India C-Arm Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD6065

December 2024

97

About the Report

India C-Arm Market Overview

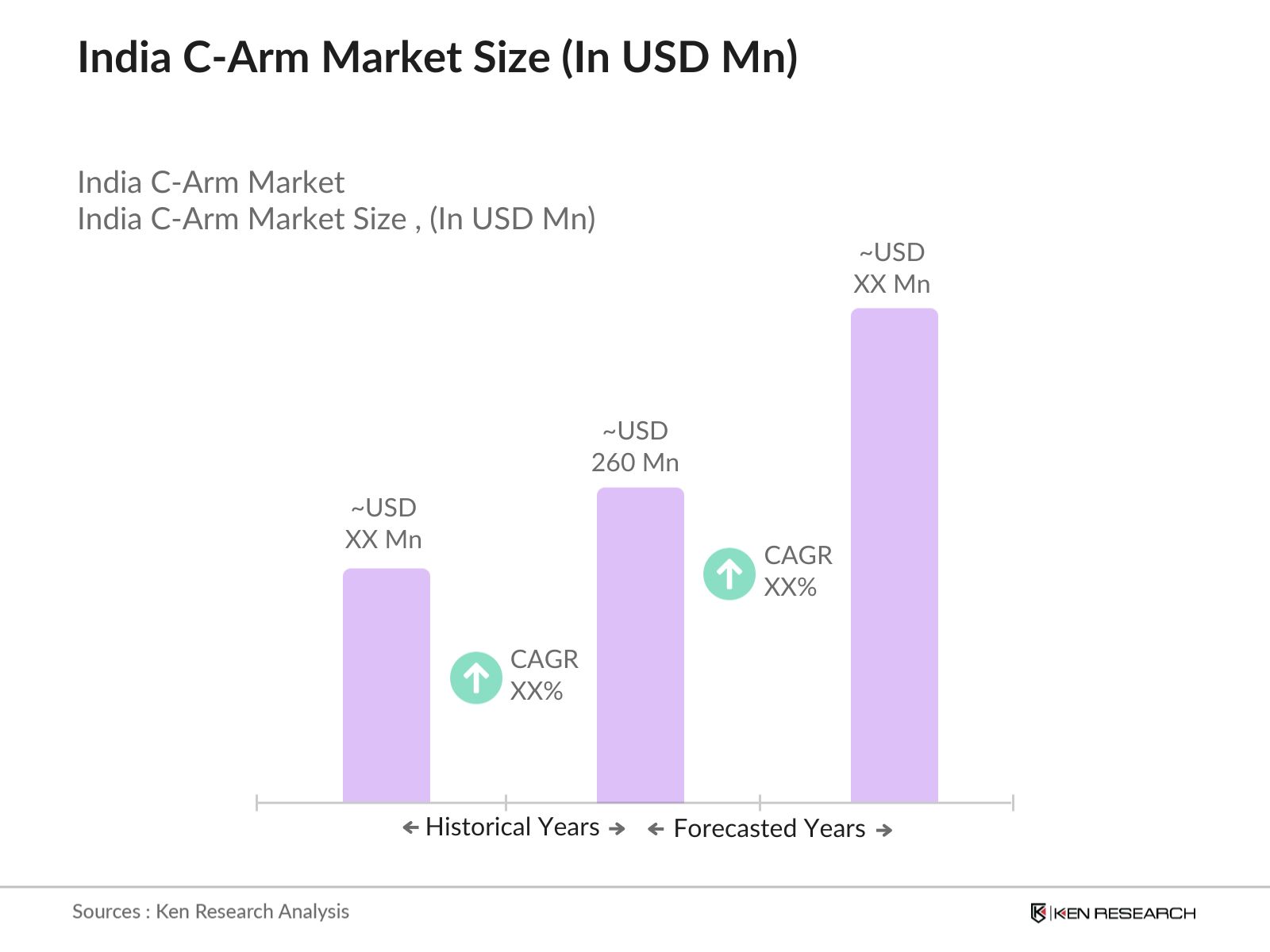

- The India C-Arm market is valued at USD 260 million, based on a five-year historical analysis. This growth is driven primarily by the increasing number of surgical procedures requiring real-time imaging, such as orthopedics, neurology, and cardiology. Additionally, the demand for minimally invasive surgeries, where C-Arms play a crucial role in guiding operations, has surged. Technological advancements, such as the adoption of flat-panel detectors, further boost the market by offering better image quality and lower radiation exposure.

