India Beverage Packaging Market Outlook to 2030

Region:Asia

Author(s):Sanjana

Product Code:KROD1197

October 2024

90

About the Report

India Beverage Packaging Market Overview

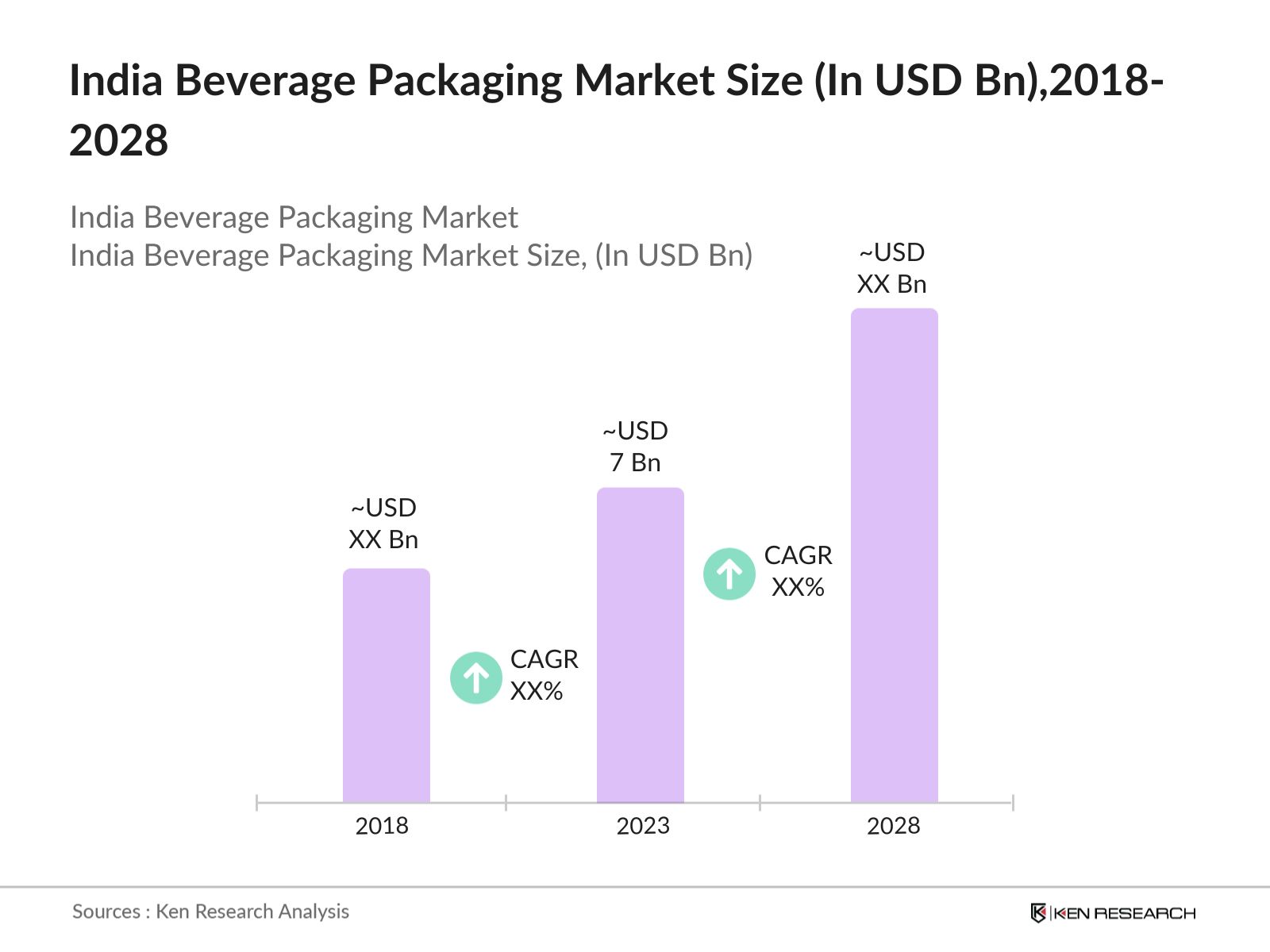

- India Beverage Packaging Market has witnessed significant growth, reaching a market size of USD 7 billion in 2023. This growth is primarily driven by the rising consumption of beverages, including soft drinks, alcoholic beverages, and bottled water. The shift towards sustainable packaging options, such as PET bottles and aluminum cans, has also played a crucial role in market expansion.

- Key players in the India Beverage Packaging Market include Tetra Pak, Amcor Limited, Ball Corporation, Crown Holdings, and Uflex Limited. These companies have established a strong presence through continuous innovation and strategic partnerships.

