India Corn Flour Market Outlook to 2028

Region:Asia

Author(s):Sudhanshu Maheshwari

Product Code:KROD6573

March 2025

80-100

About the Report

India Corn Flour Market Overview

- The India corn flour market has experienced notable growth, driven by increasing consumer awareness of health benefits associated with corn-based products. Its Market Size reached USD 1.47 Billion according to five year historic analysia. Corn flour is rich in dietary fiber, vitamins, and minerals, making it a popular choice among health-conscious consumers. Additionally, the rising trend of gluten-free diets has further propelled the demand for corn flour in India.

- Major corn-producing states such as Karnataka, Andhra Pradesh, and Maharashtra play a significant role in the corn flour market due to their favorable agro-climatic conditions and established agricultural infrastructure. These regions contribute substantially to the raw material supply, ensuring steady production and distribution of corn flour across the country.

- The FSSAI mandates strict quality standards for maize (corn) flour, including moisture below 14%, ash content under 1.25%, and 98% particle passage through a 500-micron sieve. Non-compliance leads to market rejections, penalties, and recalls, driving manufacturers to enhance quality control, ensuring consumer trust and a competitive market.

India Corn Flour Market Segmentation

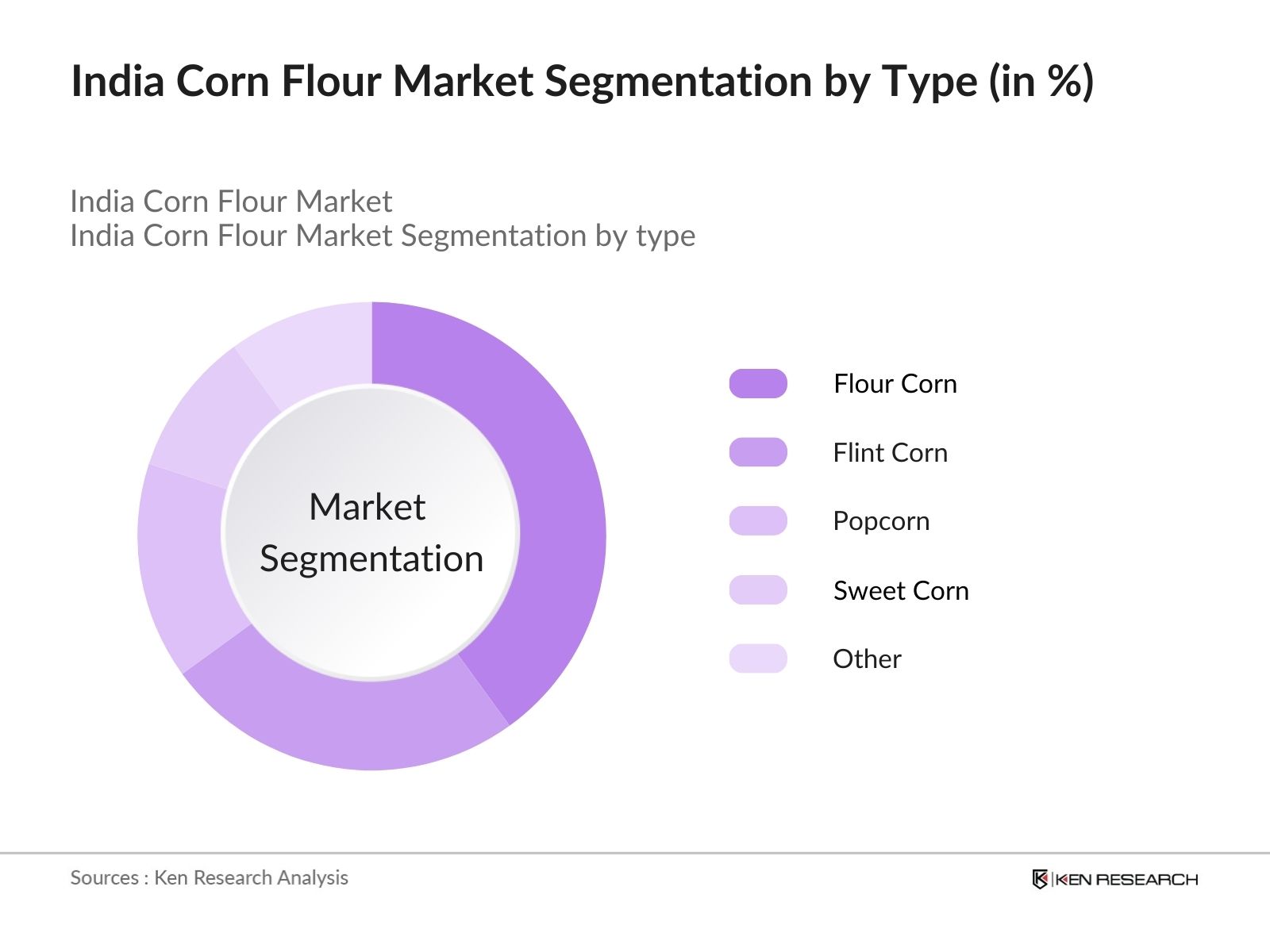

- By Type: The India corn flour market is segmented by type into flint corn, popcorn, sweet corn, flour corn, and others. Flour corn holds a dominant market share under this segmentation, primarily due to its soft starch content, which makes it ideal for milling into fine flour. This type of corn is preferred for producing various food products, including tortillas, cornbread, and other baked goods, catering to the diverse culinary preferences across different regions in India.

- By End User: The market is also segmented by end users into direct consumption, poultry & cattle feed, processed food, and others. The processed food segment dominates the market share in this category, attributed to the burgeoning food processing industry in India. Corn flour's versatility and functional properties make it a preferred ingredient in snacks, bakery products, and convenience foods, aligning with the evolving consumer demand for ready-to-eat and easy-to-prepare food items.

India Corn Flour Market Competitive Landscape

The competitive landscape of the India corn flour market is marked by the presence of both domestic and international players. Companies like Gujarat Ambuja Exports Ltd. and Cargill India Pvt. Ltd. have established significant market shares due to their extensive production capacities, diverse product portfolios, and robust distribution networks. Their adherence to international quality standards and continuous investment in research and development have further solidified their positions in the market.

India Corn Flour Market Analysis

Growth Drivers

-

Rising Demand for Gluten-Free Products: Increasing prevalence of gluten intolerance and celiac disease, affecting approximately 6-8 million people in India, has accelerated demand for gluten-free alternatives such as corn flour. Notably, the gluten-free packaged food segment in India registered nearly 20-25% annual growth in recent years. Domestic corn flour producers have expanded product lines, increasing retail distribution significantly across supermarkets, online platforms, and specialty health-food stores nationwide.