- Indias healthcare hubs, particularly in cities like Delhi, Mumbai, and Bengaluru, dominate the C-Arm market. These cities have large hospitals and specialized healthcare centers, which conduct a number of diagnostic and interventional surgeries annually. Additionally, these urban centers attract medical tourism, further elevating the demand for advanced imaging systems like C-Arms. The concentration of advanced medical facilities and healthcare infrastructure makes these cities key contributors to the market.

- The CDSCO, under the Ministry of Health & Family Welfare, regulates the approval and manufacturing of medical devices, including C-arms, in India. In 2022, the government issued new guidelines mandating the certification of C-arm devices under the Medical Devices Rules (2017), which standardizes the quality and safety of these products. As of 2023, over 80% of C-arm devices in Indian hospitals were compliant with CDSCOs guidelines, ensuring that the machines meet stringent safety and performance criteria, fostering trust in domestic and international markets.

India C-Arm Market Segmentation

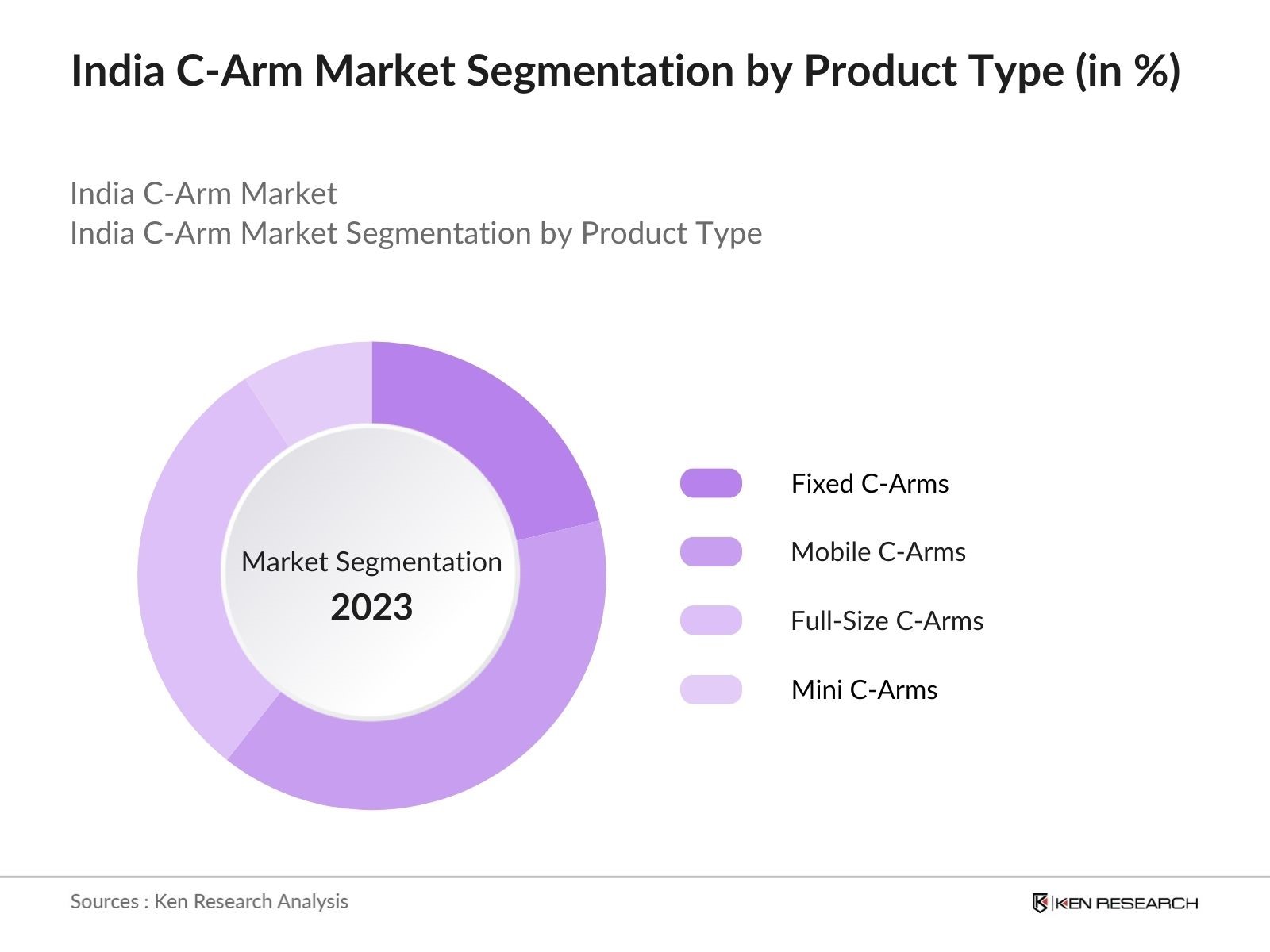

By Product Type: The market is segmented by product type into fixed C-Arms and mobile C-Arms, full-size and Mini-C Arms. Recently, mobile C-Arms, particularly full-size models, have held a dominant market share due to their flexibility and ease of use in both hospital and outpatient settings. The growing demand for minimally invasive surgeries, especially in orthopedics and pain management, has made mobile C-Arms a preferred choice in healthcare facilities. The ability to move the equipment easily between rooms while offering high-quality imaging is a factor driving the preference for this segment.

