India Car Loan Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD9583

December 2024

97

About the Report

India Car Loan Market Overview

- The India Car Loan Market is valued at USD 24 billion, driven by a growing middle-class population and the increasing demand for personal mobility. With rising disposable incomes and affordable interest rates, more consumers are choosing car loans to finance both new and used vehicles. The market is fueled by a burgeoning demand for personal vehicles, particularly in urban areas, where transportation needs are shifting due to expanding infrastructure and the rise of digital lending platforms.

- Dominant regions in the market include metropolitan cities such as Mumbai, Delhi, and Bengaluru, which lead due to their higher population density and urbanization rates. These cities are also home to a significant portion of the middle-class population with growing aspirations for vehicle ownership.

- The Indian government introduced the Vehicle Scrappage Policy to encourage the replacement of old vehicles with new, more fuel-efficient models. By 2024, the policy is expected to scrap over 5 million vehicles annually, leading to a rise in new vehicle purchases and, consequently, an increase in car loan applications. ]

India Car Loan Market Segmentation

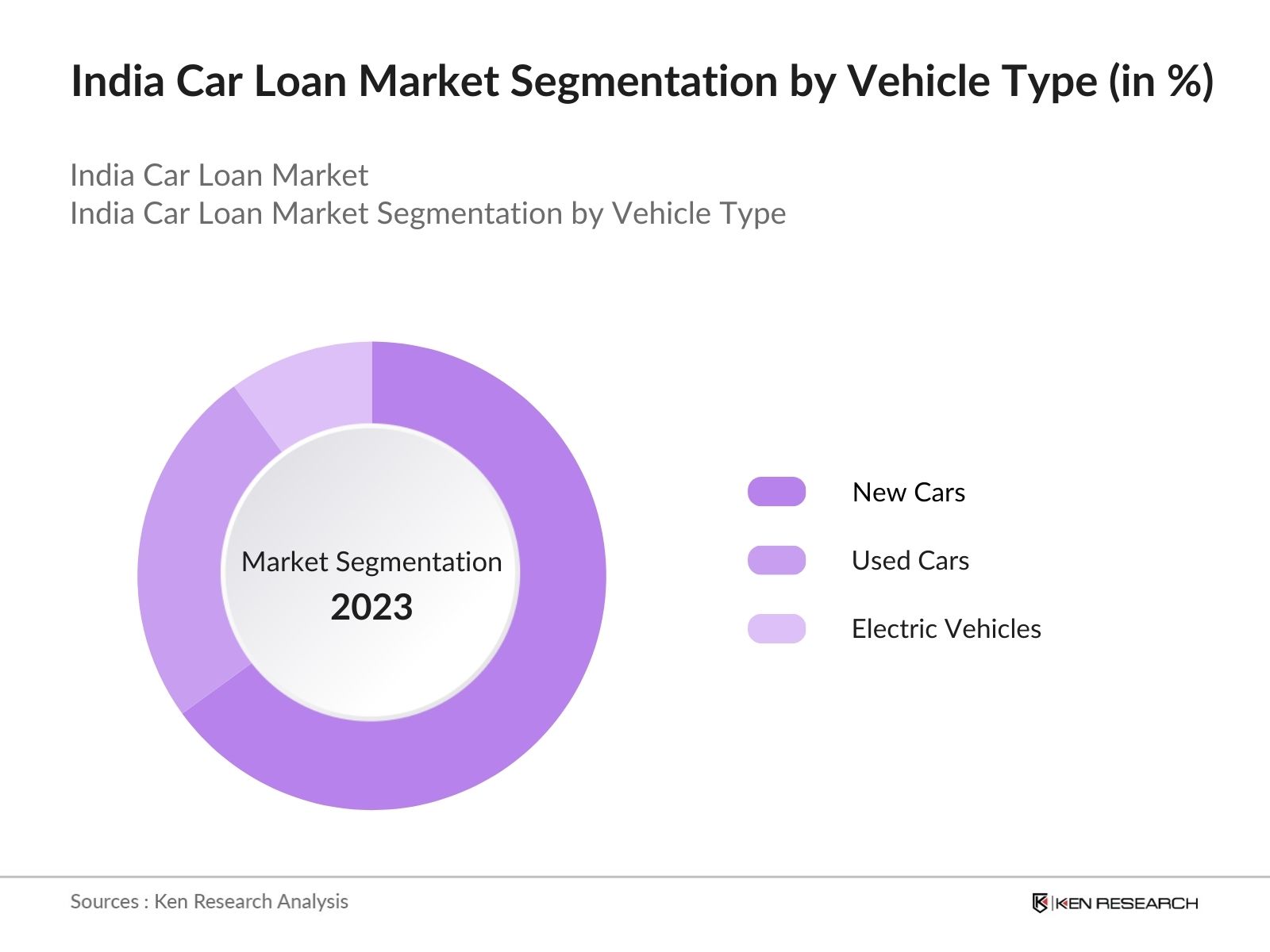

By Vehicle Type: The market is segmented into new cars, used cars, and electric vehicles. New cars dominate the market due to their affordability and favorable loan terms offered by both banks and non-banking financial companies (NBFCs). Consumers prefer new vehicles due to lower interest rates and the reliability of buying directly from authorized dealers. Additionally, the availability of vehicle financing from captive finance companies affiliated with major automobile manufacturers contributes to this dominance.

