India Invasive Ventilator Market Outlook to 2029

Region:Asia

Author(s):Sudhanshu Maheshwari

Product Code:KR1497

April 2025

80-100

About the Report

India Invasive Ventilator Market Overview

The India Invasive Ventilator Market is valued at INR 402.8 crore, based on a five-year historical analysis. This growth has been driven by the increasing demand for critical care equipment across private and government healthcare institutions. Rising cases of ARDS, chronic respiratory conditions, and surgical complications have led to higher ICU admissions, boosting ventilator procurement. With an average retail price exceeding INR 8 lakh per unit, the market has steadily expanded, supported by domestic manufacturing and favorable healthcare policies encouraging equipment indigenization.

The market is largely dominated by urban healthcare clusters such as Delhi NCR, Mumbai, and Bengaluru. These cities house top-tier hospitals like Apollo, Fortis, and Manipal, which serve as primary hubs for ICU and critical care services. Their advanced infrastructure and demand for high-quality ventilators such as neonatal or hybrid models, position them as key demand centers. Moreover, large-scale procurement by state governments in Tier-2 and Tier-3 cities like Lucknow, Indore, and Patna has strengthened the regional distribution footprint in recent years.

India classifies invasive ventilators under Class C devices, regulated by the CDSCO. As of October 2023, all ventilator manufacturers must obtain an MD-5 Import License or domestic production license, compliant with ISO 13485 and BIS 7320:2021. The government imposes a 7.5% customs duty and 5% health cess on imported ventilators, increasing cost pressures on hospitals. In March 2023, Parliament recommended lowering tariffs on critical components like turbines and valves to boost local manufacturing.

India Invasive Ventilator Market Segmentation

By Mobility: Indias invasive ventilator market is segmented by mobility into standalone and portable ventilators. Standalone ventilators dominate due to their alignment with ICU infrastructure and long-duration respiratory support needs. They are especially preferred in hospitals for treating trauma, ARDS, and pneumonia cases, which require continuous monitoring and stable airflow deliverymaking them the optimal choice for critical care settings.

