India Hospitality Industry Outlook to 2030

Region:Asia

Author(s):Pranav Krishn

Product Code:KROD303

June 2024

90

About the Report

India Hospitality Industry Overview

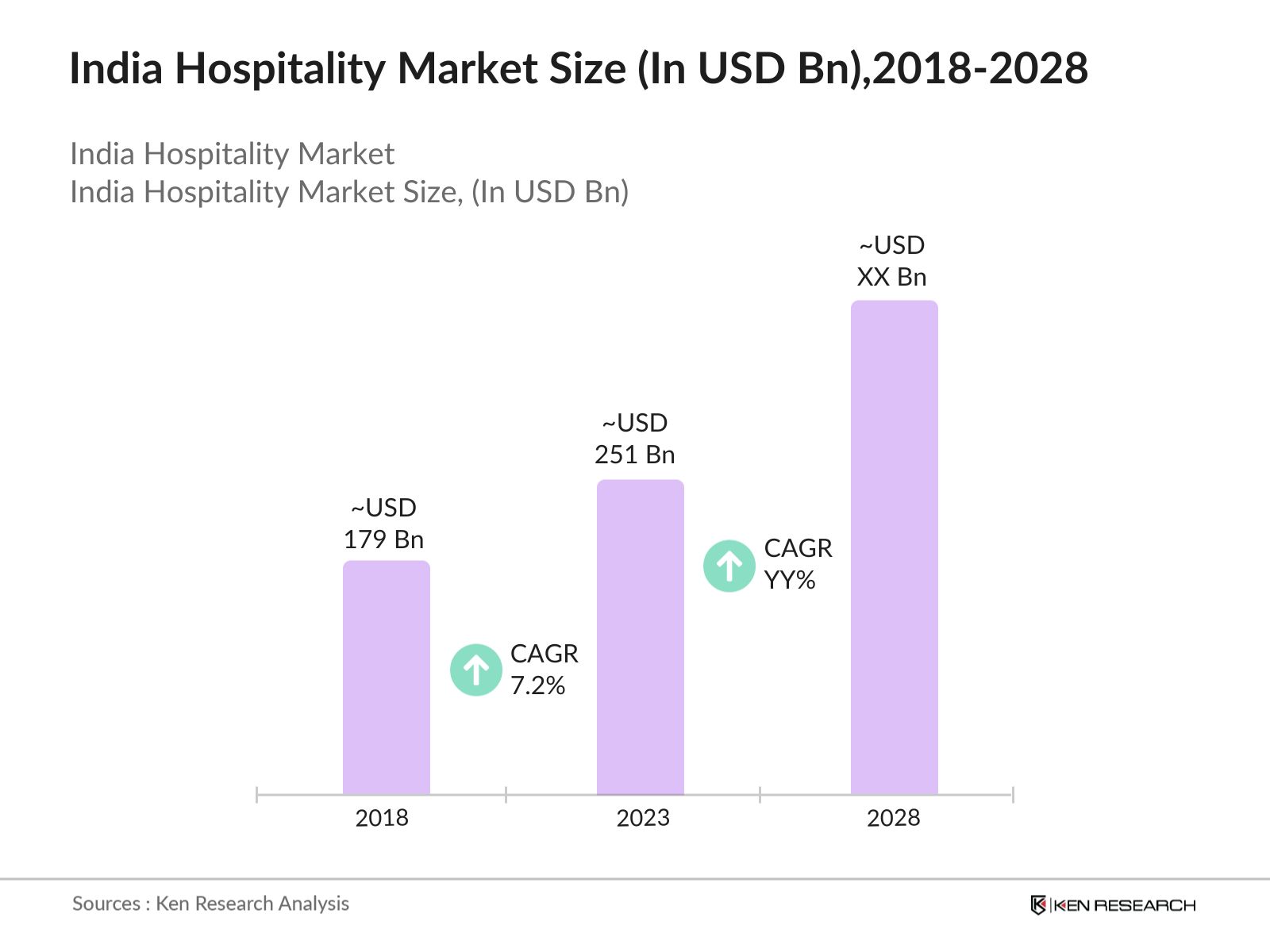

- The India Hospitality Industry was valued at USD 179 billion in 2018 and reached USD 251 billion by 2023, exhibiting a Compound Annual Growth Rate (CAGR) of about 7.2%. The market is driven by rising disposable incomes, increased business travel, and a surge in domestic and international tourism. The government's initiatives, like the Incredible India campaign and e-visa policies, have further fueled market growth.

- Major players in the Indian hospitality market include Indian Hotels Company Limited (Taj Group), ITC Hotels, Oberoi Hotels & Resorts, Lemon Tree Hotels, and Marriott International. These companies dominate the market through extensive networks, diversified offerings, and strong brand recognition.

- In 2023, Lemon Tree Hotels signed a deal to open 15 new hotels across tier-2 and tier-3 cities, aiming to cater to the increasing demand in emerging markets. This move is expected to boost Lemon Tree's market share significantly.