- In 2023, Tetra Pak introduced fully renewable aseptic cartons in India, reducing the carbon footprint of beverage packaging by 33%. This launch meets the increasing demand for eco-friendly packaging and underscores the company's dedication to sustainability.

- Mumbai, Delhi, and Bangalore dominate the India Beverage Packaging Market due to their high population density and significant consumption of packaged beverages. These cities have a strong retail infrastructure and a large number of beverages manufacturing units, contributing to their dominant market shares.

India Beverage Packaging Market Segmentation

The India Beverage Packaging Market can be segmented based on several factors:

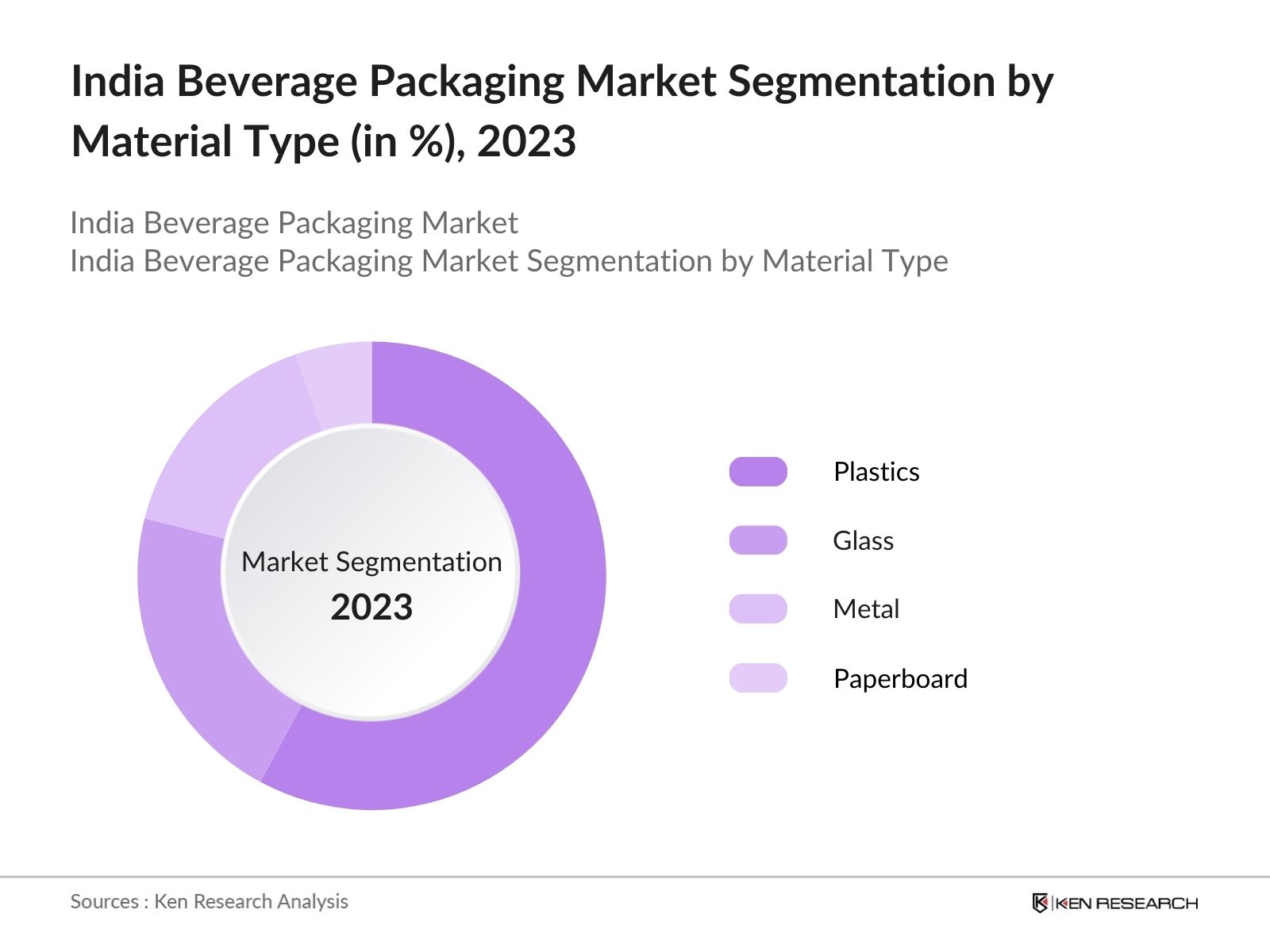

By Material Type: India Beverage Packaging Market is segmented by material type into plastic, glass, metal and paperboard. In 2023, plastic packaging holds the dominant market share due to its lightweight, cost-effectiveness, and versatility. The use of PET bottles, in particular, is prevalent due to their convenience and recyclability, making them a preferred choice for both manufacturers and consumers.