- Increasing Consumption of Corn-based Snacks: Indias urban population has grown substantially, surpassing 500 million by 2024, driving increased snack food consumption. The production volume of corn-based snacks, including tortilla chips, nachos, and taco shells, has surged by around 15-18% annually. Moreover, manufacturers introduced over 50 new corn-based snack products in 2024 alone, directly boosting corn flour demand, particularly among young adults and school-going children.

- Growing Demand from Ethanol Production: India ethanol-blending policy significantly escalated domestic corn consumption, utilizing approximately 3.5 million tons of corn to produce 1.35 billion liters of ethanol in 2024nearly fourfold growth compared to 2023. This strategic diversion of corn has tightened domestic supply, pushing corn prices up by about 25-30%, consequently influencing raw material costs and pricing dynamics across corn-dependent sectors, including corn flour production.

Market Challenges

- Technical Challenges: The maize processing industry in India faces technical challenges related to the adoption of advanced technologies and processes. The National Institute of Food Technology Entrepreneurship and Management (NIFTEM) highlights that prior to technological advancements post-2000, industries depended on imported maize, which was costly and hindered industrial growth. Although progress has been made, continuous technological upgrades are necessary to maintain competitiveness and efficiency in maize processing.

- Lack of Skilled Workforce: The flour milling industry in India requires a skilled workforce to operate advanced machinery and adhere to food safety standards. The Food Safety Management System (FSMS) guidance document by FSSAI emphasizes the need for trained personnel to ensure compliance with food safety regulations. However, there is a shortage of adequately trained professionals in the industry, leading to operational inefficiencies and potential compromises in product quality.

India Corn Flour Market Future Outlook

Over the next five years, the India corn flour market is expected to exhibit substantial growth, driven by increasing consumer demand for gluten-free and healthy food options. The expansion of the food processing industry, coupled with innovations in product development, is anticipated to create new opportunities for market players. Additionally, supportive government policies and initiatives aimed at enhancing agricultural productivity are likely to contribute to the market's positive trajectory.

Market Opportunities

- Technological Advancements Enhancing Production Efficiency: Indias corn flour industry can leverage advanced processing technologies, such as automated milling systems and precision agriculture tools, to enhance productivity. According to ICAR, adopting single-cross hybrid maize technology has already increased average maize yields from 1.9 tons/hectare in 2000 to over 3.2 tons/hectare by 2023, reflecting nearly 68% improvement. Further integration of smart-farming solutions is expected to increase production efficiency by another 15-20% by 2028.

