India Construction Chemicals Market Outlook to 2028

Driven by the Merger Acquisition of the existing players, rising demand, higher FDI inflow in Indian Construction Market

Region:Asia

Author(s):Chitra Vasu and Mukul Biradar

Product Code:KR1331

June 2023

156

About the Report

The report provides a comprehensive analysis of the potential of Construction Chemicals Industry in India. The report covers an overview and genesis of the industry, market size in terms of revenue generated.

The report has market segmentation which include segmentsby Revenue (Organized, Unorganized), by Categories (Concrete Admixtures, Waterproofing, Sealants & Tile Adhesives, Flooring, Repair & Rehabilitation, Grouting Chemicals & Others, Coatings, Others), by End-User (Infrastructure, Residential, Commercial), by Region (North, South, East, West), growth enablers and drivers; challenges and bottlenecks; trends driving adoption trends; regulatory framework; end-user analysis, industry analysis, competitive landscape including competition scenario and market shares of major players. The report concludes with future market projections of each market segmentation and analyst recommendations.

Market Overview:

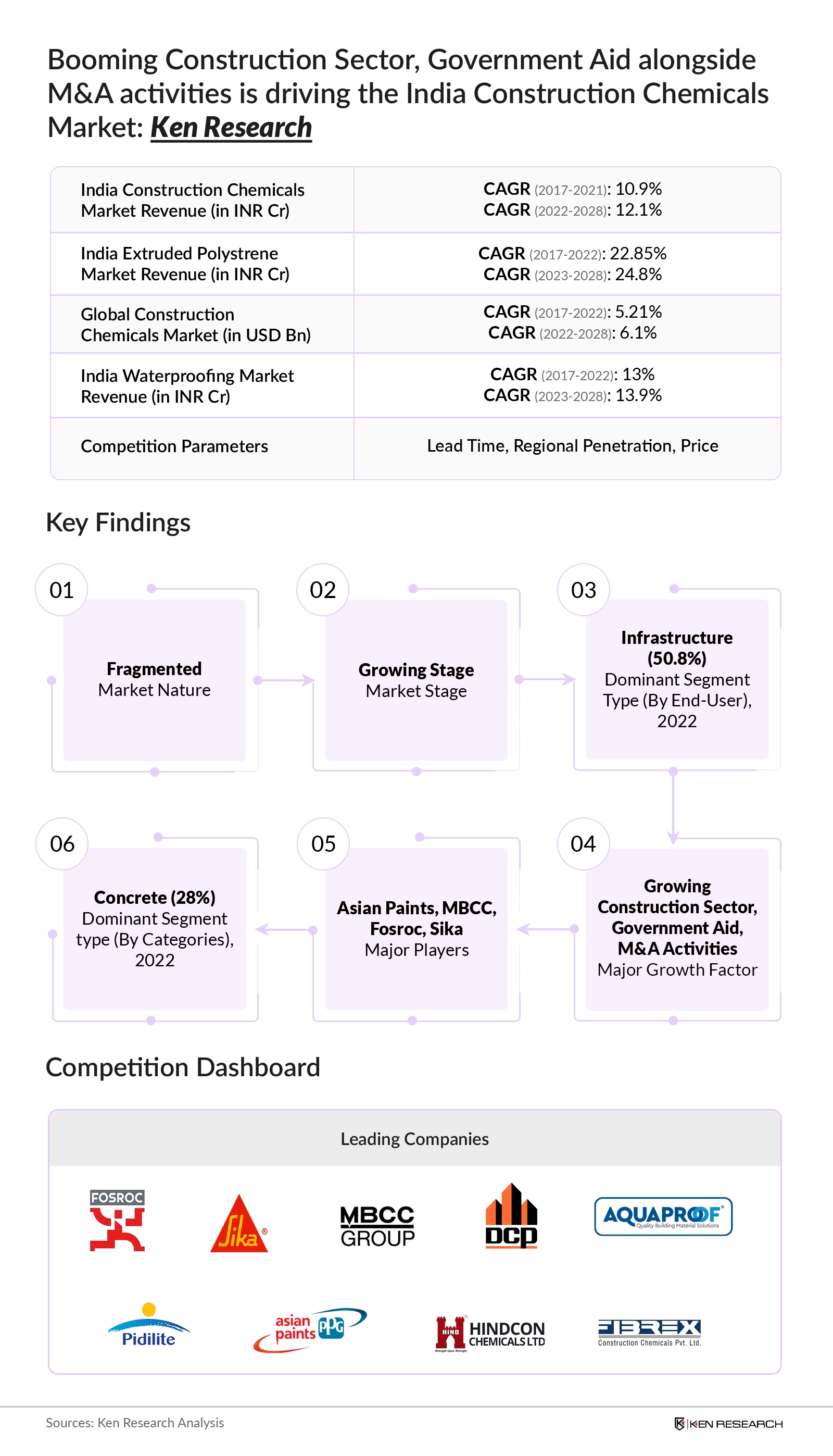

According to Ken Research estimates, the Market Size of India Construction Chemicals has shown increasing trend from 2017 to 2022. However, drop was observed in 2020. This is owing to fear and social distance among service providers during pandemic. Market Size of Construction Chemicals market is expected to show a decent growth trajectory from 2022 to 2028 at CAGR of 12.1%. This is mainly due to rapid infrastructural development which has led to services being able to reach previously un-accessible regions.

- The boost in market growth of Construction Chemicals in India has been supported by the rising urbanization and government measures to revitalize rural areas, as well as infrastructural development.

- New Innovations such as Multipurpose & Hybrid Coating, eco-friendly products for instance Nano-Coating, Green Coating for fire protection and anti-corrosion fueled the sales.

Key Trends by Market Segment:

By Revenue: Organized Market dominated the trade scenario in 2022 capturing more than half of the share.

By End-User: Infrastructure captured a major chunk of the market with more than half share.

Competitive Landscape:

Future Outlook:

Market Size of India Construction Chemicals Market is expected to show increasing trend from 2021 to 2026. This is owing to a booming construction sector, government aid alongside M&A activities which has resulted in increasing sales. Moreover, a huge number of market players have resulted in increasing competition leading to product innovation & development.

Scope of the Report

|

India Construction Chemicals Market Segmentation |

|

|

By Revenue |

Organized Unorganized |

|

By Categories |

Concrete Admixtures Waterproofing Sealants & Tile Adhesives Flooring Repair & Rehabilitation Grouting Chemicals Coatings Others |

|

By Type of End User |

Infrastructure Residential Commercial |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

- Construction Companies

- Engineers

- Industrial & Commercial Companies

- Distributers & Retailers

- Infrastructure Consultants & Research Institutions

Time Period Captured in the Report:

- Historical Period: 2017-2022

- Base Year: 2022

- Forecast Period: 2022-2028

Companies

Companies Mentioned in the Report:

- Pidilite

- Asian Paints

- MBCC Group

- Sika

- Fosroc

- Bostik

- Mapei

- Ardex Endura

- Saint Gobain

- STP Limited

- MYK Laticrete

- Jotun

- MYK Arment

- Tremco

- Kerakoll

- Asian Paints PPG

- Zydex

- Sunanda

- Fairmate

- Choksey

- Chryso

Table of Contents

1. Executive Summary

1.1 Executive Summary: Global Construction Chemicals Market, 2022-2028

1.2 India Construction Chemicals Market Product Taxonomy

1.3 India Construction Chemicals Market Sizing Analysis, FY’17-FY’28

1.4 Executive Summary: India Construction Chemicals Market By Sub-Segmentations, FY’22

1.5 Executive Summary: India Construction Chemicals Market by Sub-Segmentations, FY’28

1.6 1Executive Summary: India Construction Chemicals Market By Sub-Segmentations, FY’22-FY’28

1.7 1Market Share of Major Players in the Organized India Construction Chemicals Market, FY’22

1.8 Market Share of Major Players in the Organized India Construction Chemicals Market, FY’22

1.9 Executive Summary: Extruded Polystyrene Market, FY’19-FY’28

2. Global Construction Chemicals Market Overview

2.1 Market Size Analysis of Global Construction Chemicals Market, 2017-2028

2.2 Segmentation By Type of Construction Chemicals, 2022

2.3 Global Construction Chemical Market Size By Region, 2022

2.4 Future Segmentation By Type of Construction Chemicals and By Region, 2028

2.5 Market Overview of Construction Chemicals Market By Countries: Nepal, Bangladesh, Maldives, Philippines and Indonesia