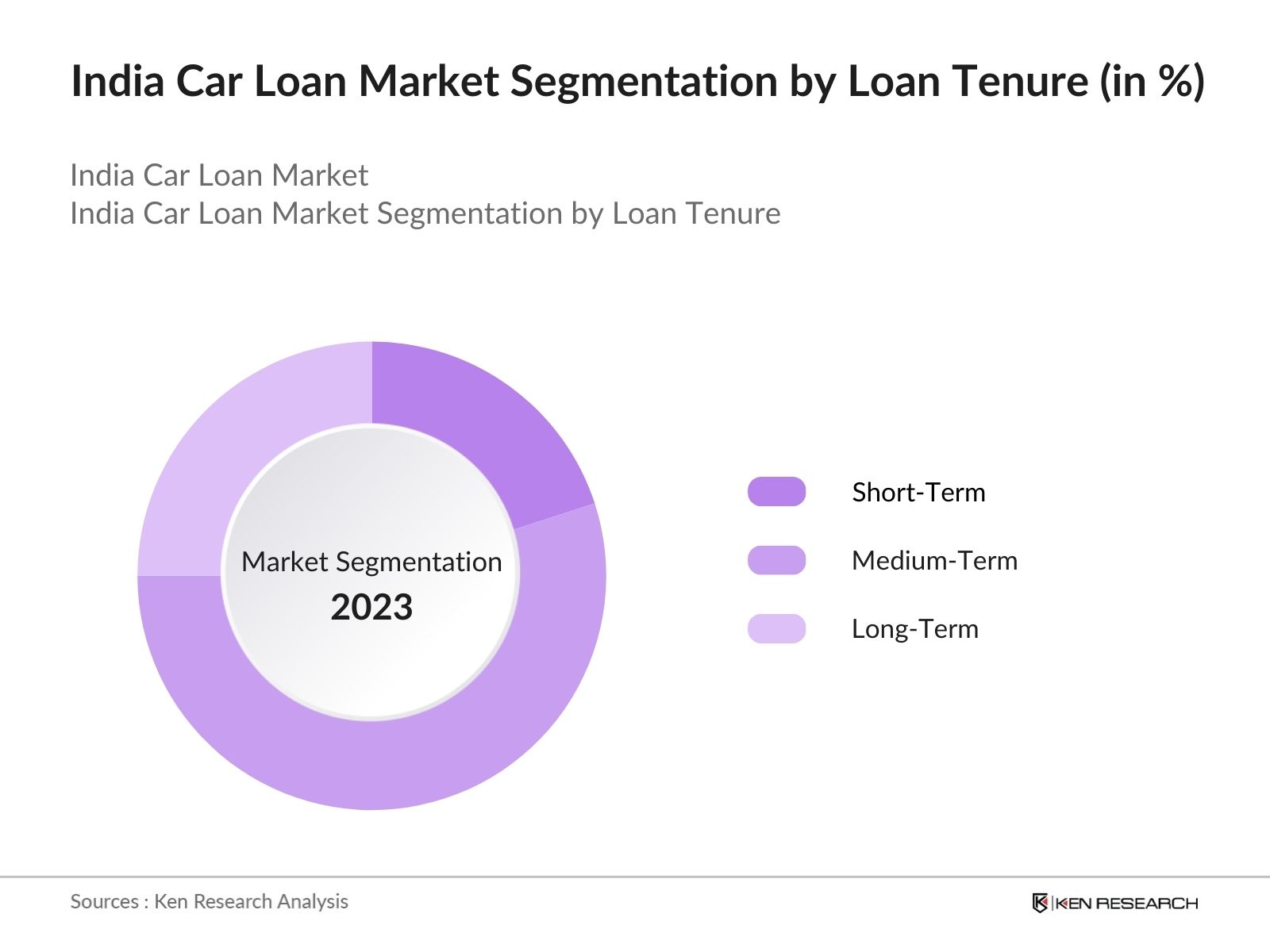

By Loan Tenure: The market is segmented into short-term loans (less than 3 years), medium-term loans (3-5 years), and long-term loans (more than 5 years). Medium-term loans dominate the market, as they offer a balance between manageable monthly payments and lower total interest. Consumers often choose this option to avoid the high interest rates associated with longer-term loans while still maintaining affordability.

India Car Loan Market Competitive Landscape

The market is marked by a mix of traditional financial institutions and emerging fintech platforms. Major players include public and private sector banks, non-banking financial companies (NBFCs), and digital lending platforms.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Loan Products |

Interest Rates |

Digital Platforms |

Customer Satisfaction |

Loan Approvals (in days) |

Partnerships (OEMs) |

|

State Bank of India |

1955 |

Mumbai |

|||||||

|

HDFC Bank |

1994 |

Mumbai |

|||||||

|

ICICI Bank |

1994 |

Mumbai |

|||||||

|

Mahindra Finance |

1991 |

Mumbai |

|||||||

|

Bajaj Finance |

1987 |

Pune |

India Car Loan Market Analysis

Market Growth Drivers

- Increasing Vehicle Ownership: The number of vehicles registered in India has been steadily increasing, with over 300 million registered motor vehicles as of 2024. As vehicle ownership expands, the demand for car loans also grows, with more individuals seeking financing options to purchase vehicles. This trend is supported by India's rising middle-class population, with millions of families seeking to upgrade from two-wheelers to cars.

- Government Push for Electric Vehicles (EVs): The Indian governments initiative to promote electric vehicles through subsidies under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II) scheme has resulted in increased demand for electric cars. By 2024, over 600,000 electric vehicles are expected to be sold annually, increasing the number of consumers seeking loans specifically for EVs.

- Rising Financial Penetration in Rural Areas: In 2024, over 60% of Indias population resides in rural areas. The expansion of banking services and the introduction of financial inclusion initiatives have enabled rural consumers to access car loans more easily. Public sector banks and private financial institutions are offering car loans to rural customers, with the number of rural car loans expected to surpass 2 million annually by 2024.

Market Challenges

- Volatility in Interest Rates: In 2024, the repo rate in India stands at 6.25%, with ongoing fluctuations impacting the cost of borrowing for car loans. High interest rates have resulted in higher EMIs for borrowers, discouraging many potential customers from opting for car loans. This interest rate volatility is particularly challenging for customers seeking long-term loans, as it increases the total cost of ownership.

