India HVDC Transmission Market Outlook to 2028

Region:Asia

Author(s):Abhinav Kumar

Product Code:KROD557

January 2025

87

About the Report

India HVDC TransmissionMarket Overview

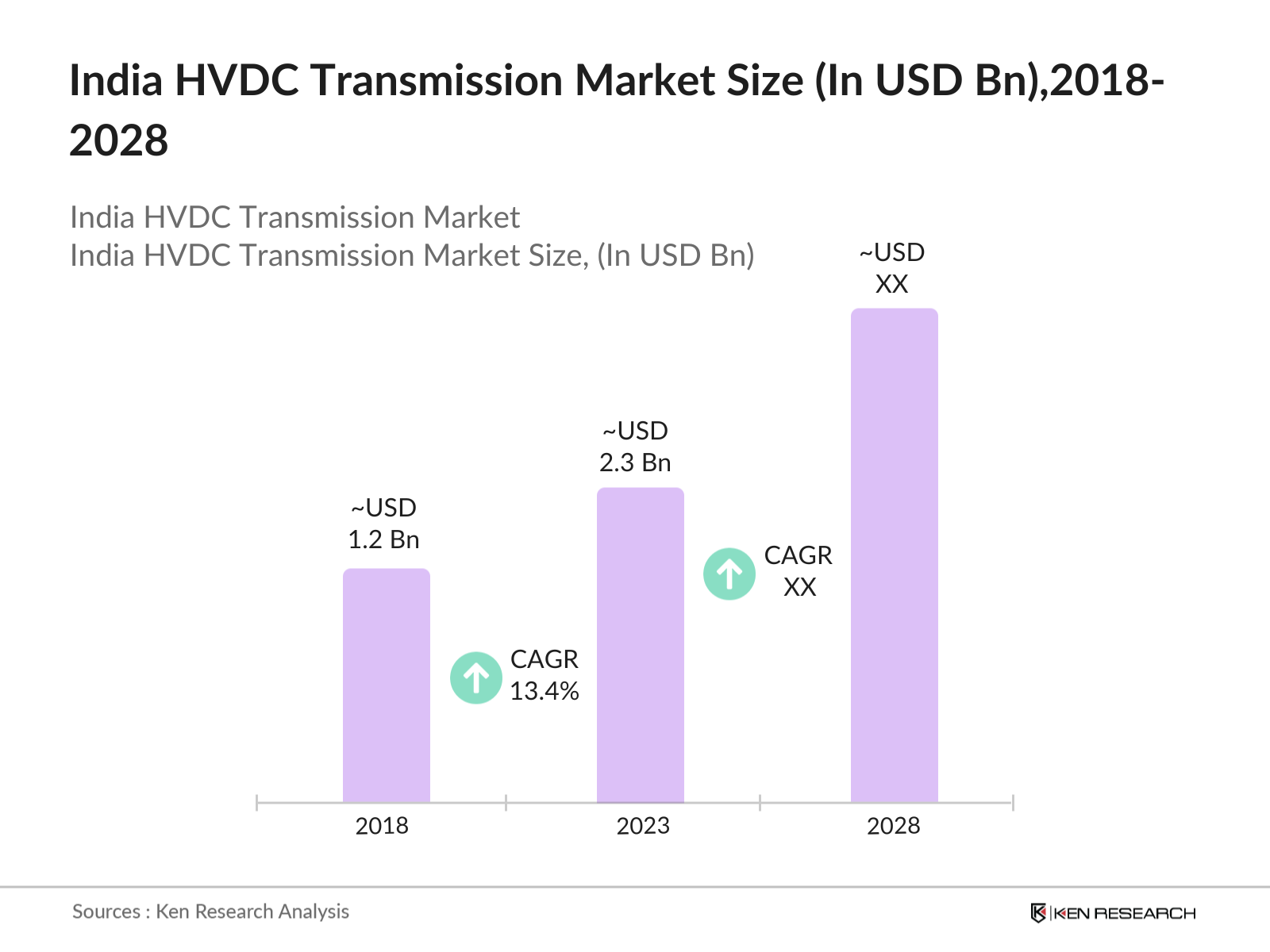

- The India HVDC (High Voltage Direct Current) Transmission market has seen growth from 2018 to 2023, driven by the increasing demand for electricity, urbanization, and the integration of renewable energy sources. In 2018, the market size was valued at USD 1.2 billion and grew to USD 2.3 billion in 2023, reflecting a robust CAGR of 13.4%.