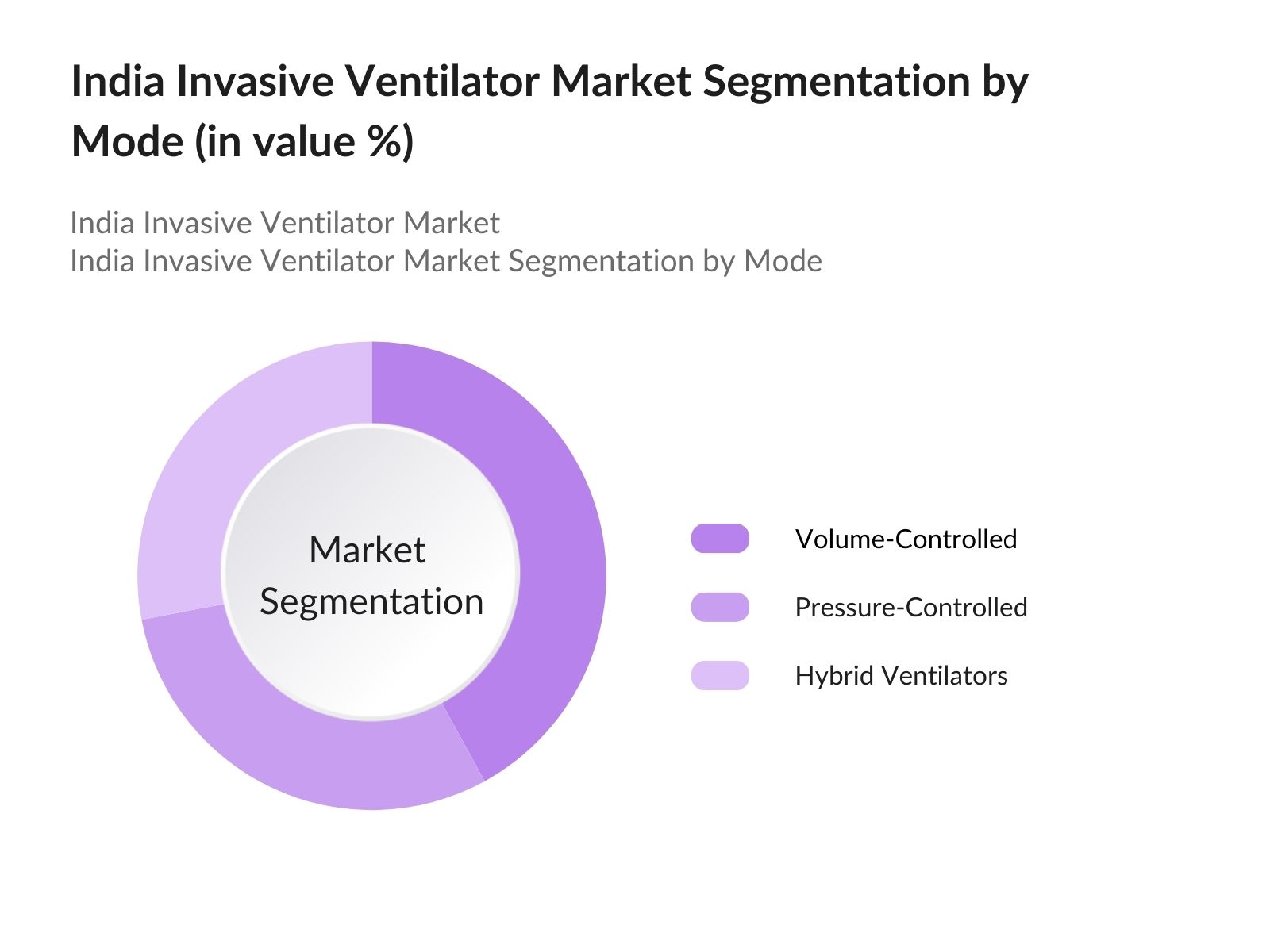

By Mode: Indias invasive ventilator market is segmented by mode into volume-controlled, pressure-controlled, and hybrid ventilators. Volume-controlled ventilators have a dominant market share as they offer precision in tidal volume delivery, especially in adult ICUs. These systems are well-integrated into tertiary hospitals where doctors and respiratory therapists are highly trained, ensuring confidence in using advanced ventilator settings for patient safety.

By Mode: Indias invasive ventilator market is segmented by mode into volume-controlled, pressure-controlled, and hybrid ventilators. Volume-controlled ventilators have a dominant market share as they offer precision in tidal volume delivery, especially in adult ICUs. These systems are well-integrated into tertiary hospitals where doctors and respiratory therapists are highly trained, ensuring confidence in using advanced ventilator settings for patient safety.

India Invasive Ventilator Market Competitive Landscape

The India Invasive Ventilator market is dominated by a mix of global OEMs and indigenous players offering specialized ventilator systems for critical care. Companies like Drger and Getinge have partnered with domestic manufacturers to deliver neonatal and ICU-specific solutions tailored to local clinical needs. Meanwhile, Indian firms are scaling production through component localization, supported by government incentives and the push for medical equipment self-reliance under national healthcare programs.

India Invasive Ventilator Market Analysis

Growth Drivers

Rising Prevalence of Respiratory Diseases: Indias burden of respiratory illness remains among the highest globally. According to the National Health Authority and WHO, India accounts for over 34 million asthma cases and 18% of the global COPD burden. These conditions often escalate to severe respiratory failure requiring mechanical ventilation. Moreover, the Indian Council of Medical Research reported over 6.4 million cases of pneumonia annually, further intensifying the demand for ICU-level respiratory support systems.

