India Laboratory Supplies Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD5725

December 2024

86

About the Report

India Laboratory Supplies Market Overview

- The India Laboratory Supplies Market is valued at USD 2,580 million, based on a five-year historical analysis. The market is driven by substantial investment in the healthcare and pharmaceutical sectors, particularly in research and development (R&D) activities. Increased focus on the adoption of advanced lab technologies has further fueled market expansion. Laboratories and research institutes, ranging from academic institutions to industrial research labs, contribute to the rising demand for laboratory supplies across the country.

- The market is primarily dominated by metropolitan cities like Mumbai, Delhi, and Bangalore, where the concentration of research institutions, pharmaceutical companies, and academic centers is the highest. These cities host numerous top-tier hospitals, R&D centers, and testing labs, which require a steady supply of advanced laboratory equipment. Their dominance is due to the infrastructure for conducting large-scale research and clinical trials, making them key hubs for laboratory supplies.

- The Indian government has introduced several policies in 2024 aimed at supporting scientific research and fostering innovation. The National Research Foundation (NRF) received funding of USD 2.5 billion in 2024 to support scientific institutions and universities in conducting cutting-edge research. These policies ensure sustained demand for laboratory supplies and infrastructure upgrades, encouraging domestic and international suppliers to invest in India's laboratory market.

India Laboratory Supplies Market Segmentation

By Product Type: The market is segmented by product type into general laboratory supplies, specialized instruments, chemicals and reagents, and consumables. Among these, specialized laboratory instruments hold a dominant market share due to the growing need for precision equipment in research activities and clinical diagnostics.