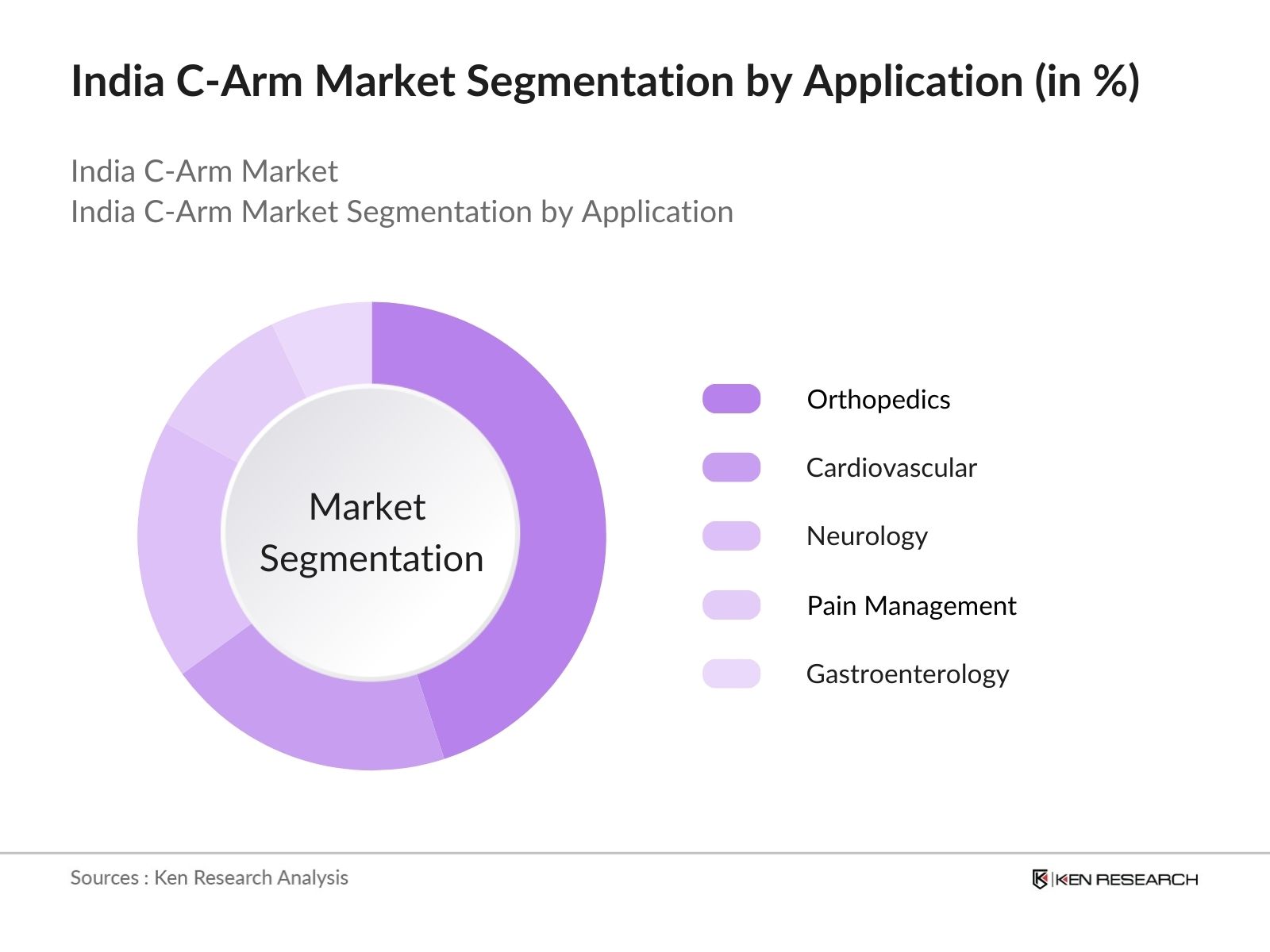

By Application: The market in India is segmented by application into Orthopedics, Cardiovascular, Neurology, Pain Management, And Gastroenterology. The orthopedic application dominates the market due to the growing number of trauma cases, fractures, and degenerative bone diseases. Additionally, the rise in road accidents and sports injuries contributes to the higher demand for real-time imaging during surgeries, making orthopedic procedures the largest application area for C-Arms in India.

India C-Arm Market Competitive Landscape

The India C-Arm market is dominated by both global and domestic players. These companies focus on providing advanced imaging technologies while maintaining a strong distribution network to meet the growing demand. The market sees moderate consolidation, with a few players holding market share due to their wide-ranging product portfolios and technological innovation. The competitive landscape highlights a mix of global players, such as Siemens Healthineers and GE Healthcare, alongside domestic companies like Allengers Medical Systems, which benefit from local expertise and government contracts.

|

Company Name |

Year Established |

Headquarters |

Revenue |

Product Portfolio |

Manufacturing Facilities |

R&D Investments |

Distribution Network |

Global Presence |

Strategic Initiatives |

|

Siemens Healthineers |

1847 |

Erlangen, Germany |

|||||||

|

GE Healthcare |

1892 |

Chicago, USA |

|||||||

|

Philips Healthcare |

1891 |

Amsterdam, Netherlands |

|||||||

|

Ziehm Imaging |

1972 |

Nuremberg, Germany |

|||||||

|

Allengers Medical Systems |

1987 |

Chandigarh, India |

India C-Arm Industry Analysis

Growth Drivers

- Rise in Minimally Invasive Surgeries: The increase in minimally invasive surgeries in India has fueled the demand for C-arms, particularly in orthopedics, cardiology, and neurology. In 2023, more than 7 million surgeries were performed in India, with minimally invasive procedures accounting for 40% of these cases, according to government health reports. The use of C-arms in procedures like endovascular surgeries, orthopedic fracture repairs, and spinal operations has become essential to minimize patient recovery time and reduce hospital stays. This trend is expected to support the growing adoption of advanced imaging technologies, further driving the market for C-arms.

