India EdTech Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD4306

November 2024

88

About the Report

India EdTech Market Overview

- The India EdTech market is valued at USD 5.13 billion, reflecting a robust growth trajectory driven by several factors. The market's expansion can be primarily attributed to the increasing internet penetration, widespread adoption of smartphones, and the digitization of education spurred by initiatives like the National Education Policy (NEP). Additionally, the demand for upskilling, reskilling, and test preparation through online platforms has surged, further driving the market size. The transition to online learning platforms is no longer limited to urban centers, with tier 2 and tier 3 cities increasingly contributing to market growth.

- The EdTech sector in India is predominantly led by cities such as Bengaluru, Hyderabad, and Mumbai. These cities host a large number of startups, access to venture capital, and government-backed innovation hubs. Bengaluru, often referred to as Indias Silicon Valley, is home to several EdTech giants like BYJUs and Unacademy, benefiting from its tech-driven ecosystem. Hyderabads strategic focus on technology and education also makes it a strong player, while Mumbai serves as a financial and investment hub, supporting the growth of EdTech companies.

- The NEP 2020 has laid the foundation for a transformative shift in Indian education by focusing on technology integration. By 2024, its impact has been evident, with over 100,000 schools incorporating digital tools for both students and teachers. The policy mandates technology-enabled learning, ensuring digital literacy is a core component of education. This regulatory shift continues to drive the growth of the EdTech market, fostering an environment that encourages innovation and the adoption of new learning technologies.

India EdTech Market Segmentation

The India EdTech market can be segmented by product type and by deployment mode.

- By Product Type: The market is segmented by product type into K-12 education, higher education, vocational training, corporate learning, and test preparation. Test preparation services, including platforms like BYJUs and Unacademy, dominate the product type segment. These platforms have built a strong brand reputation, primarily driven by the high-stakes nature of competitive exams in India. The increasing pressure on students to succeed in exams like JEE, NEET, and UPSC has resulted in a steady demand for online test preparation services, especially in metro cities and now expanding to rural areas.

- By Deployment Mode: The market is also segmented by deployment mode into cloud-based and on-premises solutions. Cloud-based platforms dominate this segment due to the scalability and flexibility they offer. Cloud-based solutions allow EdTech providers to deliver education content to a wider audience, regardless of location, and to update the content in real-time. The COVID-19 pandemic significantly accelerated the adoption of cloud-based learning, making it the preferred choice for institutions, students, and professionals seeking continuous education.