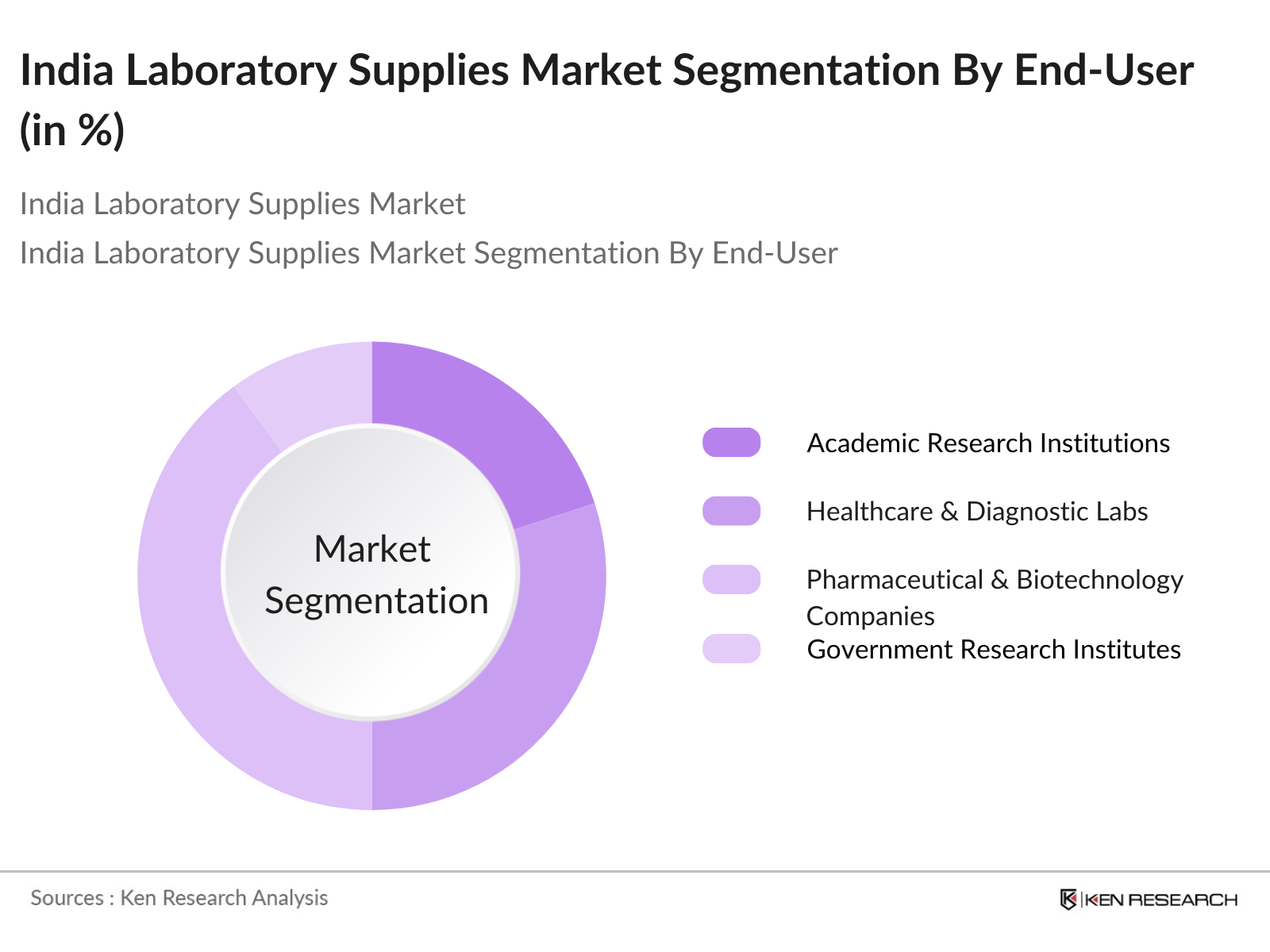

By End-User: The market is also segmented by end-user into academic research institutions, healthcare & diagnostic labs, pharmaceutical & biotechnology companies, and government research institutes. Pharmaceutical & biotechnology companies lead in market share, owing to the continuous expansion of the pharmaceutical industry in India.

India Laboratory Supplies Market Competitive Landscape

The India Laboratory Supplies Market is highly consolidated, with a few major international and domestic players dominating the landscape. These key companies are involved in the manufacturing and distribution of laboratory equipment, offering a diverse range of products catering to various end-users, including hospitals, research labs, and universities.

India Laboratory Supplies Industry Analysis

Growth Drivers

- Rise in Healthcare Expenditure (Healthcare): India's healthcare expenditure has significantly increased in recent years, with the government allocating approximately USD 30 billion for healthcare in 2024. This growing expenditure is driving the demand for laboratory supplies, particularly in hospitals and diagnostic centers where advanced testing equipment is essential for patient care. The National Health Mission also increased its funding by USD 7.5 billion in 2024, further emphasizing the need for high-quality laboratory instruments and consumables to support extensive healthcare services across the country.

- Increasing Research and Development Activities (Pharmaceutical & Biotechnology): Indias pharmaceutical and biotechnology sectors saw an influx of USD 18 billion in R&D activities in 2023. The governments emphasis on innovation, coupled with collaborations between global pharmaceutical firms and Indian research institutions, has led to a surge in demand for laboratory equipment, such as chromatography systems and spectrometers.

- Expansion of Academic Research Facilities (Education): India has witnessed the expansion of academic research facilities in recent years, with over 150 new research labs inaugurated in 2023 alone across universities and research institutes. The increased number of research facilities and funding for academic institutions has escalated the need for sophisticated laboratory instruments. A notable increase in scientific publications from India, which rose to over 200,000 in 2023, reflects the growing academic research activity, driving demand for laboratory consumables and instruments.

Market Challenges

- High Initial Costs for Specialized Equipment (Cost Barriers): Specialized laboratory equipment like electron microscopes and mass spectrometers have high initial costs, often exceeding USD 500,000 per unit. These costs pose a significant barrier for smaller research institutions and diagnostic centers with limited budgets. Despite government subsidies and grants, the expense of acquiring, installing, and maintaining such high-end laboratory supplies remains a challenge for many organizations in Indias research and healthcare sectors.