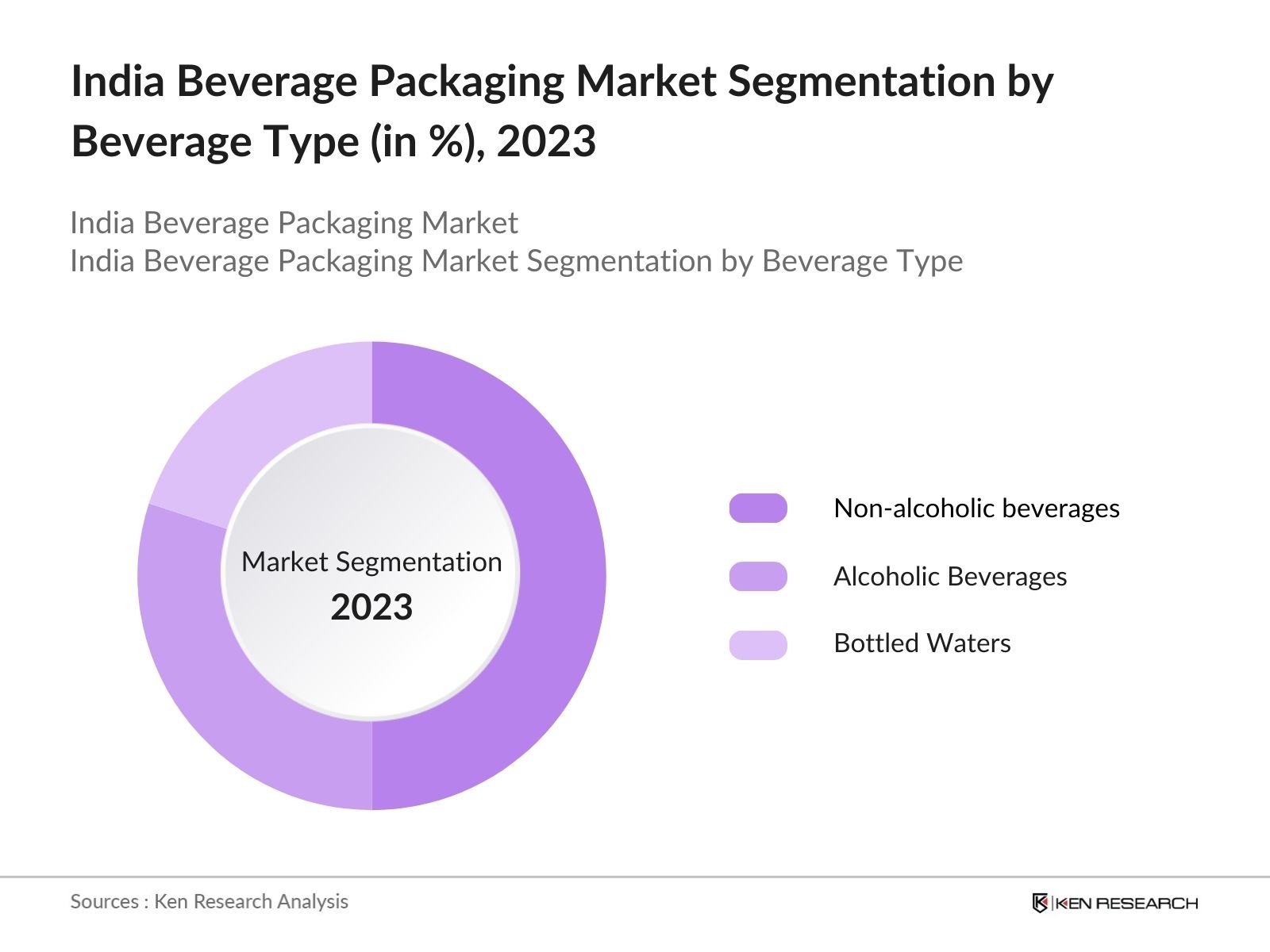

By Beverage Type: India Beverage Packaging Market is segmented by beverage type into non-alcoholic beverages, alcoholic beverages and bottled water. In 2023, non-alcoholic beverages, including soft drinks and fruit juices, dominate the market share. The increasing health consciousness among consumers and the launch of new flavors and health-focused drinks have driven the demand for non-alcoholic beverage packaging.