Expansion of Critical Care Infrastructure: India has seen rapid expansion in healthcare infrastructure. According to the Ministry of Health and Family Welfare, 250,000 Health and Wellness Centres are being expanded under Ayushman Bharat to include critical care access. The top 90 hospitals across Tier 2 and Tier 3 cities are expected to add over 4,000 ICU beds this year. This infrastructure push directly increases the use of ventilators across secondary and tertiary care settings.

Growing Elderly Population and Comorbidities: The share of Indias senior population is increasing steadily. According to the Ministry of Statistics and Programme Implementation, individuals aged 60+ now exceed 149 million in 2024. With age, the prevalence of chronic illnesses requiring long-term mechanical ventilation rises significantly, including stroke, cardiac failure, and neuromuscular diseases. As geriatric ICUs expand, the demand for ventilators capable of multi-mode functionality also increases, boosting overall market demand.

Market Challenges

Limited Access to Advanced Components: Indias dependence on imports for high-spec components like sensors, valves, and compressors limits its ability to scale local manufacturing of advanced ventilators. Over 70% of such critical parts are still sourced from the US, Germany, and China, according to the Ministry of Commerce and Industry. This not only inflates production costs but also delays timelines, particularly during global disruptions affecting supply chains or logistics.

Delayed Regulatory Clearances: Ventilators in India fall under Class C devices and require multiple approvals under CDSCO norms. The Central Drugs Standard Control Organisation mandates at least five approvals including ISO 13485 and BIS 7320:2021 compliance. Manufacturers report a delay of up to 12 months in obtaining final CDSCO licenses due to backlogs and evolving standards. These bottlenecks discourage smaller players from scaling operations despite high domestic demand.

India Invasive Ventilator Market Future Outlook

Over the next few years, the India Invasive Ventilator Market is expected to demonstrate sustained growth, driven by domestic production incentives, rising hospital expansions, and a sharp rise in demand for non-invasive and hybrid models. As India reduces its dependence on imports and pushes toward the Atmanirbhar Bharat initiative, local players are gaining traction with cost-effective yet high-performance ventilators suitable for Tier-2 and Tier-3 city deployment. Government bulk procurement, combined with increased ICU beds under schemes like PM-Ayushman Bharat, will catalyze long-term market expansion.

Market Opportunities

Domestic Innovation and Import Substitution: Indias PLI scheme for medical devices encourages local production, with 3,420 crore allocated under National Medical Devices Policy. Andhra Pradesh and Tamil Nadu are developing dedicated medical parks with shared infrastructure. These initiatives, combined with 5% customs duty reduction on essential ventilator components, are driving innovation by MSMEs, reducing dependency on imports and improving access to ICU-grade ventilators at lower cost.

Growth in Demand from Homecare Segment: Indias shift toward post-acute and palliative care is boosting in-home ventilator demand. According to NITI Aayog, around 25 million elderly individuals are functionally dependent and unable to access institutional ICUs. Portable, lightweight ventilators are being integrated into eldercare plans by hospitals like Apollo and Medanta. This shift toward decentralised care creates sustained demand for hybrid and battery-powered invasive ventilators across semi-urban areas.

Scope of the Report

|

By Mobility |

Standalone Ventilators |

|

By Mode |

Volume-Controlled |

|

By End User |

Hospitals |

|

By Sector |

Private Facilities |

|

By Region |

North |

Products

Key Target Audience

- Hospitals and ICU Procurement Managers

- OEMs and Medical Equipment Manufacturers

- Government and Regulatory Bodies (CDSCO, Ministry of Health and Family Welfare)

