India Electric Control Panel Market Outlook to 2030

Region:Asia

Author(s):Khushi Khatreja

Product Code:KR1465

January 2025

95

About the Report

India Electric Control Panel Market Overview

- The India Electric Control Panel market is valued at INR 4028.2 Cr, based on a five-year historical analysis. The growth of this market is driven by rapid urbanization, increased industrialization, and government initiatives promoting energy-efficient solutions. Integrating renewable energy systems and advanced automation technologies further fuels market expansion, particularly in sectors like manufacturing, real estate, and power generation.

- Major metropolitan cities such as Mumbai, Delhi, and Bangalore dominate the market due to their high concentration of industries, real estate developments, and advanced infrastructure projects. These cities act as hubs for technological adoption and serve as focal points for investment in automation and energy-efficient solutions, enabling them to lead in market dominance.

- The Energy Security Initiative announced in India's 2024-2025 budget, which includes an investment of INR 68,769 crores for the establishment of an 800 MW Ultra Super Critical Thermal Power Plant through a joint venture between NTPC (National Thermal Power Corporation) and BHEL (Bharat Heavy Electricals Limited), represents a significant advancement in India's electric control panel market and broader energy landscape.

India Electric Control Panel Market Segmentation

India Electric Control Panel Market is segmented into type of control, and application.

- By Type of control: TheIndia Electric Control Panel Market is segmented by type of control into High tension and Low tension. Low Tension Panels dominate the market due to their widespread application in residential, commercial, and small-scale industrial setups. These panels are cost-effective, easier to install, and meet the operational needs of most low-voltage systems, making them a preferred choice across various sectors.

