India Foodservice Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD260

June 2024

100

About the Report

India Foodservice Market Overview

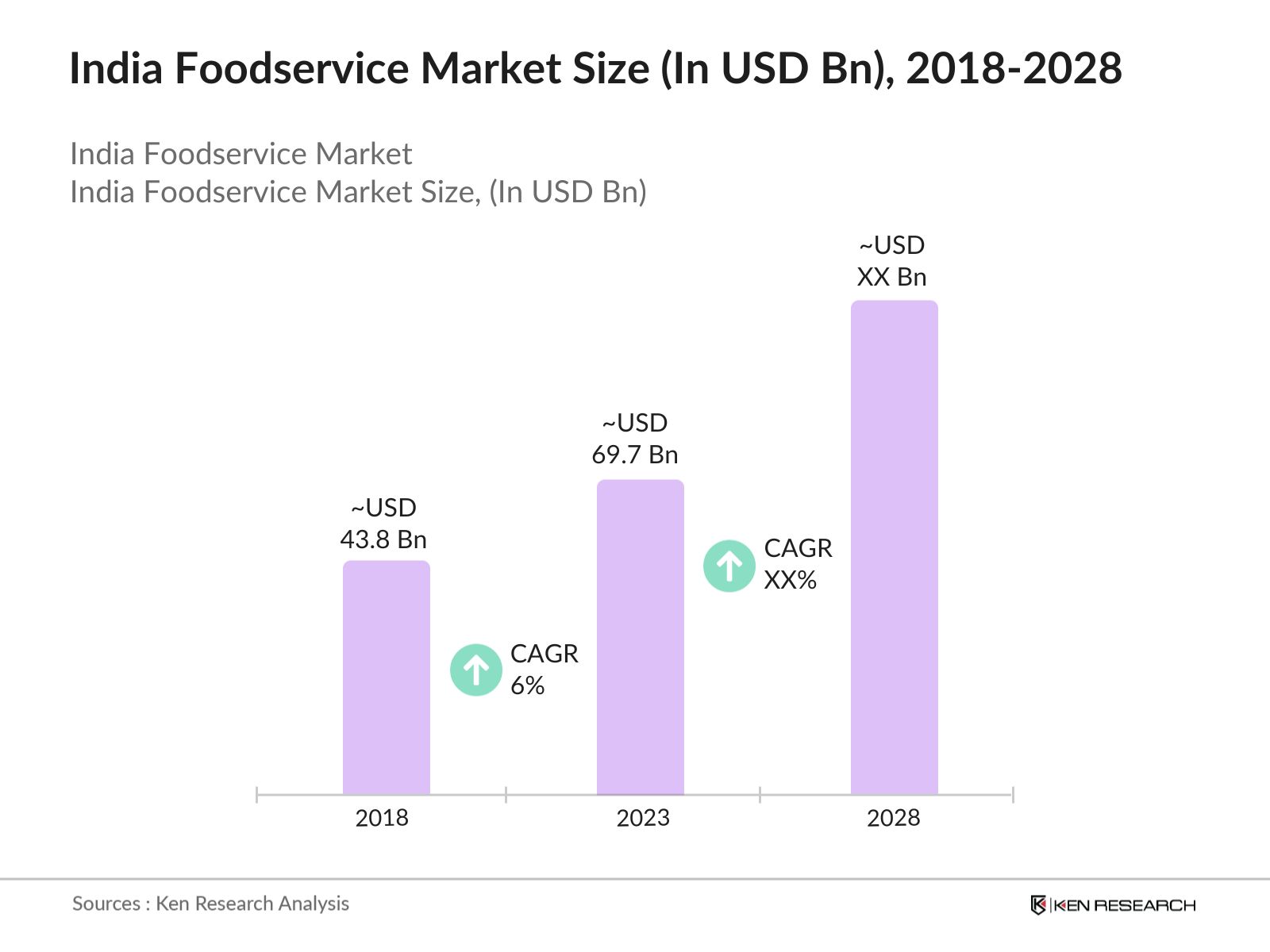

- The Indian Foodservice market is valued at USD 69.7 billion in 2023, driven by an increasing interest in exploring unconventional menu options, independent foodservice outlets emerging in densely populated cities like Mumbai, Delhi, and Bangalore.

