India laundry detergents Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD946

July 2024

98

About the Report

India laundry detergents Market Overview

- The India laundry detergents market was valued at USD 5.2 billion in 2023 growing at a CAGR of 5.5% driven by increasing consumer awareness regarding hygiene and cleanliness. Additionally, it is propelled by the expanding middle-class population, increasing disposable incomes, and the rise of urbanization.

- The India laundry detergents market is fragmented. Key players in the market include multinational corporations such as Procter & Gamble, Unilever, and Henkel, as well as strong local players like Nirma and Ghadi.

- In 2023, Hindustan Unilever Limited (HUL) announced the launch of a new eco-friendly laundry detergent brand, "Love Home and Planet." This new product line aims to cater to the growing consumer demand for sustainable and environmentally friendly products.

India laundry detergents Current Market Analysis

- The laundry detergents market in India has a remarkable impact on the country's economy, contributing to the growth of the FMCG sector. The market also supports a wide range of ancillary industries, including packaging, chemicals, and logistics.

- One of the key growth drivers in the India laundry detergents market is the rising disposable income and the consequent increase in spending on premium and specialized laundry care products. According to the World Bank, India's GDP per capita rose from $2,045 in 2018 to $2,202 in 2023.

- In 2023, the state of Maharashtra, dominated the laundry detergents market. This dominance can be attributed to the region's high urbanization rate, robust economic growth, and a large middle-class population with higher disposable incomes.

India laundry detergents Current Market Segmentation

The India laundry detergents is segmented based on product, application, and region.

By Product: The India laundry detergents market is segmented by product type into powder detergents, liquid detergents, and detergent bars. In 2023, Powder detergents dominated the market due to their cost-effectiveness and ability to cater to a wide range of consumer needs, particularly in rural and semi-urban areas.

By Application: The market is further segmented by application into household and industrial use. In 2023, Household use dominates the market due to the rising penetration of washing machines and the increasing emphasis on hygiene and cleanliness in homes. The convenience and efficiency offered by modern laundry detergents cater to the needs of busy urban households.

By Region: The India laundry detergents market is segmented by region into North, South, East, and West. In 2023, the Western region dominated the market due to its high urbanization rate, strong economic growth, and a large middle-class population with higher disposable incomes.

India Laundry Detergents Market Competitive Landscape

- Jyothy Laboratories: In a strategic move, Jyothy Laboratories acquired Henkel India in 2024 for USD 73.17 Mn. This acquisition strengthens Jyothy's market position and expands its product portfolio, allowing it to cater to a broader consumer base and enhance its market share.

- P&G: Procter & Gamble introduced an AI-powered recommendation system on their e-commerce platform in 2024. This innovation helps consumers choose the best detergent based on their specific needs, resulting in a substantial increase in online sales and enhancing customer satisfaction.

- Patanjali Ayurved Limited: In 2023, Patanjali formed marketing partnerships with large retail chains like Future Group to expand the distribution and availability of its detergent and other FMCG products across the country.

India Laundry Detergents Market Analysis

India Laundry Detergents Market Growth Drivers

- Increasing Penetration of Washing Machines: In 2023, the household penetration rate of washing machines in India households is 13%. This surge is driven by the increasing adoption of washing machines in rural and semi-urban areas, leading to higher demand for liquid and powder detergents specifically designed for machine wash. This trend is supported by government schemes promoting rural electrification and affordable home appliances.

- Rising Health and Hygiene Awareness: In 2024, there has been a notable increase in consumer spending on hygiene-related products. With the COVID-19 pandemic amplifying the importance of cleanliness, the demand for laundry detergents with antibacterial and antiviral properties has surged. This heightened awareness has led to a surge in demand for laundry detergents with antibacterial and antiviral properties, as consumers prioritize products that offer enhanced protection against germs and viruses.

- Expansion of E-commerce Platforms: The proliferation of e-commerce platforms has revolutionized the purchase patterns of consumers. E-commerce giants are expanding their reach to Tier II and Tier III cities, offering a wide range of laundry care products and making them accessible to a broader consumer base, thus driving market growth.

India Laundry Detergents Market Challenges

- High Cost of Raw Materials: In 2023, detergent manufacturers are facing significant challenges due to the rising cost of key raw materials, such as surfactants and enzymes. This increase in raw material costs has put pressure on profit margins, compelling manufacturers to reassess their pricing strategies. Among these materials, the cost of linear alkylbenzene sulfonate (LABS), a vital ingredient in detergent production, has seen a notable rise.