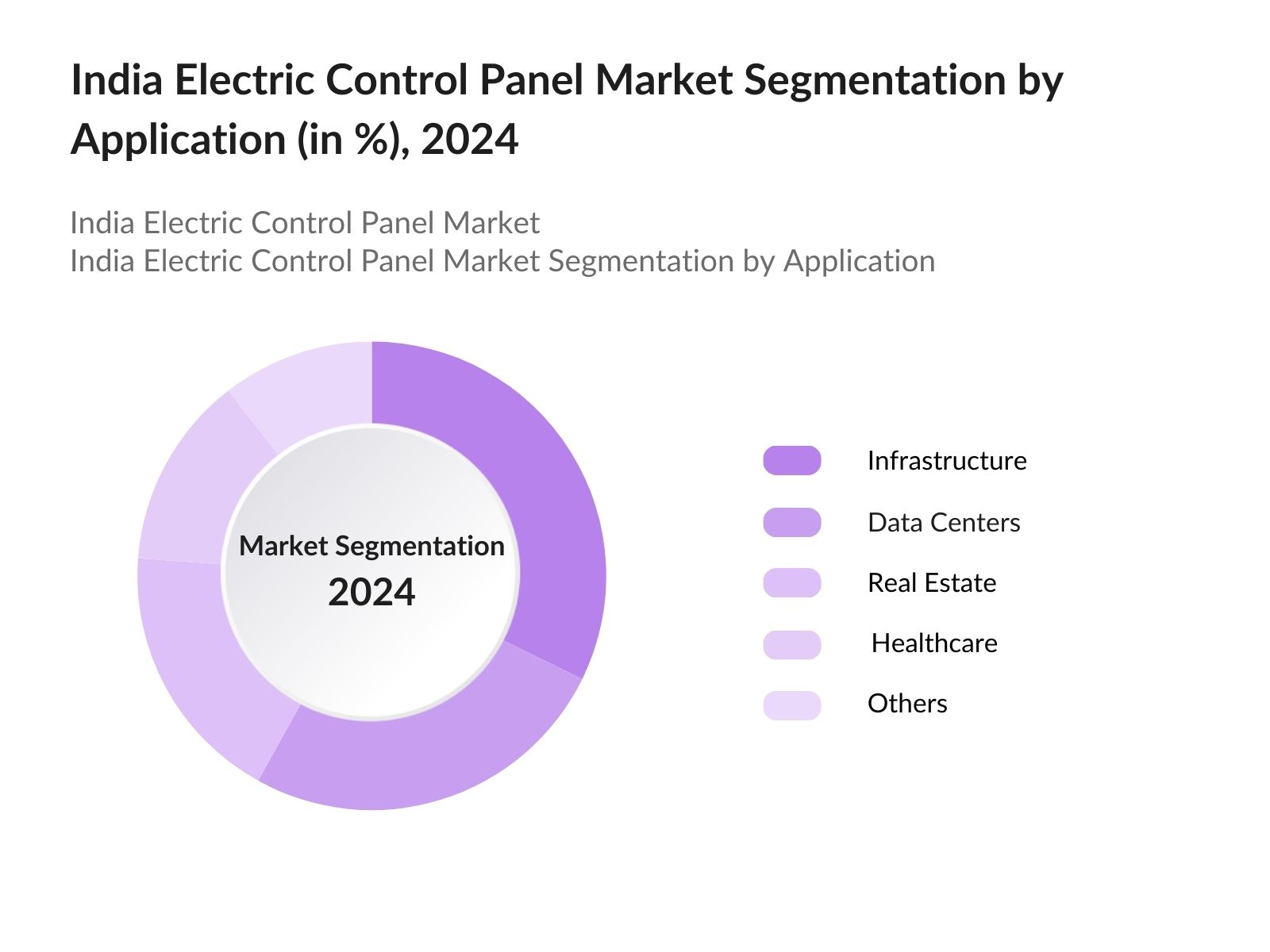

- By Application: The market is further segmented by application into infrastructure, data centers, real estate, healthcare, and others. Infrastructure holds the largest market share within this segmentation, primarily due to ongoing investments in smart city projects, public utilities, and industrial expansion. The demand for reliable and efficient electrical control systems in large-scale infrastructure projects drives the dominance of this segment.

India Electric Control Panel Market Competitive Landscape

The India Electric Control Panel market is characterized by the presence of a few dominant players who leverage their technological expertise, extensive distribution networks, and customer-centric strategies. These companies have established themselves through innovation, strategic partnerships, and investments in R&D.

India Electric Control Panel Industry Analysis

Market Growth Drivers

- Evolution of hybrid cloud technologies: The emergence ofhybrid cloud technologiesis fundamentally transforming IT infrastructure management in India, significantly increasing the demand for advanced electric control panels. In 2024, TCS signed a major agreement with Nuuday, Denmark's leading digital connectivity provider, to execute a complex cloud transformation strategy.

- Rising demand for factory automation: The evolution offactory automationis significantly transforming India's manufacturing sector, leading to a heightened demand for advanced electric control panels.ABB has investedINR 300 croresin developing these cobots, which are expected to revolutionize the manufacturing landscape by providing flexible automation solutions.

- Power sector boom: India's expanding power sector is driving significant demand for advanced electric control panels, fueled by investments in both conventional and renewable energy sources. In 2023, AGEL announced plans to invest around INR 75,000 crores in renewable energy projects over the next five years.

Market Challenges

- Lack of skilled professionals: Operating and maintaining sophisticated control panel systems necessitates skilled technicians and engineers. However, the shortage of qualified professionals in this sector can hinder effective implementation and utilization, ultimately impacting industry revenue due to technical challenges. The Indian government has recognized the skills shortage as a barrier to achieving its clean energy targets and has proposed increasing support for upskilling programs.

- Supply chain disruptions: Supply chain disruptions represent a significant challenge in India's electric control panel market. The availability of essential raw materials, such as semiconductors, steel, and wiring components, remains uncertain due to global shortages, trade barriers, and rising transportation costs. The ongoing conflict in Ukraine has exacerbated supply chain disruptions for many industries, including the electric control panel sector in India. The war has affected the availability of critical materials such as aluminum and steel, which are vital for manufacturing control panels.