India Hospitality Market Analysis

- For the fiscal year 2023-2024, the Ministry of Tourism has allocated a gross budget of USD 295.1 million. Key allocations include USD 210.2 million for the Integrated Development of Tourist Circuits under the Swadesh Darshan scheme, and USD 28.9 million for the Pilgrimage Rejuvenation and Spiritual, Heritage Augmentation Drive (PRASHAD).

- The hospitality sector significantly contributes to India's GDP, generating millions of jobs and stimulating ancillary sectors like transportation and retail. This growth drives urban and rural development through substantial infrastructure investments.

- The western region, particularly Maharashtra and Goa, leads the market due to popular destinations like Mumbai and beach resorts. In 2023, Maharashtra accounted for over 20% of total hotel revenues, fueled by business travel to Mumbai and Pune.

India Hospitality Market Segmentation

By Product Type: In 2023, India Hospitality market under product type segmentation is divided into luxury hotels, mid-range hotels, and budget hotels. Luxury hotels hold a significant market share due to their ability to cater to affluent travellers who seek exclusivity, personalized services, and high-end amenities. These hotels often benefit from prime locations in major cities and tourist destinations, further enhancing their appeal.

By Service Type: In 2023, India Hospitality market under service type segmentation is divided into accommodation, foods & beverage, event services and others (Spa, Wellness). Accommodation commands the largest market share as it forms the core offering of hospitality services. Accommodation includes a wide range of options from luxury hotels to budget stays, catering to various traveller preferences and budgets.

By Customer Type: In 2023, India Hospitality market under customer type segmentation is divided into Leisure Travelers, Business Travelers and others (Backpackers, Pilgrims). Leisure travelers represent the largest customer segment due to their significant contribution to tourism-driven revenue. This segment has seen a resurgence post-pandemic with travelers seeking holiday destinations and experiences.

India Hospitality Industry Competitive Landscape

| Company | Establishment Year | Headquarters |

| Indian Hotels Company Limited | 1903 | Mumbai, India |

| ITC Hotels | 1975 | Kolkata, India |

| Oberoi Hotels & Resorts | 1934 | New Delhi, India |

| Lemon Tree Hotels | 2002 | New Delhi, India |

| Marriott International | 1927 | Bethesda, USA |

- Major Players: Indian Hotels, ITC, Oberoi, Lemon Tree, and Marriott dominate the Indian hospitality market with extensive property portfolios and strong brand equity. These companies leverage their wide reach and premium offerings to maintain leadership and drive market growth.

- Market Impact: These leading players are instrumental in setting high industry standards, driving innovation, and enhancing quality. Their strategic expansions and diversifications play a crucial role in shaping market dynamics, significantly influencing the overall growth and development of the hospitality sector in India.

- Big News and Innovations: In 2024, Marriott International continued to invest in digital technologies to enhance guest experiences and improve operational efficiency. The company introduced mobile check-in and keyless entry options at select properties, allowing guests to bypass the traditional front desk and access their rooms directly using their smartphones.

India Hospitality Industry Analysis

India Hospitality Industry Growth Drivers

- Tourism Boom: India's tourism sector has seen a significant surge, with international tourist arrivals reaching over 12 million in 2023, and domestic tourist visits exceeding 2.1 billion. This growth is driven by improved air connectivity and the promotion of new tourist circuits. The government's continued investment in tourism infrastructure and promotional campaigns, like the Incredible India 2.0, have further boosted these numbers.

- Digital Transformation: The hospitality industry is rapidly integrating digital technologies to enhance guest experiences and operational efficiency. In 2023, approximately 40 million hotel bookings in India were made online, reflecting a shift towards digital platforms.

- Rising Business Travel: With India becoming a global business hub, the volume of business travel has increased. India is the world's fastest-growing business travel market, with business travel spending reaching USD 37 billion in 2023. The growth of industries such as IT, finance, and manufacturing in urban centers has fueled the demand for quality hospitality services.

India Hospitality Industry Challenges

- Regulatory Hurdles: The hospitality sector faces complex regulatory frameworks, including high GST rates on hotel rooms (18% for rooms priced above INR 7,500). This taxation structure increases the cost of services, making Indian hotels less competitive compared to neighboring countries

- Seasonal Fluctuations: The hospitality industry in India experiences significant seasonal variations, with peak seasons often limited to a few months. For instance, the hotel occupancy rate in hill stations like Shimla and Manali drops to as low as 30% during the off-season. This seasonality leads to inconsistent revenue streams, making it challenging for hoteliers to maintain financial stability and workforce management throughout the year.

- Workforce Shortages: The hospitality industry faces a shortage of skilled labor, with an estimated shortfall of 150,000 trained professionals as per the Ministry of Tourism. This gap affects service quality and operational efficiency, especially in high-demand periods.

India Hospitality Industry Recent Developments

-

-

- Accor's Expansion Plan: In 2023, Accor Hotels announced its plan to open 10 new properties in India over the next two years, focusing on both luxury and budget segments. This expansion is aimed at tapping into the growing demand for diverse accommodation options across major cities and tourist destinations.