- Biomedical Engineering Firms

- Investments and Venture Capitalist Firms

- Hospital Infrastructure Developers

- Equipment Financing Companies

- Diagnostic and ICU Turnkey Contractors

Companies

Players Mentioned in the Report

- Drger

- Getinge

- Mindray

- Hamilton Medical

- Skanray

Table of Contents

1. India Invasive Ventilator Market Overview

1.1. Definition and Scope (ICU-Grade Ventilators, Life Support Devices)

1.2. Market Taxonomy (Mobility, Mode, End User, Sector, Region)

1.3. Historical Growth Rate (Based on Patient Admission & ICU Expansion)

1.4. Overview of Hospital Infrastructure and Penetration Rate

2. India Invasive Ventilator Market Size (INR Cr)

2.1. Historical Market Size Analysis (Value & Volume)

2.2. Year-on-Year Unit Growth Rate

2.3. Key Milestones in Public and Private Sector Capacity Expansion

2.4. Average Retail Price Range Analysis (High-Acuity ICU Ventilators)

3. India Invasive Ventilator Market Analysis

3.1. Growth Drivers

3.1.1. Prevalence of Respiratory Diseases (COPD, ARDS, ALS)

3.1.2. Expansion of ICU Beds in Tier-2/3 Cities

3.1.3. Increase in Trauma and Emergency Surgical Cases

3.1.4. Senior Population Driving Home-Based Critical Care

3.2. Restraints

3.2.1. High Cost of Advanced Imported Components

3.2.2. Regulatory Delays in CDSCO & FDA Approvals

3.3. Opportunities

3.3.1. Public Procurement Schemes under Ayushman Bharat

3.3.2. Local Assembly of Volume-Controlled Ventilators

3.3.3. Tier-2/3 City Infrastructure Development

3.3.4. Expansion of Indigenous R&D and Local Component Integration

3.4. Trends

3.4.1. Adoption of Hybrid Ventilators (Multi-mode Units)

3.4.2. Ventilator-as-a-Service (VAAS) in ICU Leasing Models

3.4.3. Integration with AI & IoT for Predictive Respiratory Support

3.4.4. Decentralized Procurement Models by Private Chains

3.5. Government Regulation

3.5.1. CDSCO Licensing under Class C Guidelines

3.5.2. BIS Standards IS 7408 & IS 7380 for Invasive Ventilators

3.5.3. 7.5% Basic Customs Duty + 5% Health Cess on Imports

3.5.4. Revised PLI Incentives for Domestic Medical Devices

3.5.5. Approval Pipeline under MD-5 Import Licensing (2024)

3.6. SWOT Analysis (ICU Penetration, R&D Localization, Import Dependency)

3.7. Stakeholder Ecosystem (OEMs, Assemblers, Hospitals, Distributors)

3.8. Porters Five Forces (Bargaining Power of Buyers in ICU Procurement)

3.9. Competitive Landscape Summary (Market Fragmentation & Pricing Band)

4. India Invasive Ventilator Market Segmentation

4.1. By Mobility (In Value %)

- Standalone Ventilators

- Portable Ventilators

4.2. By Mode (In Value %)

- Volume-Controlled Ventilators

- Pressure-Controlled Ventilators

- Hybrid Ventilators

4.3. By End User (In Value %)

- Hospitals

- Home Healthcare

- Ambulatory Care Centres

4.4. By Sector (In Value %)

- Government Healthcare Facilities

- Private Healthcare Facilities

4.5. By Region (In Value %)

- North

- South

- East

- West

5. India Invasive Ventilator Market Competitive Analysis

5.1. Company Profiles (Product Portfolio, Price Range, ICU Integration, etc.)

5.1.1. Drger

5.1.2. Mindray

5.1.3. Hamilton Medical

5.1.4. Getinge

5.1.5. Skanray

5.1.6. Resmed

5.1.7. Aeonmed

5.1.8. Allied Medical

5.1.9. Trivitron Healthcare

5.1.10. BPL Medical Technologies

5.1.11. Nidek Medical

5.1.12. MAX Ventilators

5.1.13. Philips Healthcare

5.1.14. AgVa Healthcare

5.1.15. Lowenstein Medical

5.2. Cross Comparison Parameters

- Inception Year

- Headquarter Location

- Number of R&D Facilities

- Revenue from Ventilator Sales

- ICU Integration Models

- Distribution Coverage (Tier-2/3 Penetration)