- Regulatory Compliance and Environmental Concerns: The India government has tightened regulations concerning the environmental impact of detergent manufacturing processes. In 2024, compliance costs for detergent manufacturers have risen substantially. The implementation of stringent wastewater treatment norms and restrictions on certain chemicals has increased operational expenses, posing a challenge for market players to maintain profitability while adhering to environmental standards.

- Counterfeit and Low-Quality Products: The market is inundated with counterfeit and low-quality detergent products, particularly in rural areas. These products, often sold at lower prices, pose a challenge to established brands by eroding their market share and damaging consumer trust.

India Laundry Detergents Market Government Initiatives

- Promotion of Cleanliness under Swachh Bharat Mission 2.0: The Swachh Bharat Mission 2.0, launched in 2021, continues to play a crucial role in promoting cleanliness and hygiene across India. The government has allocated INR 41 lakh crore for this mission for the period 2021-22 to 2025-26, emphasizing the importance of using quality hygiene products, including laundry detergents, thereby boosting market demand.

- Subsidies for Eco-Friendly Products In 2024, the India government introduced subsidies for manufacturers producing eco-friendly detergents. Companies that adhere to the environmental guidelines and use biodegradable ingredients receive financial incentives, which have resulted in an increase in the production and consumption of green detergents.

- Rural Electrification and Appliance Accessibility: The Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY) has been instrumental in increasing electrification in rural areas. In 2024, an additional 5 million households were electrified, facilitating the use of washing machines and consequently driving the demand for laundry detergents in these regions.

India Laundry Detergents Market Future Outlook

The India laundry detergents market is poised for remarkable growth, driven by growth of eco-friendly and sustainable products, technological advancements in product formulations, and expansion of e-commerce and direct-to-consumer models.

Future Trends

-

- Growth of Eco-Friendly and Sustainable Products Over the next five years, the demand for eco-friendly and sustainable laundry detergents is expected to surge driven by increasing consumer awareness and government incentives for sustainable practices.

- Increasing Adoption of Subscription Services: Subscription-based models for laundry detergents are anticipated to gain traction in the coming years. Companies are likely to introduce subscription services offering regular delivery of detergents, catering to the convenience of consumers and ensuring consistent revenue streams.

Scope of the Report

|

By Product |

Powder detergents Liquid detergents Detergent bars |

|

By Application |

Household Industrial Use |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Consumer Goods Distributors

Packaging Companies

Logistics and Supply Chain Companies

E-commerce Platforms

Financial Institutions and Banks

Government Agencies and regulatory bodies (e.g., Ministry of Consumer Affairs)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