- Growing Geriatric Population: Indias geriatric population has grown, with over 138 million individuals aged 60 and above in 2024, according to the United Nations. This demographic shift has led to a surge in demand for healthcare services, particularly for age-related ailments such as arthritis, osteoporosis, and cardiovascular diseases. The increasing prevalence of chronic conditions in older adults has driven the need for advanced diagnostic imaging, including C-arms, to assist in treatments like joint replacements, spinal surgeries, and vascular interventions. The expanding geriatric population will continue to be a major driver for the C-arm market in India.

- Increasing Medical Tourism: India is a global hub for medical tourism, attracting over 6.35 lakh medical tourists in 2023, with the majority seeking treatments in fields such as orthopedics, cardiology, and oncology. The affordability of healthcare services, along with access to advanced medical equipment like C-arms, has made India an attractive destination for international patients. With an average cost savings of 65-90% compared to Western countries, Indias healthcare infrastructure, particularly in private hospitals, has seen investments in advanced imaging technologies. The influx of medical tourists has further bolstered the demand for high-quality imaging devices like C-arms.

Market Challenges

- High Equipment Costs: One of the primary challenges in the Indian C-arm market is the high cost of equipment. While larger metropolitan hospitals are able to afford state-of-the-art machines, rural and smaller healthcare facilities often find it difficult to justify the investment. In 2023, it was reported by the Medical Equipment Manufacturers Association of India that the average cost of a high-end C-arm device ranges between INR 50 lakh and INR 1 crore, limiting its accessibility in non-urban areas. This cost barrier is a challenge for hospitals and clinics in Tier 2 and Tier 3 cities.

- Lack of Skilled Operators: Another challenge in the Indian C-arm market is the shortage of trained healthcare professionals capable of operating advanced imaging devices. In 2023, the Indian Society of Radiographers reported that the country faced a shortage of over 15,000 skilled radiographers and technicians, particularly in smaller towns and rural areas. This shortage hampers the effective utilization of C-arms, as many hospitals are unable to operate them to their full potential. Additionally, the lack of standardized training programs further complicates efforts to address this gap in skilled labor.

India C-Arm Market Future Outlook

Over the next five years, the India C-Arm market is expected to show growth, driven by increasing demand for minimally invasive surgeries and the expansion of healthcare infrastructure in rural areas. Advancements in C-Arm technology, including the integration of AI for enhanced imaging, will further support the markets growth trajectory. Additionally, the push for upgrading healthcare facilities, coupled with medical tourism, positions India as a prominent market for advanced imaging systems. Indias focus on healthcare reforms, the introduction of AI-driven diagnostics, and the growing acceptance of hybrid operating rooms will bolster the C-Arm market in the future.

Future Market Opportunities

- Expansion in Diagnostic Centers and Hospitals: India has witnessed a rapid expansion of healthcare infrastructure, with over 70 new hospitals and diagnostic centers being established across metropolitan and Tier 2 cities in 2023 alone. Government initiatives such as the Pradhan Mantri Jan Arogya Yojana (PMJAY) aim to improve healthcare access and have led to investments in medical technology, including C-arms. The rising number of healthcare facilities has created substantial opportunities for manufacturers and distributors of diagnostic imaging devices, as hospitals and clinics seek to modernize their equipment and meet the growing demand for advanced medical imaging.