- International Collaborations Unlocking Global Market Access: Strategic partnerships with global institutions can enable Indias corn flour manufacturers to adopt international quality standards and expand export capabilities. The FAO predicts that urban populations worldwide will reach 68% by 2050, significantly reshaping agrifood demand. Collaborations providing exposure to advanced agritech and sustainable food-processing techniques could help Indian producers achieve up to 20-25% export growth within the next five years, tapping into emerging markets, particularly in Asia-Pacific and Middle Eastern regions.

Scope of the Report

|

By Type |

Flint Corn |

|

By End User |

Direct Consumption |

|

By Distribution Channel |

Supermarkets/Hypermarkets |

|

By Application |

Bakery and Confectionery |

|

By Region |

North |

Products

Key Target Audience

- Corn Flour Manufacturers

- Food and Beverage Companies

- Animal Feed Producers

- Retailers and Distributors

- Food Processing Industries

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Companies

Major Players Mentioned in the Report

- Gujarat Ambuja Exports Ltd.

- Roquette India Pvt. Ltd.

- The Sukhjit Starch & Chemicals Ltd.

- Cargill India Pvt. Ltd.

- ADM Agro Industries India Pvt. Ltd.

Table of Contents

1. Market Overview

1.1. Definition and Scope (Corn Flour Definition, Market Boundaries)

1.2. Market Taxonomy (Classification by Type, End-User, Region)

1.3. Market Growth Rate (CAGR, Historical and Projected)

1.4. Market Segmentation Overview (Summary of Segments)

2. Market Size (In USD Billion)

2.1. Historical Market Size (Past Revenue and Volume)

2.2. Year-On-Year Growth Analysis (Annual Growth Rates)

2.3. Key Market Developments and Milestones (Notable Events, Product Launches)

3. Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Consciousness

3.1.2. Rising Demand for Gluten-Free Products

3.1.3. Increasing Consumption of Corn-based Snacks

3.1.4. Growing Demand from Ethanol Production

3.2. Restraints

3.2.1. Availability of Substitutes

3.2.2. Fluctuating Corn Prices

3.2.3. Limited Awareness in Rural Areas

3.3. Opportunities

3.3.1. Technological Advancements Enhancing Production Efficiency

3.3.2. International Collaborations Unlocking Global Market Access

3.4. Trends

3.4.1. Adoption of Organic Corn Flour

3.4.2. Innovative Packaging Solutions

3.4.3. Integration of Corn Flour in Gourmet Recipes

3.5. Government Regulation

3.5.1. Food Safety Standards

3.5.2. Import and Export Policies

3.5.3. Subsidies and Support for Corn Farmers

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Market Segmentation

4.1. By Type (In Value %)

4.1.1. Flint Corn

4.1.2. Popcorn

4.1.3. Sweet Corn

4.1.4. Flour Corn

4.1.5. Others

4.2. By End User (In Value %)

4.2.1. Direct Consumption

4.2.2. Poultry & Cattle Feed

4.2.3. Processed Food

4.2.4. Others

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Convenience Stores

4.3.3. Online Retail

4.3.4. Others

4.4. By Application (In Value %)

4.4.1. Bakery and Confectionery

4.4.2. Snack Food

4.4.3. Others

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. West

4.5.4. East

5. Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Cargill India Pvt Ltd

5.1.2. Gujarat Ambuja Exports Ltd

5.1.3. Roquette India Pvt Ltd

5.1.4. Maharashtra Hybrid Seeds Co. (Mahyco)

5.1.5. Sukhjit Starch & Chemicals Ltd

5.1.6. Universal Starch-Chem Allied Ltd

5.1.7. Gulshan Polyols Ltd

5.1.8. Riddhi Siddhi Gluco Biols Ltd

5.1.9. Shree Gajanan Industries

5.1.10. Tirupati Starch & Chemicals Ltd

5.1.11. HL Agro

5.1.12. Vishnupriya Chemicals Pvt Ltd

5.1.13. The Sukhjit Starch & Chemicals Ltd

5.1.14. Sayaji Industries Ltd

5.1.15. Gulshan Polyols Ltd

5.2. Cross Comparison Parameters (Production Capacity, Revenue, Market Share, Geographic Presence, Product Portfolio, R&D Investments, Employee Strength)