- Stringent Loan Approval Criteria: Banks and financial institutions have tightened their credit evaluation processes due to rising NPAs. In 2024, over 25% of car loan applications are being rejected due to stricter credit assessments, with factors such as low credit scores, unstable income, and lack of proper documentation leading to higher rejections.

India Car Loan Market Future Outlook

Over the next five years, the India Car Loan industry is expected to grow, driven by government policies promoting electric vehicles (EVs), the continued rise in vehicle ownership, and the increasing penetration of digital lending platforms.

Future Market Opportunities

- Rise in Electric Vehicle Loan Disbursements: Over the next five years, the number of electric vehicle loans is expected to rise, with the Indian government targeting 30% of all vehicles sold to be electric by 2030. By 2029, over 2 million electric car loans are projected to be disbursed annually, spurred by lower interest rates, subsidies, and favorable loan terms from both public and private financial institutions.

- Expansion of Digital Loan Approvals: The digital transformation in the banking sector will lead to an estimated 60% of all car loans being approved through online platforms by 2028. Digital verification, faster loan processing, and increased penetration of internet banking in rural areas will streamline the car loan application process, making it easier for borrowers to access loans.

Scope of the Report

|

Vehicle Type |

New Cars Used Cars Electric Vehicles |

|

Loan Tenure |

Short-Term Medium-Term Long-Term |

|

Provider Type |

Banks NBFCs Fintech Platforms |

|

Borrower Profile |

Individual Borrowers Corporate Borrowers |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Car Dealerships

Original Equipment Manufacturers (OEMs)

Private Banks Equity

Non-Banking Financial Companies (NBFCs)

Government and Regulatory Bodies (Reserve Bank of India, Ministry of Finance)

Venture Capitalists and Investor Firms

Insurance Providers

Companies

Players Mentioned in the Report:

State Bank of India

HDFC Bank

ICICI Bank

Axis Bank

Mahindra Finance

Bajaj Finance

Tata Capital

Shriram Transport Finance

Toyota Financial Services India

IDFC First Bank

Table of Contents

India Car Loan Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics Overview

1.4 Market Segmentation Overview

India Car Loan Market Size (In USD Bn)

2.1 Historical Market Size (Value and Volume)

2.2 Year-on-Year Growth Analysis

2.3 Key Developments and Milestones

India Car Loan Market Analysis

3.1 Growth Drivers

3.1.1 Rise in Vehicle Ownership (Urban vs Rural)

3.1.2 Expanding Middle-Class Population

3.1.3 Favorable Interest Rates (Banks vs NBFCs)

3.1.4 Increased Adoption of Digital Platforms

3.2 Market Challenges

3.2.1 High Borrowing Costs for Low-Credit Borrowers

3.2.2 Limited Vehicle Valuation Standards (Used Cars)

3.2.3 Lack of Financial Inclusion for Tier 2-3 Cities

3.3 Opportunities

3.3.1 Expansion in Used Car Financing

3.3.2 Electric Vehicle Financing (EV Incentives)

3.3.3 Innovations in Digital Lending Platforms

3.4 Trends

3.4.1 Increasing Focus on Customer Satisfaction (Personalized Lending Solutions)

3.4.2 Rise in AI-Powered Underwriting

3.4.3 Growth in EV Financing Models (Battery Leasing)

3.5 Government Regulations

3.5.1 RBI Lending Guidelines

3.5.2 EV Subsidies and Incentives

3.5.3 Data Privacy and Consumer Protection Laws

3.6 SWOT Analysis

3.7 Competitive Landscape (Market Consolidation)

3.8 Porters Five Forces Analysis

India Car Loan Market Segmentation

4.1 By Type of Vehicle (In Value %)

4.1.1 New Cars

4.1.2 Used Cars

4.1.3 Electric Vehicles (EVs)

4.2 By Loan Tenure (In Value %)

4.2.1 Short-Term Loans

4.2.2 Medium-Term Loans

4.2.3 Long-Term Loans

4.3 By Provider Type (In Value %)

4.3.1 Banks

4.3.2 Non-Banking Financial Companies (NBFCs)

4.3.3 Fintech and Online Lenders

4.4 By Borrower Profile (In Value %)

4.4.1 Individual Borrowers

4.4.2 Corporate Borrowers

4.5 By Region (In Value %)

4.5.1 North

4.5.2 East

4.5.3 West

4.5.4 South

India Car Loan Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 State Bank of India (SBI)