- Growing Demand for Hybrid ORs: The increasing demand for hybrid operating rooms (ORs) is creating new opportunities for C-arm manufacturers in India. In 2023, the Indian Association of Cardiovascular and Thoracic Surgeons reported that 50 leading hospitals in India had set up hybrid ORs to perform complex surgeries that require both traditional and minimally invasive procedures. These rooms integrate advanced imaging technologies, including C-arms, to allow surgeons to perform real-time imaging during surgery. The growing adoption of hybrid ORs across Indias top hospitals is expected to drive the demand for high-end, mobile, and 3D C-arms.

Scope of the Report

|

Product Type |

Fixed C-Arms Mobile C-Arms (Full-size, Mini) |

|

Technology |

Image Intensifier Flat Panel Detector |

|

Application |

Orthopedics Cardiovascular Neurology Pain Management Gastroenterology |

|

End-User |

Hospitals Diagnostic Imaging Centers Ambulatory Surgical Centers |

|

Region |

North South West East |

Products

Key Target Audience

Hospitals and Healthcare Providers

Diagnostic Imaging Centers

Medical Device Manufacturers

Healthcare Investors and Venture Capital Firms

Government and Regulatory Bodies (Central Drugs Standard Control Organization, Ministry of Health and Family Welfare)

Ambulatory Surgical Centers

Technology Providers (AI and Imaging Software Developers)

Medical Tourism Operators

Banks and Financial Institutions

Companies

Major Players

Siemens Healthineers

GE Healthcare

Philips Healthcare

Ziehm Imaging

Allengers Medical Systems

Shimadzu Corporation

Canon Medical Systems

Hologic Inc.

Eurocolumbus Srl

Genoray Co. Ltd.

Carestream Health

Hitachi Medical Systems

Medonica Co. Ltd.

Agfa Healthcare

Toshiba Medical Systems

Table of Contents

1. India C-Arm Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India C-Arm Market Size (In INR Mn/USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India C-Arm Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Minimally Invasive Surgeries