- The key players in the India HVDC Transmission market include ABB Ltd., Siemens AG, Bharat Heavy Electricals Limited (BHEL), General Electric (GE), and Hitachi Energy. These companies are pivotal in advancing HVDC technology and expanding their footprint in the Indian market through strategic projects and collaborations.

- In 2023, ABB Ltd. announced a contract win to supply HVDC technology for a new transmission line in India. This project aims to connect renewable energy sources in the western region to the demand centers in the northern region, enhancing grid reliability and efficiency.

- The Western region of India, particularly the state of Gujarat, is the dominant player in the HVDC transmission market. As of 2023, Gujarat accounted for 25% of the total HVDC transmission capacity in India. This dominance is driven by substantial investments in renewable energy projects, with the state's solar power capacity expected to reach 20 GW by 2025.

India HVDC TransmissionMarket Segmentation

The India HVDC Transmission Market can be segmented based on technology, application and region.

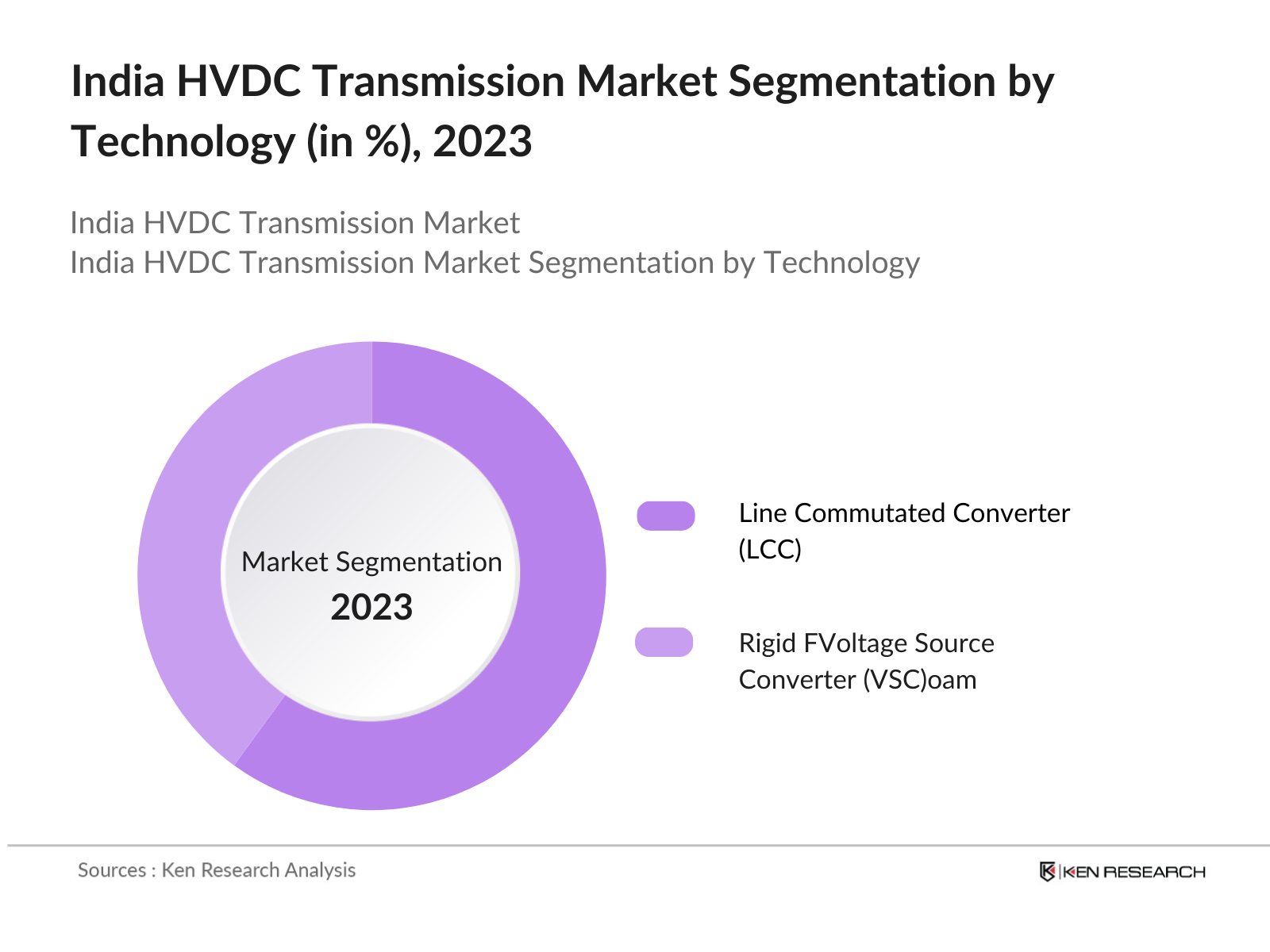

By Technology: India HVDC Transmission Market Outlook to 2028 is segmented by technology into Line Commutated Converter (LCC) and Voltage Source Converter (VSC). In 2023, LCC technology dominated, due to LCC's proven efficiency in handling high power levels and its widespread use in existing HVDC projects.