- Shortage of Skilled Professionals (Workforce Development): India currently faces a shortage of skilled laboratory technicians and researchers, with an estimated shortfall of 250,000 professionals required for laboratory roles in 2024. This shortage affects the proper utilization and maintenance of advanced laboratory equipment, leading to operational inefficiencies. Training programs and educational initiatives are still lagging, which further exacerbates the issue of workforce development in laboratories across sectors.

India Laboratory Supplies Market Future Outlook

Over the next five years, the India Laboratory Supplies Market is expected to experience steady growth driven by continuous R&D expansion in the pharmaceutical and healthcare sectors. Government initiatives supporting innovation in science and technology, along with increased collaboration between academia and industry, will play a crucial role in the growth trajectory.

Market Opportunities

- Growth of Biotechnology Sector (Sector Expansion): Indias biotechnology sector is valued at over USD 70 billion in 2024, making it one of the fastest-growing markets in the world. The expansion of this sector, driven by advancements in genetic research, bioinformatics, and biopharmaceuticals, is creating vast opportunities for laboratory supplies. The government's Biotechnology Industry Research Assistance Council (BIRAC) initiative also supports over 500 biotech startups, boosting the demand for laboratory instruments essential for innovation and discovery.

- Adoption of Digital Solutions in Lab Management (Technology Integration): Digital solutions for laboratory management, such as Laboratory Information Management Systems (LIMS), are increasingly being adopted across India. This trend is transforming laboratory operations by streamlining data collection, improving workflow efficiency, and ensuring compliance with international standards. The adoption of these digital tools has surged, with over 45% of research institutions and diagnostic centers implementing LIMS solutions by 2024, presenting a significant opportunity for providers of software-integrated laboratory supplies.

Scope of the Report

|

Product Type |

General Laboratory Supplies Specialized Laboratory Instruments Chemicals and Reagents Labware and Glassware Consumables |

| End-User |

Academic Research Institutions Healthcare & Diagnostic Labs Pharmaceutical & Biotechnology Companies Government Research Institutes Food & Beverage Testing Labs |

|

Technology |

Manual Automated Digital Solutions |

|

Application |

Clinical Diagnostics Microbiology Genomics & Proteomics Environmental Testing Material Science |

|

Region |

North India South India East India West India Central India |

Products

Key Target Audience

Pharmaceutical & Biotechnology Companies

Healthcare & Diagnostic Laboratories

Academic Research Institutions

Government Research Institutes (Indian Council of Medical Research)

Food & Beverage Testing Laboratories

Hospital & Clinical Laboratories

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Indian Council of Medical Research, Department of Pharmaceuticals)

Companies

Players Mentioned in the Report

Thermo Fisher Scientific

Merck Group

Agilent Technologies

Eppendorf AG

Sartorius AG

Danaher Corporation

Mettler Toledo

Waters Corporation

Roche Diagnostics

Siemens Healthineers

Table of Contents

1. India Laboratory Supplies Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Laboratory Supplies Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Laboratory Supplies Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Healthcare Expenditure (Healthcare)

3.1.2. Increasing Research and Development Activities (Pharmaceutical & Biotechnology)

3.1.3. Government Investments in Scientific Infrastructure (Regulatory)

3.1.4. Expansion of Academic Research Facilities (Education)

3.2. Market Challenges

3.2.1. High Initial Costs for Specialized Equipment (Cost Barriers)

3.2.2. Shortage of Skilled Professionals (Workforce Development)

3.2.3. Complex Regulatory Approvals for New Instruments (Compliance)

3.3. Opportunities

3.3.1. Growth of Biotechnology Sector (Sector Expansion)

3.3.2. Adoption of Digital Solutions in Lab Management (Technology Integration)

3.3.3. Increasing Collaborations Between Industry and Academia (Partnerships)

3.4. Trends

3.4.1. Shift Towards Automation in Laboratories (Automation)

3.4.2. Use of Artificial Intelligence for Data Analysis (AI Implementation)

3.4.3. Sustainable and Eco-Friendly Laboratory Practices (Sustainability)

3.5. Government Regulations

3.5.1. National Policies Supporting Scientific Research (Policy Support)

3.5.2. Import and Export Guidelines for Laboratory Instruments (Trade Regulations)

3.5.3. Quality Assurance Standards for Laboratory Consumables (Standardization)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. India Laboratory Supplies Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. General Laboratory Supplies