3.1.2. Growing Geriatric Population

3.1.3. Technological Advancements (e.g., 3D Imaging, Flat-Panel Detectors)

3.1.4. Increasing Medical Tourism

3.2. Market Challenges

3.2.1. High Equipment Costs

3.2.2. Limited Availability in Rural Areas

3.2.3. Lack of Skilled Operators

3.3. Opportunities

3.3.1. Expansion in Diagnostic Centers and Hospitals

3.3.2. Growing Demand for Hybrid ORs

3.3.3. Introduction of AI-Enhanced C-Arms

3.4. Trends

3.4.1. Adoption of Mobile C-Arms

3.4.2. Integration with Hospital Information Systems (HIS)

3.4.3. Rise in Demand for Compact C-Arms

3.5. Government Regulations

3.5.1. Guidelines by Central Drugs Standard Control Organization (CDSCO)

3.5.2. Medical Devices Rules and Certification Process

3.5.3. Health Technology Assessment (HTA) and Reimbursement Policies

3.6. SWOT Analysis (Specific to India)

3.6.1. Strengths (Growing Healthcare Infrastructure)

3.6.2. Weaknesses (Cost Sensitivity)

3.6.3. Opportunities (Emerging Markets)

3.6.4. Threats (Economic Slowdowns, Currency Fluctuations)

3.7. Stakeholder Ecosystem

3.7.1. Hospitals

3.7.2. Diagnostic Centers

3.7.3. Equipment Manufacturers

3.7.4. Distributors

3.7.5. Regulatory Bodies

3.8. Porters Five Forces Analysis (Customized for Indian Market)

3.8.1. Threat of New Entrants

3.8.2. Bargaining Power of Suppliers

3.8.3. Bargaining Power of Buyers

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competitive Ecosystem

3.9.1. Market Concentration Rate

3.9.2. Key Partnerships and Alliances

4. India C-Arm Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Fixed C-Arms

4.1.2. Mobile C-Arms (Full-size, Mini C-Arms)

4.2. By Technology (In Value %)

4.2.1. Image Intensifier C-Arms

4.2.2. Flat Panel Detector C-Arms

4.3. By Application (In Value %)

4.3.1. Orthopedics

4.3.2. Cardiovascular

4.3.3. Neurology

4.3.4. Pain Management and Trauma

4.3.5. Gastroenterology

4.4. By End-User (In Value %)

4.4.1. Hospitals

4.4.2. Diagnostic Imaging Centers

4.4.3. Ambulatory Surgical Centers

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. West India

4.5.4. East India

5. India C-Arm Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Siemens Healthineers

5.1.2. GE Healthcare

5.1.3. Philips Healthcare

5.1.4. Ziehm Imaging

5.1.5. Shimadzu Corporation

5.1.6. Hologic Inc.

5.1.7. Toshiba Medical Systems

5.1.8. Canon Medical Systems

5.1.9. Carestream Health

5.1.10. Genoray Co. Ltd.

5.1.11. Eurocolumbus Srl

5.1.12. Medonica Co. Ltd.

5.1.13. Allengers Medical Systems

5.1.14. Agfa Healthcare

5.1.15. Hitachi Medical Systems

5.2. Cross Comparison Parameters (Employee Count, Revenue, Manufacturing Facilities, Product Portfolio, Market Penetration, R&D Investments, Partnerships, Service Networks)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Expansions, Collaborations)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Policies and Subsidies

6. India C-Arm Market Regulatory Framework

6.1. Import and Export Policies

6.2. Pricing Regulations

6.3. Medical Device Certification Standards (ISO, BIS, etc.)

7. India C-Arm Future Market Size (In INR Mn/USD Mn)