By Application: India HVDC Transmission Market Outlook to 2028 is segmented by application into Intra-State and Inter-State. In 2023, Inter-State HVDC transmission projects dominated due to the need for efficient power transmission across long distances, connecting renewable energy-rich states to high-demand regions.

By Region: India HVDC Transmission Market Outlook to 2028 is segmented by region into North, South, East, and West. In 2023, the Western region dominated, due to investments in renewable energy projects and the presence of key HVDC infrastructure.

India HVDC Transmission Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

ABB Ltd. |

1883 |

Zurich, Switzerland |

|

Siemens AG |

1847 |

Munich, Germany |

|

Bharat Heavy Electricals Limited |

1964 |

New Delhi, India |

|

General Electric |

1892 |

Boston, USA |

|

Hitachi Energy |

1910 |

Tokyo, Japan |

- In 2023, ABB Ltd. secured a contract worth INR 24 billion to supply HVDC technology for a major transmission project in India. This project aims to connect renewable energy sources in the western region to demand centers in the north, enhancing grid reliability and efficiency.

- In 2023, Siemens AG completed an HVDC transmission project in Gujarat, valued at INR 20 billion. The project enhances the state's renewable energy integration capabilities, demonstrating Siemens' commitment to advancing HVDC technology and supporting India's renewable energy goals.

India HVDC Transmission Market Analysis

India HVDC Transmission Market Growth Drivers:

- Increasing Demand for Electricity: India's electricity demand is projected to reach 1,930 TWh in 2024, up from 1,390 TWh in 2018. This surge is driven by rapid industrialization and urbanization. The rise in demand necessitates efficient transmission systems like HVDC to handle the large-scale transfer of electricity over long distances.

- Expansion of Renewable Energy Capacity: India's renewable energy capacity is expected to expand, with solar power capacity alone projected to reach 100 GW by 2024. This growth demands robust transmission infrastructure to integrate renewable energy sources into the grid. HVDC technology, with its capability to transmit large amounts of power over long distances with minimal losses, is essential for this integration.

- Rising Industrialization and Urbanization: India's industrial output is expected to reach up to INR 120,000 billion in 2024. This industrial growth leads to increased electricity consumption and necessitates efficient power transmission solutions. HVDC systems are vital for ensuring reliable and efficient power supply to meet the rising demand in urban and industrial areas.

India HVDC Transmission Market Challenges:

- High Initial Costs: The average cost of HVDC transmission systems higher than traditional AC systems, with HVDC installation costs reaching INR 12 million per kilometer in 2023. This high cost is a barrier for many power projects, especially in developing regions where budget constraints are a significant concern.

- Technical Complexity: HVDC systems require advanced technology and expertise for installation and maintenance. In 2024, India faces a shortage of skilled professionals in the HVDC domain, impacting the implementation and operational efficiency of HVDC projects. This technical complexity poses a challenge to the widespread adoption of HVDC technology.

India HVDC Transmission Market Government Initiatives:

- Green Energy Corridor Phase II: In 2023, the Indian government launched the Green Energy Corridor Phase II, with an investment of INR 160 billion. This initiative aims to enhance transmission infrastructure to support the integration of renewable energy sources. The project includes the development of HVDC transmission lines to connect renewable energy hubs with demand centers.

- National Smart Grid Mission: The National Smart Grid Mission, launched in 2024 with an allocation of INR 50 billion, aims to modernize India's power grid infrastructure. This includes the deployment of HVDC technology to improve grid efficiency and reliability. The mission focuses on integrating renewable energy, reducing transmission losses, and enhancing grid stability.

India HVDC Transmission Market Outlook

India HVDC Transmission Market is expected to grow by 2028 along with a respectable CAGR from 2023 to 2028, driven by increasing technological advancements & expansion of online retail.

Future Trends

-

- Technological Innovations in HVDC: The next five years will witness significant technological advancements in HVDC systems, including the development of more efficient and cost-effective HVDC converters and cables. These innovations will enhance the reliability and efficiency of HVDC transmission, reducing operational costs and supporting the integration of renewable energy.