2.6 Market Size Analysis of Construction Chemicals Market By Countries: Nepal, Bangladesh, Maldives,

Philippines and Indonesia, 2019-2022

2.7 Cross Comparison of Major Players in Global Construction Chemicals Industry

2.8 Cross Comparison of Major Chinese Players in Global Construction Chemicals Industry

3. India Construction Chemicals Market Overview

3.1 Business Cycle and Genesis of India Construction Chemicals Market

3.2 India Construction Chemicals Market Ecosystem

3.3 Supply Side: Value Chain Analysis

3.4 Business Channel Analysis and Value Chain Challenges

4. Trade Scenario of India Construction Chemicals Market

4.1 Import Scenario, FY’17-FY’23

4.2 Export Scenario, FY’17-FY’23

4.3 Construction Chemicals Import Data By Construction Chemicals, FY’22

5. India Construction Chemicals Market Size and Segmentations

5.1 Market Sizing Analysis of India Construction Chemicals Market, FY’17-FY’22

5.2 Segmentation By Organized and Unorganized Market, FY’22

5.3 Segmentation By Type of Construction Chemicals, FY’22

5.4 Segmentation By Region, FY’22

5.5 Segmentation By States, FY’22

6. India Construction Chemicals Market Sub-Segmentations

6.1 Segmentation By Type of Concrete Admixtures, FY’22

6.2 Segmentation By Type of Sealants and Tile Adhesives, FY’22

6.3 Segmentation By Type of Industrial Flooring, FY’22

6.4 Segmentation By Type of Repair and Rehabilitation, FY’22

6.5 Segmentation By type of Grouting & Others, FY’22

6.6 Segmentation By Type of Protective Coating Chemicals, FY’22

7. India Waterproofing Chemicals Market Size and Segmentations

7.1 Market Sizing Analysis of India Waterproofing Chemicals Market, FY’17-FY’22

7.2 Segmentation By Type of Waterproofing Chemicals, FY’22

7.3 Segmentation By Type of Liquid and Membrane Waterproofing Chemicals, FY’22

7.4 Segmentation By Type of Membrane Waterproofing Chemicals, FY’22

8. End User Analysis of India Construction Chemicals Market

8.1 Segmentation By Type of End Users, FY’22

8.2 Cluster Analysis of End User Sector, FY’22

8.3 National Infrastructure Pipeline, FY’22-FY’25

8.4 Indian Real Estate Sector Snapshot

8.5 India Residential Sector Snapshot, H1 FY’23

8.6 India Commercial Office Sector Snapshot, H1 FY’23

9. Industry Analysis of India Construction Chemicals Market

9.1 Porter’s Five Forces Analysis of India Construction Chemicals Market

9.2 SWOT Analysis of India Construction Chemicals Market

9.3 Factors impacting the Growth of the India Construction Chemicals Market

9.4 Growth Drivers and Enablers in India Construction Chemicals Market

9.5 Challenges and Bottleneck in India Construction Chemicals Market

9.6 Recent trends & Developments in India Construction Chemicals Market

9.7 Government Initiatives in India Construction Chemicals Market

9.8 Raw Materials Used in India Construction Industry

10. Competition Analysis of India Construction Chemicals Market

10.1 Market Share of Major Players in the Organized India Construction Chemicals Market, FY’22

10.2 1Market Share of Major Organized Players in the Concrete Admixtures, FY’22

10.3 1Market Share of Major Organized Players in the Sealants and Tile Adhesives, FY’22