India Electric Control Panel Future Market Outlook

Over the next five years, the India Electric Control Panel market is expected to experience substantial growth reaching a market size of INR 9096.3 Cr by 2030, driven by technological advancements, increased investment in renewable energy, and rising demand for smart infrastructure solutions. Government initiatives to upgrade the nations power infrastructure and encourage industrial automation will further bolster the market.

Market Opportunities

- Iot Enabled control panels and switchgear: The adoption of IoT-enabled control panels is transforming how industries manage their operations. These panels facilitate real-time monitoring and data analysis, allowing manufacturers to optimize processes, reduce downtime, and improve energy efficiency. By leveraging data analytics, these panels can predict potential equipment failures before they occur, minimizing downtime and enhancing productivity.

- Expansion in Smart Switchgear Technologies: The shift towards smart switchgear technologies is another significant trend impacting the electric control panel market. Smart switchgear incorporates advanced features such as remote monitoring, automated fault detection, and improved energy management capabilities. Siemens has launched innovative smart switchgear solutions in India that support digital transformation in electrical distribution systems.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Type of Control |

High Tension Panels Low Tension Panels |

|

By Application |

Infrastructure Data Centers Real Estate Healthcare Others (Educational Institutions, Retail, etc.) |

|

By Voltage Range |

Low Voltage (up to 1 kV) Medium Voltage (1 kV - 33 kV) High Voltage (Above 33 kV) |

|

By Component |

Switchgear Circuit Breakers Motor Control Centers Power Distribution Units Protection Relays |

|

By End-User Industry |

Residential Commercial Industrial Utilities |

|

By Technology |

Conventional Panels Smart Panels |

|

By Material Type |

Metal-Clad Panels Non-Metallic Panels |

|

By Power Source |

Renewable Energy-Based Panels Conventional Energy-Based Panels |

Products

Key Target Audience

- Industrial Automation Companies

- Power Generation Companies

- Construction and Real Estate Firms

- Energy Storage Solution Providers

- Government and Regulatory Bodies (Ministry of Power, Bureau of Indian Standards)

- Electrical Equipment Distributors

- Investors and Venture Capitalist Firms

- Renewable Energy Project Developers

Companies

Players Mentioned in the Report

- ABB India Ltd.

- Siemens Ltd.

- Schneider Electric India Pvt. Ltd.

- Larsen & Toubro Limited

- Havells India Ltd.

- Bharat Heavy Electricals Limited (BHEL)

- GE India Industrial Pvt. Ltd.

- Crompton Greaves Consumer Electricals Ltd.

- Legrand India

- HPL Electric & Power Ltd.

- Bajaj Electricals Ltd.

- Anchor Electricals Pvt. Ltd. (Panasonic)

- V-Guard Industries Ltd.

- KEI Industries Ltd.

- Polycab India Ltd.