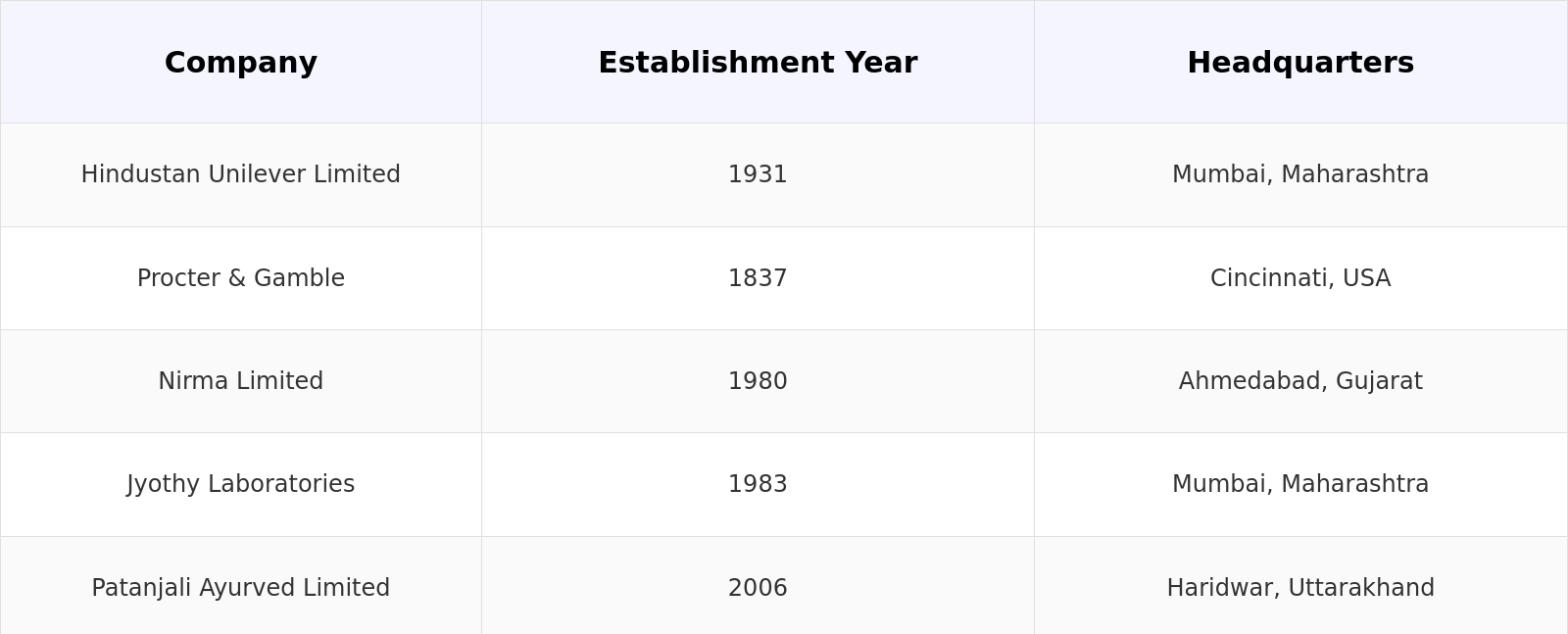

Hindustan Unilever Limited

Procter & Gamble

Nirma Limited

Jyothy Laboratories

Patanjali Ayurved Limited

ITC Limited

Godrej Consumer Products

Henkel AG & Co. KGaA

Fena Private Limited

RSPL Limited

Ghari Detergent

Amway India Enterprises

Wipro Consumer Care

Dabur India Limited

Marico Limited

Table of Contents

1. India Laundry Detergents Market Overview

1.1 India Laundry Detergents Market Taxonomy

2. India Laundry Detergents Market Size (in USD Bn), 2018-2023

3. India Laundry Detergents Market Analysis

3.1 India Laundry Detergents Market Growth Drivers

3.2 India Laundry Detergents Market Challenges and Issues

3.3 India Laundry Detergents Market Trends and Development

3.4 India Laundry Detergents Market Government Regulation

3.5 India Laundry Detergents Market SWOT Analysis

3.6 India Laundry Detergents Market Stake Ecosystem

3.7 India Laundry Detergents Market Competition Ecosystem

4. India Laundry Detergents Market Segmentation, 2023

4.1 India Laundry Detergents Market Segmentation by Product (in %), 2023

4.2 India Laundry Detergents Market Segmentation by Application (in %), 2023

4.3 India Laundry Detergents Market Segmentation by Region (in %), 2023

5. India Laundry Detergents Market Competition Benchmarking

5.1 India Laundry Detergents Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Laundry Detergents Future Market Size (in USD Bn), 2023-2028

7. India Laundry Detergents Future Market Segmentation, 2028

7.1 India Laundry Detergents Market Segmentation by Product (in %), 2028

7.2 India Laundry Detergents Market Segmentation by Application (in %), 2028

7.3 India Laundry Detergents Market Segmentation by Region (in %), 2028

8. India Laundry Detergents Market Analysts’ Recommendations

8.1 India Laundry Detergents Market TAM/SAM/SOM Analysis

8.2 India Laundry Detergents Market Customer Cohort Analysis

8.3 India Laundry Detergents Market Marketing Initiatives

8.4 India Laundry Detergents Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step: 2 Market Building:

Collating statistics on India Laundry Detergents market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Laundry Detergents market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step: 4 Research Output:

Our team will approach multiple essential laundry detergents companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from laundry detergent companies.

Frequently Asked Questions

01. How big is the India Laundry Detergents Market?Â

The India laundry detergents market, valued at USD 5.2 billion in 2023, is driven by increasing penetration of washing machines, rising health and hygiene awareness, and the expansion of e-commerce platforms.

02. What are the challenges in the India Laundry Detergents Market?Â

Challenges include the high cost of raw materials, regulatory compliance and environmental concerns, the prevalence of counterfeit and low-quality products, and the shift of some consumers to homemade laundry alternatives.

03. Who are the major players in the India Laundry Detergents Market?

Key players in the market include Hindustan Unilever Limited, Procter & Gamble, Nirma Limited, Jyothy Laboratories, and Patanjali Ayurved Limited. These companies dominate due to their extensive distribution networks, strong brand equity, and continuous product innovations.

04. What are the growth drivers of the India Laundry Detergents Market?Â

The market is driven by factors such as the increasing penetration of washing machines, rising health and hygiene awareness, expansion of e-commerce platforms, and innovations in product formulations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.