4.1.2. Specialized Laboratory Instruments

4.1.3. Chemicals and Reagents

4.1.4. Labware and Glassware

4.1.5. Consumables

4.2. By End-User (In Value %)

4.2.1. Academic Research Institutions

4.2.2. Healthcare & Diagnostic Labs

4.2.3. Pharmaceutical & Biotechnology Companies

4.2.4. Government Research Institutes

4.2.5. Food & Beverage Testing Labs

4.3. By Technology (In Value %)

4.3.1. Manual

4.3.2. Automated

4.3.3. Digital Solutions

4.4. By Application (In Value %)

4.4.1. Clinical Diagnostics

4.4.2. Microbiology

4.4.3. Genomics & Proteomics

4.4.4. Environmental Testing

4.4.5. Material Science

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

4.5.5. Central India

5. India Laboratory Supplies Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Thermo Fisher Scientific

5.1.2. Agilent Technologies

5.1.3. Merck Group

5.1.4. Sartorius AG

5.1.5. Eppendorf AG

5.1.6. Danaher Corporation

5.1.7. PerkinElmer Inc.

5.1.8. Mettler Toledo

5.1.9. Waters Corporation

5.1.10. Bruker Corporation

5.1.11. Roche Diagnostics

5.1.12. Shimadzu Corporation

5.1.13. Bio-Rad Laboratories

5.1.14. GE Healthcare

5.1.15. Siemens Healthineers

5.2. Cross Comparison Parameters (Revenue, Market Share, Regional Presence, Technological Innovation, Product Range, Employee Strength, Growth Strategy, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers & Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Laboratory Supplies Market Regulatory Framework

6.1. Regulatory Approval Processes

6.2. Compliance Standards for Laboratory Equipment

6.3. Certification and Accreditation Processes

7. India Laboratory Supplies Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Laboratory Supplies Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Technology (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. India Laboratory Supplies Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step in our research process involves identifying the key variables that influence the India Laboratory Supplies Market. This includes a deep dive into sector-specific data, stakeholder interactions, and market behavior, backed by primary and secondary research sources. The aim is to map out all major components affecting the market.

Step 2: Market Analysis and Construction

In this phase, historical data on the India Laboratory Supplies Market is compiled to provide a comprehensive understanding of market trends, revenue generation, and the current ecosystem. Market penetration rates, product adoption, and supply-demand metrics are analyzed to form the foundation of the market forecast.

Step 3: Hypothesis Validation and Expert Consultation

We develop market hypotheses based on initial findings and validate them through consultations with industry experts from leading pharmaceutical companies, healthcare labs, and research institutions. These interviews provide valuable insights into the operational landscape, helping to refine the market projections.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the research data into a structured report. This includes direct feedback from industry leaders and stakeholders to ensure an accurate representation of the market. The report is verified through both top-down and bottom-up approaches to ensure data consistency.

Frequently Asked Questions

1. How big is India Laboratory Supplies Market?

The India Laboratory Supplies Market is valued at USD 2,580 million, based on a five-year historical analysis. The market is driven by substantial investment in the healthcare and pharmaceutical sectors, particularly in research and development (R&D) activities.

2. What are the challenges in the India Laboratory Supplies Market?

The market faces challenges such as high initial costs for advanced equipment, complex regulatory requirements, and a shortage of skilled personnel capable of operating specialized instruments.

3. Who are the major players in the India Laboratory Supplies Market?

Key players include Thermo Fisher Scientific, Merck Group, Agilent Technologies, Eppendorf AG, and Sartorius AG, dominating due to their comprehensive product portfolios and strong distribution networks.

4. What drives the growth of the India Laboratory Supplies Market?

The growth is propelled by increasing R&D investment in the pharmaceutical and healthcare sectors, as well as government initiatives to bolster scientific research and innovation across the country.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.