7.1. Market Size Projections

7.2. Factors Driving Future Growth (Emerging Technologies, Increased Adoption)

8. India C-Arm Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. India C-Arm Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Competitive Benchmarking

9.3. Strategic Marketing Recommendations

9.4. Emerging White Spaces

Research Methodology

Step 1: Identification of Key Variables

In this phase, we create a comprehensive ecosystem map of the India C-Arm Market, covering major stakeholders like manufacturers, hospitals, and regulatory bodies. Our approach leverages secondary research from reliable sources and proprietary databases to map the critical factors influencing the market, including growth drivers and market restraints.

Step 2: Market Analysis and Construction

Historical data for market sizing and growth trends are gathered and analyzed. We review key segments such as product type and applications to assess their market penetration. Revenue models and pricing strategies are evaluated to ensure the data reflects accurate market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

We conduct interviews with market experts and stakeholders, including manufacturers and healthcare providers. These consultations allow us to validate the research findings and refine hypotheses based on industry feedback, ensuring a robust market analysis.

Step 4: Research Synthesis and Final Output

In the final phase, we synthesize data from various sources to develop a detailed market report. Validation from primary research sources ensures a well-rounded analysis, offering reliable insights into market trends, challenges, and opportunities in the India C-Arm Market.

Frequently Asked Questions

01 How big is the India C-Arm market?

The India C-Arm market is valued at USD 260 million, driven by a rising number of surgeries requiring real-time imaging and the growing adoption of minimally invasive procedures.

02 What are the challenges in the India C-Arm market?

Key challenges in the India C-Arm market include the high cost of C-Arm systems, limited access to advanced healthcare in rural areas, and the need for skilled operators to handle these machines effectively.

03 Who are the major players in the India C-Arm market?

Leading players in the India C-Arm market include Siemens Healthineers, GE Healthcare, Philips Healthcare, and domestic manufacturers like Allengers Medical Systems. These companies dominate the market due to their advanced technology offerings and strong distribution networks.

04 What are the growth drivers of the India C-Arm market?

The India C-Arm market is driven by an increase in orthopedic surgeries, rising demand for minimally invasive procedures, advancements in imaging technologies, and the expansion of healthcare facilities in tier-2 and tier-3 cities.

05 Which product types dominate the India C-Arm market?

Mobile C-Arms, especially full-size models, hold the largest market share due to their flexibility and growing usage in orthopedic and trauma surgeries in the India C-Arm market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.