- Key players in the market include Jubilant Food Works (Domino’s Pizza), Yum! Brands (KFC, Pizza Hut), McDonald's India, Westlife Development Ltd. (McDonald’s), Burger King India, and Café Coffee Day. These players dominate the market through extensive networks, strong brand recognition, and continuous innovation in their offerings.

- Major growth drivers include the rapid adoption of online food delivery platforms, increasing preference for convenience foods, growing urban population, expansion of international food chains, and rising disposable incomes.

- The market faces challenges like high competition, fluctuating food prices, stringent food safety regulations, and supply chain disruptions. Additionally, maintaining quality and hygiene standards remains critical, especially post-pandemic.

India Foodservice Current Market Analysis

- The Indian foodservice market is characterized by a blend of traditional dining experiences and modern QSRs and cafes. Online ordering, delivery services, and contactless payments have surged. Restaurants are leveraging technology to provide a seamless and safe dining experience.

- The market is dominated by fast food items such as burgers, pizzas, and fried chicken, along with traditional Indian snacks and beverages. The increasing demand for healthy and organic food options is also notable. Additionally, there is a growing trend towards plant-based and vegan alternatives, reflecting a shift in dietary preferences among consumers.

- Consumers are increasingly preferring home delivery services over dining out, driven by the convenience and time-saving aspects. There is also a growing demand for healthier and organic food options. Additionally, meal subscriptions and cloud kitchens are becoming popular, offering a variety of cuisines and personalized meal plans.

India Foodservice Market Segmentation, 2023

The Indian foodservice market can be segmented based on various factors, including:

By Foodservice Type: In 2023, India Foodservice Market is segmented by Foodservice Type into Full-Service Restaurants, Quick-Service Restaurants and Full-service restaurants (FSRs) currently hold the dominant position in the Indian foodservice market. Traditionally, dining out in India has been associated with a social experience and leisure activity. FSRs offer a comfortable ambience, waiter service, and a wider variety of cuisines compared to QSRs.

