India Essential Oils Market Outlook to 2028

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD916

July 2024

85

About the Report

India Essential Oils Market Overview

- The India Essential Oils Market was valued at USD 175 million in 2023 growing at a CAGR of 6.50% between 2018-2023 driven by the increasing consumer awareness of the therapeutic benefits of essential oils, rising demand in the personal care and cosmetic industries.

- The India essential oils market is fragmented, Kancor Ingredients Limited, Synthite Industries Ltd, AOS Products Pvt. Ltd, and Plant Therapy Essential Oils are some of the key players in the market.

- In 2023, Synthite Industries Ltd announced the expansion of its manufacturing facility in Kerala, enhancing its production capacity by 20%. This development is expected to meet the growing domestic and international demand for essential oils.

India Essential Oils Current Market Analysis

- The essential oils market has positively impacted various sectors, including personal care, pharmaceuticals, and food and beverages. The increased use of essential oils in aromatherapy and therapeutic applications has driven the growth of the wellness and spa industries.

- In 2023, the southern region of India, particularly Kerala, dominated the essential oils market. Kerala's dominance is attributed to its favourable climatic conditions for growing essential oil-bearing plants.

- According to the Federation of Indian Chambers of Commerce and Industry (FICCI), demand for organic personal care products, including essential oils, increased by 15% in 2023. This growth is driven by rising awareness of health benefits and a shift towards sustainable, eco-friendly products.

India Essential Oils Market Segmentation

The India Essential Oils market is segmented by various factors like Product, Application, and Region.

By Product Type: India Essential Oils Market is segmented by product type into lavender oil, peppermint oil, tea tree oil, and eucalyptus oil. In 2023, lavender oil dominated the market due to its widespread use in aromatherapy, cosmetics, and personal care products. The increasing demand for stress relief and relaxation products has further bolstered the market for lavender oil.