By Region: India Beverage Packaging Market is regionally segmented into North, South, East, and West. In 2023, North India held the largest market share due to its large population base, high beverage consumption rates, and the presence of major beverage manufacturing hubs. The regions favorable economic conditions and infrastructure development have also facilitated the growth of the beverage packaging industry.

India Beverage Packaging Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Tetra Pak India |

1987 |

Pune, Maharashtra |

|

Uflex Ltd. |

1983 |

Noida, Uttar Pradesh |

|

Manjushree Technopack |

1987 |

Bengaluru, Karnataka |

|

Huhtamaki India Ltd. |

1935 |

Mumbai, Maharashtra |

|

Essel Propack Ltd. |

1982 |

Mumbai, Maharashtra |

- Tetra Pak Industrial Protein Mixture: In 2024, Tetra Pak has introduced a new product aimed at minimizing product loss during the mixing of liquid protein. This innovation is part of the company's ongoing efforts to enhance efficiency in food processing. The Tetra Pak Industrial Protein Mixer is poised to help food and beverage manufacturers capitalize on the growing demand for protein-enriched products.

- UFlex Ltd.: In 2024, UFlex Ltd. reaffirmed its commitment to environmental stewardship on Earth Day by launching initiatives aimed at achieving carbon neutrality by 2035. These include recycling multi-layer plastic waste, implementing water conservation strategies, and conducting awareness programs in schools to promote sustainability among future generations.

India Beverage Packaging Industry Analysis

Growth Drivers:

- Rising Demand for Sustainable Packaging: The increasing consumer preference for eco-friendly and sustainable packaging solutions is a major growth driver in the India Beverage Packaging Market. In 2023, India produced more than 4.7 million metric tons of plastic waste, with a substantial portion originating from single-use beverage packaging. Therefore, there are companies like Ecoware, which focuses on biodegradable packaging made from sugarcane and bamboo.

- Increase in Packaged Beverage Consumption: India's beverage industry has seen a notable increase in the consumption of packaged beverages, particularly in urban areas. In 2023, packed water consumption exceeded 500 billion liters, making it the most consumed packed beverage type in the world. The demand for bottled water, energy drinks, and juices has surged, with major cities like Mumbai, Delhi, and Bengaluru being the largest consumers.

- Expansion of E-commerce and Online Retailing: In 2023, the total number of digital buyers was over 345 million in India with platforms like BigBasket, Amazon, and Flipkart leading the way. The shift towards online shopping has increased the demand for sturdy and protective packaging to ensure the safe delivery of beverages.

Challenges:

- Environmental Regulations and Compliance: The India Beverage Packaging Market faces significant challenges in meeting stringent environmental regulations. The Plastic Waste Management Rules, 2022, introduced by the Ministry of Environment, Forest, and Climate Change (MoEFCC), mandate the reduction of single-use plastics and encourage the use of biodegradable materials.

- Fluctuating Raw Material Prices: The volatility in raw material prices, particularly for plastics and metals, poses a significant challenge for the beverage packaging industry. The cost of PET resin, a key material used in beverage packaging, saw a sharp increase due to supply chain disruptions and rising crude oil prices. This price volatility has affected the profit margins of packaging manufacturers and led to higher costs for end consumers.

Government Initiatives:

- National Plastics and Packaging Waste Management Policy: The National Plastics and Packaging Waste Management Policy in India is primarily guided by the Plastic Waste Management Rules, 2016, which have been amended multiple times to strengthen the framework for managing plastic waste. The most significant recent amendments include the Plastic Waste Management Amendment Rules, 2021, and 2022, which aim to phase out single-use plastics and enhance the responsibilities of producers, importers, and brand owners through Extended Producer Responsibility (EPR).

- Plastic Waste Management Rules: The Plastic Waste Management (Amendment) Rules, 2022 were introduced by the Ministry of Environment, Forest and Climate Change in India to enhance the management of plastic waste, particularly focusing on the reduction of single-use plastics and the implementation of Extended Producer Responsibility (EPR). The rules state that the minimum thickness for plastic carry bags must be 120 microns, effective from December 31, 2022.

India Beverage Packaging Future Market Outlook

India Beverage Packaging Market is poised for significant growth over the next five years, driven by the increasing demand for sustainable and innovative packaging solutions. By 2028, the market is expected to witness a shift towards more eco-friendly materials, supported by government regulations and changing consumer preferences.