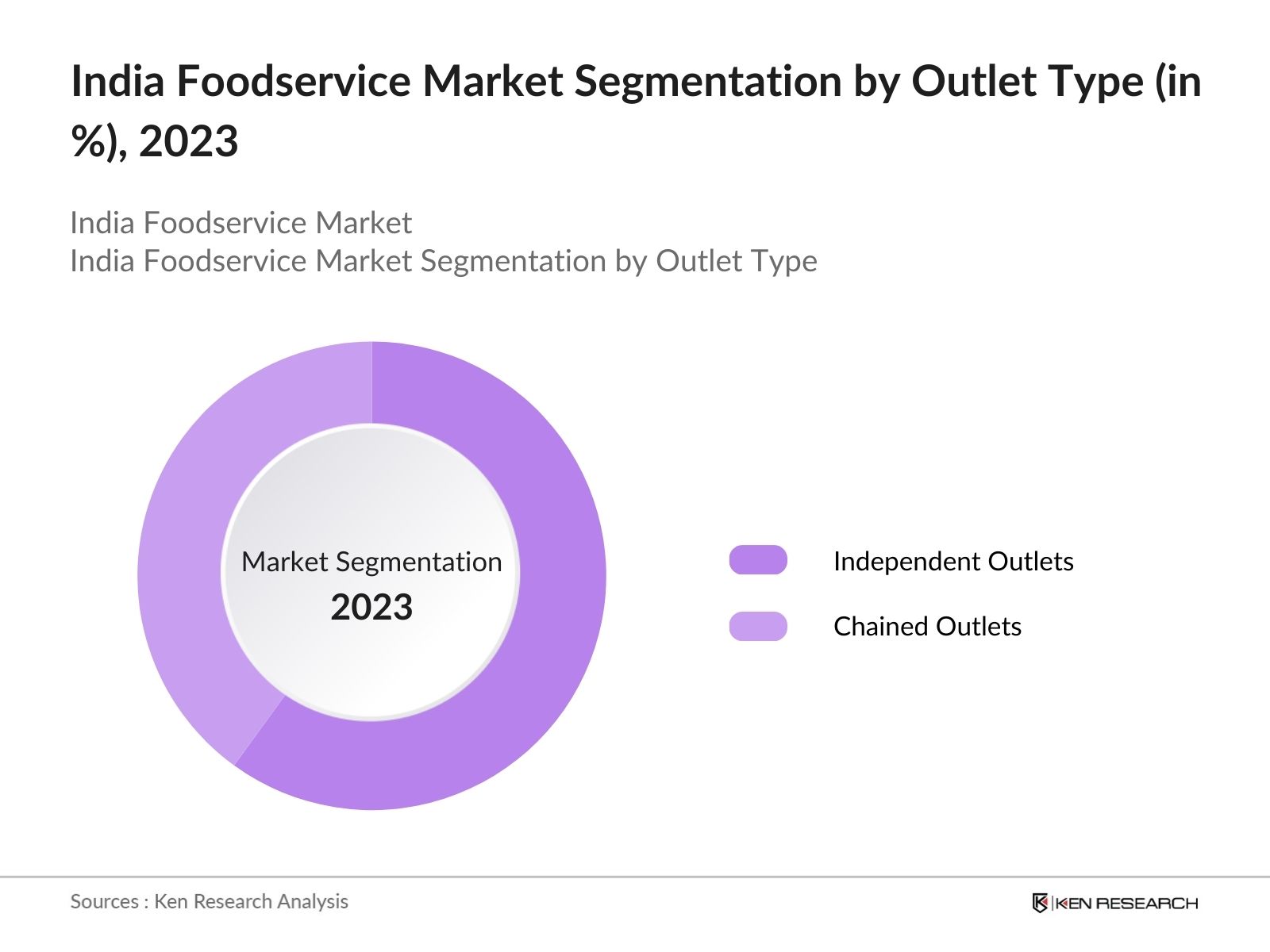

By Outlet Type: In 2023, India Foodservice Market is segmented by outlet type into Independent Outlets & Chained Outlets. Independent outlets hold the dominant share in the Indian foodservice market due to several factors that cater to the unique preferences and social aspects of dining out in India. India boasts a vast array of regional cuisines, each with distinct flavors and cooking styles. Independent outlets often specialize in a particular regional cuisine, offering a more authentic and local experience compared to chained outlets with standardized menus.

By Cuisine: In 2023, India Foodservice Market is segmented into Indian Cuisines, Asian Cuisines, Global Cuisines and other cuisines. In 2023, Indian cuisines have dominated in this market. India is known for a diverse and vibrant culinary tradition with distinct regional cuisines like North Indian (butter chicken, biryani), South Indian (dosa, idli), and East Indian (momos, thukpa). This rich heritage fosters a strong preference for familiar Asian flavors within the Indian population.

India Foodservice Market Competitive Landscape

India Food Service Market Major Players

- Network Expansion: A widespread outlet network ensures accessibility and convenience, leading to higher sales. Domino’s Pizza operates over 1,300 outlets across India, ensuring it reaches a wide customer base. This extensive network facilitates quick service and increases brand visibility, contributing significantly to the company's market dominance.

- Digital Presence: A strong digital presence is crucial for modern foodservice companies. Swiggy and Zomato, the leading food delivery platforms in India, process millions of orders monthly. For instance, Swiggy handles around 1.5 million orders per day, showcasing the importance of robust online platforms and mobile apps for customer engagement and sales growth.

- Quality and Safety Standards: Maintaining high hygiene and quality standards is essential, especially post-pandemic. Brands like KFC and McDonald's have implemented stringent safety protocols, ensuring customer trust. McDonald's India, for example, conducts over 200 quality checks daily from farm to table, reinforcing its commitment to safety and quality.