5.3. Market Share Analysis (Market Concentration, Dominant Players)

5.4. Strategic Initiatives (Partnerships, Product Launches, Expansions)

5.5. Mergers and Acquisitions (Recent Deals and Consolidations)

5.6. Investor Analysis (Top Investors, Funding Rounds)

5.7. Venture Capital Funding (Investment Trends, Startups in Corn Flour Industry)

5.8. Government Grants (Subsidies, Financial Support for Farmers and Processors)

5.9. Private Equity Investments (Market Attractiveness for Investors)

6. Regulatory Framework

6.1. Food Safety and Standards (FSSAI, AGMARK, BIS Regulations)

6.2. Import and Export Guidelines (Trade Tariffs, Government Policies)

6.3. Subsidies and Incentives (Government Support for Corn Cultivation and Processing)

7. Future Market Size (In USD Billion)

7.1. Future Market Size Projections (Growth Rate Forecasts)

7.2. Key Factors Driving Future Growth (Urbanization, Expanding Food Processing Industry)

8 . Future Market Segmentation

8.1. By Type (In Value %)

8.1.1 Flint Corn

8.1.2 Popcorn

8.1.3 Sweet Corn

8.1.4 Flour Corn

8.1.5 Others

8.2. By End User (In Value %)

8.2.1 Direct Consumption

8.2.2 Poultry & Cattle Feed

8.2.3 Processed Food

8.2.4 Others

8.3. By Distribution Channel (In Value %)

8.3.1 Supermarkets/Hypermarkets

8.3.2 Convenience Stores

8.3.3 Online Retail

8.3.4 Others

8.4. By Application (In Value %)

8.4.1 Bakery and Confectionery

8.4.2 Snack Food

8.4.3 Others

8.5. By Region (In Value %)

8.5.1 North

8.5.2 South

8.5.3 West

8.5.4 East

9. Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

9.2. Customer Cohort Analysis (Consumer Buying Patterns, Market Segments)

9.3. Marketing Initiatives (Branding, Retail Promotions, Online Campaigns)

9.4. White Space Opportunity Analysis (Untapped Markets, Emerging Trends)

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research begins with an ecosystem mapping of the India Corn Flour Market, identifying major stakeholders such as manufacturers, distributors, regulatory bodies, and end-users. Extensive desk research is conducted using secondary sources, including industry reports, government publications, and proprietary databases. This stage ensures the identification of critical market variables such as market size, growth trends, production output, consumption patterns, and regulatory frameworks.

Step 2: Market Analysis and Data Collection

This phase involves a detailed analysis of historical market data, including production volumes, trade statistics, and consumer demand. Primary research through industry surveys and in-depth interviews with market participants is also conducted. Additionally, supply chain assessments, competitive positioning, and pricing analysis are performed to ensure a well-rounded understanding of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

To validate initial findings, structured interviews are conducted with key industry players, regulatory officials, and market analysts. These expert consultations help refine revenue projections, understand competitive dynamics, and verify market constraints and opportunities. Computer-assisted telephone interviews (CATI) and focus group discussions with industry veterans play a crucial role in data verification.

Step 4: Research Synthesis and Final Report Compilation

The final stage involves synthesizing primary and secondary research insights into a comprehensive market report. Data triangulation is performed to ensure accuracy, and the bottom-up approach is utilized to validate the market size and future projections. The final output includes detailed market segmentation, growth forecasts, and strategic recommendations for market participants.

Frequently Asked Questions

01. How big is the India Corn Flour Market?

The India Corn Flour Market is valued at USD 1.47 billion, driven by increasing demand from the processed food and animal feed industries. The market has witnessed consistent growth over the years, supported by advancements in corn milling technology and the rising adoption of gluten-free diets.

02. What are the challenges in the India Corn Flour Market?

Challenges in the India Corn Flour Market include price volatility of raw materials, increasing competition from alternative flours (such as wheat and rice flour), and regulatory constraints on food safety standards. Additionally, inadequate storage and supply chain inefficiencies impact market expansion.

03. Who are the major players in the India Corn Flour Market?

Key companies operating in the India Corn Flour Market include Gujarat Ambuja Exports Ltd., Roquette India Pvt. Ltd., The Sukhjit Starch & Chemicals Ltd., Cargill India Pvt. Ltd., and ADM Agro Industries India Pvt. Ltd. These companies dominate the market due to strong production capacity, advanced R&D investments, and extensive distribution networks.

04. What are the growth drivers of the India Corn Flour Market?

The India Corn Flour market is driven by rising consumer awareness regarding gluten-free diets, the expansion of the processed food industry, and increased demand from the animal feed sector. Government support in the form of agricultural subsidies and policies has further strengthened market growth.

05. What is the future outlook for the India Corn Flour Market?

The India Corn Flour Market is expected to experience steady growth in the coming years, fueled by increasing urbanization, expanding retail penetration, and innovations in food processing technologies. The rise of organic and fortified corn flour is also anticipated to create new opportunities for market players.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.