5.1.2 HDFC Bank

5.1.3 ICICI Bank

5.1.4 Axis Bank

5.1.5 Kotak Mahindra Prime

5.1.6 Mahindra Finance

5.1.7 Bajaj Finance

5.1.8 Tata Capital

5.1.9 Shriram Transport Finance Co.

5.1.10 IDFC First Bank

5.1.11 Toyota Financial Services India

5.1.12 Bank of Baroda

5.1.13 Punjab National Bank (PNB)

5.1.14 LIC Housing Finance

5.1.15 Lendingkart (Fintech)

5.2 Cross Comparison Parameters (Loan Approval Time, Interest Rates, Digital Process Integration, Market Share, Customer Satisfaction)

5.3 Market Share Analysis (Banks vs NBFCs)

5.4 Strategic Initiatives (New Product Launches, Collaborations)

5.5 Mergers and Acquisitions

5.6 Investment and Funding Analysis

5.7 Venture Capital and Private Equity Activity

India Car Loan Market Regulatory Framework

6.1 RBI and SEBI Guidelines

6.2 Data Protection and Privacy Regulations

6.3 EV Subsidies and Incentives

India Car Loan Future Market Size (In USD Bn)

7.1 Future Market Projections

7.2 Key Factors Influencing Future Market Growth

India Car Loan Future Market Segmentation

8.1 By Vehicle Type

8.2 By Loan Tenure

8.3 By Provider Type

8.4 By Borrower Profile

8.5 By Region

India Car Loan Market Analyst Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Retention Strategies (Digital Tools)

9.3 Market Expansion Opportunities (Tier 2-3 Cities)

9.4 White Space Opportunities in EV Financing

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping all the major stakeholders in the Indian car loan market, including banks, NBFCs, and OEM-affiliated financial arms. We use comprehensive desk research, leveraging proprietary databases, to identify key variables such as loan interest rates, digital transformation trends, and consumer demographics.

Step 2: Market Analysis and Construction

In this phase, historical data on car loan approvals, interest rates, and market penetration rates are analyzed. This helps us estimate the growth trajectory and assess market demand across various segments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed from the data are validated through interviews with key industry players, including loan officers from banks and executives from leading NBFCs. This helps refine our market estimates and ensures the accuracy of our projections.

Step 4: Research Synthesis and Final Output

Finally, insights are gathered through direct consultations with car manufacturers and their financing arms to ensure a comprehensive, validated analysis of loan products, consumer behavior, and market dynamics.

Frequently Asked Questions

01. How big is the India Car Loan Market?

The India car loan market is valued at USD 24 billion, driven by rising vehicle ownership and a growing middle class seeking affordable car financing options.

02. What are the challenges in the India Car Loan Market?

Challenges in the India car loan market include high borrowing costs for consumers with poor credit, lack of standardized valuation for used vehicles, and limited access to car loans in Tier 2-3 cities.

03. Who are the major players in the India Car Loan Market?

Key players in the India car loan market include State Bank of India, HDFC Bank, ICICI Bank, Mahindra Finance, and Bajaj Finance, all offering competitive loan terms and embracing digital platforms to enhance customer experience.

04. What are the growth drivers of the India Car Loan Market?

The India car loan market is driven by increasing demand for personal vehicles, government support for electric vehicle financing, and the rise of digital lending platforms that streamline the loan approval process.

05. How is digital transformation affecting the India Car Loan Market?

Digital transformation, including the use of mobile apps and AI-powered underwriting, has reduced loan approval times and improved customer experience, contributing to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.