- Expansion of HVDC Transmission Projects: India is projected to add over 10,000 kilometers of HVDC transmission lines by 2028, driven by the need for efficient long-distance power transmission. These projects will connect renewable energy hubs with demand centers, enhancing grid stability and supporting the country's renewable energy goals.

Scope of the Report

|

By Technology |

Line Commutated Converter (LCC) Voltage Source Converter |

|

By Application |

Intra-State Inter-State |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing This Report:

- Power Generation Companies

- Transmission System Operators

- Renewable Energy Developers

- Government Energy Departments

- Utility Companies

- Grid Operators

- HVDC Technology Providers

- Electric Power Research Institutes

- Engineering Procurement and Construction (EPC) Firms

- Financial Institutions

- Investment Firms

- Regulatory Bodies

- Industrial Associations

- Infrastructure Development Agencies

- State Electricity Boards

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Players Mentioned in the Report: Â

- ABB Ltd.

- Siemens AG

- Bharat Heavy Electricals Limited (BHEL)

- General Electric (GE)

- Hitachi Energy

- Toshiba Corporation

- Alstom SA

- Adani Transmission Limited

- Reliance Infrastructure Limited

- Power Grid Corporation of India Limited

- Sterlite Power

- Larsen & Toubro Limited

- KEC International Limited

- Kalpataru Power Transmission Limited

- Siemens Energy

- NKT A/S

- Prysmian Group

- Nexans

- Sumitomo Electric Industries

- TBEA Co., Ltd.

Table of Contents

1. India HVDC Transmission Market OverviewÂ

1.1 India HVDC Transmission Market TaxonomyÂ

2. India HVDC Transmission Market Size (in USD Mn), 2018-2023Â

3. India HVDC Transmission Market AnalysisÂ

3.1 India HVDC Transmission Market Growth DriversÂ

3.2 India HVDC Transmission Market Challenges and IssuesÂ

3.3 India HVDC Transmission Market Trends and DevelopmentÂ

3.4 India HVDC Transmission Market Government RegulationÂ

3.5 India HVDC Transmission Market SWOT AnalysisÂ

3.6 India HVDC Transmission Market Stake EcosystemÂ

3.7 India HVDC Transmission Market Competition EcosystemÂ

4. India HVDC Transmission Market Segmentation, 2023Â

4.1 India HVDC Transmission Market Segmentation by Technology (in value %), 2023Â

4.2 India HVDC Transmission Market Segmentation by Application Channel (in value %), 2023Â

4.3 India HVDC Transmission Market Segmentation by Region (in value %), 2023Â

5. India HVDC Transmission Market Competition BenchmarkingÂ

5.1 India HVDC Transmission Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)Â

6. India HVDC Transmission Future Market Size (in USD Mn), 2023-2028Â

7. India HVDC Transmission Future Market Segmentation, 2028Â

7.1 India HVDC Transmission Market Segmentation by Technology (in value %), 2028Â

7.2 India HVDC Transmission Market Segmentation by Application (in value %), 2028Â

7.3 India HVDC Transmission Market Segmentation by Region (in value %), 2028Â

8. India HVDC Transmission Market Analysts’ RecommendationsÂ

8.1 India HVDC Transmission Market TAM/SAM/SOM AnalysisÂ

8.2 India HVDC Transmission Market Customer Cohort AnalysisÂ

8.3 India HVDC Transmission Market Marketing InitiativesÂ

8.4 India HVDC Transmission Market White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information. Â

Step 2: Market Building

Collating statistics on India HVDC Transmission Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India HVDC Transmission Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared. Â

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives. Â

Step 4: Research Output

Our team will approach multiple HVDC transmission companies and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from HVDC transmission companies and distributors companies.

Frequently Asked Questions

01 How big is the India HVDC Transmission Market?

The India HVDC Transmission Market was valued at USD 2.3 billion in 2023, driven by increasing electricity demand, the expansion of renewable energy capacity, and government investments in power infrastructure.

02 What are the challenges in the India HVDC Transmission Market?

Challenges in the India HVDC Transmission Market include high initial costs, technical complexity, regulatory and environmental hurdles, and integration with existing grid infrastructure.

03 Who are the major players in the India HVDC Transmission Market?

Key players in the market include ABB Ltd., Siemens AG, Bharat Heavy Electricals Limited (BHEL), General Electric (GE), and Hitachi Energy. These companies lead due to their technological expertise and extensive industry experience.

04 What are the growth drivers of the India HVDC Transmission Market?

The India HVDC Transmission Market is driven by the increasing demand for electricity, the expansion of renewable energy capacity, significant government investments in power infrastructure, and the rise in industrialization and urbanization.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.