India EdTech Market Competitive Landscape

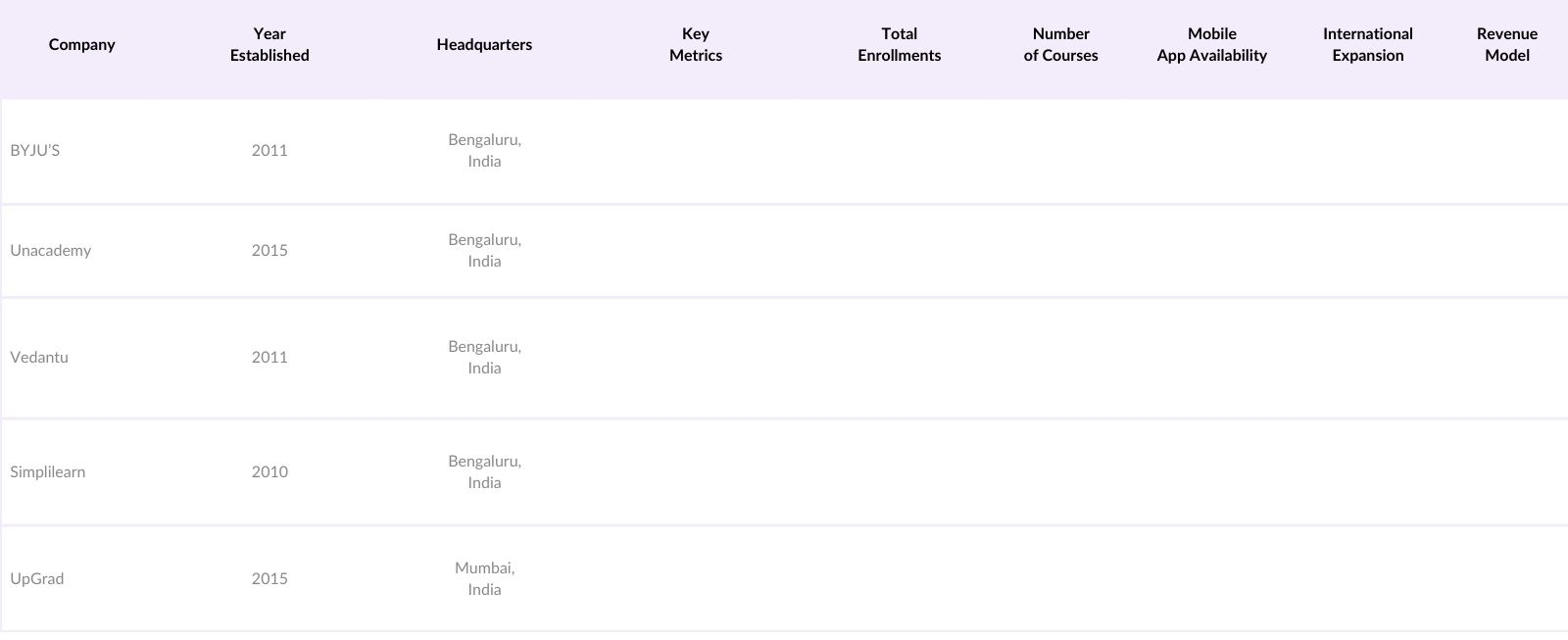

The EdTech market in India s dominated by a few major players who have established themselves as leaders in the digital learning space. These companies are leveraging technology, partnerships, and funding to scale their offerings across India and internationally. The competitive landscape is characterized by constant innovation, heavy investment in research and development, and the integration of artificial intelligence and machine learning to personalize learning experiences. Leading players include:

India EdTech Industry Analysis

Market Growth Drivers

- Digital Adoption (EdTech Platform Growth): The rapid rise in digital adoption in India has fueled significant growth in the EdTech market. As of 2024, India has over 800 million internet users, with rural internet connectivity increasing due to government-backed initiatives such as BharatNet. The surge in digital infrastructure has resulted in the extensive use of online learning platforms, which have seen unprecedented growth since 2022. Platforms like SWAYAM and Diksha have enabled over 33 million students and educators to access digital resources. This growth is expected to stabilize as more platforms emerge, addressing the growing demand for quality digital education across India.

- Increased Internet Penetration (Access to Online Learning): India has experienced a significant increase in internet penetration, with over 750 million mobile internet users in 2024. The availability of affordable data plans has enabled students, particularly from rural areas, to access digital learning resources. Rural penetration has reached over 38%, improving access to online learning across Tier 2 and Tier 3 cities. The government has been a key player in increasing digital access through its Digital India initiative, supporting education through e-learning platforms like e-Pathshala and SWAYAM. This rise in connectivity directly supports the growth of the EdTech sector.

- Government Initiatives (NEP 2020, SWAYAM, Diksha): The Indian government has played a crucial role in promoting EdTech through policies such as the National Education Policy (NEP) 2020. NEP emphasizes digital literacy and includes provisions to integrate EdTech in the education system. Platforms like SWAYAM and Diksha, launched under government initiatives, have witnessed massive adoption, with over 58 million registered users on SWAYAM by 2024. The push for digital learning through NEP's reforms is fostering a nationwide shift towards technology-driven education, encouraging hybrid learning and improving educational inclusivity.

Market Challenges

- Affordability in Tier 2 and Tier 3 Cities (Pricing Sensitivity): Despite the widespread use of EdTech platforms, affordability remains a critical barrier in Tier 2 and Tier 3 cities. The average household income in these regions is below 15,000 per month, making it difficult for families to pay for premium digital learning resources. Government initiatives, such as the Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA), are attempting to bridge this gap, but the challenge of pricing sensitivity persists, with many EdTech providers offering tiered pricing models to accommodate lower-income users.