Table of Contents

1. Executive Summary

1.1. India Electric Control Panel Market Overview

2. Research Methodology

2.1. Market Definitions

2.2. Abbreviations

2.3. Market Sizing and Modeling

2.3.1. Consolidated Research Approach

2.3.2. Limitations

2.3.3. Conclusion

3. Global Macroeconomic Landscape

3.1. Global Economic Landscape

3.2. Trade Policies & Tariffs

3.3. Interest Rates: Its Impact on Major Economies

3.4. Currency Dynamics Linked to US Dollar and Euro

4. Indian Economic Outlook Landscape

4.1. Overview of Indian Economic Environment

4.2. Government, Private Capital Expenditure & Initiatives Impacting the Energy Sector

4.3. FDI Flow, Investment Climate and Trends in India

4.4. Currency Dynamics Linked to Rupee-Dollar Exchange Rate

4.5. Energy Infrastructure Growth in India

4.6. India Power Generation & Consumption

4.6.1. India Electricity Production and Consumption Gap

4.6.2. Factor Influencing Power Demand in India

5. Indian Electric Control Panel Market Landscape

5.1. India Electric Control Panel Production & Consumption Gap

5.1.1. Delays in Projects due to Construction Halt

5.1.2. Regulatory Challenges

5.2. India Installed Capacity & Its Augmentation

5.3. Importance of Electric Control Panel in Key Industries

5.3.1. Infrastructure

5.3.2. Data Center

5.3.3. Real Estate

5.3.4. Healthcare

5.3.5. Manufacturing and Industrial Automation

6. Global Electric Control Panel Market Outlook

6.1. Global Electric Control Panel Market Size, FY'20, FY'24 & FY'30F

6.2. Regional Electric Control Panel Market Outlook

7. India Electric Control Panel Market Outlook

7.1. Indian Electric Control Panel Market Size FY'20 – FY'30F

7.2. India Electric Control Panel Market Segmentation by Type of Panels, FY'24 & FY'30F

7.2.1. Technological Landscape

7.2.1.1. High/Medium Voltage Control Panel

7.2.1.2. Low Voltage Control Panel

7.3. India Electric Control Panel Market Segmentation by Application, FY'24 & FY'30F

7.4. End User Industry - Growth Drivers

7.4.1. Infrastructure

7.4.1.1. Smart Road Infrastructure & Expanding Economic Corridors

7.4.1.2. Government Initiatives

7.4.1.3. Technological Advancements and Smart Infrastructure

7.4.1.4. Ports Gaining Momentum with Logistics Activities

7.4.1.5. Government Initiatives and Policy Framework

7.4.1.6. Technological Advancements and Automation

7.4.2. Data Center

7.4.3. Real Estate

7.4.3.1. Commercial Properties

7.4.3.2. Residential Properties

7.4.4. Healthcare

7.5. Factors Influencing Electrical Power Generation and Distribution Sector in India

7.5.1. Growth Drivers for Power Generation and Distribution Sector

7.5.2. Investments in Power Sector

7.5.3. Policy Push and Government Initiatives

8. India Bus Duct Trunking System Market Outlook

8.1. Overview of India Bus Duct Trunking System Market, FY’20 – FY’30F

9. India Electric Control Panel Market - Annual Maintenance Contract (AMC) Analysis

9.1. India Annual Maintenance Contract (AMC) Market Size for Control Panels

10. India Electric Control Panel Market Analysis

10.1. Key Growth Drivers of the India Electric Control Panel Market

10.1.1. Evolution of Hybrid Cloud Technologies

10.1.2. India Power Sector Boom

10.1.3. Rising Demand for Factory Automation

10.2. Key Trends in the India Electric Control Panel Market

10.2.1. Custom Industrial Control Panels

10.2.2. IoT Enabled Control Panels and Switchgear

10.2.3. Expansion in Smart Switchgear Technologies

10.3. Key Strengths in the India Electric Control Panel Market

10.3.1. Industrial Growth in India

10.3.2. Government Initiatives and Electrification Projects

10.3.3. Advances in Technology and Product Innovation

10.4. Key Challenges in the India Electric Control Panel Market

10.4.1. Lack of Skilled Professionals

10.4.2. Supply Chain Disruptions

10.4.3. Regulatory Compliance

10.5. Key Threats in the India Electric Control Panel Market

10.5.1. Cyberattacks in Power Generation Industry

10.5.2. Price Volatility

10.5.3. Technological Obsolescence

11. India Electric Control Panel Market Supply Chain Analysis

11.1. Overview of the Supply Chain for Panel Components

11.1.1. Complexity of Manufacturing

11.1.2. Quality Assurance in Component Manufacturing

11.1.3. Bottleneck

12. India Electric Control Panel Regulatory Landscape

12.1. International Electrotechnical Commission Standards

12.2. ISO Standards

12.3. Indian Standards (IS)

12.4. Electrical & Fire Safety Regulation

12.5. Environmental Regulation

12.6. Additional Certification Requirements

12.7. Testing & Certification Process in India

12.8. Documentation & Labelling Requirements

13. India Electric Control Panel Market Competition Analysis

13.1. Key Players in India Electric Control Panel Market

13.1.1. Positioning of Arrow Electricals

13.2. Cross-Comparison of Major Players

13.3. Key Competitors Financial KPIs

14. Conclusion – Way Forward

14.1. Future Market Growth Attractiveness of the Industry

14.2. Potential of Domestic Manufacturing & Assembly

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Major Players and Product Mapping