10.4 1Market Share of Major Organized Players in the Industrial Flooring, FY’22

10.5 Market Share of Major Organized Players in the Repair and Rehabilitation, FY’22

10.6 Market Share of Major Organized Players in the Grouting and others, FY’22

10.7 Market Share of Major Organized Players in the Protective Coatings, FY’22

10.8 Market Share of Major Organized Players in the Waterproofing, FY’22

10.9 Financial Analysis of India Construction Chemicals Market, FY’22

11. Cross Comparison of Major Players in India Construction Chemicals Market

11.1 Cross Comparison of Major Players in India Construction Chemicals Market

11.1 1Product Landscape Analysis of India Construction Chemicals Market

11.3 Retail Pricing Landscape of India Construction Chemicals Market

12. Financial Analysis of Major Players in India Construction Chemicals Market

12.1 Financial Cross Comparison of Major Companies in India Construction Chemicals Market

12.2 Current Ratio Analysis for Major Players, FY’22

12.3 Capex Analysis for Major Players, FY,22

12.4 Inventory Turnover Ratio Analysis for Major Players, FY’22

12.5 Financial Analysis for Major Players, FY’22

13. India Extruded Polystyrene Market (XPS Market)

13.1 Market Sizing Analysis of Extruded Polystyrene Market, FY’19-FY’28F

13.2 1Value Chain of Extruded Polystyrene Market

13.3 Pricing Analysis and Sales Channel Analysis

13.4 1Segmentation By Applications, FY’22

13.5 Segmentation by End Users, FY’22

13.6 Segmentation by Region, FY’22

13.7 1Future Segmentation y Applications, FY’28

13.8 Future Segmentation by Applications, FY’28

13.9 Future Segmentation by Applications, FY’28

14. Future Outlook of India Construction Chemicals Market Size and Segmentations

14.1 Future Market Sizing Analysis of India Construction Chemicals Market, FY’22-FY’28

14.2 Future Segmentation by Organized and Unorganized Market and By Type of Construction

Chemicals, FY’22

14.3 1Future Segmentation by Type of Construction Chemicals, FY’28

14.4 Future Segmentation by Region, FY’28

14.5 End Users Future Outlook in Construction Chemicals Industry

14.6 Industry Insights on Future Outlook of India Construction Chemicals Market

14.7 Government Initiatives, 2025

14.8 End Users Future Outlook in Construction Chemicals Industry

15. Future Outlook of India Construction Chemicals Market Sub-Segmentations

15.1 Future Segmentation By Type of Concrete Admixtures, FY’28

15.2 Future Segmentation by Type of Sealants and Tile Adhesives, FY’28

15.3 Future Segmentation by Type of Industrial Flooring, FY’28

15.4 Future Segmentation by Type of Repair and Rehabilitation, FY’28

15.5 Future Segmentation by Type of Grouting and others, FY’28

15.6 Future Segmentation by Type of Protective Coatings, FY’28

16. Future Outlook of India Waterproofing Chemicals Market Size and Segmentations

16.1 Future Market Sizing Analysis of India Waterproofing Chemicals Market, FY’22-FY’28

16.2 Future Segmentation by Organized and Unorganized Market, FY’28

16.3 Future Segmentation by Type of Waterproofing Chemicals, FY’28

16.4 Future Segmentation by Type of Liquid Waterproofing Chemicals, FY’28

16.5 Future Segmentation by Type of Membrane Waterproofing Chemicals, FY’28

16.6 Future Segmentation by Type of Bituminous Waterproofing Chemicals, FY’28

17. Analyst Recommendations

17.1 Product Mapping in India Construction Chemicals Market

17.2 Product Penetration in India Construction Chemical Market

17.3 Target addressable Market V/s Service Obtainable Market

17.4 Logistics Ease of Construction Chemical by Region

17.5 Ideal Sector to Target in India Construction Chemical Market

17.6 Green and Bio-Based Construction Chemicals

17.7 Factors Influencing the Purchase Decision of End Users

17.8 Areas of Improvement

17.9 Business Model Canvas

17.20 Recommendations for Digital Penetration

17.21 Next Phase

18. Research Methodology

18.1 Construction Chemicals Product Taxonomy

18.2 1Market Definitions and Assumptions

18.3 Market Abbreviations

18.4 Market Sizing Approach

18.5 Consolidated Research Approach

18.6 Primary Research Approach

18.9 Sample-Size Inclusion

18.10 Limitations and Future Conclusion

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on India construction chemicals market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India’s construction chemicals market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple construction chemicals providing channels and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from construction chemicals providers.

Frequently Asked Questions

01 How big is the India Construction Chemicals Market?

In 2022, the India Construction Chemicals Market was valued at USD 2.2 billion.

02 What is the future of the construction chemical industry in India?

The future market size of the India Construction Chemicals market is expected to reach USD 3.75 Bn in the forecasted period of 2023-2028 with a CAGR of 13.9 %.

03 Which are the Major construction chemical manufacturers in India?

Pidilite, Asian Paints, MBCC Group, Sika, and Fosroc are some of the leading manufacturers operating in the India Construction Chemicals Market.

04 Which is the largest chemical distributor in India?

Vimal Group of Companies, founded in 1986 is currently ranked as one of the top global distribution companies by ICIS and one of the biggest specialty chemical distributors in India.

05 What are the latest trends in the India Construction Chemicals Market?

Green and Sustainable Construction, High-Performance Admixtures, and Waterproofing Solutions are some of the key trends in the India Construction Chemicals Market.

06 What are the growth drivers of the India Construction Chemicals Market?

The Merger Acquisition of the existing players, rising demand, higher FDI inflow in industry are some of the major growth drivers of the India Construction Chemicals market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.