- Low Engagement Rates (EdTech Course Completion): One of the critical challenges faced by the Indian EdTech market is the low engagement and completion rates for online courses. While millions enroll in digital learning platforms, less than 25% of students complete the courses they begin. Factors contributing to this low engagement include a lack of personalized learning experiences and inadequate access to learning resources in lower-income regions. Platforms are exploring ways to enhance user engagement through interactive content and gamification, but this remains a significant hurdle in realizing the full potential of EdTech.

India EdTech Market Future Outlook

Over the next five years, the India EdTech market is poised to experience substantial growth, driven by continuous government support, technological advancements, and a growing demand for digital education solutions across diverse segments. The increasing emphasis on lifelong learning and the integration of AI-powered learning tools are expected to redefine the landscape of education in India. As more individuals from rural areas gain access to digital education, the market will likely witness expansion in untapped regions, providing further momentum to the sector.

Market Opportunities

- Growing Demand for Skill Development (Vocational Learning): India is witnessing a growing demand for skill development, particularly in vocational education. As of 2024, over 30 million students are enrolled in vocational courses to enhance their employability. The governments Skill India initiative has significantly contributed to this rise, with over 15 million youths trained under the program since its inception. This surge in vocational learning provides a substantial growth opportunity for EdTech platforms to offer skill development courses that align with the growing demand for industry-relevant education.

- International Collaborations with Global Universities: Collaborations between Indian EdTech platforms and global universities are becoming more prominent, offering students access to international education from prestigious institutions. By 2024, more than 100 partnerships between Indian EdTech companies and international universities have been established. These collaborations provide students with globally recognized certifications and access to world-class academic resources, offering significant market growth opportunities. This trend is further fueled by NEP 2020, which encourages internationalization in Indian education.

Scope of the Report

|

K-12 Education Higher Education Vocational Training Corporate Learning Test Preparation |

|

|

By Deployment Mode |

Cloud-Based On-Premises |

|

By Learning Mode |

Synchronous Learning Asynchronous Learning Blended Learning |

|

By End-User |

Students Corporates Educational Institutions |

|

By Region |

North East West South |

Products

Key Target Audience

Venture Capital and Private Equity Firms

Government and Regulatory Bodies (Ministry of Education, AICTE, UGC)

EdTech Platforms

Corporate Training Providers

Vocational Training Institutions

Banks and Financial Institutes

Educational Content Creators

K-12 and Higher Education Schools

Technology Solution Providers

Companies

Major Players in the India EdTech Market

BYJUS

Unacademy

Vedantu

UpGrad

Simplilearn

Great Learning

Toppr

Classplus

LEAD School

WhiteHat Jr

Embibe

Educomp Solutions

Khan Academy India

Coursera India

Meritnation

Table of Contents

1. India EdTech Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India EdTech Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India EdTech Market Analysis

3.1. Growth Drivers

3.1.1. Digital Adoption (EdTech Platform Growth)

3.1.2. Increased Internet Penetration (Access to Online Learning)

3.1.3. Government Initiatives (NEP 2020, SWAYAM, Diksha)

3.1.4. Increased Smartphone Usage (Mobile Learning Penetration)

3.2. Market Challenges

3.2.1. Affordability in Tier 2 and Tier 3 Cities (Pricing Sensitivity)

3.2.2. Low Engagement Rates (EdTech Course Completion)

3.2.3. Lack of Skilled Educators for Digital Platforms

3.3. Opportunities

3.3.1. Growing Demand for Skill Development (Vocational Learning)

3.3.2. International Collaborations with Global Universities

3.3.3. Expansion of B2B EdTech Offerings (Corporate Learning)

3.4. Trends

3.4.1. Gamification in Education

3.4.2. AI and Machine Learning Integration (Adaptive Learning)

3.4.3. Rise of Hybrid Learning Models (Blended Learning)

3.5. Government Regulation

3.5.1. National Education Policy (NEP) 2020 Reforms

3.5.2. Public-Private Partnerships in Digital Education

3.5.3. EdTech Accreditation Frameworks

3.5.4. State-Level Educational Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Institutions, Startups, Government Bodies)