Identification of key players in the India Electric Control Panel market and categorization of their product offerings by panel type (e.g., Power Control Centers (PCC), Motor Control Centers (MCC), Distribution Panels, Instrumentation Panels, and VFD Panels). Market size is calculated using data from credible industry sources such as government publications, power sector reports, industry associations (e.g., IEEMA), and manufacturers sales data. Additional insights are obtained from industry white papers, market research reports, trade publications, and corporate filings to ensure comprehensive product mapping and competitive analysis.

Step 2: CATI (Computer-Assisted Telephonic Interviews)

Conduct CATIs with key stakeholders, including C-level executives from panel manufacturers, electrical contractors and consultants, representatives from industrial and commercial end-users, and distribution network representatives and power utilities. These interviews aim to uncover market demand dynamics across regions (e.g., North, South, East, West India), pricing trends, raw material costs (e.g., copper, steel), profit margins, adoption rates of advanced technologies like smart panels and IoT-enabled control systems, and end-user preferences across industries (e.g., manufacturing, real estate, energy, and infrastructure).

Step 3: Exhaustive Secondary Research

A Bottom-Up approach is employed to analyze market segmentation by panel type, voltage level (Low Voltage, Medium Voltage, High Voltage), and application sector (e.g., industrial, commercial, residential). Segmentation shares and market size are validated using manufacturer revenue data, government procurement statistics, and import/export records obtained from sources such as the Directorate General of Foreign Trade (DGFT). Secondary research also evaluates the penetration of automation, smart energy management solutions, and IoT-based monitoring in electric control panels. Regional factors, including power sector development, infrastructure projects, and government policies such as the "Make in India" initiative and renewable energy targets, are considered to ensure accurate market insights.

Step 4: Bottom-Up Market Estimation Approach

Validation steps include interviews with industry experts, electrical consultants, and distributors to cross-check findings. Proxy variables, such as industrial energy consumption, urbanization rates, real estate developments, and investments in smart grids and renewable energy infrastructure, are incorporated. Market drivers and restraints are also analyzed, considering factors such as the National Smart Grid Mission, increasing electrification, raw material price volatility, and competition from unorganized players. Demographic, economic, and technological indicators are factored in to refine segmentation shares and market size projections, aligning them with industry trends and macroeconomic conditions.

Frequently Asked Questions

01. How big is the India Electric Control Panel market?

The India Electric Control Panel market is valued at INR 4028.2 Cr, driven by rapid industrialization, urbanization, and technological advancements in automation and energy efficiency.

02. What are the challenges in the India Electric Control Panel market?

Challenges in India Electric Control Panel market include high initial costs, technical complexities in panel integration, and a lack of skilled workforce to manage advanced control systems.

03. Who are the major players in the India Electric Control Panel market?

Key players in India Electric Control Panel market include ABB India Ltd., Siemens Ltd., Schneider Electric India Pvt. Ltd., Larsen & Toubro Limited, and Havells India Ltd., known for their innovative products and strong distribution networks.

04. What drives growth in the India Electric Control Panel market?

Growth in India Electric Control Panel market is driven by infrastructure development, government initiatives promoting renewable energy, and the rising adoption of smart technologies in industrial and residential sectors.

05. What are the trends in the India Electric Control Panel market?

Trends in India Electric Control Panel market include the integration of IoT-enabled systems, energy-efficient solutions, and the development of customizable and modular panels to cater to diverse industrial requirements.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.