India Foodservice Industry Analysis

India Foodservice Market Growth Drivers

Rising Disposable Income:

Increasing disposable incomes allow more frequent dining out and food ordering. In 2022, India's per capita income was estimated at INR 172,000 reflecting a rise in consumer spending power.

Digital Penetration & Food Delivery Apps:

The growth of internet usage and smartphone penetration supports the expansion of online food delivery. India has over 700 million internet users, and food delivery apps like Swiggy and Zomato leverage this digital penetration.

Changing Lifestyles:

Busy urban lifestyles and a preference for convenience foods are driving market growth. With the working-age population constituting over 60% of India’s total population, the demand for quick, convenient meal options has increased.

India Foodservice Market Major Trends

Organic Food Options:

There is a growing demand for healthy and organic food options. The organic food market in India is expected to increase by USD 64 billion by 2024. Consumers are increasingly seeking healthier menu options, prompting foodservice providers to introduce nutritious and organic meals.

Sustainable Food Packaging:

Sustainable practices, including eco-friendly packaging and sourcing, are gaining importance. Brands like Subway use biodegradable packaging, reducing their environmental footprint. This focus on sustainability resonates with environmentally conscious consumers, driving brand preference and loyalty.

Advent of Ghost Kitchens:

Ghost kitchens, operating solely for delivery, are becoming popular. Rebel Foods, with over 350 cloud kitchens, exemplifies this trend. These kitchens reduce overhead costs and allow for a wider menu offering, catering to the growing demand for delivery services.

India Foodservice Market Challenges

High Competition between Local & International Players:

Intense competition requires continuous innovation and differentiation. The presence of numerous local and international players makes it challenging for businesses to maintain market share. Constant innovation in menu offerings and services is necessary to stay competitive.

Adherence to Food & Safety Regulations:

Adhering to stringent food safety and hygiene regulations is challenging. The Food Safety and Standards Authority of India (FSSAI) mandates strict compliance, which can be costly and complex.

Demand for Fresh Ingredients & Supply Chain Disruptions:

Dependence on a smooth supply chain for fresh ingredients makes the market vulnerable to disruptions. Events like the COVID-19 pandemic have highlighted the fragility of supply chains, impacting the availability of ingredients and overall operations.

India Foodservice Market Recent Developments

Merger & Acquisition (Jubilant FoodWorks & Barbeque Nation):

Jubilant FoodWorks acquired a significant stake in Barbeque Nation, expanding its portfolio. This acquisition enables Jubilant to diversify its offerings and tap into the growing demand for casual dining experiences, enhancing its market presence.

Investments (Swiggy):

Swiggy secured significant funding to expand its delivery network and enhance technology integration. This investment supports Swiggy's growth strategy, enabling it to reach more customers and improve service efficiency through advanced technology.

Partnerships (Zomato):

Zomato partnered with numerous local restaurants to expand its cloud kitchen operations. These partnerships allow Zomato to offer a wider variety of cuisines, improving its service offerings and customer reach.

India Foodservice Market Government Initiatives

FSSAI Regulations:

The Food Safety and Standards Authority of India (FSSAI) introduced stricter regulations to ensure food safety and hygiene. These regulations require foodservice providers to maintain high standards, ensuring consumer safety and trust.

GST Benefits:

The reduction in Goods and Services Tax (GST) for restaurants has made dining out more affordable. This tax relief boosts consumer spending in the foodservice industry, encouraging more frequent dining out experiences.

Start-Up India:

The Start-Up India scheme provides support to new foodservice ventures, encouraging innovation and growth. Financial incentives and regulatory ease under this scheme help startups thrive, contributing to market dynamism.

India Foodservice Future Market Outlook

The Indian foodservice market is projected to grow because of the following factors:

- Growing Online Food Delivery: Online food delivery platforms will continue to play a significant role in market growth, providing wider access and convenience to consumers.