3.8. Porters Five Forces (Market Competition, Supplier and Buyer Power, etc.)

3.9. Competitive Landscape (EdTech Platform Providers, Content Providers)

4. India EdTech Market Segmentation

4.1. By Type (In Value %)

4.1.1. K-12 Education

4.1.2. Higher Education

4.1.3. Vocational Training

4.1.4. Corporate Learning

4.1.5. Test Preparation

4.2. By Deployment Mode (In Value %)

4.2.1. Cloud-Based

4.2.2. On-Premises

4.3. By Learning Mode (In Value %)

4.3.1. Synchronous Learning

4.3.2. Asynchronous Learning

4.3.3. Blended Learning

4.4. By End-User (In Value %)

4.4.1. Students

4.4.2. Corporates

4.4.3. Educational Institutions

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. West

4.5.4. East

5. India EdTech Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BYJUS

5.1.2. Unacademy

5.1.3. Vedantu

5.1.4. UpGrad

5.1.5. Toppr

5.1.6. Simplilearn

5.1.7. Great Learning

5.1.8. Embibe

5.1.9. WhiteHat Jr

5.1.10. Meritnation

5.1.11. Classplus

5.1.12. LEAD School

5.1.13. Educomp Solutions

5.1.14. Khan Academy India

5.1.15. Coursera India

5.2. Cross Comparison Parameters (Headquarters, Revenue, Total Students Enrolled, Monthly Active Users, Market Share, Learning Format, Mobile App Availability, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Digital Expansion, Partnerships, Investments)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. India EdTech Market Regulatory Framework

6.1. Digital Education Policies

6.2. Compliance and Accreditation Requirements

6.3. Certification Programs for EdTech Platforms

7. India EdTech Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India EdTech Market Analysts' Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Learner Behavior Analysis

8.3. Marketing Strategies for EdTech

8.4. White Space Opportunities in Tier 2 and Tier 3 Cities

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the key stakeholders in the India EdTech market, such as EdTech providers, government bodies, and investors. Comprehensive desk research was conducted using secondary sources, including industry reports and databases, to identify critical market drivers, challenges, and growth trends.

Step 2: Market Analysis and Construction

Historical data from 2018 to 2023 was compiled to analyze market growth, adoption rates, and digital learning penetration. This stage also focused on understanding the revenue models of EdTech companies, with detailed analysis on subscription models, advertising revenues, and B2B partnerships.

Step 3: Hypothesis Validation and Expert Consultation

Consultations were conducted with key industry experts from prominent EdTech platforms to validate hypotheses related to market size, consumer behavior, and technological integration. These consultations provided actionable insights on the scalability and market expansion strategies of the key players.

Step 4: Research Synthesis and Final Output

In the final phase, insights gathered from both secondary data sources and primary consultations were synthesized to create a comprehensive market report. The findings were cross-validated to ensure accuracy and consistency in the final output, providing a holistic view of the India EdTech market.

Frequently Asked Questions

01. How big is the India EdTech Market?

The India EdTech market is valued at USD 5.13 billion, driven by increasing digital adoption, growing demand for test preparation services, and the rise of upskilling platforms.

02. What are the key challenges in the India EdTech Market?

Challenges in India EdTech market include affordability for users in rural areas, lack of engagement in digital courses, and regulatory hurdles. The shortage of skilled educators for online platforms also poses significant challenges to market growth.

03. Who are the major players in the India EdTech Market?

India EdTech market Major players include BYJUS, Unacademy, Vedantu, Simplilearn, and UpGrad. These companies dominate the market due to their extensive product offerings, strong brand presence, and growing subscriber base.

04. What are the growth drivers of the India EdTech Market?

The India EdTech market is driven by the adoption of digital learning platforms, government initiatives like NEP 2020, the rise of internet penetration, and the increasing demand for test preparation and vocational training services.

05. How is the corporate learning segment performing in the India EdTech Market?

Corporate learning is growing rapidly as companies invest in upskilling and reskilling their workforce to stay competitive. The demand for flexible, on-demand training programs has significantly contributed to the growth of this segment.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.