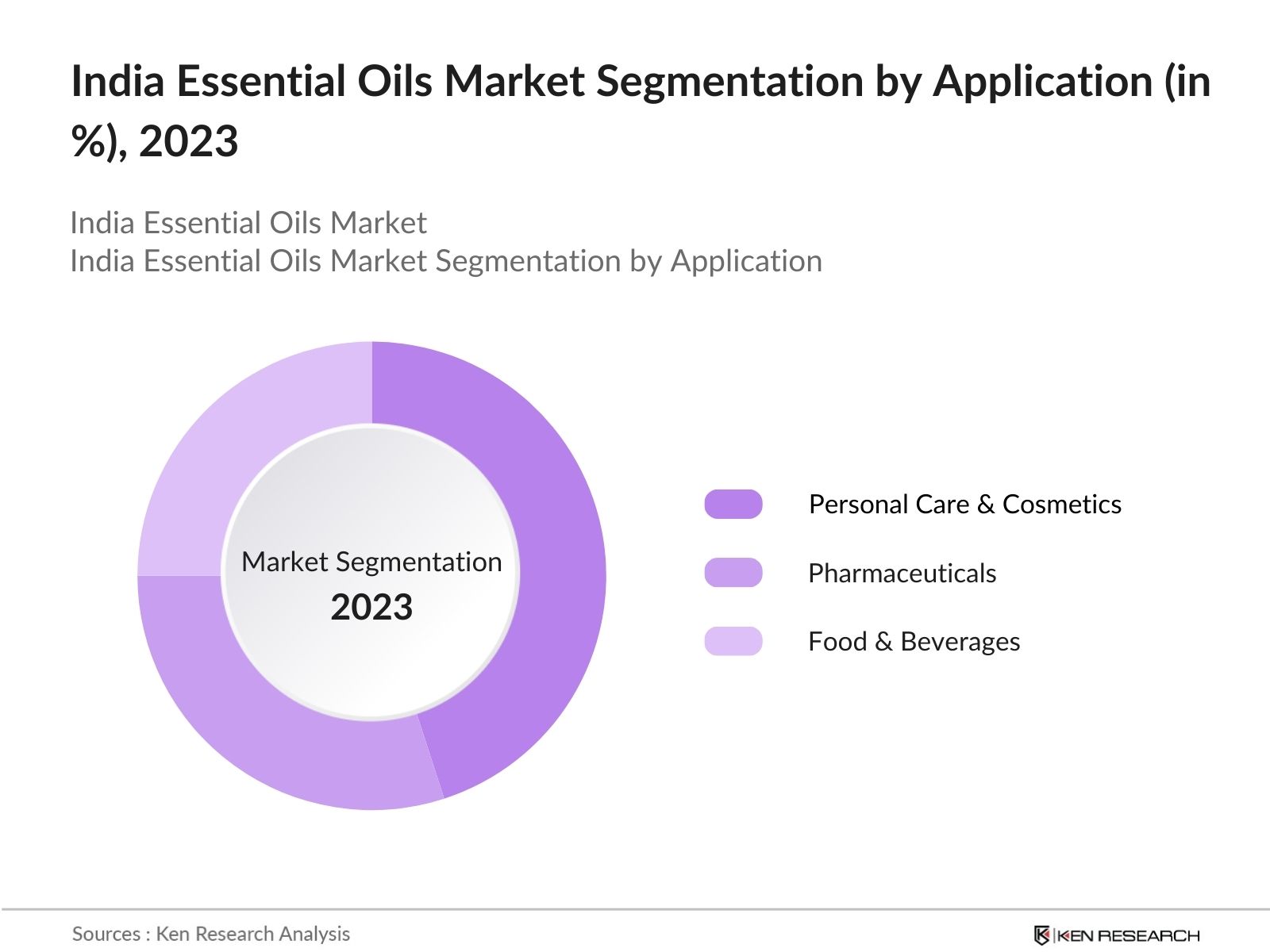

By Application: India Essential Oils Market is segmented by application into personal care and cosmetics, pharmaceuticals, and food and beverages. In 2023, the personal care and cosmetics segment dominated the market driven by the increasing consumer preference for natural ingredients in skincare and haircare products.

By Region: India Essential Oils Market is segmented by region into North, South, East, and West. In 2023, the southern region dominated the market due to its favourable climate for growing essential oil-bearing plants, coupled with established agricultural practices and processing facilities, which has contributed to its dominance.

India Essential Oils Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Kancor Ingredients Limited |

1969 |

Kerala, India |

|

Synthite Industries Ltd |

1972 |

Kerala, India |

|

AOS Products Pvt. Ltd |

2009 |

Uttar Pradesh, India |

|

Plant Therapy Essential Oils |

2011 |

Idaho, USA |

|

Aroma Treasures |

2000 |

Mumbai, India |

- Kancor Ingredients Limited: In June 2023, Kancor Ingredients Limited launched a new range of certified organic essential oils catering to the increasing consumer preference for organic products. This launch is expected to drive sales and expand market reach.

- AOS Products Pvt. Ltd: In 2023, AOS Products Pvt. Ltd introduced advanced CO2 extraction technology, which improves the purity and potency of essential oils. This innovation is expected to set new industry standards and boost product quality.

- Plant Therapy Essential Oils: India exported essential oils and resinoids worth USD 1.04 billion in 2023 to various countries. Companies like Plant Therapy Essential Oils expanded their export operations to new markets in Europe and North America.

India Essential Oils Market Analysis

India Essential Oils Market Growth Drivers

- Increasing Consumer Awareness and Demand for Natural Products: In 2024, the market for natural and organic personal care products is anticipated to grow significantly, with essential oils playing a significant role in this growth. The demand for natural remedies and wellness products is driving the essential oils market, as consumers become more conscious of the ingredients in their personal care routines.

- Expanding Applications in Aromatherapy and Wellness: The increasing impact and demand for aromatherapy in India have significantly risen, driven by its widespread use in promoting relaxation and mental well-being across wellness centers, spas, and personal home use. As a result, the aromatherapy market in India is expected to generate USD 1 billion in revenue by the end of 2024.

- Rising Pharmaceutical Applications: The pharmaceutical industry's adoption of essential oils for their antimicrobial and therapeutic properties is increasing. In 2023, the Indian pharmaceutical market was valued at USD 54 billion, with a notable segment dedicated to natural and alternative therapies, including essential oils for treatments and preventive care.

India Essential Oils Market Challenges

- Fluctuating Prices of Raw Materials: The cost of essential oil-bearing plants like lavender, peppermint, and eucalyptus is subject to fluctuations due to weather conditions, farming practices, and global demand-supply dynamics. In 2023, India was the 8th largest importer of essential oil raw materials, highlighting the dependency on external sources and the vulnerability to price volatility.

- Quality Control and Standardization Issues: Ensuring consistent quality and purity of essential oils remains a challenge. In 2023, a huge quantity of essential oils tested by regulatory authorities were found to be adulterated or below standard. This affects consumer trust and hampers market growth.

- Regulatory and Compliance Hurdles: The Indian essential oils market faces stringent regulations regarding the use of natural extracts in pharmaceuticals and cosmetics. In 2023, the regulatory approval process for new essential oil-based products took an average of 12 months, slowing down product launches and market entry.

India Essential Oils Market Government Initiatives

- National Medicinal Plants Board (NMPB): In 2023, the Indian government allocated INR 100 crore to the NMPB initiative to promote the cultivation of medicinal plants, including those used for essential oil extraction. This initiative aims to increase domestic production and reduce import dependency.

- Subsidies for Organic Farming: The government announced subsidies totalling INR 200 crore in 2023 for farmers transitioning to organic farming practices, which include the cultivation of essential oil-bearing plants. This move is expected to boost the supply of high-quality raw materials.

- Ayushman Bharat Scheme: The Ayushman Bharat Scheme, with a budget of INR 6,400 crore for 2024, promotes the use of traditional and alternative medicine, including essential oils, in healthcare. This initiative is likely to increase the adoption of essential oils in medical treatments.