- Product Pricing Range (Min-Max INR)

- Key Partnership/Tender Wins

5.3. Strategic Initiatives

5.4. Mergers and Acquisitions

5.5. Government Tenders and Grants

5.6. Private Equity and VC Funding Landscape

6. India Invasive Ventilator Market Regulatory Framework

6.1. CDSCO Regulatory Steps (Class C Approvals, QMS, ISO 13485)

6.2. BIS Specifications for Technical Testing (IS 7408 & IS 7380)

6.3. Import Duty & Tariff Policies

6.4. PLI Scheme and State-Level Incentives

6.5. Customs Exemptions on Essential Components

7. India Invasive Ventilator Future Market Size (In INR Cr)

7.1. Projected Value-Based Growth

7.2. Projected Volume-Based Demand

7.3. Public Sector Contribution Forecast

7.4. Private Hospital Network Expansion Impact

8. India Invasive Ventilator Future Market Segmentation

8.1. By Mode (Volume/Pressure/Hybrid)

8.2. By End User (Homecare vs ICU-Based Demand)

8.3. By Region (Demand Distribution Forecast)

8.4. By Mobility (Technological Advancements & Demand Split)

8.5. By Sector (Government Scheme Uptake vs Private)

9. India Invasive Ventilator Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. ICU Capacity Mapping vs Ventilator Supply

9.3. R&D Partnership Roadmap

9.4. Import Substitution & Indigenous Innovation Strategy

9.5. Price-Band Targeting Strategy for Hospitals & Homecare

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first stage involved identifying the entire value chain for the India invasive ventilator market, covering raw material procurement, OEMs, distributors, and end users. Desk research and proprietary databases helped determine parameters like ventilator mobility, usage environments, and procurement routes.

Step 2: Market Analysis and Construction

We compiled historical volume and value data for invasive ventilator sales from FY2019 to FY2024. Pricing, hospital demand, ICU bed expansion, and state-level procurement programs were factored into market sizing and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

We conducted structured interviews with industry stakeholders including respiratory specialists, biomedical engineers, and hospital procurement heads across 15 cities. These expert insights helped validate mode preferences, demand concentration, and product specifications.

Step 4: Research Synthesis and Final Output

Final projections and analysis were synthesized by triangulating insights from OEM production, regulatory filings, and hospital infrastructure expansion reports. The outcome reflects validated current-state and forward-looking analysis tailored to Indias healthcare delivery framework.

Frequently Asked Questions

01. How big is the India Invasive Ventilator Market?

The India invasive ventilator market is valued at INR 402.8 crore, based on unit sales across hospitals and standalone ICUs, driven by rising respiratory complications and increasing ICU bed capacity.

02. What are the challenges in the India Invasive Ventilator Market?

Challenges faced by India invasive ventilator market include high dependency on imported components and delayed regulatory approvals from CDSCO and CE certification. These cause bottlenecks in local manufacturing scale-up and impact price competitiveness.

03. Who are the major players in the India Invasive Ventilator Market?

Key players of India invasive ventilator market include Drger, Mindray, Getinge, Hamilton Medical, and Skanray. These companies dominate with ICU-integrated ventilator models, neonatal configurations, and large hospital tie-ups.

04. What are the growth drivers of the India Invasive Ventilator Market?

India invasive ventilator market growth is driven by expansion in critical care infrastructure, with over 250,000 Health and Wellness Centers being upgraded. Government incentives for local production and bulk procurement from Tier-2/3 hospitals further fuel market demand.

05. Which ventilator types are in high demand in India?

In India invasive ventilator market Standalone volume-controlled ventilators are most in demand due to their compatibility with high-dependency ICU units. These are widely adopted in both public and private tertiary care hospitals.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.