- Technological Advancements: Technological advancements like automation and data analytics will improve operational efficiency, personalize customer experiences, and provide valuable insights for restaurants to optimize their business strategies.

- Expansion of Tier 2 & 3 Cities: Tier 2 and 3 cities are expected to be key growth drivers as these regions witness rising disposable incomes and increasing urbanization. Restaurant chains will likely target these areas with localized offerings and expansion strategies.

Scope of the Report

|

India Foodservice Market Segmentation |

|

|

By Foodservice Type |

Full-Service Restaurants Quick-Service Restaurants Cloud Based Services |

|

By Business Model |

Independent Outlets Chained Outlets |

|

By Cuisines |

Indian Cuisines Asian Cuisines Global Cuisines Others |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Foodservice Companies

Investors and Venture Capitalists

Government & Policymakers

Suppliers & Distributors

Technology Providers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:Â

Jubilant FoodWorks (Domino’s Pizza)

Yum! Brands (KFC, Pizza Hut)

McDonald's India

Westlife Development Ltd. (McDonald’s)

Burger King India

Café Coffee Day

Tata Starbucks Pvt Ltd

Barbeque Nation

Subway India

Haldiram's

Bikanervala

Sagar Ratna

Paradise Food Court

Saravana Bhavan

Rebel Foods (Faasos, Behrouz Biryani)

Table of Contents

1. India Foodservice Market Overview

1.1 India Foodservice Market Taxonomy

2. India Foodservice Market Size (in USD Bn), 2018-2023

3. India Foodservice Market Analysis

3.1 India Foodservice Market Growth Drivers

3.2 India Foodservice Market Challenges and Issues

3.3 India Foodservice Market Trends and Development

3.4 India Foodservice Market Government Regulation

3.5 India Foodservice Market Porter's 5 Forces/SWOT Analysis

3.6 India Foodservice Market Stake Ecosystem

3.7 India Foodservice Market Competition Ecosystem

4. India Foodservice Market Segmentation, 2023

4.1 India Food Service Market Segmentation by Foodservice Type, By Value, (In %), 2023

4.2 India Food Service Market Segmentation by Outlet Type, By Value (In %), 2023

4.3 India Food Service Market Segmentation by Cuisine, By Value (In %), 2023

5. India Foodservice Market Competition Benchmarking

5.1 India Foodservice Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Foodservice Future Market Size (in USD Bn), 2023-2028

7. India Foodservice Future Market Segmentation, 2028

7.1 India Food Service Market Segmentation by Foodservice Type, By Value, (In %), 2028

7.2 India Food Service Market Segmentation by Outlet Type, By Value (In %), 2028

7.3 India Food Service Market Segmentation by Cuisine, By Value (In %), 2028

8. India Foodservice Market Analysts’ Recommendations

8.1 India Foodservice Market TAM/SAM/SOM Analysis

8.2 India Foodservice Market Customer Cohort Analysis

8.3 India Foodservice Market Marketing Initiatives

8.4 India Foodservice Market White Space Opportunity Analysis

9. Disclaimer

10. Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2: Market Building:

Collating statistics on India Foodservice market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Foodservice market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4: Research Output:

Our team will approach multiple Foodservice companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Foodservice companies.

Frequently Asked Questions

01 What is the current size of the Indian foodservice market?

The Indian foodservice market was valued at approximately USD 69.7 billion in 2023

02 Who are the major players in the Indian foodservice market?

Some of the major players include Jubilant Foodworks (Domino's Pizza), Yum! Brands (KFC, Pizza Hut), McDonald's, Burger King, Starbucks, and local giants like Haldiram's and Barbeque Nation

03 What is the dominant type of foodservice in India?

Full-service restaurants (FSRs) currently hold the largest market share in India, offering a sit-down dining experience with a wider variety of cuisines. However, the organized segment, encompassing QSRs and cloud kitchens, is growing rapidly.

04 What are the major challenges faced by the Indian foodservice industry?

High food inflation, rising real estate costs, labor shortages, and intense competition are some of the key challenges faced by the industry.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.