- Make in India Campaign: Under the Make in India campaign, the government is providing incentives and support to local manufacturers of essential oils to enhance production capabilities and promote exports. In 2023, this initiative resulted in the establishment of 50 new essential oil production units.

India Essential Oils Future Market Outlook

The India Essential Oils Market is poised for significant growth, driven by Increased Adoption of Organic Farming Practices, Technological Advancements in Extraction Processes, and Expansion of Distribution Channels.

Future Market Trends

- Increased Adoption of Organic Farming Practices: Over the next five years, the adoption of organic farming practices for essential oil-bearing plants is expected to rise significantly, driven by government incentives and consumer demand for organic products.

- Technological Advancements in Extraction Processes: The use of advanced extraction technologies, such as supercritical CO2 extraction, will become more prevalent. This technology enhances the purity and potency of essential oils, meeting the stringent quality standards required for pharmaceutical and cosmetic applications.

Scope of the Report

|

By Product |

Lavender oil Peppermint oil Tea tree oil Eucalyptus oil |

|

By Application |

Personal Care and Cosmetics Pharmaceuticals Food and Beverages |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

- Banks and Financial Institutions

- Pharmaceutical Companies

- Cosmetic Manufacturers

- Personal Care Product Manufacturers

- Food and Beverage Companies

- Aromatherapy and Wellness Centers

- Government and regulatory Agencies (e.g., National Medicinal Plants Board)

- Essential Oil Extraction Companies

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

- Kancor Ingredients Limited

- Synthite Industries Ltd

- AOS Products Pvt. Ltd

- Plant Therapy Essential Oils

- Aroma Treasures

- Young Living Essential Oils

- doTERRA International

- Pure Essential Oils

- Falcon Essential Oils

- Shiv Sales Corporation

- Rakesh Sandal Industries

- Moksha Lifestyle Products

- Manish Minerals & Chemicals

- Rajkeerth Aromatics and Biotech Pvt Ltd

- Floracopeia Inc

- Indian Essential Oils

- Praveen Aroma Pvt Ltd

- Bo International

- Allin Exporters

- Ajmal Group

Table of Contents

1. India Essential Oils Market Overview

1.1 India Essential Oils Market Taxonomy

2. India Essential Oils Market Size (in USD Bn), 2018-2023

3. India Essential Oils Market Analysis

3.1 India Essential Oils Market Growth Drivers

3.2 India Essential Oils Market Challenges and Issues

3.3 India Essential Oils Market Trends and Development

3.4 India Essential Oils Market Government Regulation

3.5 India Essential Oils Market SWOT Analysis

3.6 India Essential Oils Market Stake Ecosystem

3.7 India Essential Oils Market Competition Ecosystem

4. India Essential Oils Market Segmentation, 2023

4.1 India Essential Oils Market Segmentation by Product (in %), 2023

4.2 India Essential Oils Market Segmentation by Application (in %), 2023

4.3 India Essential Oils Market Segmentation by Region (in %), 2023

5. India Essential Oils Market Competition Benchmarking

5.1 India Essential Oils Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Essential Oils Future Market Size (in USD Bn), 2023-2028

7. India Essential Oils Future Market Segmentation, 2028

7.1 India Essential Oils Market Segmentation by Product (in %), 2028

7.2 India Essential Oils Market Segmentation by Application (in %), 2028

7.3 India Essential Oils Market Segmentation by Region (in %), 2028

8. India Essential Oils Market Analysts’ Recommendations

8.1 India Essential Oils Market TAM/SAM/SOM Analysis

8.2 India Essential Oils Market Customer Cohort Analysis

8.3 India Essential Oils Market Marketing Initiatives

8.4 India Essential Oils Market White Space Opportunity Analysis

9. Disclaimer

10. Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on India Essential Oils market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Essential Oils market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with Industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple essential oil companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from mattress companies.

Frequently Asked Questions

01 How big is the India Essential Oils Market?

The India Essential Oils Market was valued at USD 175 million in 2023, driven by increasing consumer awareness of the therapeutic benefits of essential oils, rising demand in personal care and cosmetics, and the popularity of natural and organic products.

02 What are the challenges in the India Essential Oils Market?

Challenges in the India Essential Oils Market include fluctuating prices of raw materials, quality control and standardization issues, regulatory and compliance hurdles, and limited investment in research and development.

03 Who are the major players in the India Essential Oils Market?

Key players in the India Essential Oils Market include Kancor Ingredients Limited, Synthite Industries Ltd, AOS Products Pvt. Ltd, Plant Therapy Essential Oils, and Aroma Treasures. These companies dominate due to their extensive product portfolios, significant R&D investments, and strong distribution networks.

04 What are the growth drivers of the India Essential Oils Market?

Growth drivers of the India Essential Oils Market include increasing consumer awareness and demand for natural products, expanding applications in aromatherapy and wellness, rising pharmaceutical applications, and the growing popularity of natural food and beverages.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.