Future Trends

- Growth of Sustainable Packaging Solutions: The future of the India Beverage Packaging Market will be characterized by a strong emphasis on sustainable packaging solutions. Companies will increasingly adopt biodegradable and recyclable materials, such as paperboard and glass, to meet consumer demand for eco-friendly options. This trend will be driven by stricter environmental regulations and the growing awareness of the environmental impact of packaging waste.

- Technological Innovations in Packaging: Technological advancements in the packaging industry will play a crucial role in shaping the markets future. Innovations such as smart packaging, which includes features like QR codes and NFC tags, will enhance the consumer experience and provide valuable data for manufacturers. These technologies will enable better product tracking, improve supply chain efficiency, and offer personalized marketing opportunities, contributing to the markets growth.

Scope of the Report

|

India Beverage Packaging Market Segmentation |

|

|

By Material Type |

Plastic Glass Metal Paperboard |

|

By Beverage Type |

Non-Alcoholic Beverages, Alcoholic Beverages Bottled Water |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Beverage Manufacturers

Packaging Machinery Manufacturers

Recycling Companies

Packaging Material Suppliers

Packaging Design Companies

Logistics and Supply Chain Companies

Investment & Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FSSAI, MoEFCC)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

Tetra Pak India

Uflex Ltd.

Manjushree Technopack

Huhtamaki India Ltd.

Essel Propack Ltd.

Piramal Glass

Amcor India

Ball Corporation

WestRock India

Polyplex Corporation Ltd.

Table of Contents

1. India Beverage Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Beverage Packaging Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Beverage Packaging Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Sustainable Packaging

3.1.2. Increase in Packaged Beverage Consumption

3.1.3. Expansion of E-commerce and Online Retailing

3.2. Restraints

3.2.1. Environmental Regulations and Compliance

3.2.2. Fluctuating Raw Material Prices

3.2.3. Recycling and Waste Management Issues

3.3. Opportunities

3.3.1. Technological Innovations in Packaging

3.3.2. Expansion into Rural Markets

3.3.3. Growth in Sustainable Packaging Solutions

3.4. Trends

3.4.1. Adoption of Smart Packaging Solutions

3.4.2. Increasing Use of Biodegradable Materials

3.4.3. Integration of Packaging with Branding and Marketing Strategies

3.5. Government Regulations

3.5.1. National Plastics and Packaging Waste Management Policy (2023)

3.5.2. Plastic Waste Management Rules (2022)

3.5.3. Swachh Bharat Mission 2.0 (2021)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. India Beverage Packaging Market Segmentation, 2023

4.1. By Material Type (in Value %)

4.1.1. Plastic

4.1.2. Glass

4.1.3. Metal

4.1.4. Paperboard

4.2. By Beverage Type (in Value %)

4.2.1. Non-Alcoholic Beverages

4.2.2. Alcoholic Beverages

4.2.3. Dairy Products

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. West

4.3.4. East

5. India Beverage Packaging Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Tetra Pak India

5.1.2. Uflex Ltd.

5.1.3. Manjushree Technopack

5.1.4. Huhtamaki India Ltd.

5.1.5. Essel Propack Ltd.

5.1.6. Amcor India

5.1.7. Piramal Glass

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. India Beverage Packaging Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

7. India Beverage Packaging Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. India Beverage Packaging Market Future Size (in INR Cr), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. India Beverage Packaging Market Future Segmentation, 2028

9.1. By Material Type (in Value %)

9.2. By Beverage Type (in Value %)

9.3. By Region (in Value %)

10. India Beverage Packaging Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on India Beverage Packaging Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Beverage Packaging Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple beverage packaging suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from beverage packaging suppliers and distributors companies.

Frequently Asked Questions

01 How big is India Beverage Packaging Market?

India Beverage Packaging Market has witnessed significant growth, reaching a market size of USD 7 billion in 2023. This growth is primarily driven by the rising consumption of beverages, including soft drinks, alcoholic beverages, and bottled water.

02 What are the growth drivers of the India Beverage Packaging Market?

Growth in India Beverage Packaging Market is driven by the rising demand for sustainable packaging, the increasing consumption of packaged beverages in urban areas, and the expansion of e-commerce and online retail platforms, which require durable and secure packaging solutions.

03 What are challenges in India Beverage Packaging Market?

India Beverage Packaging Market faces challenges such as strict environmental regulations, fluctuating raw material prices, and inefficient recycling and waste management systems. These issues increase operational costs and complicate the supply chain, impacting overall market growth.

04 Who are major players in India Beverage Packaging Market?

Key players in the India Beverage Packaging Market include Tetra Pak, Amcor Limited, Ball Corporation, Crown Holdings, and Uflex Limited. These companies have established a strong presence through continuous innovation and strategic partnerships.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.