenge for AI adoption across industries.

India Artificial Intelligence (AI) Market Future Outlook

Over the next few years, the India Artificial Intelligence market is expected to experience robust growth, driven by continued investments in AI research and development, expanding applications in various sectors, and increasing demand for automation solutions. The government's initiatives, such as the National AI Strategy, aim to position India as a global AI leader. These efforts, combined with advancements in AI technologies and rising consumer awareness, are likely to fuel the market's momentum.

Opportunities

- AI in Healthcare and Life Sciences: AI has significant applications in Indias healthcare sector, particularly in diagnostics and predictive analytics. As of 2024, the AI healthcare market is growing rapidly, with public hospitals like AIIMS using AI tools for early diagnosis of diseases like cancer. The National Health Mission has also invested 1,200 crore in AI research for public health, aiming to enhance preventive healthcare systems. AI-powered platforms such as Aarogya Setu are used to monitor health data, opening vast opportunities for AI integration in healthcare services.

- Automation in Manufacturing: Indias manufacturing sector is increasingly adopting AI technologies for automation, especially in automotive and electronics industries. In 2024, companies like Tata Motors and Mahindra have integrated AI-driven automation systems in their production lines, reducing production time by nearly 25%. The governments Make in India initiative also encourages manufacturers to adopt AI technologies to improve efficiencies. With investments of 10,000 crore under the Production-Linked Incentive (PLI) scheme, AI-driven automation is poised to transform India's manufacturing sector, opening up new business opportunities.

Scope of the Report

|

By Component |

Hardware Software Services |

|

By Application |

Healthcare Retail Automotive Financial Services |

|

By Technology |

Machine Learning Natural Language Processing Computer Vision |

|

By Deployment Mode |

Cloud On-Premises |

|

By Region |

North India South India East India West India |

Products

Key Target Audience

- Investor and Venture Capitalist Firms

- Government and Regulatory Bodies (NITI Aayog, Ministry of Electronics and Information Technology)

- Technology Industries

- Enterprises across Various Industries

- Healthcare Industry

- Automotive Companies

Companies

Major Players in the Market

- Tata Consultancy Services

- Infosys

- Wipro

- HCL Technologies

- Accenture

- IBM India

- Microsoft India

- Google India

- Amazon Web Services India

- Tech Mahindra

- Larsen & Toubro

- Zensar Technologies

- Fractal Analytics

- Mu Sigma

- Quantiphi

Table of Contents

1. India Artificial Intelligence (AI) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Artificial Intelligence (AI) Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Artificial Intelligence (AI) Market Analysis

3.1. Growth Drivers

3.1.1. Digital Transformation Initiatives

3.1.2. Investment in Research and Development

3.1.3. Increasing Data Generation and Adoption

3.1.4. Government Initiatives and Policies

3.2. Market Challenges

3.2.1. Data Privacy Concerns

3.2.2. Skill Shortage in AI

3.2.3. Ethical and Regulatory Issues

3.3. Opportunities

3.3.1. AI in Healthcare and Life Sciences

3.3.2. Automation in Manufacturing

3.3.3. Smart Cities Initiatives

3.4. Trends

3.4.1. Integration of AI with IoT

3.4.2. Cloud-based AI Solutions

3.4.3. Rise of Conversational AI

3.5. Government Regulation

3.5.1. National AI Strategy

3.5.2. Data Protection Laws

3.5.3. Intellectual Property Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Artificial Intelligence (AI) Market Segmentation

4.1. By Component (In Value %)

4.1.1. Hardware

4.1.2. Software

4.1.3. Services

4.2. By Application (In Value %)

4.2.1. Healthcare

4.2.2. Retail

4.2.3. Automotive

4.2.4. Financial Services

4.3. By Technology (In Value %)

4.3.1. Machine Learning

4.3.2. Natural Language Processing

4.3.3. Computer Vision

4.4. By Deployment Mode (In Value %)

4.4.1. Cloud

4.4.2. On-Premises

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Artificial Intelligence (AI) Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tata Consultancy Services

5.1.2. Infosys

5.1.3. Wipro

5.1.4. HCL Technologies

5.1.5. Accenture

5.1.6. IBM India

5.1.7. Microsoft India

5.1.8. Google India

5.1.9. Amazon Web Services India

5.1.10. Tech Mahindra

5.1.11. Larsen & Toubro

5.1.12. Zensar Technologies

5.1.13. Fractal Analytics

5.1.14. Mu Sigma

5.1.15. Quantiphi

5.2. Cross Comparison Parameters (Revenue, No. of Employees, Headquarters, Year of Establishment, Key Technologies, Client Base, R&D Investments, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Artificial Intelligence (AI) Market Regulatory Framework

6.1. Data Protection Regulations

6.2. Compliance Requirements

6.3. Certification Processes

7. India Artificial Intelligence (AI) Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Artificial Intelligence (AI) Market Future Segmentation

8.1. By Component (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Deployment Mode (In Value %)

8.5. By Region (In Value %)

9. India Artificial Intelligence (AI) Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing a comprehensive ecosystem map that includes all major stakeholders within the India Artificial Intelligence market. Extensive desk research will be conducted, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary goal is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the India Artificial Intelligence market will be compiled and analyzed. This includes assessing market penetration, the ratio of various applications to service providers, and resultant revenue generation. An evaluation of service quality statistics will ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through consultations with industry experts representing diverse companies. These consultations will provide valuable operational and financial insights, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple AI solution providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement statistics derived from the bottom-up approach, ensuring a comprehensive and validated analysis of the India Artificial Intelligence market.

Frequently Asked Questions

01. How big is the India Artificial Intelligence market?

The India Artificial Intelligence market is valued at USD 5.95 billion, driven by significant investments in technology and the increasing adoption of AI solutions across various industries.

02. What are the challenges in the India Artificial Intelligence market?

Challenges include data privacy concerns, a shortage of skilled professionals in AI, and ethical and regulatory issues that may hinder the market's growth and adoption.

03. Who are the major players in the India Artificial Intelligence market?

Key players include Tata Consultancy Services, Infosys, Wipro, HCL Technologies, and Accenture, each dominating due to their extensive resources and innovative AI solutions.

04. What are the growth drivers of the India Artificial Intelligence market?

Growth drivers include government initiatives supporting AI development, advancements in machine learning and natural language processing, and rising demand for automation solutions across industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.