- Technological Advancements by Taj: In 2024, the Indian Hotels Company Limited (Taj Group) introduced an AI-powered customer service platform to enhance guest interactions and operational efficiency. This platform uses machine learning to provide personalized recommendations and streamline service requests, improving overall guest satisfaction and operational productivity.

-

India Hospitality Industry Future Outlook

The Indian hospitality market is projected to grow substantially from 2023 to 2028, driven by increasing tourism, economic growth, and evolving consumer preferences towards experiential travel.

Future Trends

-

-

- Sustainable Tourism: There is a growing emphasis on eco-friendly and sustainable tourism practices. Hotels are increasingly adopting green certifications and implementing energy-efficient measures. For instance, the number of LEED-certified hotels in India increased by 300 properties in 2023.

- Health and Wellness Tourism: Post-pandemic, there is a significant rise in health and wellness tourism. Ayurveda and yoga retreats have seen a booking increase of 200,000 in 2023. This trend is supported by India's rich heritage in holistic wellness practices and the global demand for health-centric travel options.

-

Products

Key Target Audience – Organizations and Entities Who can Benefit by Subscribing this Report:

Hotel Chains and Operators

Travel Agencies and Tour Operators

Real Estate Developers

Government and Policy Makers

Investors and Financial Analysts

Technology Providers for Hospitality

Tourism Boards and Associations

Hospitality Management Schools and Institutions

Event Management Companies

Corporate Travel Management Firms

Online Travel Agencies (OTAs)

Luxury and Boutique Hotel Owners

Food and Beverage Suppliers

Hospitality Training and Development Centers

Facility Management Companies

Marketing and Advertising Agencies Specializing in Hospitality

Financial Institutions Providing Hospitality Financing

Eco-Tourism and Sustainable Tourism Advocates

Insurance Companies Offering Hospitality Insurance

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

The Indian Hotels Company Limited (Taj Hotels)

ITC Hotels

Oberoi Hotels & Resorts

Marriott International

Accor Hotels

Hyatt Hotels

Lemon Tree Hotels

Radisson Hotel Group

Hilton Hotels & Resorts

Ginger Hotels

Sarovar Hotels & Resorts

Royal Orchid Hotels

Fortune Hotels

IHG Hotels & Resorts

Sterling Holiday Resorts

Table of Contents

1. India Hospitality Industry Overview

1.1 India Hospitality Industry Taxonomy

2. India Hospitality Industry Size (in USD Bn), 2018-2023

3. India Hospitality Industry Analysis

3.1 India Hospitality Industry Growth Drivers

3.2 India Hospitality Industry Challenges and Issues

3.3 India Hospitality Industry Trends and Development

3.4 India Hospitality Industry Government Regulation

3.5 India Hospitality Industry SWOT Analysis

3.6 India Hospitality Industry Stake Ecosystem

3.7 India Hospitality Industry Competition Ecosystem

4. India Hospitality Industry Segmentation, 2023

4.1 India Hospitality Industry Segmentation by Product Type (in %), 2023

4.2 India Hospitality Industry Segmentation by Service Type (in %), 2023

4.3 India Hospitality Industry Segmentation by Customer Type (in %), 2023

5. India Hospitality Industry Competition Benchmarking

5.1 India Hospitality Industry Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Hospitality Industry Future Market Size (in USD Bn), 2023-2028

7. India Hospitality Industry Future Market Segmentation, 2028

7.1 India Hospitality Industry Segmentation by Product Type (in %), 2028

7.2 India Hospitality Industry Segmentation by Service Type (in %), 2028

7.3 India Hospitality Industry Segmentation by Customer Type (in %), 2028

8. India Hospitality Industry Analysts’ Recommendations

8.1 India Hospitality Industry TAM/SAM/SOM Analysis

8.2 India Hospitality Industry Customer Cohort Analysis

8.3 India Hospitality Industry Marketing Initiatives

8.4 India Hospitality Industry White Space Opportunity AnalysisÂ

Disclaimer Contact UsResearch Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2 Market Building:

Collating statistics on India Hospitality Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Hospitality Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4 Research Output:

Our team will approach multiple hospitality market companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such hospitality industry companies.

Frequently Asked Questions

01 How big is the India Hospitality Industry?

The current market size of the India Hospitality Industry is approximately at USD 251 billion in 2023. The market is driven by rising disposable incomes, increased business travel, and a surge in domestic and international tourism.

02 Who are the major players of the India Hospitality Industry?

Major players in the India Hospitality Market include The Indian Hotels Company Limited (Taj Hotels), ITC Hotels, Marriott International, and Accor Hotels, among others.

03 What factors drive the India Hospitality Industry?

Factors driving the India Hospitality Industry include increasing domestic tourism, government initiatives promoting tourism, rising disposable incomes, and technological advancements.

04 What are some challenges in the India Hospitality Industry?

Some challenges in the India Hospitality Industry include high operational costs, regulatory complexities, seasonal demand fluctuations, intense competition, and evolving customer expectations.

05 Which segment dominates the India Hospitality Industry?

Accommodation dominates the India Hospitality Industry by service type, accounting for half of the market share in 2023.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.